Mainstreet Equity (TSX:MEQ) - The apartment tycoon investing in real estate differently

Should you buy and run a rental, or just get the best guy in town named Bob Dhillon to do it for you?

Disclosure: We own this one.

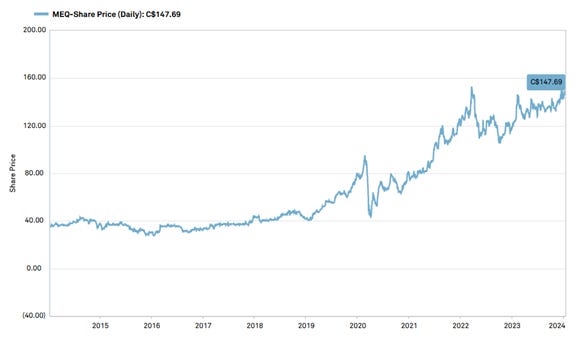

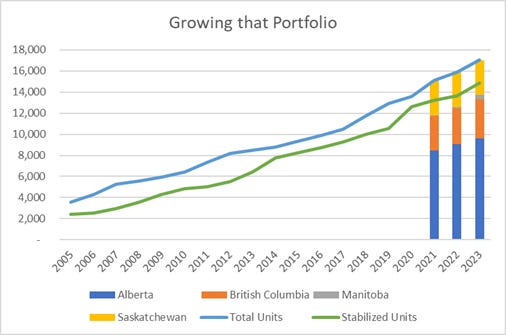

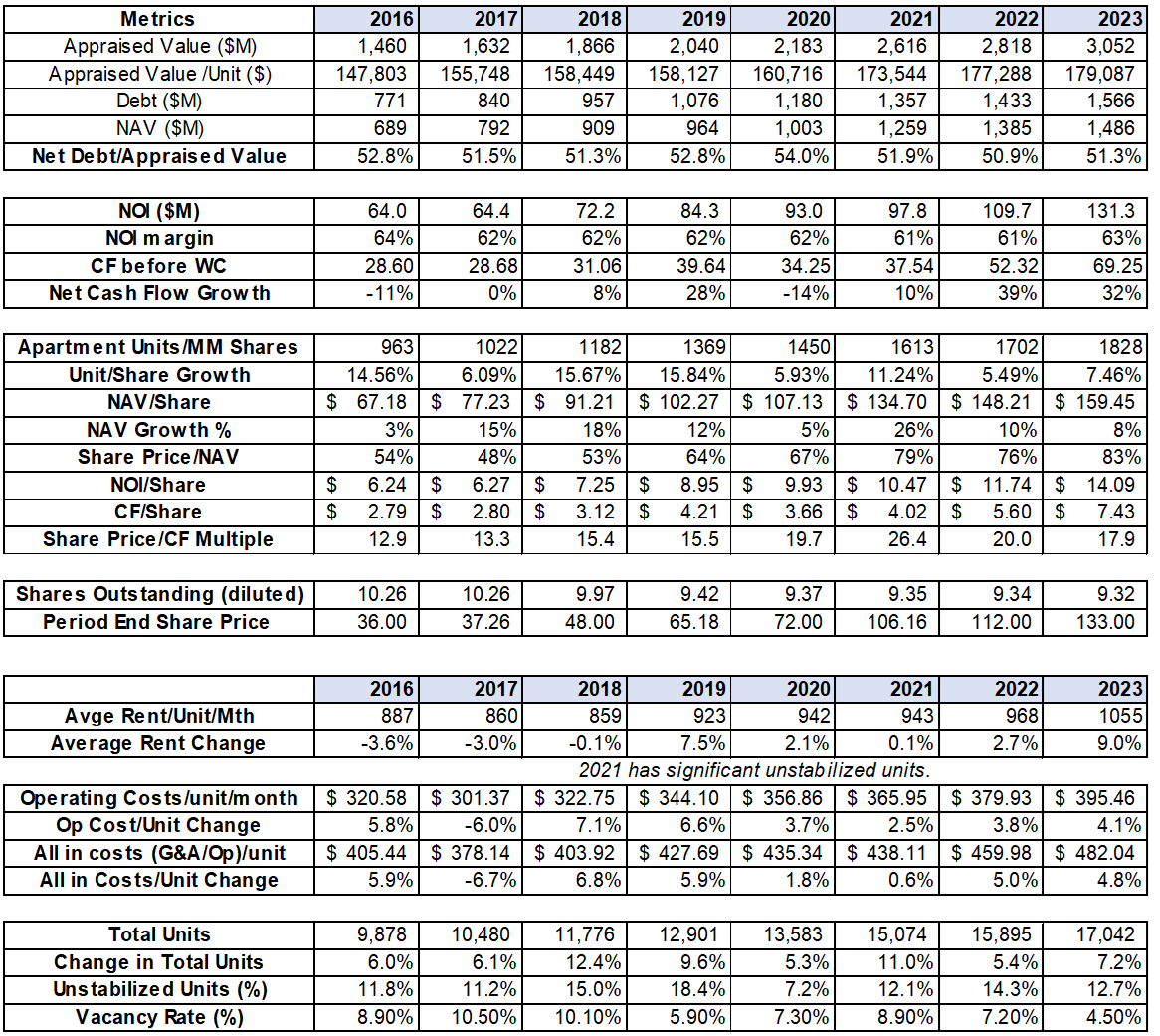

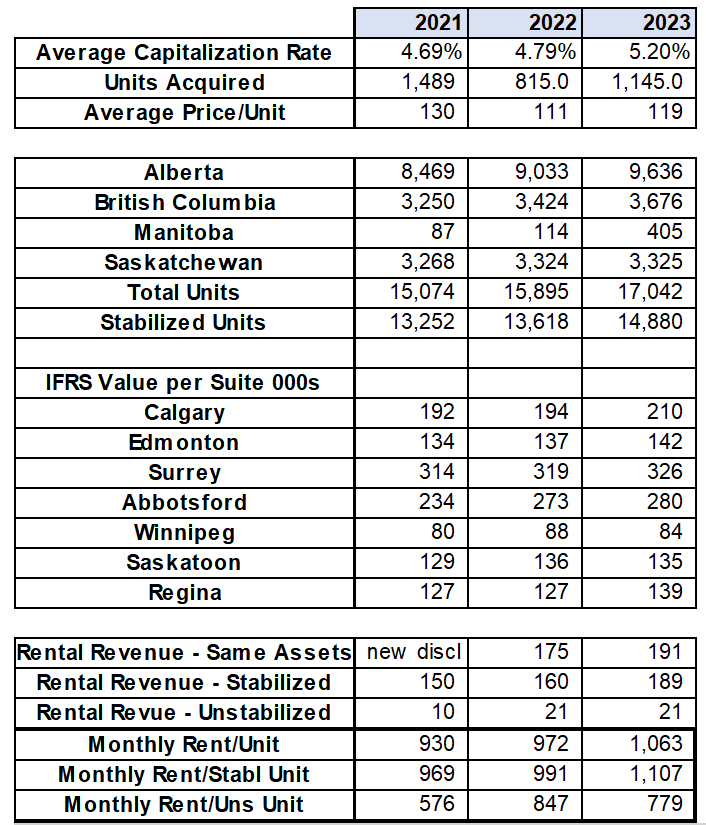

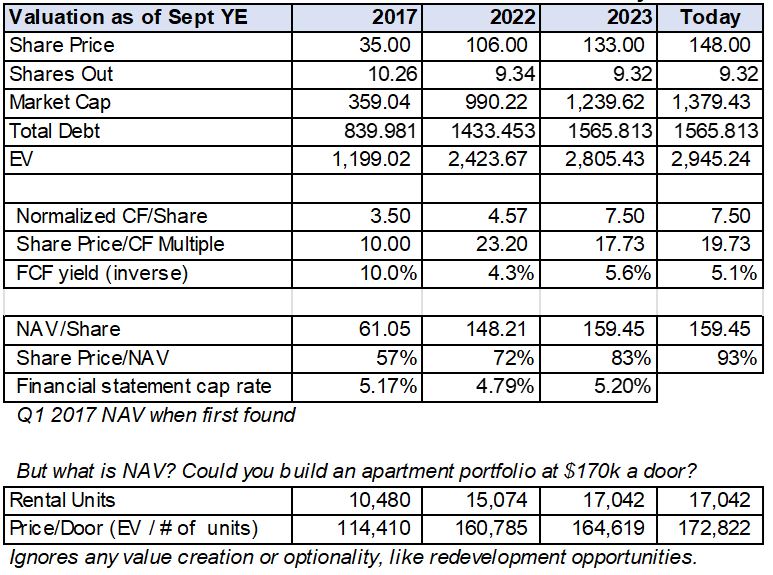

Back in 2017 when we first learned about Mainstreet, we did an article about their unique laser focused business model that they have consistently had for over 20 years. They seek out distressed mispriced mid-market real estate bargains and grew their apartment unit count from 1,370 in 2000, to 10,480 in 2017. Since then, they have grown to over 17,000 units without any dilution, continued to grow cash flow per share, NAV per share, and apartment units per share, while the stock has increased by another 300% (over 5,000% since founding).

Their portfolio consists of value-oriented rental buildings they renovate themselves in Western Canada, in markets now facing record low vacancy from a worsening housing crunch. With the recent announcement of implementing a quarterly dividend for the first time, we wondered if they are at the end of their runway, or if this is just the next chapter.

It is the only publicly listed real estate company we have ever invested in. There are a few things that make it special.

The Apartment Tycoon

Mainstreet Equity is a very different kind of real estate company. They are not a REIT continually issuing equity and paying you back with your own money (Mainstreet’s share count has been declining since 2009). They also do not buy large low cap rate office towers and sit on them. Mainstreet is much more fun.

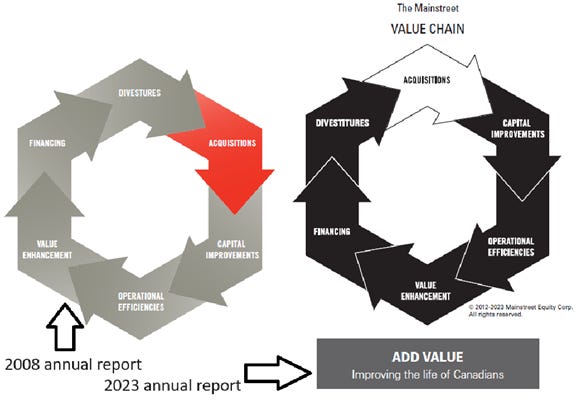

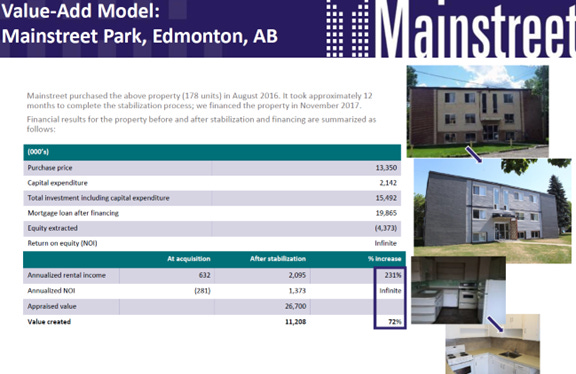

Their business strategy is to:

Buy underperforming/distressed mid-market rental assets.

Upgrade interiors cost effectively, add energy efficiency improvements such as new windows and efficient boiler, and increase curb appeal.

Stabilize the properties, increase rents, and then refinance the properties using larger low-rate mortgages, taking out most if not all of their initial equity,

Reinvest in new properties.

The Company’s argument is that these properties have historically been selling for significantly below their replacement value (the cost to build a new building), especially after they have been renovated. Stabilization takes 1-2 years.

Guardrails: They are focused on Western Canada and only invest in properties that can be had for a bargain. The bread and butter originally was three to four story walk ups in Western Canada, but now have scale and are able to look at other types of opportunities selectively.

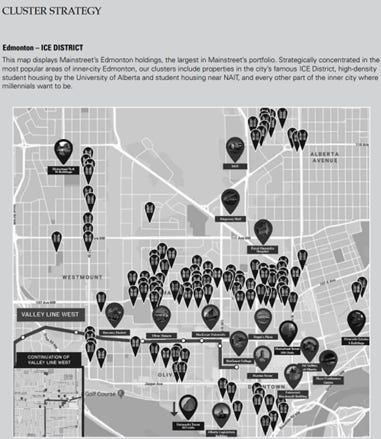

The strategy also incorporates technology and ideas like clustering of properties to reduce costs, enabling them to do an excellent job of managing costs effectively. Now at scale, they are also building a brand and can do things like list their own properties on their own site - https://www.mainst.biz/apartments/

Bob Dhillon is the CEO and founder. This is his baby, and he owns roughly 40% of the Company. Their strategy has been stated and executed consistently by him and his team since its founding. They also have a history of disciplined buying, which we like. For example, around 2006 Calgary property prices were not meeting their required returns, and they instead focused on Saskatoon, southern B.C. and Edmonton where there was less competition (Mainstreet started buying in Calgary again in 2010). Mainstreet also acquired properties in Ontario but prudently decided to exit the market in 2012 due to valuation/return concerns and high competition compared to its other markets.

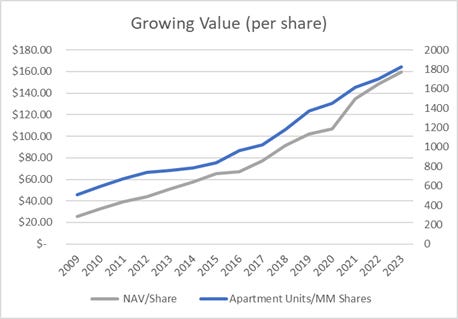

The Company has grown from 1,370 units in 2000 to 9,936 at the end of Q1 2017 when we first looked, to over 17,000 today. Remarkably, this has been done by only reinvesting cash flow and new mortgages since the mid-2000s with no new equity (with the exception of options originally issued in the early 2000s). Mainstreet has again been buying back shares over the past few years (see below) as the Company views itself as being undervalued. Apartment units per million shares (a fun metric we have made up) has grown from 148 in 2000, to over 1,800 in 2023.

There are three interrelated core pieces to their strategy:

Acquisition advantage – They have an edge for acquisitions by:

1) Having extremely deep knowledge about their local markets including expected renovation costs and building history, and

2) Being able to move quickly with a strong reputation of being able to execute on bids. Their offers are very quick and in cash and are a go-to buyer for a market that continues to be fragmented and opaque (unlike residential real estate). The benefit of being strongly capitalized to move without any financing conditions combined with a deep knowledge of costs cannot be understated.

Renovation advantage – They also have an edge in post-purchase renovations, what they call stabilizations. They buy in bulk – think a container of toilets straight from China – and have their own in-house team to manage the whole process. They have recently been stabilizing over 1,000 units a year.

Property management at scale – They have become a good manager of properties and can spread management and technical/operating costs over many doors.

Our 2017 concerns

It sometimes hurts to be too conservative in your analysis. The strength of a company is important, but it is also important to keep in mind its relative strength and remember the context of the industry it operates in.

We had two key concerns in 2017:

1) We thought the business had a shorter runway than it has had.

2) We were concerned about leverage and multiples.

Runway – We are amazed at their ability to continually purchase new properties at very low cost per unit ($115-135k from 2018-2023). We do wonder what the plan is for the next twenty years. Eventually their properties will come to the end of their life, and we are curious how they are going to handle that. These units are typically older but are also generally in good areas given their age, and their replacement values in the meantime might far outrun depreciation given inflation concerns and general inability to build anything efficiently in Canada. They have also successfully moved into larger developments, such as a recent 222 unit purchase in Saskatoon at $97k per door.

Redevelopment could eventually be another meaningful source of value as many properties are in good locations. This is coming to fruition now in Edmonton where they have a significant number of properties in the Edmonton ICE district (see below). The portfolio of decent apartments at a relative bargain will likely do well in most rental markets and likely safer than say high-cost brand new builds.

Industry Norms – We look at a lot of industries and real estate gives us heartburn when we think of typical leverage. However, it is important to think about the industry norms that a company operates in. Real estate businesses typically operate with relatively high leverage. Banks and other financing firms are historically comfortable with this, are used to real estate being a large part of their loan book, and have whole teams of people dedicated to it. In the context of our 2017 analysis, Mainstreet had net debt to appraised value of 52.7% and interest eating up about 1/3rd of net operating income (Note: Taking Financing Costs from the balance sheet needs to be adjusted for refinancing costs as they refinance and adjust continuously).

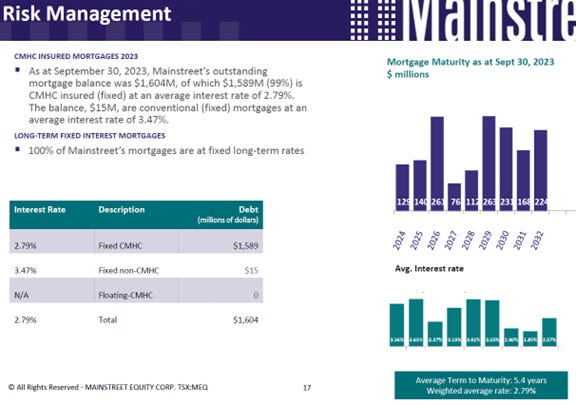

For us this seemed “high”, but in the world of real estate investors and lenders being used to Mainstreet’s peers leveraging much closer to appraised values and have much much lower interest coverage, Mainstreet was actually relatively underlevered. In a pronounced regional downturn they would likely have been one of the last real estate companies standing. In fact, in hindsight we think that absolute leverage was not so bad (they had and continue to have significant clear title and underlevered properties; As of September 30, 2023, the they had 82 clear title properties and five development lots with fair value of $468MM). They have also done a fantastic job of refinancing properties, moving towards longer-term fixed rates (the average 2021 refinancing was done at 10-year fixed rates of 2.07%; current average interest is 2.79% with average term to maturity of five years).

What is different today?

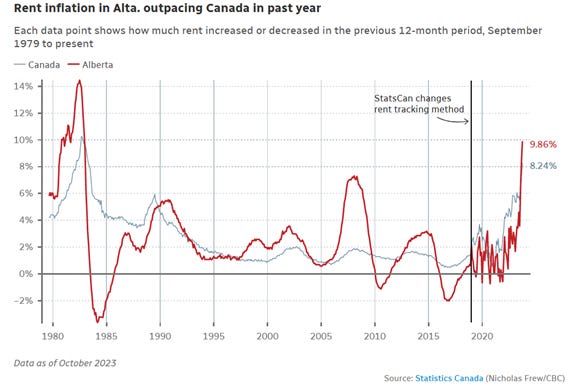

https://www.cbc.ca/news/canada/edmonton/alberta-rent-inflation-cost-of-living-1.7061756

We thought before that Mainstreet was fully valued, or at least the market noticed what they are doing, and the cushion has been eroded by the multiple expansion. But just maybe we should not underestimate their ability to continue to reinvest capital. In addition, since we last looked closely at Mainstreet, two things have changed:

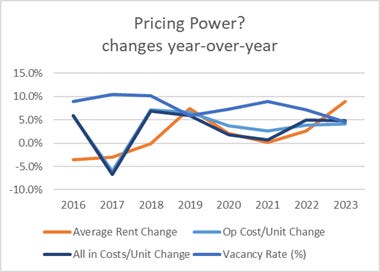

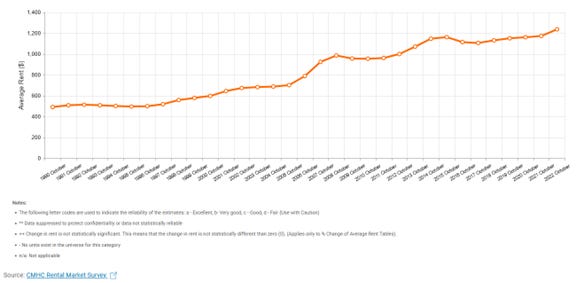

1) The housing shortage in Western Canada is finally leading to serious pressure on rents and their portfolio of relatively low-cost rentals is positioned very well. It is important to keep in mind that Mainstreet built their empire in a relatively terrible period for Alberta.

2) They just announced initiating a regular dividend. Why are they doing a dividend?

“We plan to introduce a nominal dividend—$0.11 per share starting in Q1 2024—for the sole purpose of widening our shareholder base and increasing trading volume. This decision comes after significant numbers of fund managers expressed interest in investing in Mainstreet, but said they were prohibited from taking positions in non-dividend paying corporations.”

This will indeed open up an investment in Mainstreet to a number of funds, never mind retail investors who demand a dividend. The crazy thing about investment funds, ETFs, money managers, and such, is that they often live in a world full of checkboxes. Would you rather have a company reinvesting its capital at high rates without any dilution for decades, or a REIT because it is a REIT paying a dividend, return on capital be damned? We digress. Mainstreet has long been a bit of an orphan and outlier, historically never paying a dividend. It has been the right decision based on how they have reinvested capital. However, the nominal dividend resolves this issue, providing potential additional short-term stock price re-rating.

And the dividend really is nominal; $0.44 a year per share equals about $4MM a year compared to acquisitions of ~$130MM per year recently. That said, we do believe they are closer to the end of their runway of being able to buy cheap distressed properties. Mathematically they must, but maybe we will continue to be surprised as we have been every year since 2017.

Valuation – What is it worth?

If you are set on getting Western Canada real estate exposure, we would argue that you are probably better off buying MEQ stock instead of shopping for an apartment for rental. You get an expert purchasing team, significant diversification (compared to the risk of owning one unit in one building), no need for personal guarantees for mortgages, and no midnight maintenance problem calls. We cannot compete with Bob and stopped looking for rental investments ourselves.

Mr. Market did not like Bob’s vision and approach (“where is my dividend?!” they said) but Mr. Market is now coming around. “In the short run, the market is a voting machine but in the long run it is a weighing machine.”

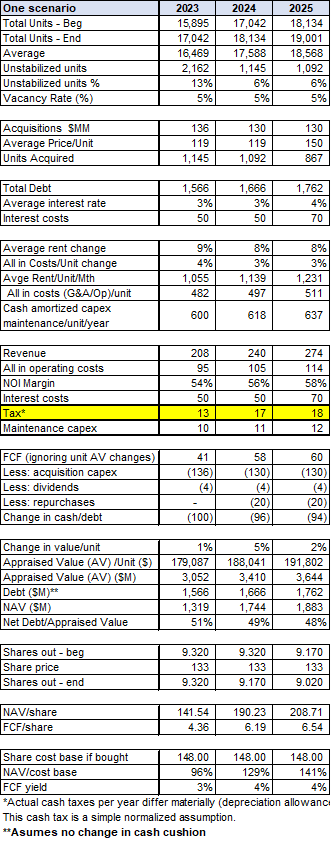

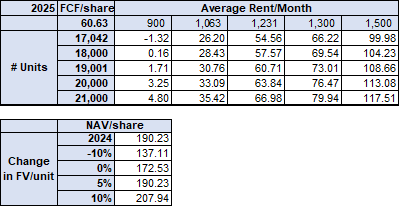

What’s next for Mainstreet? Here is a bit of history and a few scenarios.

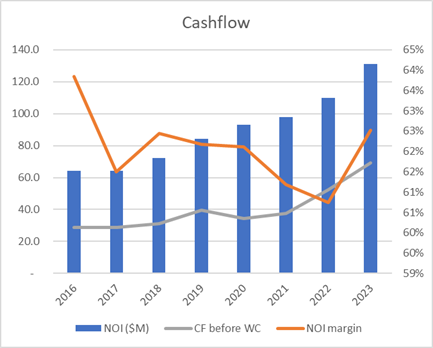

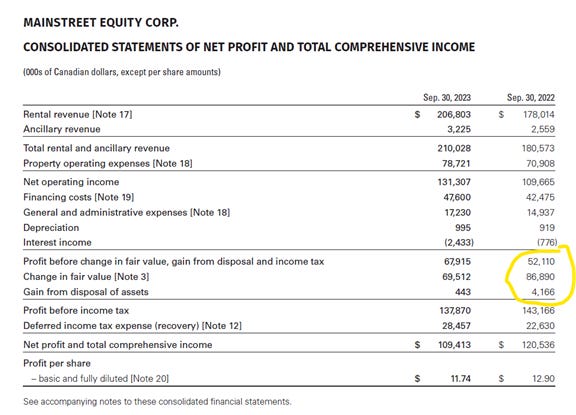

When we are looking at Mainstreet to see if it is undervalued, we have focused on two things: Cash flow per share and NAV per share. The Company was trading at approximately 57% of Q1 2017 net asset value but the discount has disappeared. One could argue that NAV could be overstated (it uses a market standard but low-for-us cap rate) but when thinking on a per door basis it seems reasonable, they continually make prudent acquisitions and unlock value, and increasingly have optionality from redevelopment of existing properties.

Secondly is cash flow. It is important to keep in mind that they are making significant investments still – over 1,100 units last year – and stabilization takes time. We think of free cash flow before investment capex. We note that like other property managers they are facing cost pressures and meaningful rent increases have not flowed through yet.

The thought process is that they can continue to increase cash flow through stabilization of existing properties, rents now increasing in their key Alberta markets, and continued asset growth. We are not projecting what cash flow will be next year; we are more focused on the general direction. These things all move cash flow in the right direction.

A few of the things to look out for:

Significant debt, but positioned extremely well relative to typical real estate companies and debt levels prudently managed consistently over its history with increasing focus on long-term CMHC insured debt. Available liquidity is over $400MM.

Very frequent acquirer making it very difficult to calculate normalized profit/cash flow and creates noise about gains and losses. For example, in 2008 stabilized properties had FFO of $5.84M while non-stabilized properties had a loss of $2.1M. Now that the company is significantly bigger, this is less of a concern.

Assets now valued at “fair value” since the adoption of IFRS. The cap rate is typical for real estate but relatively low for us as we think about absolute cash flow yield in general, but additional acquisitions and redevelopments give levers to continue to increase NAV over time.

Maintenance capex. There is some maintenance cost included in operating expense, but it is prudent to add additional normalized capitalized maintenance costs. We have added an additional $600 per door per year.

We think it is important to keep in mind the actual cash flow of the underlying portfolio vs just thinking about headline profit they state.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).