Solitron Devices, Inc. (OTCPK:SODI) – Reading the Turnaround Tea Leaves (originally published May 8, 2022)

This is a reposting from our original site canadianvalueinvestors.com from May 8, 2022 to coincide with our January 2024 update.

Disclaimer: At time of original publishing we did not have a position in this stock. As of reposting on Substack we do have a position.

Here at Canadian Value Investors, we love looking for oddball stocks that are underfollowed as this is the area of the market that is most likely to be mispriced. Today we are covering a defense contractor you have likely never heard of trading at a few times earnings, giving you a possible stock idea and a window into the U.S. defense industry.

When you think of American defense contractors, you have likely heard of the giants like Lockheed Martin (market cap: ~$120 billion), Raytheon (market cap: ~$140 billion), and Boeing (market cap: ~$90 billion). But you have probably not heard of Solitron Devices, Inc. (market cap: ~$20MM), a tiny defense contractor that has been doing its thing since the 1950s. They hit a bumpy road in the early 2010s, but new management has come in with fresh eyes and new ideas. Today we discuss this interesting story of a turnaround in progress.

What does Solitron do?

Let’s start with the product. Boeing’s American B-52 bomber has been a core piece of the American war machine since 1955. The 52’s flying today are not the same as the originals of course, going through continual retrofits, upgrades, repairs, and improvements. But, by all accounts, they have had a remarkably long service life and expect to do so for years to come. You can read more background here: https://www.boeing.com/defense/b-52-bomber/

Although the B-52 is branded as Boeing, it actually involves dozens of manufacturers and contractors, and Solitron is one of them. Solitron “manufactures a large variety of bipolar and metal oxide semiconductor ("MOS") power transistors, power and control hybrids, junction and power MOS field effect transistors ("Power MOSFETS"), field effect transistors and other related products. Most of the Company's products are custom made pursuant to contracts with customers whose end products are sold to the United States government. Other products, such as Joint Army/Navy ("JAN") transistors, diodes and Standard Military Drawings (“SMD”) voltage regulators, are sold as standard or catalog items.” What does this all mean? They make power control modules that are very small things in very big very expensive things like B-52 bombers, radar systems, and guidance systems. Reliability is of extreme importance.

In general, when you are a small but mission critical piece in a giant machine, your customers are less concerned about price and more so concerned about reliability of the product. Your customer likely does not ask too much about the price because you make up less than a fraction of a percent of the total cost of the equipment. It is not worth the time to chase the small suppliers, and it is not worth switching them out for a cheaper bidder if everything is working. It is just not worth the risk.

Keeping with our B-52 example, you fight over the big things, like the engines. The U.S. government selected Rolls-Royce to replace the engines in the fleet as part of a major refurbishment program, and that engine contract alone is about $2.5 billion vs Solitron’s annual sales of $10-12 million a year as a supplier for that program. It also becomes particularly sticky business when you incorporate the government/national security angle. You cannot be outbid by a Chinese knockoff start up on Alibaba marketplace.

As contracts come up for programs, like the B-52 retrofit, Solitron bids on participating. The large defense contractors are also incentivized to use approved but smaller contractors where possible. In fact, concentration of suppliers in the defense space is a huge concern of the U.S. Department of Defense. Here’s an example report from the DoD – https://media.defense.gov/2022/Feb/15/2002939087/-1/-1/1/STATE-OF-COMPETITION-WITHIN-THE-DEFENSE-INDUSTRIAL-BASE.PDF

Increasing Opportunities for Small Businesses. DoD should increase small business participation in defense procurement, with an emphasis on increasing competition in priority industrial base sectors.

…

During the 1990s, the U.S. defense industry underwent drastic consolidation. As an example, the number of aerospace and defense prime contractors shrank from 51 to 5: Lockheed Martin (LM), Raytheon, General Dynamics (GD), Northrop Grumman (NG), and Boeing.5 The trend toward consolidation has continued in the last five years, due to vertical and horizontal integrations and the entry of private equity firms performing roll ups

…

Small business participation in defense procurements as prime and subcontractors is vital to the defense mission, competition, and the health of the DIB. Small businesses spur innovation, represent the majority of new entrants into the DIB, and, through their growth, create a pipeline of the next generation of suppliers with diverse capabilities to support the DoD mission. They are also essential to the nation’s economic prosperity.

The fact that Solitron is in power systems is particularly interesting when thinking about how their product actually interacts in the overall engineered system. They are integral in how the entire system operates and are a critical failure point. When upgrading a plane or building the next generation one, you are much more likely to contemplate upgrades to systems like radar, that minimally interact with other systems, but are powered by the common power distribution system. Changing the power distribution affects all of these downstream systems and puts the whole system at risk. You are more likely to match the new system to the existing distribution system than the other way around. Of course, this niche is still subject to technological improvement, with the next generation of technology being silicon carbide, but this is already a big focus of the Company.

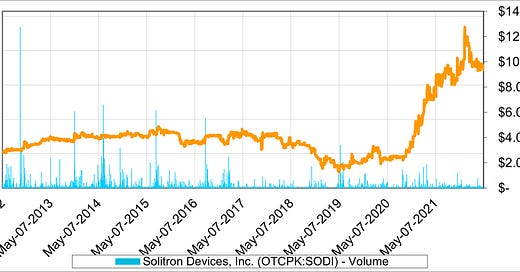

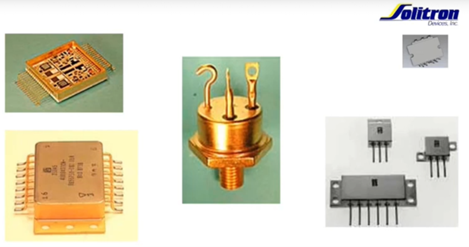

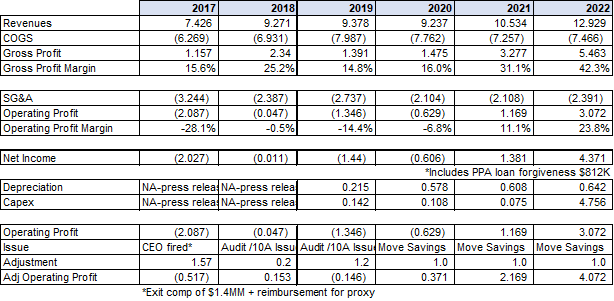

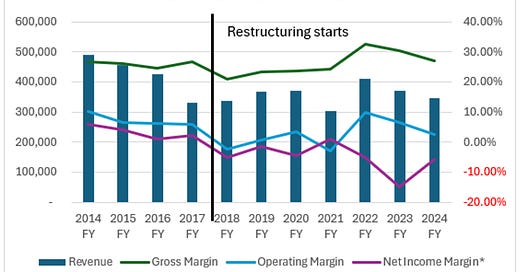

Sounds great for Solitron, doesn’t it? Then what happened between 2015 and 2021?

What the numbers don’t tell you is that:

There was a multi-year shareholder battle from 2014-2016 with Cedar Creek Partners LLC.

The sleepy CEO was ultimately fired, and a new CEO (a Cedar Creek principal partner) and new COO were brought in.

The entire engineering team was fired and replaced and is now working on a new line of products.

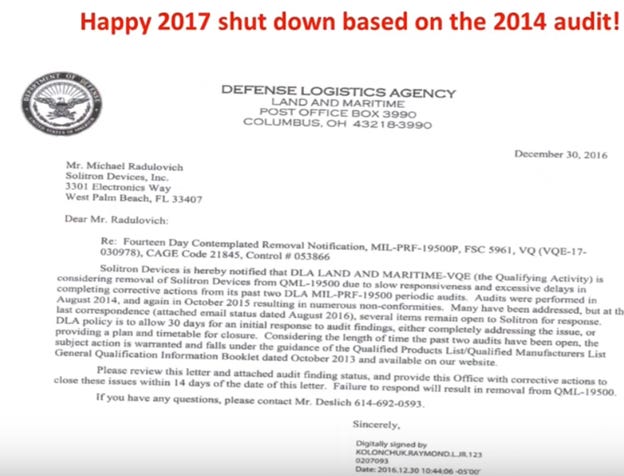

As the keys to the building were handed over, the new management team then immediately ended up dealing with a shut down by the DoD over quality concerns and an accounting problem that is one of the strangest arguments with accountants we have ever seen, causing a few years of issues getting audited financial statements out and burning cash to deal with it (both now resolved).

The Company is making operational changes that are creating step-changes in their cost structure.

Takeover Battle

Cedar Creek Partners is an interesting shop. They focus on concentrated investments in the small caps. They “believe that meaningful outperformance can be achieved by being a smaller player and finding niches that are too small for larger funds.” It is run by Tim Eriksen, who is a thoughtful value-oriented investor. The fund has managed to grow at about 14% a year on average since 2006. They sometimes get involved, but we would not consider them an “activist investor” in the traditional sense. Taking over Solitron is a bit outside of their typical mandate and was not the original plan.

Solitron’s previously entrenched management team and the Board did not seem to have shareholders interests top of mind. Here’s the background from a 2016 Cedar Creek letter:

Update on Solitron Devices - Two years ago we started buying shares of a very tiny illiquid company called Solitron Devices (SODI). At the time of our purchase we expected a 12-24 month timeframe before we would see any meaningful returns. In the summer of 2014 the company was earning approximately $800,000 per year, had $7.2 million in cash, and a market value of $9 million. The problem was how shareholders were being treated. Annual meetings were not held between 1993 and 2012. When meetings were finally held in 2013 and 2014, shareholders voted against every director but the Board would just appoint someone new. Once it even appointed the same guy shareholders had just voted off. Based on the cash level we felt we had a low probability of loss and a good probability of decent gains. By late 2014 we filed as a 5% owner. We asked to be considered for a board seat, which was rejected. In early 2015 we announced our intention to run two rival directors for board seats. We had never seriously attempted any activism before. It was more time consuming and expensive than we thought. At the 2015 annual meeting we resoundingly won two seats to the Board by getting nearly 67% of the vote. Unfortunately, the Board spent significantly to fight against us, we still only had two of five board seats, and to make matters worse, business results soon began to decline. Sales have declined for five quarters in a row and the company has reported losses in three of the last four quarters (mostly due to legal fees). Thanks to the large cash balance, the position has only declined in value by about 5% since purchase, net of dividends received. After an immense amount of effort by the Board, we are pleased to report that last Friday after market Solitron issued a press release announcing significant changes. The CEO is retiring, the company entered into a separation agreement which includes the company repurchasing his stock and options, a new COO has been hired, I have been named CEO, and David Pointer, the other nominee in my proxy fight, has been named Chairman.

You can find all of their letters here, and we have put together all of the highlights together for you (button below) and are sourced from - https://www.eriksencapitalmgmt.com/investor-letters

They stepped in thinking they could make a few changes for efficiency and cost management. Instead, they realized that: 1) The Company’s customers, and ultimate customer (the U.S. government) were very unhappy that Solitron was not maintaining its standards, and so Solitron was losing new business and even some existing business, 2) had also not been investing in future business at all, and 3) former management stumbled into an argument with their accountants that cost a few million to resolve and a few years. Those flat but stable sales for an entire decade through to 2016 did not tell the story of what was happening inside the Company. Yikes!

The New Solitron

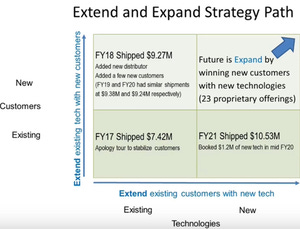

A lot has changed since the management switch. Only two employees that were there in 2016 are still there. While operational improvements have been going on and are significant (see New Facility next), they have also started a completely new line of Silicon Carbide products, which are the next generation of power modules and have been used extensively in EVs already. They used the reset of staff and COVID to develop a brand new portfolio of products. They also rebuilt relationships from scratch (an “apology tour” as management calls it). The VP of sales Jack Worthen also came back. He was here at 2013/2014 and joined based on the business plan of the new management team.

We should note that historically they have manufactured everything themselves but are not manufacturing these new products given the dynamics in the space. There are 5-6 core companies making the wafers and Solitron is using the advantages of leveraging these suppliers to then create standard and custom products for customers. The advantage of standard products that can be customized is that the customer says “gee can if it just was changed in this way it could be used in our system. Can you make something just slightly different?” The focus is on stickiness. They appear to be making good progress on their new product portfolio, but frankly it is just hard to be sure given how niche this is.

Revamping the Business - New Facility Example

They have done a lot of things to streamline costs while also working on developing new products. The most obvious and best example is their new facility, which they just finished moving into. In 2021 Solitron “announced it had entered into an agreement to purchase a new building for $4.2 million, and expects to make improvements to the building in order to relocate its existing operations later in the calendar year. Currently Soliton is in a rented facility. Subsequent to the end of the quarter, Solitron closed on the building purchase, putting 25% down and financing the balance at 3.8% fixed rate for the first ten years.” Through a combination of savings on rent, utilities, and equipment changes, they expect to save ~$1 million a year.

The assumptions seem reasonable and are quite amazing, given the size of the Company.

DoD and Accounting Shenanigans

As we do not want to make this article too long, we note that the DoD issue and the accounting audit issues have both been resolved. Here is what an angry letter from the Department of Defense looks like.

Accounting - As noted in our previous press release, we terminated our auditor in January 2019. Based on a number of factors, including the Company’s current cash levels and estimated costs to complete audits for fiscal years 2017 through 2019, the Board has made the determination that it is in the best interest of shareholders for the company to rebuild its cash position before hiring an auditor. Therefore, at this time, it is unlikely that fiscal 2020 results will be audited.

…

The Company has incurred an unaudited cumulative loss of approximately $1.6 million over the twenty-two months since the audit began (the end of fiscal 2017 through December 2018), nearly all of the loss occurring in fiscal 2019. Approximately $1.4 million of the loss is directly attributable to the costs of the audit and the 10A investigation demanded by the auditors which we believe was unnecessary.

The new auditor came in with the first year being 2020, with no issues since.

Where does this leave us today?

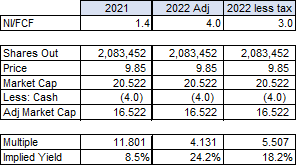

That’s a lot of moving pieces, and we have done our best to make adjustments. We note that 2021 sales and inventory are a bit inflated as one of the cost cutting measures was building up inventory in certain legacy products and then discontinuing them and not moving the equipment to the new facility.

Key questions are:

• What are the true run-rate operating costs today?

• Will the Company have success with their new line of products?

• Is the benefit of having third party manufacturers heavily involved in the process for these new products outweigh the risk that they can lose business by being cut out of the process?

• Where will the Company put their money? (Management notes they are repurchasing shares and looking at potential acquisitions)

As of writing, we are still on the sidelines because of these questions. The Company’s stock price to us does not imply much if any growth and does not seem to even incorporate the cost savings from their initiatives. Yet, there is a lot of noise in the numbers. If they are successful, this could be quite something. We are going to go dwell over this while re-watching Top Gun and Lord of War. In the meantime, this is a great reminder that you always have to look into the numbers and to pay attention to what management is and is not telling you. The flat but stable sales through to 2016 hid a lot of rot in the business.

For more background we suggest you start by watching a recent shareholder meeting of theirs:

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).