Disclosure: We own this one.

Do we like AMMO, Inc. because of its ticker, POWW? We do like fun tickers (PBR is still our favourite). However, we try to not be biased by these things.

Instead, we think that POWW is potentially under-valued, definitely under-followed, and underlying improvements are hidden by accounting. It is a story of two companies, the first in turnaround and second being an Ebay hiding underneath, with a new CEO focusing on the right things. This is our kind of story. We first covered this Company before our migration to Substack and thought it was time to do a full refresh.

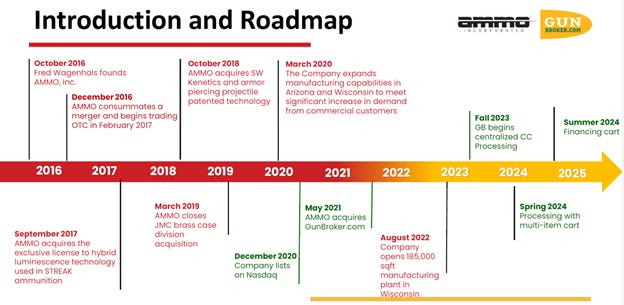

Ammo came into existence in 2016 and prior to this the corporation was an unrelated shell/failed company:

“-On this date, our CEO and Chairman, Fred Wagenhals, acquired the outstanding shares of the former Company, resulting in a change of control

-The name of the company was changed to AMMO, Inc.

-The OTC trading symbol was changed to POWW

-As the sole director, Mr. Wagenhals approved a 1-for-25 reverse stock split

-A plan of merger was filed to re-domicile and change the state of incorporation from California to Delaware

-Under the domicile change, a new certificate of incorporation was filed increasing the number of authorized shares of common stock from 15.0 million to 100 million; establishing a par value of $0.001

On March 17, 2017, AMMO Inc. acquired all of the outstanding shares of a private company incorporated in the State of Delaware, using the same trade name "AMMO, Inc.". The combined operations for AMMO, Inc. was reorganized as a designer, manufacturer, and marketer of performance-driven, high-quality and innovative ammunition products.

First, the Ammo Business

The original vision for Ammo, Inc. seems to have taken a shotgun approach. The idea was to purchase and/or make partnerships with companies and inventors to produce unique proprietary products, like streak visual ammunition (licensed from University of Louisiana at Lafayette). What is “streak visual ammunition” anyway?

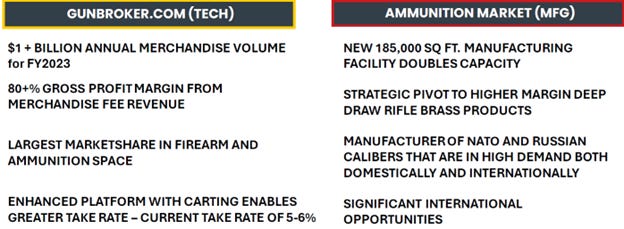

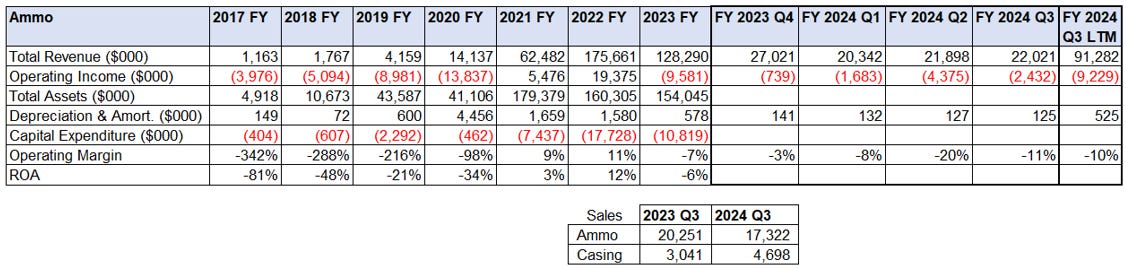

Overall, this has been painful so far except for a COVID bump. However, there have been recent changes that are unfolding: 1) The Company opened a new manufacturing plant in Wisconsin in August 2022 and 2) Ammo is working through operational hiccups while 3) a new CEO is streamlining its product offerings to focus on higher margin products with lower working capital needs (e.g. making just shell casings instead of a complete bullet) instead of chasing volumes.

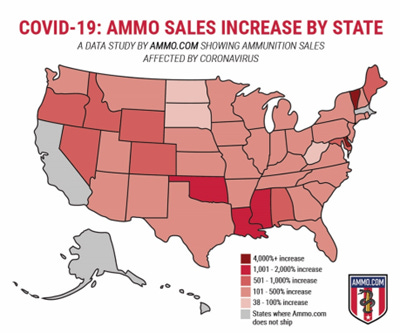

Unfortunately, similar to some other industries, the U.S. ammo industry is working through inventory overhang and customer over-purchasing during COVID. An interesting case study is at the unrelated ammo.com (see chart below) - https://ammo.com/coronavirus-impact-on-ammunition-sales This macro environment has not been helpful. And then there were press problems.

Note: Financials are off-cycle, with FY2023 ending March 31, 2023 (i.e. the new plant opened mid-FY2023).

Ammo division’s press problems

They continue to have ramp up issues while also having their sales mix in flux as part of their overall refocusing. This is not unexpected for us and is built into our thesis, but if things do not improve shortly, we will start to wonder. From Q2 FY 2024:

With this backdrop, our results were further impacted because the major investments we've made in contact tool for brass production equipment did not come online in the quarter and our overhead absorption for the plant suffered. This is by no means from a lack of demand, but due to the mechanical and electrical failure of our primary presses for our rifle place production. While we initiated the investments for mechanical and electrical failure redundancy, we did not have the investments in place to keep our workforce and the downstream processes operational. This led to an additional $1.75 million in expenses for the quarter. Of the $1.75 million, there is roughly $800,000 in total expenses incurred in the quarter that will help offset future costs of these presses come back online.

There does seem to be anecdotal stories about quality problems, though not very widespread.

Combined with this was an inventory overhang causing them to sell through some old stock at a loss. It appears they have worked through their key operational issues. We do not treat this as a permanent state; long-term the business unit will be fixed, sold, or fixed then sold.

Gunbroker.com

The website was launched in 1999 by Steve Urvan. It become the eBay for guns (and was actually created because eBay banned sales). It is by far the largest online website in the U.S. and has the same network effects of eBay while also benefitting from regulatory red tape slowing down competitors. About 40% of FFL (Federal Firearms License) holders (think stores) use the site. An individual lists and sell it to anyone in the U.S. However, sales can only be picked up by purchasers at a FFL, which does the background check through the National Instant Criminal Background Check System (NICS) before handing it off.

We want to pause here on the potential value of the platform. It takes a bit of time to understand the culture if you are not in it and we imagine some of our Canadian readers might be particularly unaccustomed. It is not just utility and not all sales are created equal. There are many types of buyers; for example, some customize and some collect antiques. Ever seen a Martini-Henry? https://en.wikipedia.org/wiki/Martini%E2%80%93Henry There are some in the world that really covet this neat piece of kit and this makes an eBay platform very valuable for some buyers and, importantly, it does not necessarily compete against the Walmarts of the world.

The site takes a percentage of every sale (~6%) and has 50% operating margins (~$30MM). More importantly, it has these margins while not having any credit card processing, shipping assistance/service, or even a shopping cart. You literally have to buy one item at a time and accessories were not to be found on the site. This is changing. See the product pipeline below.

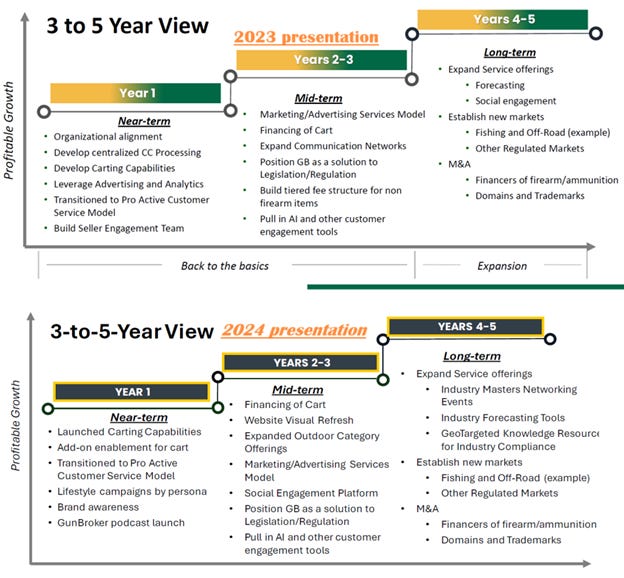

It was purchased by Ammo in the middle of COVID. They acquired it for $240MM, albeit in a complicated deal structure that led to years of board battles after Steve joined the Board. - https://www.globenewswire.com/en/news-release/2021/05/03/2221342/0/en/AMMO-Inc-Announces-Closing-of-Acquisition-of-GunBroker-com.html The two key issues were the vision for gunbroker (whether it should be a neutral platform or promote Ammo ammo) and Steve’s compensation for the sale (significant stock, which declined in price after the deal). It is a bit awkward that the combined entity’s market cap approximates the purchase price. We cover the new CEO later, but the vision since he joined has been consistent; see a comparison of IR presentations below.

The major Board problems appear to be largely settled (or at least the vision for the platform is settled), with the new CEO coming in a few months after the Settlement Agreement. A key piece of the whole story is the new CEO, Jared Smith. Since onboarded, the vision has been clear and he has been transparent. The legal issues with Steve are not quite settled (see background).

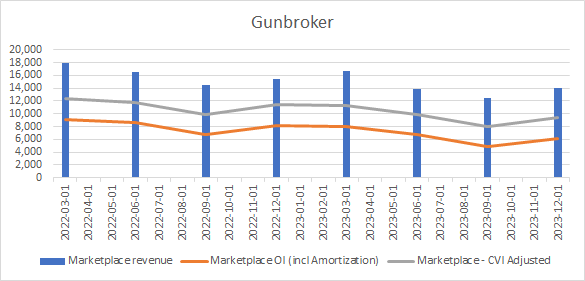

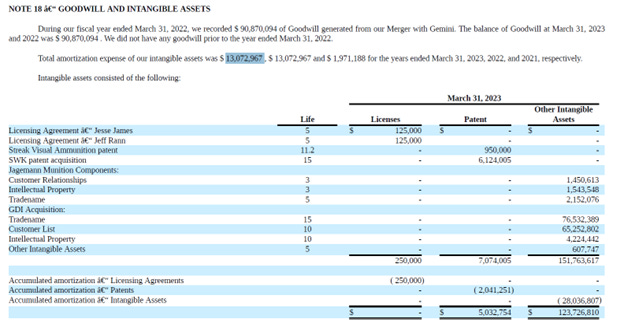

When looking at the division it is important to adjust for the non-cash amortization costs related to the purchase as we show in the chart below.

The cart and payments launched this March - https://www.globenewswire.com/en/news-release/2024/03/14/2846269/0/en/AMMO-Inc-Announces-Launch-of-Multi-Item-Cart-and-Single-Payment-Portal-on-GunBroker-com-to-Streamline-Customer-Experience.html

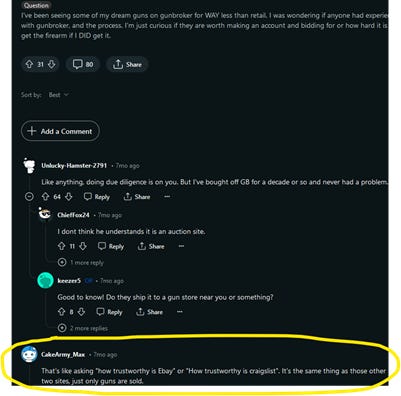

Anecdotal reviews of the platform are pretty consistent. Here is an example.

https://www.reddit.com/r/Firearms/comments/16bnm5n/how_trustworthy_is_gunbroker/

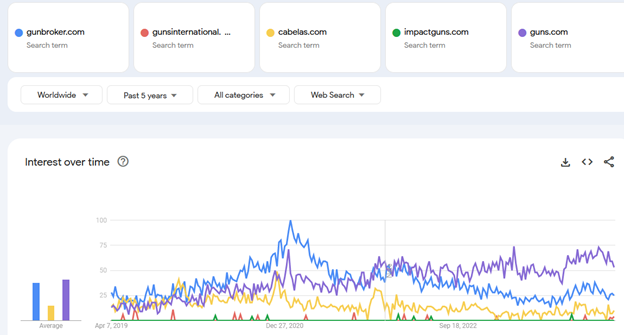

There has been an increase at one competitor, though it is not apples to apples (gunbroker is auction-like/many sellers, the former is fixed price).

NICS Background Checks – The sales indicator

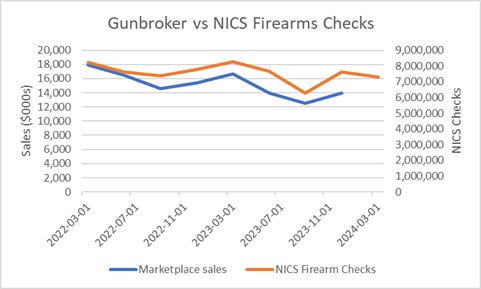

Platform sales largely track overall NICS background checks. We have put together full stats for NICS below. The COVID bump was real.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.