Here is the latest from Canadian Value Investors!

Berkshire Hathaway AGM – We miss you Charlie

Seneca Foods turns 75

Joel Greenblat’s Magical Formula in practice

Liberty Sirius – Ted keeps buying

Saker Aviation SKAS – Is Saker Aviation taking off or grounded?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Berkshire Hathaway AGM – We miss you Charlie

We sure missed Charlie at the Berkshire AGM this year. You can find the full recording here.

There has already been a lot of coverage of this as usual, and so we do not have much to add. Two interesting points were that Buffet “does do not feel uncomfortable in any shape or form putting our money into Canada. In fact, we’re actually looking at one thing now.” We are coffee betting it is in the utility/infrastructure space. Some suggested it might be CNR or CPKC, but we think another class 1 railroad merger would never pass regulatory approval.

Secondly, they have for the first time provided the AGM intro movie to the public as an homage to Charlie. Historically, you had to attend in person and the video was shown one time only. This year’s video included a few clips from past years we attended (the Breaking Bad skit from a few years ago is our favorite). They also had a number of his more famous quotes. A few we live by:

"I think you would understand any presentation using the word EBITDA (earnings before interest, taxes, depreciation, and amortization) if every time you saw that word, you just substituted the phrase 'bullshit earnings'."

"I don't think you can trust bankers to control themselves. They're like heroin addicts."

“If you mix raisins with turds, they're still turds.”

Charlie with Todd Combs

A good find by Clark Square Capital @ClarkSquareCap on Twitter is a recap of a conversation Charlie had with Todd Coombs at the Singleton Prize for CEO Excellence in 2022. https://x.com/ClarkSquareCap/status/1789075333213569449 https://drive.google.com/file/d/132Aul_OH0hNP3B00S5jcIEtgAnbdV1Cq/view?pli=1

Is there a time you enjoyed investing most [Charlie]?

Well, that's the thing is, it's the sowing when you're almost sure of the wind is almost funner than the reaping. I'm not sure that I don't enjoy the sowing. I like them both, but I think I may like the sowing better than the reaping. When you know you're going to nail it, every single transaction, every day, that's a very satisfying feeling.

Seneca Foods turns 75

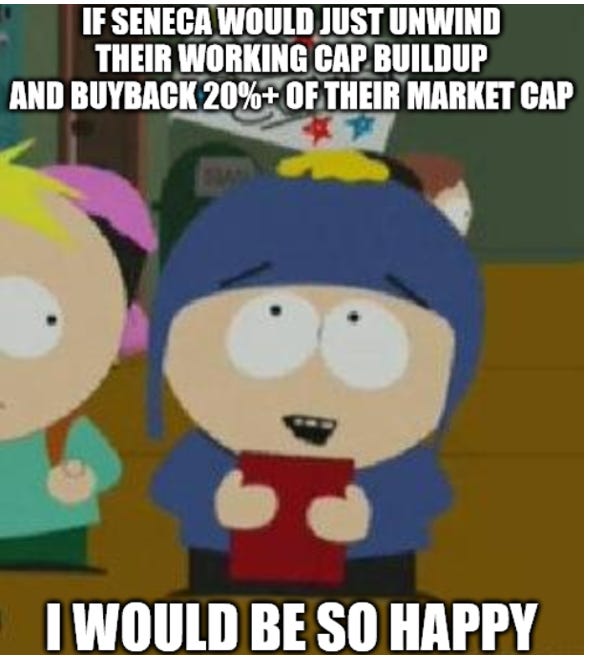

Our favourite canned food company has turned 75. Here is a link to our original post. It continues to be cheap (in our view) and we continue to hold. https://canadianvalueinvestors.substack.com/p/seneca-foods-nasdaq-senea-canning

Since our last update, the Green Giant frozen food business owned by B&G is now up for sale; if you recall they purchased the Green Giant canned food business from them last November. https://www.fooddive.com/news/bg-foods-sale-green-giant-frozen-canned-vegetable-businesses It is not clear that Seneca would want to (or could) buy this business, but the remaining canned goods business would be an obvious fit.

We continue to hold and eagerly await the working capital unwind.

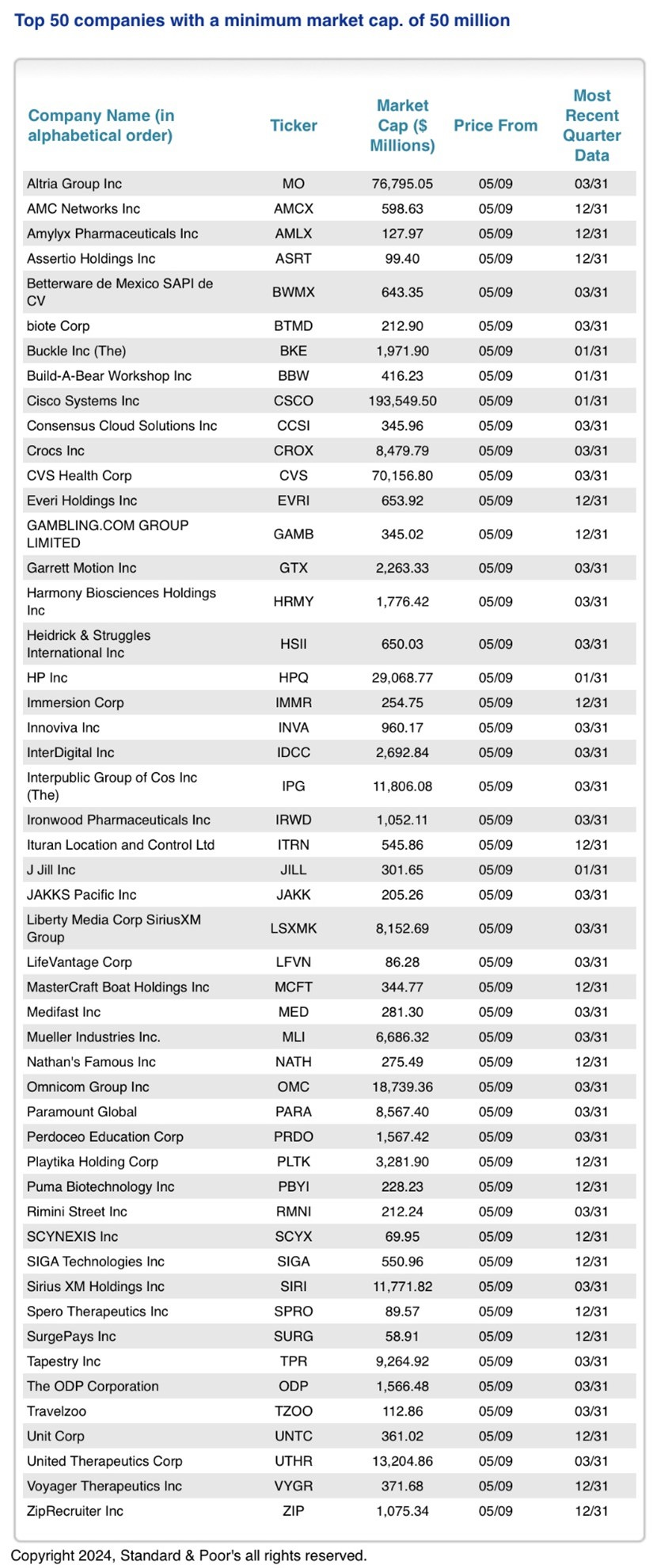

Joel Greenblat’s Magical Formula in practice

Another great find recently was by ToffCap.

https://twitter.com/toffcap/status/1789272494060589553

Joel Greenblatt's book The Little Book That Beats the Market” outlines a simple screen to find investment ideas, being:

1) Earnings Yield (inverse of P/E), and

2) Return on Capital

Greenblatt suggests ranking all stocks by these two criteria, then buying a portfolio of the top-ranked companies. Investors are advised to hold each stock for a year, then re-evaluate their portfolio by rerunning the formula and making necessary adjustments.

ToffCap ran the screen (minimum market cap of $50MM) and interestingly it comes up with some talked about value favourites, including Sirius XM/Liberty Sirius (we are long along with Ted Weschler, see next), Crocs, Unit Corp, Build-a-Bear, and AMC Networks (no positions at the moment). Happy hunting.

Liberty Sirius – Ted keeps buying

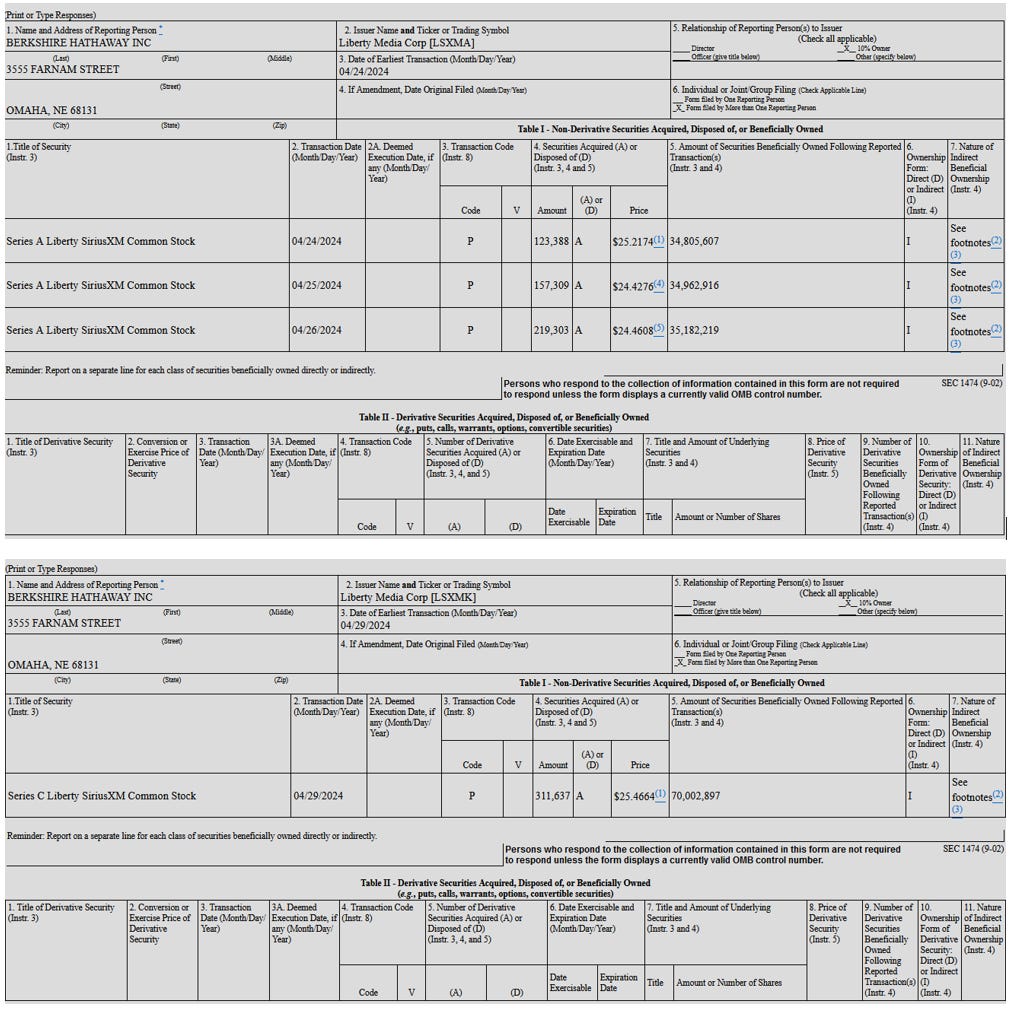

As we noted in our April 23rd post about cloning ideas in practice, Sirius XM remains an idea to copy. And goodness. Berkshire Hathaway (really Ted Weschler we think) now owns over 105 million shares of The Liberty SiriusXM Group between $LSXMA and $LSXMK, or about 32% of shares outstanding. And they continue buying. We remain long.

Is Saker Aviation SKAS taking off or grounded?

Disclosure: We own this one.

We love oddball companies, and Saker Aviation definitely is one.

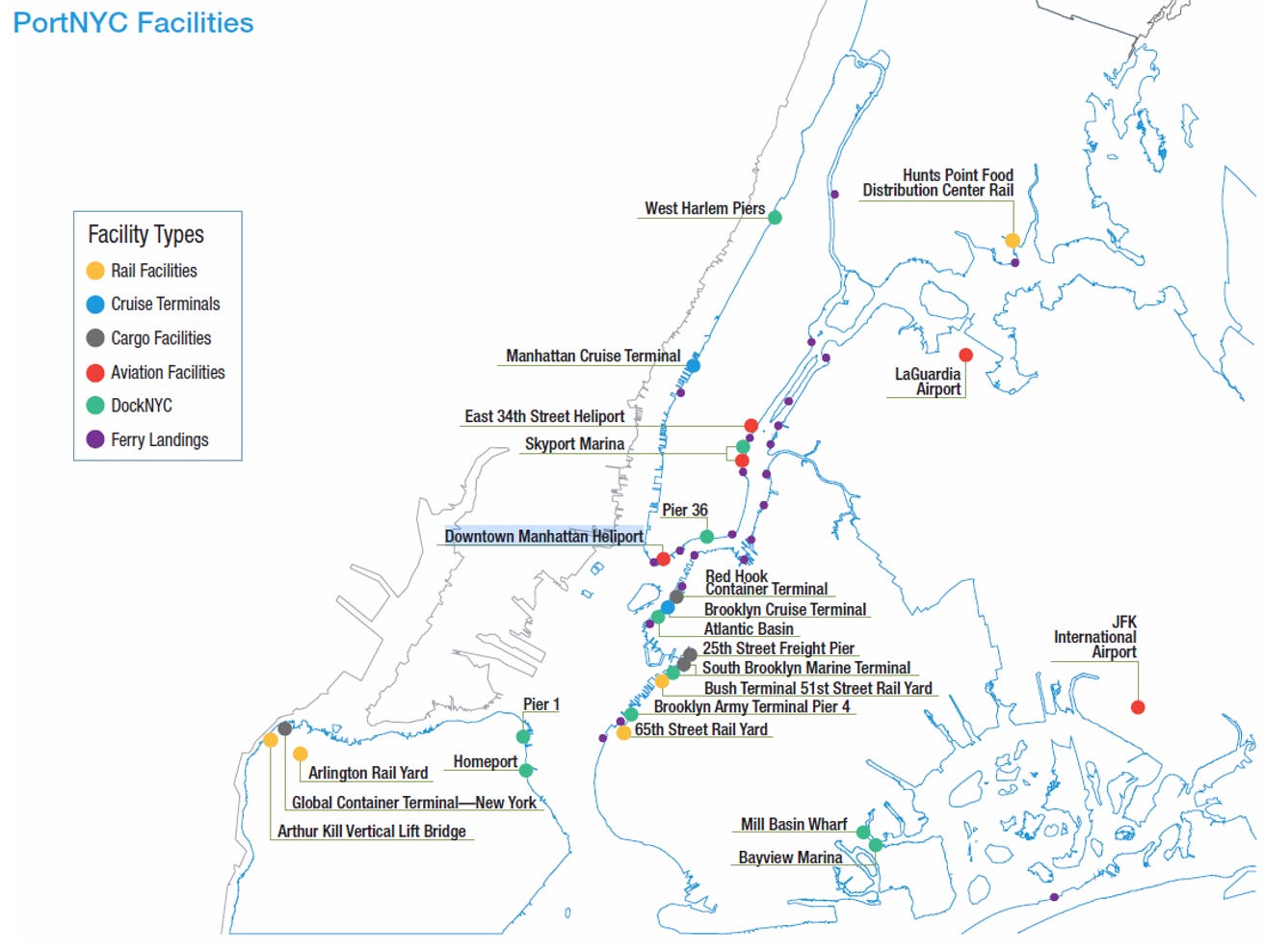

Our business activities at the Downtown Manhattan Heliport commenced in November 2008 when we were awarded the Concession Agreement by the City of New York to operate the Heliport, which we assigned to our subsidiary, FirstFlight Heliports, LLC d/b/a Saker Aviation Services (“FFH”).

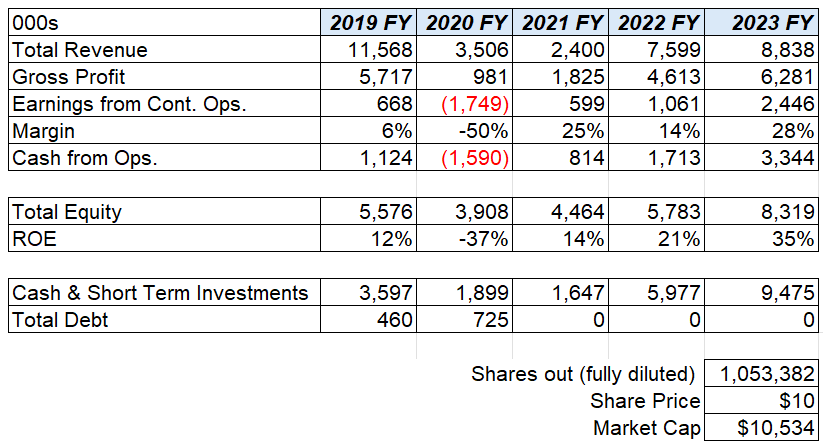

This tiny nano cap is trading at about $10MM in total market cap, has nearly that in cash without any debt, and earned $2.4MM last year. But is this business going to take off or get grounded?

The Heliport

Saker has been operating the only commercial heliport in downtown Manhattan for over 15 years.

The issue is the heliport is going through an RFP process that is a bit different than previous ones and being New York, it is quite political.

https://edc.nyc/press-release/downtown-manhattan-heliport-to-transform-sustainable-transportation-local-deliveries Mayor Adams, NYCEDC Move to Transform Downtown Manhattan Heliport into First-of-Its-Kind Hub for Sustainable Transportation, Local Deliveries. It was a November 2023 RFP (with a relaunch in there) originally a January deadline, and was later extended to February.

Previous NIMBYism has affected the business, with the biggest change occurring in 2016.

On February 5, 2016, the Company and the New York City Economic Development Corporation (the “NYCEDC”) announced new measures to reduce helicopter noise and impacts across New York City (the “Air Tour Agreement”). Under the Air Tour Agreement, the Company has not been allowed to permit its tenant operators to conduct tourist flights from the Downtown Manhattan Heliport on Sundays since April 1, 2016. The Company was also required to ensure that its tenant operators reduce the total allowable number of tourist flights from 2015 levels by 20 percent beginning June 1, 2016, by 40 percent beginning October 1, 2016 and by 50 percent beginning January 1, 2017. The Air Tour Agreement also provided for the minimum annual guarantee payments the Company is required to pay to the City of New York under the Concession Agreement.

Fights have been ongoing. For example, in March of 2023:

Congressman Dan Goldman Calls on Governor Hochul and Mayor Adams to End Non-Essential Helicopter Flights From Manhattan Heliports Targeted News Service Targeted News Service

NEW YORK, May 26 -- Rep. Daniel Goldman, D-New York, issued the following news release and letter on May 24, 2023:

Congressman Dan Goldman (NY-10) today joined Congressman Jerry Nadler (NY-12) in leading a request to Governor Kathy Hochul and New York City Mayor Eric Adams to end non-essential helicopter flights from New York City's West 30th Street Heliport, East 34th Street Heliport, and Downtown Manhattan Heliport. New York City has one of the world's highest rates of non-essential helicopter use, creating untenable amounts of noise and air pollution. Over 95 percent of the 58,000 annual helicopter flights from the NYCEDC-owned East 34th Street Heliport and Downtown Manhattan Heliport are non-essential flights.

The letter was joined by Representatives Adriano Espaillat (NY-13), Yvette Clarke (NY-11), Nydia Velazquez (NY-07), Jamaal Bowman (NY-16), and Alexandria Ocasio-Cortez (NY-14).

"Non-essential helicopter flights are a blight on quality of life for our communities on the waterfront," Congressman Dan Goldman said. "For years, New Yorkers have been subjected to unacceptable levels of noise pollution and a continuing decrease in air-quality due to the thousands of non-essential helicopter flights traveling over Manhattan. While my office continues to push for meaningful solutions from the FAA, we have the opportunity to take action at the state and local level to address New Yorkers' pressing quality of life concerns by ending non-essential flights taking off from the City."

There is also a push to turn it into the heliport of the future! “Mayor Adams, NYCEDC Move to Transform Downtown Manhattan Heliport Into First-of-its-Kind Hub for Sustainable Transportation, Local Deliveries”

The Contract

What does a contract with New York look like? Here you go - https://contracts.justia.com/companies/saker-aviation-services-inc-2216/contract/1262196/

The full scope of their role is outlined in the contract. Duties include helicopter services, maintenance of the facility and related equipment, and – a fitting necessity for New York – pest control. See background note on the contract timeline/history in the appendix.

Section 2.02 Scope of Services. Operator shall operate the Heliport as a public-use heliport and for any other purpose consistent with the terms of this Agreement, and perform or cause to be performed, the services required for such operation. Operator shall manage the operations of the Heliport in a safe and efficient manner and maintain the Heliport in a clean, orderly, safe and operational condition in conformity with all applicable national safety guidelines, federal, state and local laws, rules, regulations and other requirements, including all Department of Environmental Protection (“DEP”) and FAA directives, regulations and restrictions. Operator will conduct such operations in a manner that is responsive to directives of the City and Agreement Administrator; confer with the community surrounding the Heliport and the users of the Heliport; and cooperate with the City and Agreement Administrator in resolving community complaints and concerns. Operator’s services shall include, but not be limited to, the following:

Customer concentration is high as expected.

“Beginning in April 2022, the Company’s customers began operating at pre-pandemic levels which continued through the end of 2022. In June 2022, a new tenant began operating at our Downtown Manhattan Heliport. For the fiscal year ended December 31, 2022, three customers represented approximately$184,000, or 75%, of the balance of accounts receivable. In addition, these three customers represented approximately 83% of our revenue in 2022. The Company has a security deposit in place for each of these customers.

In September 2023, one of the Company’s former customers resumed operations. For the fiscal year ended December 31, 2023, four customers represented approximately $248,000, or 84.1%, of the balance of accounts receivable. In addition, these four customers represented approximately 84.8% of our revenue in 2023. The Company has a security deposit in place for each of these customers.”

There have been other ideas over the years in the business, including most recently their Garden City business.

As disclosed in a Current Report on Form 8-K fi led with the SEC on November 2, 2022, on October 31, 2022 (the “Closing Date”), the Company sold its subsidiary FBO and MRO operations of FBO Air-Garden City, Inc. (“GCK”) to Crosby Flying Services, LLC (the “Buyer”) for an aggregate purchase price of $1.6million.

The Buyer paid the purchase price on the Closing Date less $160,000 (the “Installment Payment”) which was paid in cash upon the first anniversary of the Closing Date.

GCK results of operations have been reported as discontinued operations in the Condensed Consolidated Statements of Operations for the year ended December 31, 2022.

Is a high risk, illiquid, concentrated business with key contract risk for everyone? Absolutely not. In fact, it is appropriate for very few. But it is neat to own a slice of New York (or at least a lease of it).

Thank you for subscribing!

Background note - Contract Timeline

The Company was party to a Concession Agreement, dated as of November 1, 2008, with the City of New York for the operation of the Downtown Manhattan Heliport (the “Concession Agreement”). Pursuant to the terms of the Concession Agreement, the Company was required to pay the greater of 18% of the first $5,000,000 in any program year based on cash collected (“Gross Receipts”) and 25% of Gross Receipts in excess of $5,000,000, or minimum annual guaranteed payments.

On February 5, 2016, the Company and the New York City Economic Development Corporation (the “NYCEDC”) announced new measures to reduce helicopter noise and impacts across New York City (the “Air Tour Agreement”). Under the Air Tour Agreement, the Company has not been allowed to permit its tenant operators to conduct tourist flights from the Downtown Manhattan Heliport on Sundays since April 1, 2016. The Company was also required to ensure that its tenant operators reduce the total allowable number of tourist flights from 2015 levels by 20 percent beginning June 1, 2016, by 40 percent beginning October 1, 2016 and by 50 percent beginning January 1, 2017. The Air Tour Agreement also provided for the minimum annual guarantee payments the Company is required to pay to the City of New York under the Concession Agreement.

Additionally, since June 1, 2016, we have been required to provide monthly written reports to the NYCEDC and the New York City Council detailing the number of tourist flights conducted out of the Downtown Manhattan Heliport compared to 2015 levels, as well as information on any tour flight that flies over land and/or strays from agreed upon routes. The Air Tour Agreement also extended the Concession Agreement for 30 months and gave the City of New York two one-year options to extend the term of the Concession Agreement. The term of the Concession Agreement was subsequently extended by the City of New York through April 30, 2023 by the city’s exercise of both its two one-year option renewals.

On February 15, 2023, NYCEDC reported that it would be bringing a new concession agreement with the Company as the operator of the Downtown Manhattan Heliport to the New York City Franchise and Concession Review Committee meeting on March 3, 2023. The item was subsequently removed from the agenda, with NYCEDC announcing on April 7, 2023 that the previous Request for Proposals ("RFP") had been cancelled and that it is their intention to put out a new RFP in 2023.

On April 28, 2023, the Company entered into a Temporary Use Authorization Agreement (the “Use Agreement”), effective as of May 1, 2023, with the City of New York acting by and through the New York City of Department of Small Business Services (“DSBS”). The Use Agreement has a term of one year. Pursuant to the terms of the Use Agreement, the Company has been granted the exclusive right to operate as the fixed base operator for the Downtown Manhattan Heliport and collect all revenue derived from the Downtown Manhattan Heliport operations. In addition to terminations for an event of default, the Use Agreement could be terminated at any time by the Commissioner of the DSBS or suspended at any time by the NYCEDC. The Company was required under the Use Agreement to remit a monthly administrative fee to the NYCEDC in the amount of $5,000. During the twelve months ended December 31, 2023, the Company incurred $40,000 in administrative fees which are recorded in the cost of revenue.

On July 13, 2023, the DSBS was granted approval by the Franchise and Concession Review Committee to enter into an Interim Concession Agreement (the “Interim Agreement”) with the Company to provide for the continued operation of the Downtown Manhattan Heliport. The Interim Agreement became effective upon registration with the Comptroller of the City of New York and commenced on December 12, 2023. The Interim Agreement provides for one (1) six-month term (the “Initial Period”), with two (2) six-month options to renew (the “Renewal Periods”). The Company is required to pay the greater of

$1,036,811 or 30% of Gross Receipts during the Initial Term and the greater of $518,406 or 30% of Gross Receipts during both Renewal Periods. In addition to terminations for an event of default, the Interim Agreement can be terminated at any time by the Commissioner of the DSBS or suspended at any time by the NYCEDC.

On November 13, 2023, the DBS and NYCEDC released the new RFP. The initial due date for submissions was January 12, 2024, with the due date being subsequently extended to February 12. 2024. The Company submitted a timely proposal in compliance with the terms of the RFP. The Interim Agreement will govern the Company’s operation of the Downtown Manhattan Heliport until the RFP process is concluded and an operator selected unless terminated earlier pursuant to its terms.