CVI Update: Exited Talen Energy, Taiga Building Product’s parent tries to go private

And we fret about inflation

Here is the latest from Canadian Value Investors!

Talen Energy Corp (NASDAQ:TLN) exited: A case study of re-rating

SiriusXM Holdings (NASDAQ:SIRI) – Berkshire buys more

A macro moment: Druckenmiller on inflation

Palantir – A sign of the times

Taiga Building Products (TSX:TBL) - Their Singapore parent Avarga tries to go private

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

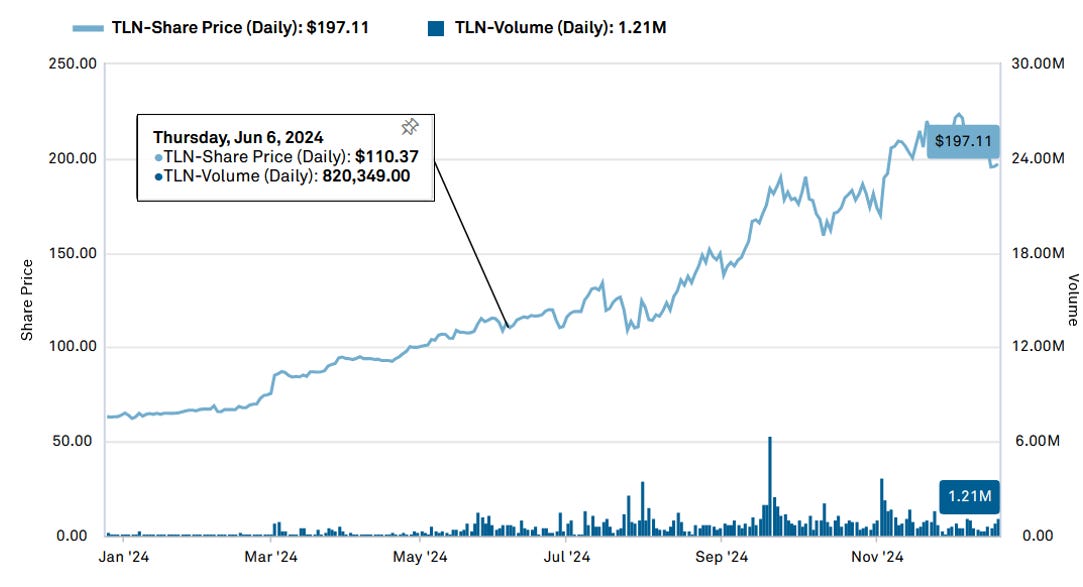

Talen Energy Corp (NASDAQ:TLN) exited: A case study of re-rating

We have exited Talen Energy Corp (NASDAQ:TLN), our favorite out-of-bankruptcy nuclear power plant (and other power generation assets). We wrote this up in June and it went as expected. After posting the company uplisted to the NASDAQ from OTC. The combination of repurchases and rerating of the multiple to a more normalized level as well as a good underlying power demand outlook caused it to double. See original article here - https://open.substack.com/pub/canadianvalueinvestors/p/talen-energy-corporation-otc-tlne

They announced further repurchases primarily through normalizing leverage. After repurchases, there are ~46MM shares outstanding for a market cap of ~$9.2B. Why are we selling? For us it is always checking relative value and absolute value. It is now up to a ~20x free cash flow multiple. This is still a discount to other comps like Constellation Energy Corporation (though it should trade at some discount), it is much too expensive compared to our other holdings. They will continue repurchases, but accounting for the multiple improvement does not offset the debt starting to get beyond our comfort levels. Additionally, the excitement over power demand due to AI causes us to fret. We like easier problems and will leave the stock to those wanting infrastructure asset level-returns.

HOUSTON, Dec. 13, 2024 (GLOBE NEWSWIRE) -- Talen Energy Corporation (“Talen” or the “Company”) (NASDAQ: TLN) announced today that the Company has closed on its previously announced $850 million incremental Term Loan B credit facility (the “Financing”) and the repurchase (the “Repurchase”) of an equivalent value of shares of Talen’s outstanding Talen common stock, par value $0.001 per share (“Common Stock”) from affiliates of Rubric Capital Management LP (collectively, “Rubric”).

The Company previously announced it would use the proceeds from the Financing to repurchase an equivalent value of shares of Common Stock held by Rubric. Upon the successful upsizing of the Financing from $600 million to $850 million, the Company determined it would use cash on hand to further increase the value of the Repurchase from $850 million to $1 billion in aggregate purchase price. Shares repurchased using the proceeds from the Financing are incremental to the Company’s previously announced share repurchase program. The additional shares repurchased with $150 million of cash on hand utilized capacity under the existing share repurchase program, leaving approximately $1.08 billion of remaining capacity available under the program through 2026…Following the Repurchase, 45,961,910 shares of the Company’s Common Stock remain outstanding.

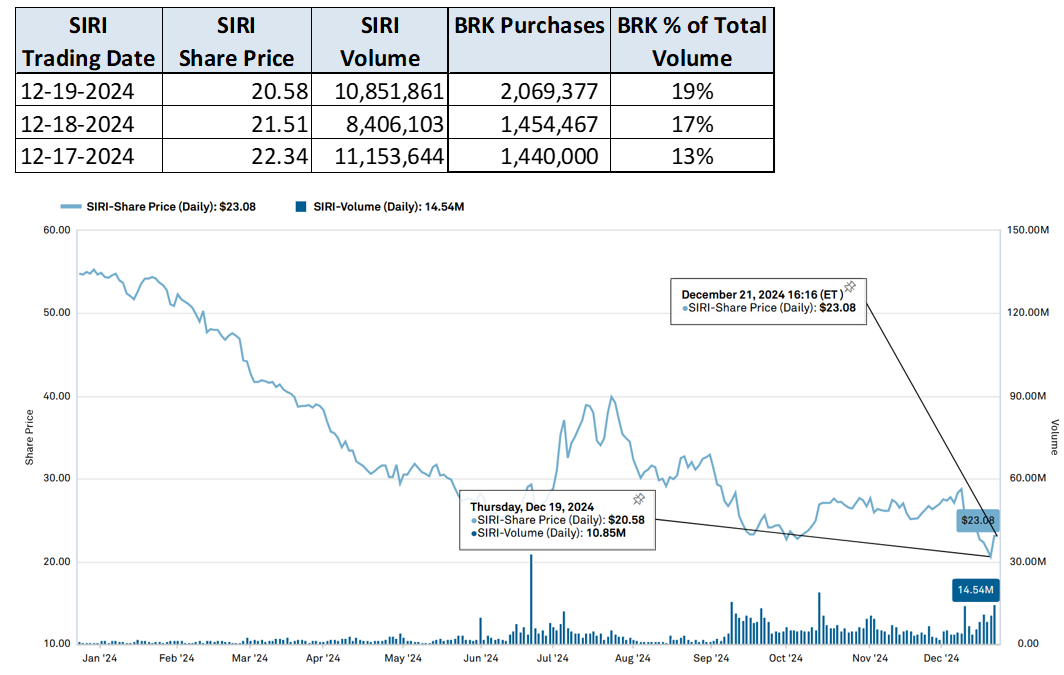

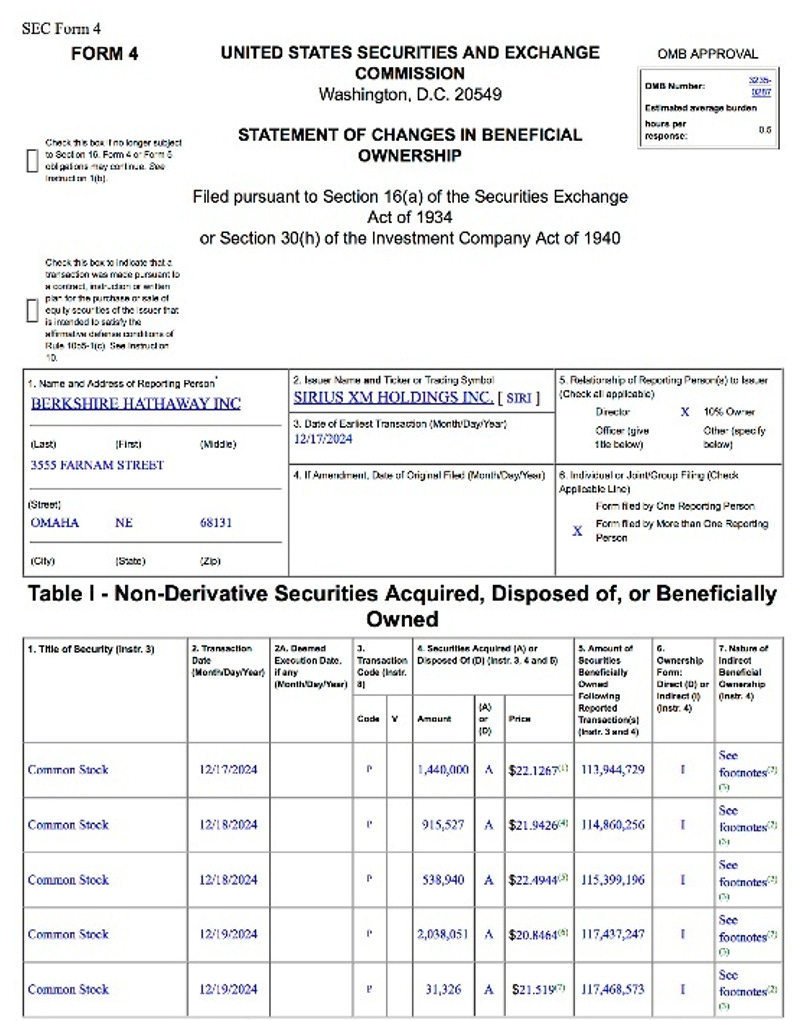

SiriusXM Holdings Inc. (NASDAQ:SIRI) - Berkshire buys more

Disclosure: We remain long SIRI.

Lots of market noise, but Berkshire Berkshire just keeps on buying Sirius XM like satellite radio ain’t going out of style. Another ~$100 million over a week, bringing total share count to ~117MM of ~339MM or ~35%. They are the largest holder by far now and we continue to think it is Ted Weschler. How does Berkshire trade anyway? We were curious and checked their proportion of daily volume – we calculated 13-19% over the three days based on their filing. See our last background post here - https://www.canadianvalueinvestors.com/p/liberty-sirius-siri-lsxma-lsxmk-in

A macro moment: Stanley Druckenmiller on Inflation

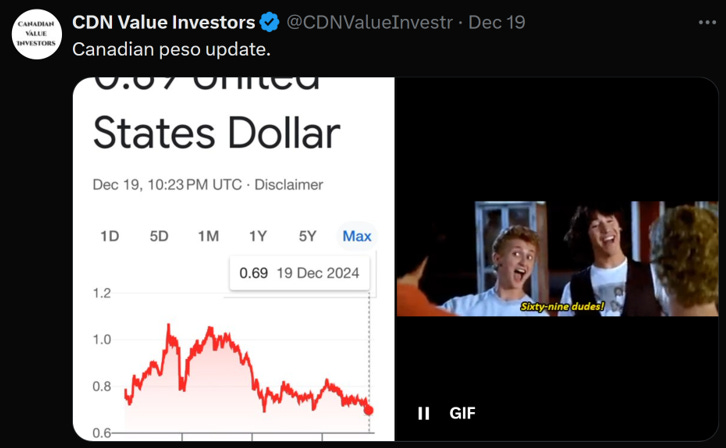

Structural deficits, cheap money, oh my. We continue to worry about inflation and Canada in general. Structural deficits are an increasing problem everywhere. Canada just blew through it’s expected $40B deficit to hit $62 (with some gaming to keep even that number down) and our finance minister Christina Freeland dropping the mic on her way out. Her full resignation letter is at the end.

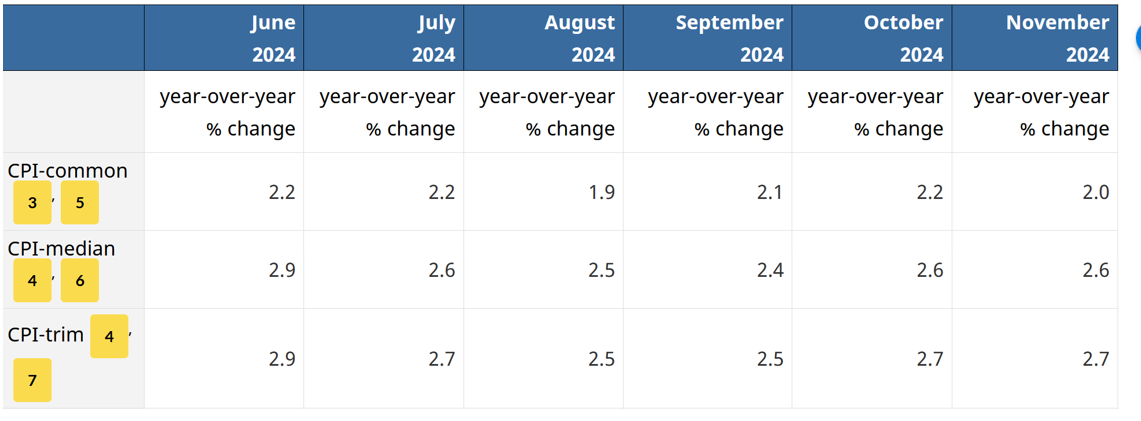

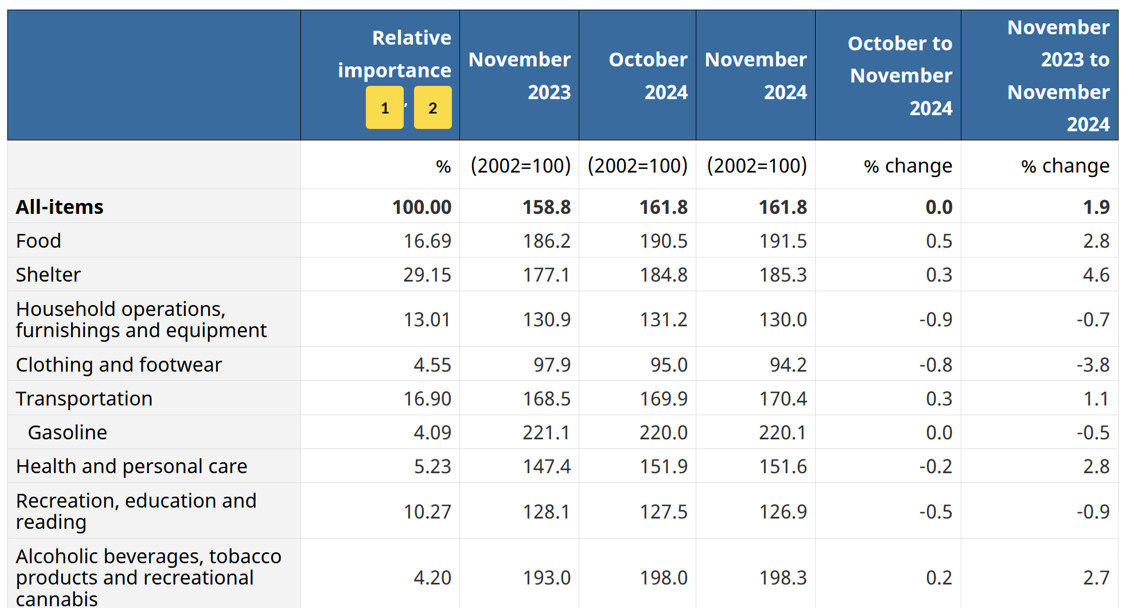

Recent headlines about inflation in Canada have said things like “Canada’s inflation rate cools more than expected” (Financial Post). We like looking at the actual numbers. For items people need like food, shelter, and (increasingly) alcohol and marijuana, inflation remains stubbornly high; housing is at 4.6% year-over-year and we still cannot build houses (see next). Table below sources from https://www150.statcan.gc.ca/n1/daily-quotidien/241217/t001a-eng.htm and https://www150.statcan.gc.ca/n1/daily-quotidien/241217/t004a-eng.htm

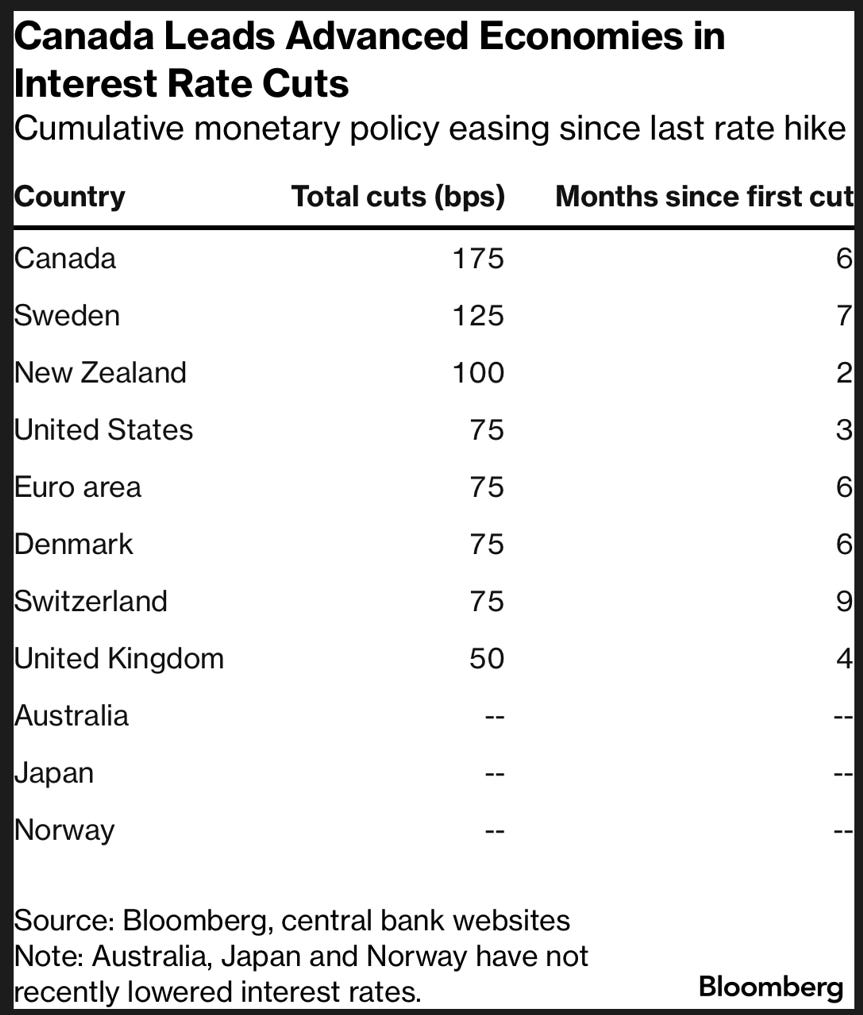

The latest political noise of Freeland resigning from government has helped pushed the Canadian Peso to a new low. At least Canada is finally #1 at something; interest rate cuts.

https://x.com/cafreeland/status/1868659332285702167

And then there’s China.

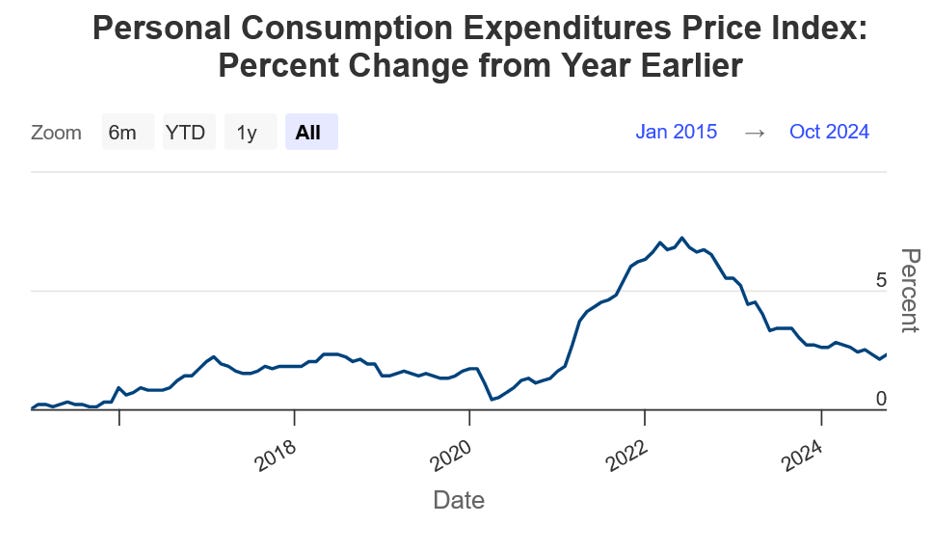

The U.S. inflation rate also seems a bit stuck, or possibly ticking up. https://www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm

What does Stanley Druckenmiller think?

Stanley has an extremely good investment track record and has also been right about a number of macro calls. His 2021 article was particularly on point – The Fed Is Playing With Fire: Clinging to an emergency policy after the emergency has passed, Chairman Powell courts asset bubbles.

https://www.wsj.com/articles/the-fed-is-playing-with-fire-11620684980

And a quote from 2021: “I can’t find any period in history where monetary and fiscal policy were this out of step with the economic circumstances, not one.”

So we tend to listen to what he has to say. He recently did an interview and touched on inflation.

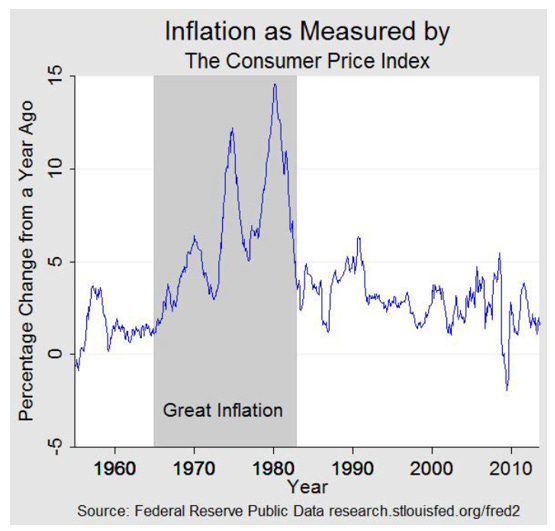

In the 1970s inflation came down from a remarkably similar level to where it was in 2021. Back then, inflation peaked at 9%, while in the 1970s, it reached about 8%. Inflation in the 1970s dropped to 3% as the Fed eased due to the 1975 recession, but it quickly spiked back up, peaking at 12% when Volcker came in and smashed it. While I’m not predicting that [scenario], but when you’re easing monetary policy during a financial market melt-up, combined with the current fiscal policy, it is certainly a risk. I think it is a mistake to not be taking that risk into account.

I don’t really understand the rush to 50 basis points. I think that markets have priced in a 97% chance of a cut at the next meeting; that’s all because of Fed guidance. My friend Jim Grant, one of my favorite writers, said they’re not really data-dependent; they’re forward-guidance dependent. And that’s what they’re showing again. Look, he might be right— and I hope he is—but it’s a big risk. Because if they’re wrong and inflation takes off because monetary policy isn’t actually restrictive, and we have fiscal expansion going on, then they’ll have to tighten again. It could be a nightmare for markets and maybe even for the independence of the Fed. You can’t make multiple mistakes like that. But I’m not predicting it—I’m just asking why they went 50 and why they need this forward guidance.

Question: I’m glad you brought up Fed independence. Are you concerned about it in the scenario of a Donald Trump win? In an interview just a day ago, Bloomberg’s editor-in-chief, John Micklethwait, said the job of the Fed is to show up in the office once a month and flip a coin. On the other hand, your longtime colleague Scott Bessant has been informally advising Trump and floated the idea of a shadow Fed chair. How compromised is Fed independence at this juncture?

Well, I think a shadow Fed and this kind of talk is a horrible idea and irresponsible. However, if Trump were elected, I think the institution would hold. A bigger threat to the Fed would be major mistakes by the Fed itself. I think the Fed is obsessed with soft landings and fine-tuning, but to me, that’s not their real job. Their job is to avoid the kind of problems we had with the Great Financial Crisis, which, in my opinion, happened because the Fed was too easy-going and created a housing bubble. And then obviously, after COVID—not the initial actions, but sticking with it for a year and a half, buying bonds while the money supply exploded—to me [that’s where the problems were]. They’ve got to stop the fine-tuning and look at the bigger picture. If they stick to forward guidance and inflation starts rising again, that could lead to a hard landing, not the soft one they’re aiming for.

He also commented on Trump’s chances pre-election and the impact of a red sweep. Note this was pre-election on October 16th.

Question: Looking forward, another big uncertainty is the November election. What’s the Druckenmiller playbook for this election cycle? What do you think is the most likely scenario, and how are you setting up for it?

Well, it’s an evolving situation. If you’d asked me 12 days ago, I would’ve said I had no clue. Honestly, I still don’t have conviction on who’s going to win. But as I’ve said before, I like market indicators—not just for the economy and financial restrictiveness, but for elections too. I remember how right the market was about Reagan in 1980, even when the pundits disagreed. Over the last 12 days, the market and insiders in the market have been very convinced Trump is going to win. You can see it in the bank stocks, in crypto, even in DJT, his social media company. Across the board, industries that would benefit from deregulation under Trump are outperforming the others. If you put a gun to my head—thank God there’s not one—I’d say Trump is the favorite to win. But who knows what these polls even mean? Nobody responds to them anymore.

As for the potential outcomes, let’s consider four: a blue sweep, a red sweep, Trump with a blue Congress, or Harris with a red Congress. A blue sweep seems extremely unlikely. State-by-state polls suggest Republicans will take the Senate, so the math just doesn’t work. A blue sweep would be rough for equities for three to six months—higher taxes, lower business confidence, no regulatory changes—it’s just not good for investors…The good news, or bad news depending on your view, is that it’s highly unlikely, so that playbook probably won’t matter.

A red sweep, though, is more likely than Trump winning with a blue Congress. Anyone voting for Trump is probably not flipping to vote Democrat in Congress. A red sweep could bring animal spirits back in the business community. You get deregulation…which might provide a short-term boost for the economy, maybe three to six months. My fear, though, is that bond yields already don’t reflect the proper economic outlook, and a bad reaction in fixed-income markets could snuff out any equity rally…there are stocks and things to do.

I also think that under a red sweep and [for the reasons I just listed and relationships] I think the Fed would be much more hawkish than under a Harris administration.

Subsequent to this, the Fed cut by 25 bps “but Signals 2025 Rate Cuts Likely Sparse”. https://www.forbes.com/sites/dereksaul/2024/12/18/fed-announces-another-25-basis-point-interest-rate-cut-but-signals-2025-rate-cuts-likely-sparse/

It is important to remember that even the Great Inflation of the 1970s was not a straight line up. https://www.federalreservehistory.org/essays/great-inflation

Palantir – A sign of the times

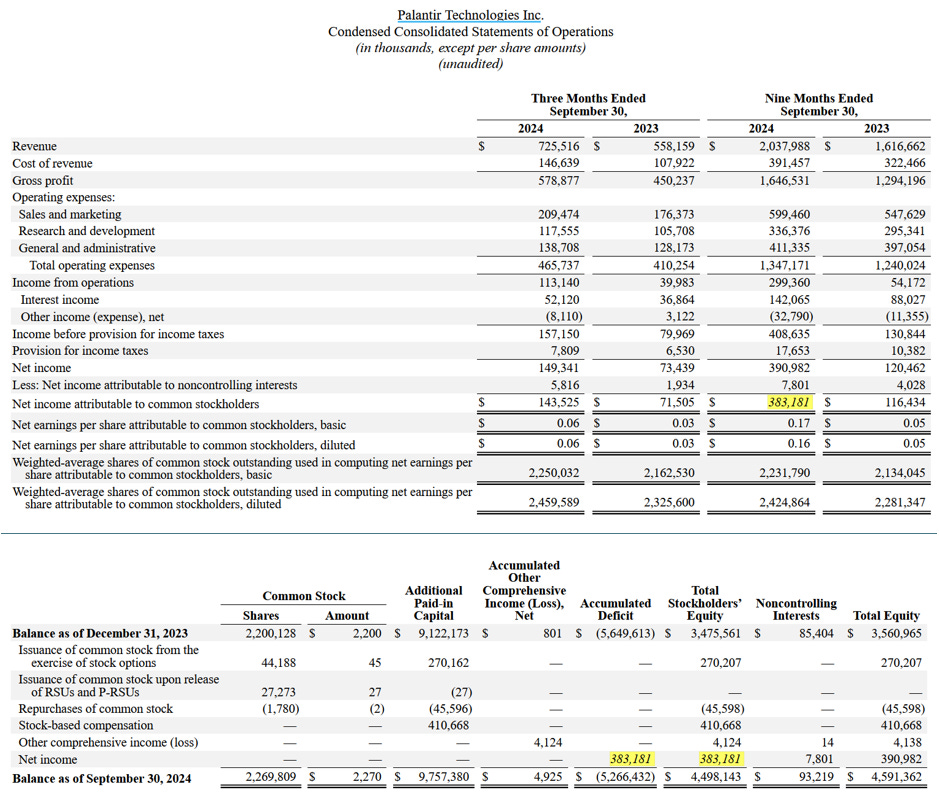

We have no position in Palantir. The CEO recently gave an interview though that made us wonder about the times we are in. Is $183 billion a reasonable market cap for this kind of cash flow and management compensation of half a billion a year plus? All we know is he sure is excited about his business.

These short sellers who are going short on a truly great American company, not just ours. But they just love pulling down great American companies so that they can pay for their coke. The best thing that can happen to them is, we will lead their coke dealers to their homes after they can’t pay their bills.

https://x.com/jawwwn_/status/1767940876146241809?s=12

Taiga Building Products (TSX:TBL) – Their parent Avarga tries to go private

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.