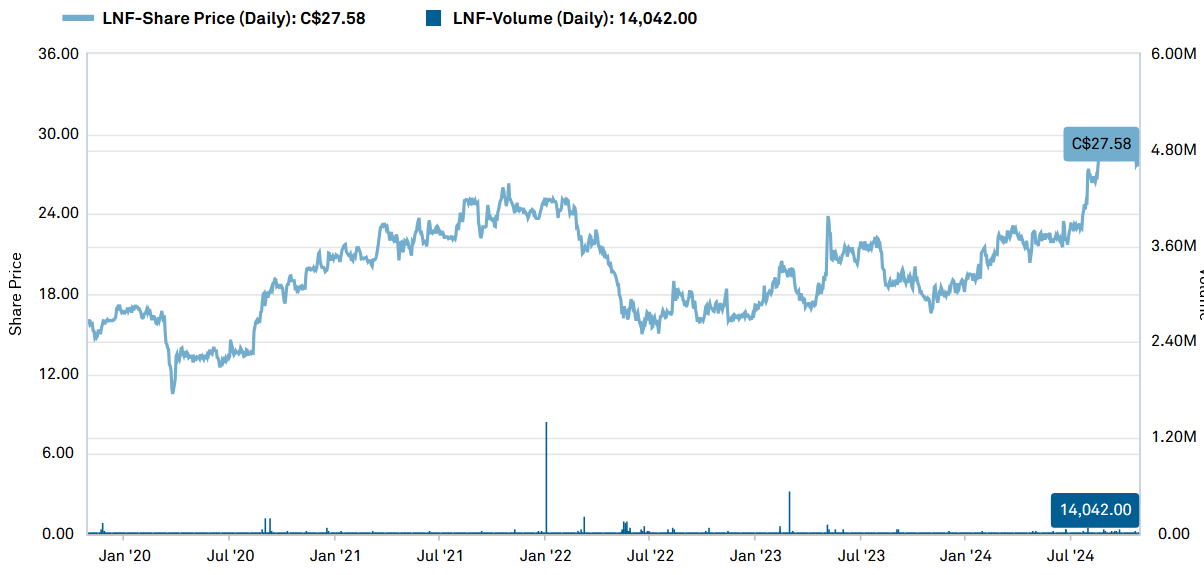

Leon’s Furniture TSX:LNF – Every lot is for sale, but the real story is about capital allocation

Disclosure: We own this one.

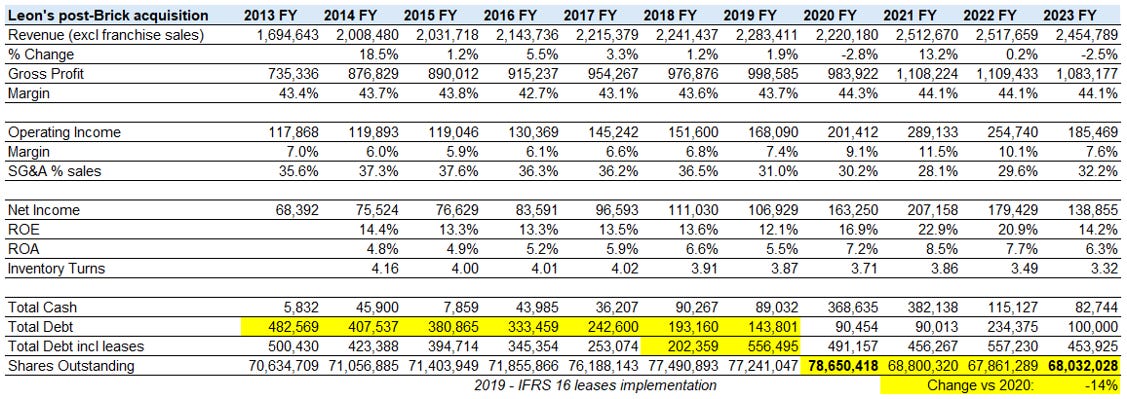

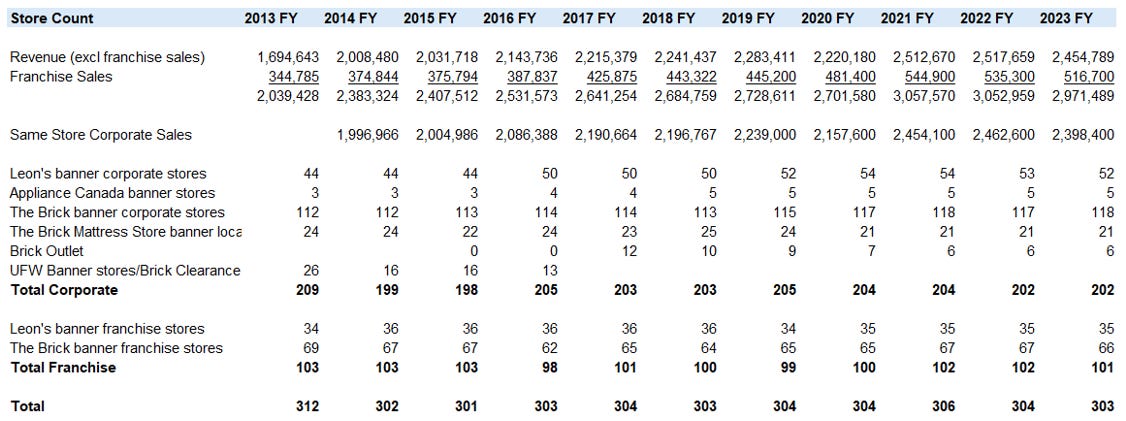

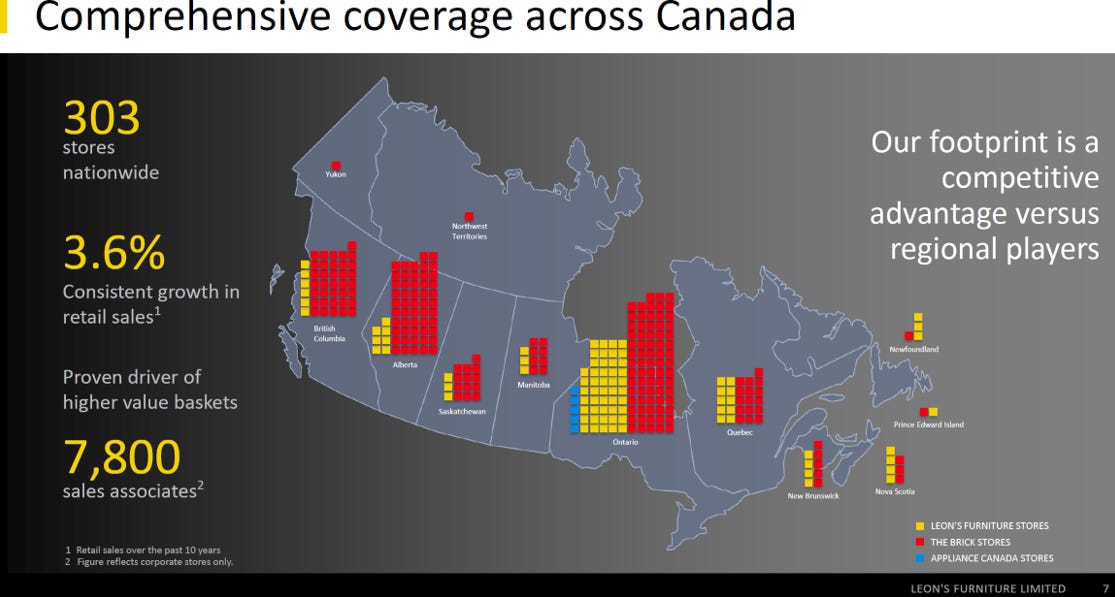

Leon’s is a fixture in the Canadian furniture market. The Leon’s brand has existed for over 100 years (since 1909 to be exact) and they were arguably the first to bring big box retailing to Canada at scale. They continued to grow until 2013 when they made a bet the farm acquisition of ~$700MM on The Brick (a successful competitor started in 1971) that actually had more stores than they did.

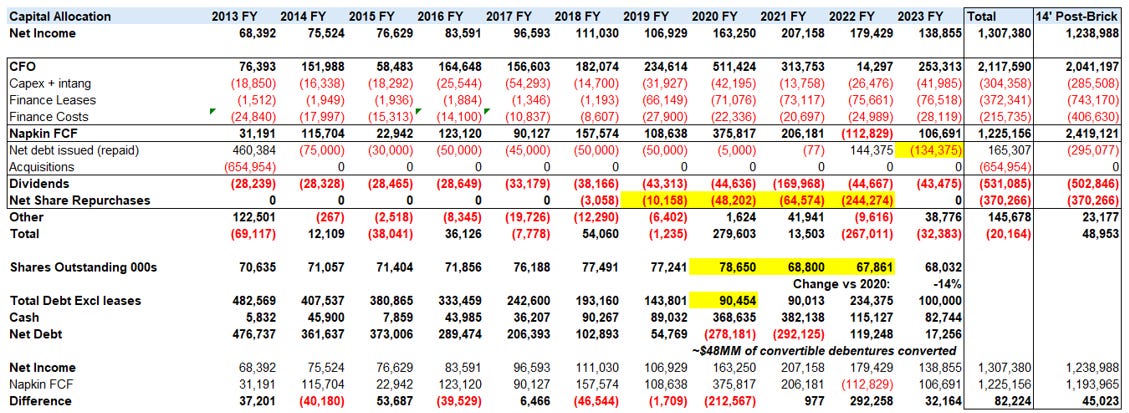

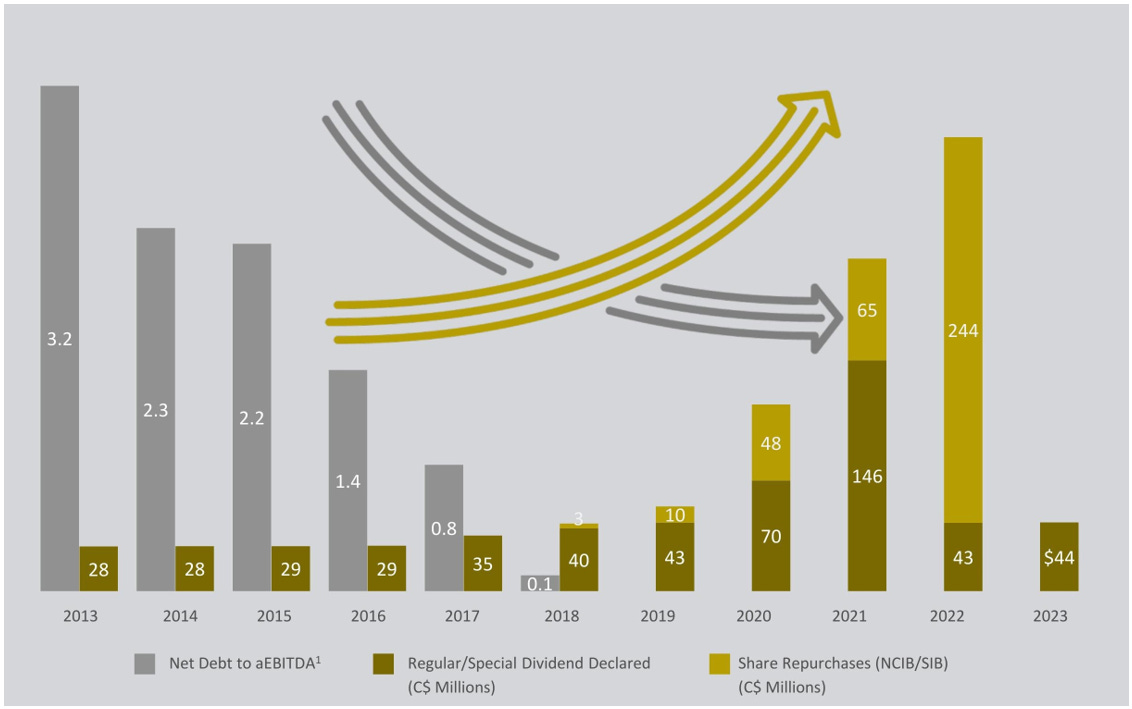

After the acquisition, they began to de-lever and now total debt approximates cash and while they reduced their share count by 14% over the past few years. Now they have $3 billion in system-wide sales (including franchises), warranty and insurance sales, and likely a bit more than a billion of real estate at fair value held on the books for ~$250MM. And they have announced that they plan to unlock the value of these significant real estate holdings. Interested?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

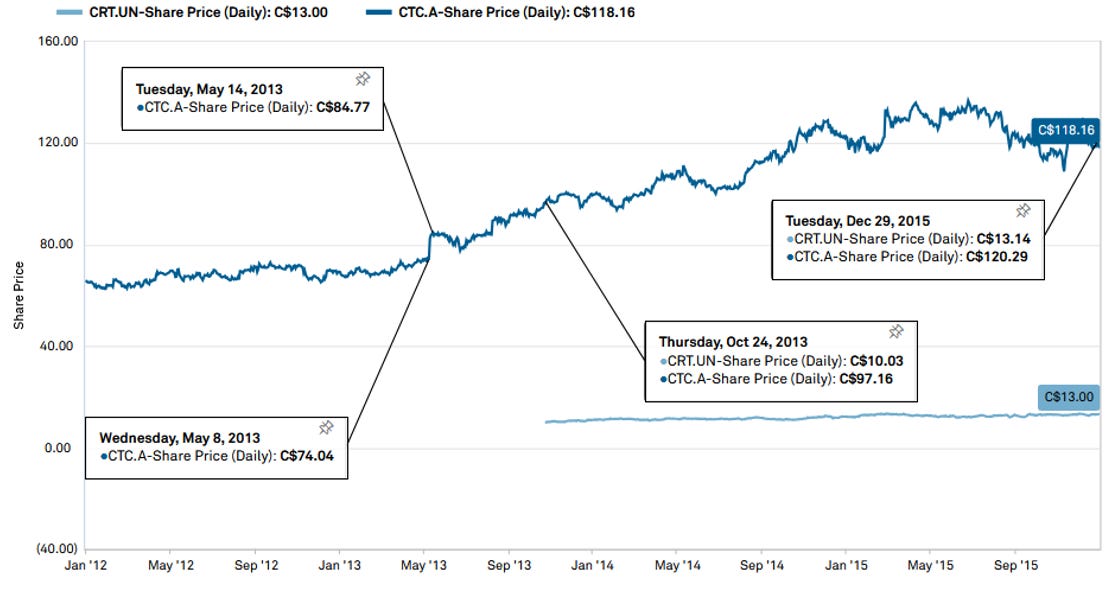

“This is like when Canadian Tire spun off their real estate” some might say, especially since Leon’s President and CEO Michael Walsh, and CFO Victor Diab both spent time at Canadian Tire. However, we think the situation is a lot more interesting than a simple real estate multiple play. But first, what did Canadian Tire actually do?

The Canadian Tire Spinoff

The formal announcement was on May 09, 2013:

Canadian Tire will create a $3.5-billion real estate investment trust to unlock the value of its property holdings, with an initial public offering expected later this year.

Canadian Tire says the properties, totalling about 18 million square feet, have an approximate market value of $3.5 billion.

"We are executing a strategy that reinforces the strength of our company while pursuing new growth opportunities organically and through acquisition," president and CEO Stephen Wetmore said in a statement.

"Today's announcement regarding a REIT would increase CTC's financial flexibility, providing us with the ability to access funds at an attractive cost of capital as we continue to invest in and grow our business."

…

CTC would retain a significant ownership interest of 80 to 90 per cent of the REIT with the remainder of the REIT's units offered to the public via an initial public offering anticipated in the fall.

On October 23, 2013 the transaction closed:

TORONTO, Oct. 23, 2013 /CNW/ - Canadian Tire Corporation, Limited ("Canadian Tire" or the "Company") (TSX: CTC) (TSX: CTC.a) announced today that CT Real Estate Investment Trust ("CT REIT") (TSX: CRT.UN) has completed a $263.5 million initial public offering of trust units (the "Units"). In connection with the closing of the initial public offering, Canadian Tire sold a portfolio of 256 properties (the "Portfolio of Properties") indirectly to CT REIT for a total purchase price of approximately $3.5 billion.

At closing, Canadian Tire holds an approximate 85.0% effective interest in CT REIT (and will hold an approximate 83.1% effective interest if the over-allotment is exercised in full) on a fully diluted basis through ownership of 59,711,094 Units and all of the Class B limited partnership units of CT REIT Limited Partnership (the "Partnership"), which are economically equivalent to and exchangeable for Units. In addition, Canadian Tire holds all of the outstanding Class C limited partnership units of the Partnership.

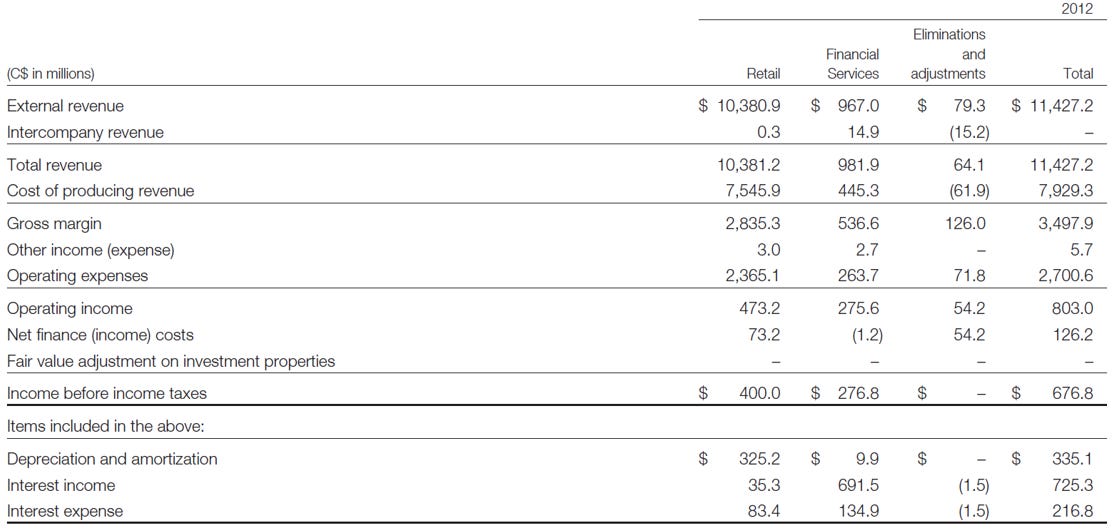

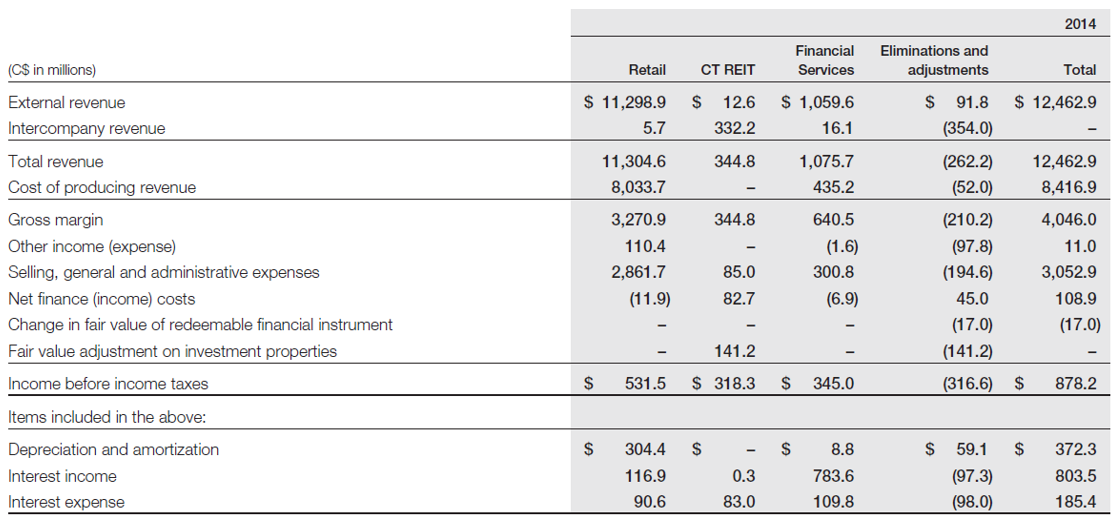

Here is the last full year before the split out (2012) vs the first full year after (2014), with it having limited immediate financial impact given the structure. It did provide some opportunities for development – “During 2014, CT REIT completed 13 property acquisitions (including seven purchases from CTC, or “vend-ins”), six intensifications, two development land acquisitions, and two developments, all of which comprise approximately 1.5 million additional square feet of gross leasable area.”

Since the transaction, Canadian Tire has performed reasonably well. If you had continued to hold the stock since the date of closing, you would have received about $45 in dividends to-date and another $60 in share price appreciation for an IRR of about 8%. We think that they have faced Canadian Tire-specific operational issues, but that is for another post.

CT REIT Valuation

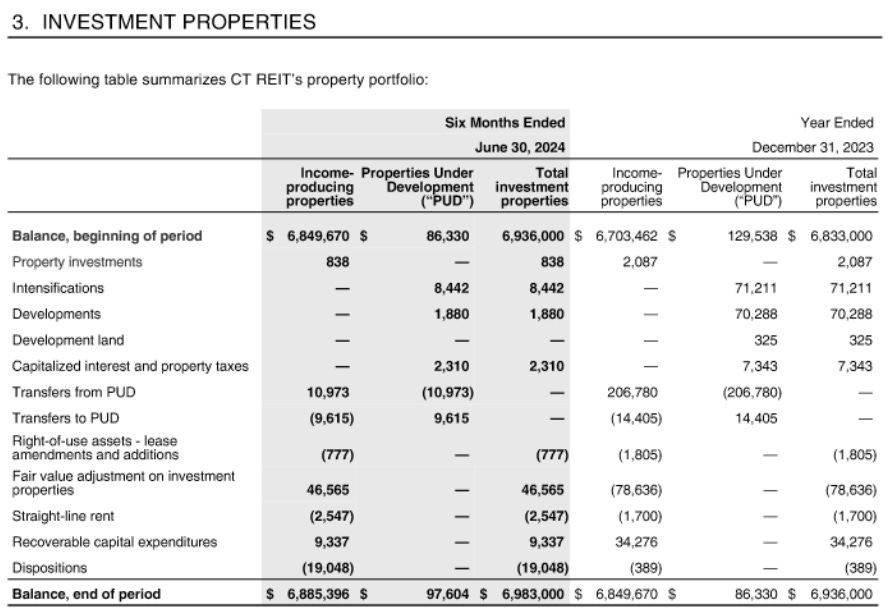

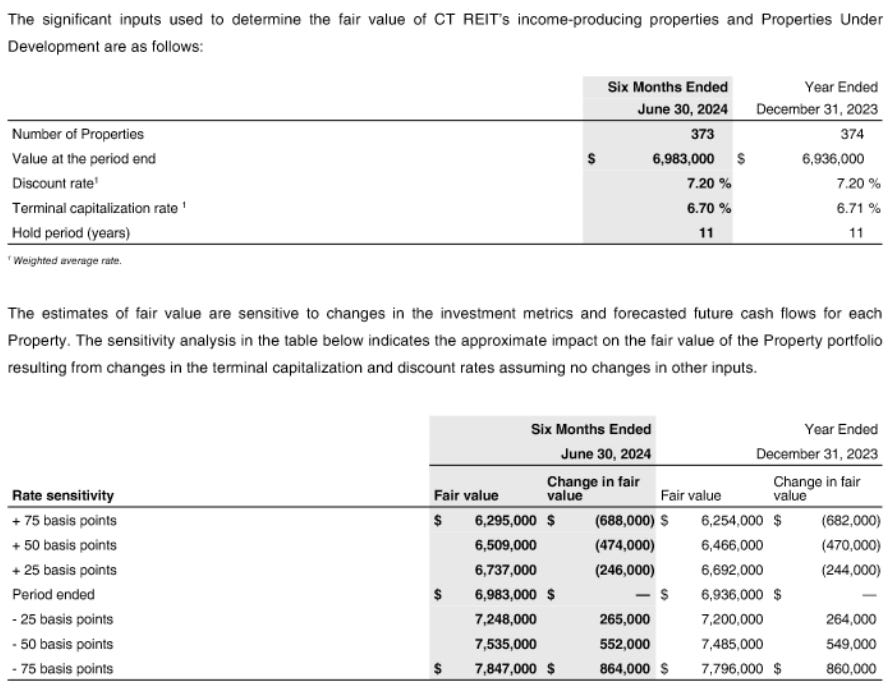

As for valuation of their assets (which are not just Canadian Tire properties), the current fair value assumptions per their financials are as follows (effectively a ~7% cap rate). The implied market derived cap rate is similar. https://www.ctreit.com/English/properties/default.aspx

For those curious, another example not covered is Loblaw’s (TSX:L) spin out of their real estate in 2013 (Choice Properties, TSX:CHP.UN).

The Leon’s Story

Although the store count has stayed relatively stable since the acquisition, they have done a lot under the hood focusing on Leon’s/Brick integration, including implementing a company wide sales system in 2016 and consolidating distribution (including a new B.C. distribution center in 2017 supporting both brands) among other initiatives.

Their other levers

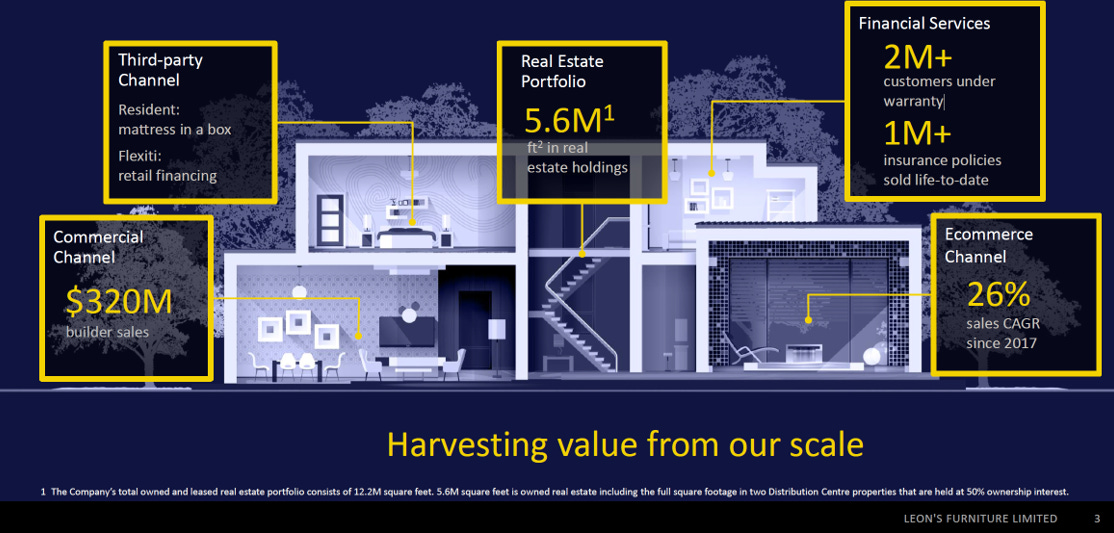

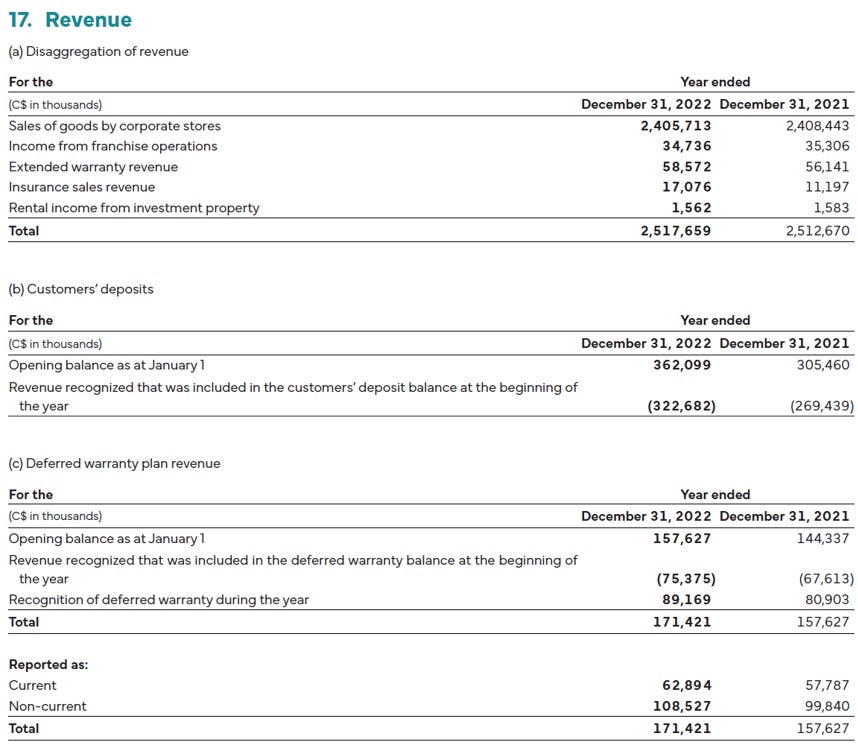

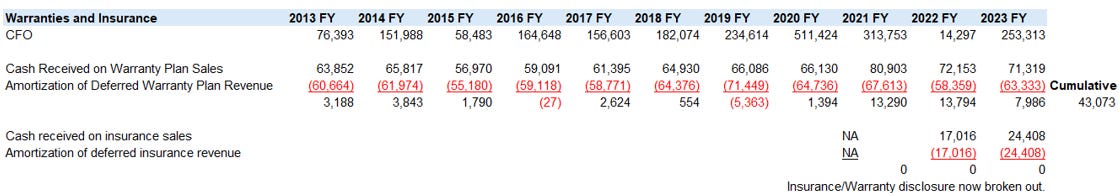

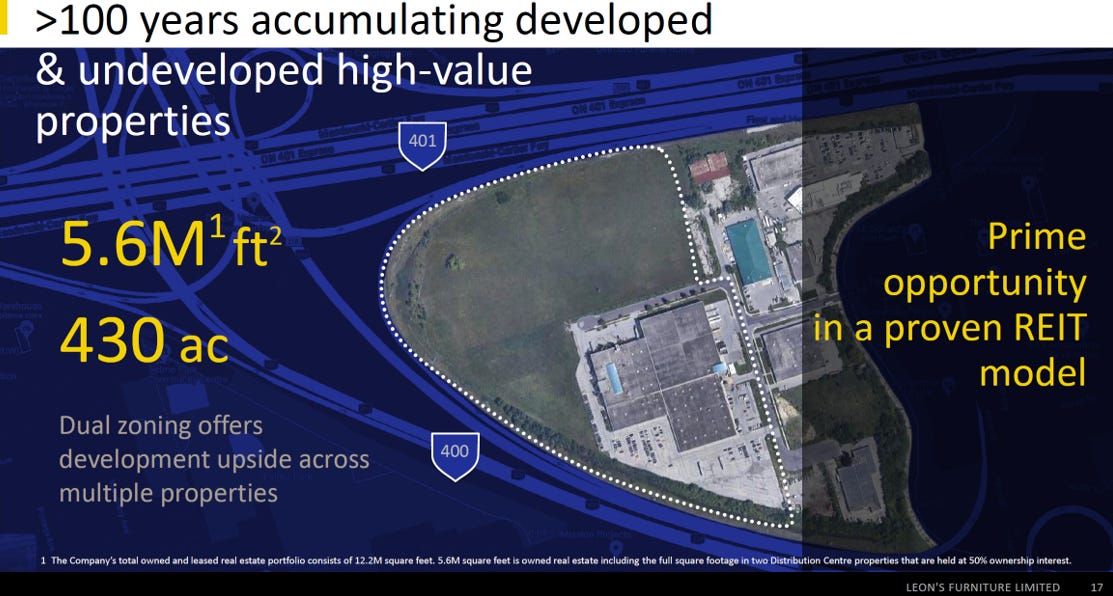

They have done a good job of building out their repair and warranty/insurance businesses. The warranty business has served as a source of float, and can continue to do so (particularly if warranty sales are growing). However, if improperly priced this could create a very real future liability. The track record seems good, but this needs to be monitored. They now break out insurance (see Additional notes – Warranty/Insurance for detail).

Their repair division Trans Global Services (“TGS”) is their growing in-house repair company that also supports some manufacturers as well now. The original creation of business was driven by The Brick per their 2013 AR.

The acquisition of The Brick has also given us the opportunity to improve the way we provide warranty service to our customers. While Leon’s warranty work was previously outsourced, we now own a separate service company that is generating profit by handling the service work of our combined operations as well as third-party clients.

The goal is to create a better more comprehensive service for their customers, increasing loyalty and the value of each sale. Management provided good context at a recent conference.

I mean, for people that don't understand what we've done over the years, it's interesting to kind of go back and say everything that we've done within our ecosystem has been to facilitate more of a sale to a customer that wants to buy product. So you come in, you buy an appliance, you want installation. We can do that. You want warranty, we can do that. You want to finance that, we can do that. You want to protect the financing in terms of credit insurance. We can do that. We can deliver it with our own people and make sure that it's a good experience.

Once you get to a sizable amount in terms of scale across that ecosystem, in order to reduce your cost, you have to look at how do you monetize those assets in other ways. And that's what we've done with our insurance business. The deals that we've struck with our retail financing partner, Flexiti Financial, that's currently owned by Questrade, is a prime example of that. You know, we offer our insurance, credit insurance to them as a white label. Our warranty business is is very, very well-executed internally. We're going to be turning that into a third-party business and offering that could be sold to other retailers.

…

We [have] boots on the ground in Asia. And so think of it in terms of quality control. We go direct to the factories. We don't use a middleman. In most cases we use First Oceans. And so they're literally in a factory when the it comes off, they're sitting in it. So instead of most companies have to send samples back and forth from Canada to Asia, we have somebody that is there that knows exactly what the buyer wants. And it gives us great opportunity in the future to turn that into somewhat of a design centre and expand it. So, I think it gives us a competitive advantage, and for sure it did during the pandemic.

The real estate

The real estate portfolio was first really brought to attention in their 2017 annual report, specifically point #5… the last point.

REAL ESTATE. Many of our stores in our retail network occupy company-owned commercial real estate that are situated in the heart of Canada’s largest and fastest growing metropolitan areas. This 4.2 million square foot real estate portfolio is carried on Leon’s balance sheet at historical cost. Over the past year, we have been working with industry consultants to more accurately determine the market value of our real estate, identify the most promising development opportunities and evaluate different scenarios for value creation.

In 2018 it received a bold header.

REAL ESTATE

At the end of 2018, LFL Group owned a commercial real estate portfolio of 4.2 million square feet, most of it located in the heart of Canada’s largest and fastest growing communities. While this portfolio is carried on Leon’s balance sheet at historical cost, we are fully aware that it represents billions of dollars in potential residential and mixed-use development. Over the past year, we have continued to assess properties for their potential and explore opportunities with prospective development and investment partners to monetize the value of our real estate portfolio. One such property, the 40-acre site that is home to our head office and showroom in west Toronto, has been an obvious focal point in our considerations. This is a deliberate process with many facets, including necessary approvals, but we look forward to sharing any news on this front when the time is appropriate.

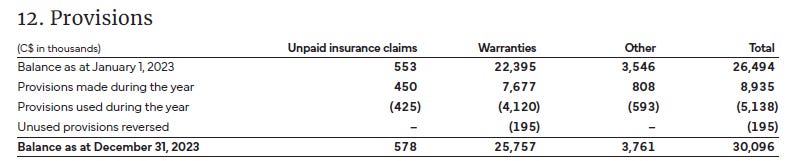

Finally, it was formally announced on November 8, 2023. “LFL's Board of Directors approved the Company's resolution to create a Real Estate Investment Trust (REIT) via initial public offering (IPO). The timing is subject to prevailing market conditions and receipt of required regulatory approvals.”

Today you are a bit late to the party, but we do not think the party is over.

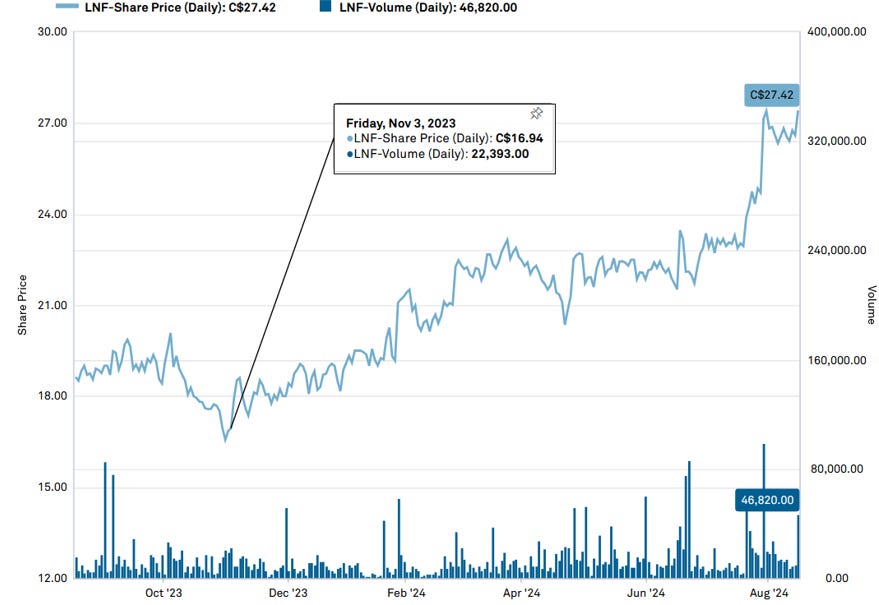

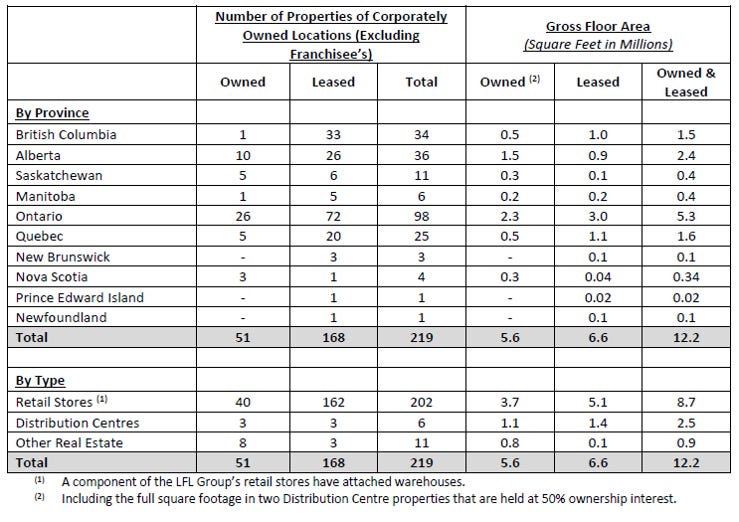

They have built quite the real estate book:

The Company’s total owned and leased real estate portfolio consists of 12.2M square feet. 5.6M square feet is owned real estate including the full square footage in two Distribution Centre properties that are held at 50% ownership interest. The Company’s owned real estate is comprised of mixed-use retail and industrial space. The company’s industrial space is substantial including a mix of Distribution Centers and large warehouses attached to retail stores. The owned portfolio is diversified across Canada with Ontario representing 41% of the total square footage, Alberta 27% and British Columbia and Quebec at approximately 9% each. The Greater Toronto Area represents 22%.

In aggregate, the Company’s owned portfolio of retail stores, warehouses and distribution centres sit on a total of 430 acres of land, which includes a significant amount of excess and undeveloped land. In the first quarter of 2024, the company announced a 40 Acre High Density Mixed-Use Development in Toronto at the Crossroads of Highways 401 and 400 as part of its multi-pronged strategy to unlock the value of its substantial real estate holdings.

LFL Group’s Board of Directors also approved the Company’s resolution to create a Real Estate Investment Trust (REIT) via initial public offering (IPO). The timing is subject to prevailing market conditions and receipt of required regulatory approvals.

They expanded on this in March:

Traditionally we've purchased land in areas that have developed into industrial nodes. Everybody knows the value that has been ascribed to industrial properties these days and rents. So I would say that, you know, in order for us to be in a position to feel that a window opens up, that would be predicated on a different rate environment. And to see a bit of a closure between discount to NAV as it relates to the industrial assets that we have. But it's definitely something that we're viewing in the short term rather than the medium term.

Given their store count and expected cap rate for those properties combined with the development opportunities, it is quite possible, if not likely, that the real estate portfolio is worth in excess of a billion dollars, while the business itself trades at a reasonable price. For context, Sleep Country Canada was just acquired by Fairfax Financial for ~17x earnings or ~9x EBITDA, well in excess of Leon’s and without a real estate portfolio like Leon’s.

However, we think this is missing the point and this is more than a short-term trade. The real question is what will they do with capital in general?

Capital allocation is key

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.