Ensign Energy ESI / Calfrac Well Services – Expectations are low and key owners are buying more

Merger Arbitrages – The Regulatory Minefield

Here’s the latest from Canadian Value Investors!

-Merger Arbitrages – The Regulatory Minefield

-Cedar Creek / Solitron Presentation

-Ensign Energy ESI / Calfrac Well Services – Expectations are low and key owners are buying more

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Merger Arbitrages – The Regulatory Minefield

Disclosure: We own none of these.

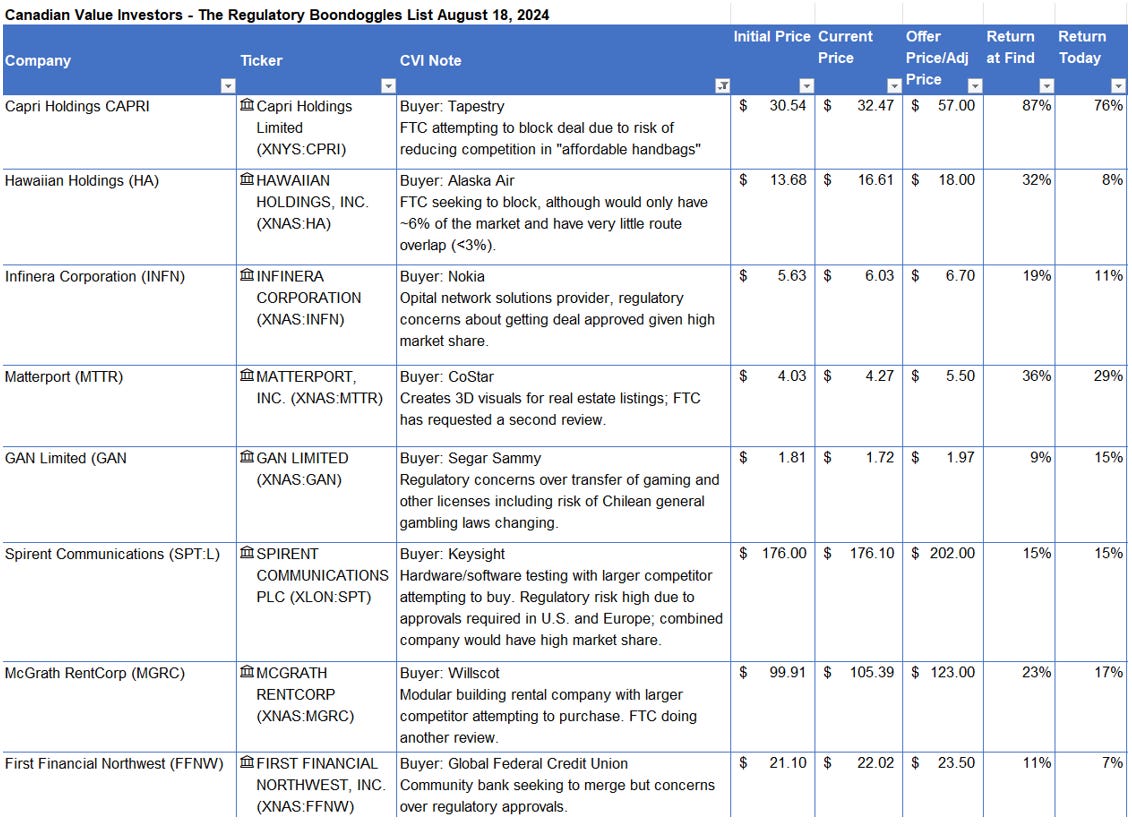

We are always looking through mergers to see if there is a bit of an arbitrage play for us. What we find remarkable is the number of mergers that are floating out there stuck dealing with regulatory uncertainty. Here’s a list of the main ones we have looked into. We are on the sidelines for all of these after our recent experience (see next). A big driver of this has been the FTC under Lina Khan. While some of her initiatives have been admirable or at least understandable, we scratch our heads about some concerns like a reduction in the competition in affordable handbags (CAPRI below). From the outside, it appears that they are just looking for a fight on every transaction rather than a thoughtful-but-still-consumer-oriented approach.

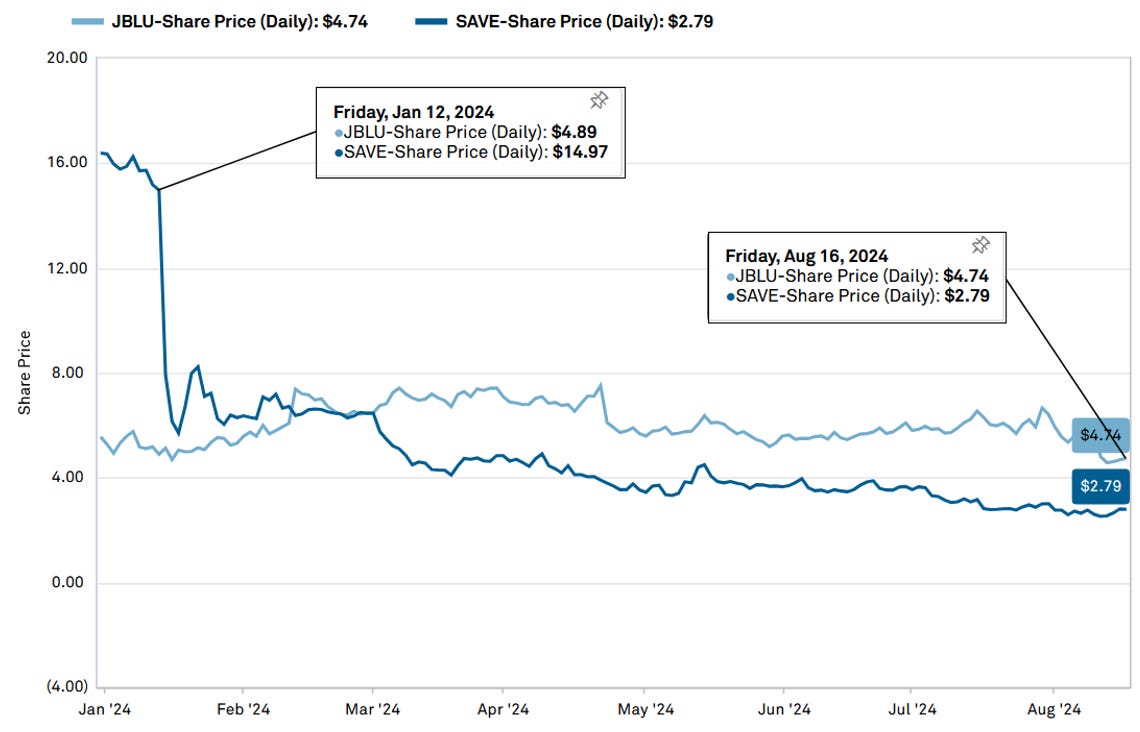

As we wrote previously, we successfully made money on Activision Blizzard merger (along with the OG Warren Buffett) but were caught up in a thankfully small position on the JBLU / SAVE merger blow up.

The Jetblue / Spirit merger failure is particularly remarkable (see chart below) in that it is unclear to us that Spirit will even be able to survive as an airline as they scramble to save the company (far from a merger of mighty titans), but we hope Lina Khan at the FTC has enjoyed celebrating her win.

One wild card of the upcoming election is that a Trump win would very likely result in Lina looking for a new job immediately. In the meantime, we will look for easier ideas.

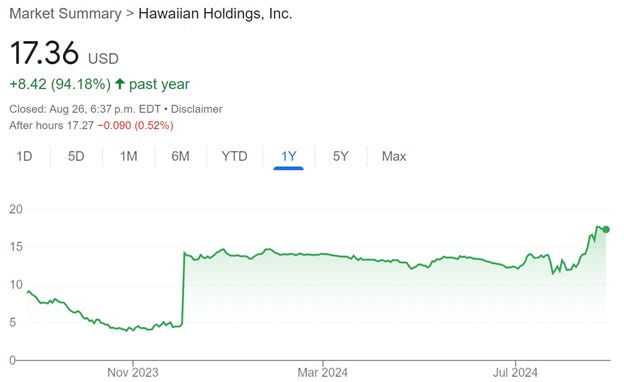

And the noise level is sky high. Just look at Hawaiian Air’s August 14th release below, which was nine months into the process.

On December 2, 2023, Hawaiian Holdings, Inc., a Delaware corporation (“Hawaiian”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Alaska Air Group, Inc., a Delaware corporation (“Alaska”), and Marlin Acquisition Corp., a Delaware corporation and a wholly owned subsidiary of Alaska (“Merger Sub”), providing for the merger of Merger Sub with and into Hawaiian (the “Merger”), with Hawaiian surviving as a wholly owned subsidiary of Alaska.

As previously disclosed, on May 7, 2024, Hawaiian and Alaska certified substantial compliance with a request for additional information and documentary material (the “Second Request”) received from the Antitrust Division of the Department of Justice (the “DOJ”) on February 7, 2024 in connection with the DOJ’s review of the Merger, which triggered the start of a Review Period (as defined below) under a timing agreement Hawaiian and Alaska entered into with the DOJ on March 27, 2024. Pursuant to the timing agreement, Hawaiian and Alaska agreed, among other things, not to consummate the Merger before 90 days following the date on which both parties certified substantial compliance with the Second Request (the “Review Period”) unless they received written notice from the DOJ prior to the end of the Review Period that the DOJ has closed its investigation of the Merger. The Review Period was previously scheduled to expire on August 5, 2024.

As previously disclosed, on July 29, 2024, Hawaiian and Alaska agreed with the DOJ to extend the Review Period until 12:01 a.m., Eastern Time, on August 15, 2024, and on August 13, 2024, Hawaiian and Alaska agreed with the DOJ to extend the Review Period until 12:01 a.m., Eastern Time, on August 16, 2024.

On August 14, 2024, Hawaiian and Alaska agreed with the DOJ to further extend the Review Period until 12:01 a.m., Eastern Time, on August 20, 2024.

Hawaiian and Alaska continue to cooperate with the DOJ in this review process.

Just a few days ago, they press released an update. “Good news” with HA trading at ~$17.40, closer to the $18 offer. Reading it though does not exactly seem like exciting endorsement from the government given “the time period during which the parties were prohibited from closing under the HSR Act has expired. The government’s review is ongoing.” https://news.alaskaair.com/company/doj-review-period-under-hsr-act-expires-alaska-airlines-awaiting-next-steps-with-dot/

It did open the door for Carl Icahn to take a position in Jetblue shortly after and start making some changes. We will have to see how this plays out (no position and evaluating).

One investor believes in the turnaround of JBLU - Vladimir Galkin. Who is he? Just a guy with a side hobby in investing. He made a fortune on Gamestop and is now the third largest shareholder of JBLU, owning more than Icahn’s main fund. He said “I don’t day trade” and “although he’s never discussed JetBlue with Icahn, Galkin said “I’ve had good fortune having followed activist investors before. They work out great.” To the moon.

https://finance.yahoo.com/news/jetblues-third-largest-shareholder-one-090016356.html

Cedar Creek / Solitron Presentation from MicroCapClub

Disclosure: We remain long on Solitron.

At the Microcap Leadership Summit, Tim Eriksen, portfolio manager and subsequently also CEO of Solitron, gave a great overview of his philosophy and the latest at Solitron. Disclosure: We are still long Solitron.

Ensign Energy ESI / Calfrac Well Services CFW – Expectations are low and key owners are buying more

Disclosure: We own both.

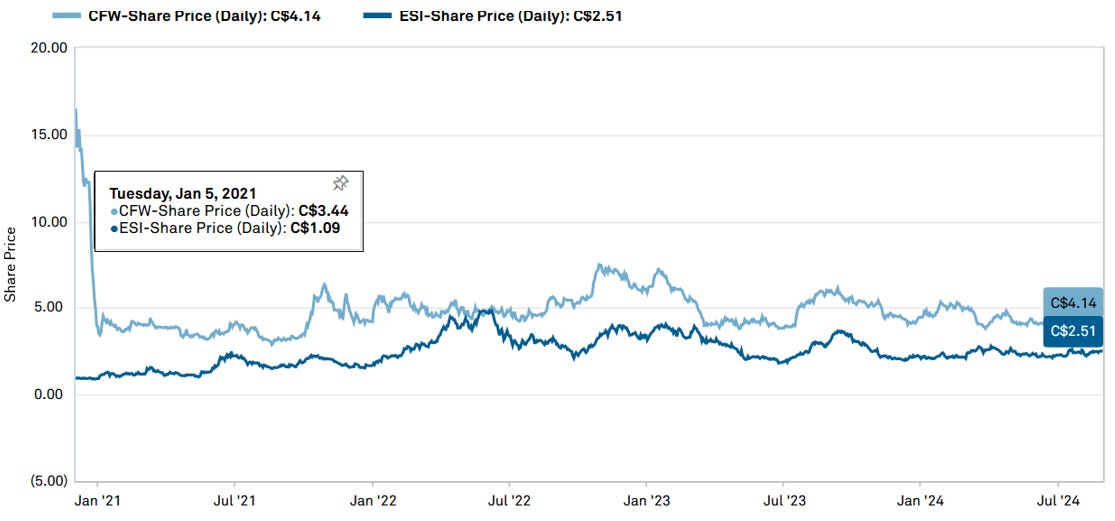

The oil and gas industry is complex and we do not even attempt to provide a full overview of oil and gas services. Instead, we want to provide some historical context of two companies and how, based on current implied expectations, it does not take much for it to go well for shareholders of both companies.

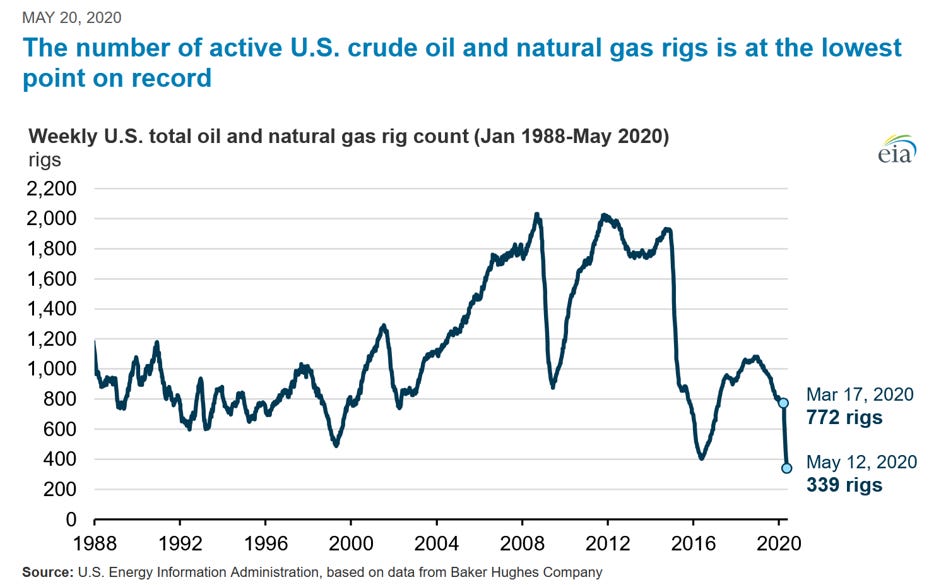

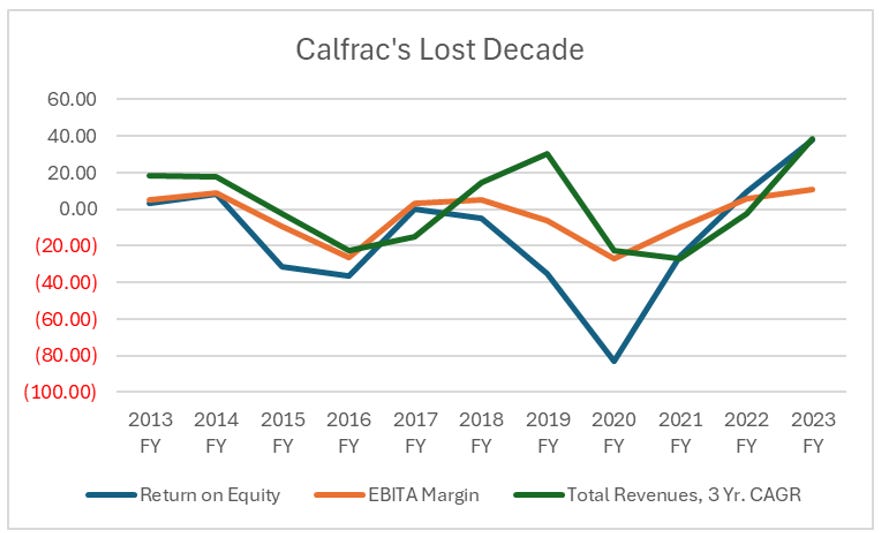

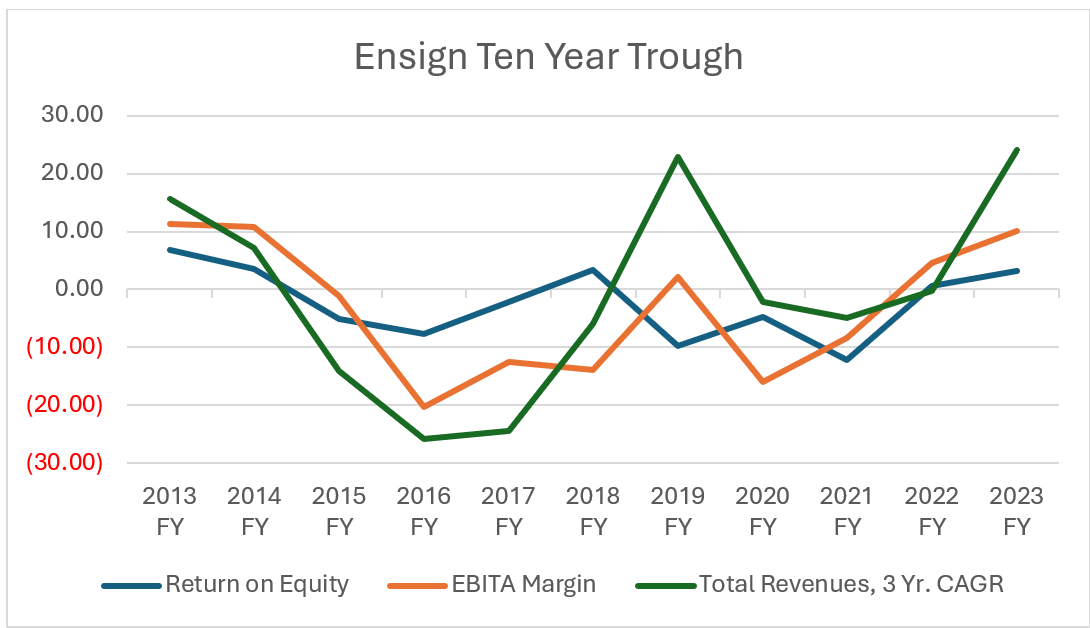

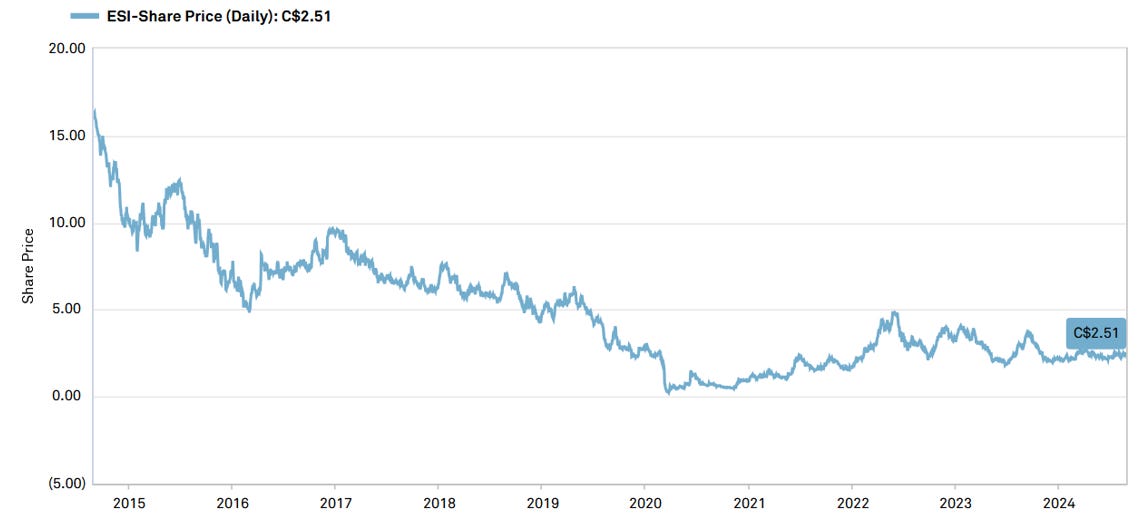

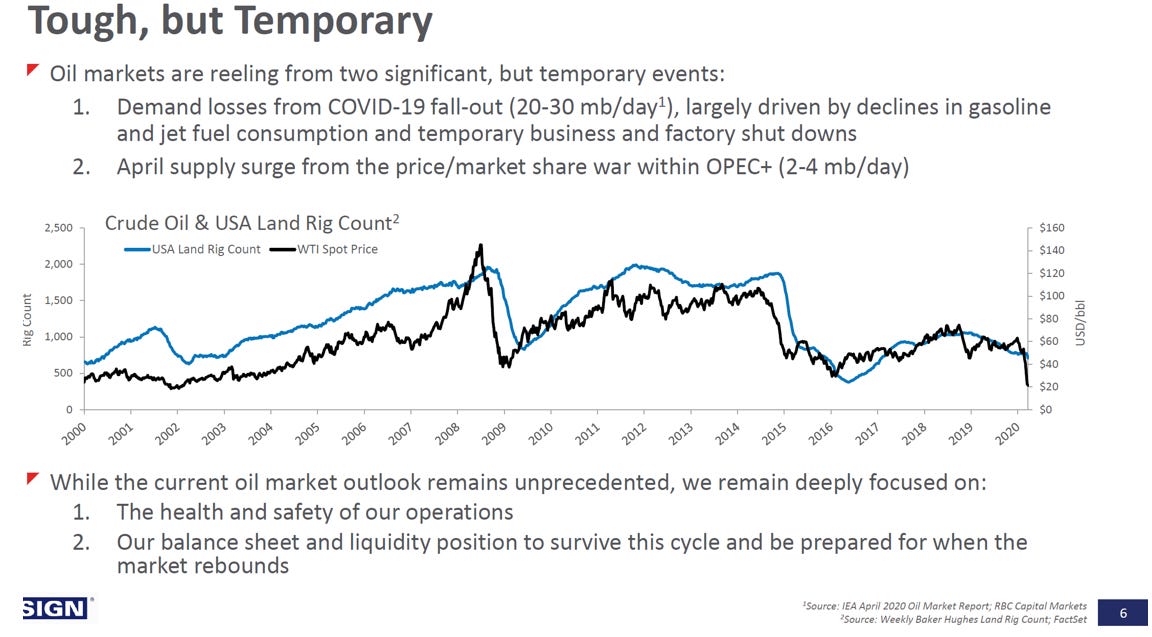

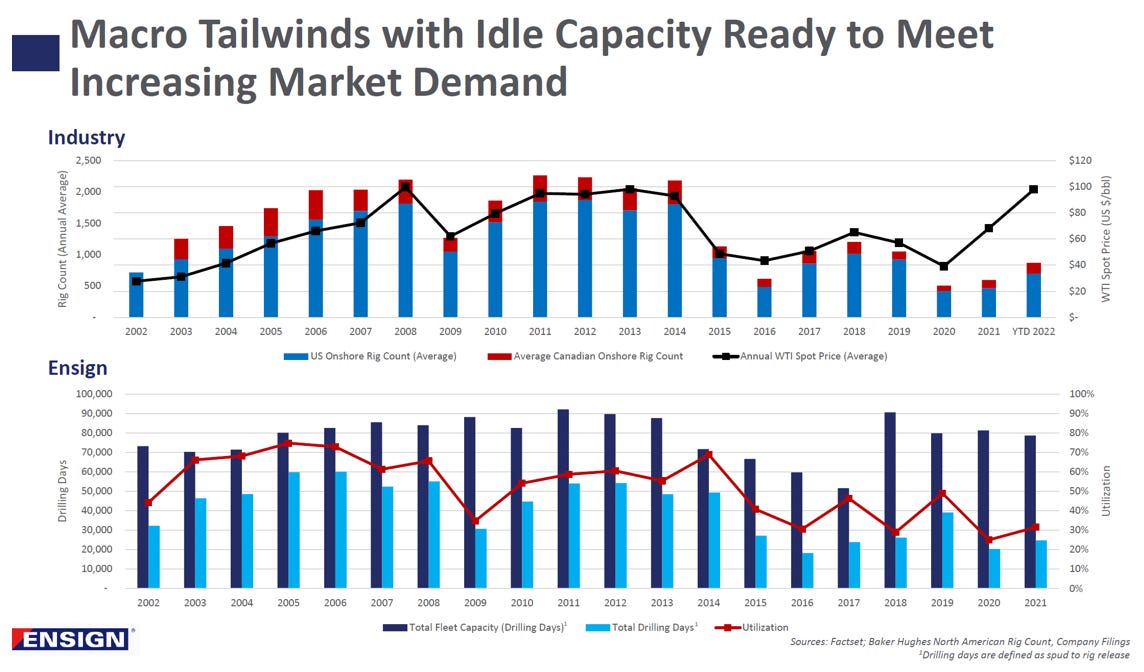

To say investing in the North American energy services industry has been unpleasant is like saying a lobotomy is mildly uncomfortable. The sector has faced relentless headwinds over the past decade, with collapsing oil prices, regulatory challenges, and pipeline constraints (in Canada) severely limiting growth. Companies like Ensign Energy and Calfrac Well Services saw their stock prices plummet as demand for drilling and fracking services dried up during periods of low commodity prices. Additionally, the shift towards ESG-focused investing and the transition to renewable energy has left traditional oilfield services struggling for investor interest. Even when oil prices rebounded, oversupply of equipment and intense competition led to poor profitability and high debt loads, making the sector an investment minefield.

However, a lollapalooza of companies being more cautious, capital restrained, investor fatigue and consolidation of some services in some regions seems to be helping overall industry profitability. Will it stick?

Ensign and Calfrac are interesting, in that:

-Both went through very tough periods, with one going through a debt restructuring (Calfrac) and the other’s hand being held by their key investor.

-Both have significantly improved their balance sheets and continue to do so.

-Both have key owners who are making purchases.

-Both seem to have never had lower expectations to beat.

Ensign Energy Services and Calfrac Well Services are both Canadian oilfield service companies listed on the Toronto Stock Exchange, operating primarily in the energy sector’s upstream segment. Ensign Energy specializes in drilling, well servicing, and directional drilling services. It operates a significant fleet of drilling rigs across North America, the Middle East, and Latin America. The company supports oil and gas exploration by providing advanced rigs, including Automated Drilling Rigs (ADRs) that optimize drilling efficiency.

Calfrac Well Services focuses on providing hydraulic fracturing (fracking), coiled tubing, and cementing services. With operations in North America and Argentina, Calfrac is heavily involved in the completion and stimulation phases of oil and gas production. Its primary business is in pressure pumping, where the company offers well completion services that enhance production in tight oil and gas formations, such as shale.

A story in charts

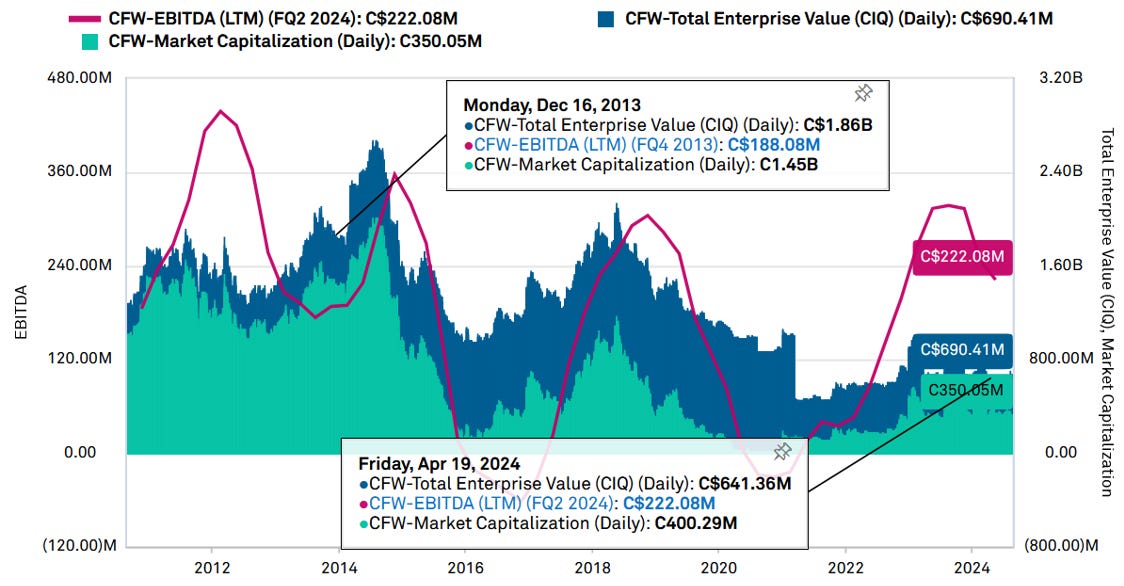

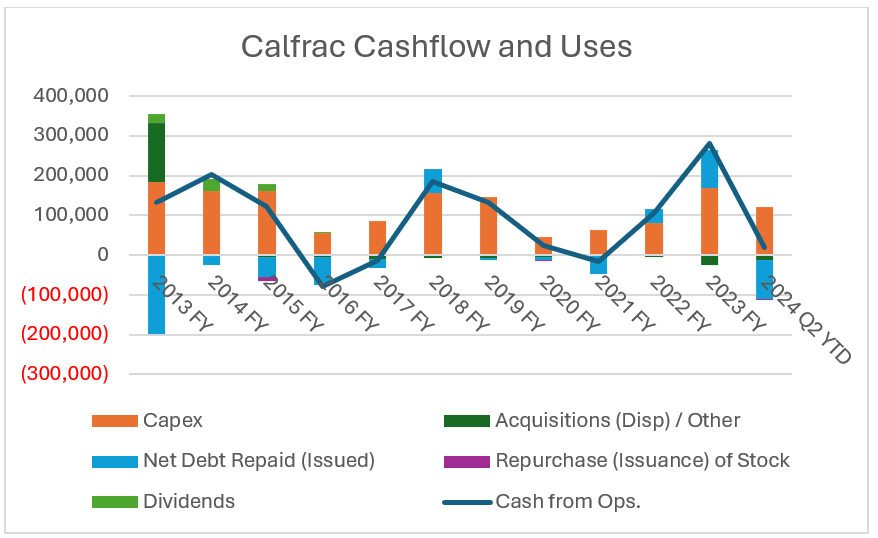

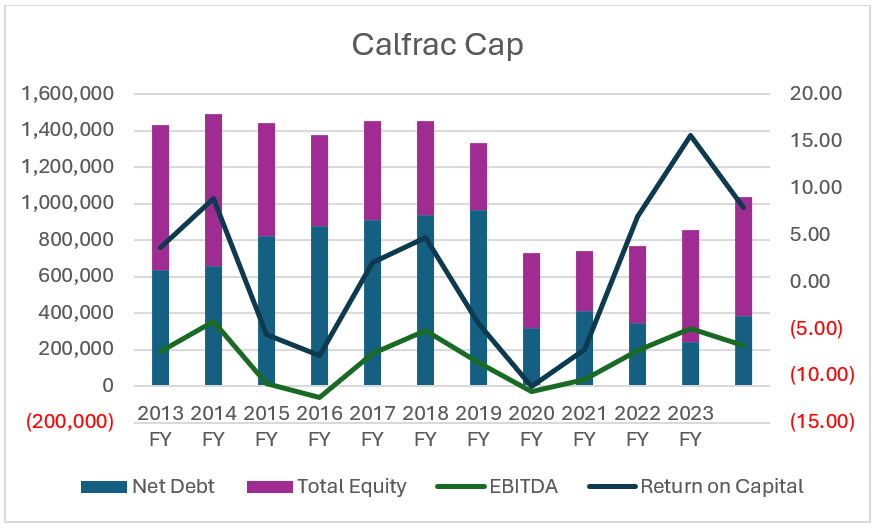

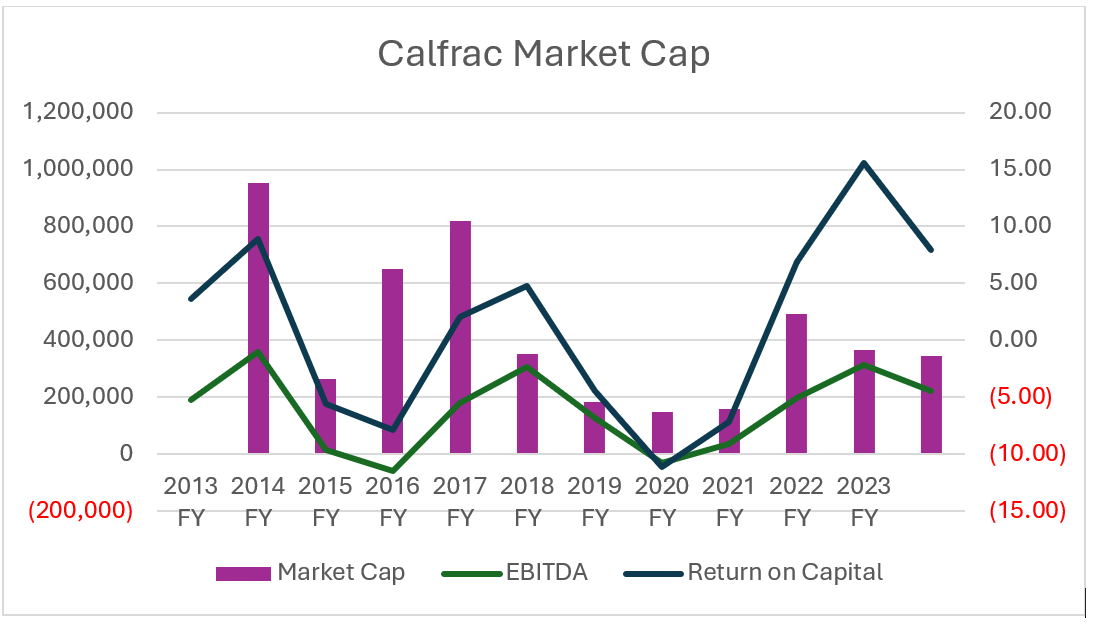

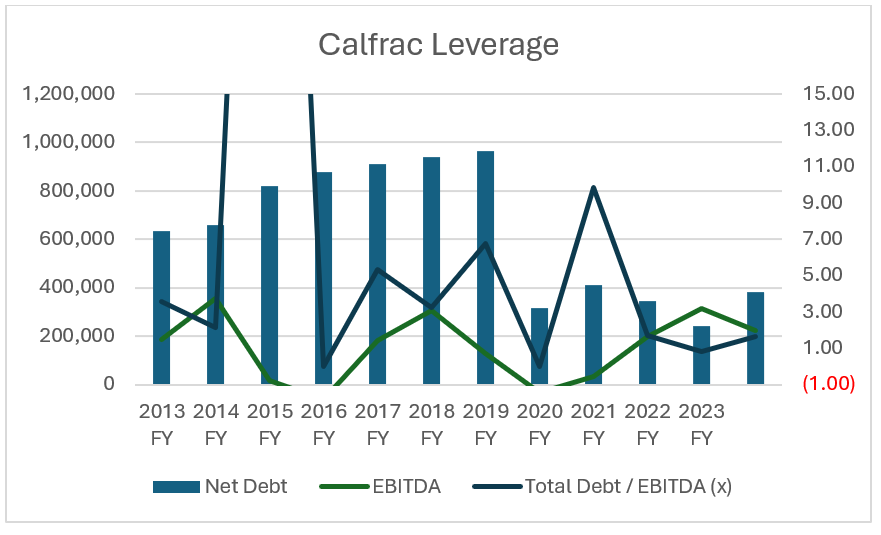

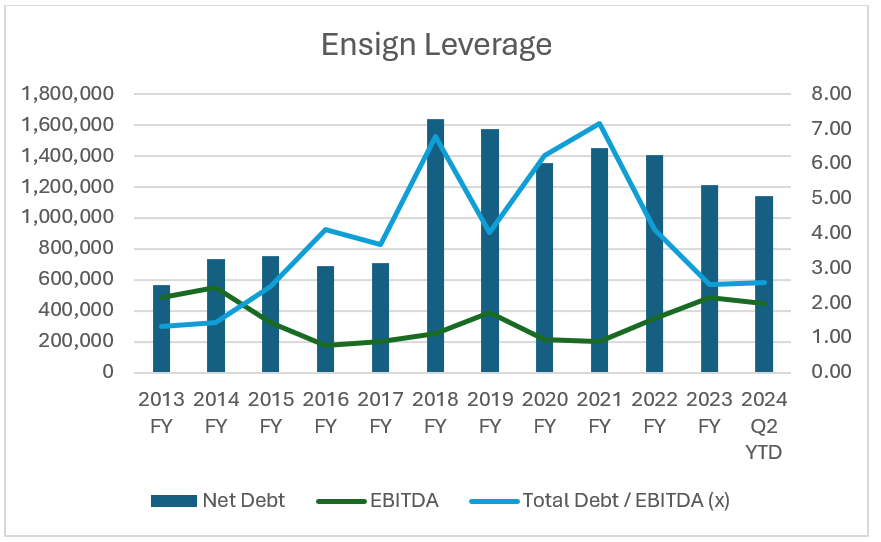

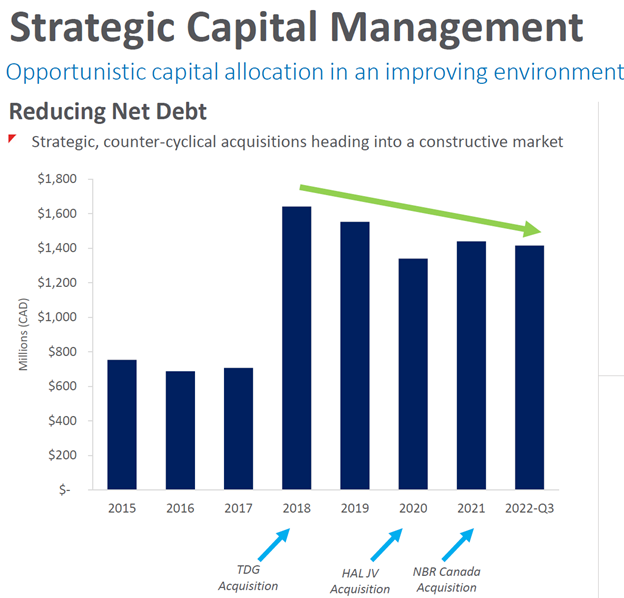

Both companies just ran with too much leverage for this industry and have been paying for it. As shown below, you should be able to guess about when Calfrac’s restructuring occurred. What drove it? The early 2010s boom of cheap capital and optimism led to significant over-investment in all types of services.

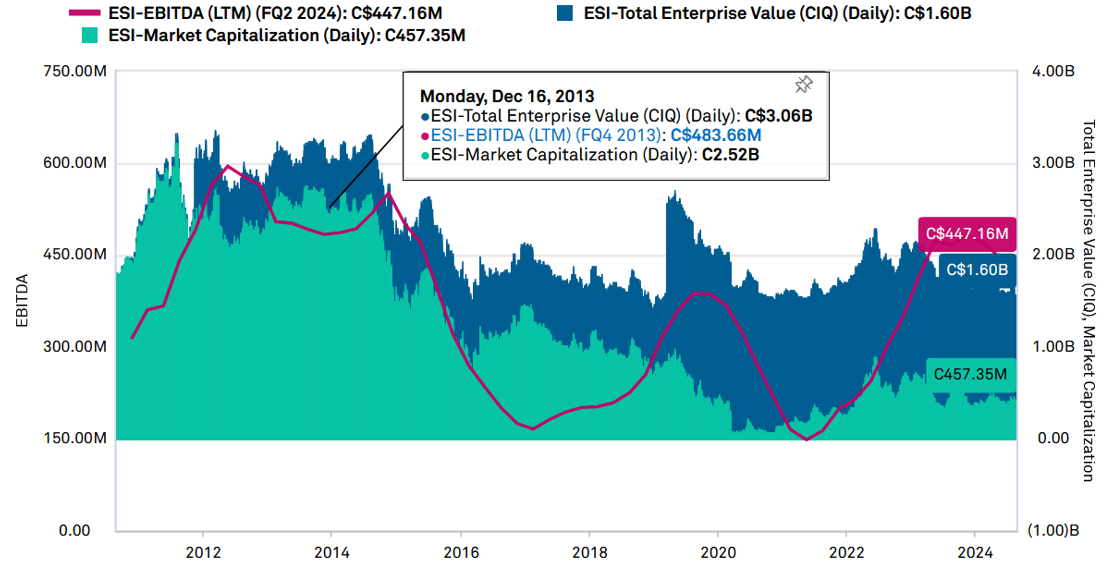

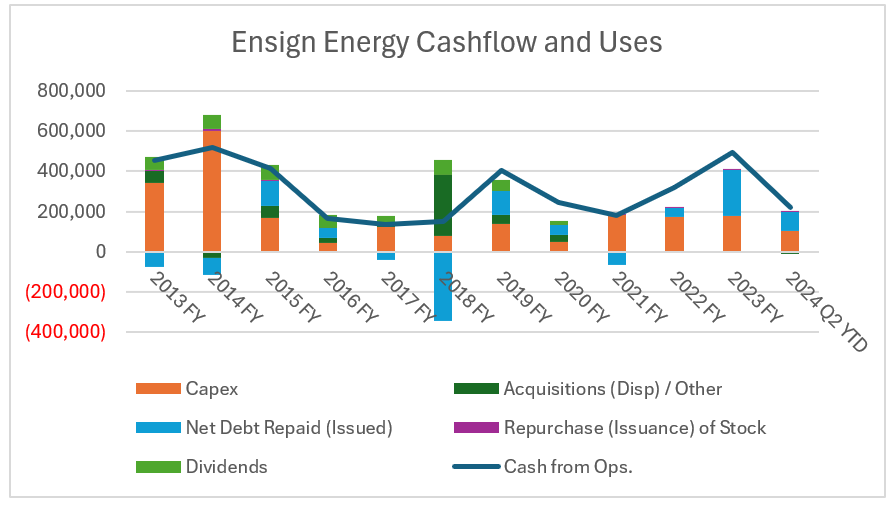

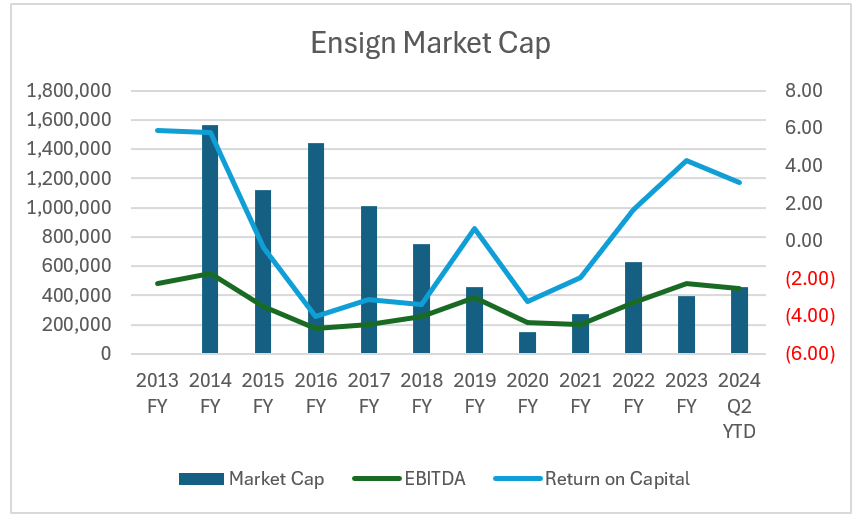

What we find interesting is when you overlay their EBITDAs with their market caps and enterprise values. While EBITDA is terribly crude, *especially for* capital intensive services like them, it is still a proxy for performance. Not to spoil the ending, but ESI’s free cash flow after all capex is about $200MM this year and is being used for debt repayment.

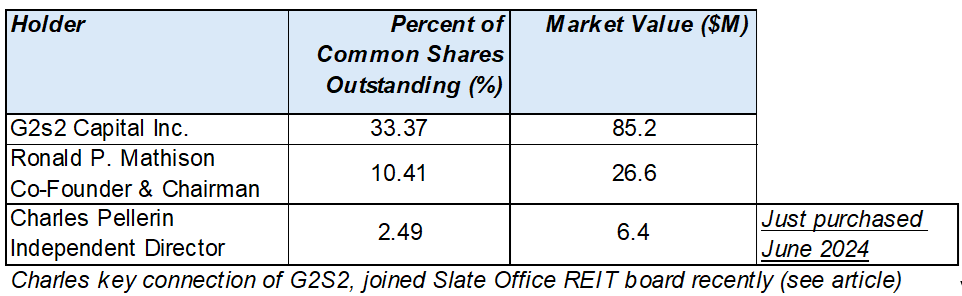

Calfrac and G2S2 - December 2020 Restructuring

The key owner now at Calfrac post-restructuring is G2S2. We have written about them previously (see our articles on Clarke, Inc., and more importantly, Slate Office REIT) where they are the key shareholder there.

They have a history of creative restructuring. G2S2 largely drove the restructuring of Bonavista Energy. They first became a material holder in August of 2019 when the company was already in trouble. We have put together this summary as well as provided the full restructuring agreement press release at the end. Calfrac has been similar.

Importantly, they key person who just joined the Board of Slate Office REIT also just made a significant investment in Calfrac.

A bit of history.

CALGARY, AB, Dec. 18, 2020 /CNW/ - Calfrac Well Services Ltd. ("Calfrac" or the "Company") (TSX: CFW) is very pleased to announce the completion of its previously disclosed amended recapitalization transaction.

The amended recapitalization transaction was implemented pursuant to a Plan of Arrangement (the "Plan") under the Canada Business Corporations Act ("CBCA"). This Plan was approved by an order of the Court of Queen's Bench of Alberta dated October 30; and an order giving full effect to the Plan in the United States was entered effective December 1.

Calfrac's Executive Chairman, Ron Mathison, commented: "We are delighted to make this announcement, which represents a new beginning for Calfrac. Calfrac now enters 2021 with: much lower debt; dramatically reduced interest expenses; a significant $60 million increase in the Company's liquidity; and a number of new, well-engaged investors."

Lindsay Link, Calfrac's President and Chief Operating Officer added: "We are becoming increasingly optimistic about client activity in all of the geographic areas that we serve. The combination of today's capital structure changes, improving business conditions and continuing expense reductions all bode well for the coming year."

A presentation containing the details of the Plan, as well as other important information, is available on the Company's website or by clicking here. A short summary of the specific elements of the Plan can be found below.

Two new directors have been appointed to the Calfrac Board: the well-known entrepreneur and investor, Mr. George Armoyan; and a senior investment manager, Mr. Anuroop Duggal. Mr. Armoyan is now the most significant investor in Calfrac; and Mr. Duggal is the nominee of another important new investor.

With the appointment of the two new directors, Messrs. Kevin R. Baker, QC and James S. Blair have retired from the Board. Mr. Mathison noted: "Both Kevin and Jamie have been exemplary directors throughout their long tenure. Their hard work, sound judgement and untiring dedication have served all of Calfrac's stakeholders exceedingly well. In Mr. Blair's case, I would specifically like to recognize his many notable contributions to Calfrac's extensive Health, Safety, Environment and Quality Management initiatives. For Mr. Baker, I would like to acknowledge his combination of legal expertise and extensive business experience which allowed him to bring particularly valuable perspectives to Calfrac's board."

Mr. Link also stated: "We are most grateful to the clients and vendors who have been steadfast partners of Calfrac, certainly over time, but especially throughout the past turbulent year. In addition, the Calfrac managers and employees in the field, in the various districts and at head office have never faltered. The long and complex process of completing the Plan could never have been accomplished without the efforts of our financial and legal advisors, our executive team and our board of directors. We offer sincere thanks to them all."

SUMMARY OF SPECIFIC ELEMENTS OF THE PLAN

As a result of the Plan, Calfrac has been able to:

-Reduce indebtedness by approximately $576 million, converted using the exchange rate as of September 30, primarily representing the face value of the Senior Unsecured Notes that were exchanged for common equity in the Company;

-Reduce annual interest costs by as much as $51 million, converted using the exchange rate as of September 30;

-Secure an increase in liquidity of $60 million, representing the capital injected by investors in the 1.5 Lien Convertible Notes. This amount is before the payment of remaining transaction costs;

-Issue to shareholders of record as of December 17, two share purchase warrants for every Calfrac share held. Each warrant allows the holder to purchase a share of common equity from the Company for $0.05 ($2.50 post consolidation). These warrants have a three-year term following the effective date, expiring on December 18, 2023 and will be listed for trading on the TSX under the symbol CFW.WT;

-Complete, using existing liquidity, a prior tender offer for Calfrac shares, where 6,061,561 shares were tendered for $909,234 in cash. The holders of these shares will also receive warrants for shares tendered per the terms of the tender offer;

-Execute an amendment to the Company's Senior Bank Credit Facility, including a waiver of the Funded Debt to Bank EBITDA covenant through Q2/21; and,

-Execute a share and warrant consolidation at a 50:1 ratio, resulting in approximately 37.4 million shares outstanding at closing, before giving effect to future warrant exercises, backstop fees, equity-linked compensation or conversion of the 1.5 Lien Convertible Notes. No fractional shares or warrants were issued as a part of the consolidations.

Separately, G2S2 provided a bridge loan, which was subsequently repaid.

On March 4, 2022 and March 15, 2022, the Company negotiated waivers and amendments to the 2020 Credit Agreement including, among others, the following: (i) the Funded Debt to Adjusted EBITDA covenant was waived for the quarter ended December 31, 2021, and increased to 3.75x for the quarter ended March 31, 2022; (ii) the minimum $15.0 million liquidity requirement was temporarily waived through March 15, 2022, and reinstated through the term of an extended covenant relief period expiring June 30, 2022; and (iii) the execution of a secured bridge loan of up to $25.0 million from G2S2 Capital Inc., a company controlled by Mr. Armoyan (“G2S2”) in order to fund the Company’s short-term working capital requirements (the “Bridge Loan”) was permitted.

And where are they today? Per a recent presentation.

Calfrac has made great strides in all key financial metrics during 2023 as higher free cash flow enabled us to invest heavily in our new Tier IV CAT-on-CAT dual-fuel equipment, while at the same time reducing long-term debt.

The economic reforms that were put in by the government have also considerably eased the cast restrictions that were implemented by the previous government. These reforms have greatly accelerated the cash back to Canada, including the transfer of profits out of the country. In the first quarter, we invested $18 million in a BOPREAL bond, and this bond allows for full amount of this cash to be evenly brought back to Canada over 12 months. So that's the first time that's happened.

A major fleet modernization will eat up significant capital this year (~$200MM), but Argentinian operations appear to be benefiting from the recent improvement in government.

Ensign – A bit more exciting to us

Where have we been and where are we going? As per their Q1 2024 call, “since 2019, Ensign has clipped off close to CAD 0.5 billion of debt off the balance sheet, that while executing on a few opportunistic acquisitions, which are generating strong EBITDA margins and free cash flow today. “will provide sufficient free cash flow to maintain our fleet in top condition and keep to our debt reduction targets of CAD 200 million a year.” Today’s market cap is ~$450MM.

Trinidad Timing

What really hurt Ensign was the timing of their acquisition of Trinidad Drilling. While opportunistic and made sense strategically, it just simply used too much debt.

On November 27 and 28, 2018, Ensign announced the successful acquisition of a total of 66.73% of the outstanding common shares of Trinidad Drilling Ltd. ("Trinidad"), including the 9.82% previously held by Ensign, which increased to 89.3% by December 21, 2018. After the November 27th announcement, all of Trinidad's directors and senior officers resigned and were immediately replaced with Ensign nominees. The acquisition of greater than 50% of the common shares of Trinidad and replacement of the Trinidad board required Ensign, as of such date, to fully consolidate Trinidad for financial statement purposes. As such, for the financial year ended December 31, 2018, Ensign will consolidate, in its year-end financial statements, the assets and liabilities of Trinidad as well as one month of operations, all with a corresponding minority interest of 10.7%. This minority interest will reduce to zero in the first quarter of 2019 due to the successful outcome of the special meeting of the shareholders of Trinidad held on January 31, 2019, at which an amalgamation transaction with a wholly-owned subsidiary of Ensign was approved. The result is that Trinidad will become 100% owned by Ensign prior to the end of February 2019 and will cease to be a reporting issuer shortly thereafter.

As previously announced, Ensign has entered into a three-year CAD$1,250 million revolving credit facility (the "Credit Facility") for the purposes of funding the Trinidad acquisition, the redemption of Ensign's US$200 million senior guaranteed notes due February 2019 and 2022, the repayment of Ensign's previous bank facilities, and for normal course operating requirements. As of February 14, 2019, the Credit Facility was reduced to CAD$900 million, using a portion of the proceeds from a US$700 million senior loan facility (the "Senior Loan"). A portion of the proceeds from the Senior Loan was also utilized, on February 14, 2019, to repurchase 99.93% of the outstanding US$350 million of Trinidad senior notes due 2025 (the "Notes"), and to pay related consent fees. The Notes were tendered, and the consent fees were paid, pursuant to our change of control offer to purchase and solicitation of consents announced on December 28, 2018. The Notes were repurchased at 101% plus accrued and unpaid interest. Consenting holders also received 0.5% for their consent.

2020 was not much better, but they continued on. Importantly, they stopped spending capex speculatively along with all of their competitors. Rebuilds need to be backed by contracts that will recover capex profitably.

Key Investors – First Murray Edwards, then Fairfax

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.