Solitron Devices, Inc. (OTCPK:SODI) Is Tim Eriksen building a baby Berkshire? (originally published June 22, 2023

This is a reposting from our original site canadianvalueinvestors.com from June 22, 2023 to coincide with our January 2024 Substack update.

Disclosure: We did not have a position at the original publish date. As of reposting on Substack we do have a position.

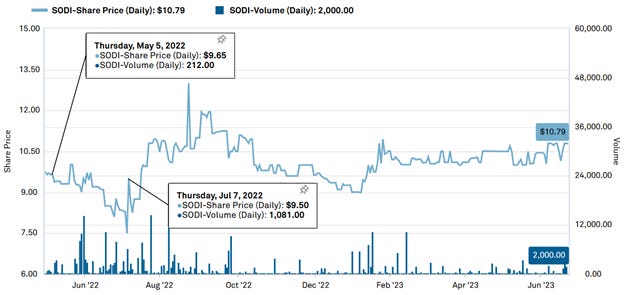

For readers that have been around for awhile, you know that we have been following Solitron Devices, Inc. for a few years now. Our first article was May 2022 - Reading the Turnaround Tea Leaves - followed by an update in July. Our writings have typically focused on things that we have acquired but have had several requests for articles covering what we have not purchased and why. This is a great example. We think there might be something here, but have not yet pulled the trigger. Here’s why.

Since our last update, CEO Tim Eriksen and company have been busy.

As a quick refresh:

-Solitron makes power control modules/junctions/etc, for weapons systems and airplanes like the B-52 bomber. This is typically sticky business supporting the life of the system, so long as you perform. And lives can be long, shown best by the B-52 that has been around in one form or another since 1952.

-Tim Eriksen, activist investor turned CEO, is a few years into a turnaround with major step changes, including moving their facility to a cheaper/better owned facility and is in the middle of rationalizing and improving production.

-The U.S. government continues to prioritize smaller contractors as part of their Increasing Opportunities for Small Businesses policy (see original article).

-We stayed on the sidelines last year primarily because 1) we were unsure of the success of their plant move (i.e. what true run-rate sales and costs would become), and 2) we were unsure where they would put their cash. We now have an answer to one and almost both questions.

-Since our initial check, the Ukraine war has create a bit of an embarrassing weapons stockpile problem for the U.S. “Slower manufacturing and expenditure of reserves in Ukraine have many worried about the state of U.S. munition stockpiles and military readiness.” https://www.heritage.org/defense/report/rapidly-depleting-munitions-stockpiles-point-necessary-changes-policy

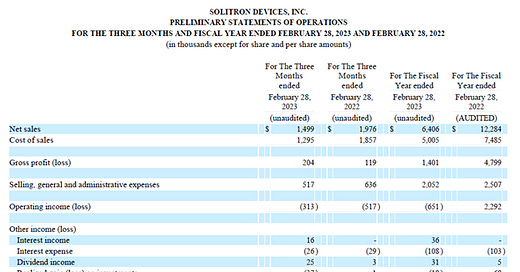

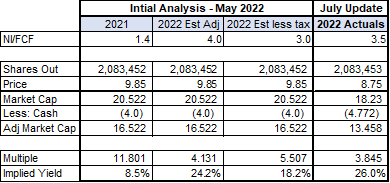

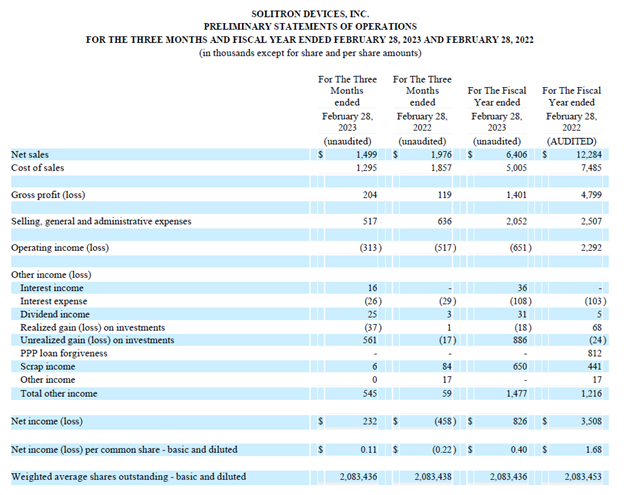

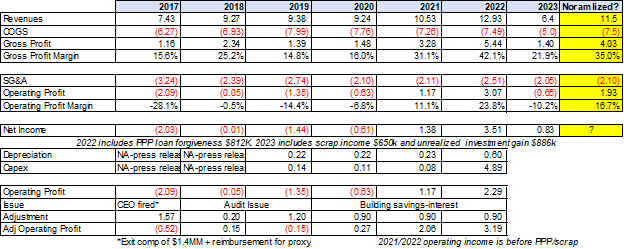

Our initial analysis and July update was as follows. How have things gone? They just provided their (off-cycle February) 2023 year-end financials

.Key highlights:

1) The trickle down of the U.S. stockpile problem leading to sales – “As we noted in our fiscal third quarter release, in December 2022 the President signed the $1.7 trillion omnibus spending bill. Included in the bill are appropriations to replenish supplies used in Ukraine and to increase stockpiles. A number of programs are included in the spending, including two that represent Solitron‘s two largest revenue sources. The increased stockpiles program is a multi-year program that we currently expect to add approximately $20 million in total revenues starting in late calendar 2024 and running through 2028, or approximately $4 million annually. Actual contract awards are expected to occur by the fall of 2024.”

2) Sales were impacted by the plant move as expected. “Bookings were strong in the quarter, exceeding $3.5 million and backlog finished at $9.1 million, our highest quarter end level since February 2021.” We note that some 2022 sales were actually pulled from 2023 in advance of the move.

3) Most importantly, it looks like Tim and Co are indeed trying to use the company as platform to grow into something larger through public holdings and acquisitions (see notes below). They had $4.3MM of cash and investments at year-end. For us, this means we need to ignore the surplus cash and instead make assumptions about expected returns.

“We had significant unrealized gains on investments during the fiscal fourth quarter and fiscal year 2023. In the middle of the fiscal year the Board approved a revision to our approach toward investments to allow for more concentrated positions. We purchased 1.1% and 1.5%, respectively, of the outstanding shares of two small community banks that were recipients of the Emergency Capital Investment Program (ECIP). …

On June 1 Solitron signed a non-binding term sheet for a potential acquisition of a target company which produces electronic components primarily for the medical industry. We are now in a due diligence process which is estimated to last approximately 75 days. The terms set forth in the term sheet contemplate that, if completed, the acquisition would be funded from cash and securities on hand. An initial payment of approximately $3.0 million would be due upon close. Additional earnout payments of up to approximately $450,000 each would be payable over each of the next three years. The target company produces electronic components primarily for the medical industry. Revenue for 2022 was approximately $5.9 million as compared to $5.5 million in 2021. One customer accounted for approximately 90% of revenues. We can make no guarantees that the transaction will be able to be consummated, or if it is that it will yield the results or benefits desired or anticipated.”

They are also doing concentrated bets on holdings; these appear to crossover with Tim Eriksen’s fund. https://www.eriksencapitalmgmt.com/manager

We had significant unrealized gains on investments during the fiscal fourth quarter and fiscal year 2023. In the middle of the fiscal year the Board approved a revision to our approach toward investments to allow for more concentrated positions. We purchased 1.1% and 1.5%, respectively, of the outstanding shares of two small community banks that were recipients of the Emergency Capital Investment Program (ECIP). Due to increased interest rates, we also moved most of our cash to treasury bills which is considered Short-term investments on the balance sheet.

Our takeaways

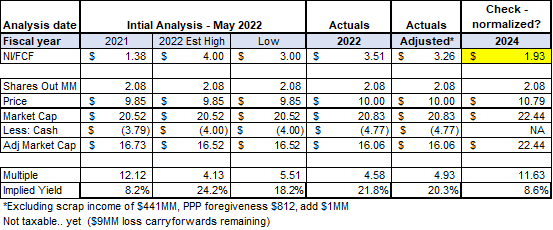

-We assume surplus cash is now not going to be distributed, or at least subtracting “surplus” cash from the market cap is not an appropriate way to calculate an adjusted P/E anymore.

-You need to trust management and key owners with their capital allocation strategy. So far, we view the operations strategy they have taken as the right approach in general.

-What are normalized operating earnings? Based on $11.5MM of “normalized” sales (2021-2022) and slightly improved margins (efficiency initiatives), the P/E multiple is about 11-12x excluding any value for their investments, which are material with cash and investments of $4.3MM vs market cap today of $22.5MM at $10.79/share.

There is significant uncertainty, both upside and downside. The key conundrum is what are normalize sales and margins after winding down some product lines while ramping up others. Will new product launches work? What about future stock picks? Will they make a major acquisition? If so, will that work? The contemplated $3MM + earn-out offer is not a bet-the-farm type of deal, but it is material.

We find this to be a funny Berkshire-like situation. Warren Buffett accidentally built Berkshire. He did not plan to create a massive, diversified conglomerate, but it worked out that way. In this situation, Tim accidentally became the operator of Solitron and now is moving forward one stock pick and one deal at a time. Maybe it is worth a bet on Tim and Co to see where they take this

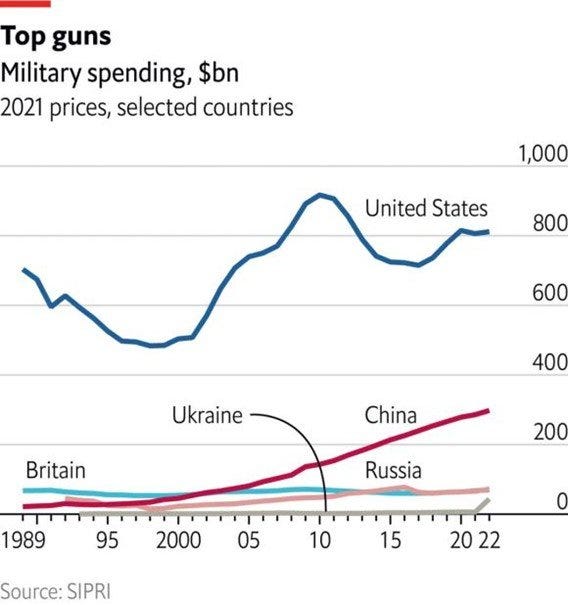

Bloomberg - Defense Spending is Booming

Bloomberg - Has the Ukraine war started a new arms race? Yes, to judge by figures published on Monday by the Stockholm International Peace Research Institute, a think-tank. Global defence spending rose by 3.7% in real terms in 2022 to a record $2.24trn. It shot up by 9.2% in Russia and septupled in Ukraine. Farther west in Europe, military spending grew by 3.6% to levels unseen since the end of the cold war.

Yet the picture is fuzzy. The economic burden of armed forces, at 2.2% of GDP, remains close to its post-cold-war low. In part, the world economy has grown. Of the biggest arms spenders, America was flat and China dipped as a share of GDP. But many of the promised spending increases are yet to come. Inflation may abate. And geopolitical tension—a long war in Ukraine, and talk of a future one between America and China—will push countries to buy ever more weapons.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).