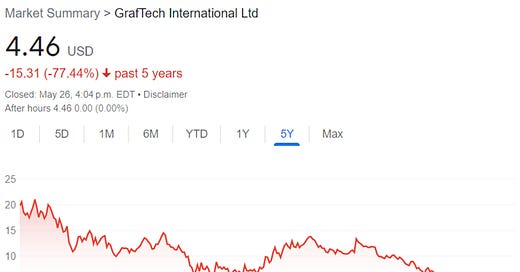

(From May 2023 archives) - Graftech (NYSE:EAF) – Scuttlebutt, and tail risks, and value traps, oh my

Disclosure: This article was originally posted in our pre-Substack CVI Club in May 2023

In 2019, we first wrote about Graftech International, the spin-off “niche business that the market forgot”. It was an interesting business trading at cheap multiples, but we ultimately did not hold it for long and this turned out to be the right decision. We dodged a bullet. Subsequent to our investment, they had a major regulatory hiccup at their key facility in Mexico (temporarily shut down completely; #awkward). Was this foreseeable? Maybe this is a good business after all, and it is time to buy? We find post-mortems extremely valuable. Secondly, this is a good example of using scuttlebutt in a modern world. And finally, we still might take action on this depending on how their issues get resolved…

What is Graftech? Brookfield’s turnaround pitch

What did we decide?

Chapter 2: The Monterrey strike scuttlebutt - Scuttlebutt in practice in a modern world

Chapter 3: The long tail (risk)

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Graftech and Graphite Electrodes 101

“So what would you say you do here?”

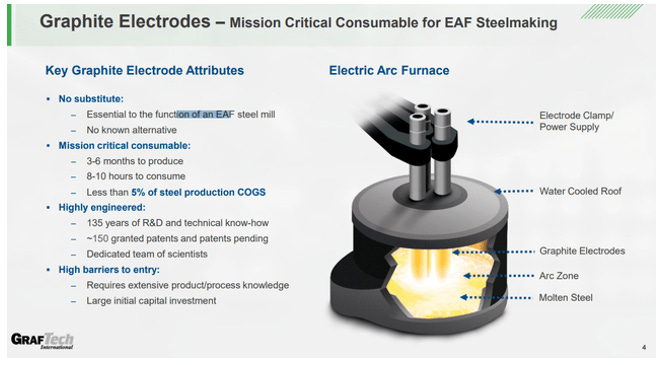

• Graftech describes itself as “a leading manufacturer of high-quality graphite electrode products essential to the production of electric arc furnace (or EAF) steel and other ferrous and non-ferrous metals.”

• The gist – Produce niche product graphite electrodes, which are essential to make EAF steel.

• They are one of the few if only vertically integrated manufacturers that also makes the main input to graphite electrodes, petroleum needle coke.

• It was a Brookfield Asset Management baby taken private, turned around, and then taken public 2018.

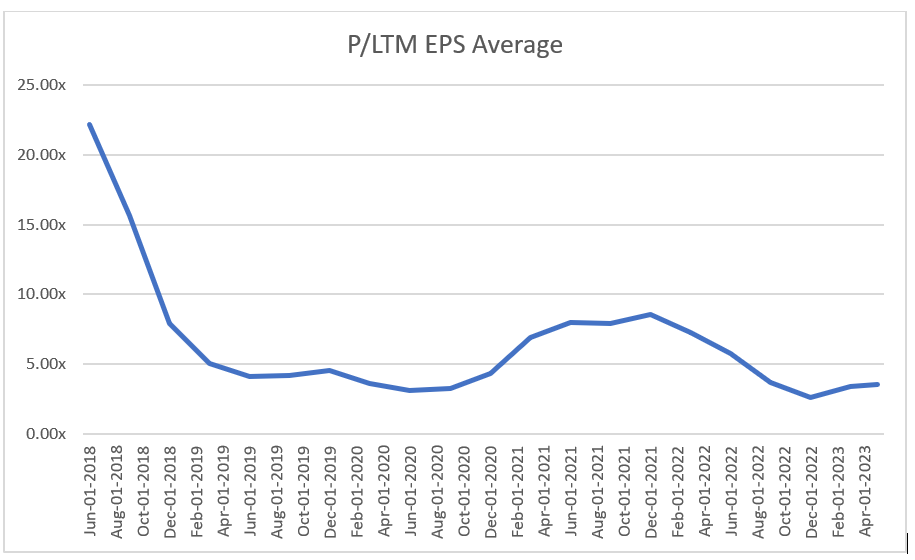

• It was trading at 4-5x free cash flow when we found it in 2019.

What are graphite electrodes?

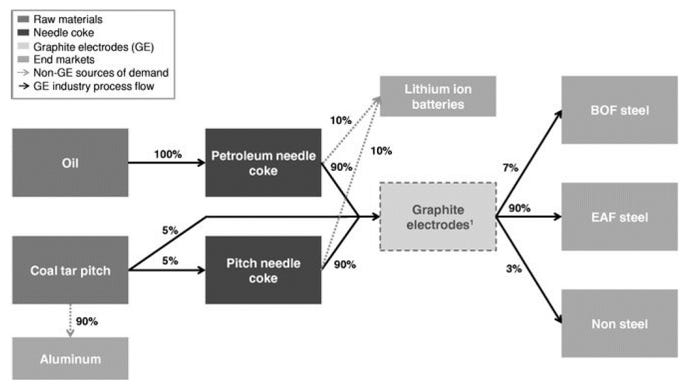

Petroleum needle coke is a high-quality form of coke derived from oil refinery byproducts.

It is called "needle coke" because of its long, needle-like structure, which is essential for producing high-quality graphite electrodes that have a unique combination of high thermal conductivity, low coefficient of thermal expansion, and high mechanical strength.

Graphite electrodes are typically made from high-purity graphite and are used as conductive elements in EAFs to generate high temperatures required for melting scrap metal and other raw materials. These electrodes are highly resistant to heat and can withstand the extreme conditions of the EAF, which can reach temperatures of up to 3,000°C.

How graphite electrodes fit in

The table below summarizes the process well. Effectively, electrodes are a small but absolutely essential part of EAF steelmaking. Quality is also paramount and they are relatively hard to manufacturer (at least the highest grades are); if they fail/are low quality/fail prematurely, this can cause expensive operational problems and downtime. They argued that this made for sticky customers who are willing to pay for quality, so long as you are actually high quality and reliable…

Typically 1.7 kilograms of electrodes is required to make 1 ton of steel, and needle coke is turned into graphite electrodes on a roughly 1:1 basis by weight.

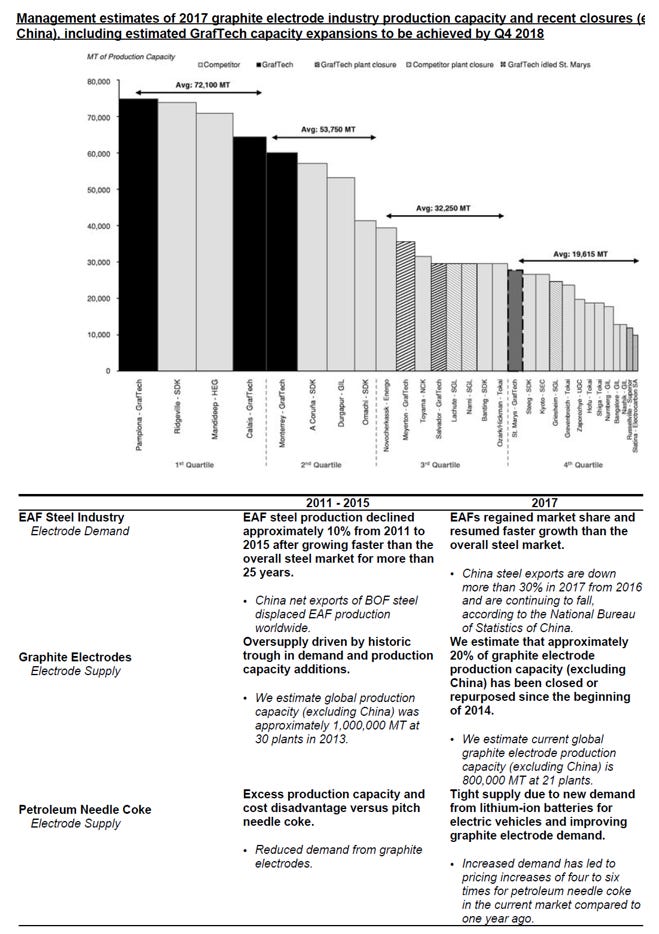

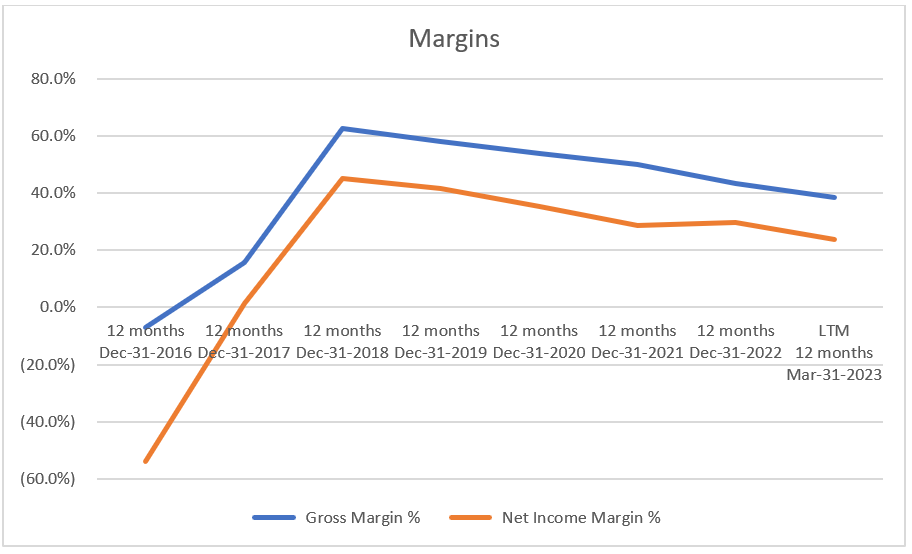

Brookfield’s turnaround pitch

Brookfield acquired Graftech for $1.25 billion and put it through their turnaround process.

”We have achieved annual fixed manufacturing cost improvements and capital expenditure reductions of approximately $190 million since 2012, while also improving the productivity of our plant network We have strategically shifted production from our lowest to our highest production capacity facilities to increase fixed cost absorption.”

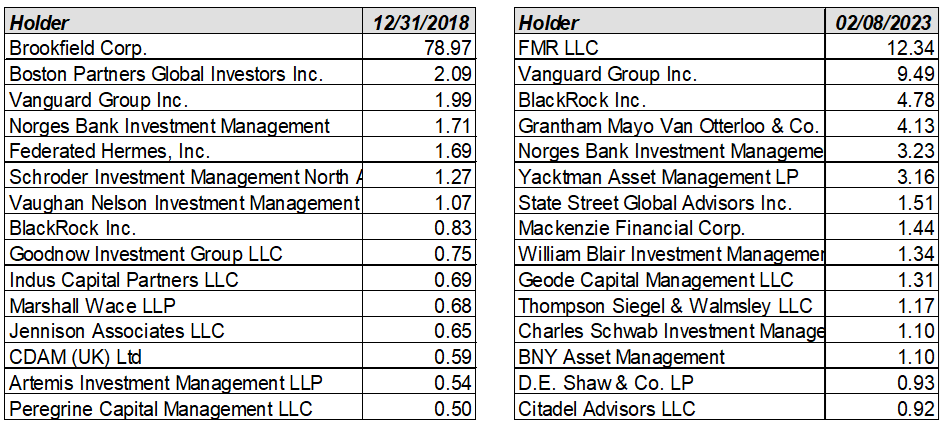

They IPO’d the business in 2018 at ~4.5 billion and subsequently sold down most of their holdings. With ~80% ownership at the IPO, they did well to put it lightly. https://ir.graftech.com/investors/news/news-details/2018/GrafTech-Announces-the-Closing-of-its-Initial-Public-Offering/default.aspx

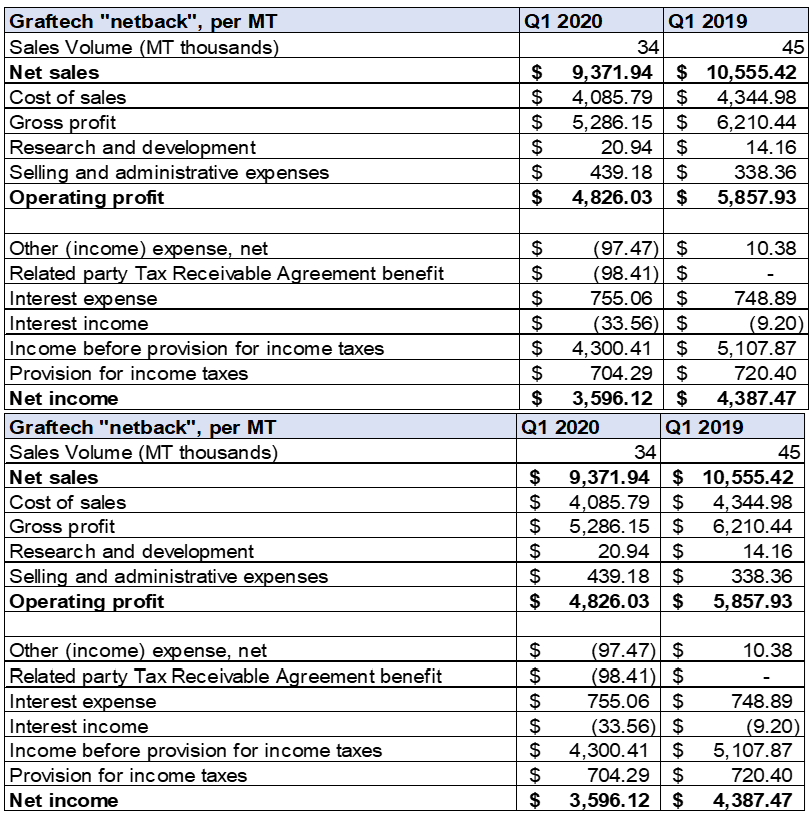

Graftech “netback”

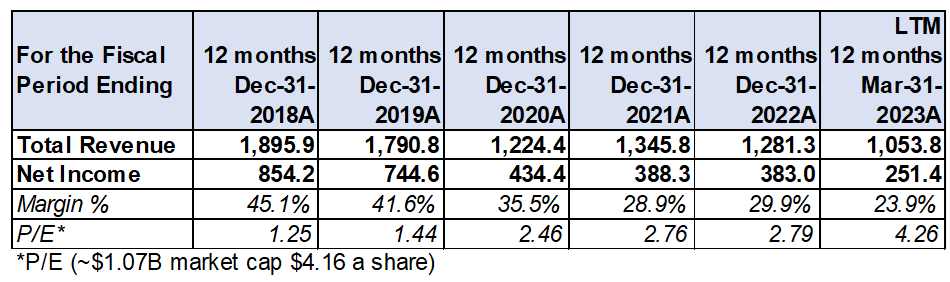

We have covered oil and gas quite a bit, and the term "netback" refers to the profitability of a barrel of oil or natural gas after deducting all associated cash operating costs, such as transportation, processing, and marketing expenses (not accounting for the cost to find a barrel; a discussion for another day). For Graftech, you can do a similar analysis. Here is what it looked like when we did our first check.

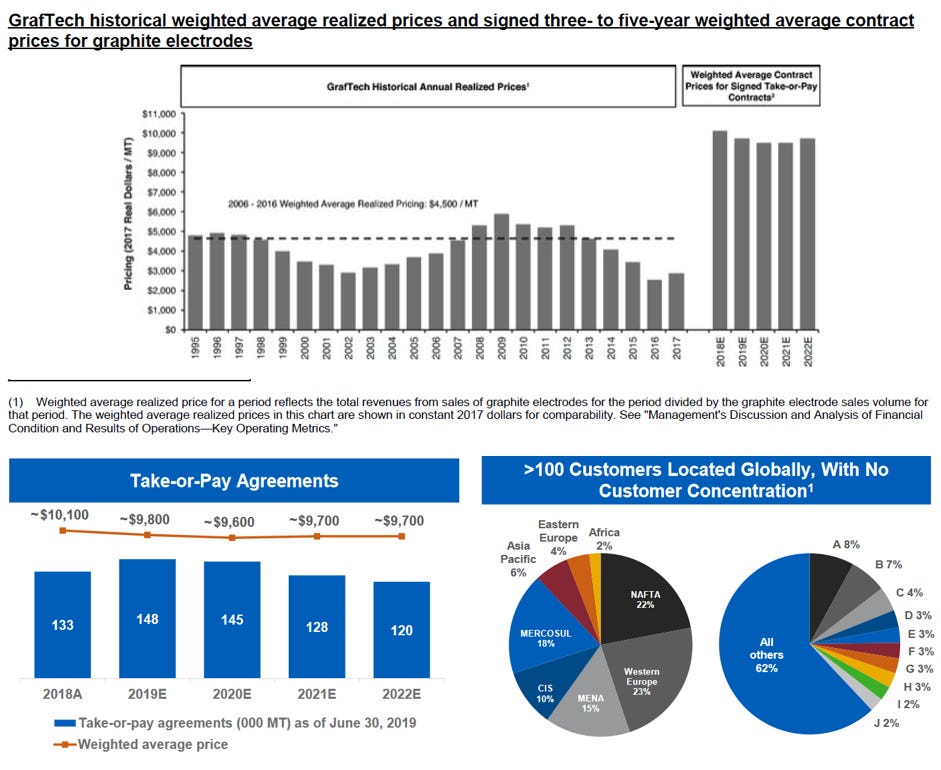

This looks great when compared to their long-term contracted rates, but not so great when compared to historical rates or spot rates. “Where were those new contract renewals” we wondered? Maybe they will come.

Measuring price and success since 2015 acquisition by Brookfield

(with the benefit of hindsight and more data than our original purchase)

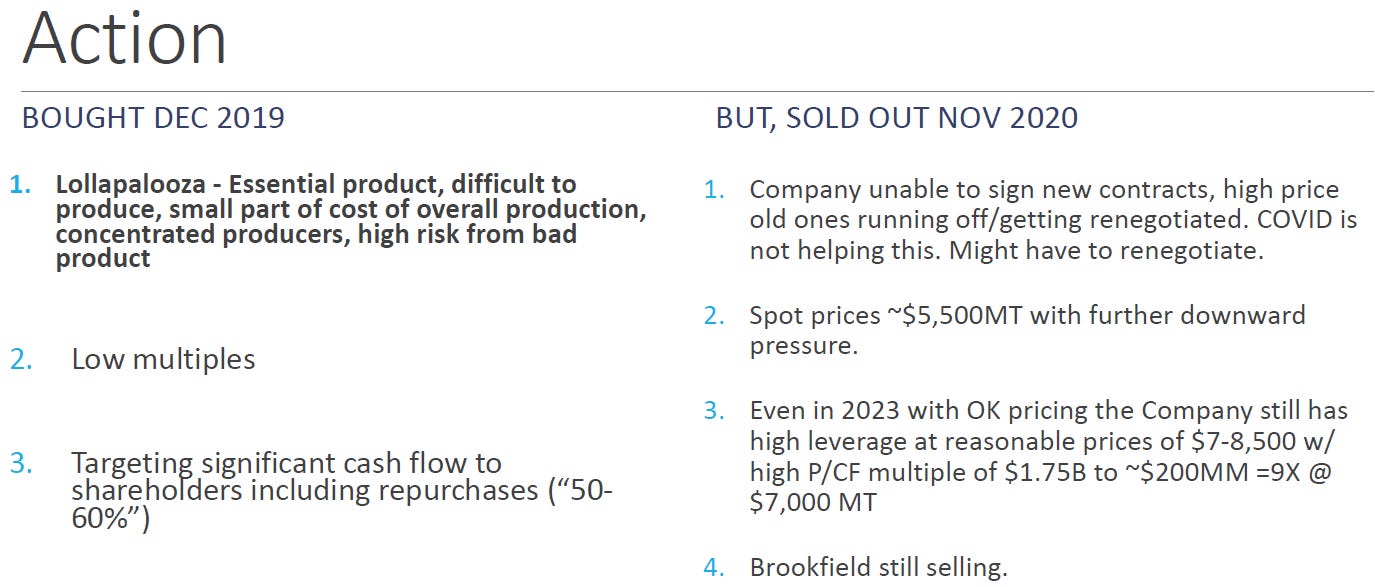

What did we decide in 2019? It was time to buy!

We bought in December 2019 because:

Lollapalooza - Essential product, difficult to produce, small part of cost of overall production, concentrated producers, high risk from bad product.

Low multiples and delevering plans in place supported by long-term fixed price contracts.

Targeting significant cash flow to shareholders including repurchases (“50-60%”).

But we ultimately sold out in November 2020 because:

The Company unable to sign new contracts, high price old ones running off/getting renegotiated. COVID was not helping this and we worried they might have to even renegotiate existing contracts, never mind not be able to find new ones.

Spot prices were ~$5,500MT with further downward pressure.

Even with OK pricing the Company still has high leverage at reasonable prices of $7-8,500 w/ high P/CF multiple of $1.75B to ~$200MM =9X @ $7,000 MT

Brookfield was still selling, causing sell down pressure (and the nagging feeling that you are buying from a smart counterparty that has much more knowledge than you).

Chapter 2: The Monterrey strike scuttlebutt - Un problema grande

What is scuttlebutt? It is (to us) using various sources of public information to get an edge in investing. fun set of cases of practical use is in the book "Sleuth Investor" is a financial guide written by Avner Mandelman that focuses on the principles and techniques of value investing that are effectively scuttlebutt. It is a bit “value investing 101”, but has numerous interesting examples, such as calling a company’s sales team and their competitors and actual customers to get a feel for what the competitive dynamics are, and if they are changing. We use these techniques (particularly helpful with Philips last December) and put a twist on them using social media, forums, etc.

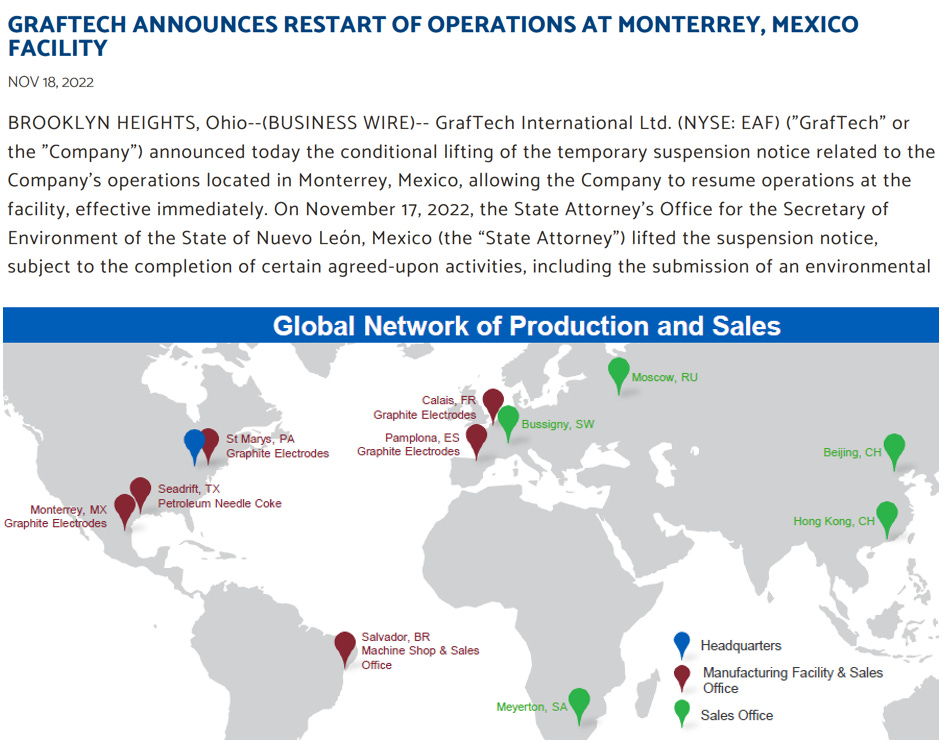

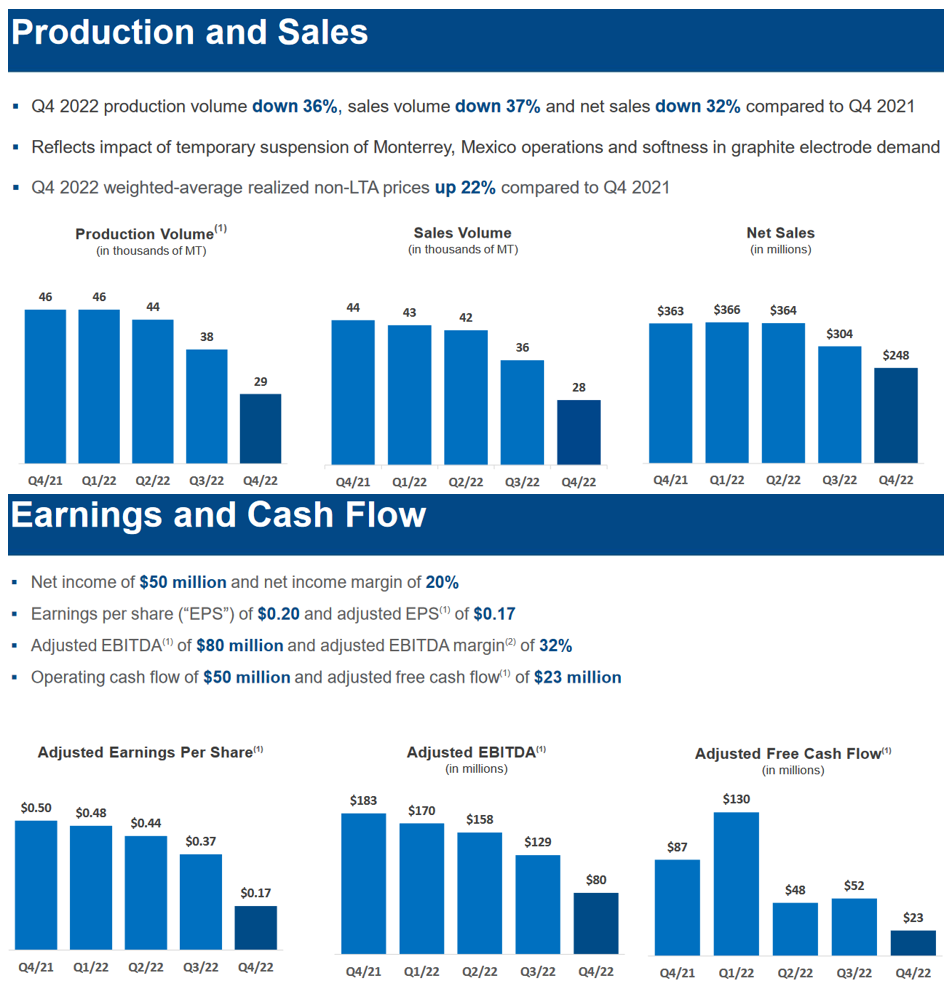

When Graftech had to shut down their key facility in Monterrey Mexico seemingly out of the blue, it was the perfect practice ground. The following slide summarizes the issues well...

• The plant has been operating for decades, but was shut down without much public warning in 2022. However, after digging into this it appears the issues go back at least a decade. For example, in 2014, the community in Apodaca Nuevo Leon sent Graftech videos and various letters about pollution (the “black powder of Apodaca”!). Some examples of the things we found include:

• El polvo negro de Apodaca - YouTube

• El Polvo Negro de Apodaca 2 - YouTube

• A Facebook group https://m.facebook.com/nt/screen/?params=%7B%22note_id%22%3A10159109741233081%7D&path=%2Fnotes%2Fnote%2F

• We note our public list is limited; a key lesson from Sleuth Investor is to protect your sources.

Everything is fine?

Ultimately, they resolved their “issues” and said they were restarting as per their filings without much detail. But, if you also did your own digging, you could also find tidbits such as a local press conference with the local mayor by their side for the announcement among other things. In Mexico, this means the issue is resolved. But, just because their plant is reopened does that mean everything is fine? What about customers?

Chapter 3: The tail risk

The hidden cost of efficiency, like just in time delivery, is a loss of resilience. After Brookfield’s efficiency push, “Monterrey is also the only facility that supplies connector pins for all UHP (Ultra High Power) GE production at GrafTech.” #Awkward

(November 2022 update, emphasis ours)

In addition, on the commercial front, the timing of the suspension coincides with the critical time frame to secure customer orders for the first half of 2023. As a result of the uncertainty caused by the suspension during this contract negotiation window, our ability to enter into new customer commitments for the first half of 2023 was limited.

In mid-November, we announced that our efforts towards the resolution resulted in an agreement with the authorities that allows for the conditional lifting of the suspension notice and the restart of the facility. The lifting of the suspension notice was subject to a completion of certain agreed-upon activities, and we are well on track to accomplish all aspects of the condition.

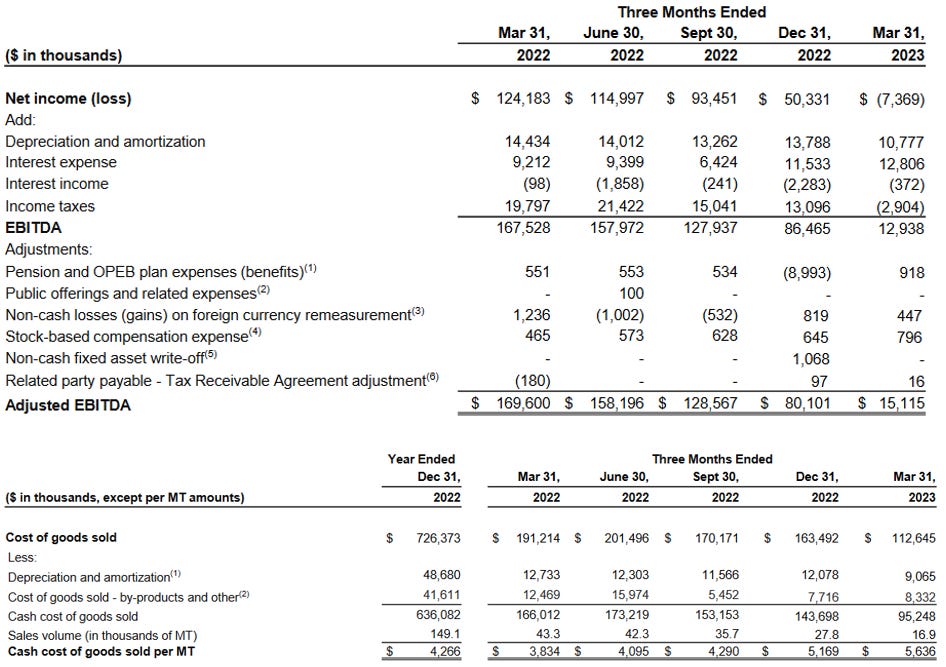

(Q1 2023 report, emphasis ours)

Although the facility resumed production during the fourth quarter of 2022, the suspension coincided with a key commitment window for customer purchases covering the first six months of 2023. The resulting uncertainty during this timeframe limited our ability to enter into new customer commitments for the first half of 2023. In addition, the lower sales volume was partially attributable to softness in graphite electrode demand.

(more detail)

Although the facility resumed production during the fourth quarter of 2022, the suspension coincided with a key commitment window for customer purchases covering the first six months of 2023. The resulting uncertainty during this timeframe limited our ability to enter into new customer commitments for the first half of 2023. In addition, the lower sales volume was partially attributable to softness in graphite electrode demand. A shift in the mix of our business from volume derived from our take-or-pay agreements that had initial terms of three-to-five years("LTA") to volume derived from short-term agreements and spot sales ("non-LTA") further contributed to the decline in net sales.

The suspension of our operations in Monterrey, Mexico in late 2022 will have a significant impact on our sales volume through the end of the second quarter of 2023. In addition, we anticipate continued soft demand for graphite electrodes due to ongoing economic uncertainty and geopolitical conflict. Reflecting these factors, we estimate our sales volume for the second quarter of 2023 will be in the range of 24 thousand MT to 27 thousand MT. In the second half of the year, we anticipate sales volume levels will further recover, as we move past Monterrey suspension-driven uncertainty, however we expect demand for graphite electrodes will continue to be impacted by softness in the commercial environment. Among other factors, this reflects graphite electrode inventory levels at our customers that currently exceed typical norms. As a result, we estimate our sales volume for the full year of 2023 will be in the range of 100 thousand MT to 115 thousand MT.

This is a great example of how operating leverage can go both ways. More importantly, high quality and reliability is what their success hinges on, and this is the opposite of that. And check out that operating leverage below in their per MT COGS.

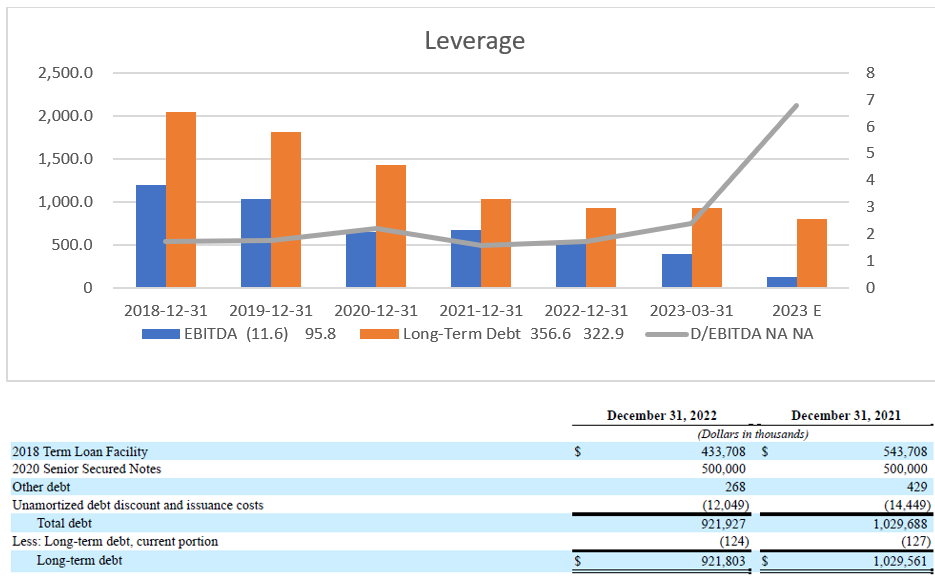

And, of course, it is also a great example of how quickly leverage can change. Imagine this happened in 2018 when they had almost twice as much debt…

Here are the covenants.

The 2018 Credit Agreement contains customary representations and warranties and customary affirmative and negative covenants applicable to GrafTech and restricted subsidiaries, including, among other things, restrictions on indebtedness, liens, investments, fundamental changes, dispositions, and dividends and othe distributions. The 2018 Credit Agreement contains a financial covenant that requires GrafTech to maintain a senior secured first lien net leverage ratio not greater than 4.00 to 1.00 when the aggregate principal amount of borrowings under the 2018 Revolving Credit Facility and outstanding letters of credit issued under the 2018 Revolving Credit Facility (except for undrawn letters of credit in an aggregate amount equal to or less than $35.0 million),

But, at least the ownership has cleaned up? The Brookfield overhang is now gone.

What will happen with sales/margins going forward?

Is Graftech a value trap? The key conundrum that we cannot answer is will these customers come back or is the business permanently impaired? If these customers do come back, does that mean the product is much more commoditized than we thought? If that’s the case, are (lower) spot prices the best prices to use? Our netback table above gives an indication of how tight (or great) this business can get at various prices. Graftech might ultimately turn out to be a great investment if you buy it today, but we are staying on the sidelines.

It is a good reminder that:

• You need to beware of tail risks – In this case, we missed the hidden risk of the strike and the second order effects (business moat depends on being dependable)

• Scuttlebutt can be useful

• You need to track your thesis – In this case, ours broke when they weren’t able to recontract anything a year after investment and, in turn, we sold.