Disclosure: We are long RPR.UN and convertibles. Position size: Small. Conviction: Low. But, is the story interesting? Yes. Very.

We have been following the ongoing restructuring of Ravelin REIT (formerly Slate Office REIT) and it is turning out to be one of the most interesting stories we have ever followed. Our interest and investment began when their convertibles were trading at 10-20 cents on the dollar. We largely exited with their partial recovery when they hit the 50s, but continue to follow closely.

It is a multi-year board battle over the management of a pool of class B office buildings with a billion dollars of debt in default. Continuing from our last article, at the end of last year they announced a Christmas gift to shareholders, on Christmas Eve. The new Board, led by George Armoyan / G2S2 Capital Inc., managed to negotiate an early termination of the former very expensive management team (already kicked off the Board), put in a new CEO, and announced a rebranding. They now have a full team in place.

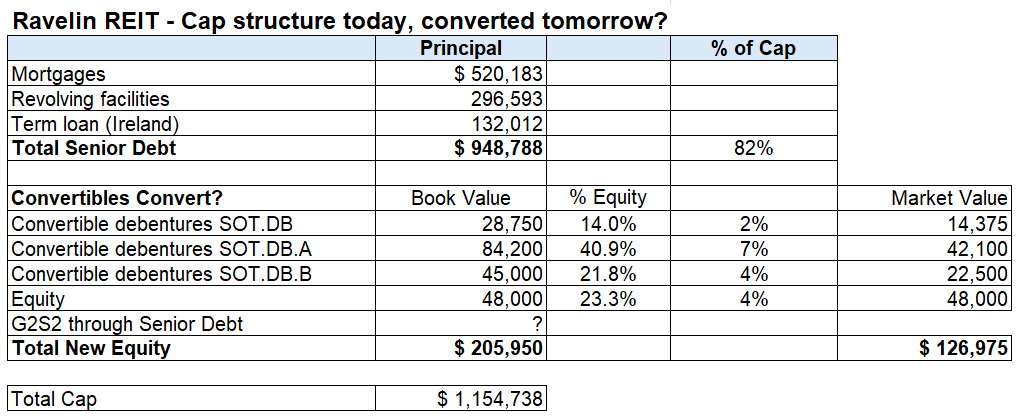

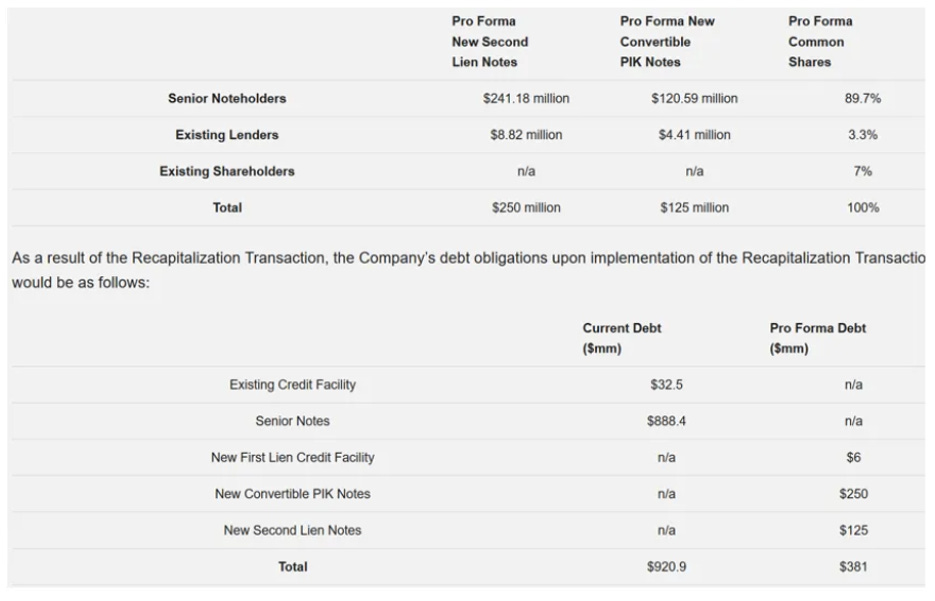

But they still had a major problem with their debt, about $1.1 billion of complex financings (including publicly traded subordinated debentures we own), effectively in default. We have been scratching our heads wondering how G2S2 was going to address this. Last Friday they announced how. This is a G2S2 party, and for investors it might not be as fun as an S Club Party (see appendix).

Our original article is here and all articles here - https://www.canadianvalueinvestors.com/t/sotun

Slate Office REIT (TSX:SOT) Convertible Debentures: Will a key shareholder make these a bargain or a loss making boondoggle?

Disclosure: We own Slate Office REIT Debentures, but not the stock.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Don’t like your bank covenants? Just finance it yourself!

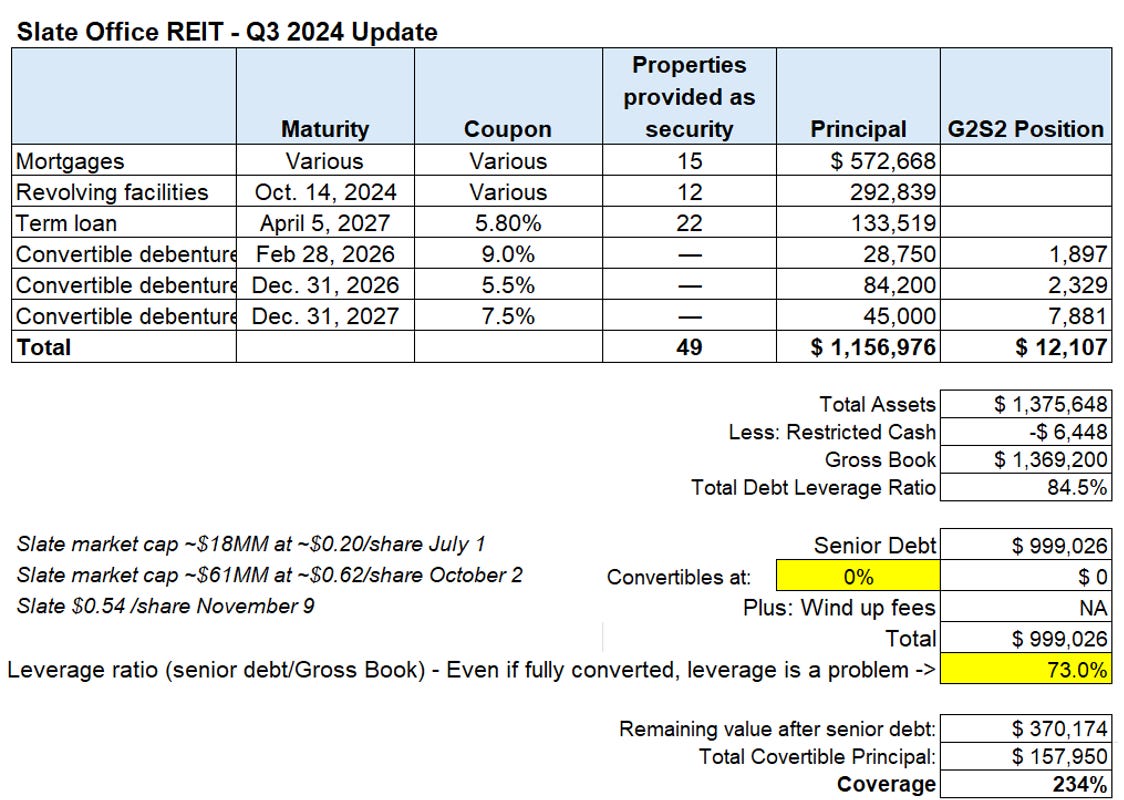

As we noted before, the revolving facility covenants (more restrictive than a typical single property mortgage) could not be met even if you fully converted the convertible debentures and we seriously doubted senior lenders would permanently loosen these.

Last Friday they announced the following. We note that it is not clear what separate financing G2S2 has in the background to support these transactions.

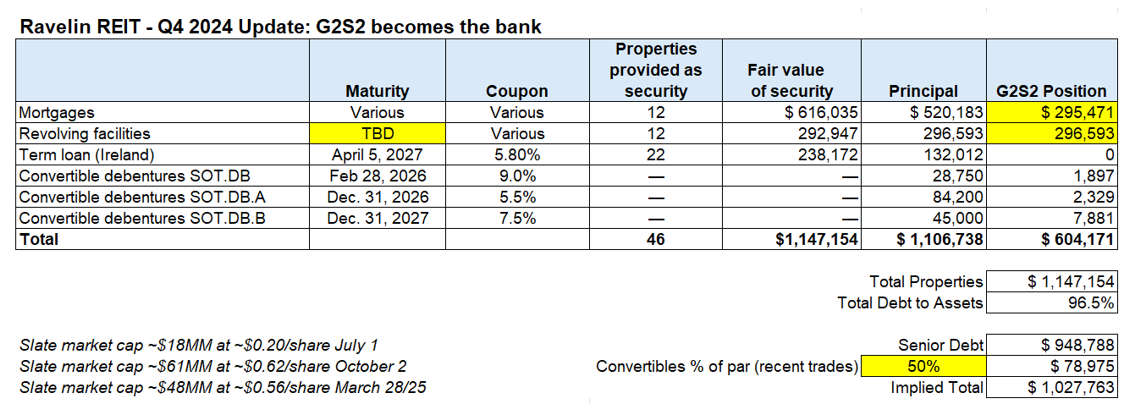

Ravelin Properties REIT's Syndicate of Secured Lenders Assigns Credit Agreement to G2S2 Capital

TORONTO, March 28, 2025 /CNW/ - Ravelin Properties REIT (TSX: RPR.UN) ("Ravelin" or the "REIT"), an internally managed global owner and operator of well-located commercial real estate, announced today that the secured lenders party to its Second Amended and Restated Credit Agreement dated November 14, 2023 as amended (the "Syndicated Credit Agreement") have completed a sale and assignment of all the indebtedness and obligations under the Syndicated Credit Agreement to G2S2 Capital Inc. ("G2S2"), a major unitholder of the REIT, in the aggregate principal amount of CAD$233,047,602.23 and USD$43,700,000.00.

Additionally, Royal Bank of Canada, a senior secured lender of the REIT, is expected to complete a sale of all the indebtedness and obligations under certain bilateral loan agreements (the "Bilateral Loans") to G2S2 on March 31, 2025, in the aggregate principal amount of CAD$295,471,630.31.

The completion of the sale and assignment of the Syndicated Credit Agreement and the Bilateral Loans required the consent of the REIT under the agreements governing the loans. In connection with providing consent to the sale and assignment, an independent committee of trustees of the REIT sought and obtained a six-month forbearance from G2S2 to allow the REIT additional time to negotiate the terms of a recapitalization plan.

"This is a significant step in progressing the REIT's recapitalization plan," said Shant Poladian, Chief Executive Officer of the REIT. "We welcome the support of G2S2, which is also a significant unitholder of the REIT, and look forward to working together on managing the REIT's debt as we move forward with our strategic direction."

The key point is G2S2 has negotiated a six month window with Ravelin for the restructuring.

A reminder of G2S2 ownership:

(a) 15,110,200 Units, representing approximately 17.61% of the outstanding Units on a non-diluted basis but including the outstanding Class B LP Units;

(b) $1,897,000 aggregate principal amount of 2018 Debentures. Assuming conversion of such 2018 Debentures as of the date of this Annual Information Form, G2S2 would indirectly own 344,909 Units, representing approximately 0.40% of the total issued and outstanding Units (assuming no changes to the number of issued and outstanding Units from the date of this Annual Information Form);

(c) $2,329,000 aggregate principal amount of 2021 Debentures. Assuming conversion of such 2021 Debentures as at the date of this Annual Information Form, G2S2 would indirectly own 358,308 Units, representing approximately 0.41% of the total issued and outstanding Units; and

(d) $7,881,000 aggregate principal amount of 2022 Debentures. Assuming conversion of such 2022 Debentures as at the date of this Annual Information Form, G2S2 would indirectly own 1,432,909 Units, representing approximately 1.64% of the total issued and outstanding Units.

…

If G2S2 was the sole convertible debenture holder to convert convertible debentures to trust units, it would indirectly own a total of 17,407,192 trust units (December 31, 2023: 17,282,165), representing an economic interest of approximately 19.7%

Just under 20%. A fun part of the story ties back to the 2023 settlement agreement where G2S2 agreed not to (without the prior written consent of the REIT acting through the Board):

(a) acquire, or seek to acquire (i) beneficial ownership of any outstanding units of the REIT which, together with other outstanding units beneficially owned by G2S2 and any joint actors, would constitute more than 20% of outstanding voting units of the REIT, or (ii) beneficial ownership of any securities of the REIT, which together with other units of the REIT or securities that are convertible into units of the REIT beneficially owned by G2S2 or any joint actors, would constitute more than 25%of outstanding units of the REIT (on a fully-diluted basis assuming the conversion of all outstanding convertible securities of the REIT);

… Except as otherwise provided in the Settlement Agreement, the Settlement Agreement will terminate on the close of business day on the earlier of (i) the day following the 2024 Meeting, and (ii) June 30, 2024.

Though as we noted previously, it was subsequently amended last January 2024 leading ultimately to G2S2 to take over the Board and then fire Slate’s related management.

The original covenant breaches tied to the revolving credit facility:

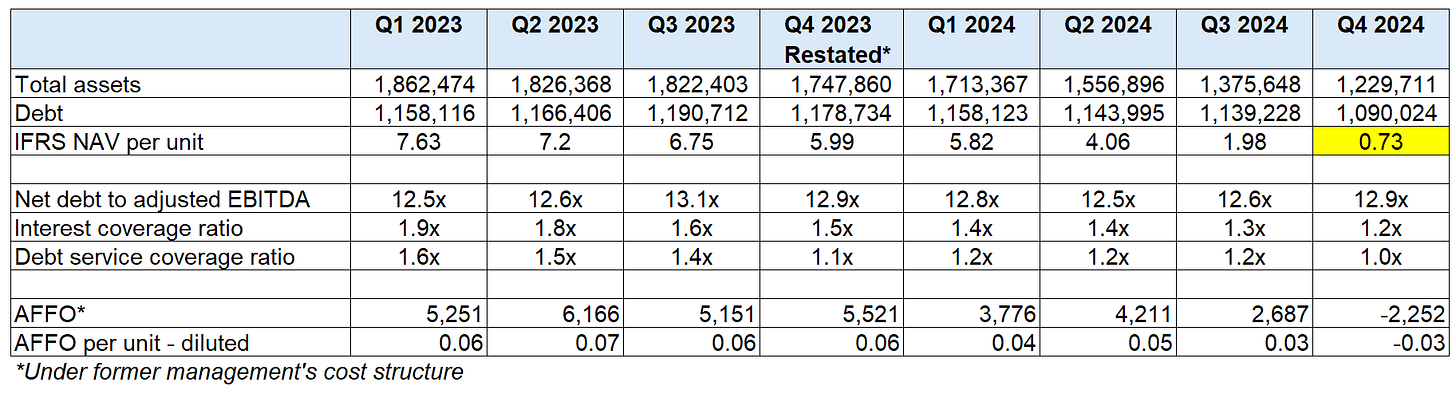

As at December 31, 2024, the REIT breached financial leverage, debt service coverage and minimum unitholders' equity covenants pertaining to the Revolving Credit Facility and certain mortgage agreements, and failed to repay principal due on maturity, totaling $889.7 million of breached debt.

Other debt cross-defaulted, and it also stopped the payments on the convertibles as we noted previously – “In addition, pursuant to the trust indentures governing the REIT's convertible debentures, due to default letters provided by senior lenders, the REIT is currently restricted from making payments of accrued interest in respect of its convertible debentures so long as such defaults have not been cured or waived.”

G2S2’s separate support provided last summer is also in default –“On August 28, 2024, G2S2 Capital Inc. provided the REIT with credit support in the aggregate of up to $13.4 million and a letter of credit in favour of a tenant of the property for certain obligations that the REIT has undertaken in connection with its pursuit of leasing opportunities, such as leasing costs and tenant inducements. As at December 31, 2024, $3.2 million has been advanced to the REIT”.

Assets

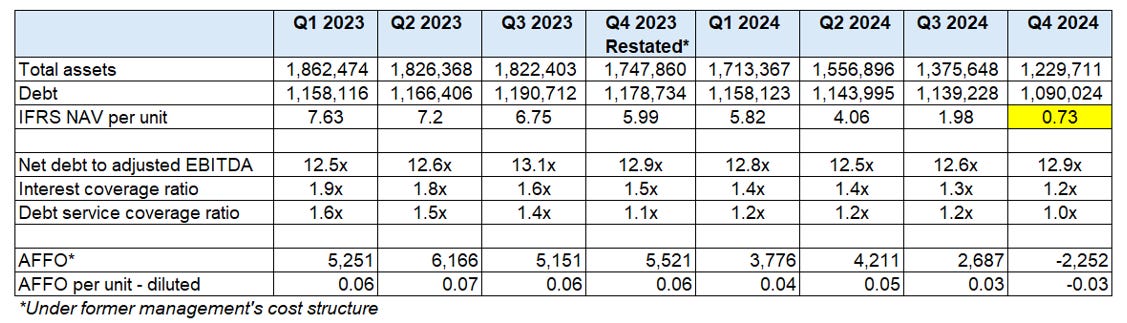

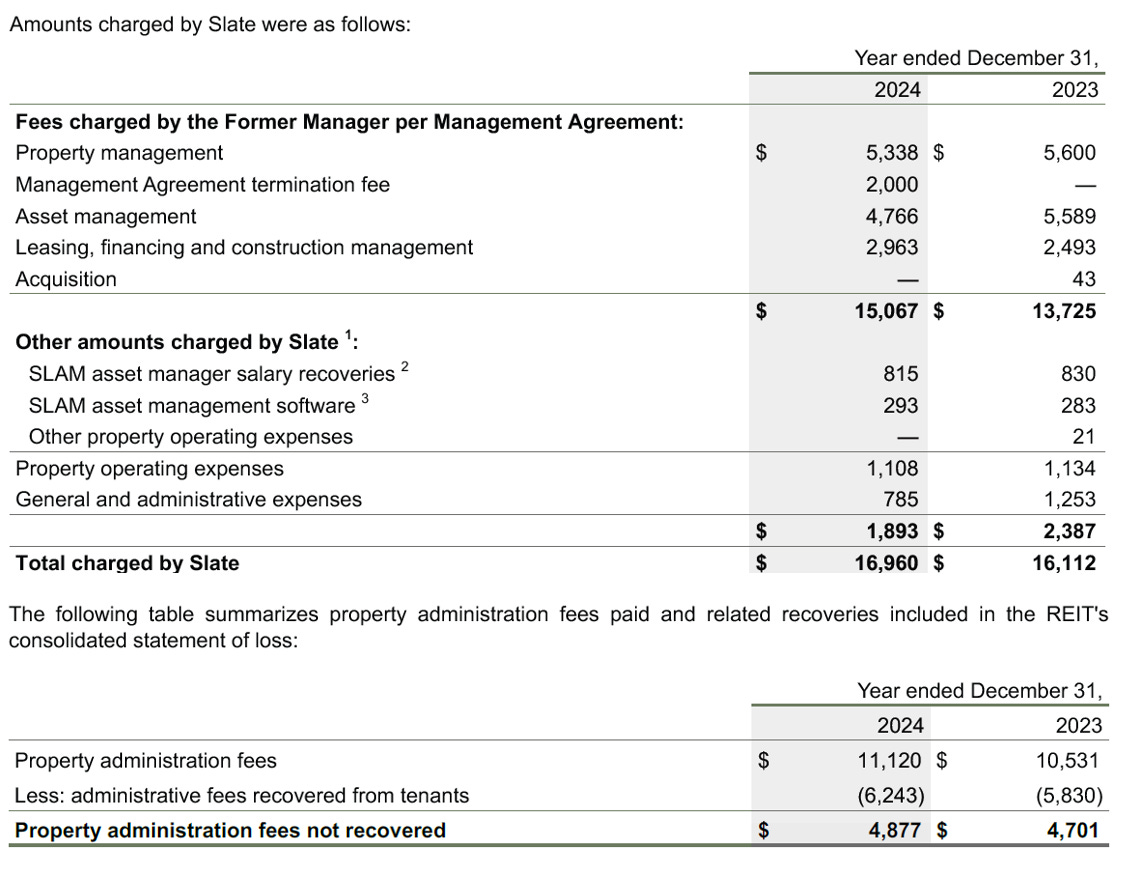

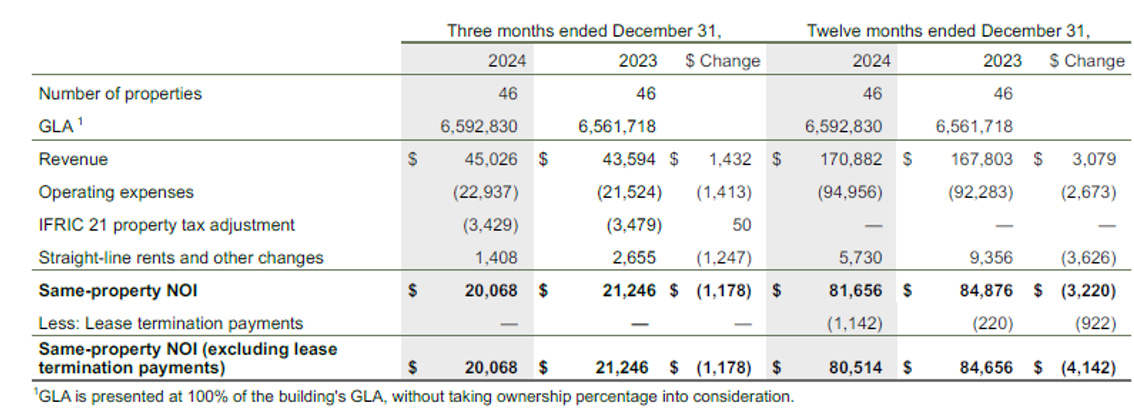

Asset performance remains challenged with some underlying assets showing improvement. There is also a 2023 restatement that we are not going to get into. The issue is the write-downs (see next). Thankfully, Slate’s management fees have stopped (see below)

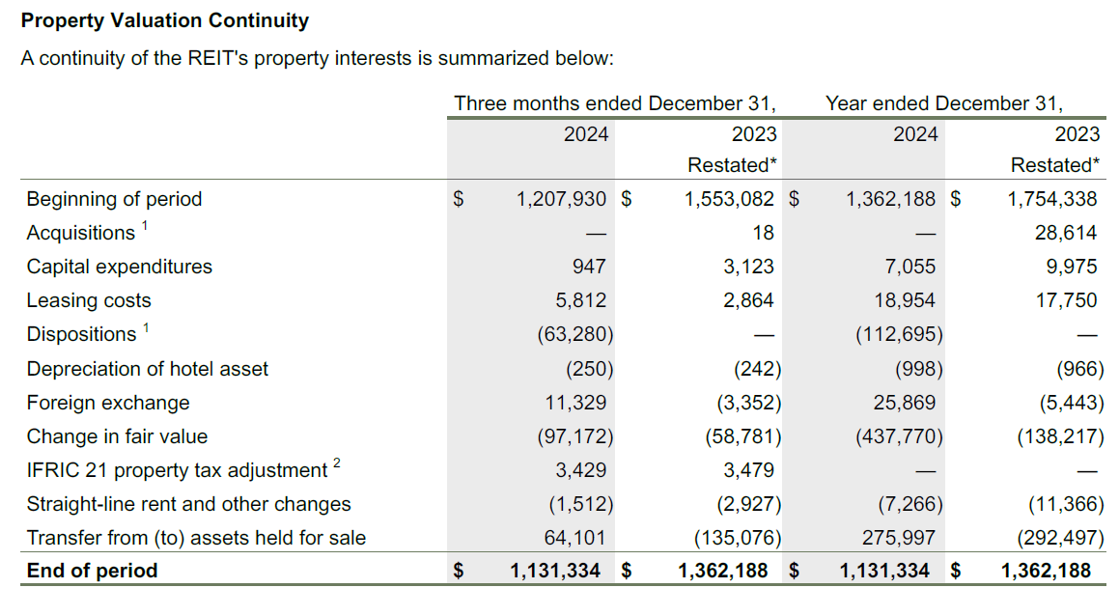

Another Write Down

What’s another $97 million between friends? Write downs from 2022 to today are now ~$660 million. We note that properties are largely considered by us to be at a trough, write-downs are being driven by higher discount rates, and the overall equity NAV value is very sensitive to it.

The weighted average discount rate and terminal capitalization rate used to determine the estimate of the fair value of the REIT's property as at December 31, 2024 was 8.78% and 7.93%, respectively. These rates represent an increase of 0.79% and 0.50% compared to December 31, 2023.

Of the fair value change for the year ended December 31, 2024, 17.5% of the change in fair value was attributable to five independently appraised properties with the balance of the change attributable to management's estimate of fair value. Of the fair value change for the year ended December 31, 2023, 35.4% of the change in fair value was attributable to 15 independently appraised properties with the balance of the change attributable to management's estimate of fair value.

G2S2 holds the wheel

Of course, common equity would be diluted down on conversion.

The key risk here is convertible and common shareholders interests do not fully align with G2S2 now given their senior exposure, which greatly exceeds the value of the other investments they have made in Ravelin. It is also unclear if G2S2 is assuming the revolver and other debt at par or if the banks are taking a discount.

We have to admit we are a bit perplexed by this whole situation. G2S2 did not come in at the 11th hour. This has been a mult-year battle with Slate’s management. If G2S2 wanted to just rip out the real estate leaving everyone else behind, why go through the trouble building a robust board (two new board members just added, see appendix), a big team, and put so much effort into a rebrand (or at least before restructuring is done)? It would be better to just rip out the properties you want and push off the rest. Slate/Ravelin did not have alternatives.

The financing G2S2 is providing is a bridge loan for sure. As they restructure, they can get higher advance rates and less restrictions by replacing the line with individual mortgages on properties while selectively selling some. Will they sell off Ireland (turning around nicely it seems) or maybe the U.S.? Ravelin can survive, it is just that G2S2 can engineer a major or complete wipeout of convertibles and common along the way.

Will this go worse than for Bonavista Energy investors?

G2S2 largely drove the restructuring of Bonvavista Energy as we have outlined before. They first became a material holder in August of 2019 when the company was already in trouble (see background here - https://www.canadianvalueinvestors.com/i/146174504/bonavista-energy-and-gs )

One thing we know for sure is that this is a G2S2 party and we are all invited, for now.

Appendix: New Board Members

Just before the announcement, they announced two new board members with good relevant experience.

Calvin Younger

Mr. Younger retired from his role as Vice Chair, Real Estate Finance – Canada with CIBC effective March 1, 2025. While with CIBC, he had previously served as Senior Vice President, Real Estate Finance – Canada and Senior Vice President, National Businesses. Prior to joining CIBC in 2001, he was a partner with Ernst & Young LLP and Managing Partner, Ernst & Young Kenneth Leventhal – Canada, the firm’s real estate advisory subsidiary. Prior to that, Mr. Younger held a variety of executive positions with Deutsche Bank Canada. He is also an Executive-in-Residence and Adjunct Professor at Rotman School of Management, University of Toronto.

Mr. Younger holds a Bachelor of Commerce degree from Trinity College, University of Toronto and an MBA from Schulich School of Business, York University.

Jane Rafuse

Ms. Rafuse is the former Chief Financial Officer of Holloway Lodging Corporation (“Holloway”), which owns and operates hotels in Canada. Holloway was initially structured as a REIT, before converting to a corporation. Ms. Rafuse was a member of Holloway’s executive team from its inception and before its initial qualifying transaction in 2006 until 2020. As a former CFO of a public company, Ms. Rafuse has extensive experience in financial reporting and analysis, financing and refinancing of mortgages and other debt, purchase and sale transactions, real estate and investor relations.

Ms. Rafuse has a Bachelor of Business Administration degree from Acadia University and is a Chartered Professional Accountant and a Certified Management Consultant. She also serves on the Audit Committee and Board of Directors of Clarke Inc.

Note that Clarke Inc. is another G2S2 company.