Slate Office REIT (TSX:SOT) Convertible Debentures: Will a key shareholder make these a bargain or a loss making boondoggle?

A case study of the current office building real estate market

Disclosure: We own Slate Office REIT Debentures, but not the stock.

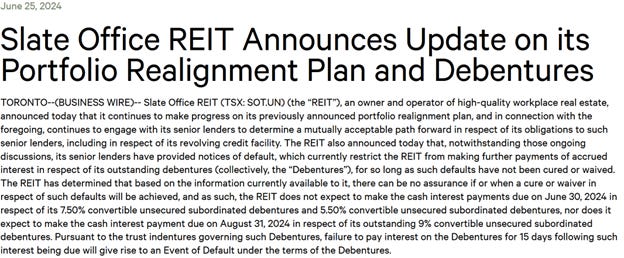

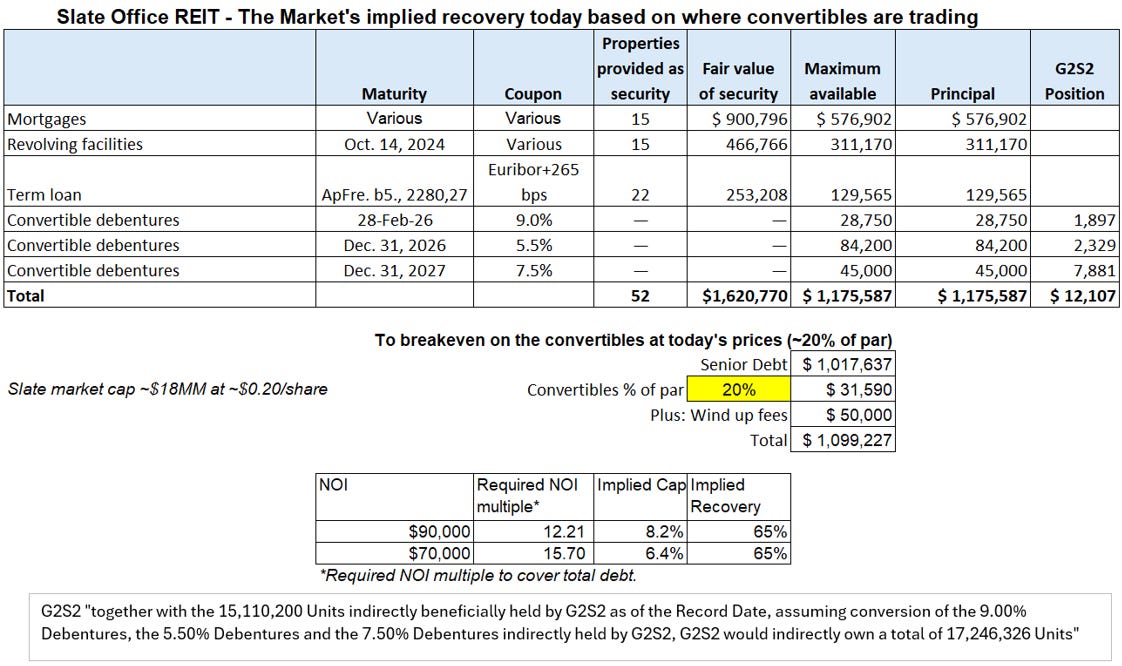

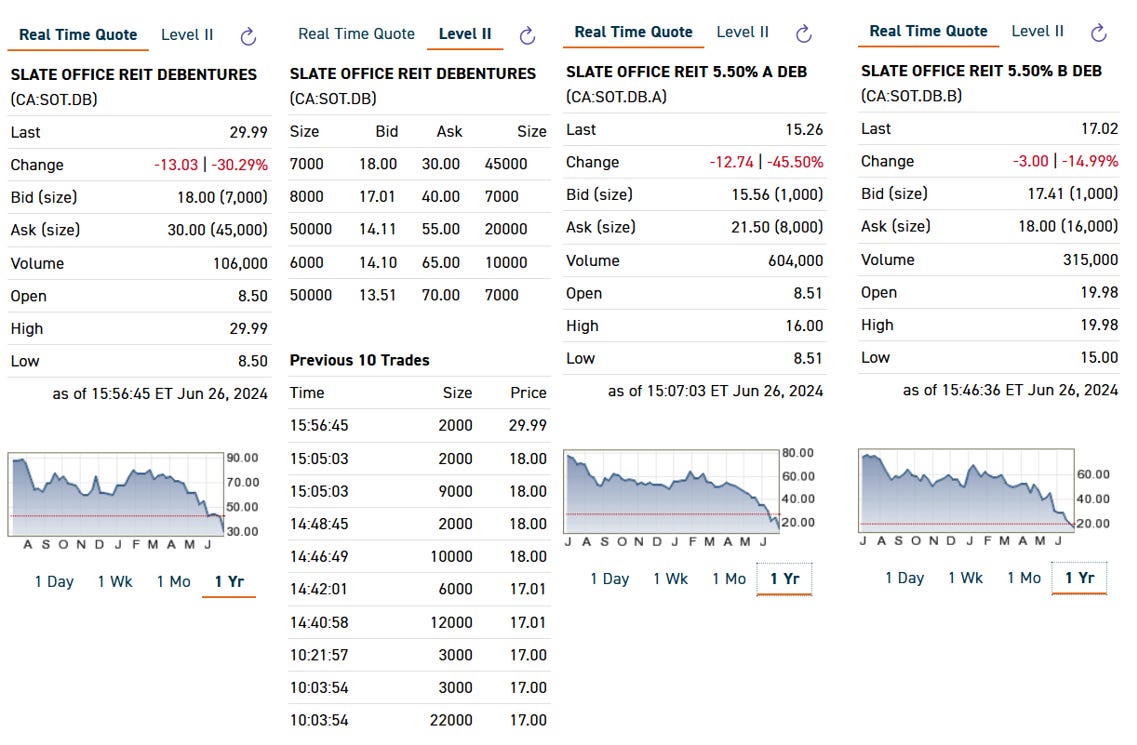

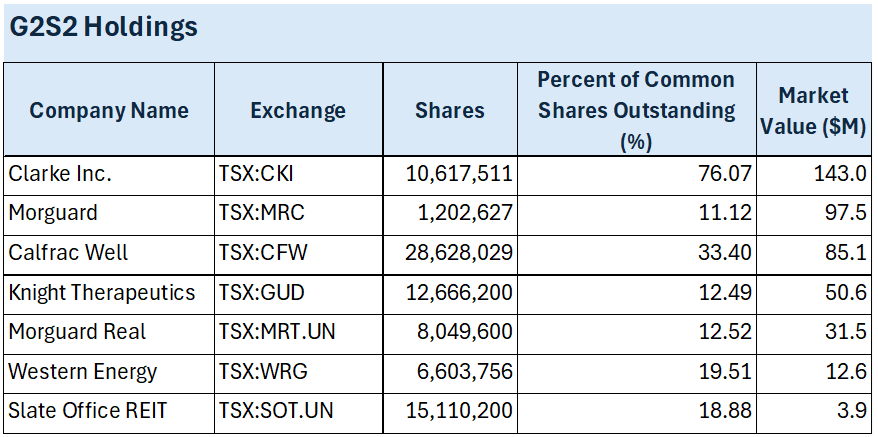

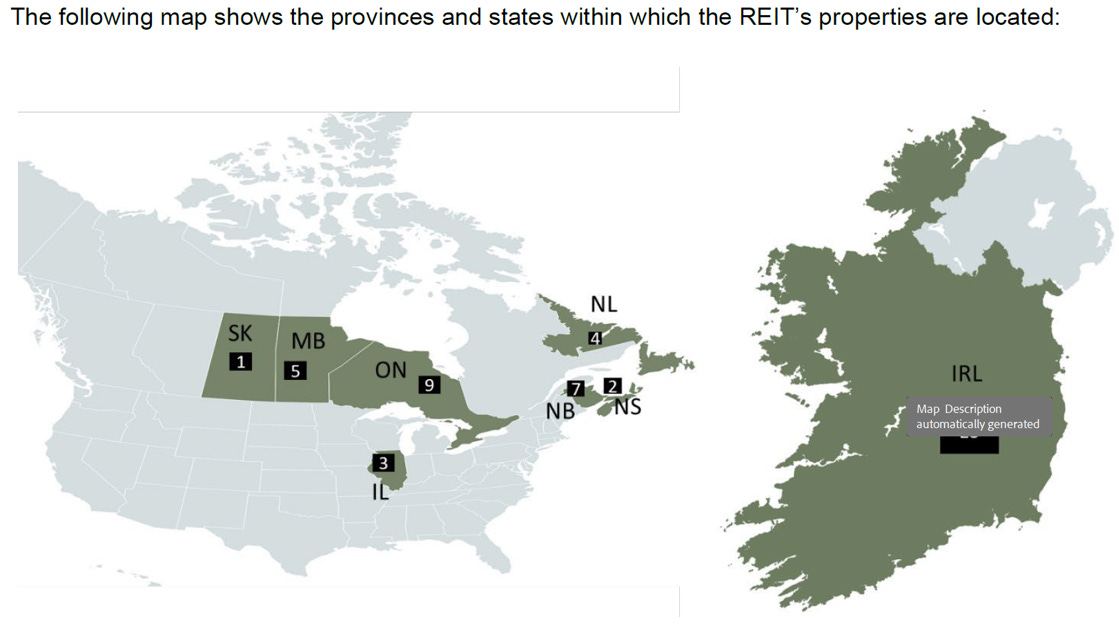

For those not following the office space real estate market, things are not going very well. For Slate Office REIT (TSX:SOT), things have been going particularly poorly. On June 25th, the Company, which owns ~50 of mostly office properties spread out across Eastern Canada, Chicago, and Ireland, announced that payments on their convertible debentures are now being blocked by senior lenders. However, what makes this situation interesting to us is a key investor, G2S2, has just taken over the Board after a two-year battle and has a track record of creative turnarounds. The publicly traded convertible debentures now trading at 20 cents on the dollar provide (we think) an interesting opportunity. But is it too late for G2S2 to fix this?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The story:

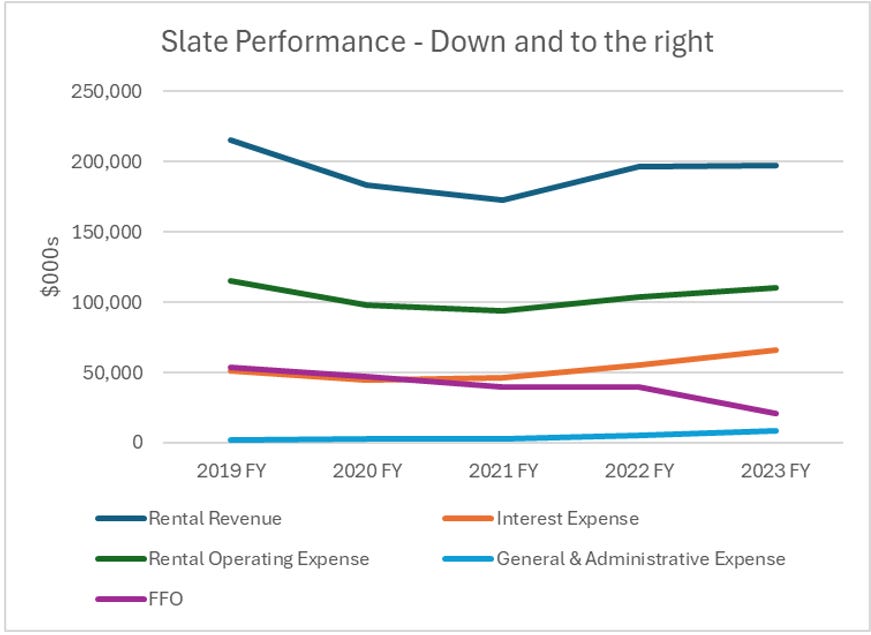

-Slate has faced high vacancy and lease rate pressure in their properties, high G&A, higher interest rates, and is running out of liquidity and support from increasingly frustrated senior lenders.

-G2S2, a key shareholder and convertible debenture noteholder, has been publicly fighting with Slate management since 2022 when they said “we have watched as SLAM has mismanaged this REIT over the past number of years. Transactions that don't add value, slashing the distribution by 50%, fees on top of fees," said George Armoyan, Executive Chairman of G2S2. "SLAM owns less than 10% of the REIT but they have set it up to have complete control. They are the only unitholder that is making any money from this investment."

-The Company then started on a strategic plan to sell non-core properties and streamline the business, but progress has been slow in a challenging office real estate market. An interim settlement agreement did not go far enough and G2S2 kept fighting.

-Subsequent to the default, Charles Pellerin joined the Board on June 27th (Principal Partner and President of Pellerin Potvin Gagnon S.E.N.C.R.L., one of the largest independent accounting firms in Quebec, and long-time connection of G2S2), leaving the Board in G2S2’s hands:

Charles Pellerin – New, G2S2 connected

Samuel Altman – New, Board Chair

George Armoyan – G2S2 Chairman, key man

Brian Luborsky – New, G2S2 connected

Blair Welch - Slate

Brady Welch - Slate

Where will they take shareholders in this bad office tower market? They have a history of dealing with distressed situations, and we think that G2S2’s investment in Bonavista Energy (a billion dollar turnaround) is a telling tale of what might happen.

We cover the full background of G2S2’s relationship with Slate, where we are at today, and what happened with Bonavista, but before all of that we want to cover off how we first came across G2S2.

Our introduction to G2S2 was through Clarke Inc.

Our first investment involving G2S2 was Clarke (TSX:CKI). We have written previously about them. As noted in a post we did in March 2024 (“We’re off the ferry” linked below, and originally wrote up an overview in 2023 on the pre-Substack blog), it is a very neat pool of investments, including a mini-ferry monopoly and a large Ontario development, that was trading at a discount to NAV/our fair value and had a motivated key owner, G2S2. We sold earlier this year given the significant increase in price and closure of the discount, but maybe we sold too soon. https://canadianvalueinvestors.substack.com/i/142272617/clarke-inc-tsxcki-were-off-the-ferry

G2S2 is a material holder and did a few interesting things. In April 2023 they increased their holdings of Clarke.

CLARKE INC. ("CKI-T") - G2S2 Capital Inc. Announces Increased Investment in Clarke Inc.

G2S2 Capital Inc. ("G2S2"), announces that it has acquired ownership of, and control over, an additional 46,300 common shares of Clarke Inc. ("Clarke"), representing 0.33% of the outstanding common shares of Clarke ("Common Shares"). G2S2 acquired the Common Shares on April 20, 2023, through the facilities of the Toronto Stock Exchange at a price of $12.05 per share (the "Acquisition").

Prior to the Acquisition, G2S2 owned and exercised control over an aggregate of 10,457,101 Common Shares and $13,404,400 principal amount of Clarke Series B Convertible Debentures ("Convertible Debentures") which, if converted, would entitle G2S2 to an additional 975,572 Common Shares, representing a securityholding percentage of 76.30% (assuming conversion of the Convertible Debentures held by G2S2). Immediately after the Acquisition, G2S2 owns and exercises control over 10,503,401 Common Shares and $13,404,400 principal amount of Convertible Debentures, representing a security holding percentage of 76.61% in the Common Shares (assuming conversion of the Convertible Debentures held by G2S2).

And a few months later on June 28, 2023, Clarke announced it was repaying its publicly traded subordinated debentures with a credit facility from G2S2 (which provided us a neat trade as well).

HALIFAX, NS, June 28, 2023 /CNW/ - Clarke Inc. (the "Company" or "Clarke") (TSX: CKI) announced today that it has delivered a notice to Computershare Trust Company of Canada ("Computershare"), as debenture trustee under the trust indenture between the Company and Computershare dated September 30, 2019, as supplemented by the first supplemental indenture dated September 30, 2021 (together, the "Indenture"). Such notice of redemption provides that the Company will redeem the entire aggregate principal amount of $35,000,000 of its outstanding 5.50% Series B Convertible Unsecured Subordinated Debentures due January 1, 2028, which are listed for trading on the Toronto Stock Exchange under the symbol CKI.DB (the "Debentures") in accordance with the terms of the Debentures.

…

In connection with redemption of the Debentures, the Company has entered into a credit facility (the "Credit Facility") with the Company's controlling shareholder, G2S2 Capital Inc. ("G2S2"). The Credit Facility bears interest at 6.00% and is interest payments only until January 1, 2028, whereby afterwards the Credit Facility will continue as a revolving line of credit on demand. The interest-only period aligns with the current maturity date of the Debentures, ensuring that the Company will maintain the liquidity requirements that the Debentures provided.

Importantly, Clarke has a $200MM hotel business and $150MM of investment properties, including a key on below, providing some context for G2S2’s experience with real estate.

Construction continues on the first phase of our development on Carling Avenue in Ottawa, ON. The development, which is branded as the Talisman, will consist of a five-building residential rental complex including extensive tenant amenities, parkland and ground-floor commercial space. The Talisman’s first phase, which is two towers and 404 rental units, is nearing completion, and we expect to welcome our first residents in June 2024.

G2S2’s investment portfolio is one of the more interesting books we have come across.

Slate Stumbles

The value destruction, so far, is quite remarkable. The market cap has declined from ~$360MM to ~$20MM, while the $158MM of debentures are trading at ~20 cents on the dollar (albeit illiquid) equating to another ~$125MM decline in value, while the Company has taken ~$220MM of write downs on their portfolio over the last two years. It is also running with a high and growing amount of G&A (not helped by their team consisting of “approximately 168 professionals with dedicated acquisition, leasing, in-house legal, construction management, finance and taxation teams for its U.S., European and Canadian commercial real estate businesses”). It also appears to us that this would be a weird real estate book to manage. They have a navigable list here - https://www.slateofficereit.com/portfolio

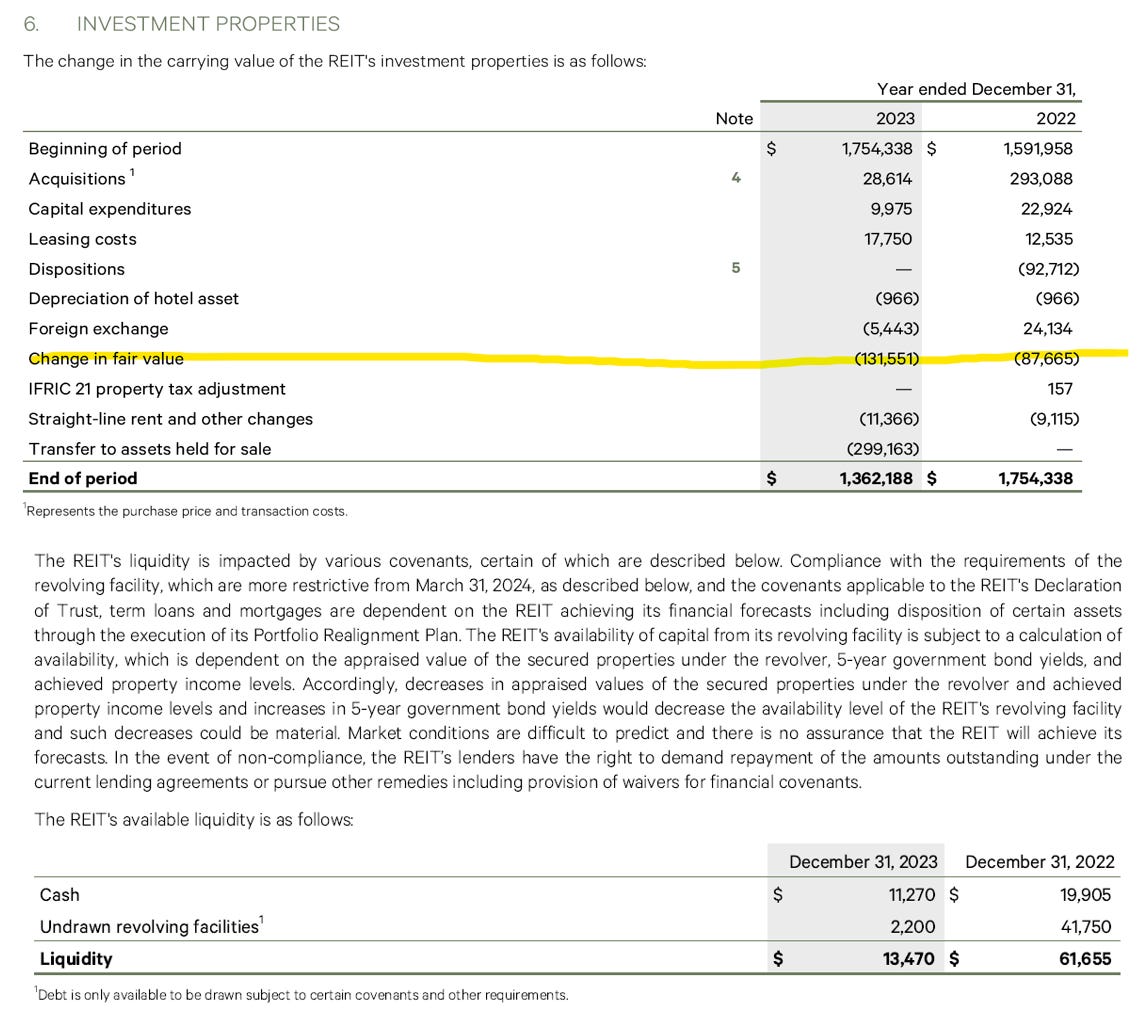

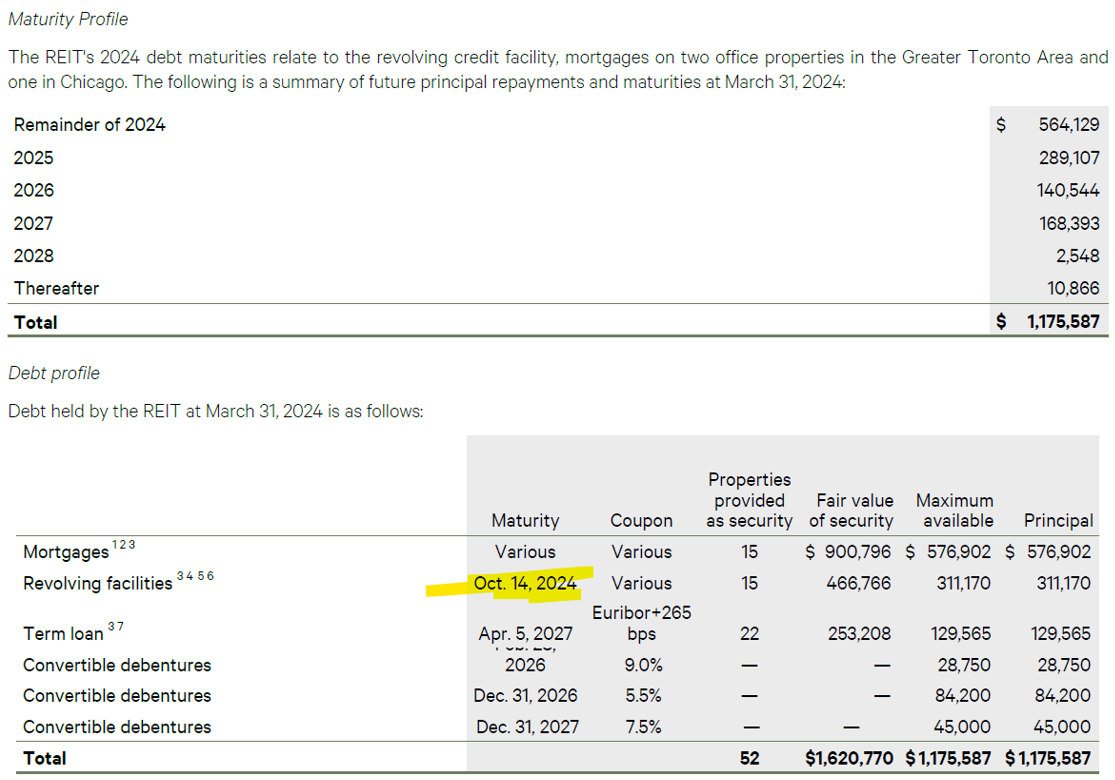

Liquidity has dried up and lenders are clearly unhappy. Senior lenders started taking away liquidity last year. “On November 14, 2023, the REIT amended its revolving credit facility. The amended revolving credit facility provided certain financial covenant relief in addition to increased borrowing base availability through to March 31, 2024. The Canadian revolving credit commitment was initially reduced from $260.0 million to $252.0 million and the U.S. dollar revolving credit commitment was reduced from $76.2 million to $59.3 million, with further reductions required at future dates. Concurrently with the amendment, the REIT repaid $7.3 million on the U.S. dollar revolving credit commitment. The drawn amount on the Canadian revolving credit commitment was unaffected.”

Liquidity fully disappeared subsequent to year-end.

The G2S2 / Slate Timeline

Where it all started - October 20, 2022, G2S2 letter to Slate

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.