Always Thinking About Relative Value – MEQ, BTI, and The “Magnificent” Seven

Here’s the latest from Canadian Value Investors!

-The “Magnificent” Seven – A few charts

-Ideas from around the web – NYSE:BTI British American Tobacco “offers much better risk/reward than the magnificent seven”

-Mainstreet Equity TSX:MEQ Additional Thoughts – Not a “REIT”, and case study of growing scale

The “Magnificent” Seven

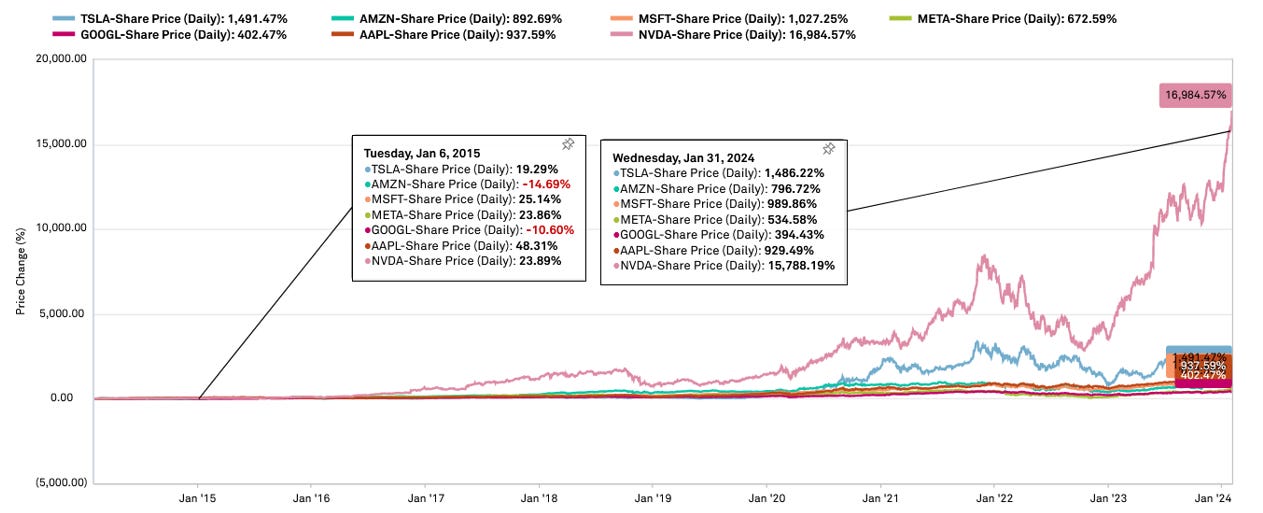

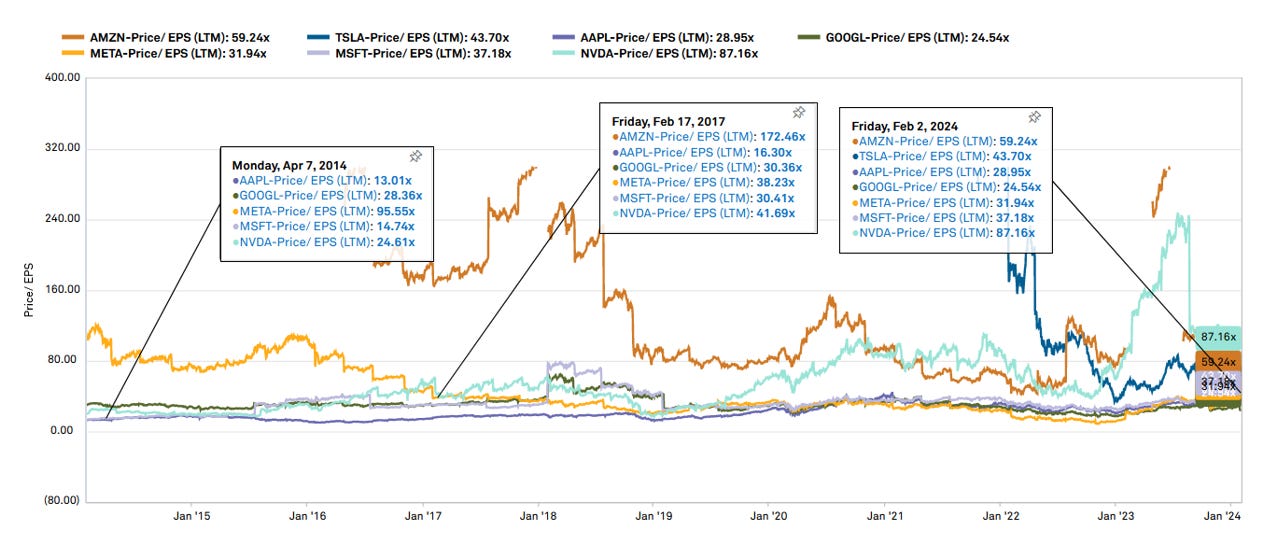

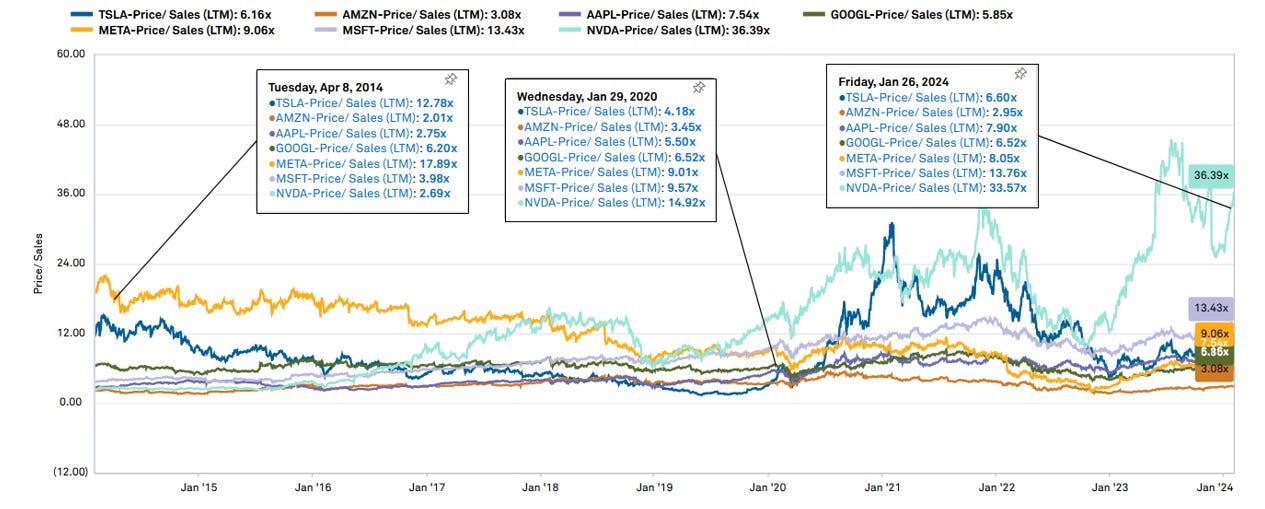

Up and away The Seven go. NVIDIA is particularly remarkable, with their price/sales multiple increasing from 2-3x to 30x+. We hope it works out for shareholders and in the meantime, we will continue to work on finding easier ideas. We always get nervous when the market gives a name to a group; The Nifty Fifty always comes to mind - https://en.wikipedia.org/wiki/Nifty_Fifty or BAT (Baidu, Alibaba, Tencent), and then there was The Four Horsemen of the Internet(Amazon, eBay, Yahoo, and AOL).

Tidefall Capital Management - British American Tobacco BAT - “This 10% yielding consumer goods stock offers much better risk/reward than the Magnificent Seven”

Disclosure: We have no position at time of publish but are evaluating.

We have seen a number of articles discussing BAT. They are the mega-tobacco company you are probably thinking of, but their investor presentations take a different spin (as shown above). The best short-form summary we have found is the recent Globe and Mail piece. https://www.theglobeandmail.com/investing/investment-ideas/article-british-american-tobacco-may-lack-the-magnificent-sevens-cheery/

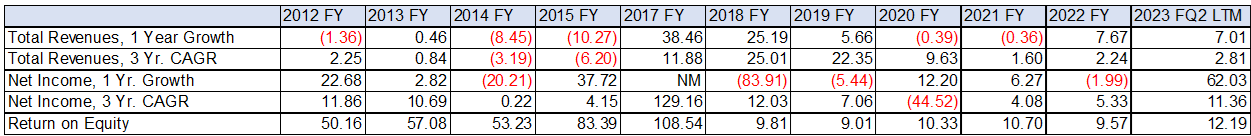

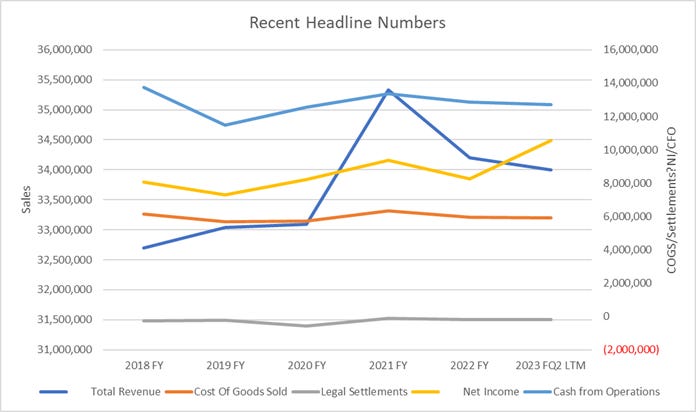

Despite increasingly moving away from traditional cigarettes to innovative reduced-harm offerings, the company has been abandoned by most active managers and passive funds because of an assumed terminal decline and ESG mandates…However, even under a backdrop of falling cigarette volumes, profits have steadily increased owing to higher prices as customers have limited price sensitivity…

The future of the tobacco sector began in 2015 with the first successful commercial vaporizer from Juul Labs…At present, it is estimated by BAT that at least 60 per cent of the U.S. vape industry is illegal (compared with estimates as low as 7 per cent for illicit cigarette sales). These difficult conditions combined with an ill-timed massive purchase of tobacco company Reynolds in 2017 pushed BAT’s shares down to today’s 14-year lows and a historic low of six times earnings… BAT is especially interesting because of its ownership of Vuse, the number one legal vape brand in the U.S. with a stunning 47-per-cent market share in tracked channels…We believe that investors are missing the potential for the removal of illegal vape devices in BAT’s key U.S. market…we believe we are near peak pessimism in the tobacco market.

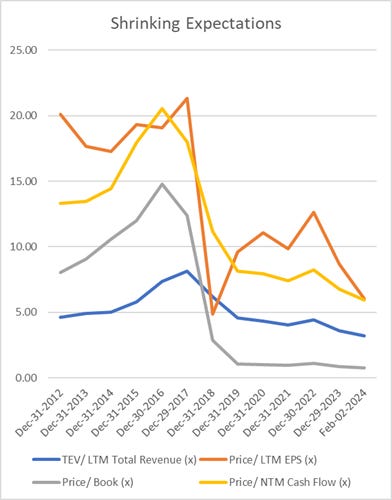

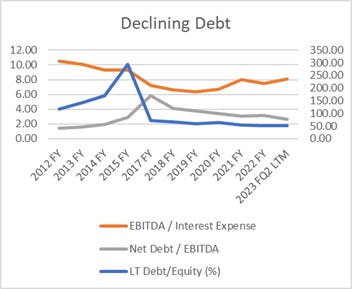

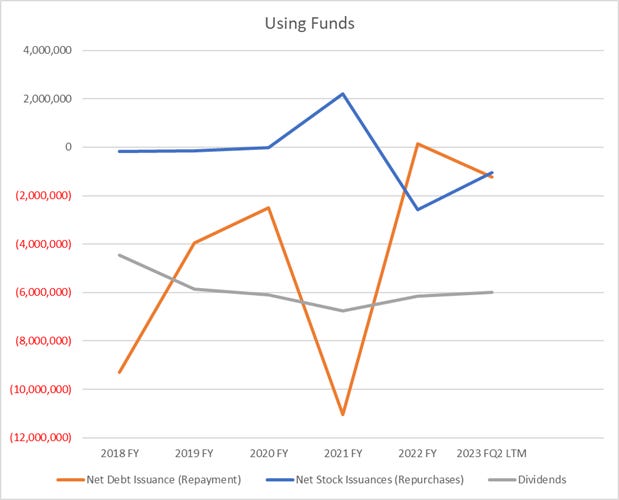

We note that it is also another interesting case study of collapsing expectations (our charts) while the underlying business appears to have improved.

There are headwinds – “BAT Takes $31.5 Billion Charge on U.S. Cigarette Brands Maker of Camel, Newport and Pall Mall brands says U.S. sales hit by smokers switching to cheaper products” - https://www.wsj.com/business/earnings/british-american-tobacco-sees-gbp25-bln-impairment-but-backs-guidance-28d3d7cf

But, expectations are very low.

Other sources - Emerging Value did a good article in early 2023 about them as well, albeit with more focus on the emerging markets angle. -

Mainstreet Equity TSX:MEQ Additional Thoughts – Relative value, and case study of growing scale

We wanted to provide a bit more color on our recent post on Mainstreet Equity.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.