Energy Services Expectations - STEP Energy Go-Private Offer, Calfrac/Ensign key owners keep buying

And Saker Aviation loses its contract

Here is the latest from Canadian Value Investors!

STEP Energy Go-Private Offer

Calfrac Energy Services – Insiders continue to buy

Ensign Energy – A bit more interesting, and Fairfax ramps up purchases

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

STEP Energy Go-Private Offer

Disclosure: We still own both Ensign Energy ESI / Calfrac Well Services CFW, no position in STEP

As we wrote in August, to say investing in the North American energy services industry has been unpleasant is like saying a lobotomy is mildly uncomfortable. However, a lollapalooza of companies being more cautious, capital restrained, investor fatigue and consolidation of some services in some regions seems to be helping overall industry profitability. Will it stick?

As stated before, Ensign and Calfrac are interesting to us because:

Both went through very tough periods, with one going through a formal debt restructuring (Calfrac) and the other’s hand being held by their key founder.

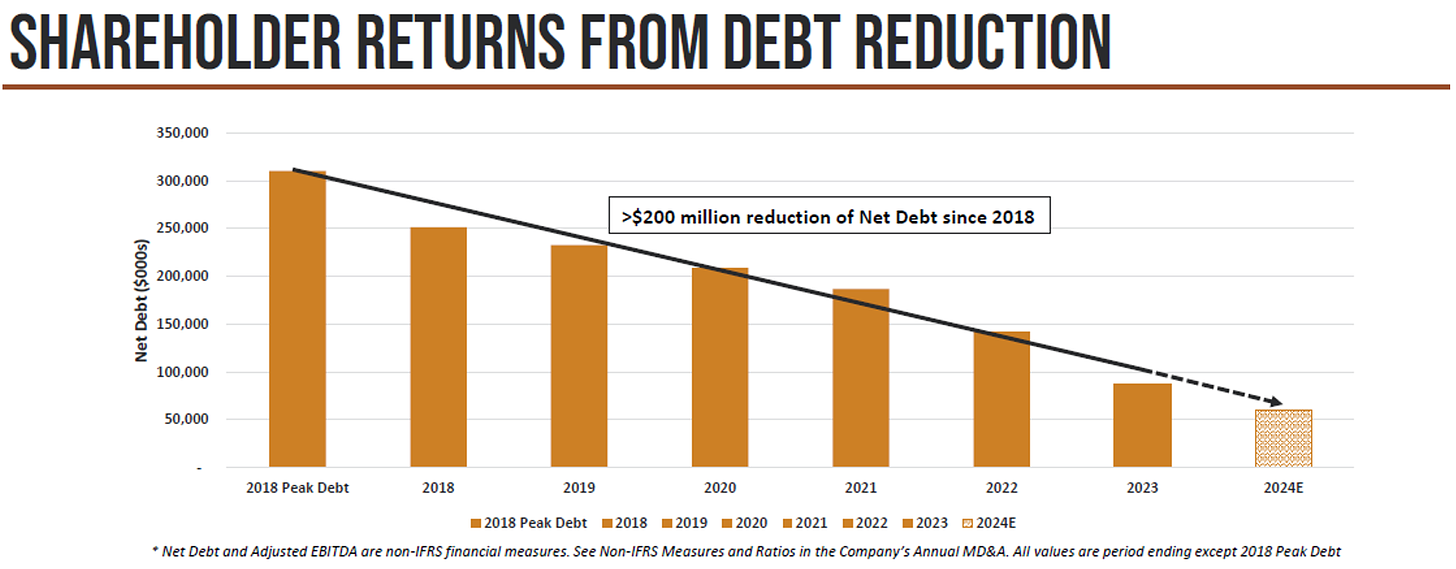

Both have significantly improved their balance sheets and continue to do so.

Both have key owners who are making purchases.

Both seem to have never had lower market expectations to beat.

We should have had STEP on the list.

See article for background on Ensign and Calfrac https://www.canadianvalueinvestors.com/i/148174117/ensign-energy-esi-calfrac-well-services-cfw-expectations-are-low-and-key-owners-are-buying-more

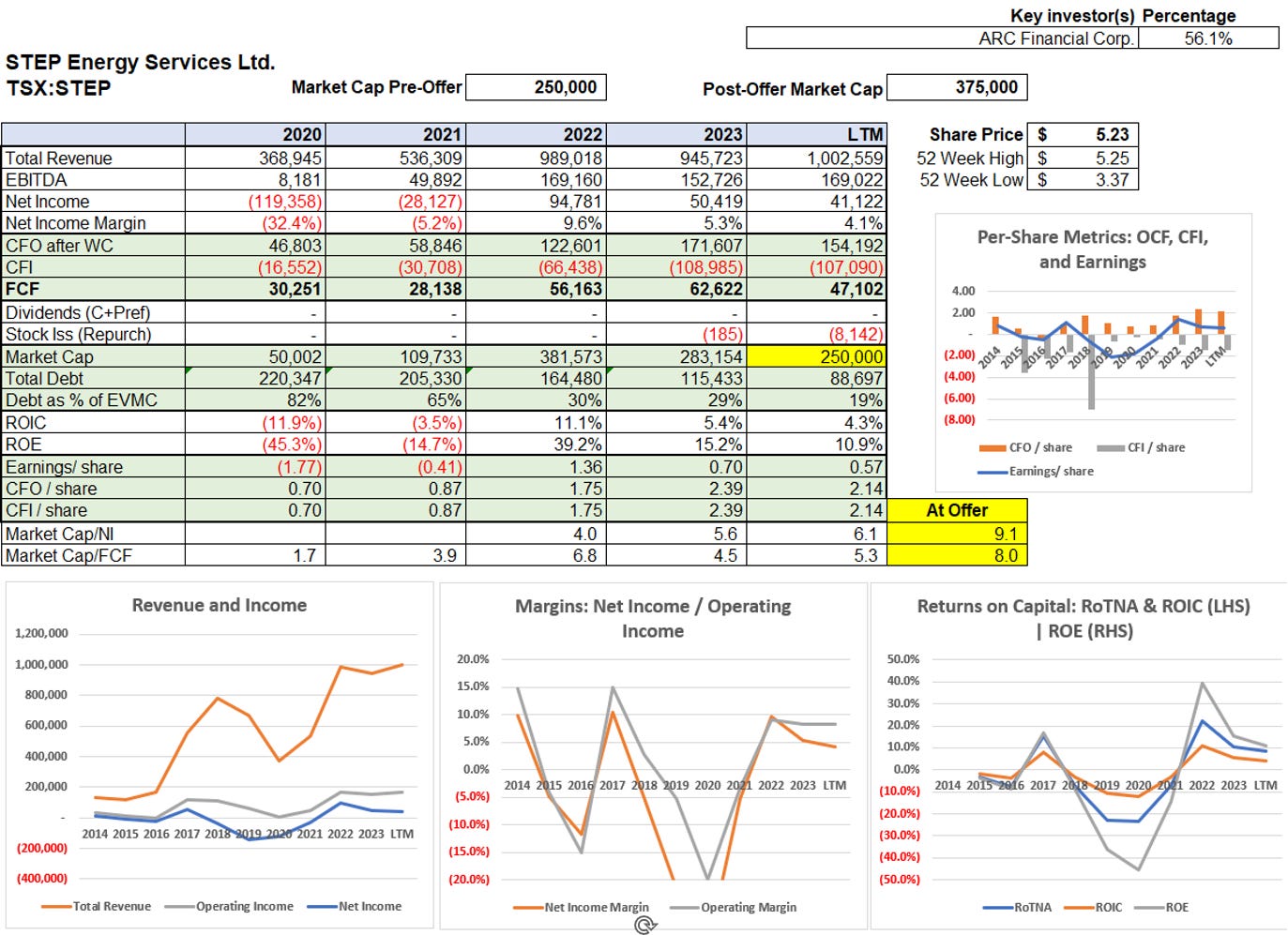

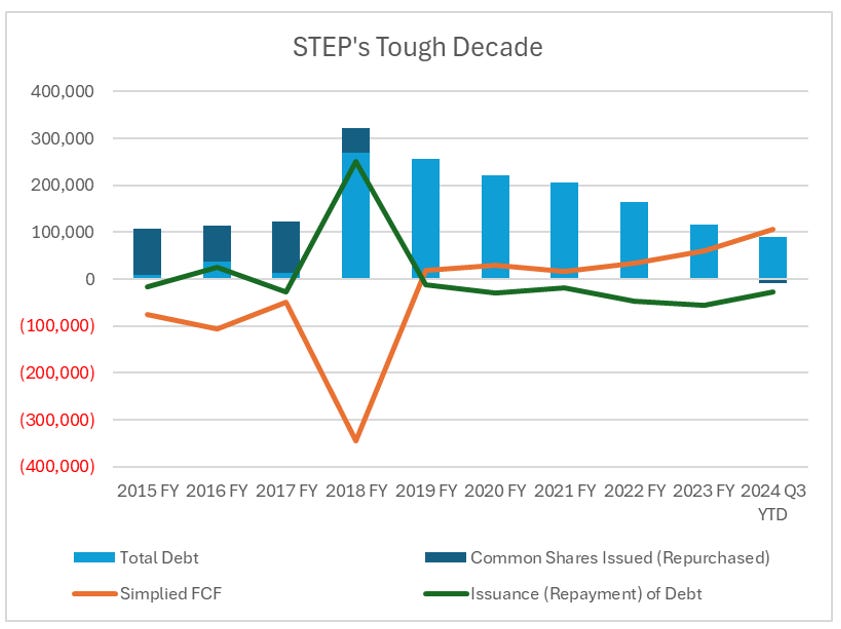

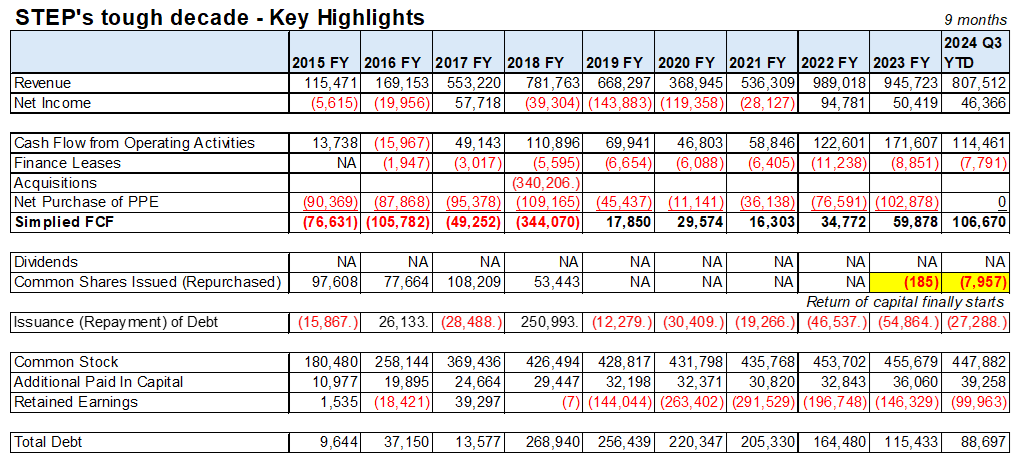

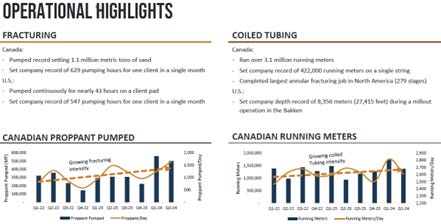

STEP is similar to Calfrac and Ensign (though STEP more so directly competes with Calfrac) in that the underlying business appeared to be improving and the market was just not interested. It has been a tough decade, with returns to shareholders just starting (via repurchases) after five years of de-levering.

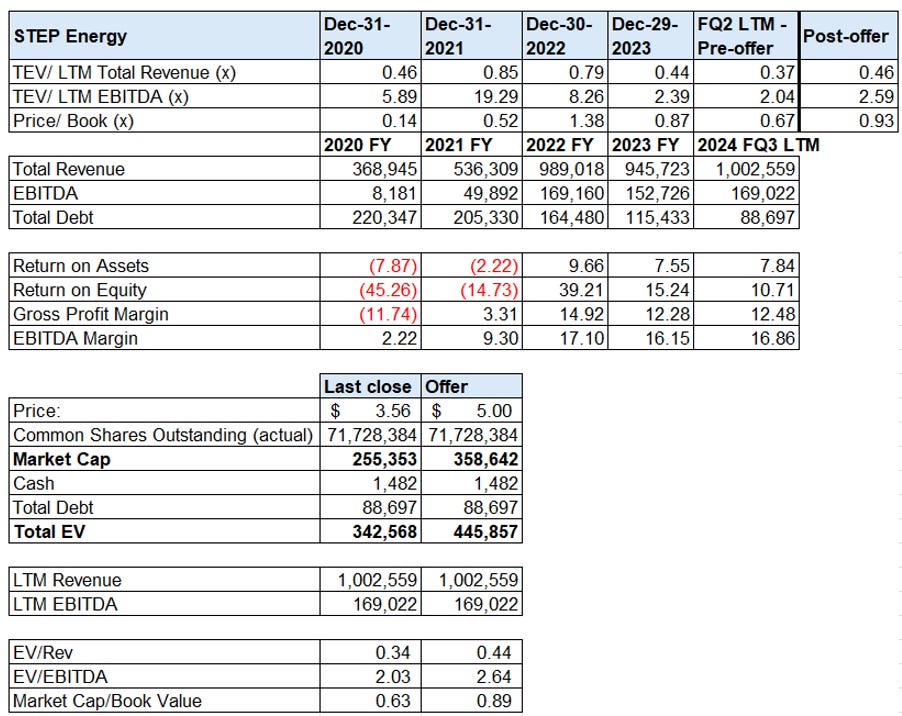

Key shareholder – ARC Financial Corp. –put an offer out to take the company private.

On November 3, 2024, STEP, the Purchaser, ARC Energy Fund 8 Canadian Limited Partnership, ARC Energy Fund 8 United States Limited Partnership, ARC Energy Fund 8 International Limited Partnership and ARC Capital 8 Limited Partnership (collectively, "ARC Energy Fund 8"), entered into a definitive arrangement agreement (the "Arrangement Agreement") pursuant to which ARC Energy Fund 8, a private equity fund advised by ARC Financial Corp. ("ARC"), will indirectly acquire, through the Purchaser, all of the issued and outstanding Shares, other than those Shares owned, controlled or directed, directly or indirectly, by ARC Energy Fund 6 Canadian Limited Partnership, ARC Energy Fund 6 United States Limited Partnership, ARC Energy Fund 6 International Limited Partnership and ARC Capital 6 Limited Partnership (collectively, "ARC Energy Fund 6"), the Purchaser, ARC Energy Fund 8, or any other person controlled or managed, directly or indirectly, by ARC (such persons together with ARC Energy Fund 6 and ARC Energy Fund 8, the "ARC Funds") for $5.00 in cash per Share (the "Consideration").

Key Highlights of the Offer

Significant Premium: The Consideration offered to Shareholders under the Arrangement Agreement represents a substantial premium, including a premium of approximately:

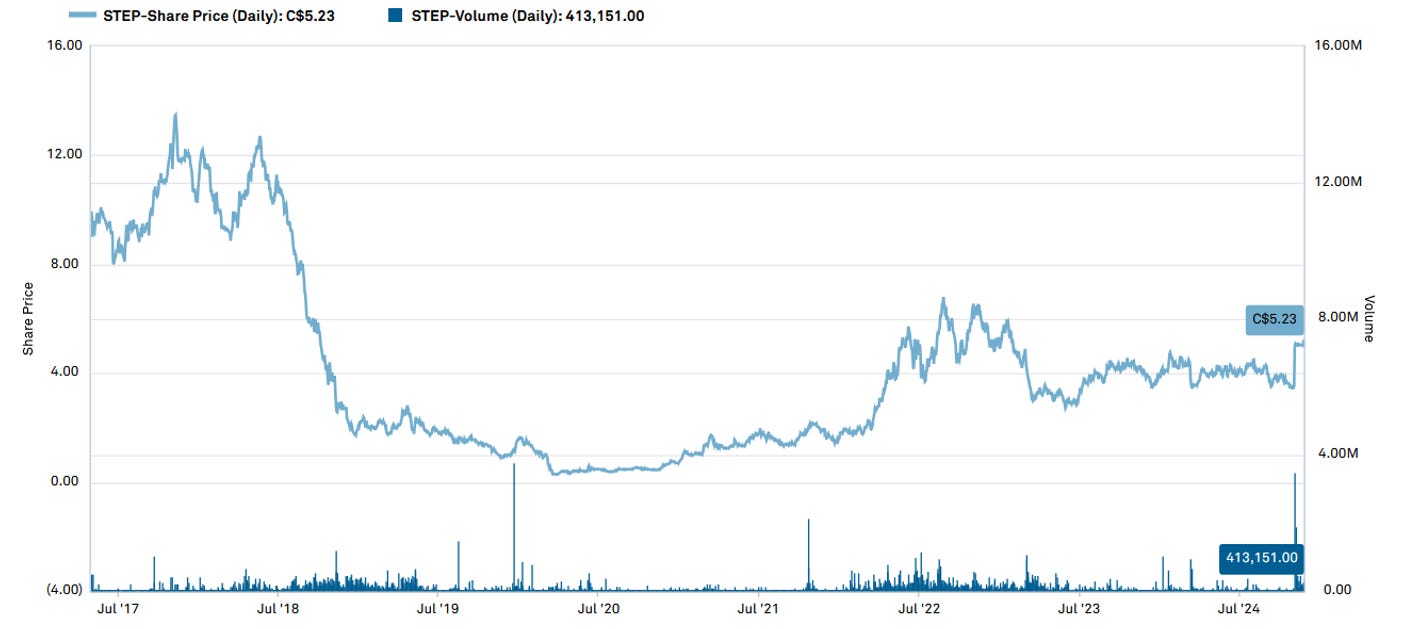

40.4% to the closing price of the Shares of $3.56 on the Toronto Stock Exchange (the "TSX") on November 1, 2024, being the last trading day prior to the execution of the Arrangement Agreement;

43.3% to the 10-day volume-weighted average price of the Shares of $3.49 on the TSX as of the end of trading on November 1, 2024; and

35.5% to the 30-day volume-weighted average price of the Shares of $3.69 on the TSX as of the end of trading on November 1, 2024.

2. Certainty of Value: The all-cash offer provides immediate and certain value and liquidity to all Shareholders, eliminating the uncertainties associated with market fluctuations.

STEP has recently started to trade above the offer in the low $5s. We have no opinion on if the offer might be increased.

What we do know is that it has been a long difficult road for shareholders and ARC’s interest goes back pre-IPO in 2017. https://www.stepenergyservices.com/news-releases/step-energy-services-ltd-completes-initial-public-offering

CALGARY, May 2, 2017 - STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to announce that it has completed its previously announced initial public offering (the “Offering”) of 10.0 million common shares at a price of $10.00 per common share for aggregate gross proceeds to STEP of $100.0 million.

The limited partnerships comprising ARC Energy Fund 6 and ARC Energy Fund 8 (collectively, the “Selling Shareholders”) have granted to the Underwriters an over-allotment option, exercisable in whole or in part for a period of 30 days following the closing of the Offering, to purchase up to an aggregate of an additional 1.5 million common shares of the Company from the Selling Shareholders at a price of $10.00 per common share. The Company will not receive any proceeds from any exercise of the over-allotment option.

At the offer ARC is getting the business at low multiples regardless of the measure and actually below book value, while it appears the underlying industry dynamics have improved. Good timing.

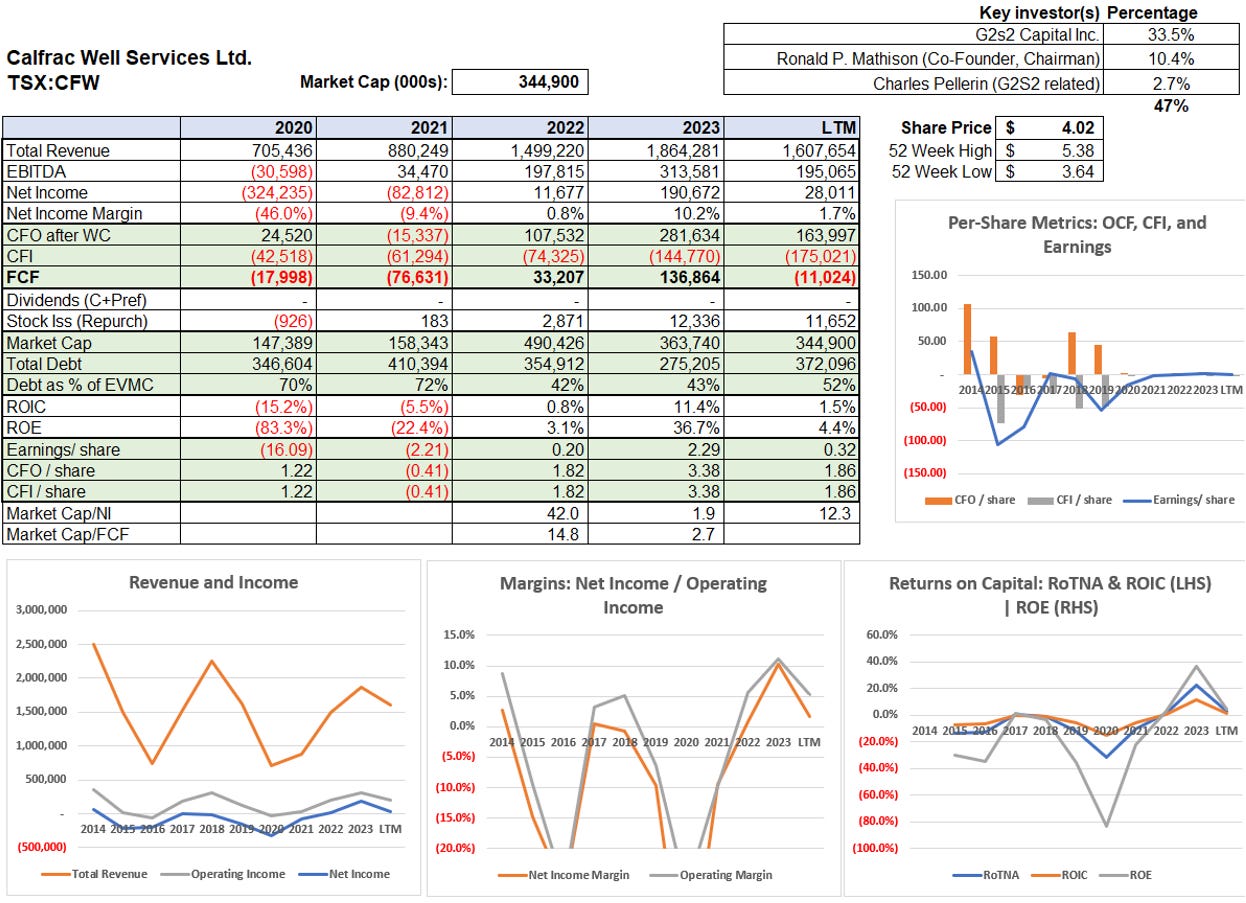

Calfrac – Insiders continue to buy

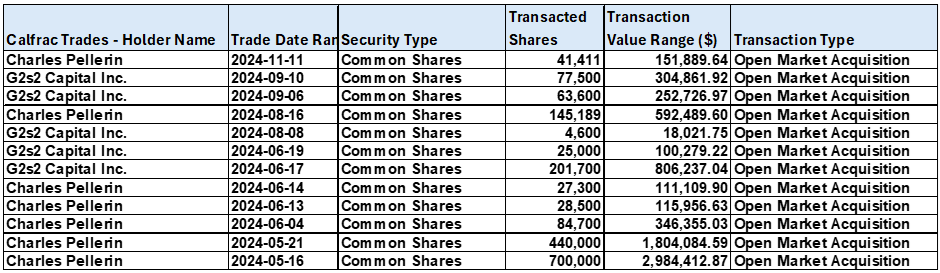

Since we wrote our August article, G2S2 and Charles Pellerin (affiliated with G2S2 – See Slate Office REIT articles https://www.canadianvalueinvestors.com/t/sotun ) have continued to buy. We expect that they might be a bit distracted for a bit though by their ongoing restructuring of Slate.

Calfrac’s Q3 was challenging in the U.S., but Argentina and Canada continue to do well. Capex spend should slow in 2025, unless investment opportunities are worthwhile. Note that the chart per share metrics reflect the previous painful debt conversion.

Ensign Energy – More interesting, and Fairfax ramps up purchases

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.