Disclosure: We own TSX:NFI.

Today we tell the tale of NFI, North America’s largest bus manufacturer. It has gone through several years of supply chain hell, only to emerge out of it into an unprecedented trade war with Trump. Why would you invest in a Canadian domiciled bus manufacturer in the middle of all of this?

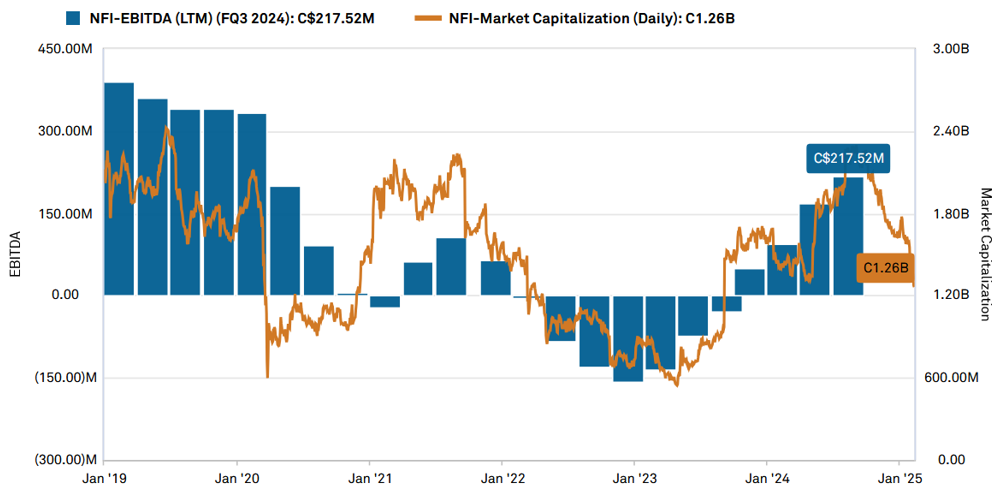

We think the market is missing the story. NFI is just turning the corner returning to positive EBITDA, improved contracting and procurement processes, and a record $12 billion backlog, while many competitors have gone bankrupt or have exited the market. Now, North America is down to two key manufacturers of transit buses, with the other smaller one being at full capacity. And although NFI is headquartered in Canada, they have been producing buses for years that already comply with Buy America rules.

Is it time to get on the bus? We just got on with purchases made this past week.

Table of contents:

A bit of history

Macro demand

Competitive landscape

Gillig #2

Making a bus is hard

The refinancing and Coliseum’s Coup

Trump Noise and Buying American

Is this your bus?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

A bit of history

Bus manufacturing in North America has gone through significant consolidation. Similar to car manufacturing, there used to be a lot of players and even the big car companies were also making buses. For example, their key U.S. competitor is Gillig, a company that used to make carriages starting in 1890. General Motors was in on it too. Some of our readers probably remember their fishbowl buses - https://transitheritage.ca/2182-2/ As a side note, Rapido Trains makes an excellent model. https://rapidotrains.com/rapido-s-new-look-bus

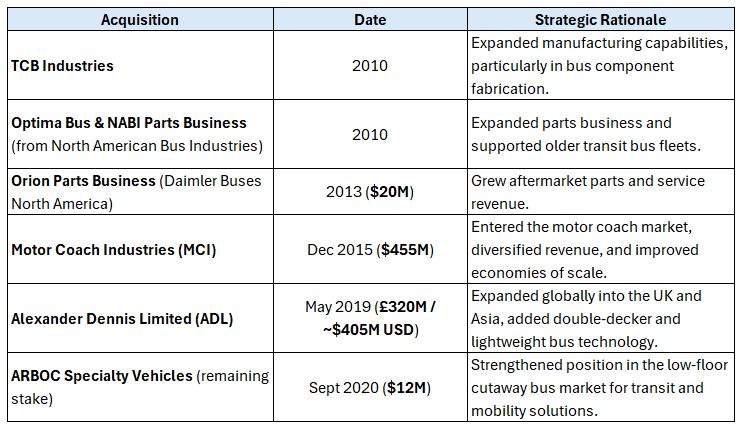

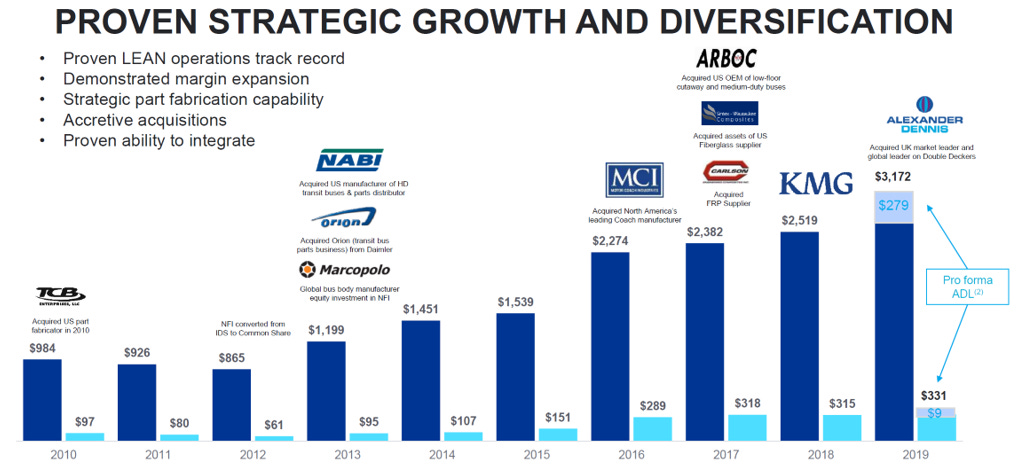

NFI Group was previously New Flyer Industries, which was originally founded in 1930 as the Western Auto and Truck Body Works Ltd in Manitoba. We began looking at NFI in the mid-2010s after its acquisition of Motor Coach Industries (MCI). The transaction had a good fit, with NFI diversifying its product offering. Many players exited the industry and consolidation continued. For example, General Motor’s sold its bus division to MCI, which NFI subsequently acquired.

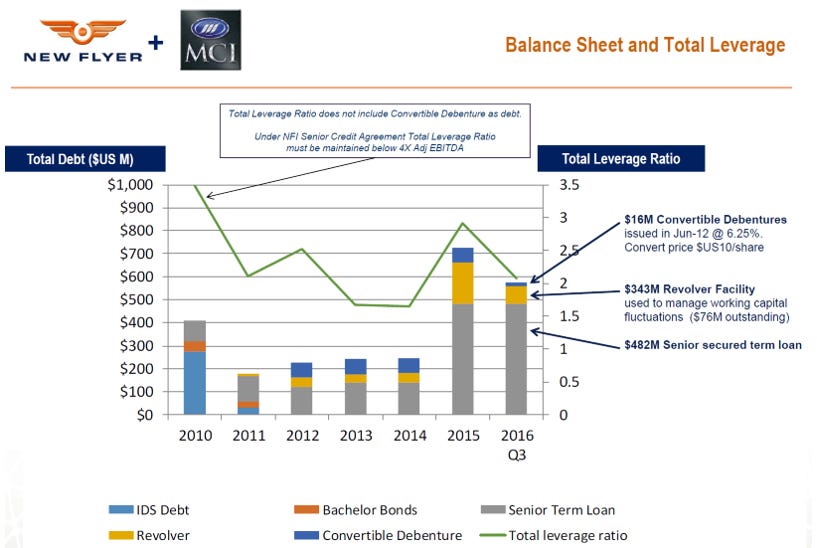

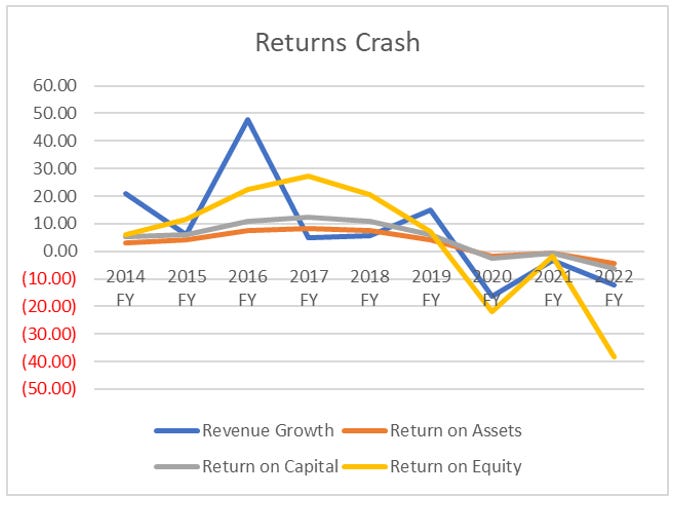

However, the stock was under pressure at the time due to leverage from a series of strategic mergers, with MCI at the tail end, but we felt the macro situation was interesting. Demand for transit and long-haul buses looked good and consolidation of seemingly rational producers and long-term procurement contracts seemed like a good setup for good returns on capital.

We moved on as we were a bit uncomfortable with the leverage/operational integration and found other simpler ideas. Good thing we did.

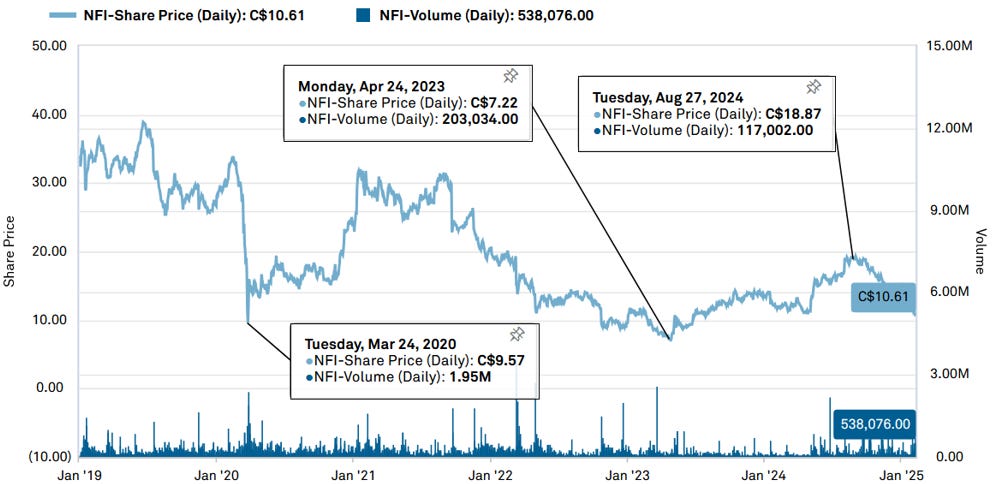

The COVID crash – A story through charts

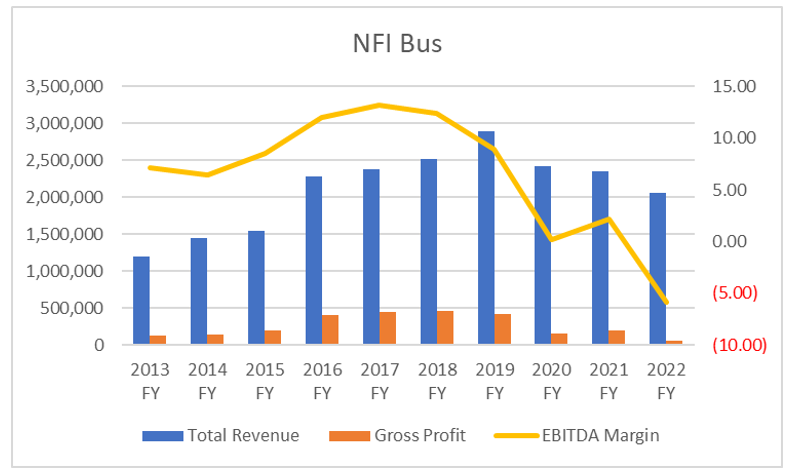

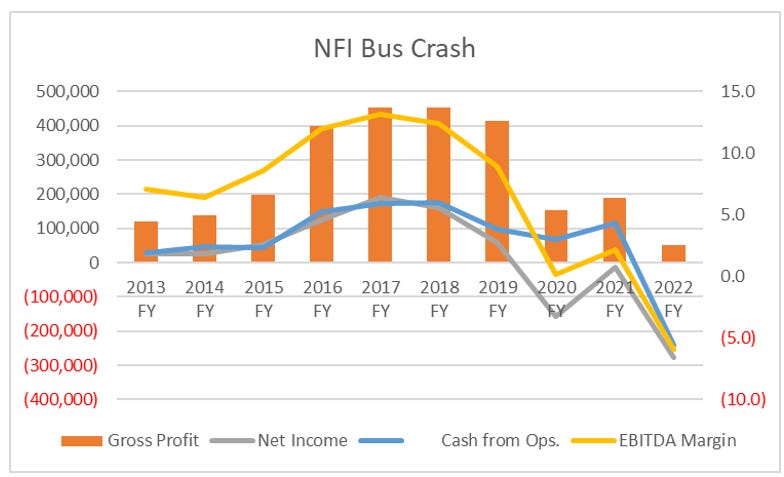

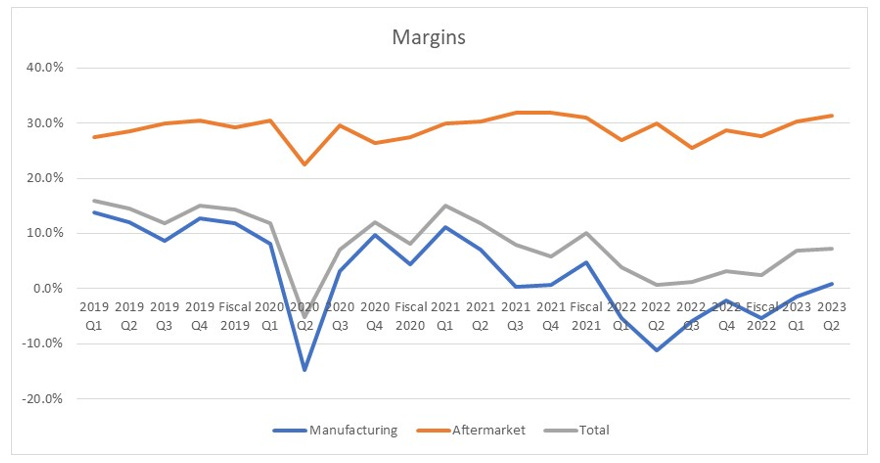

Historically, NFI was relatively stable and seemed to be doing a decent job at integrating their acquisitions. However, these charts speak for themselves. COVID’s timing was also terrible. It happened just when NFI was making some operational and leadership changes, starting to insource some additional parts, and trying to ramp up new EV and hydrogen models.

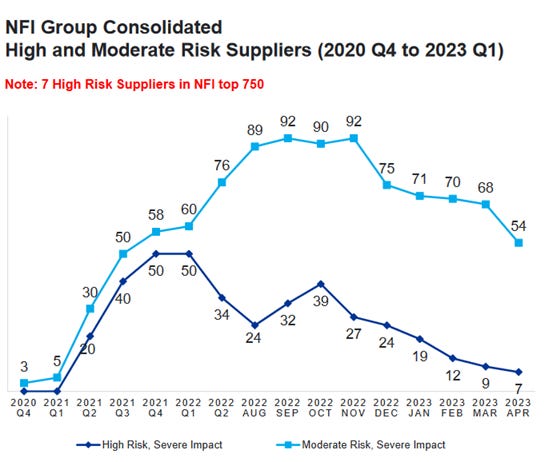

This was driven by a massive hiccup throughout their entire supply chain. Buses are big and complex, and we expected they would have some COVID supply chain issues like everyone else. But we did not fully appreciate just how complicated their supply chain was and how bad it could get as we get into below (see Making a bus is hard). Historically, a few suppliers per year had issues supplying their parts on time at agreed cost. During COVID this jumped to over 100.

They tried plugging their balance sheet with a convertible denture raise in 2021, but their balance sheet was just not built for this hiccup and they had to go through a refinancing (see 2023 Refinancing below). They required covenant waivers from their senior lenders and later a restructuring that was completed in 2023. Is this enough? First, let’s cover off macro demand and competition.

It is important to note that there are really two businesses: manufacturing new buses and aftermarket parts, roughly split 80/20 historically.

Macro demand

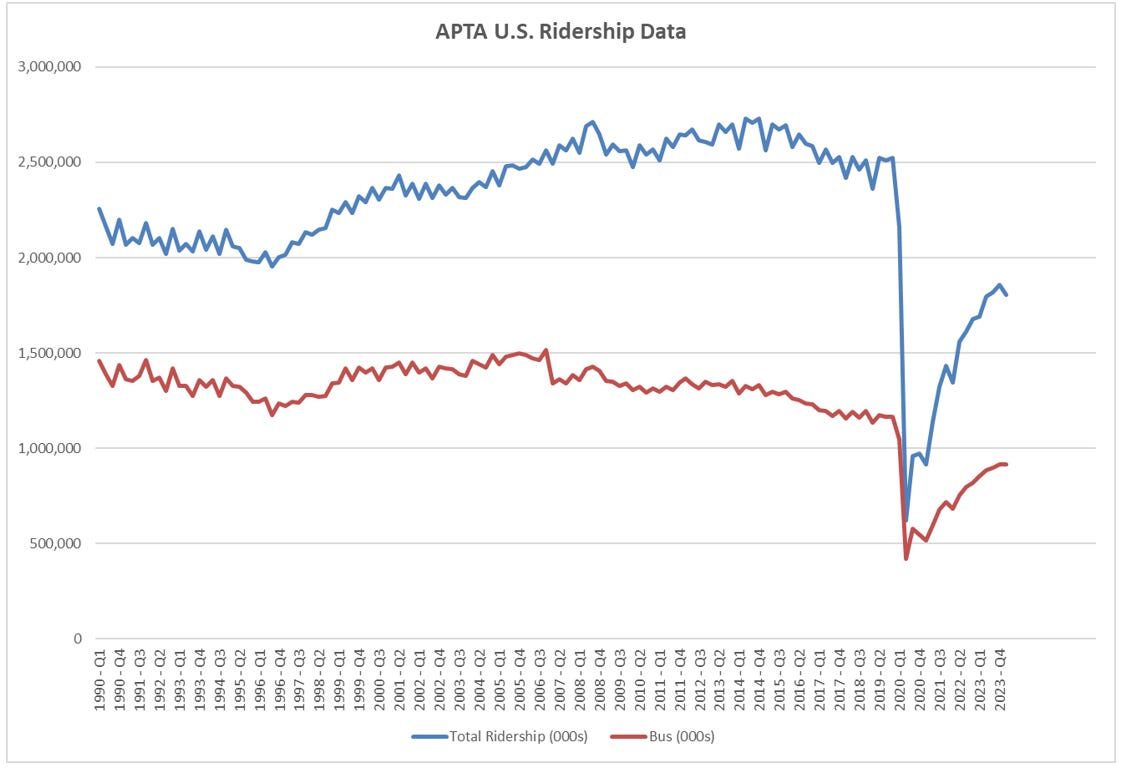

In the U.S., the Infrastructure Investment and Jobs Act ("IIJA") signed in 2021 includes $86.9 billion over five years for the FTA; the IIJA also authorized an additional $21.2 billion in supplemental appropriations from general revenues, for a total of $108 billion in FTA funding, a ~60% increase from the previous government funding act. Generally, U.S. public agencies can secure up to 80% of the capital costs for a new transit bus from FTA funds, with the remaining 20% coming from state and local sources. The best chart and source of information we are aware of is here - https://www.apta.com/research-technical-resources/transit-statistics/ridership-report/ Ridership in the U.S. has still not recovered from pre-COVID though the fleet needs to be continually refreshed. Given consolidation and continual fleet renewal needs, NFI does not require a significant increase in demand to do well.

Competitive Landscape

One key aspect that we think the market might be missing is how tough things have been for everyone and how much this might help NFI going forward. If you looked just a few years ago, there was a lot of excitement about greening transportation, particularly electric buses. It led to a large number of upstarts that seemed to mirror the excitement that Tesla created. In fact, a number of these upstarts traded a mindboggling multiples of minor or even non-existent revenue. What we did not understand is why NFI was trading so cheaply relatively. It seemed to parrot GM vs Tesla, but buses are not cars.

First, NFI was not behind and was already making electric, hydrogen, and natural gas buses. One of their key strengths has turned out to be that they are propulsion agnostic. Secondly, buses are nothing like cars. Bus purchasers, typically transit authorities, want a long-term dependable partner that will be able to service them. They also have complex contracting requirements and long lead times from winning the initial contract to actually receiving cash flow. In addition, a number of them focused on electric buses only,

We did not understand all the excitement and it seems we were right.

Examples include:

Proterra (electric buses and battery packs) – Failed August 2023 https://www.reuters.com/business/autos-transportation/ev-firm-proterra-files-chapter-11-bankruptcy-2023-08-07/ and acquired by Volvo Group out of Chapter 11 bankruptcy in February 2024.

While Volvo’s Nova Bus exited the U.S. market in 2023 to focus on Canada - https://www.volvogroup.com/en/news-and-media/news/2023/jun/news-4571491.html

Lion Electric – CCAA, trying to recover https://www.insolvencies.deloitte.ca/en-ca/Pages/Lion-Electric-Company.aspx https://www.ctvnews.ca/montreal/article/lion-electric-plans-to-focus-on-buses-rather-than-trucks/

Vicinity Motor – failed in November 2024 https://electricautonomy.ca/automakers/2024-11-21/vicinity-motor-receivership-canada-electric-bus-truck/ and trying to return in some form https://insolvencyinsider.ca/p/vicinity-motor-corp-tsxv-vmc-et-al-receivership

Vicinity is a particularly useful case study. They IPO’d in July of last year. Per their prospectus.

The bus industry and the electric vehicle industry are highly competitive and the Company is likely to face competition from a number of sources. The Company may not be successful in competing in these industries, which may materially adversely affect business, results of operations or financial condition. The North American medium and heavy-duty bus market is highly competitive today and the Company expects it will become even more so in the future. The Company’s principal competition for their traditional medium and heavy-duty buses come from manufacturers of buses with internal combustion engines powered by diesel and CNG fuels. This includes New Flyer, Nova, Gillig and Rev Group, and other automotive manufacturers. The Company cannot assure that customers will choose its vehicles over those of its competitors’ traditional buses. As of the date hereof, few battery electric buses are being sold in the United States or Canada. However, the Company expects that an increasing number of competitors will enter the electric vehicle market within the next several years and as they do so the Company expects that it will experience significant competition. A number of private and public companies have announced plans to offer battery electric buses, including companies such as GreenPower, Motiv, and others. Based on publicly available information, a number of these competitors have displayed prototype buses and have announced target availability and production timelines, while others have launched pilot programs in some markets. In addition, the Company is aware that competitors, including New Flyer, Proterra, GreenPower, Lion Electric and others, are currently manufacturing and selling battery electric buses.

After all of this, the U.S. is now down to two main manufacturers of transit buses, NFI Group and Gillig.

Gillig #2

Gillig is NFI’s key competitor. It is a private company and, being founded in 1890, it is America’s oldest surviving bus manufacturer (albeit making carriages at first).

Gillig’s business model is quite different than NFI. Gillig has centralized its operations at one key facility, relocated from Hayward to a state-of-the-art, 600,000-square-foot facility in Livermore, California to accommodate growth and enhance production capabilities. NFI has a significantly higher production capacity, capable of manufacturing up to 3,000 buses annually across multiple U.S. and Canadian plants, while we estimate Gillig can produce about 1,000. NFI also offers a broader product range, including 60-foot articulated buses and fuel cell options that Gillig does not produce.

Gillig being centralized simplifies logistics and improves efficiency compared to NFI. It has also decided to focus on standardized bus designs results in faster lead times, making it a good choice for agencies needing quick fulfillment but not customization. By limiting customization, Gillig avoids production inefficiencies, leading to more predictable costs and delivery schedules. It also excels in serving medium-sized fleets (500 buses or fewer).

Gillig’s streamlined standardized approach works for some contracts, while NFI’s strength lies in its ability to meet large-scale, customized fleet demands. Gillig is a strong competitor, but very different than NFI and there appears to be enough business to go around (NFI’s backlog is now US$12 billion, discussed later).

Making a bus is hard

How did the supply chain hiccup happen? COVID created industry-wide impacts while NFI was hit particularly hard because they were also insourcing some production at the time and trying to ramp up new EV buses and other services like EV charging system design and construction. This interview from 2023 with NFI’s supply chain lead provides a lot of good background on the supply chain mechanics.

To understand our supply chain, one must appreciate its complexity and critical role. A single transit bus requires sourcing over 10,000 parts, and that’s just at our level. For instance, an engine is considered a single part number within that 10,000. If you look deeper into our suppliers, their components also consist of thousands of sub-components. At the Tier 2 level of our supply chain, I estimate that well over a million part numbers come together to manufacture our vehicles.

The nature of our business is engineered-to-order, meaning that each contract we build involves hundreds of parts unique to that order. Electrical harnesses, powertrain systems, and bus models all vary, making inventory planning a significant challenge. Unlike a retail store that can function with 99% of its inventory, if we are missing just 1% of our parts, we can’t build anything. Certain critical parts, such as flooring or power electronics, can halt production entirely.

During the microprocessor shortages of last year, we built buses for three months without their main controllers. This meant that none of those buses could run or undergo essential system validations, causing massive delays and inefficiencies. Thousands of hours were spent on electrical testing and road validations, all waiting on a single part to arrive.

Before COVID-19, we maintained a highly efficient supply chain with 100% schedule attainment for a decade. However, the pandemic brought immediate challenges. The first warning came in February 2020 from Cummins, which issued a force majeure letter stating that 100 parts for their engines came from China’s affected regions. Shortly after, production was completely shut down for six weeks across all plants, and our J coach production ceased for 18 months due to market collapse.

As production resumed in 2020, initial supply chain conditions were stable due to existing inventories. However, by early 2021, significant imbalances emerged due to shifting demand patterns and supply shortages across multiple industries, most notably microprocessors. Our buses contain hundreds of microprocessors, impacting nearly half of our top 100 suppliers.

By late 2021 and into 2022, supply chain disruptions reached their peak. Suppliers ranging from local machine shops to large Tier 1 suppliers faced shutdowns, labor shortages, and component delays. At one point, we had 30 to 40 force majeure letters from key suppliers. The biggest challenge was the lack of visibility and predictability. We had to decide whether to continue production despite uncertainty or shut down operations entirely. We chose to power through, maintaining over 98% parts availability despite the disruptions.

On not renegotiating contracts; force measure. Why did they not push back? It is because it would greatly affect future business.

Part of what was different in the past compared to now is that we got hammered with hyperinflation. We made the choice not to send all our people home because we had such strong order books, knowing we would absorb all kinds of non-productive labor. The second decision we made was not to default on any customer contracts. A few customers—nine, to be exact—helped us with pricing, working capital, or milestone payments, but the rest held firm, emphasizing that we had to fulfill government contracts. As an industry leader in a small community, we understood that defaulting on a government contract or forcing our customers into a difficult position would be like signing our own death certificate—everyone in the industry would know.

In the Buy America world, any contract default must be disclosed in every future proposal, making it nearly impossible to win new business. Imagine a city approaching its board and saying they wanted to choose New Flyer, only for someone to respond, "Oh, those are the guys that defaulted on contracts."

We don’t operate that way anymore. Now, when we bid, we do so with much greater confidence in our bill of materials, the cost of the bus, and overall pricing. We add insurance above and beyond for peace of mind—if we miscalculate one part, we can make up for it elsewhere. As a result, we've significantly increased our margin expectations to navigate 2023, 2024, and 2025. Our win rate on zero-emission contracts continues to improve relative to historical levels.

…

Entering 2023, conditions have drastically improved. We spent $7 million on high-cost broker buys for chips in 2022, compared to just $200,000 in the first half of 2023. Our most critical suppliers, particularly in power electronics, are now delivering on time, though some fragility remains in the supply chain.

Parts availability in our production lines has returned to pre-COVID levels. Our supply chain performance is improving but is not yet at 2018-2019 levels. On-time delivery from suppliers is now around 95-96%, compared to 99% pre-pandemic. Some suppliers are still struggling with capacity and labor issues, but these are isolated cases rather than industry-wide disruptions.

Inventory levels have more than doubled as a buffer, helping ensure smooth production despite lingering supplier challenges. However, we still need full supplier recovery to return to just-in-time efficiency. While risks remain, all indications suggest continued improvement, and we are confident about returning to full operational health soon.

Looking ahead, the transition to electric vehicles (EVs) is introducing additional complexity. EVs involve different suppliers and components, such as battery systems and electric powertrains. Our production plan includes tripling zero-emission vehicle (ZEV) output next year, requiring careful coordination with suppliers like Ballard for fuel cells and other specialized components.

It his hard to understate how hard hit some suppliers were during COVID. The best example is one of their seat suppliers. Not only have the bus manufacturers themselves consolidated, but a lot of their suppliers have as well, causing the overall industry to be very fragile. If you have 95% of a bus you cannot do anything with it. Missing chips, seats, or even a mirror means you cannot do road tests and final inspections, causing severe knock-on effects. There are two key seat suppliers in North America.

I'll give an example, and there are many companies just like it. We have a seating supplier in Chicago. In 2019, prior to COVID, they had 900 employees. We were one of their larger customers, along with others in the bus and related industries. When the pandemic hit and supply chain challenges arose, their sales volume dropped by over 60%, primarily because chassis weren’t available. They supply a lot of seats for the body-on-chassis business, and with Ford and GM not sending out chassis, we could only get 150 of the 500 we needed in Arboc, for example—about 30% of what we wanted.

As a result, in 2021, they laid off 450 of their 900 employees. Then, rolling into 2022, chassis started becoming available again, and demand surged. They had to go out and rehire 400 people. Since then, they’ve been shipping seats late to us and to Arboc, which has had to install them in the yard, working extra hours to keep up with late deliveries. Despite these challenges, they’ve managed quite well, staying mostly on plan, even though they’ve been dealing with these delays for eight months. We maintain daily and weekly calls with them, discussing their plans, staffing levels, and any updates they’ve heard each week.

And this is not fully resolved. In Q3 2024:

Despite the ongoing challenge with the seat supplier in 2024 Q3, the Company has seen significant improvement in overall supplier performance resulting in improved on-time production over the past year, supporting NFI’s continued efforts to ramp-up vehicle production rates. In 2024 Q3, Manufacturing deliveries decreased by 57 EUs, or 5.4%. Transit buses saw the largest decrease in deliveries of 132 EUs, or 16.5%, leading to a 2.5% decrease in new vehicle revenue. In 2024 Q3, Transit deliveries were negatively impacted by the seat supply issue and lower labour production efficiency, reflecting both the impact of disrupted seat supply and higher zero-emission bus production.

…

Seating Supplier Disruption

The most significant supply challenge impacting the Company’s North American operations relates to customer-selected passenger seats and seating kits. North American transit orders contain numerous customer specified parts and components used in the production of buses. These customer specifications, combined with Buy-America compliance, limit North American transit’s ability to procure certain parts and components from alternate suppliers. This dynamic applies to seating, which is currently negatively impacting NFI and its peers in American resulting in unfinished units remaining in WIP as NFI awaits seats for final installation. There were 79 EUs of unfinished units waiting for seats at the end of 2024 Q3. The Company expects this disruption will continue through the remainder of 2024 and into early 2025.

Given NFI’s limitation in onboarding new seating suppliers or using an alternative supplier on existing contracts, the duration necessary to secure adequate seating supply is difficult to predict and may take longer than anticipated. NFI is working closely with the customer specified supplier to execute on their production recovery plan to improve the delivery of seating kits and to finalize buses missing seats. These actions include the supplier engaging an external operational advisor and the use of third-party labour by the seat supplier to improve their production rates, and efficiency. NFI is also working with another seating supplier to establish Buy America compliant seat production in 2025, and discussing potential progress payments with customers whose vehicles are essentially complete except for seat installations.

We also note that EV and hydrogen buses are harder to make than diesel (see Appendix: Fires). They also cost more. EV buses have ~$300k of EV specific parts compared to ~$500k total cost for a diesel bus, but partly offset by elimination of other parts/simplification of maintenance).

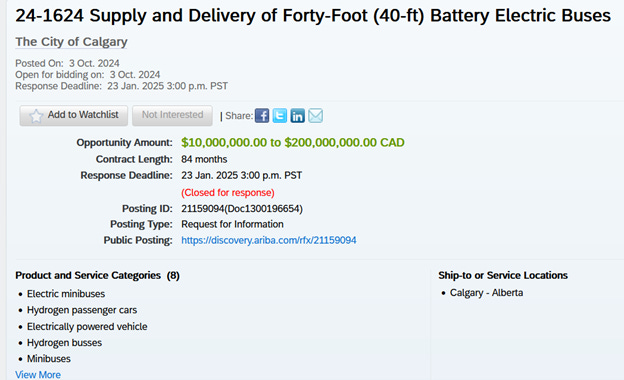

Procurement process example – Calgary Transit

Calgary Transit is going through an RFP process right now for 180 zero-emission electric buses.

https://www.calgarytransit.com/plans---projects/40-foot-electric-buses.html and https://service.ariba.com/Discovery.aw/ad/viewRFX?id=21159094

The 2023 refinancing and Coliseum’s Coup

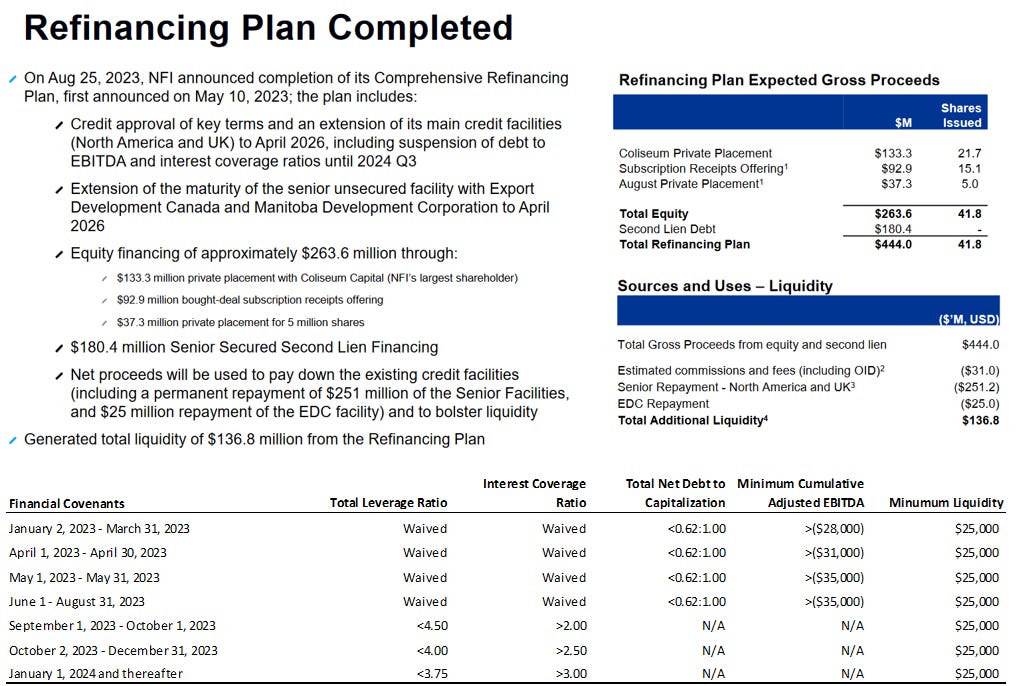

On May 10, 2023, the Company announced its refinancing plan.

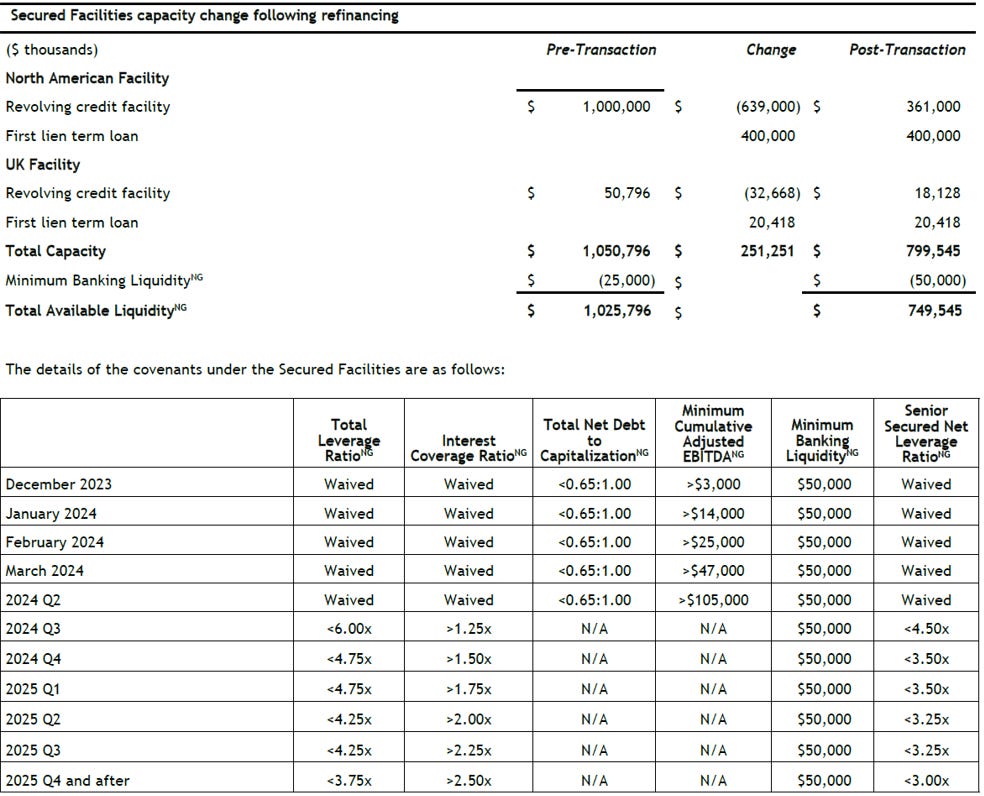

As part of the Refinancing Plan, the elements of which are further described below and which was completed on August 25, 2023, NFI amended its existing North American senior secured credit facility (the “North American Facility”) and UK senior secured credit facility (the “UK Facility”, and together with the North American Facility, the “Secured Facilities”), extended the Manitoba Facility and the EDC Facility and raised additional funds through the sale of new Shares and the Second Lien Financing

At the same time Coliseum Capital Partners increased their stake at a bottom tick of the stock. NFI was stuck.

On May 11, 2023, NFI announced that, as part of the Refinancing Plan, it had entered into an investment agreement (the “Investment Agreement”) with Coliseum Capital Management, LLC (“CCM”), Coliseum Capital Partners, L.P. (“CCP”) and Blackwell Partners LLC – Series A (“Blackwell”), a fund and an account managed by CCM, respectively (collectively referred to herein as “Coliseum”). Pursuant to the Investment Agreement, Coliseum (which was then a 12.4% holder of Shares) agreed to purchase Shares from NFI on the terms and conditions in the Investment Agreement. The issuance of Shares to Coliseum was approved by NFI’s shareholders at a special meeting of shareholders held on June 27, 2023. On closing of the Refinancing Plan on August 25, 2023, Coliseum purchased an aggregate of 21,656,624 Shares, on a private placement basis, at a subscription price of $6.1567 per Share, for aggregate gross proceeds to NFI of approximately $133.3 million (the “Coliseum Private Placement”) and Coliseum became NFI’s largest shareholder holding approximately 26.2% of the Shares.

The company put together a pretty significant restructuring. The full presentation can be found here - https://www.nfigroup.com/static-files/ee7de0e7-a0d7-4ffe-9695-4964d22430f6

And press release - https://www.nfigroup.com/news-releases/news-release-details/nfi-completing-comprehensive-refinancing-plan

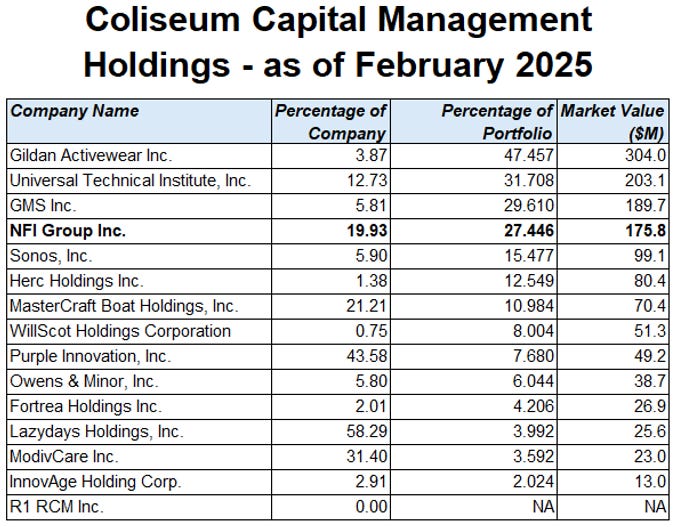

A key shareholder, Coliseum Capital Management LLC, a value-oriented investment firm, provided significant support. It’s their top holding worth about $300MM and they are by far the largest shareholder at 20%. (previously ~25% but appear to have made a partial sale in Q3 last year). They had a minor position pre-COVID, made additional purchases in 2021/22 accumulating ~9.5 million shares before this transaction. They run a very concentrated and interesting book.

Trump Noise and Buying American

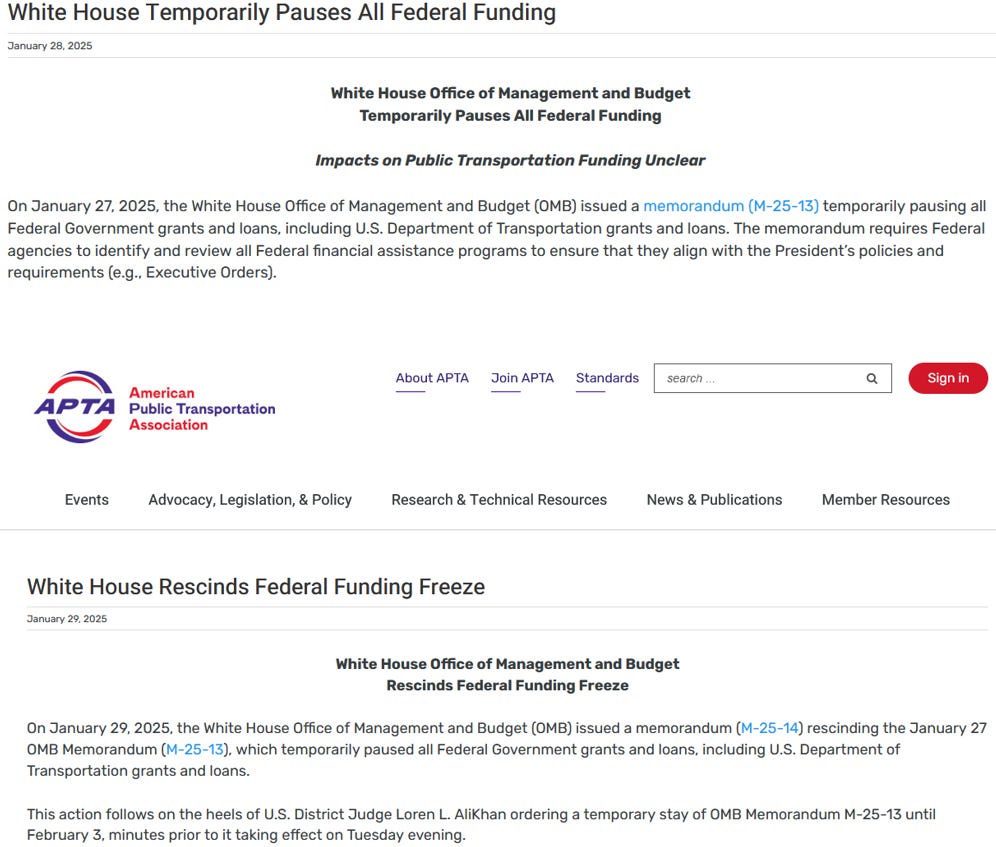

The start of the Trump’s second term has been very noisy to say the least. His pause of federal funding is another example, which would have affected bus procurement. Tariffs is another.

The thing is that although they are based in Winnipeg, they are already Buy America compliant. This is not new.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.