MicroCap Club Leadership Summit 2024 Pitch Summaries and KITS Eyecare: Are they at an inflection point?

And NVDA VS U.S. Treasuries Update

Here is the latest from Canadian Value Investors!

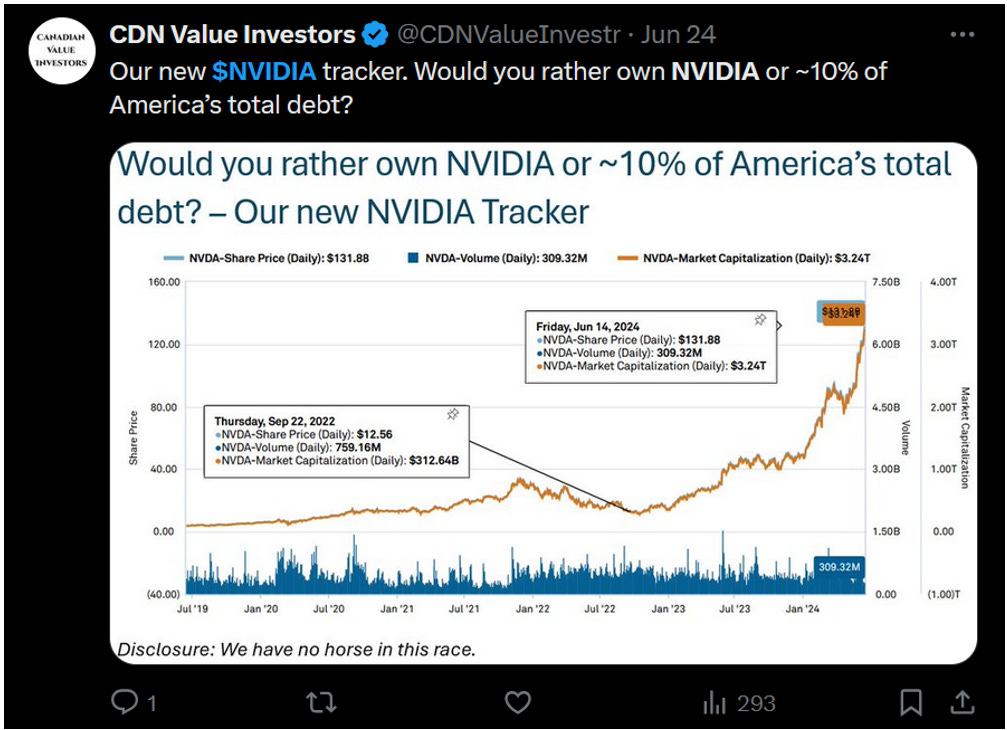

NVDA VS U.S. Treasuries Update

MicroCap Leadership Summit August 2024 Pitch Summaries and Highlights

KITS Eyecare (TSX:KITS) at an inflection point?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

NVDA VS U.S. Treasuries

Back in June we asked ourselves… if someone forced us to hold either NVIDIA or U.S. Treasuries for the next five to ten years, which would we want? We voted Treasuries.

Here is our $NVDA vs U.S. Treasuries ~3 month update. So far, so good (for Treasuries). About $1,000 in Treasury dividends to date too helping juice those returns.

MicroCap Club Leadership Summit August 2024 Pitch Summaries and Highlights

In August MicroCap Club (https://microcapclub.com/) held their Summit in Coeur d'Alene, Idaho. As part of the conference, they had a pitch hour from attendees. We wanted to provide a summary for our readers. Is South Korea the next value investing frontier? No spoilers.

Disclosure: We do not own any of the following except for CZBS.

The full video is here.

00:00:20 - Aldeyra (ALDX) - Daron Evans - MCC: @DeBio - Twitter: @DaronEvans3

00:09:49 - Zomedica (ZOM) - Andrew Rem - MCC: @Andrew Rem

00:18:39 - Shelly Group (SLYG.F) - Jean Phillipe Tissot - MCC: @Jean - Twitter: @jptissot1

00:26:40 - Kraken Robotics (PNG.V) - Geert Campaert - MCC: @geertcampaert - Twitter: @CampaertGeert

00:34:08 - Net Lease Office Properties (NLOP) - David Bastian - MCC: @kingdomcapital - Twitter: @kingdomcapadv

00:43:15 - Citizens Bancshares (CZBS) - Tim Eriksen - MCC: @Tim Eriksen - Twitter: @eriksen_tim

00:52:29 - Prospect Ridge Resources (PRR.CN) - John LaGourgue - MCC: @John Lagourgue - Twitter: @lagourgue1

00:59:28 - Jeil Technos Co, Ltd. (038010) - Sean Iddings - MCC: @Sean Iddings

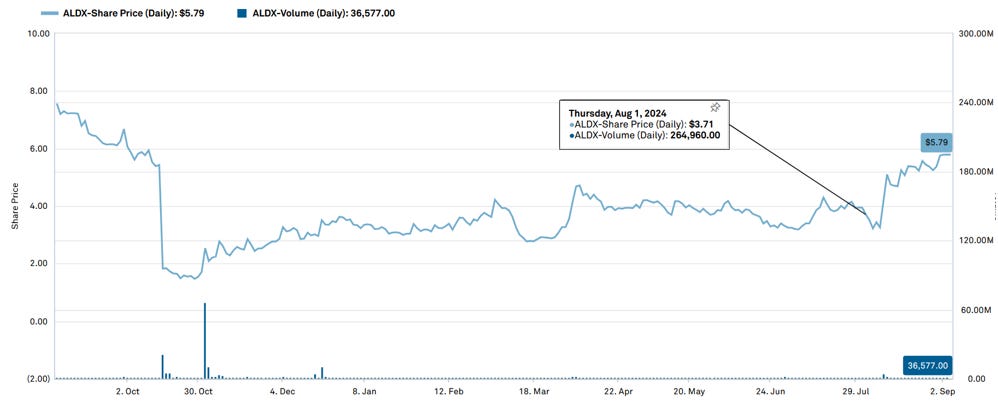

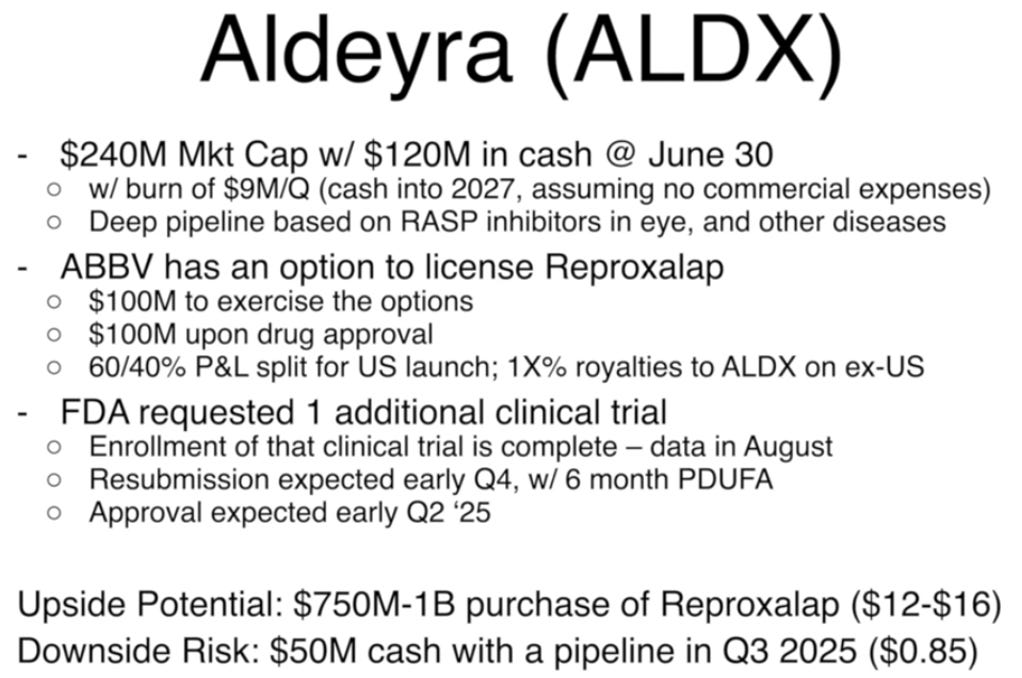

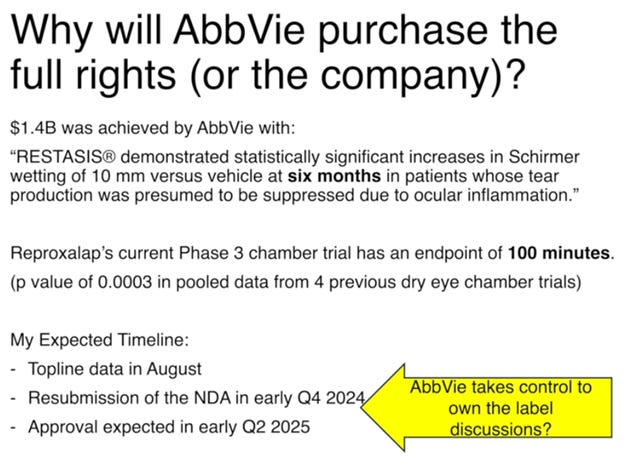

Alderyra (ALDX)

Daron Evans - MCC: @DeBio - Twitter: @DaronEvans3

Aldeyra is a biotech company focused on developing treatments for diseases related to inflammation. Their lead product is a reactive aldehyde species (RASP) inhibitor for dry eye disease. The company faced a major setback when the FDA issued a Complete Response Letter (CRL), leading to a sharp decline in stock value. Despite this, Aldeyra raised substantial capital and secured a co-promotion deal with AbbVie. The company is preparing for a final trial, with expectations of a favorable outcome and a potential buyout by AbbVie if successful.

Note: They subsequently received good news about the trial shortly after this presentation and the stock price jumped. https://ir.aldeyra.com/news-releases/news-release-details/aldeyra-therapeutics-achieves-primary-endpoint-phase-3-dry-eye

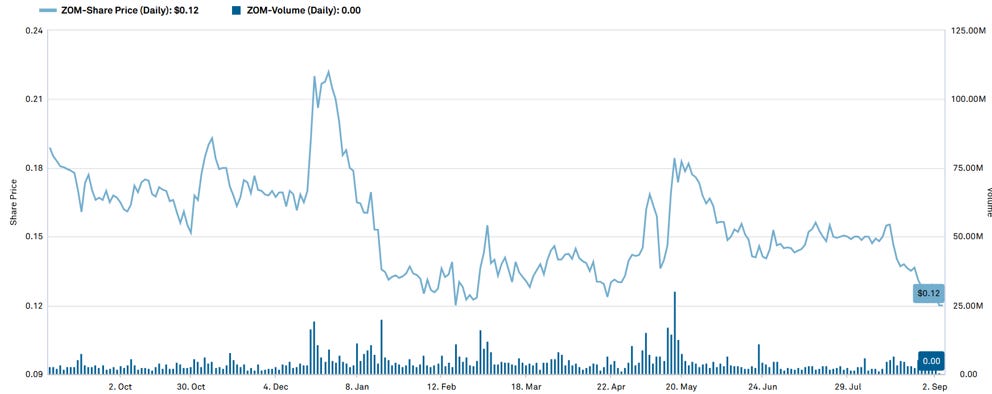

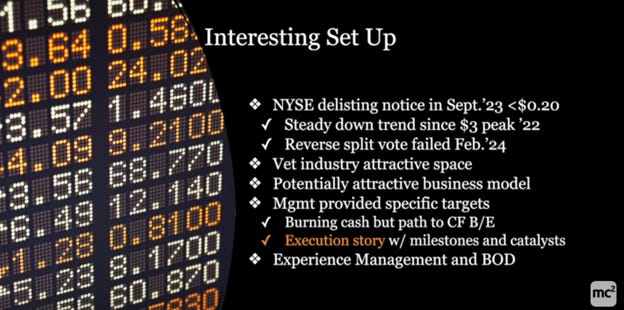

Zomedica (ZOM)

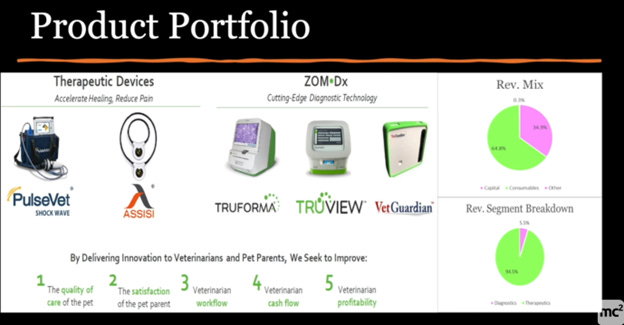

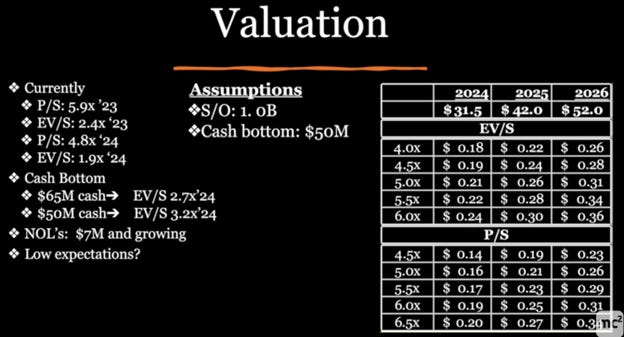

Zomedica is a veterinary MedTech company focused on improving the quality of care, clinic workflow, and profitability for veterinarians. Their primary products include PulseVet, a therapeutic system used mainly for tendon and ligament issues, and TrueForma, a point-of-care diagnostic system that generates recurring revenue through diagnostic assays. The company is also expanding into digital microscopes and remote monitoring systems. With strong gross margins (70%+) and promising execution under experienced management, Zomedica aims to improve cash flow and reach $50 million in revenue by 2025.

We note that this is a fallen 2022 IPO, peak of $3 and down to <$0.20. However, he argues that the business is at an inflection point and can be monitored with key milestones. We note the Company has no anchor shareholders to block or encourage takeover/go-private.

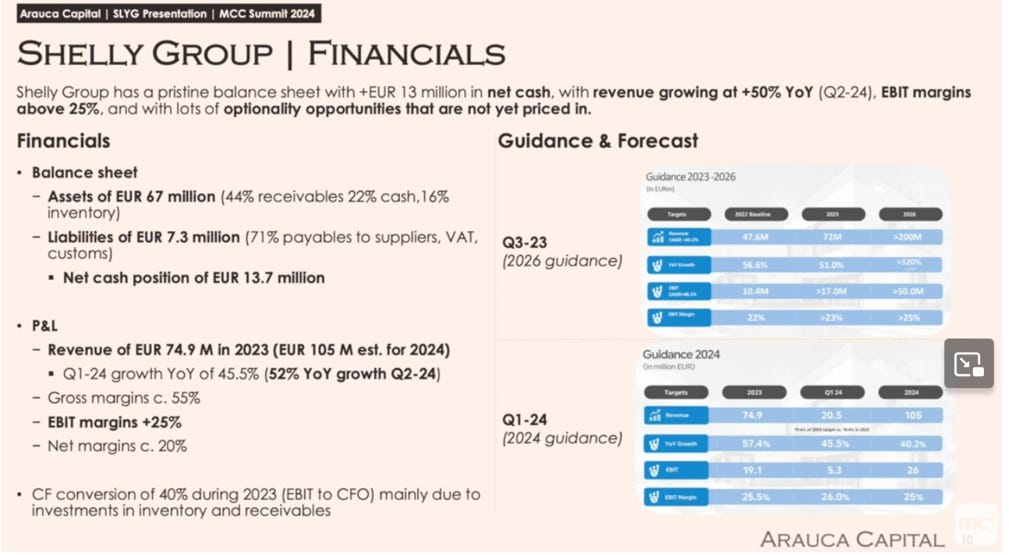

Shelly Group (SLYG.F)

Jean Phillipe Tissot - MCC: @Jean - Twitter: @jptissot1

Shelly Group is a leading designer and distributor of Internet of Things (IoT) products, enabling users to control appliances remotely. Specifically, it provides home automation relays/system that is flexible and open is growing significantly year-over-year. There are many avenues of growth including providing the tech provider for appliance makers including cloud data (key competitor is Chinese firm with a closed system). Trading at 30x earnings today, but 16x 2026 forecasted earnings that do not include any benefit of ongoing initiatives/new products.

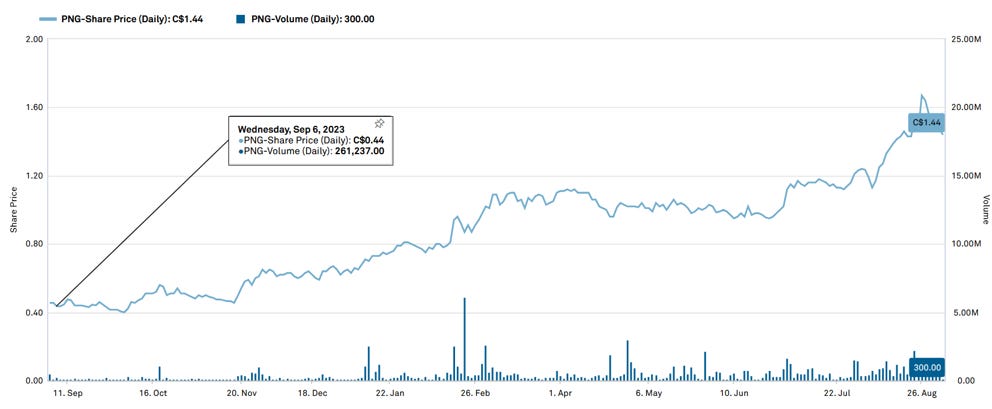

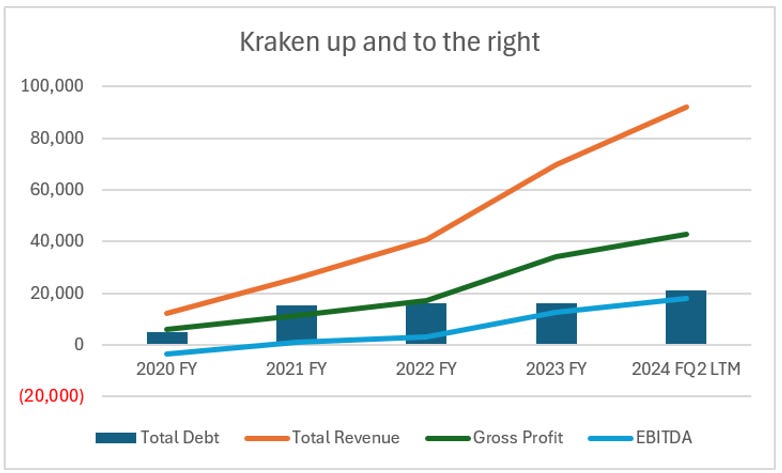

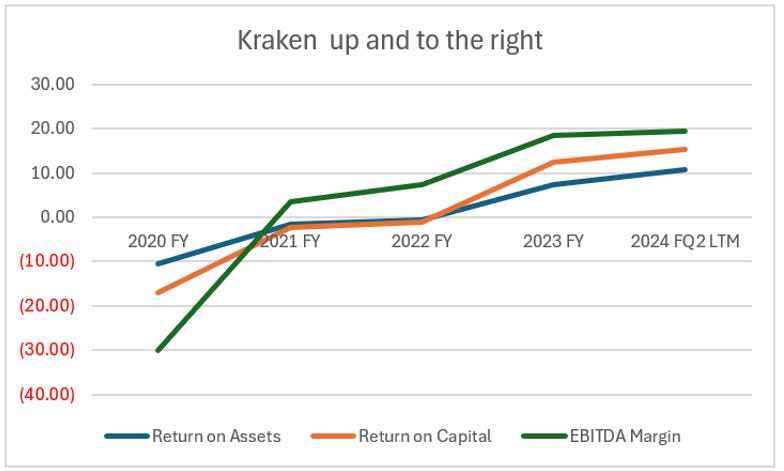

Kraken Robotics (PNG.V)

Geert Campaert - MCC: @geertcampaert - Twitter: @CampaertGeer

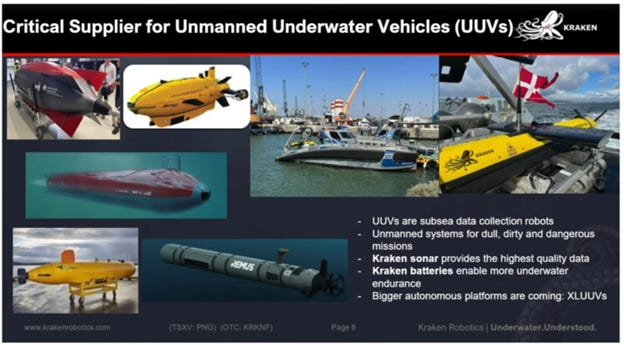

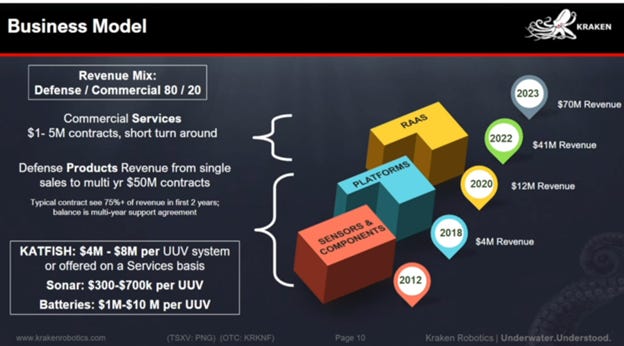

They are a Canadian company that started out as producers of synthetic aperture sonar for unmanned underwater vehicles (UUVs) for uses like naval mine-hunting and deep sea drilling. Kraken has expanded into producing its own sonar-equipped UUVs and specialized batteries. The company's revenue has surged from $4 million in 2018 to nearly $100 million in 2023, with strong contracts from navies worldwide. Kraken also sees significant future opportunities in battery demand and naval upgrades. He believes the most likely outcome is a takeover and notes a key customer of Kraken, Anduril, just did a $1.5 billion share issuance.

We note that they presented at Planet Microcap in Vancouver in September 2023. We did not buy at that time, unfortunately (see our charts and their 2023 video below). There is also a subreddit, but not really the kind of analysis we are looking for. https://www.reddit.com/r/KrakenRobotics/

Net Lease Office Properties (NLOP)

David Bastian - MCC: @kingdomcapital - Twitter: @kingdomcapadv

Net Lease Office Properties, a company undergoing a liquidation process. The company is disposing of office properties spun off from WP Carey, focusing on attractive deals for property sales, debt reduction, and managing leases. The strategy includes selling key properties, some at high values like a CVS building and a Google office in Venice Beach, while also walking away from underwater mortgages. He argues there is relatively low downside risk and anticipates the liquidation to be completed in two to three years.

We note that this seems like a less risky/more straightforward version of Slate Office REIT (see our articles - https://www.canadianvalueinvestors.com/t/sotun )

Citizens Bancshares (CZBS)

Tim Eriksen - MCC: @Tim Eriksen - Twitter: @eriksen_tim

Disclosure: We still own this one.

A century-old, African-American-founded bank based in Atlanta. After receiving $95 million from the Emergency Capital Investment Program (ECIP), the bank’s capital grew significantly, allowing them to improve profitability and buy back 10% of their stock. Despite already quadrupling its stock price, the bank remains undervalued. The speaker argues that the real potential lies in using the ECIP funds to grow its loan book and asset base, potentially increasing earnings and positioning the bank for long-term growth and profitability.

As disclosed above, we are shareholders of CZBS but have not written about it. Some good additional background sources:

Tim’s Third Quarter 2022 letter - https://www.eriksencapitalmgmt.com/investor-letters

Highlight:

The Best Investment Opportunity We Have Seen in a While

The fund has taken large positions in two small community banks. Citizens Bancshares (CZBS) and M&F Bancorp (MFBP) along with smaller positions in similar banks. All these banks have a skewed risk reward profile. Thanks to funding through Emergency Capital Investment Program (ECIP) these two banks received capital equal to two to three times their book value (or market value).3 This funding is in the form of perpetual non-cumulative Preferred stock. 4 Thus, the banks have more capital than most banks and are thus able to withstand negative events to a greater degree. Since the funding is in the form of low yielding Preferred stock, the common stockholders have nearly all the upside from the increased earnings potential of the additional capital.

…

Citizens Bancshares (CZBS) is an Atlanta, Georgia based bank with similar characteristics. Its shares have jumped a bit due to the write up on twitter I mentioned above. Citizens has roughly 2 million shares outstanding. Shares traded last at $23 per share. Citizens received $95.7 million of additional capital. Citizens does not report quarterly earnings, but the bank and the parent both file quarterly Call Reports. Both are available on otcmarkets.com. Earnings for the first half of 2022 were about $1.60 per share, but that is inflated due to a $1.8 million grant. Q2 EPS excluding the grant were roughly $0.55 per share. Thus, Citizens is also trading at around ten times its earnings run rate. Citizens has additional tailwinds beyond ECIP. The fund started buying in June at $12 per share.

ToffCap ECIP recipients backgrounder from 2023 - https://toffcap.com/ecip-recipients/

Bossert Capital Q1 2024 update -

https://twitter.com/alexbossert/status/1785747561694831099

Prospect Ridge Resources (PRR.CN)

John LaGourgue - MCC: @John Lagourgue - Twitter: @lagourgue1

For the mining bugs out there (we view this as out of our circle of competence). Prospect Ridge Resources is a mining exploration company based in British Columbia with a large, untapped land package. Its flagship project, the Holy Grail property, has never been drilled but shows significant potential based on surface samples containing gold, silver, and copper. The company is fully funded for drilling, which has already started. Prospect Ridge’s management team is experienced, and the company’s location in a geologically favorable area (near the prolific Golden Triangle) provides strong potential for high-impact exploration results.

Jeil Technos Co, Ltd. (038010)

Sean Iddings - MCC: @Sean Iddings

Jeil Technos Co. is a South Korean micro-cap company primarily involved in producing deck plates for construction, with a focus on high-rise buildings, nuclear power plants, and naval shipbuilding. The company has grown significantly in recent years, improving its margins and return on capital. Major tailwinds include government support for nuclear energy and increased naval investments, with Jeil being a key supplier. Despite its growth and market position, he argues that Jeil is undervalued largely due to foreign investment barriers in South Korea.

This was our first exposure to investing in South Korea and think it might be a great area to start hunting in general given the success value investors have had in Japan. The Republic of Korea loosened the rules around foreigners trading in their market at the end of 2023 https://www.reuters.com/markets/asia/skorea-scrap-foreign-registration-rule-share-trading-thurs-regulator-2023-12-13/ and IBKR recently added the Republic of Korea - https://www.interactivebrokers.com/en/accounts/open_account_country_list.php

Company Highlight - KITS Eyecare (TSX: KITS) at an inflection point?

Disclosure: No position held at posting.

One of the presenting companies that caught our eye was KITS Eyecare (TSX: KITS). We have not written about a Canadian company in a while, and we felt this was one worth talking about while helping to dispel claims that our blog’s name is false advertising.

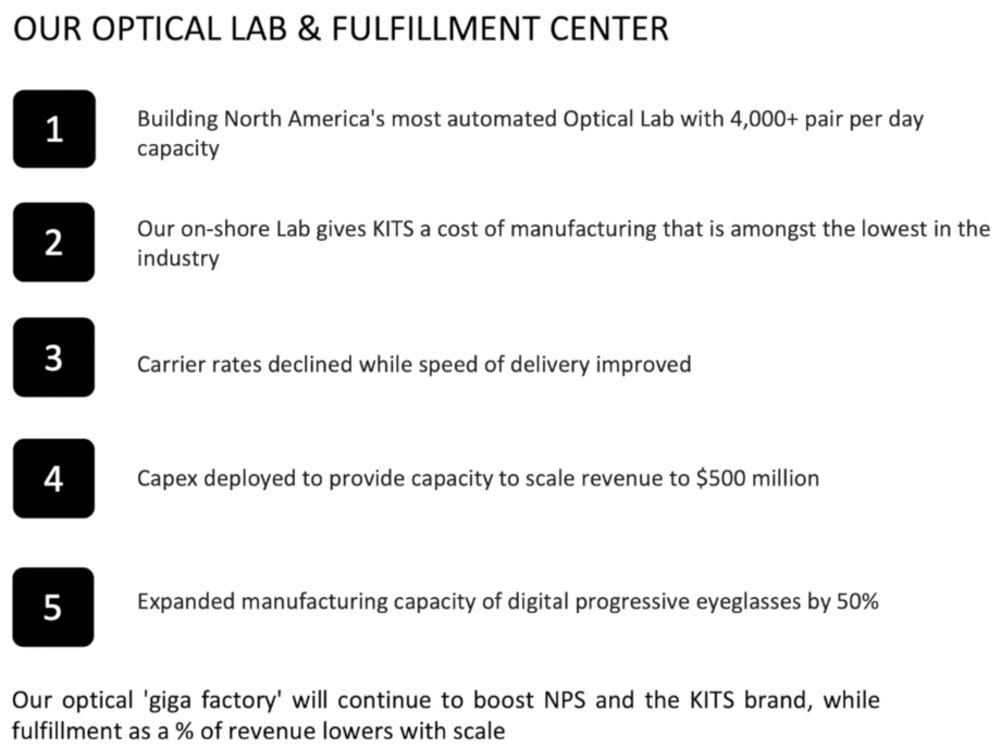

To put it simply, they sell glasses online. However, what they have done is built their own “state of the art” (in their words) manufacturing facility in Richmond, B.C. that is highly automated. What it has let them do is enable them to do is get a pair of glasses to a customer in only two or three days after ordering.

One of the co-founders is Roger Hardy, who founded and sold Coastal Contacts for $450MM. A few sources note it appears KITS was started shortly after a possible non-compete clause lapsed, e.g. here (and general good background) - https://www.eyecarebusiness.ca/practice/disruptive-coastal-contacts-founder-re-enters-eyecare-industry/

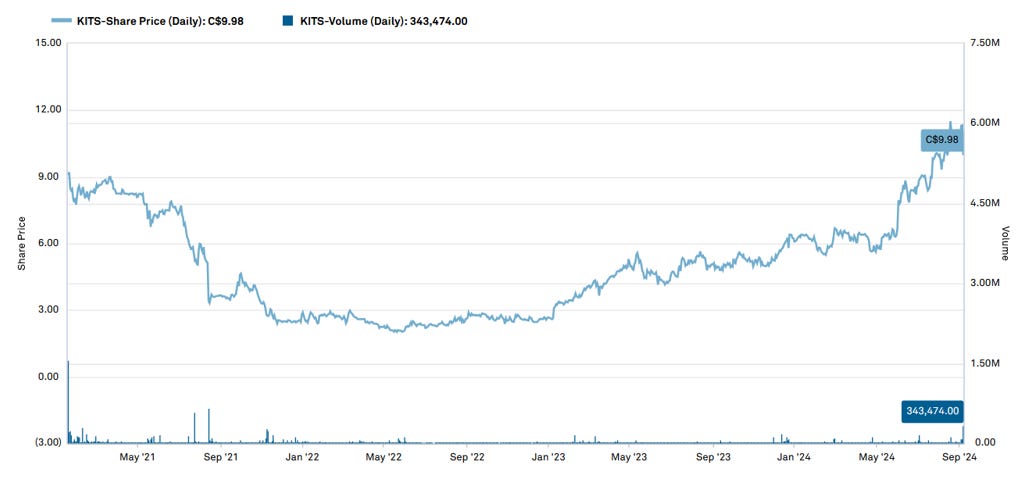

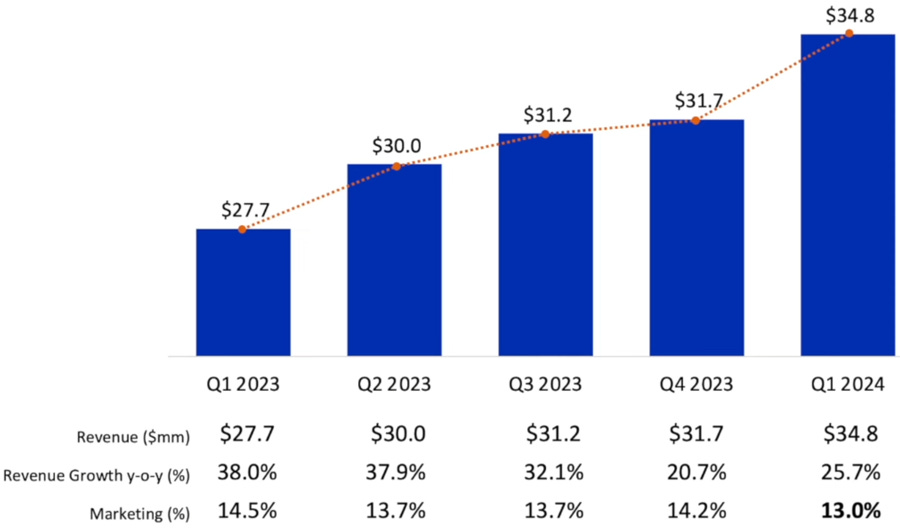

KITS was founded in 2018 by Roger Hardy, Joseph Thompson, and Sabrina Liak. The company went public on the Toronto Stock Exchange on January 19, 2021, following a $55 million IPO, with shares initially priced at $8.50. This was a frothy period for IPOs. Despite continued execution and revenue growth, the share price did not recover until earlier this year and is now on sale for $9.98.

Business Model

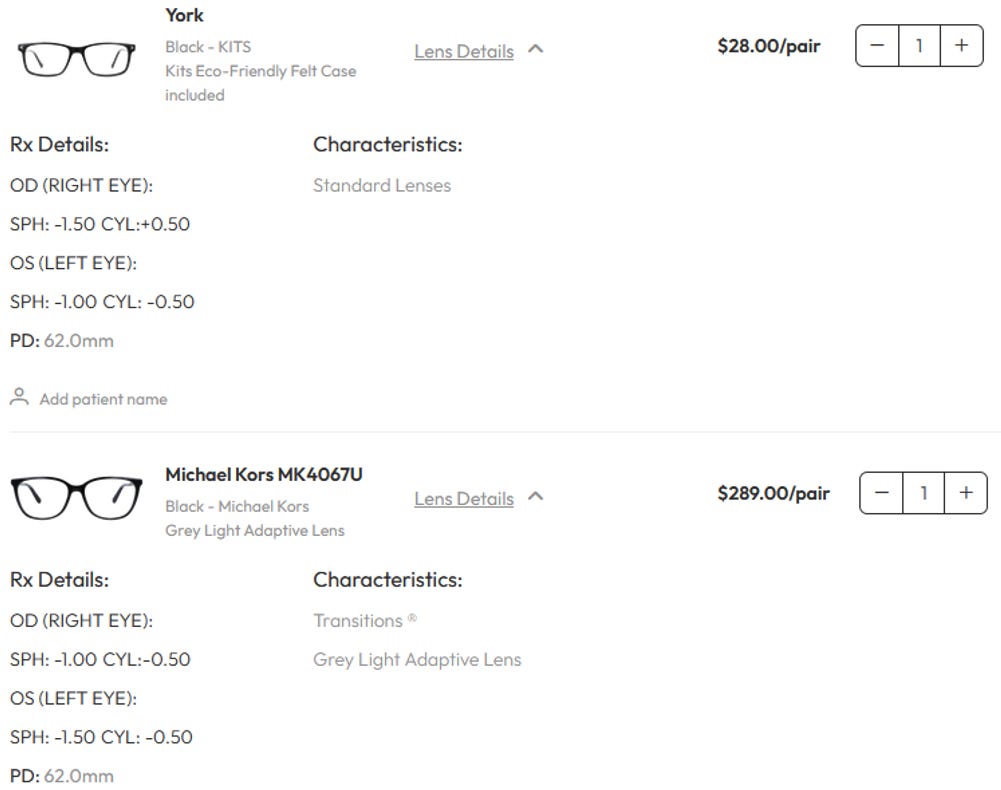

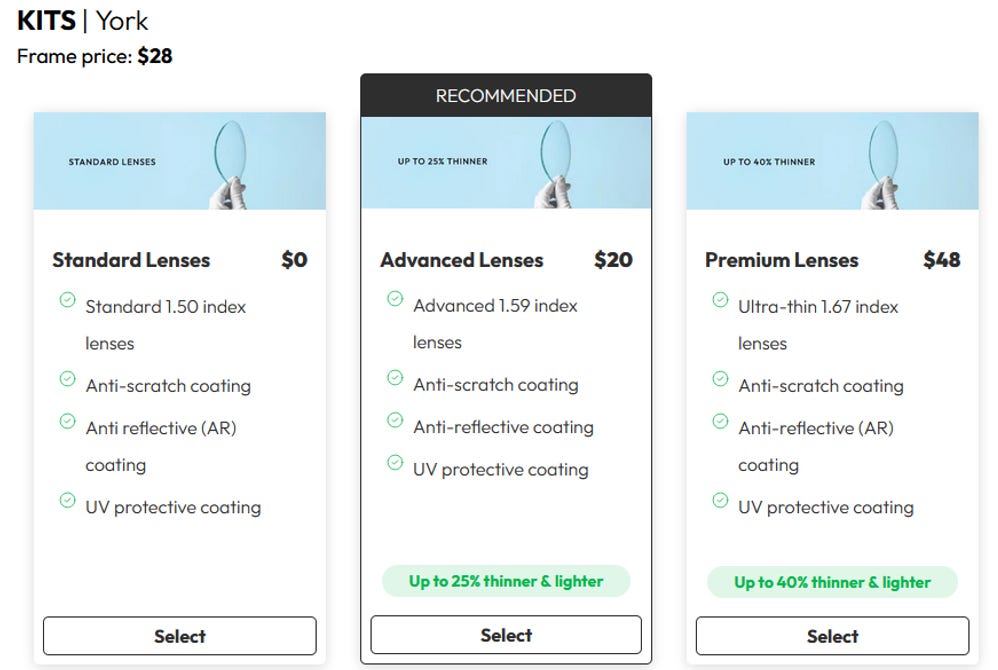

Besides their head office showroom store in Vancouver, they do not have any retail presence. Their claim to fame is selling a full pair of glasses for $28, but this is a bit of a red herring as their average order price is much higher.

Per Q2 2024 – “We were delighted on average order value of about CAD 180. That's underneath that, that growth. We're happy to see both glasses and contact lenses contributing to that and both Canada and US contributing to it. And so, we do think that there – we haven't put any targets out there for later 2024 or 2025 average order value, but we do see more appreciation there. And that's going to come in our minds predominantly from more growth in the eyeglasses sector.”

When customers add things like thinner lenses or choose designer frames it gets more expensive (and higher margin) but remains much cheaper than our retail channel checks. An exception would be Costco. As Costco customers who have bought glasses at Costco, we think that they are by far the strongest retail competition.

And it is recurring.

“In addition, we generated 64% of our revenue from our loyal core customer, reflecting their strong affinity for our brand and ensuring a steady revenue stream. We achieved a record 13.8 million from 72,000 new customers during the second quarter, a 21% increase year over year.”

How big is the market?

“We have some data. It's not perfect, but it is directional. And so, what we've seen on the eyeglasses segment is pre-pandemic. Percentage of glasses bought online was in the mid-single digits around 6% to 8% of revenue. And in the latest numbers that we are seeing from the industry and this is US data mostly is that number on eyeglasses is now approaching 20% in around 18% to 19% for the category, now transacted online. And on contact lenses, little bit higher, so pre-pandemic. That number was around 16% to 18% of the category online. And the latest numbers that we've seen from the vision count on the US suggested it's around 42% in the US now bottom line, so growing rapidly. Numbers may not be perfect, but they are trending up.”

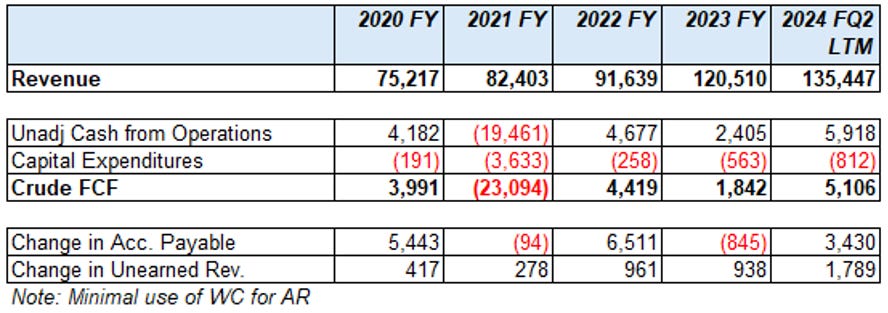

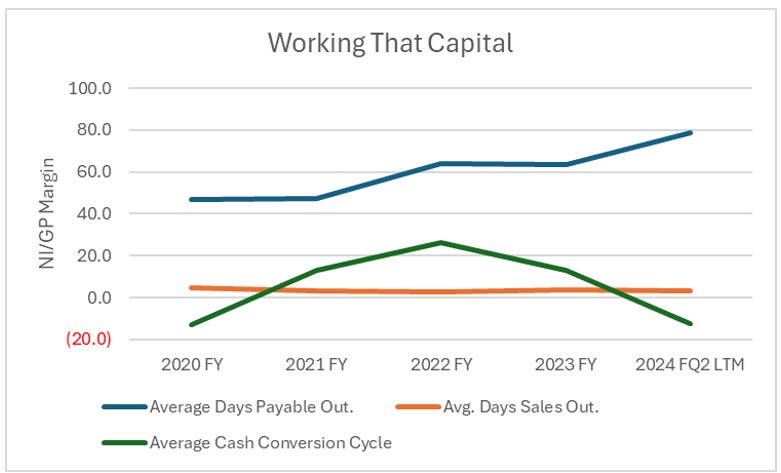

An inflection point

With a market cap of about $300MM Canadian today (share price on sale at $9.98), this obviously would be quite different than our other holdings, which are typically in the low single digit multiples of free cash flow and ideally a catalyst in the background.

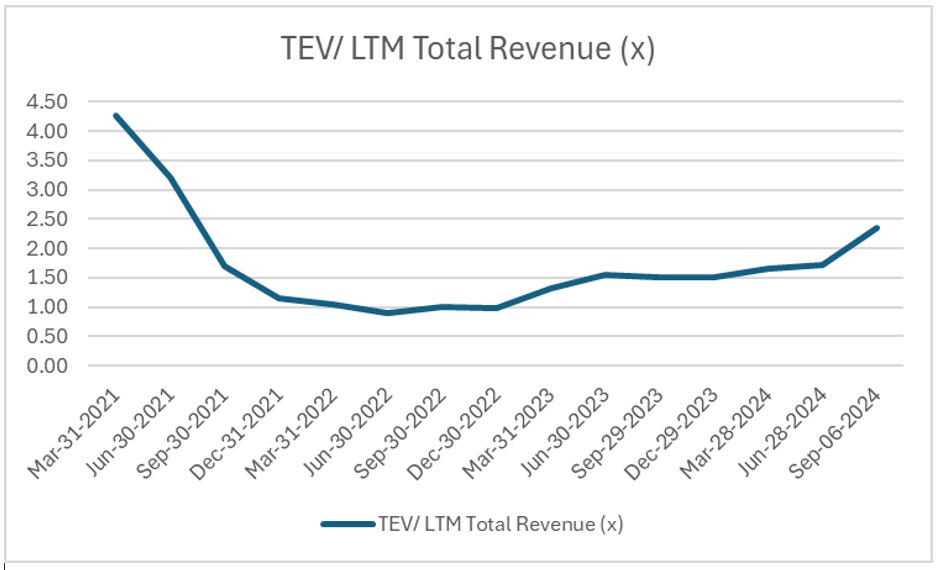

We note that while the share price has run up, expectations remain below the IPO as shown in the EV/revenue chart below. Expectations seem high for us being the cheap curmudgeons we are. However, if this wheel continues to turn it could end up being quite the bargain. We will continue to evaluate.