Building a Practical Framework for Value Investing

How do we manage our day-to-day without getting lost?

Here is the latest from Canadian Value Investors!

Ideas from around the web – CNOOC, LUR,FFH

Building a Practical Framework for Value Investing – How do we manage our day-to-day without getting lost?

Ideas from around the web

Disclosure: We do not have a position in any of these companies unless noted, but are evaluating.

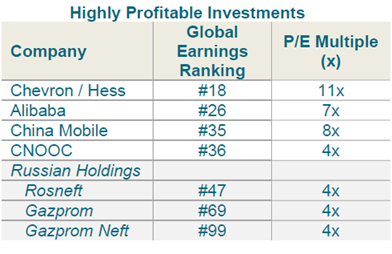

CNOOC Limited - We do not own CNOOC, but we do own Petrobras PBR, the Brazilian equivalent (see archives, remains our largest hold), and the dynamics are similar, albeit PBR is not so cheap anymore. What is the right premium for the political risk?

“Our largest holding is CNOOC, China’s premier oil company which produces 2% of the world’s oil. CNOOC trades on a price to earnings multiple of just 4x and is rapidly expanding its output with a focus on offshore China and Guyana, where it holds a 25% interest in the enormous Stabroek discovery alongside Exxon and Hess.”

https://www.packerco.com/media/newsletters/PackerCo_December2023.pdf

Alpha Vulture: Latitude Uranium merger arbitrage - Uranium (CNSX:LUR) and 92 Energy (ASX:92E) – Large spread possibly driven by where it is listed.

https://alphavulture.com/2024/01/11/latitude-uranium-merger-arbitrage/

Note on Fairfax TSX: FFH short – Muddy Waters

You have probably heard about the Muddy Waters short report on Fairfax Financial. We thought our readers might want a link to the actual report. We do not have a position in Fairfax Financial (we do own Fairfax India), but we were a shareholder of Atlas Corp, one of the case studies. We were bought out by insiders and Fairfax in its privatization. We do not have any comment on the report (other than “The GE of Canada” is a great bombastic headline), but we think the actual Atlas transaction was a great deal for them. In fact, we were actually quite annoyed at the price and would have preferred to continue owning it.

https://www.muddywatersresearch.com/research/ffh/mw-is-short-ffh/

Building a Practical Framework for Value Investing

Value investing is a nightmare.

-It is totally unstructured. There are thousands of companies in hundreds of markets; one week we compared the expected return of a Canadian condo investment to an Australian coal mine.

-It has very weak obvious correlation between effort and outcome, and unlike those blindly confident stock-charters, we do not believe there is simple “head and shoulders” pattern that will guarantee profits.

-You are usually on an island a feel like you are talking to Wilson - You are typically going against market sentiment – the market does not think your idea is undervalued by definition – and so most people by default disagree with you to at least some degree.

-It is very easy to feel like you are going nowhere. – Very correct trades can take years to play out.

-All together, it is delayed gratification on steroids.

Yet, we do this every day.

We genuinely love value investing. There is something about the hunt for an idea and the bet working out that just makes us want to tap dance to the (now virtual) office as Buffett would say. However, the pitfalls of this being how you spend your time has real pitfalls. We have long contemplated about how to keep ourselves motivated to work for decades on ideas that take years. We were recently asked about our day-to-day, and so one of our contributors put together notes on their process and thought it might be a useful article for our readers. Of course, they do not think it is perfect and are always looking for ways to improve, so please reach out if you have any feedback.

Building a Toolbox

In this completely unstructured world of investing, how do you 1) keep on track and 2) feel like you are on track? This framework has really come from combining a few key insights from others:

Charlie Munger on problem solving – “Invert. Always invert.” Charlie Munger’s Standard Causes of Human Misjudgment talk will likely always be our favorite talk. It is meant as a list of warning, but if you invert? How do you take advantage of our under-recognition of the power of what psychologists call “reinforcement”, our bias from consistency and commitment tendency, and simple psychological denial to keep yourself motivated? https://www.canadianvalueinvestors.com/charlie-mungers-list

Steve Jobs on finding the right problems to work on – “I have looked in the mirror every morning and asked myself: "If today were the last day of my life, would I want to do what I am about to do today?" And whenever the answer has been "No" for too many days in a row, I know I need to change something.”

Elon Musk on time – "If you give yourself 30 days to clean your house, it will take 30 days. If you give yourself 3 hours, it will take 3 hours." Elon Musk (supposedly) uses a time management tool called a timebox, which is a tool I have incorporated (discussed below).

Todd Coombs on choosing what investing ideas to pursue – “I think of things in concentric circles. I knew banking and insurance. You don’t jump to technology. He moved into industrials like Cat and Harley. If you can understand their finance arm their industrial arm is generally easier. He grew concentric circles from there.

Marcus Aurelius – “Look inward, not outward. Don’t complain. Don’t meddle in the affairs of others.”

Charlie Munger #2 – “The world is not driven by greed; it's driven by envy.” For investing, this means we should not get distracted by the latest SPAC or the next bitcoin.

Lee Iacocca: Where I Started

Getting the opportunity to run one of America’s largest car companies is an achievement. Lee Iacocca ran two. He started out as an engineer and ended up (near) the top of Ford (under Henry Ford II) as President from 1970-78 and later was hired in 2009 to save Chrysler in the financial crisis.

What was particularly interesting is he had a structured framework to manage his time and priorities.

The first thing is so simple yet immensely helpful. Lee kept a journal where he sat down every Sunday to set the goals for the week.

The ability to concentrate and use your time well is everything if you want to succeed in business–or almost anywhere else, for that matter. Ever since college I’ve always worked hard during the week while trying to keep my weekends free for family and recreation. Except for periods of real crisis I’ve never worked on Friday night, Saturday, or Sunday. Every Sunday night I get the adrenaline going again by making an outline of what I want to accomplish during the upcoming week. It’s essentially the same schedule I developed at Lehigh [University].

Secondly, he was extremely good are concentrating.

As a little kid I had learned how to do my homework right after school so that I could play after supper. By the time I got to college, I knew how to concentrate and how to study without a radio or other distraction. I used to tell myself: “I’m going to give this my best shot for the next three hours. And when those three hours are up, I’ll set this work aside and go to the movies.”…..

……I’m constantly amazed by the number of people who can’t seem to control their own schedules. Over the years, I’ve had many executives come to me and say with pride: “Boy, last year I worked so hard that I didn’t take any vacation.” It’s actually nothing to be proud of. I always feel like responding: “You dummy. You mean to tell me that you can take responsibility for an $80 million project and you can’t plan two weeks out of the year to go off with your family and have some fun?”

If you want to make good use of your time, you’ve got to know what’s most important and then give it all you’ve got.

This reminded me of Vinod Khosla, founder of Khosla Ventures and co-founder of Sun Microsystems. (We wrote an article on his strategies on building teams - http://www.canadianvalueinvestors.com/vinod-khosla-how-to-build-and-manage-a-team-2017 )

As Vinod has noted, you make progress on what you measure.

Work metrics get measured and analyzed but we're terrible about being as accountable in our personal lives — even though the latter can make a huge qualitative difference in performance.

"It's great to know how to recharge your batteries, but it's even more important that you actually do it," Vinod Khosla, a partner at the venture capital firm Kleiner, Perkins, Caulfield and Byers told Fast Company. "I track how many times I get home in time to have dinner with my family. My assistant reports the exact number to me each month. Your company measures its priorities. People also need to place metrics around their priorities…"

The Process in Practice

How do you stay motivated, build in positive reinforcement, commitment, and hope, while spending as little time as possible on planning and tracking? In university, we had time to learn math, science, history, and philosophy all in the same week. How? Through a simple schedule and task list forced on us by the registrar and professors.

At the core, processes need to practical and easy for you to want to use them.

Originally I created a simple Word document on my networked account. It links to all computers and my phone and I pinned the file in my Word apps to make it as easy as possible to access and update.

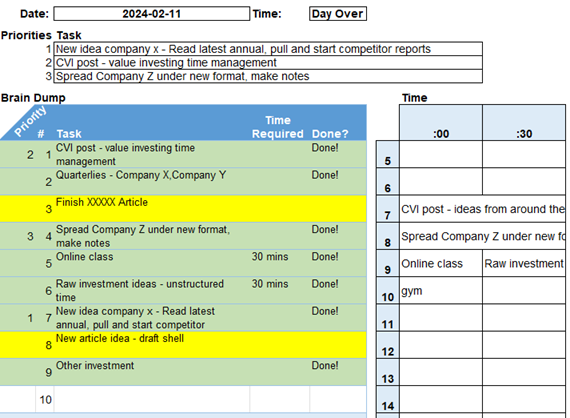

Every Sunday I sat down and wrote down what I really want to accomplish over the next week. For larger tasks I split them into steps that can be done in a week. I updated my progress throughout the week and review the following Sunday. I marked items completed in green and things… not quite done in yellow. Then I could go back and see if I’m really working on what I think is really important instead of getting distracted, and also can visually see the progress I’m making.

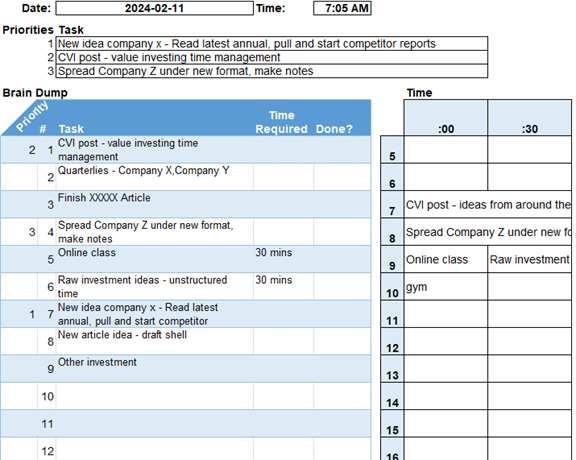

Step 2: Timebox on Steroids

The problem with a weekly Word doc is that you can get lost during the week. It is just messy to try and think day-to-day this way. Instead, I still complete the Sunday list, but now abbreviated and instead mixed that with the addition of a seven-day Excel sheet shown below (one day shown; there is one for each day of the week). Elon Musk is rumored to use a timebox technique, and others like John D. Rockefeller used scheduling, albeit way beyond

With a bit of conditional formatting, it automatically tracks if we completed what we wanted to do or not. At the end of a day or week, we can sit down and see quickly how we are doing. We create a new tab for each week.

The human brain is simple; seeing green helps. If I find myself not seeing green throughout the week, that means I need to ask myself as Steve Jobs would, did I really want to do what I was planning to do this week? If I really did, then what went wrong?

“I do not have time for this” is what I originally thought, but 1) it takes less than five minutes to do in the morning and 2) it keeps me grounded all day. You can easily get lost switching from one idea to the next and at the end of the day feel like you did anything. I now get a lot more done and feel better about it. What do I actually want to get done today? I must note that with this process there is a small risk of you having an existential crisis.

The key for me was not to overengineer. I only put large tasks and possibly group several small tasks to make sure I get them done. I believe Rockefeller had his day broken down into five-minute increments; no thank you. Another big help was literally getting rid of my phone for tasks and closing outlook. I use a simple desktop timer combined with the Japanese Pomodoro system, breaking tasks into 25-minute focused work intervals (Pomodoros) followed by a 5-minute break. The phone sits in another room.

In the unpredictable sea of value investing, where delayed gratification challenges even the most patient souls, constructing a practical framework is not just beneficial – I think it is essential.