AMMO Inc. (NASDAQ: POWW) Update – Ammunition division sold… have shareholders made it out of the minefield?

Disclosure: We are long POWW/POWWP at time of publishing.

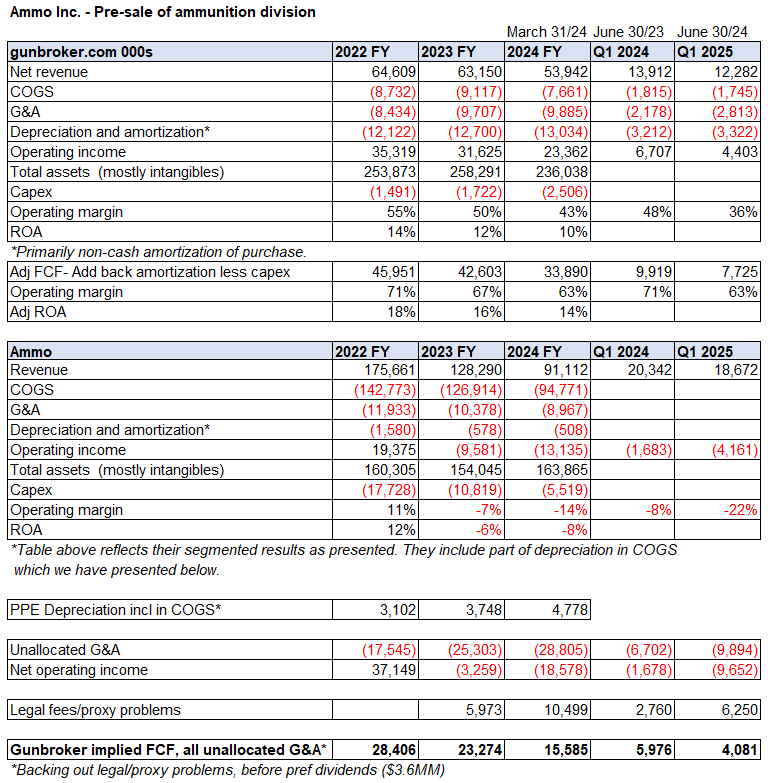

As we have said at the beginning of all our pieces on Ammo Inc, we would like to start by saying this has a bit of a complicated history that we will attempt to explain briefly. It really is a tale of two companies, the original ammo company started in 2016 and then later the COVID-acquired gunbroker.com marketplace. The manufacturing business has been facing weak pricing compounded by operational challenges while a long-running Board fight has distracted management from executing on their marketplace initiatives. Oh, and accounting problems to boot.

With the company announcing the sale of its ammunition business (thankfully), we will soon have a story of a company that owns one capex light business with a decent regulatory moat, no debt, surplus cash, and trading at a low normalized FCF multiple. But what about the other problems?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The announcement

On January 21st, the Company announced it was selling its key manufacturing plant to Olin for $75MM to focus exclusively on its marketplace business. We believed that this business should be sold and likely would be, though we did not expect this timing. Olin is a very credit buyer (market cap: $~$4B, manufacturer of Winchester ammo among other businesses).

The sale press release.

“Following a thorough process supported by our independent financial and legal advisors, the Board determined that a sale of AMMO’s ammunition manufacturing assets to Olin is in the best interest of the Company’s stockholders and positions us for long-term success. We believe the Company has significant opportunities to grow and scale GunBroker.com as the e-commerce space for the firearms and shooting sports industries continues expanding. We expect this sale will enable us to capitalize on these opportunities, while allowing the Company to become a more focused, streamlined and profitable organization.”

Within GunBroker.com, the Company’s profitable e-commerce segment, actions taken to improve the checkout process and upgrade offered services in outdoor experiences have enhanced the customer experience. The successful completion of this transaction is expected to further simplify the business, while reinforcing AMMO’s cash position to support expansion and thoughtful capital allocation.

Transaction Details

The disposition will include AMMO’s 185,000 square foot production facility and ballistic range located in Manitowoc, Wisconsin. This facility utilizes a highly trained and dedicated workforce committed to constantly improving all aspects of production to ensure that customers receive the best possible product. The Manitowoc facility and employees will complement Olin Winchester’s existing production capabilities and benefit from Winchester’s deep economies of scale and integration across the commercial ammunition value chain – from raw material sourcing, to projectiles, primers, and loading capabilities.

The closing of the transaction is subject to satisfaction of customary conditions for a transaction of this nature and is expected to be completed in the second calendar quarter of 2025. AMMO will undertake rebranding process and complete a corporate name change upon closing the transaction.

AMMO was advised by Baird and represented by Bryan Cave Leighton Paisner LLP. Lake Street Capital Markets provided a fairness opinion to the Board.

They also provided an update on the accounting problem.

Updates on Independent Investigation and Historical Financial Statements

As disclosed in a Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on September 24, 2024, a Special Committee of the Board has retained a law firm to conduct an independent investigation, focused on fiscal years 2020 through 2023, related to certain disclosure and accounting matters. The independent investigation is in its final stages. Furthermore, the Company previously disclosed that certain historical financial statements and auditors’ reports previously filed by the Company should no longer be relied upon. The Company expects to provide investors with an update related to such financial statements in the first calendar quarter of 2025.

How did we get here?

2024 flashbacks; The key issues then VS today

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.