Here is the latest from Canadian Value Investors! Today we have updates on Saker, our New York City helipad, and SiriusXM satellite radio, with Saker having the smallest market cap we own today (~$11MM) and Sirius one of the largest (~$8.7B).

Sirius XM – Transaction closes, Berkshire buys more

Saker Aviation Q3 Update – Another short-term contract extension, Empire dispute resolved

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

SiriusXM post-transaction check-in, Berkshire still buying

Disclosure: We still own this one.

We have written about SiriusXM a few times now, most recently here - Liberty Sirius SIRI / LSXMA / LSXMK: In Ted Weschler we trust, August update https://www.canadianvalueinvestors.com/p/liberty-sirius-siri-lsxma-lsxmk-in

The merger vote of Sirius SIRI / Liberty Sirius LSXM went through as expected, the transaction was completed on September 9th, and the merger arbitrage was a trap indeed. However, as we wrote in August, we were focused on the long-term of Sirius and LSXMA at a discount was just a cheaper way to get in.

ENGLEWOOD, Colo. & NEW YORK--(BUSINESS WIRE)-- Liberty Media Corporation (“Liberty Media”) (Nasdaq: FWONA, FWONK, LLYVA, LLYVK) and Sirius XM Holdings Inc. (Nasdaq: SIRI) announced that they completed the split-off (the “Split-Off”) of Liberty Sirius XM Holdings Inc. (“New Sirius”) today at 4:05 p.m., New York City time. Following the Split-Off, at 6:00 p.m., New York City time, a wholly owned subsidiary of New Sirius merged with and into Sirius XM Inc. (formerly known as Sirius XM Holdings Inc., “Old Sirius”), with Old Sirius surviving the merger as a wholly owned subsidiary of New Sirius (the “Merger”). As a result of these transactions, New Sirius is now an independent public company separate from Liberty Media, and has been renamed Sirius XM Holdings Inc. https://investor.siriusxm.com/news-events/press-releases/detail/2104/liberty-media-and-sirius-xm-announce-completion-of

…

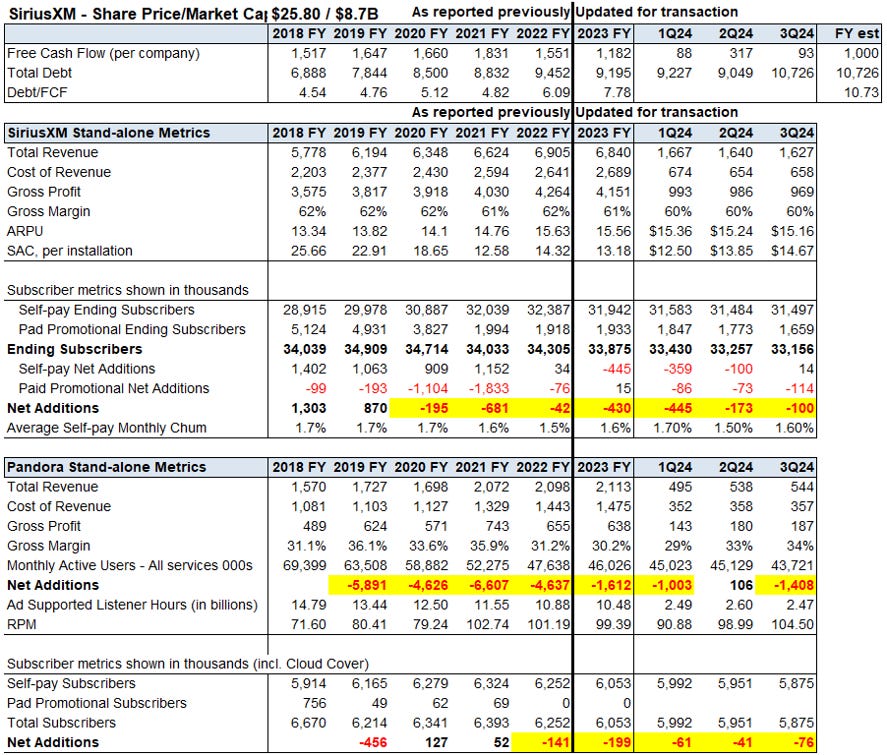

We are adjusting full-year revenue guidance to $8.675 billion due to softer second-half ad revenue but remain on track to generate approximately $2.7 billion in adjusted EBITDA and $1 billion in free cash flow in 2024.

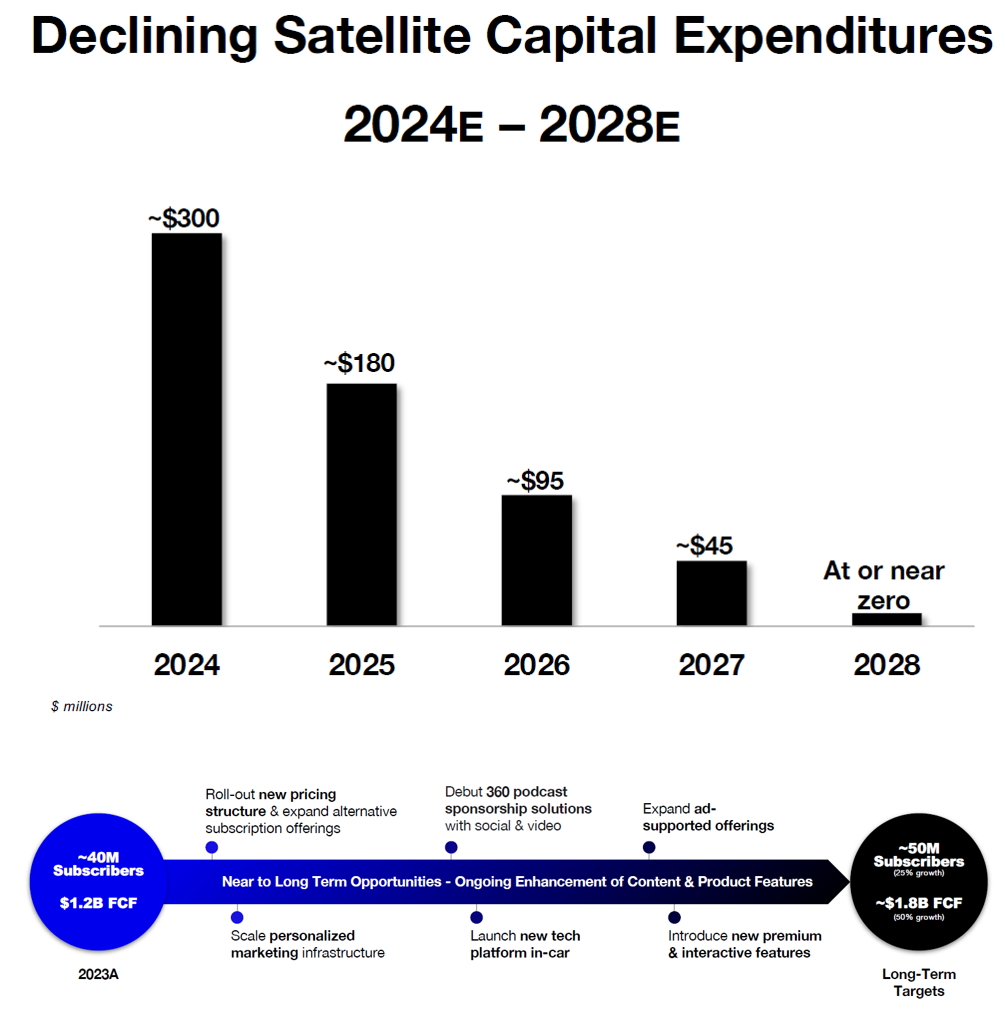

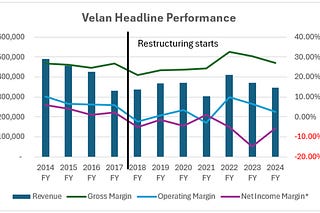

Two key issues are top of mind. 1) The churn rate for Sirius remains very low, but they just have not been able to grow their subscriber base. 2) They are now quite levered due to the transaction. However, capex going forward should decline (see satellite chart) and de-levering should progress now that the transaction is out of the way and Sirius finally has a normal simple capital structure.

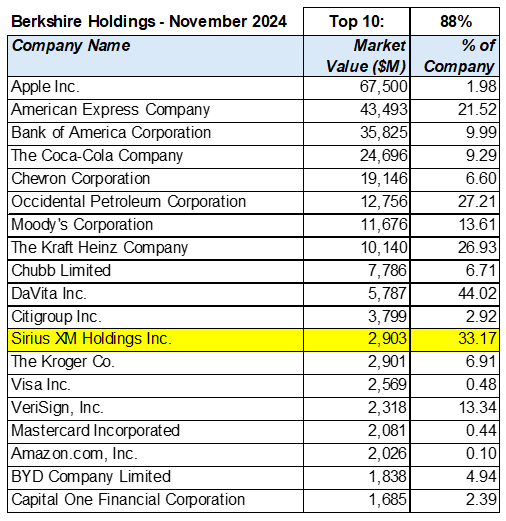

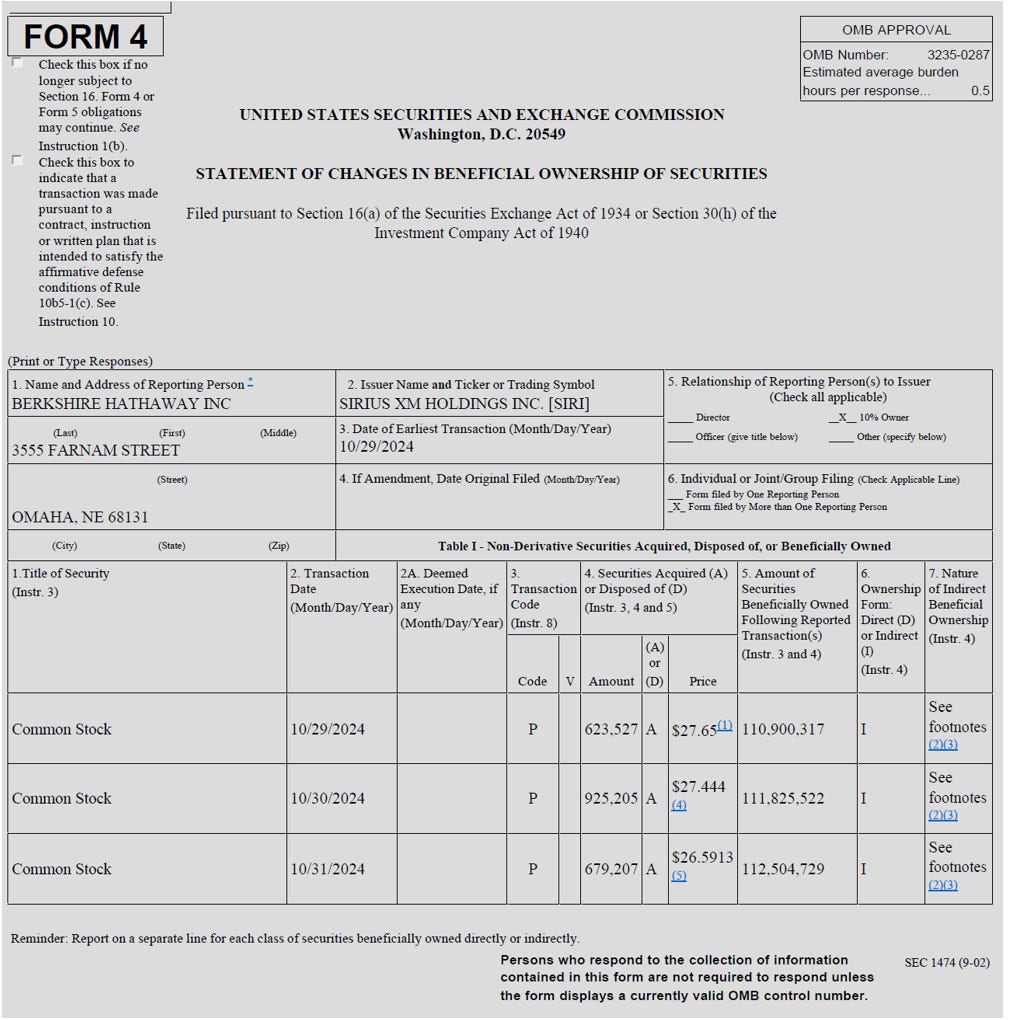

Although the stock has performed terribly, Berkshire has continued to buy through the end of October (see Form 4 below) and now owns about 33% of the company. The most recent buying was during the last week of October. It does not quite break the top ten holdings of Berkshire. However, at ~33%, it is the second largest percentage of ownership of a public company, just behind DaVita (see table below). Maybe we will see a Sirius booth at the Berkshire Hathaway AGM one day.

Saker Aviation Q3 Update – Another short-term contract extension, Empire dispute resolved

Disclosure: We still own this one.

Saker is one of our favourite holdings, partly because we get to say we are part owners of a (leased) heliport in New York City at cocktail parties. It also might work out well as an investment. We first wrote about them in May - https://www.canadianvalueinvestors.com/i/144567273/is-saker-aviation-skas-taking-off-or-grounded

To recap, the key issue is their key contract is expiring and the RFP for the next contract was caught up in New York politics.

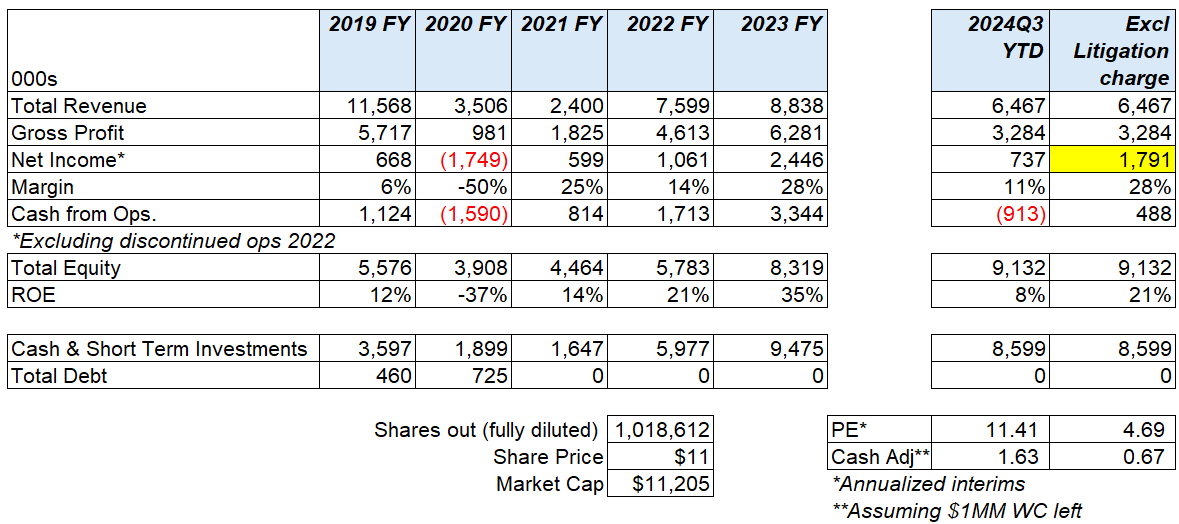

They released their Q3 results. The good news is they finally resolved their dispute with Empire, with Saker paying $1.4MM. The bad news is the new contract has not been awarded, but at least the interim agreement has been extended.

On April 30, 2024, the Company received notice from DSBS of its exercise of the first of the two six-month renewal options extending the term of the Interim Concession Agreement through December 12, 2024. On October 18, 2024, the Company received notice from DSBS of its exercise of the second of the two six-month renewal options extending the term of the Interim Concession Agreement through June 12, 2025. In addition to terminations for an event of default, the Interim Agreement can be terminated at any time by the Commissioner of the DSBS or suspended at any time by the NYCEDC. During the nine months ended September 30, 2024 and 2023, we incurred approximately $1,969,000 and $0 in fees under the Interim Agreement, respectively, and $0 and$532,000 in fees under the Concession Agreement, respectively, which are recorded in the cost of revenue.

On November 13, 2023, the DBS and NYCEDC released the new Request for Proposals (“RFP”). The initial due date for submissions was January 12, 2024, with the due date being subsequently extended to February 12, 2024. The Company submitted a timely proposal in compliance with the terms of the RFP. The Interim Agreement will govern the Company’s operation of the Downtown Manhattan Heliport until the RFP process is concluded and an operator selected unless terminated earlier pursuant to its terms.

…

On July 8, 2024, the Company was notified of the arbitrator's decision. The arbitrator found in favor of Empire in the amount of $1.4 million (the “Judgement Amount”), such amount representing approximately $1,036,000 in unpaid Management Fees due under the Management Agreement plus accrued interest of approximately $363,000. The Judgement Amount was immediately payable and accrued per diem interest of $511.08 for each day until it was paid in full. On July 10, 2024, the Company paid Empire the Judgement Amount including per diem interest through the date of payment. The Company recorded Litigation Expense of $1,054,200 at June 30, 2024, representing the difference between the Judgement Amount and the expense accrued by the company in 2023. The Company does not plan to appeal the arbitrator’s decision.

For those not following the story, this heliport was flagged by Mayor Adams as a potential “first-of-its-kind hub for sustainable transportation” (being battery helicopters effectively). https://www.nyc.gov/office-of-the-mayor/news/861-23/mayor-adams-nycedc-move-transform-downtown-manhattan-heliport-first-of-its-kind-hub-for#/0 Subsequently, and unrelated to the heliport, he is now dealing with alleged bribery and campaign finance offences. Life in the big city! https://www.justice.gov/usao-sdny/pr/new-york-city-mayor-eric-adams-charged-bribery-and-campaign-finance-offenses

The contract RFP process itself has had its own issues (allegedly) - https://www.ebroadsheet.com/for-hover-money/

Saker’s franchise at the DMH was nearing its end in April, the bidding process for a new contract raised ethical concerns when it was revealed that Saker’s chairman is a law partner of an EDC board member. This prompted two rival bidders for the DMH contract, Thoroughbred Sea & Air and Helo Holdings, to file formal complaints. In the aftermath of these filings, a March hearing to determine the new operator (at which EDC was expected to recommend renewing Saker’s contract) was called off. Before that cancellation, according to documents reviewed by the Broadsheet, EDC expected to earn at least $25 million over the ten-year life of the new lease it had planned to give Saker.

It remains unclear to us what capex would be required to retrofit the facility to make it a “sustainable transportation hub” and how much this could cost the winner, but we expect if they do win some of the cash will be used. When thinking about downside, cash and investments almost fully support the current market cap. Stay tuned.

As a fun side note, it was recently covered by The Northeastern University Student Value Fund – “Market Overlooks Significant Operations Moat in RFP Win”. Maybe the kids will be alright.

https://x.com/northeasternsvf/status/1844145942272045382

Thank you for subscribing!