Inflation and Stocks: The first rule of a happy life is low expectations – PBR, BATS/BTI

We realized that we accidentally built what might seem like a prepper's stock portfolio of guns, canned vegetables, building supplies, and oil, with a pinch of hurricane insurance. We swear it's just the best deals I can find at the moment. $SODI $POWW $SENEA $PBR $TBL $ACIC

Here is the latest from Canadian Value Investors!

Ideas from around the world

Interest rates and stocks: “The first rule of a happy life is low expectations”

Petrobras: Dividend expectations

British American Tobacco: Low expectations

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Ideas from around the world

The Opus: Investing Adventures in Georgia [the country] -

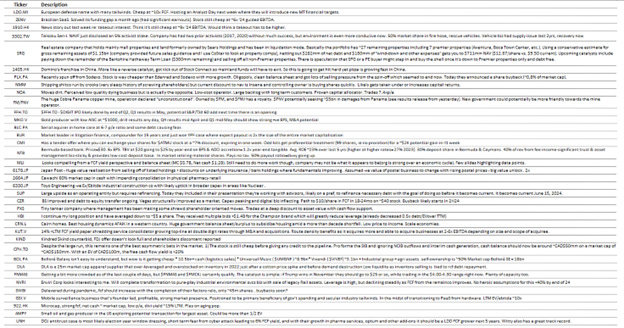

Clark Square Capital Idea Roundup - Clark periodically does a Twitter survey and it is always fun to read through.

https://x.com/clarksquarecap/status/1765885467051106613?s=12

Interest Rates and Stocks: “The first rule of a happy life is low expectations”

Charlie Munger had a number of sayings, and one of our favourites is that “the first rule of a happy life is low expectations”. We have taken this to heart, and we think it is prudent advice that can help investors avoid some misery.

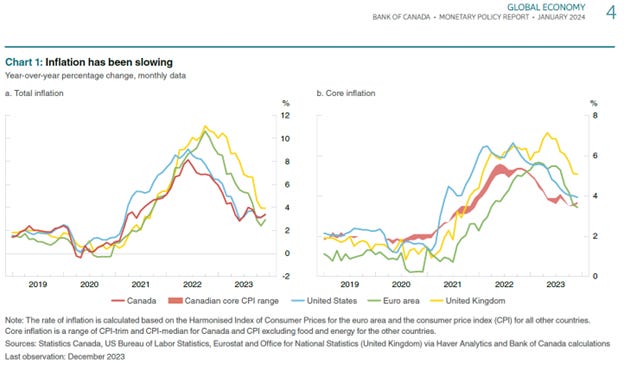

A great case study is interest rates. Last year some speculators were tripping over each other forecasting how fast rates were going to decline. And now, “Fed’s Powell to Double Down on ‘No Rush to Cut’ Message” https://www.bloomberg.com/news/articles/2024-03-02/fed-rates-latest-powell-is-about-to-double-down-on-no-rush-to-cut

The “danger of moving too soon is that the job’s not quite done, and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading.”

Inflation expectations are also a bit sticky, and we are seeing stories like Boeing’s largest union asking for a 40% pay raise - https://nwlaborpress.org/2024/03/boeing-back-in-bargaining-first-time-in-16-years/

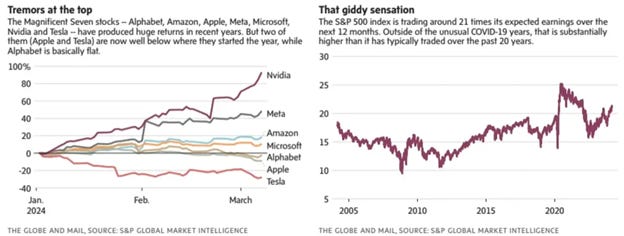

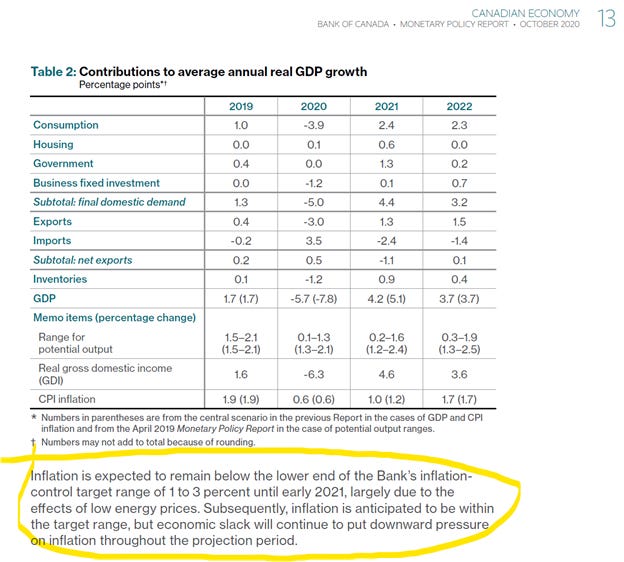

We continue to think people are underestimating how awkward it is for the central banks of the world. The inflation run-up was missed and the incentives to not miss again are high. We highlight below the Bank of Canada’s 2020 and 2022 views on inflation below. To be clear, we do not know where rates and inflation are going and are always focusing on ideas that will be resilient in most tides.

We have also noticed a number of companies getting hit hard after earnings this year, even companies that have improving bottom lines. They are just not meeting high expectations.

Petrobras: Dividend expectations

Disclosure: We are still long.

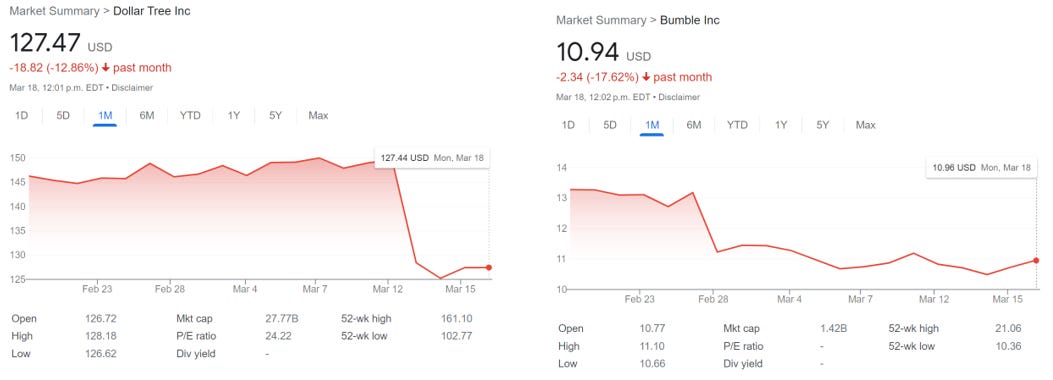

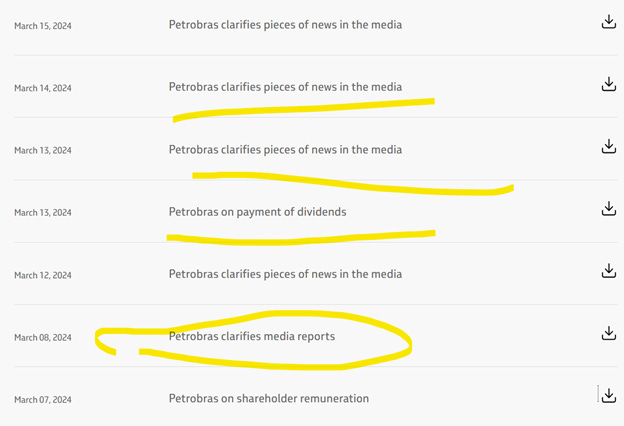

Petrobras announced on March 7th their dividend proposal for the AGM. The market was expecting extraordinary dividends on top of regular dividends (difference outlined below) and we were not. The general expectations around extraordinary dividends were a bit silly, and the reaction - to us - is shortsighted. We purchased some incremental shares post-announcement. We find it hard to complain; dividends at original 2023 cost are about 30% to-date while underlying business performance continues to improve and commodity prices continue to cooperate.

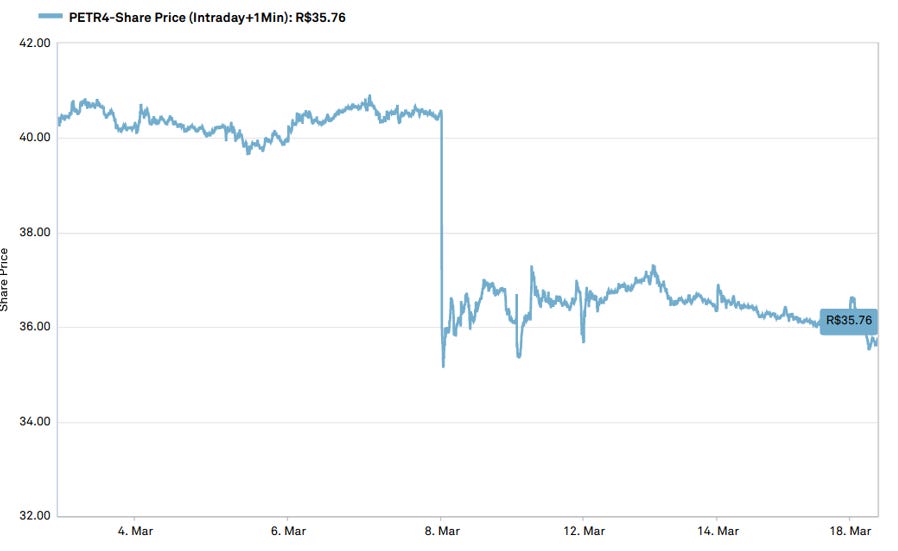

We do think working in Petrobras’ investor relations department might be one of the worst jobs in finance. Post-announcement they issued a number of press releases “clarifying news in the media”. For those that do not subscribe to their press releases, these sorts of releases are frequent…

https://www.investidorpetrobras.com.br/en/results-and-announcements/notice-to-the-market/

The Dividend announcement

Rio de Janeiro, March 7, 2024 – Petróleo Brasileiro S.A. – Petrobras informs that its Board of Directors (BoD), in a meeting held today, approved the submission to the Annual General Assembly (AGM), scheduled for April 25, 2024, of the proposed distribution of dividends equivalent to R$ 14.2 billion. If approved by the AGM, considering the dividends anticipated by the Company throughout the year, adjusted by Selic, the total dividends for the year 2023 will total R$ 72.4 billion.

The proposed distribution is in line with the Shareholder Remuneration Policy (Policy), approved on 07/28/2023, which provides that, in the case of gross debt equal to or lower than the maximum level of debt defined in the strategic plan in force (currently US$ 65 billion), Petrobras must distribute 45% of the free cash flow to its shareholders. The proposed dividends already take into account the value of shares repurchased in the fourth quarter of 2023 of R$ 2.7 billion and the correction by SELIC on the advances of dividends and interest on own equity related to the 2023 fiscal year, in the amount of R$ 1.1 billion, which were deducted from the total remuneration to shareholders, in accordance with the provisions of the Policy and the Bylaws, respectively.

The approval of the dividend is compatible with the Company's financial sustainability and is in line with the commitment to generating value for society and shareholders, as well as the best practices of the global oil and natural gas industry.

“Clarification” - One of many.

Rio de Janeiro, March 15, 2024 – Petróleo Brasileiro S.A. – Petrobras, regarding the article "Controversy puts dialogue between Petrobras and the market in check", published in Valor Econômico this Friday, reiterates that the company did not promise or signal a direction for extraordinary dividends at an event with analysts and investors, as already disclosed in a release on March 12.

Petrobras reaffirms that the material presented at the event held with analysts and investors on 01/30/2024 and 01/31/2024 does not signal the payment of extraordinary dividends, as wrongly stated in the article. The part of the presentation that mentions the dividend process contains public information on parameters, guidelines and the process that supports shareholder remuneration decisions. The material is available on the company's investor website, as well as at the CVM and the SEC.

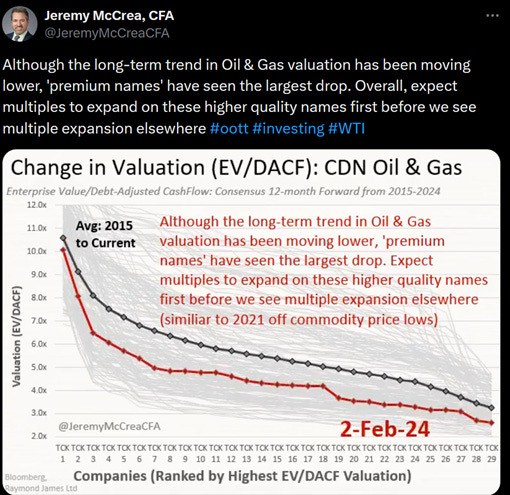

Expectations of energy companies in general continue to be low. https://x.com/JeremyMcCreaCFA/status/1754909108942340310

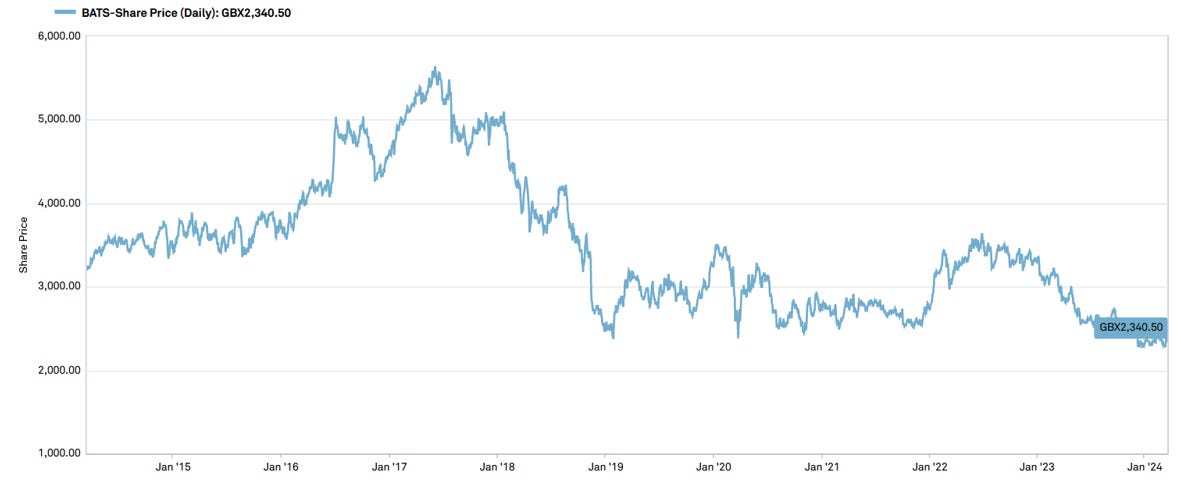

British American Tobacco BTI / BATS: Low expectations

Disclosure: We own this one.

One company that the market has low expectations for is British American Tobacco.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.