Post-COVID's Booms and Busts – Some COVID case studies and how it is still providing investment opportunities

SITC, Paypal, TBL, and more

Here is the latest from Canadian Value Investors! Our theme today is long-COVID; how it impacted industries differently and is still providing investment opportunities.

Ideas from around the world

Wedgewood Holdings: Paypal Holdings – A COVID gem that has crashed hard, but maybe oversold?

Sweet Stocks: SITC – “the Ryanair of container shipping stocks” benefited from very high COVID shipping rates

Other COVID winners and losers – Lumber (West Fraser / Taiga Building Products) vs airplanes (Air Canada)

A reminder of what Berkshire did

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Paypal Holdings – Nasdaq:PYPL – Wedgewood Partners

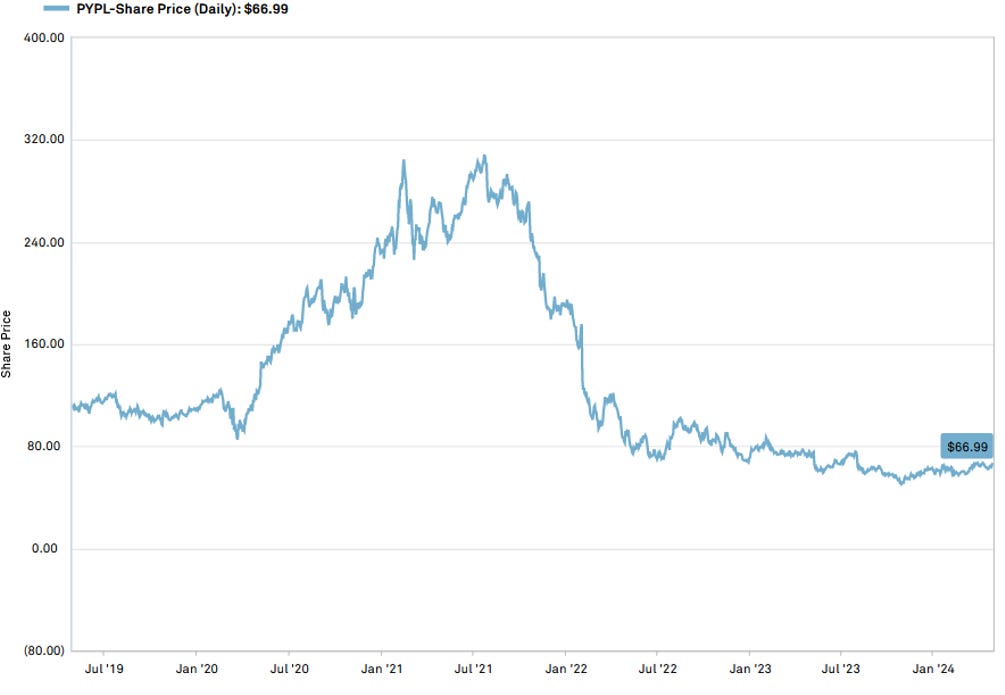

No position. Paypal is a potentially interesting opportunity given the extent of its crash since the COVID boom. The share price collapse is pretty remarkable, and the P/E multiple has declined from almost 80x to 10-15x (depending on your forecast). Wedgewood has an interesting overview in their Q1 2024 letter of the COVID boom when they sold out and why they are re-buying now. https://wedgewoodpartners.com/investor-resources/

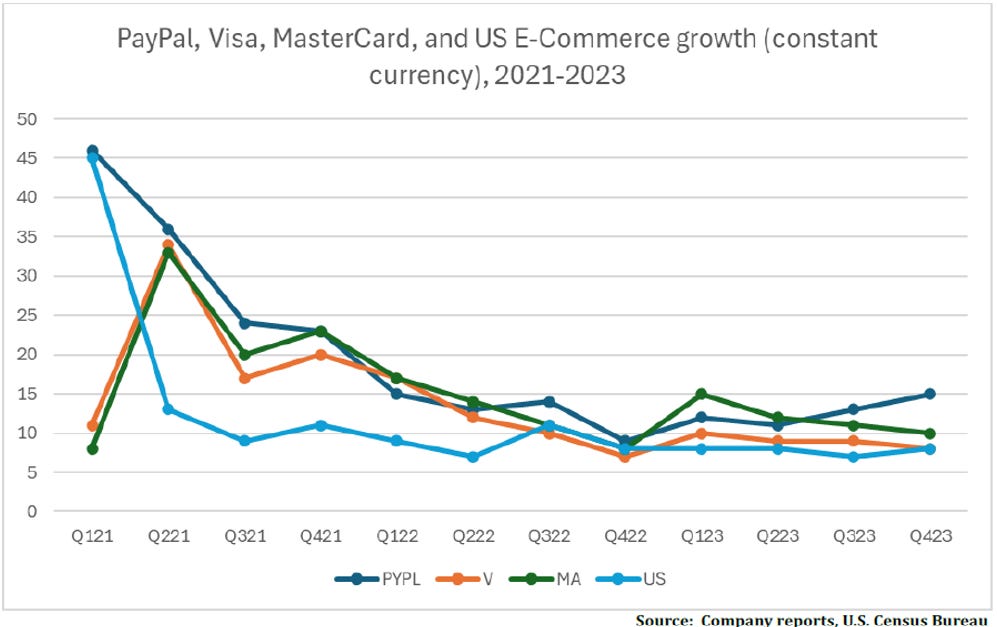

We continue looking at the fundamentals: for example, the company reported +23% earnings per share growth and +13% TPV growth for 2023, growing at or near the top end of the digital payments market...In the couple of months since the Company provided [2024] initial guidance, the management team has been presenting at investor conferences, acknowledging their conservativism. Trends within the business have remained steady in relation to the healthy 2023 trends…The Company is also cutting headcount by +9%, and management will buy back at least as much stock as it did last year, representing another -8% reduction in share count. All of which we expect to be supportive of notably better results than management's initial 2024 guidance.

It is our experience these "wandering bear thesis" stories tend to come to an end at a point that is often difficult to predict…We would highlight similar enough dynamics that played out at Meta Platforms, which has been one of our largest holdings for some time.

SITC – The Ryanair of container shipping stocks

No position but this piqued our interest. We used to be in shipping containers – Atlas Corp. – until Fairfax Financial and friends bought us out in what is likely turning out to be a great deal for them. (Boooo Fairfax). SITC is also a great case study of the impact COVID had.

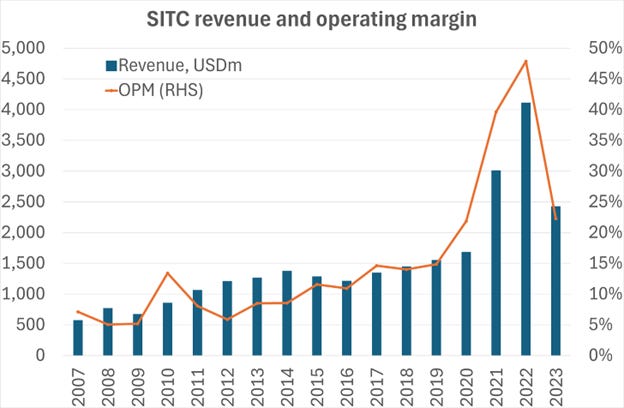

SITC is a quality growth shipping company, specialised in the intra-Asia trade. Like the famous Irish low-cost airline, its niche positioning generates defendable competitive advantages that enable it to sustain profitable growth over the long term in an otherwise unattractive and cyclical industry.

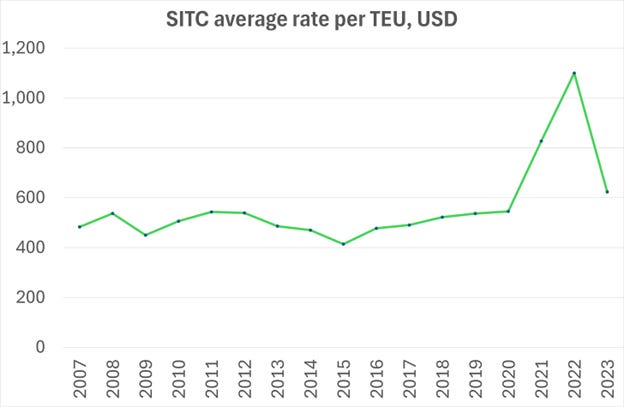

SITC was nicely profitable every year during the tough 2010s, when overcapacity dogged the industry and forced peers into losses. Then when freight rates spiked due to COVID, the boom generated multi-billion dollar windfall profits and dividends, and also whipsawed the stock.

That cycle has now played out, and from here the strong fundamentals can return to the fore. At 10x current P/E on fairly sensible estimates…

Other COVID winners and losers – Lumber (West Fraser / Taiga Building Products) vs airplanes (Air Canada)

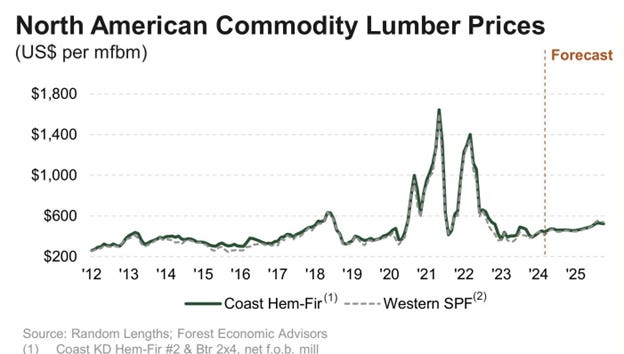

Lumber during COVID was similar as anyone who was doing a renovation will painfully remember. As we have written about previously, Taiga Building Products was a big beneficiary of the surge in lumber prices and used it to completely de-lever their balance sheet (and we think the market is still mispricing; we are still long). https://canadianvalueinvestors.substack.com/p/taiga-building-products-tsxtbl-single

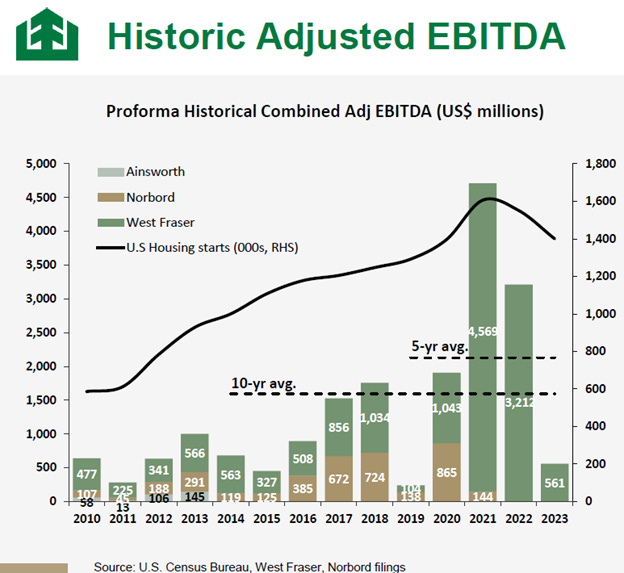

West Fraser is another great case study (no position). COVID cash flows dwarf the previous decade.

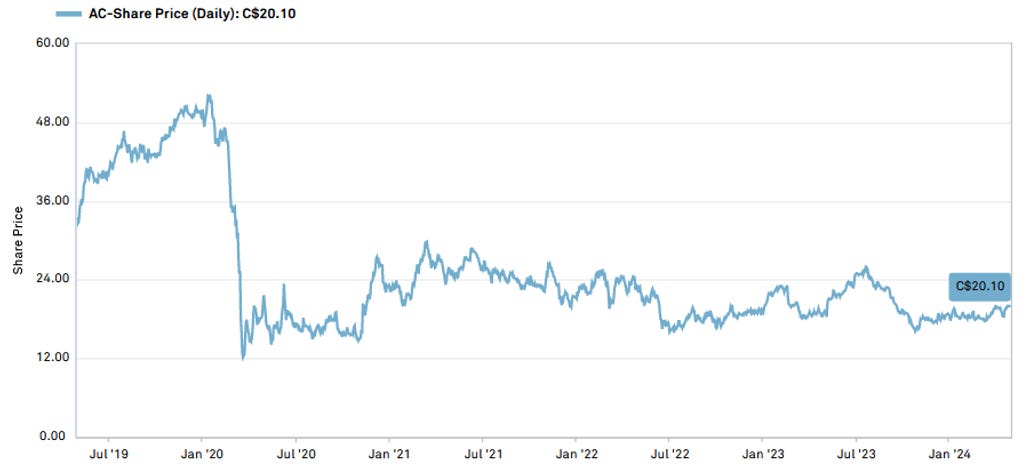

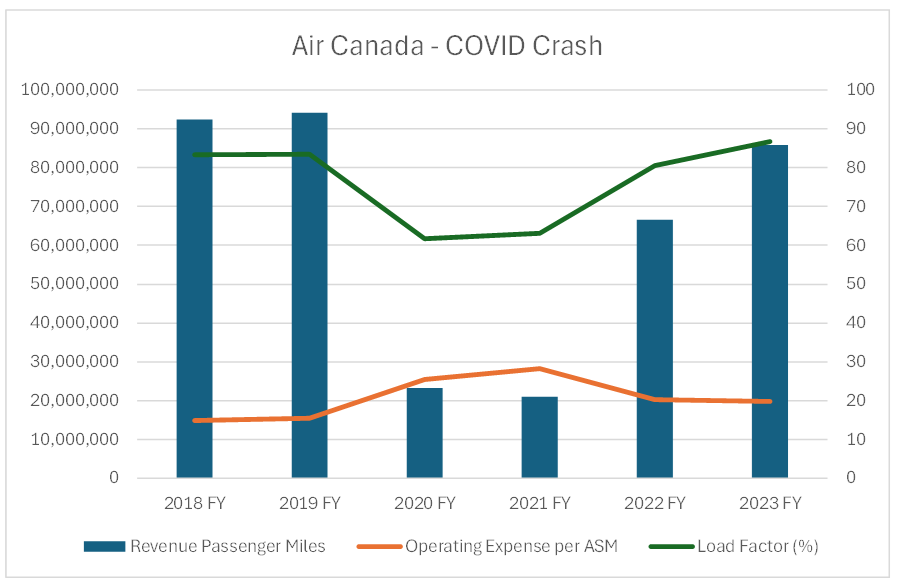

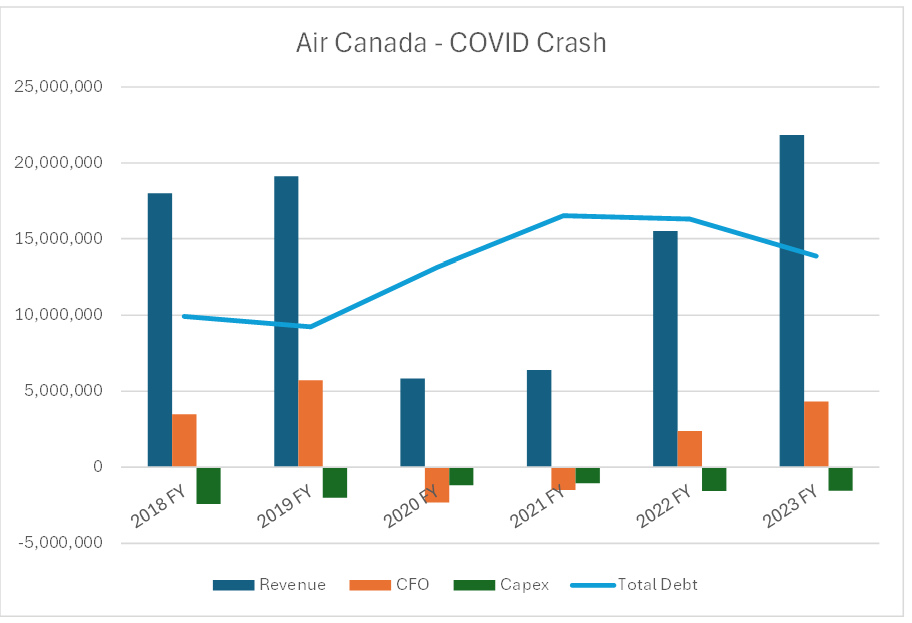

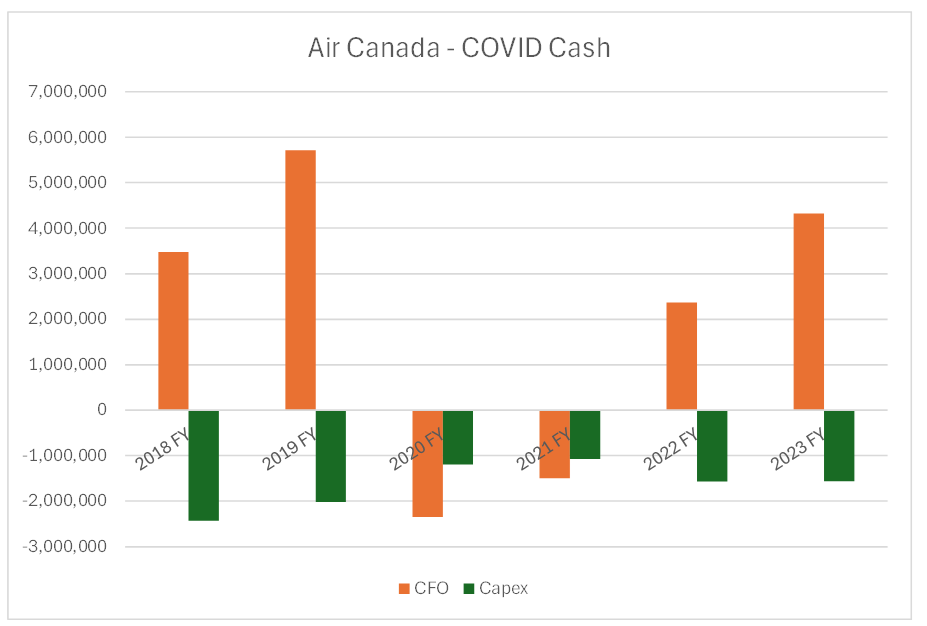

Air Canada had the opposite experience

No position. Less flights and still lots of empty seats led to a 50%+ increase in debt (despite government support) and still have not fully recovered.

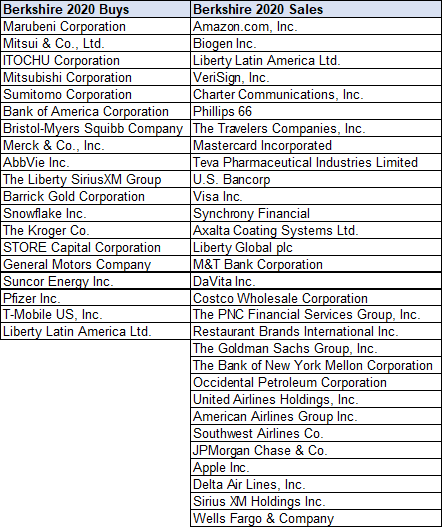

A reminder of what Berkshire did

We always track BRK’s trades in their $250+ billion portfolio as we recently covered in our note on Sirius XM (we are long). As a reminder: 1) Berkshire Hathaway is required to disclose their trades in publicly listed stocks and 2) Trades consist of Warren Buffet, but also Ted Weschler and Todd Combs, who each run separate standalone portfolios.

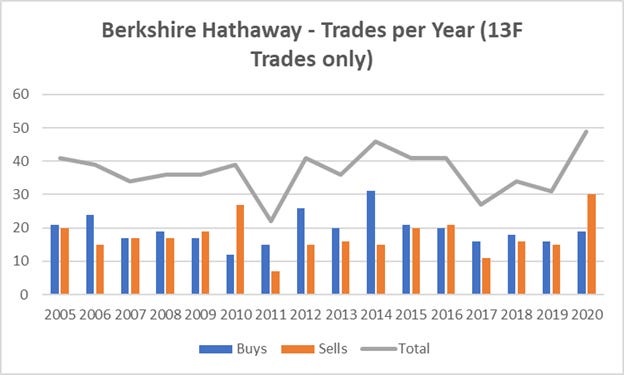

Here’s the raw data from 2020 through Q3 reflecting the full initial panic-period of COVID-19):

How did this compare to historical activity? Well, they’re active, but it really isn’t significantly different than previous years. Compare this to a lot of other active investors reacting to COVID-19 and it looks downright boring. Years later, their pre-COVID top holds they are still holding have done just fine. Their screening process likely did not directly think of pandemics, but it turns out a benefit of strong businesses with big moats is that they are resilient in general to all sorts of headwinds. Food for thought.

Thank you for subscribing!