Liberty Sirius SIRI / LSXMA / LSXMK: In Ted Weschler we trust, August update

Here is the latest from Canadian Value Investors!

-SiriusXM Merger Update – The merger arbitrage trap

-And who is Ted Weschler anyway?

SiriusXM Merger Update – the merger arbitrage trap

The merger vote of Sirius SIRI and Liberty Sirius LSXM has finally been confirmed – August 23rd

This has continued to be a painfully unsuccessful merger arbitrage play (LSXM again trades at a large “discount” to SIRI and SIRI is down 45% YTD). Our base case is the merged entity will likely initially revert closer to the value implied by LSXM and not SIRI, but we are focused on the longer term.

Berkshire Hathaway (really Ted Weschler) has continued to purchase LSXM and they are now the largest holder.

Noise from the transaction has made Sirius the cheapest it has ever been and might not be such a bad bet.

Disclosure: We are long LSXMA.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Our April view

We first wrote about SiriusXM back in April. As we wrote then, we are sure you have heard of them. Their programming helps over 30 million people get through daily traffic jams through what is effectively a monopoly on satellite radio in the United States. What you might not know is that Liberty SiriusXM Group (Tickers: LSXMA/B/K) is a holding company created by Liberty Media Corporation (a John Malone baby) and holds interests in the (also) publicly listed Sirius XM Holdings Inc. (Ticker: SIRI), the parent company of SiriusXM. Confused? You can thank John Malone. https://canadianvalueinvestors.substack.com/p/cloning-investment-ideas-in-practice

As a quick summary for those new to the story, LSXM was trading at a huge discount to its implied value of SIRI earlier this year after the deal was announced last December and there were numerous posts about this “arbitrage”. The spread persisted because SIRI shares were too illiquid and not available to borrow at low rates. Unfortunately for LSXMA/K holders, the spread has largely collapsed down via SIRI declining rather than LSXM rising.

Since April, there has been a lot of selling pressure and it has continued to be a bit painful for shareholders. De-indexing is part of it. On May 14th MSCI declared that both SIRI and LSXMK would be removed from its MSCI midcap indexes effective May 31st. https://app2.msci.com/eqb/gimi/stdindex/MSCI_May24_STPublicList.pdf

And then they were removed from the Nasdaq 100 effective June 24th.

However, on July 24th, they finally confirmed the long awaited vote date.

ENGLEWOOD, Colo.--(BUSINESS WIRE)--Liberty Media Corporation (“Liberty Media”) (Nasdaq: LSXMA, LSXMB, LSXMK, FWONA, FWONK, LLYVA, LLVYK) will hold a virtual special meeting of its Series A Liberty SiriusXM common stock (“LSXMA”) and Series B Liberty SiriusXM common stock (“LSXMB”) holders on Friday, August 23, 2024 at 10:15 a.m. M.T. At the special meeting, such stockholders will be asked to consider and vote on a proposal related to Liberty Media’s proposed transaction to separate the Liberty SiriusXM Group by means of a redemptive split-off into a separate company (“SplitCo”), following which SplitCo will subsequently combine with Sirius XM Holdings Inc. (“Sirius XM”) (the “Transactions”).

The original announcement is here - https://www.bamsec.com/filing/110465923125188

The slide deck is here, see December 12th - https://www.libertymedia.com/investors/news-events/presentations

Berkshire bets bigger

Berkshire Hathaway has been a holder of Sirius and Liberty Sirius for a decade, but they significantly ramped up their purchases over the last few months during the recent decline. They are now the largest holder (and still own some SIRI as well) representing over 20% of the post-merger entity.

However, the hold is really (we are almost sure) Ted Weschler’s pick. When looking at Berkshire’s holdings you have to be careful. Warren Buffett hired Ted Weschler and Todd Combs to run separately managed investment portfolios ($34 billion combined as of 2022) while larger holdings are still effectively Warren’s.

For Sirius, it is very likely a Ted holding. He has a long history of investing in cable companies and Liberty (Malone) companies in particular.

Ted’s claim to fame is growing his retirement account from $70,000 to over $130 million in 22 years. Dirtcheapstocks has done a great backgrounder on Ted that you can read here. It is not often that you get to hold hands with Berkshire Hathaway in a turnaround special situation, and we have been holding hands with them since April.

One thing to note is their dollars involved. The Berkshire LSXM holding is worth about $2.2B today and the SIRI shares they have are another $100MM or so, though even after literally doubling down the combined value is still below the 2019/2020 combined peak of ~$3 billion. Assuming we are correct, this is a greater than 10% hold for Ted and, with recent purchases, meets our definition for Cloning 101 - https://www.canadianvalueinvestors.com/cloning-investments-101

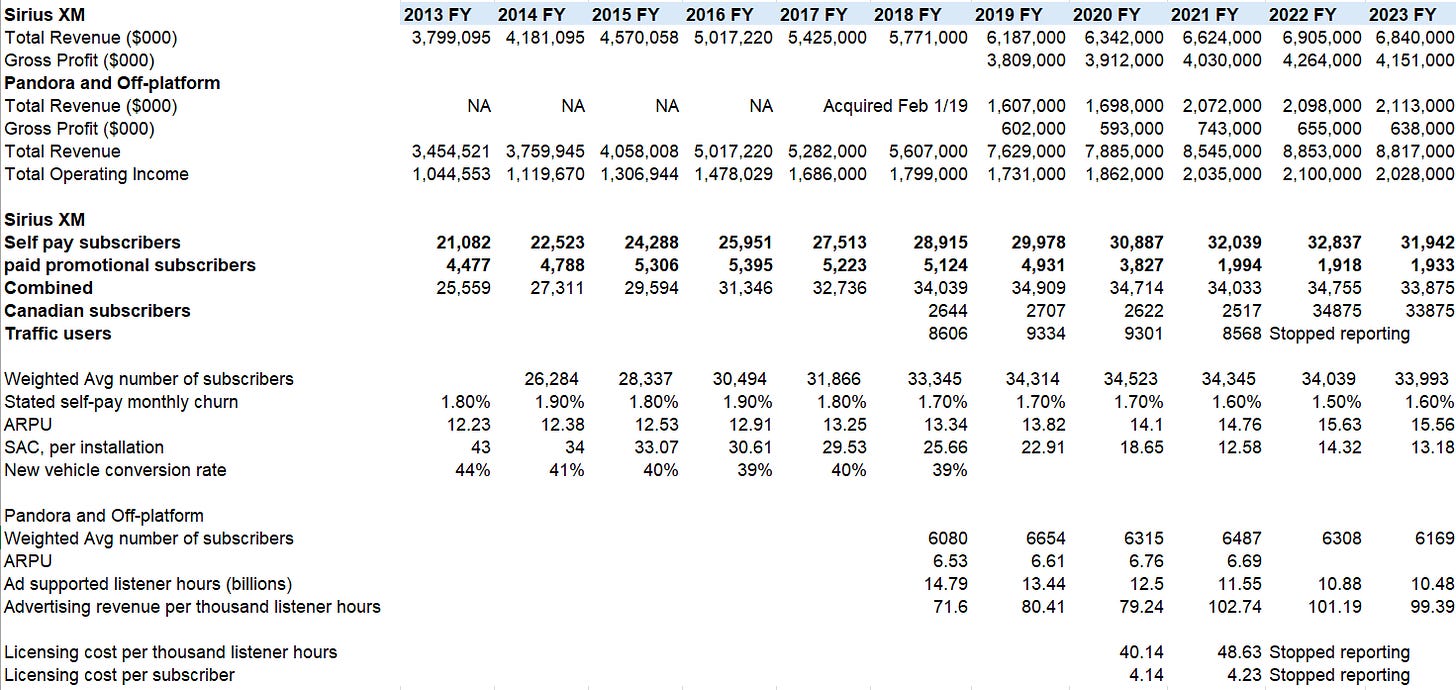

Sirius Today - What you get

As we noted above, we are long LSXMA and have never owned SIRI. There were originally Sirius and XM satellite radio, but they were allowed to merge in 2008 into a U.S. monopoly. Subsequently, the Company then effectively merged in its Canadian division (see notes).

Capex largely consists of satellites, which is cyclical (last ~15 years), as well as ground-based repeaters in urban areas and spending related to subsidized equipment. The satellite system is supported by licenses from the FCC, which the Company renews and expects to be able to continue to renew so long as they follow the terms of the license as we expect them to (see FCC licenses).

Besides the complex Liberty Sirius structure used (and thankfully going away now), they also levered up debt to repurchase shares. They spent an impressive amount on share buybacks as shown below, but unfortunately the multiples have collapsed faster than repurchases.

The merger spread largely went away for a short while but has recently blown out again. So, to keep the math simple, if you buy Sirius XM LSXM today at ~$21, it implies New Sirius is worth ~$9 billion, while SIRI is still trading at ~$11 billion or so, at $3.06. Our base case is that the multiple collapses into the current LSXMA price, at least initially. The key to a happy life is low expectations as Charlie Munger says. Or to put it another way, LSXMA is just a cheaper way to purchase SIRI and we think you have to be long SIRI to be involved with this.

There is concern that this is a melting ice cube and frankly we would prefer a lower debt burden to provide more resiliency. That said, they are doing a number of initiatives, like:

New approach to cars – “We are also introducing a new way for automakers to present SiriusXM to their customers, which enables General Motors, Mercedes-Benz, Volkswagen and more to include a three-year SiriusXM subscription with the purchase of select new vehicles. These packages highlight SiriusXM's unique position from our expansive podcast network to our strong relationships with automakers and dealers.”

“A SiriusXM Podcast+ subscription will be available on Apple Podcasts.”

“In car, where we will have even more opportunity following the start of our broader migration to the new backend tech platform beginning in 2025, we are leveraging the flexibility of 360L, which shows improved conversion and retention rates in vehicle to launch new features and cars already on the road.”

“This quarter, we introduced SiriusXM Free Access, our first-ever free ad-supported version of SiriusXM, now available in select vehicles.”

They are also exiting a period of high capex spend that was needed for cyclical satellite replacements – “We still expect to have our highest level of CapEx for 2024. And to look at the – more broadly at the outer years of 2026/2027, we believe that CapEx will be somewhere around $300 million.”

Subscriber churn

Deliverance 1972

Why use Sirius?

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.