British American Tobacco: A case study on the impact of high inflation through their publicly-listed Zimbabwean subsidiary.

Disclosure: We own British American Tobacco and only own a position in British American Tobacco Zimbabwe through the parent’s interest. We would also like to go to Victoria Falls one day. https://www.go2africa.com/african-travel-blog/zimbabwe-zambia-choosing-sides-victoria-falls

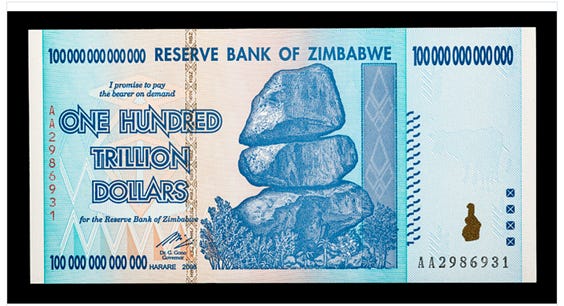

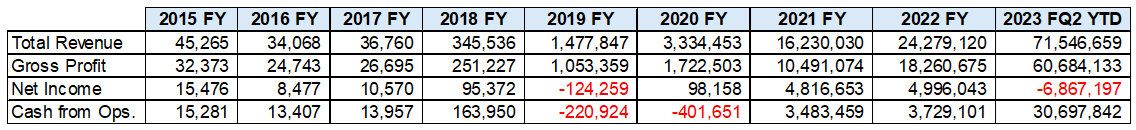

Have you ever held one hundred trillion dollars in your hand? We have. Back in 2008 during Zimbabwe’s hyperinflation, the government issued a remarkable 100 trillion dollar bank note that is now a collectable. One of us has a framed one in our office providing a daily reminder of how things can go very wrong… and keep going.

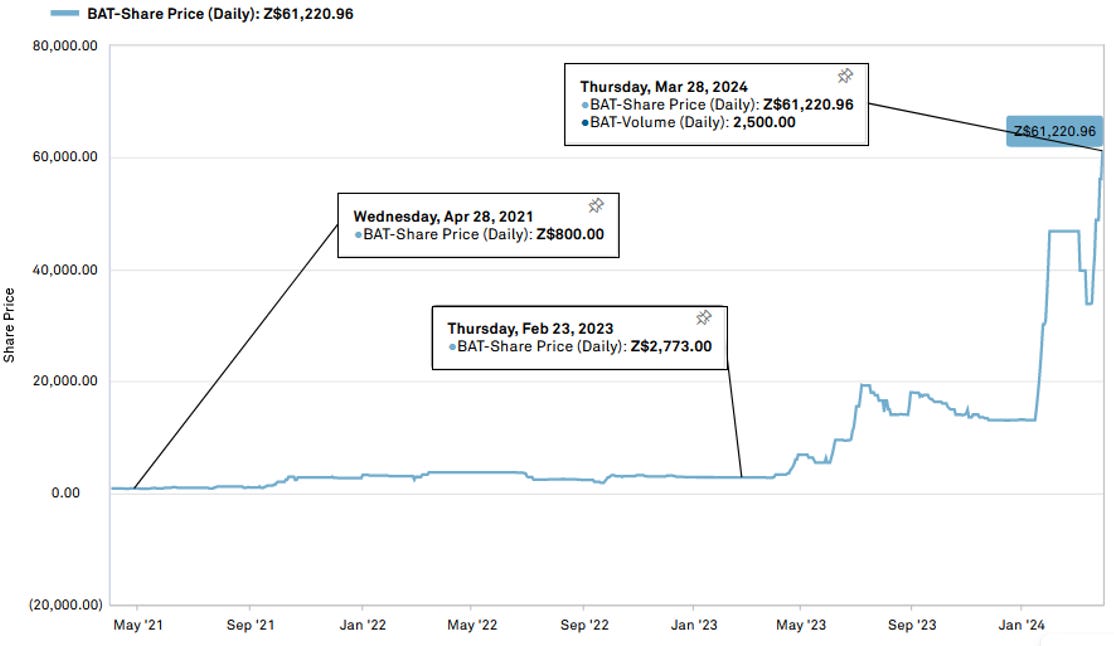

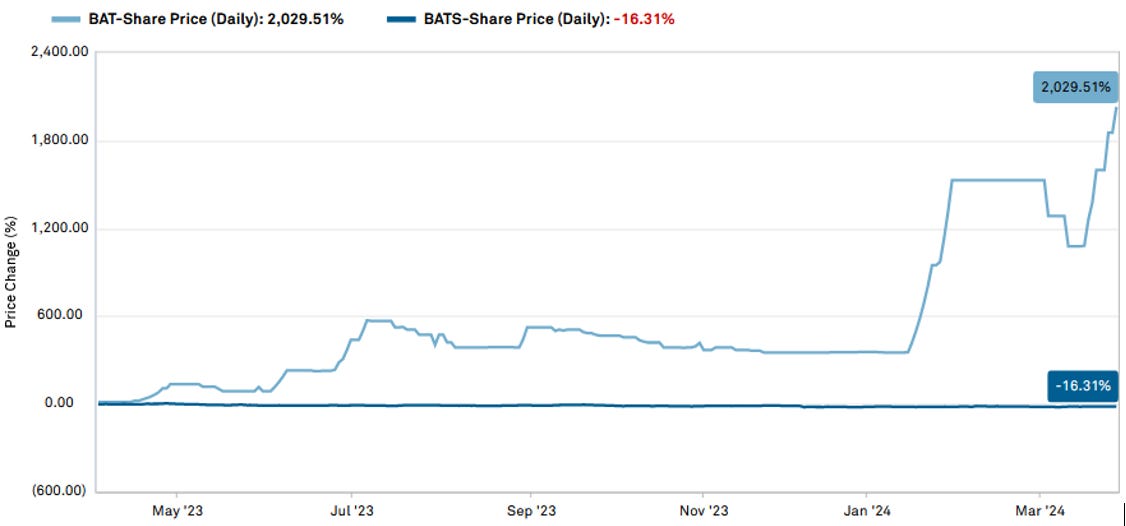

As part of our research into British American Tobacco (TL;DR we think it is cheap on very low expectations - https://canadianvalueinvestors.substack.com/p/inflation-and-stocks-the-first-rule), we came across their Zimbabwean subsidiary and could not resist looking into it. It is largely owned by BAT but listed on the Zimbabwean exchange. If you owned the subsidiary, you would be up a remarkable 2,000% in just the last year compared to a negative return for the parent. Who needs NVIDIA when you can get returns like this? Of course, these are not all measured in the same currency. Today we are going to provide a live example of what happens when inflation runs amuck and what might happen to your holdings if your country one day follows a similar path.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

https://www.si.edu/object/100000000000000-dollars-zimbabwe-2008%3Anmah_1694052

The Zimbabwe Stock Exchange and Inflation

The Zimbabwe Stock Exchange, or ZSE, is the official stock exchange of Zimbabwe. It was founded in1896 but has only been open to foreign investment since 1993 (but is unfortunately not accessible on Interactive Brokers). The exchange has about 50 companies.

https://www.zse.co.zw/

Importantly, the ZSE is a Ben Graham fan, or at least someone working on their Twitter account team is.

https://x.com/ZSE_ZW/status/1773240836999807476?s=20

The current official inflation rate in Zimbabwe is about 50%. Not so bad compared to some others; Argentina was over 200% recently. Still, they are in the top 15. Here is an interesting list of the highest rates in the world at the moment - https://www.ghanaweb.com/GhanaHomePage/business/Top-15-countries-with-the-highest-inflation-rates-in-the-world-as-of-February-2024-1923579

British American Tobacco Zimbabwe

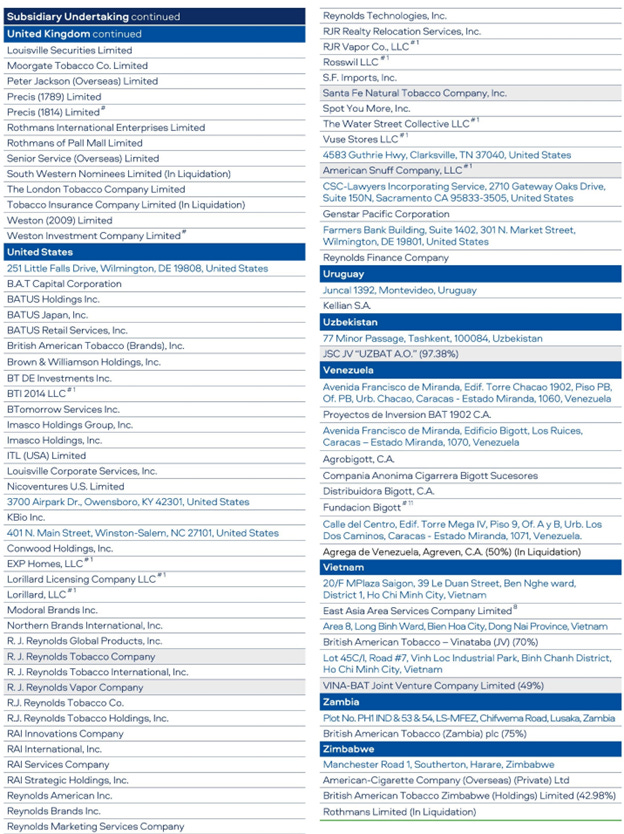

Tucked into page 320 of British American Tobacco’s annual report is the disclosure of their Zimbabwean subsidiary.

“British American Tobacco Zimbabwe (Holdings) Limited (“the Group”) manufactures, distributes and sells cigarettes to a network of independent distributors, wholesalers and retailers. The Group has a cigarette manufacturing factory in Zimbabwe and sells cigarettes solely in the domestic market while cut rag is exported.”

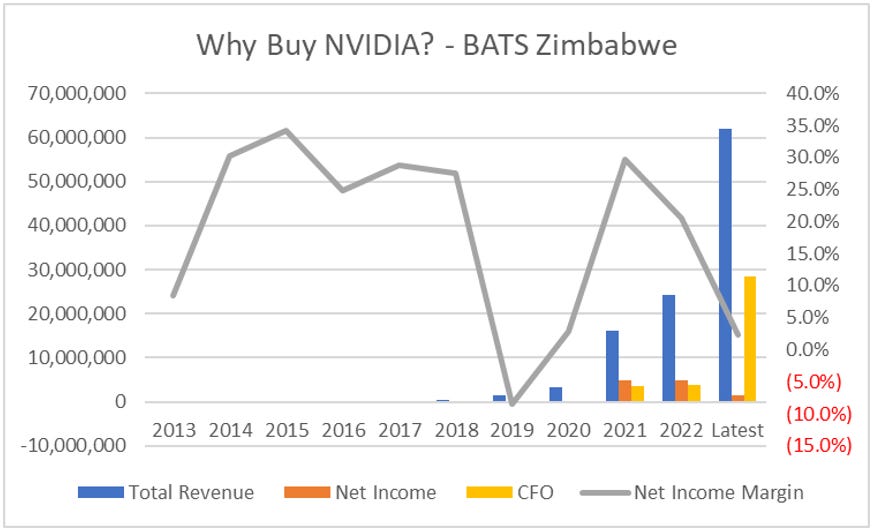

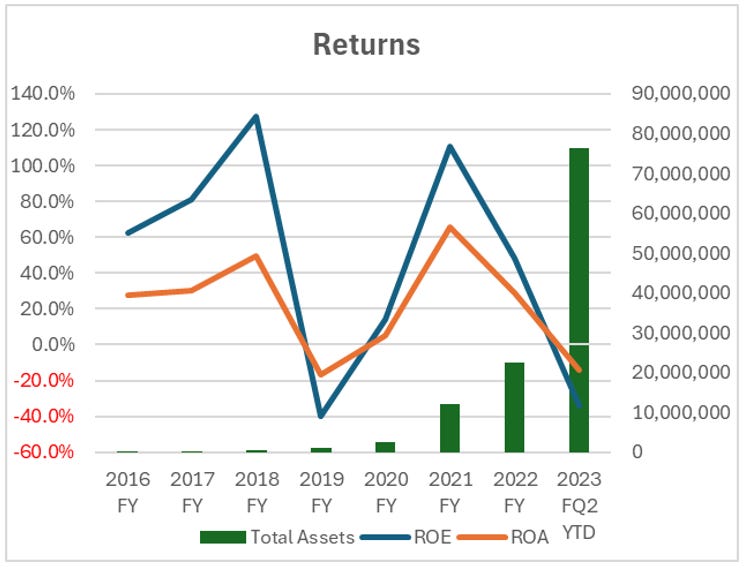

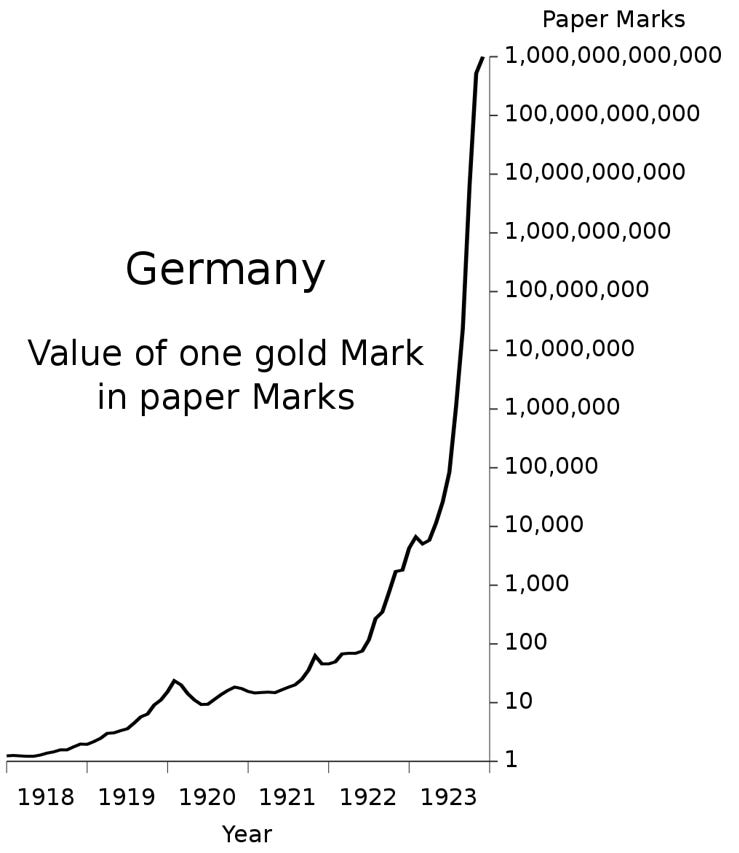

The financial statements are available through the Zimbabwean exchange. How are things going? On a nominal basis, absolutely fantastic. But similar to Canadian’s celebrating 2-3% interest rates on their bank accounts, you sadly are not “richer than you think” as Scotiabank would like you to believe. The stock chart below compares BAT Zimbabwe in ZW$ to BATS the parent in British Pounds.

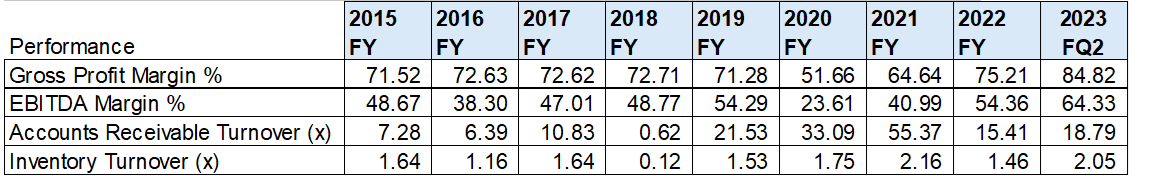

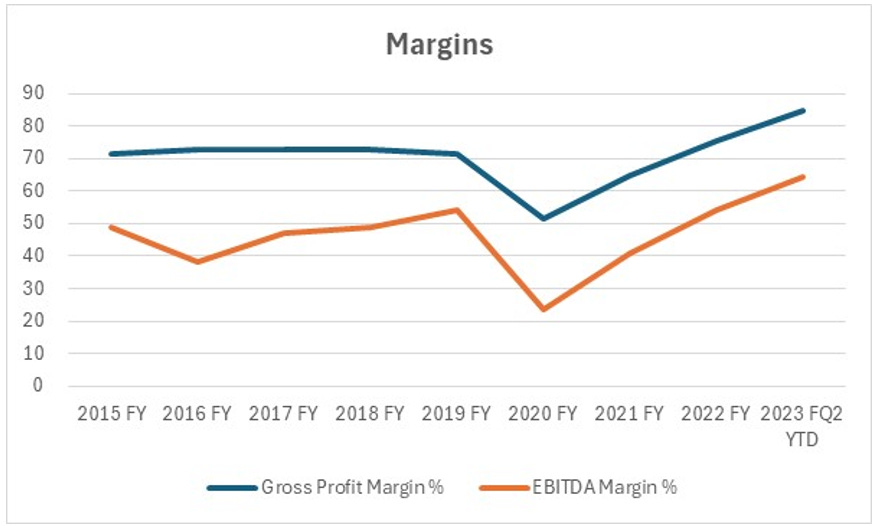

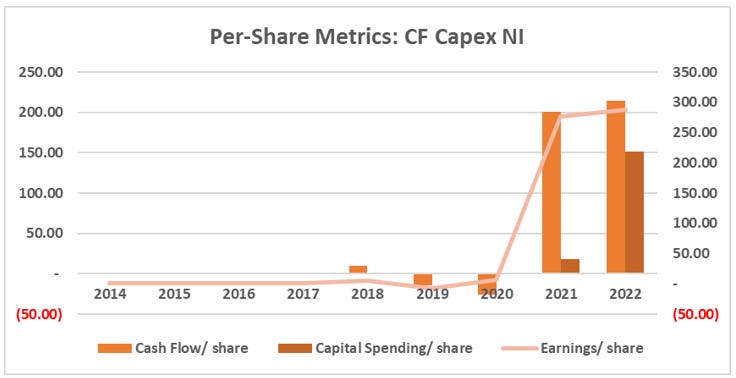

Standard financial performance metrics initially appear quite good. Strong gross and EBITDA margins and generally improving AR and inventory turnover. Sales are also going to the moon putting even NVIDIA’s revenue growth to shame. Per share metrics tell a similar story.

Of course, the problem is inflation and it is high enough that it is obscuring meaningful volume declines. As per their half-year update for 2023:

Financial Highlights

Commentary on financial performance is based on inflation-adjusted figures in a challenging operating environment.

Cigarette sales volumes declined by 15%, impacted by the scarcity of ZW$ across the domestic value chain.

Gross revenue increased to ZW$71.5 billion, driven by optimal cigarette pricing strategies and revenue from cut-rag tobacco exports.

Cost of sales increased by 89% to ZW$Z4 billion, mainly driven by currency devaluation.

Cash generated from operations increased by 281% to ZW$36.2 billion driven by working capital management initiatives implemented during the period under review.

Click here for a recent report we attached for your convenience. You can find more filings here - https://www.zse.co.zw/british-american-tobacco-zimbabwe-limited-2/

And then there are other issues like “increased power shortages” and blocked funds.

Blocked funds registration

As at 30 June 2023, the Reserve Bank of Zimbabwe ("RBZ”) registered blocked funds amounting to US$15.7 million. This was in respect of outstanding dividends and foreign suppliers, consistent with the blocked funds guidelines provided in the Exchange Control Directive RU28 dated 21 February 2019 and Exchange Control Circular No. 8 of 24 July 2019. Following the registration of the blocked funds, an amount of ZW$15.7 million was transferred to the RBZ to allow settlement of the registered blocked funds.

What are blocked funds? It looks like a deal with reached in February of this year.

Treasury has struck a deal to pay off long standing foreign debts on behalf of troubled local companies…Blocked funds constitute debts and funds that companies or individuals incurred for the supply of goods and services by foreign entities and for which the Reserve Bank of Zimbabwe was unable to pay due to shortage of foreign currency.

…

The debts incurred following the reintroduction of the Zimbabwe dollar in 2019 were about US$3,3bn and were assumed by the Reserve Bank of Zimbabwe (RBZ).

https://businesstimes.co.zw/treasury-strikes-deal-on-blocked-funds/

Their auditor KPMG had to make a note of the matter.

As described in the Basis for qualified opinion section above, the Group and Company have continued to account for foreign liabilities amounting to US$15.7 million, approved as blocked funds, at an exchange rate of US$1:ZW$1, which is not in compliance with IAS 21. We have, therefore, concluded that the other information is materially misstated for the same reasons with respect to the amounts or other items in the Chairman’s statement, the Directors’ report and the Financial highlights.

Issues were similar in 2020 but the outlook was a bit more upbeat.

The economic situation in the country remained challenging in 2020. The effects of the COVID-19 pandemic coupled with the shortages of foreign currency led to a significant contraction in the key economic sectors of the country. The introduction of the foreign exchange auction system by the Reserve Bank of Zimbabwe (“RBZ”) at the end of June 2020, brought some exchange rate stability for the second half of the year. However, high inflation eroded the disposable income of consumers, thereby depressing domestic demand. Notwithstanding these core macro-economic variables amongst others, the Company managed to register growth in operating profit for the year under review.

…

Zimbabwe’s economy is forecast to rebound in 2021 as the country shrugs off the effects of the COVID-19 pandemic and the government takes further measures to stabilize the currency and thus bring down inflation We strongly believe that the Company will continue to transform during this period of unprecedented change to ensure that we grow value for our shareholders.

Based on our cursory view, it appears that the management team at BAT Zimbabwe is doing a pretty remarkable job despite the environment they are operating in. Secondly, owning high quality businesses is likely the least-worse option when these things happen. This this is similar to the German stock market under the Weimar Republic where the market cap of the top 25 companies increased roughly 3x between 1919 and 1920.

The trouble with bankruptcies and economic failures is that they happen “two ways. Gradually, then suddenly.”

Thank you for subscribing!