Here is the latest from Canadian Value Investors!

Keeping up with expectations – Lululemon NASDAQ: LULU

Canadian Housing and Mainstreet Equity MEQ

Fishing for ideas – HMM.A DADA SEA TVK

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Keeping up with expectations

Keeping with our recent theme on expectations, Lululemon missed last week (Disclosure: No position).

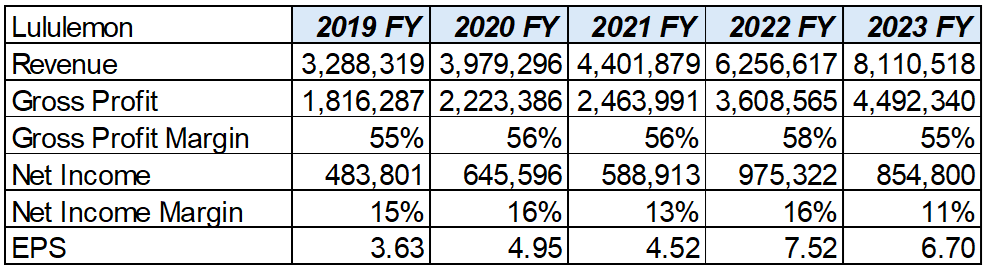

Just looking at the numbers, things do not appear to be so bad. However, the top line growth shown below slightly missed analyst estimates and their guidance for 2024 came in slightly below expectations. It brings to mind Janet Jackson’s banger What have you done for me lately? It is a good reminder that it is hard to keep up with the market’s expectations when you are trading at ~30x next year’s P/E (or ~3% earnings yield).

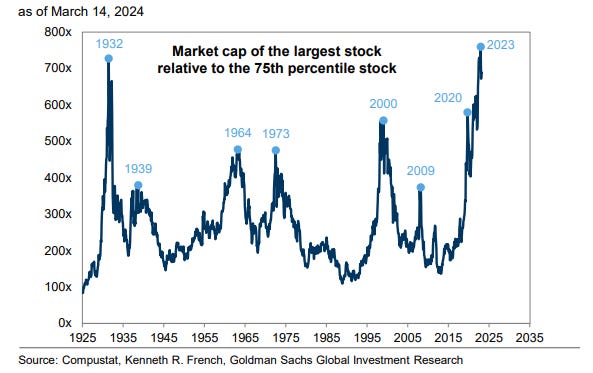

As of this March, concentrations of expectations in the largest of caps have never been higher.

Canadian Housing and Mainstreet Equity TSX:MEQ

We recently did an update of our favorite real estate company, Mainstreet Equity TSX:MEQ (Disclosure: We remain long): https://canadianvalueinvestors.substack.com/p/mainstreet-equity-tsxmeq-the-apartment

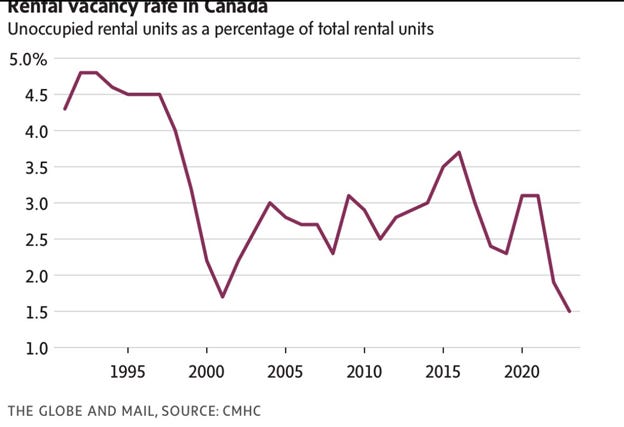

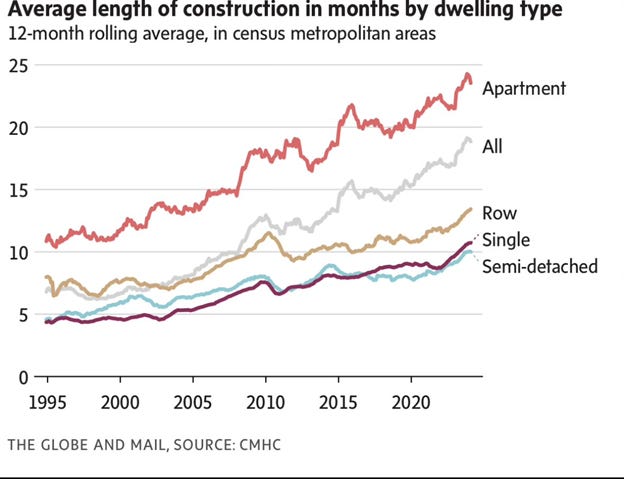

As a follow up, we wanted to highlight two charts that put in perspective the unfolding housing crisis. First, vacancy rates nationwide are now at the lowest level since the early 2000s. Secondly, Canada’s ability to create new housing continues to worsen. Compared to 1995, it now takes at least twice as long to build all types of housing. Mainstreet is well positioned; they provide renovated properties at a reasonable price while they are the best team in town at buying good deals to renovate, never mind potential redevelopment opportunities in their portfolio.

Maybe things will turn, but our immigration target remains at about half a million people per year. https://www.canada.ca/en/immigration-refugees-citizenship/news/notices/supplementary-immigration-levels-2024-2026.html

Fishing for Ideas – HMM.A DADA SEA TVK

We are always looking for new ideas and thought our readers might be interested in what we are looking at. Here are a few. We do not own any of the following at the moment but are evaluating.

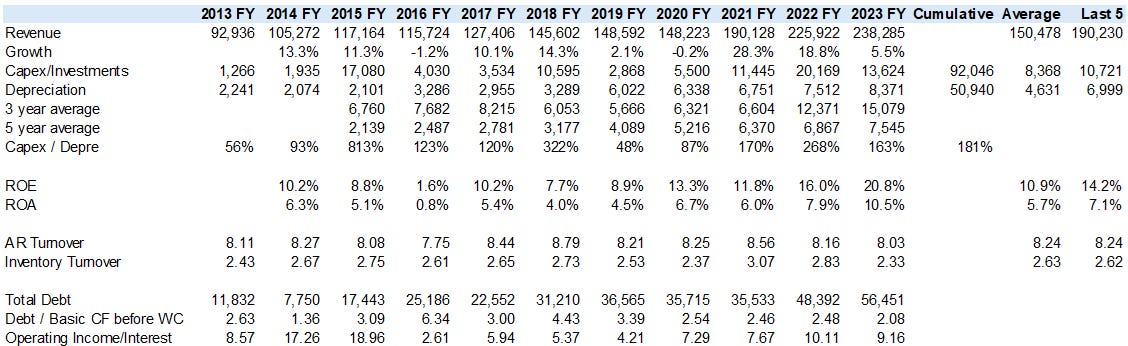

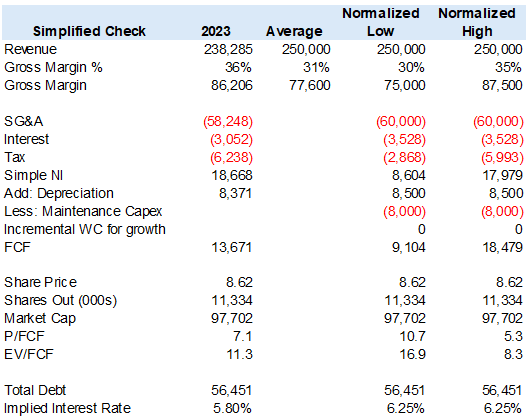

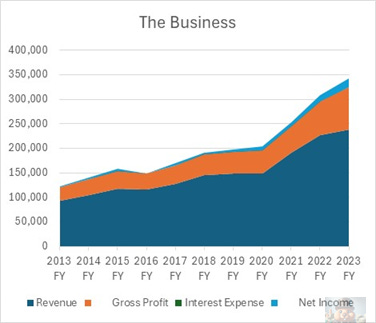

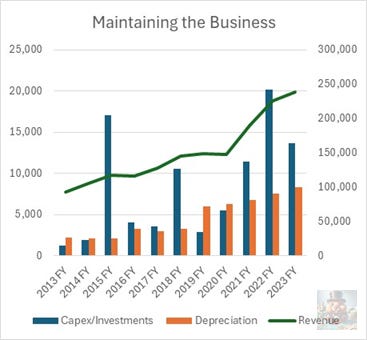

Hammond Manufacturing HMM.A – This is a neat story. This Canadian company is building electrical enclosures, racks, power strips, etc, including for data centers. Products are sold to distributors/OEM. They recently built a new facility which was significant capex and a step change for the business. Disclosures are light (no celebrating of recent success; minimal breakout of segment sales), governance seems good (no incremental shares issued for years, but no insider buying). It was very cheap but now less cheap after a recent run. The conundrum is trying to understand future sales and margins. We are trying to better understand the customer/competitive dynamics; if any of our readers is familiar with data center buildouts before please let us know.

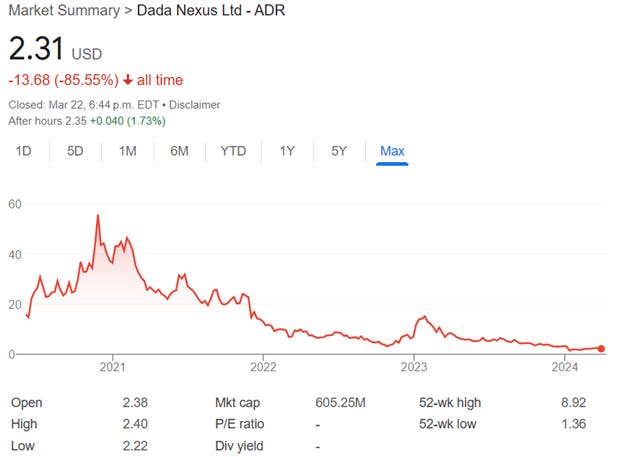

DADA - We have seen a number of fallen angel tech darlings crash with some getting bought out. In this case, a recent accounting scandal has not helped. Maybe this is another candidate given the interesting ownership structure, or at least it is an interesting case study.

I did more digging on Dada Nexus (DADA) (previously mentioned here when it was trading just under $1.7 and closed here at $2.6). The company owns Dada Now, a crowd sourced last mile delivery service and JD Daojia or JDDJ, an on demand retail platform with over 200k stores and brand owners that also provides other functions such as online delivery inventory look-up for store employees, crm services such as membership passes etc.

Dada Now makes up about 36% of revenue with JDDJ the rest. Dada Now was growing faster in 2023 at a 30% rate in Q3 vs JDDJ which grew at 15% (and I think JDDJ had its revenue overstated, so it is probably even a bit lower).

JD owns ~54% of DADA and Walmart ~9%.

A group of lower level managers had overstated both costs and revenue at the same time. JD appointed a new chairman and CFO at the end of 2023 (JD logistics veterans) and an independent review was started which has recently concluded that both revenue and costs the first 9 months of 2023 were overstated by about 500 million RMB. Or about $70 million. No other irregularities were discovered.

Market cap is just over $600 million and net cash is roughly $500 million.

2023 revenue will likely come in at $1.55 billion.

Stock trades at ~1x Gross profit.

Value Investing Substack - SEA Ltd (SE), “the Amazon of Southeast Asia famously crashed and burned following the bursting of the 2021 Tech Bubble, becoming the poster child for profitless Tech firms which pursued growth at all costs in an era of easy money…However, SEA Ltd recently reported its first full-year profit since its IPO. On top of that, it seems to be in the midst of graduating into a kind of Amazon in the regional e-commerce sector, having 30%-50% traffic share in much of the 11 Southeast Asian countries.”

https://valueinvesting.substack.com/canyousea1

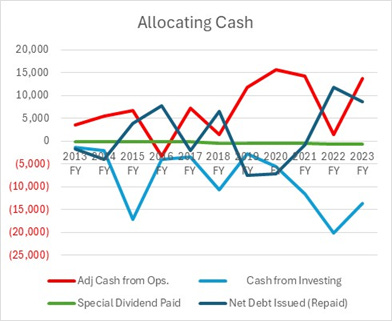

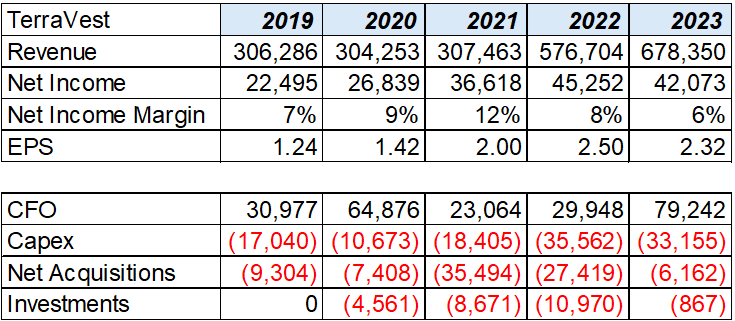

Yet Another Value Blog Podcast – Terravest – Another neat Canadian roll-up company.

Chris Waller, Founder and CIO at Plural Investing, joins the podcast to discuss his thesis on TerraVest Industries Inc. (TSX: TVK), a manufacturer of home heating products, propane, anhydrous ammonia (“NH3”) and natural gas liquids (“NGL”) transport vehicles and storage vessels, energy processing equipment and fiberglass storage tanks.

Some key numbers:

Thank you for subscribing!