Security Corp NASDAQ: STRT – Hidden value of their JV unlocked.. now what?

Here is the latest from Canadian Value Investors!

Wisdom of the crowds

Talking your book – what do they do?

Portfolio update

Charlie Munger’s last interview

Strattec Security – Hidden value of their JV unlocked.. now what?

Wisdom of the Crowds

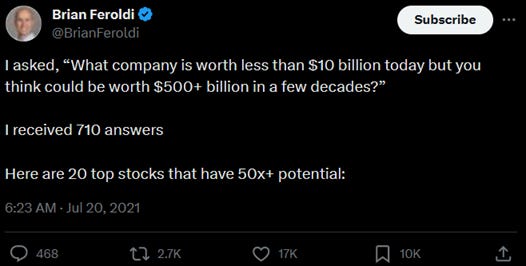

[2021] Brian Feroldi https://x.com/BrianFeroldi/status/1417460154078011400?s=20

I asked, “What company is worth less than $10 billion today but you think could be worth $500+ billion in a few decades?”

I received 710 answers

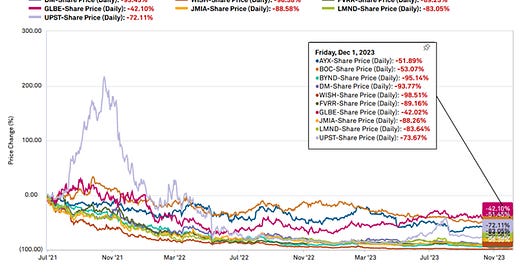

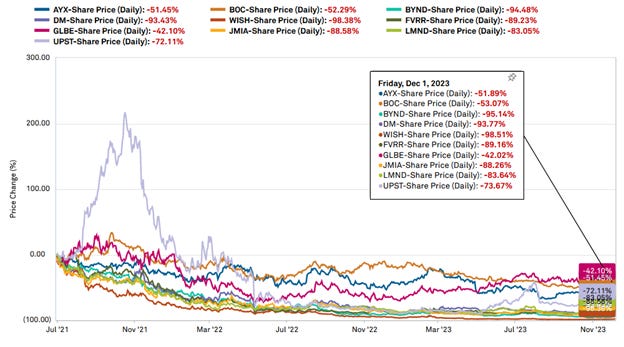

It is an amazing list to have shorted in 2021. Here is a stock chart of the top 10 to-date. To be fair, they all still have a few decades to turn it around. Top ten details at the end. TLDR; a lot of money would have been lost if you held the top ten shown below.

E.g. #3: Beyond Meat - $BYND

2021 market cap: $7.9 billion

What it does: Plant-based meat

Current market cap: $0.6 billion

Talking your book – What do they do exactly?

One of our top five investing interview moments.

Portfolio update

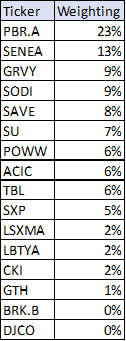

Since our last update we have reduced our positions in both SU and PBR. They had a good run, but were quite overweight in a high political risk industry and declining price environment. Or, in other words, we do not want to rely on high prices for the positions to make sense. SAVE and Liberty-family holds make up our new positions. Speaking of SAVE, here is another summary of the latest -

But, maybe the recent pullback in oil is just a hiccup and things have changed. They seemed to have for coal. https://x.com/mfwarder/status/1731689434431574443

Charlie Munger’s last interview

Rest in peace Charlie.

Strattec Security Corp NASDAQ:STRT – Hidden value of their JV unlocked.. now what?

Disclosure: We do not own this at time of publication, but are evaluating and – as always - might own in the future.

Have you ever wondered where the start button or the lift gate of your car comes from? It might be from Strattec! Back in 2021 we looked at this; it had a growing joint venture – VAST – hidden underneath their business that was probably worth something, and all together the business seemed like it might be cheap. But, we continued to worry about supply chain issues and the auto industry in general and so we passed. Fast forward to today – They have sold VAST and an activist investor - GAMCO, an investment firm founded by Mario Gabelli - has come in to unlock value. Is there something here? The following is our 2021 views followed by our view today.

What did Strattec look like in 2021?

Strattec has been a separate public company since 1995 when it was spun off from Briggs & Stratton. The Company primarily makes car door handles and locks, but more recently powered lift gates. GM recognized them for their collaboration on the powered lift gate for the Silverado - https://www.vastglobal.com/General-Motors-Honors-STRATTEC--as-Winner-of-Coveted-Supplier-Innovation-Award-_6982.aspx

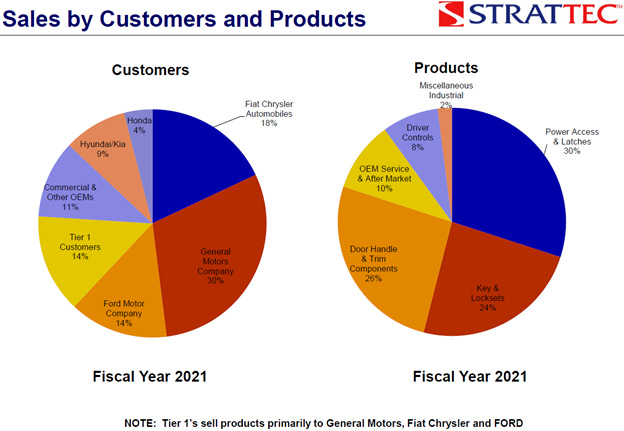

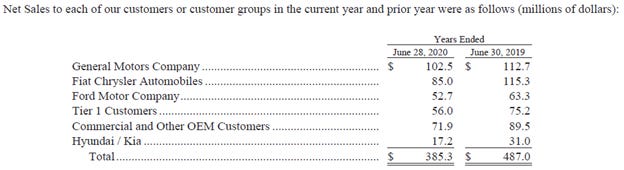

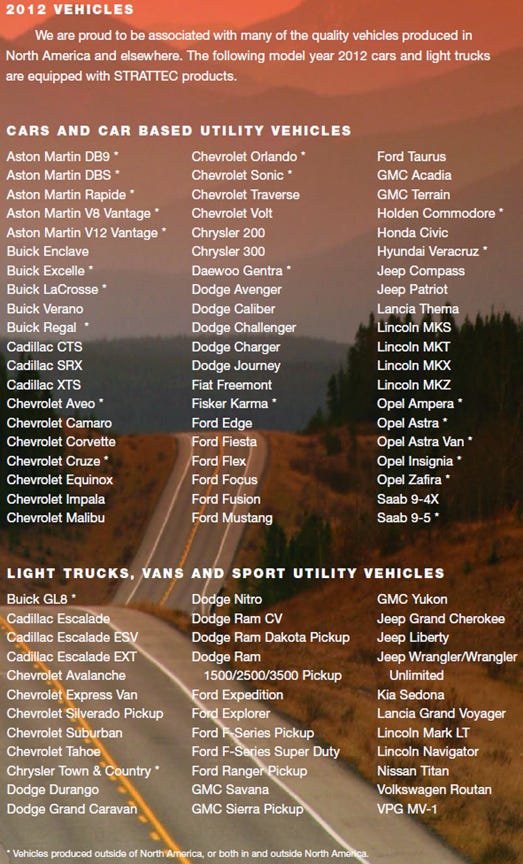

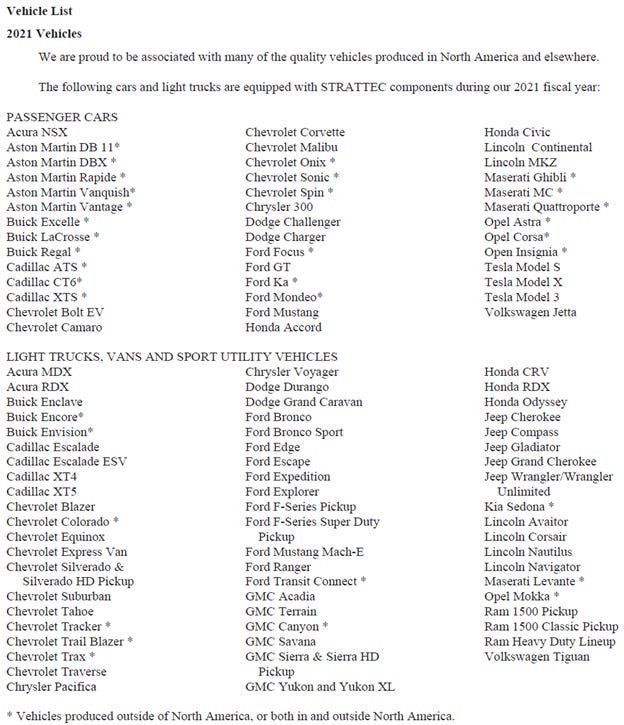

The models they are supplying are quite stable with customers weighted heavily to U.S. automakers and models (see 2012 vehicles supplied vs 2021 below). They contribute to some high-volume models like the Chevrolet Silverado. https://www.caranddriver.com/news/g36005989/best-selling-cars-2021/

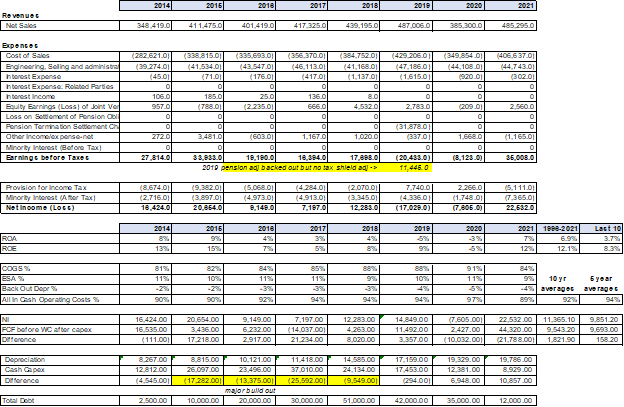

Here’s the recent financial performance. Note the material capex for facility expansions in both the U.S. and Mexico, and noise from pension wind up. We were concerned about how inflation would work its way through, and it did turn out to be a problem. Fixed price contracts and rising input costs put a major squeeze on financial performance. However, there has been some relief – e.g. the Company noted in Q1 FY2024 $10.8 million in revenue renegotiated pricing relief, of which $8.0 million was one-time retroactive pricing.

The Company cleaned up the tail risk of its pension plan in 2018/19.

Additionally, during the three months ended December 30, 2018, we entered into an agreement with an insurance company to purchase from us, through a series of annuity contracts, our remaining obligations under the Qualified Pension Plan and, as a result, we settled the remaining obligations under the plan for the remaining participants utilizing funds available in the Qualified Pension Plan trust. No additional cash contributions to the trust were required to settle the pension obligations. As a result of these actions, a non-cash pre-tax settlement charge of $31.9 million was recorded during fiscal 2019. A non-cash compensation expense charge of $4.2 million was also recorded during fiscal 2019 related to the future transfer of the excess assets in the Qualified Pension Plan to a STRATTEC defined contribution plan for subsequent pay-out to eligible STRATTEC employees based on a plan approved by the Board of Directors in June 2019. An additional $4.8 million non-cash compensation expense charge related to the final transfer and pay-out of the excess Qualified Pension Plan assets was recorded during our fiscal 2020. During fiscal 2020, the excess Qualified Pension Plan assets were transferred to our defined contribution plan and distributed to eligible STRATTEC employees, which completed the full termination of the Qualified Pension Plan.

What made this particularly interesting in 2021 though was the VAST joint venture, which is included in equity earnings of joint ventures.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.