Seneca Foods NASDAQ: SENE.A – Canning Cash

Note: This article was originally posted at www.canadianvalueinvestors.com on August 27, 2023. We owned a position at time of posting and continue to hold.

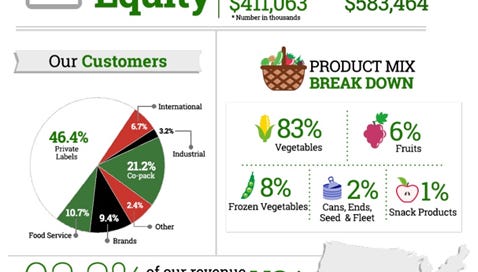

Seneca is our kind of boring company. It produces canned and frozen vegetables and fruits and has been operating since 1947. It has historically not been a great business to be in, but recent performance, share buybacks, and industry dynamics have made it interesting. We argue:

The industry has continued to consolidate, and it appears that competitors are becoming a bit more rational. The Company, and industry in general, have been acquiring competitors and then consolidating operations to improve costs (in fact, Seneca is one of two companies making up 90% of canned vegetable production in the U.S.). For example, at Senenca, full-time and seasonal staff headcounts are down 15% and 50% since 2010 on higher sales.

The Company’s LIFO accounting obscures underlying performance.

It is trading at low adjusted earnings multiple, can be argued to be a net-net depending on your perspective of inventory and physical assets. More importantly, with continued share buybacks this might be quite good. But, earnings volatility and tough industry dynamics do give us pause.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.