October “Q3” Portfolio Update: “What kind of investor are you?”

And an update on Slate Office REIT

Here’s the latest from Canadian Value Investors!

“What kind of investor are you” – Portfolio Update

Slate Office REIT Update

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

“What kind of investor are you” – Portfolio Update

We had an absolute blast at the Planet MicroCap Vancouver conference, and we will be posting our highlights soon. In the meantime, we have a number of new readers and wanted to provide an update on our approach and portfolio.

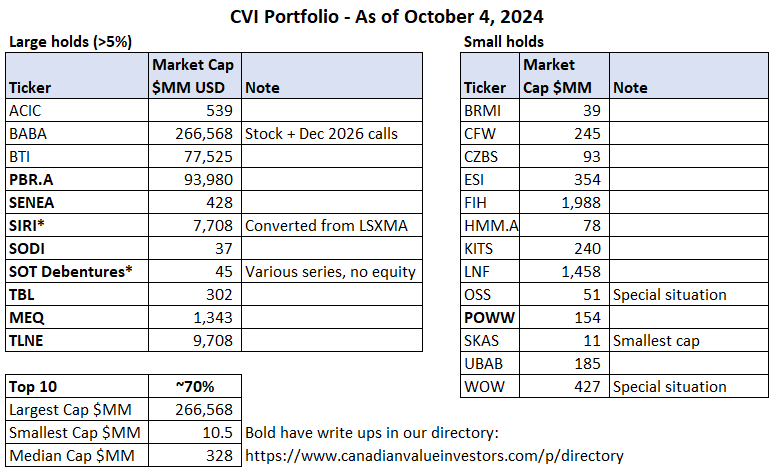

At the conference someone asked us “what kind of investor are you?” As you can see, with our portfolio it is a bit hard to explain briefly. What could vegetable canning, Brazilian oil, a nuclear power plant, and distressed office real estate debentures have in common? Upon reflection, we think of ourselves as realists, not contrarians, making concentrated bets on companies that are likely cheap and misunderstood. A longer description of our approach can be found here https://www.canadianvalueinvestors.com/p/value-investing-101 and directory here https://www.canadianvalueinvestors.com/p/directory

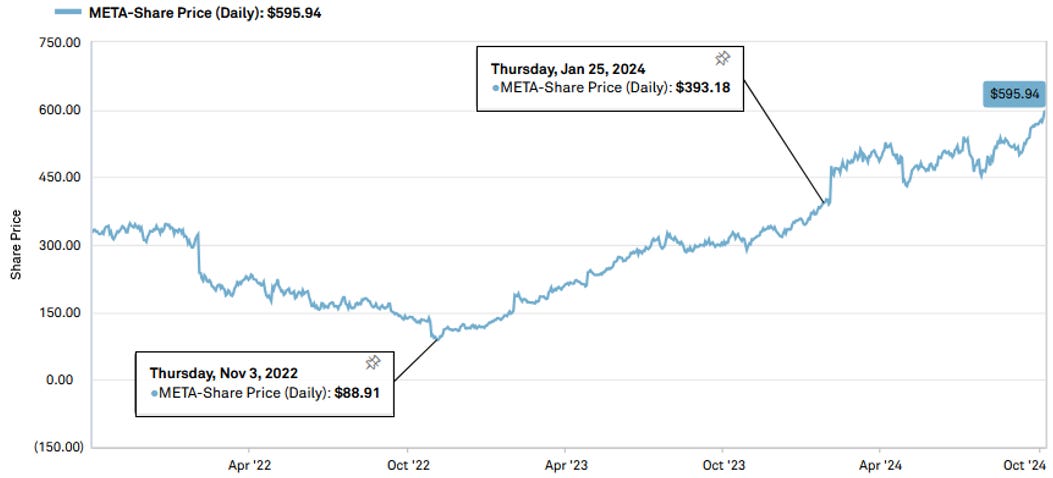

We think that investors, particularly value investors, often needlessly pigeonhole themselves. “I would never invest in energy.” “I only look at micro caps.” “I only look at industry x and y in Canada and never overseas.” We think that the best opportunities are likely in small caps, but large caps provide opportunities too. Case in point – META.

We must fish where the fish are and need to try to continually expand our circle of competence. We get particularly excited when we hear the crowd chanting the words “I would never invest in that no matter what the price is.”

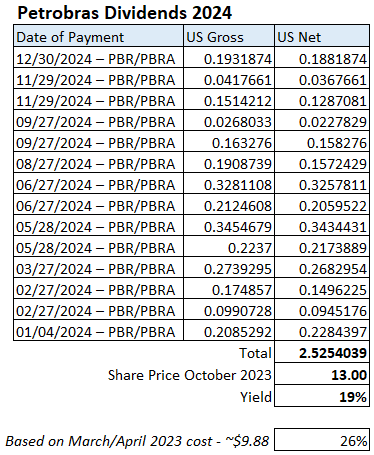

For example. we would never be invested in energy companies full-cycle, but have recently and are at the moment. Petrobras has been a very interesting ongoing case study for us (Disclosure: we remain long). We find that nothing has really changed since we first purchased it in early 2023, except for a small improvement in the market’s perception of PBR (while our perception has become a bit more bearish interestingly).

Had you bought this time last year, you would have received credit card rates of dividends (~19%) reflecting their defined capital allocation program. Dividends since our first purchases are approaching 50%. To be clear, we think that the political risk is very high, but not as high as what is being priced into the stock. With the price increase we have partially sold out the position for our other ideas; the price changed and, in turn, the risk/return changed. It seems OK today, but not nearly as interesting as it was at single digits.

Rio de Janeiro, October 2, 2024 – Petróleo Brasileiro S.A. – Petrobras informs that Moody's rating agency has raised the outlook on Petrobras' ratings from stable to positive and reaffirmed the credit rating at “Ba1”, reflecting the company's solid credit metrics, positive track record of operational and financial improvement and the agency's expectation of the Company's operational and financial discipline.

Petrobras’ improved outlook reflects the upgrade of Brazil's sovereign rating from “Ba2” to “Ba1”, sustaining its positive outlook.

So far, so good

The year is going well, with us beating the standard indexes and such so far, but we do not like to celebrate early. In fact, we hate quarterly checkups. There is just too much noise for it to be meaningful. This year is an extreme example for us. Just a few days apart our portfolio “return” YTD is wildly different, given 2026 dated calls on Alibaba bought earlier this year and Slate Office debentures. Hopefully it is a good Christmas.

Slate Office REIT Update

Disclosure: We are still long their convertible debentures.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.