Cloning investment ideas in practice – SiriusXM and Ted Weschler's big bet at Berkshire Hathaway

SIRI LSXM

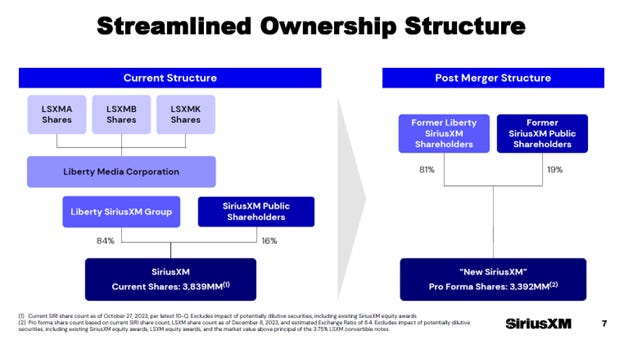

SiriusXM – Putting an end to the cross-holding confusion

Disclosure: We own this one (specifically LSXM).

We are sure you have heard of Sirius XM. Their programming helps over 30 million people get through daily traffic jams through what is effectively a monopoly on satellite radio in the United States. What you might not know is that Liberty SiriusXM Group (Tickers: LSXMA/B/K) is a holding company created by Liberty Media Corporation (a John Malone baby) and holds interests in the (also) publicly listed Sirius XM Holdings Inc. (Ticker: SIRI), the parent company of Sirius XM. Confused? You can thank John Malone.

Who is John Malone? He is a maverick from the cable-age similar to (but not as overbearing) the oil barons of yesteryear like Rockefeller, Carnagie, and Doc. He started as a consultant in the cable industry and ended up with over ten billion dollars. Not bad. Our favorite interview ever is here -

Part of his genius is doing fancy tax-management things like reverse Morris trusts (which allow a company to spin off and sell assets while avoiding taxes). Unfortunately, these structures have come to confuse the market and Liberty Sirius was stuck trading at a large discount to its implied holdings in Sirius. In turn, Sirius announced last December it is finally merging the two entities to simplify their structure into one public listing. At the end of the day, based on the expected deal mechanics, it is trading at about 10x free cash flow or so and Berkshire Hathaway is buying a lot.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Transaction Overview

Per their pitch:

Liberty separates Liberty SiriusXM Group (“LSXM”) through redemptive split-off to form SplitCo holding all LSXM assets and liabilities

Immediately following split-off, SplitCo acquires SiriusXM in all stock transaction to form New SiriusXM with one class of common stock

LSXM shareholders receive 1 share of New SiriusXM for each share of SiriusXM previously held at LSXM, adjusted for LSXM net liabilities

Results in estimated Exchange Ratio of 8.4 shares of New SiriusXM per share of LSXM held

SiriusXM minority shareholders receive 1 share of New SiriusXM for each share of SiriusXM held

Subject to required approvals, including majority vote of LSXM shareholders, receipt of tax opinions, required regulatory approvals and customary closing conditions

Expected to close early Q3’24

Of course, in John Malone fashion, the “transaction is intended to be tax free to LSXM and SiriusXM shareholders, except with respect to cash received in lieu of fractional shares”.

The original announcement is here - https://www.bamsec.com/filing/110465923125188

The slide deck is here, see December 12th - https://www.libertymedia.com/investors/news-events/presentations

LSXM was trading at a huge discount to its implied value of SIRI earlier this year and there were numerous posts about this “arbitrage”. The spread persisted because SIRI shares were not available to borrow at low rates. Unfortunately for LSXMA/K holders, the spread has largely collapsed down via SIRI declining rather than LSXM rising.

The Berkshire Bet

As we have talked about before, one investing strategy is to clone investments (“bowling with bumpers” as Mohnish Pabrai says). To properly copy, we think you need to buy ideas that:

1) Are from a fund manager with a long history of success – 15-20+ years is ideal.

2) Represent high conviction by the fund manager – Realistically a meaningful hold – 20+% ideally, but 10% might be sufficient to qualify depending on their portfolio strategy.

3) Can be bought at a price similar to what they bought it at.

4) The idea is (ideally) within you circle of competence – Focus on ideas you can understand and spend as much time as you can learning to increase your circle of competence.

SIRI is checking boxes one to three and the fourth, of course, depends on the reader.

When looking at Berkshire’s holdings you have to be careful. Warren Buffett hired Ted Weschler and Todd Combs to run separately managed investment accounts ($34 billion combined as of 2022) while larger holdings are still effectively Warren’s. Berkshire’s book is much larger than ours and ends up being a bit more diversified given the size and management structure; an expected and welcome problem for folks with a portfolio over $300 billion. For example, buying $2 billion more of a stock would be very high conviction if it is Ted or Todd but immaterial for Buffett. That said, the top 5 in the book make up over 75% at the moment, a remarkable level of concentration.

If you are fishing for ideas from Ted and Todd, you have to separate out the portfolio and remove holdings that are clearly Buffett. One or both of the managers might also have a position in the same company as Buffett and each other, given they are all truly separately managed, but it still gives you a good indication of their holdings.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.