Seneca Foods NASDAQ:SENEA Q3 (ending Dec) Update

Disclosure: We own this one.

We originally wrote up Seneca back in August of 2023 at canadianvalueinvestors.com before we moved to Substack, and have reposted the article here - https://canadianvalueinvestors.substack.com/p/seneca-foods-nasdaq-senea-canning?sd=pf

Seneca is our kind of boring company. It produces canned and frozen vegetables and fruits and has been operating since 1947. It has historically not been a great business to be in, but recent performance, share buybacks, and industry dynamics have made it interesting. We viewed it as cheap.

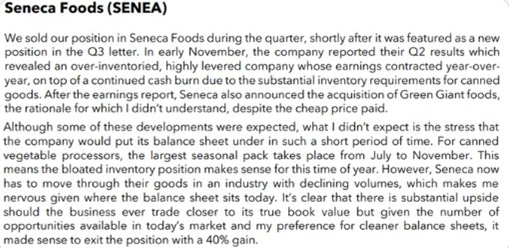

But now, leverage is going up – a lot – driven by inventory and it has spooked some, like Greystone - https://www.greystonevalue.com/ and they also made an acquisition of Green Giant canned goods that some do not seem to like.

Is there a problem?

This year has shown us two things:

There is indeed value in the fixed assets, and

Being able to use this value for additional term debt has protected them, so far, from having a liquidity problem.

Understanding their debt

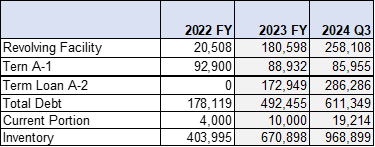

The Company has typically had a revolver for working capital and then some term debt (Term A-1, and now also A-2) financed by fixed assets. The maximum headline borrowings under the Revolver are $300MM from April through July and $400MM from August through March, but the actual amount available is based on a borrowing base calculation. (We have included their loan agreements below for those that want the details)

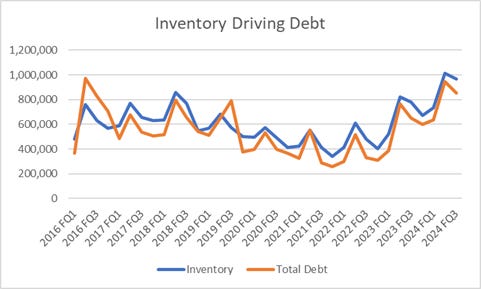

“Seasonal working capital needs are affected by the growing cycles of the vegetables the Company packages. The majority of vegetable inventories are produced during the months of June through November and are then sold over the following year. Payment terms for vegetable produce are generally three months but can vary from a few days to seven months. Accordingly, the Company’s need to draw on the Revolver may fluctuate significantly throughout the year.”

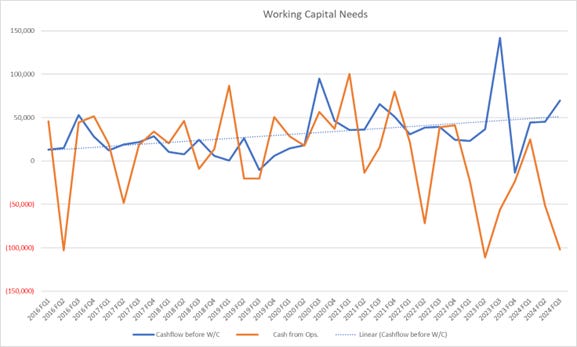

What the headline total debt number does not tell you is that they would have been out of liquidity, or at least very tight, if they did not put in place new term loans earlier this year as shown below. What provides us a bit of comfort is that they were proactive. The term loan increase closed last March (their note below). However, a new issue is they now have to deal with higher interest payments and also amortization on the term debt (Term Loan A-1: $1MM a quarter, A-2: $3.75MM, or ~$20MM a year). We note that, in general, ag-related businesses in both the U.S. and Canada have access to more and cheaper credit than a lot of other industries (an article for another day). In Seneca’s case, their main term loan lender is a large ag-focused cooperative - https://www.farmcrediteast.com

“On May 23, 2023, the Agreement was amended by the Second Amended and Restated Loan and Guaranty Agreement Amendment which amends, restates and replaces in its entirety Term Loan A-2 (the “Amendment”). The Amendment provides a single advance term facility in the principal amount of $125.0 million to be combined with the outstanding principal balance of $173.5 million on Term Loan A-2 into one single $298.5 million term loan (“Amended Term Loan A-2”). Amended Loan Term A-2 is secured by a portion of the Company’s property, plant and equipment and bears interest at a variable interest rate based upon SOFR plus an additional margin determined by the Company’s leverage ratio. Quarterly payments of principal outstanding on Amended Term Loan A-2 in the amount of $3.75 million commenced on June 1, 2023. The Amendment continues all aspects of Term Loan A-1 as defined in the Agreement. As of December 30, 2023, the interest rate on Amended Term Loan A-2 was 7.10%.”

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.