Planet MicroCap Vancouver 2024 Highlights

KITS Eyecare Ltd. TSX:KITS – I see the light, and it only cost me $28

Planet MicroCap Vancouver was fantastic and hats off to the organizers. About 50 companies presented and were available for 1 on 1 meetings. We had a chance to see and speak to a lot of them, and wished we had more time.

There were a lot of great companies presenting and we could not hope to cover all of them comprehensively for you. Instead, we wanted to highlight a few that have particularly interesting business models or are just plain fun. That said, the whole list is worth a look, and you can see our cheat sheet with a high-level summary of all companies that we put together here - https://www.canadianvalueinvestors.com/p/planet-microcap-vancouver-2024-cheatsheet Organizers will also be posting some of the presentations to YouTube. Their channel here - https://www.youtube.com/@PlanetMicroCap

Today’s highlights (companies in alphabetical order) include:

Canadian Markets Checkup – How are we doing?

Atlas Engineered Products TSXV:AEP – Leaving a dedicated founder to do his thing

BeWhere Holdings Inc. CVE:BEW – Fixing big problems with little boxes

Foraco International SA – TSX:FAR – Digging for gold

Gamehost Inc. TSX:GH – How are casinos in Alberta doing anyway?

KITS Eyecare Ltd. TSX:KITS – I see the light, and it only cost me $28

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

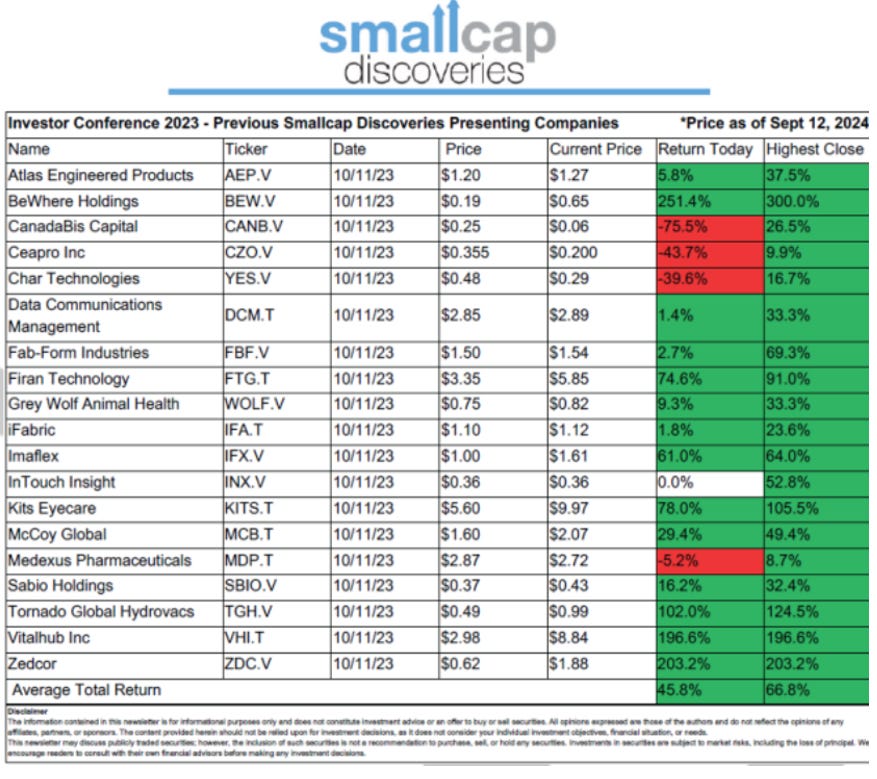

Last Year’s Crop

As noted at the event, if you bought an equally weighted basket for the 2023 Vancouver conference you would have returned 45%.

The next conferences have been announced:

Las Vegas April 22-24, 2025 in partnership with MicroCapClub

For the first time, Toronto October 21-23, 2025 also in partnership with MicroCapClub

We look forward to both!

Canadian markets check up – How are we doing?

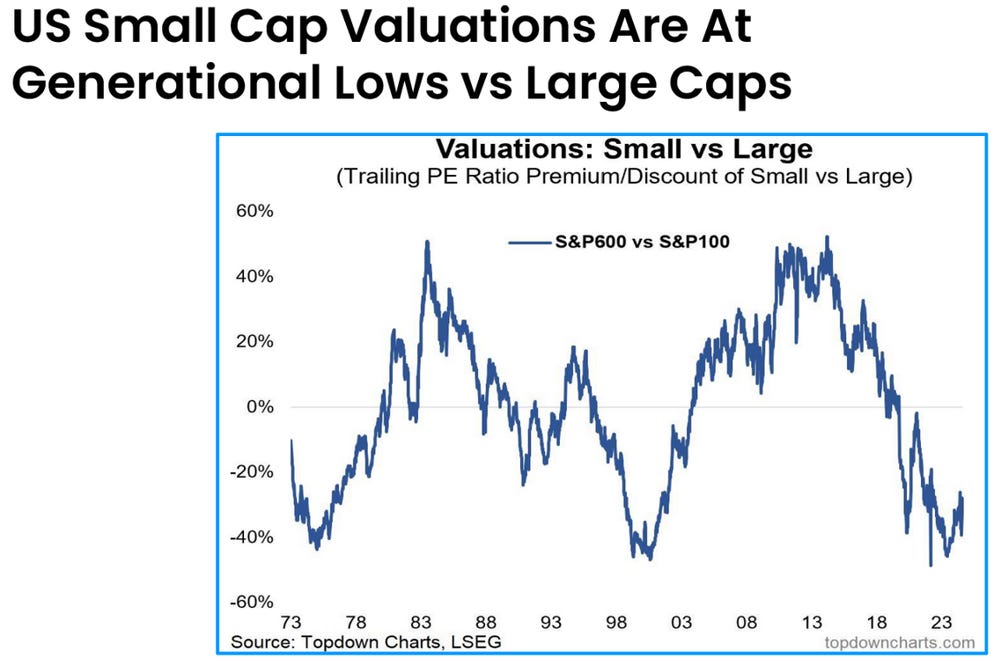

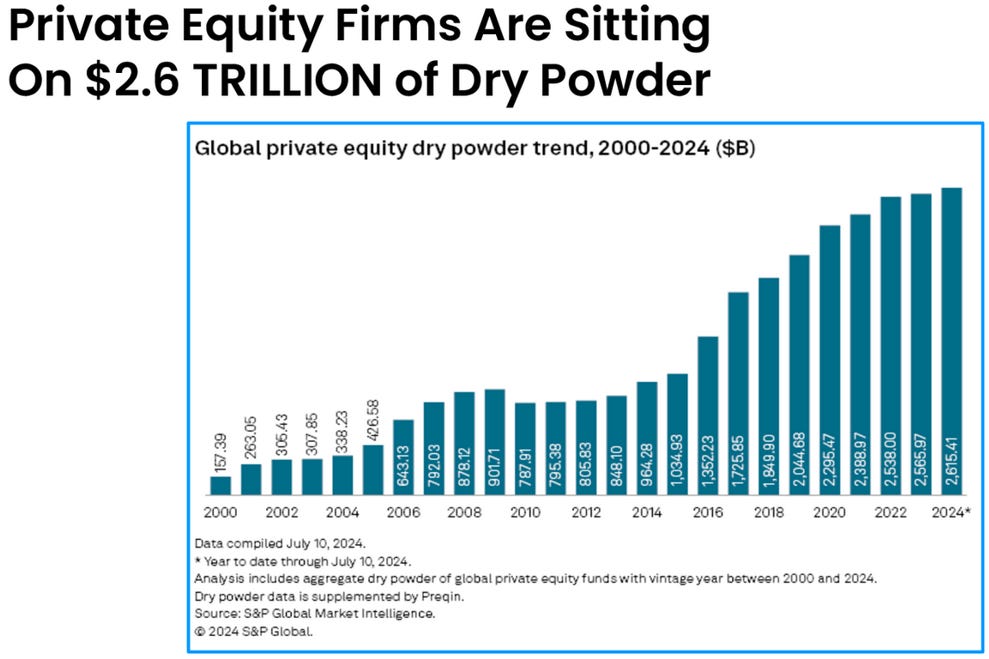

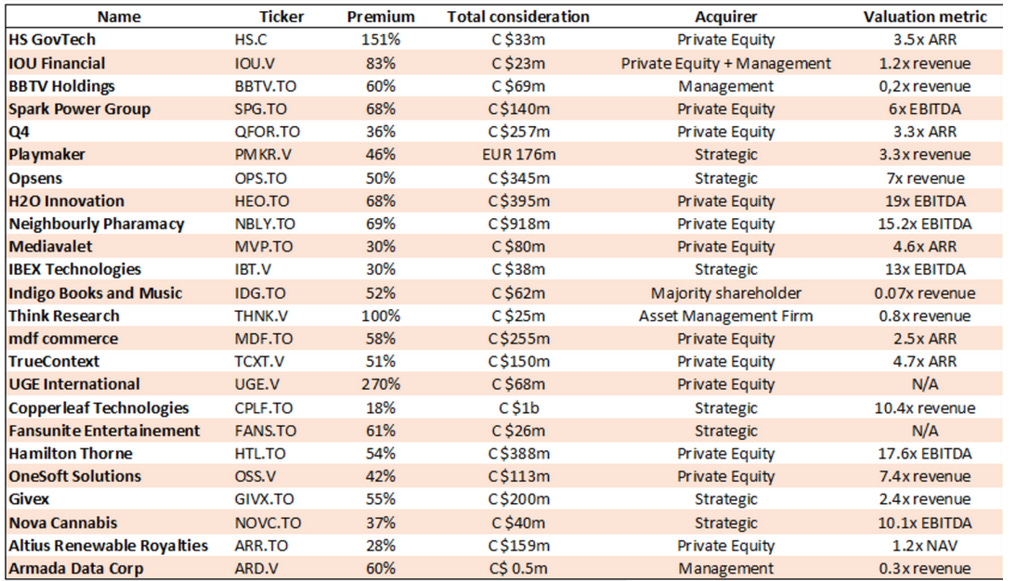

Although the TSX just hit an all-time high, the Canadian small cap world continues to trail far behind and multiples, in general, remain low. PE firms are also increasingly knocking on the doors of Canadian companies. Mathieu Martin (Stocks & Stones)

did a great presentation at the conference about this. He covered some of his presentation in this thread as well - https://x.com/Stocks_Stones/status/1844351464006721611 His list of recent transactions is below.

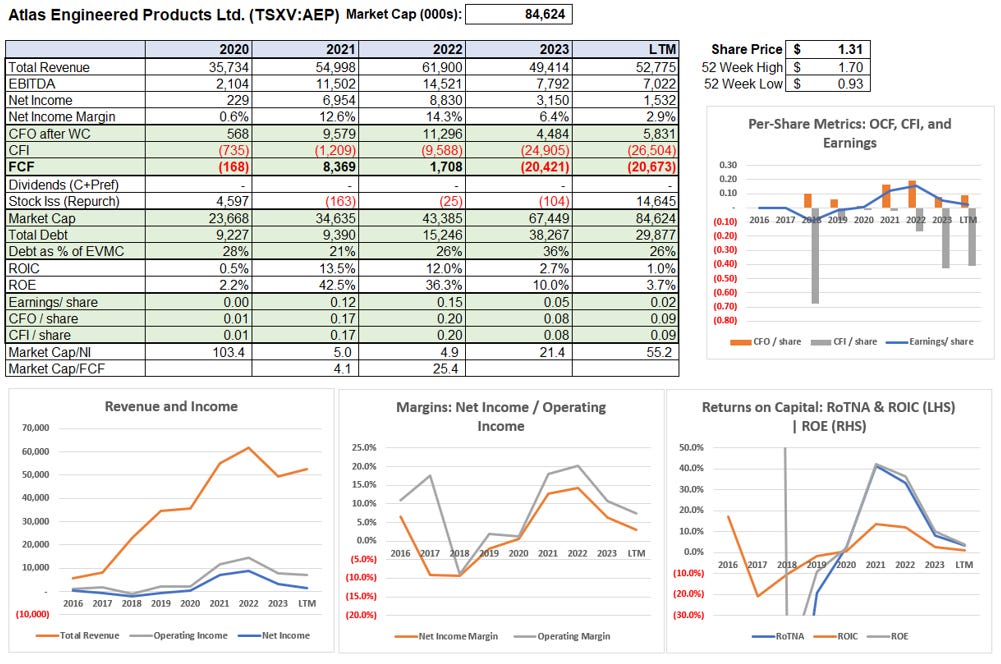

Atlas Engineered Products TSXV:AEP – Leaving a dedicated founder to do his thing

Disclosure: No position at time of posting.

Atlas Engineered Products is doing a roll up of truss/wall panel/engineered product companies in Canada and is run by CEO / Founder Hadi Abassi. He lives and breathes the business, and he has been busy with 8 acquisitions since going public in 2017. Their approach is to centralize sales while operations/plants are done by province and given autonomy to perform.

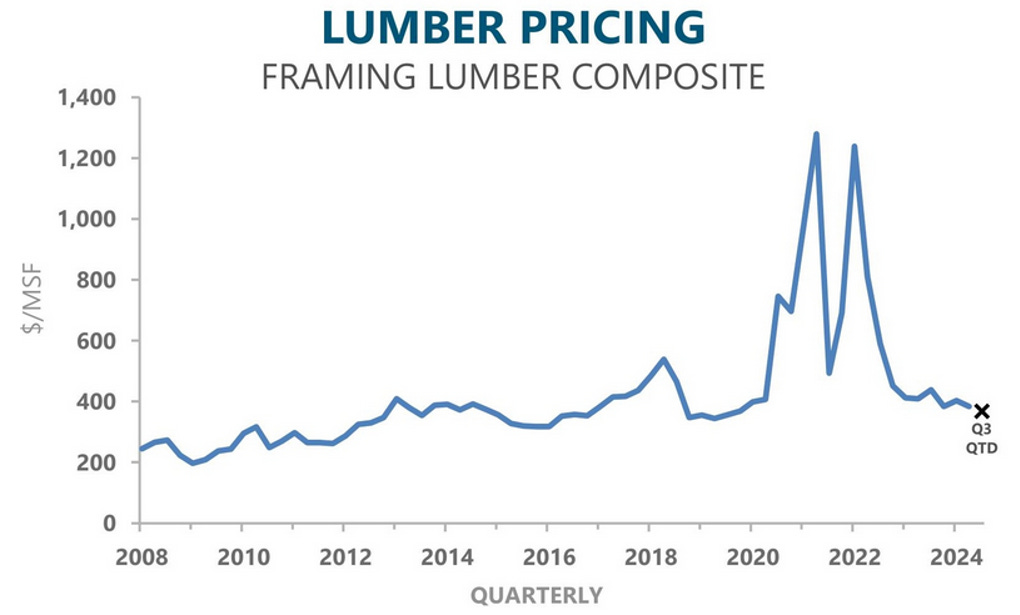

We find it interesting as they have operated through the wild COVID-lumber market (see chart from Weyerhaeuser below). The volatility provided, in general, higher margins temporarily throughout the industry. This subsequently has made making acquisitions difficult as sellers want multiples based on peak-COVID earnings and buyers like Hadi understandably do not want to take that approach. Acquisitions have been at reasonable multiples and we will be watching where Hadi takes shareholders.

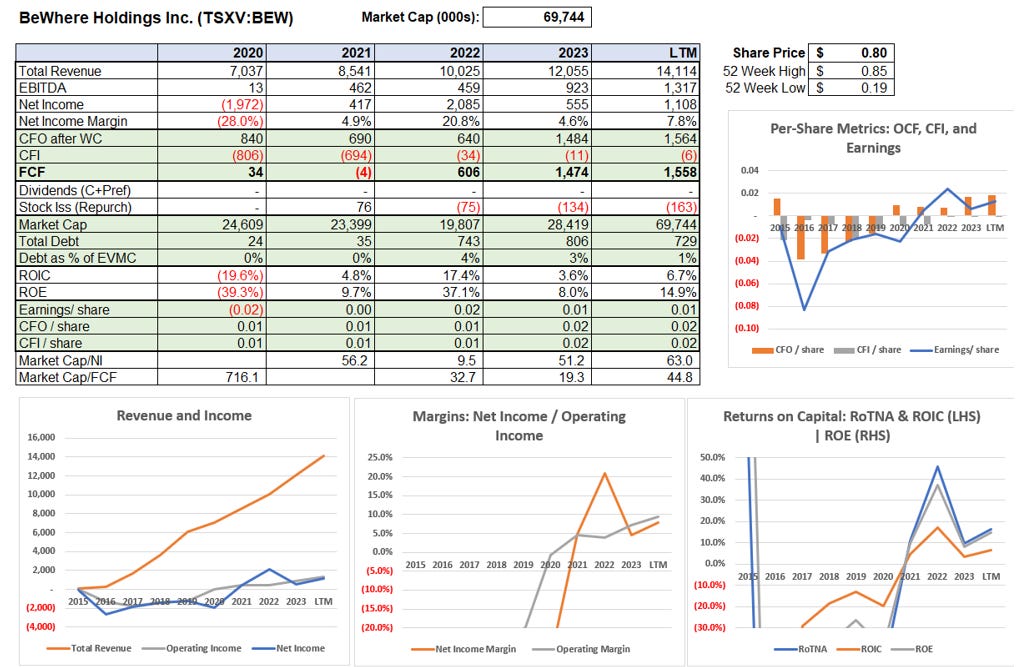

BeWhere Holdings Inc. CVE:BEW – Fixing big problems with little boxes

Disclosure: We do not own this at time of posting.

The growth here is pretty remarkable, and we think a case study or two will explain.

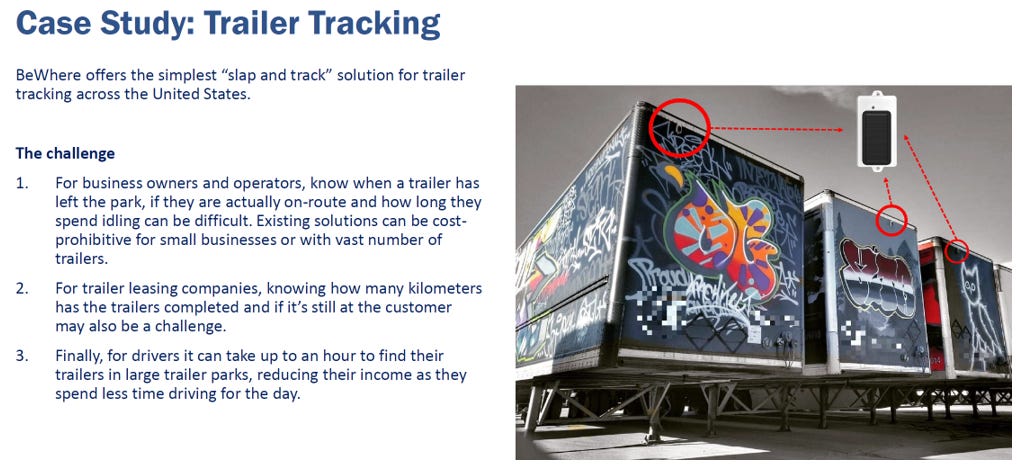

They provide GPS tracking for trailers, bikes, and anything else you would want to track. They are solar/battery powered typically, though can draw power from the equipment if powered. A typical tractor trailer device is ~$80 + ~$3-4/month subscription, with a typical strategy of low gross margin on hardware, higher on the subscription. Their trailer tracker is design to last the life of the trailer, ~10-15 years. They also have a shipping container version.

Bikes is another market, and they are likely the supplier for the rentable bikes/scooters in your city. The sensor is in head of bike.

The run up in the price of the stock can be explained by the potential size of the market. Their pilot with a major grocer is a good case study. They started with trailers at a facility helping drivers find trailers in huge lots. Previously it could take a driver up to two hours to find the trailer they needed to pick up and now can do it in 5 minutes using temporary magnet trackers on each trailer while it’s in the facility. The pilot is ~7,000 devices at 2 distribution centers. They also have another deal covering rented trailers (10,000+) of a very large parcel company. The customer wanted to see if they were using them efficiently and realized, after using the sensors, they were renting 15% too many. Time and capital savings can easily cover the cost of the devices.

For context, here is a link to one of Costco’s distribution centers. https://maps.app.goo.gl/x6bzoNiisRDvCkPW6

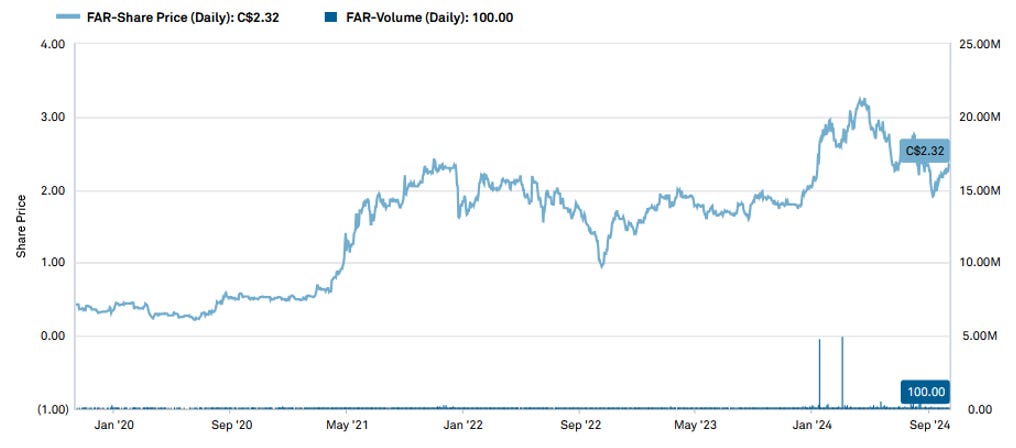

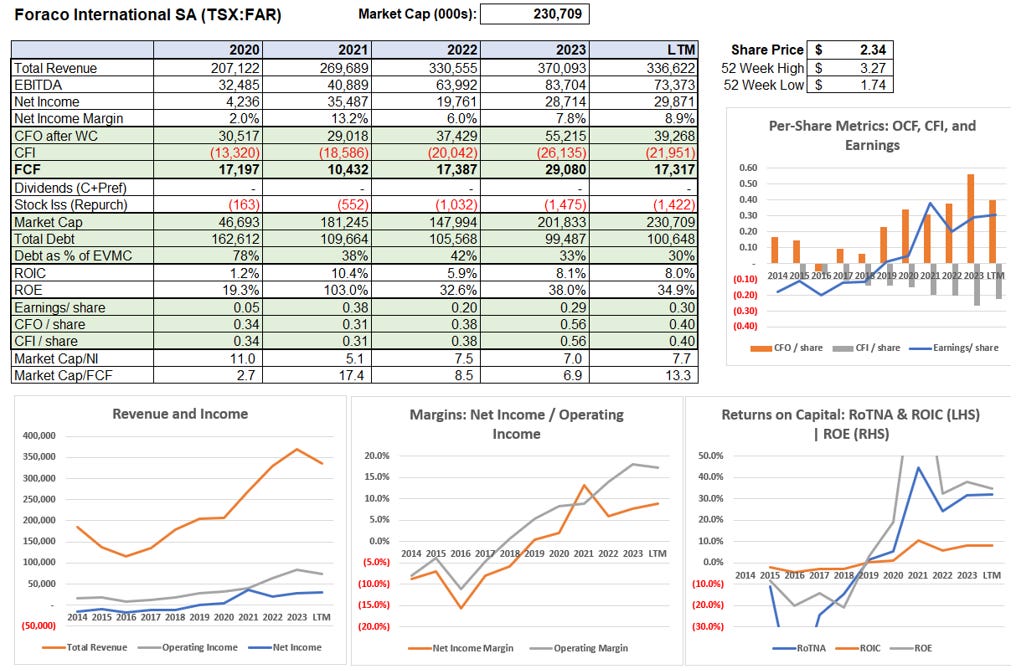

Foraco International SA – TSX:FAR – Digging for gold

Disclosure: We do not own this at time of posting.

https://www.webcaster4.com/Webcast/Page/3056/51148

Foraco is a global drilling services contractor that operates across several major mining regions. We find this interesting as the bull case thesis seems to be similar to our thoughts on certain oil and gas service companies (Ensign and Calfrac); it was over-levered but greatly improved today, still undervalued/followed, peers are likely more capital disciplined than before leading to potentially higher structural margins, and management has learned a lot.

A great write up on the company was done by Forterra here - https://www.forterrainvest.com/insights/blog-post-title-one-4c433

We continue to dig into it.

Our post on Ensign/Calfrac is here - https://www.canadianvalueinvestors.com/p/ensign-esi-calfrac-cfw-20240827

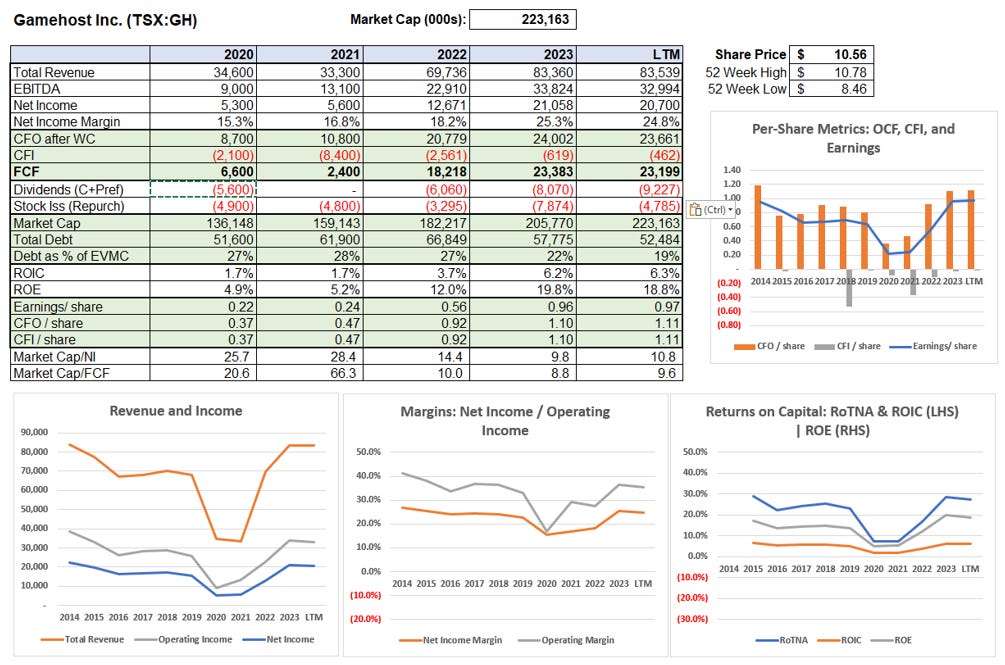

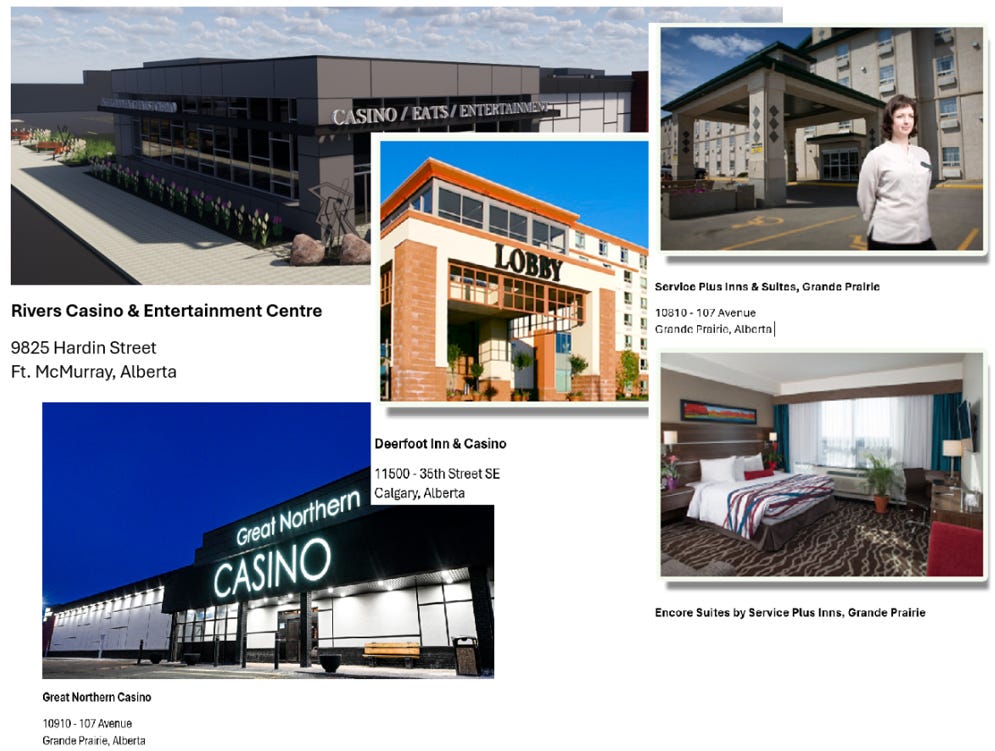

Gamehost Inc. TSX:GH – How are casinos in Alberta doing anyway

Disclosure: We do not own this at time of posting.

This is a fun Alberta story. Two key partners put together their hotels and gaming licenses to build a few key properties. And then the government of Alberta legalized slot machines in 1991. This followed the establishment of the Alberta Gaming Commission in 1987, which oversaw the regulation and expansion of gaming activities in the province.

How slot machines work in Alberta – The government owns the actual slot machines and receives 70% interest. They do not want to saturate the market and have an incentive to limit gaming licenses geographically. Based on Alberta’s growth there is potential for new licenses/new locations.

COVID was very challenging as you would expect, but they used it as an opportunity to complete some renovations. Hotels in Alberta are still not back to where they were (and we think are suffering from overbuilding), but gaming is and their hotels are driven by gaming. Now they are repurchasing shares, paying a dividend (~5% yield), and paying down debt while building dry powder for an acquisition.

KITS Eyecare Ltd. TSX:KITS – I see the light, and it only cost me $28

Disclosure: We are long at time of posting.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.