Solitron Devices, Inc. OTC:SODI Q3 Update

Here is the latest from Canadian Value Investors!

-CVI Soapbox - “Predicting” inflation

-Ideas from around the web

-Solitron Devices, Inc. OTC:SODI Q3 Update

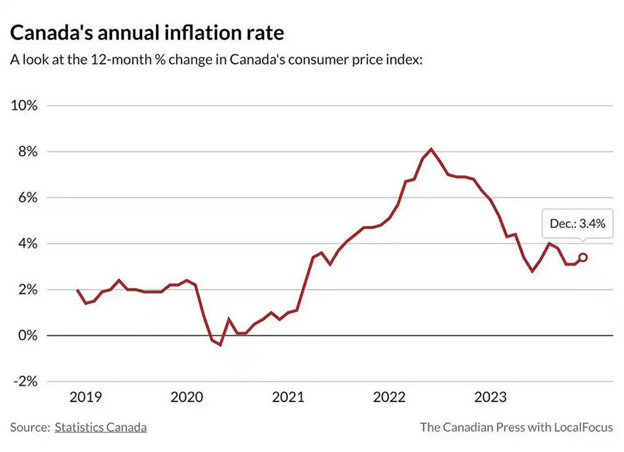

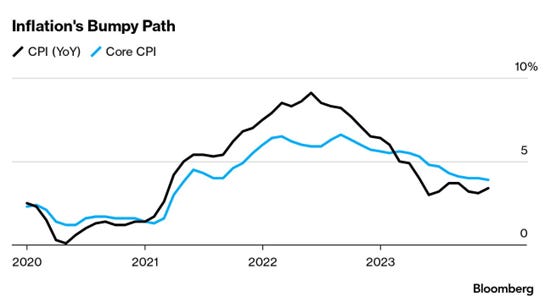

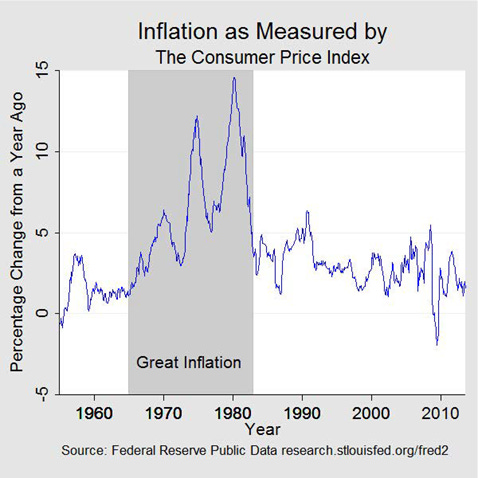

“Predicting” inflation

We have been reading a lot of “when interest rates are cut in a month or two” type-analysis. Maybe rates will not get cut, or at least the pa. We would rather focus on companies that can float well in many different interest rate environments, rather than have our thesis even partially rely on something that even the “best” forecasters have such a bad track record of predicting - https://www.federalreservehistory.org/essays/great-inflation

Ideas from around the web

Disclosure: We have no positions in these at time of posting.

AerCap Holdings (AER)

“Imagine a stock trading below 8x fwd P/E. The CEO strategically sells company assets above book value and uses the proceeds to buy back shares below book value. They're on track to repurchase about 20% of their shares in 2023!”

Dada Nexus (DADA)

A Chinese last mile delivery service and on demand retail platform reported that about 500mn RMB ($70mn US) of revenue and costs were overstated for the first 3 reported quarters of 2023. Now trading below cash, and issue was not in core business, while key shareholder JD owns 50%.

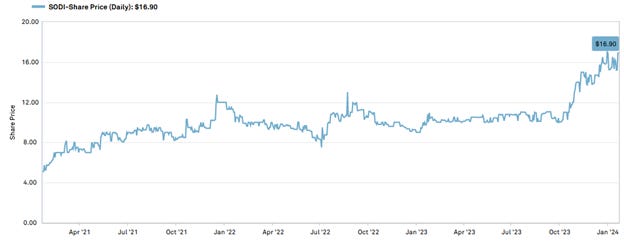

Solitron Devices, Inc. OTC:SODI Q3 Update

Disclosure: We own this one.

We have been following Solitron since early 2022 and started purchasing shortly after the press released their acquisition of Micro Engineering, Inc.

https://microeng.com/

We have added the key posts from our www.canadianvalueinvestors.com archives to Substack for this update:

-First post in 2022 with full background - https://canadianvalueinvestors.substack.com/p/solitron-devices-inc-otcpksodi-reading

-June 2023 update - https://canadianvalueinvestors.substack.com/p/solitron-devices-inc-otcpksodi-is

There is a lot happening over at Solitron and thought it was worthwhile to do an update.

How are things going for Solitron?

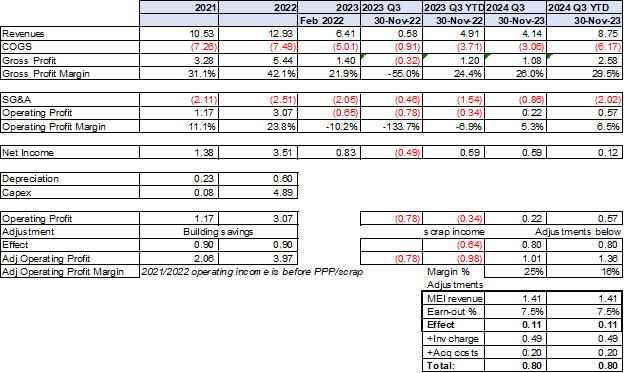

As a reminder, their core manufacturing business is power transistors and control modules primarily as a small but absolutely essential input into various weapons systems. It was historically run out of one leased facility, but in 2021 (under new leadership) they decided to find and purchase their own facility. They built up stock, closed down the old facility, and moved the equipment to the new facility. The move was done in the three months ending November 2022, or Q3 FY2023 (year-end is February to add to the confusion).

Note: If you are not familiar with Solitron, the full background post is essential.

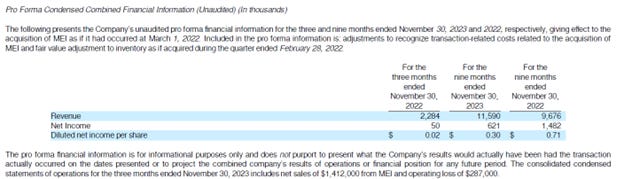

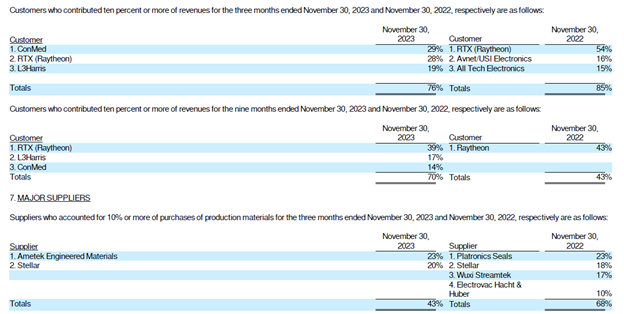

As we noted last summer, the Company stepped out of its core business into a somewhat related business, acquiring Micro Engineering, Inc. (see June 2023 update). As expected, more than half of MEI’s sales are to one customer, ConMed. You can see the before and after impact on customer concentration below:

Key question for the core defense business is the backlog, which seems healthy. Here are the notes year-over-year:

November 2022 note - Net bookings for the three months ended November 30, 2022 increased 68% to $2,257,000 versus $1,340,000 during the three months ended November 30, 2021. Backlog as of November 30, 2022 increased 101% to $6,430,000 as compared to a backlog of $3,197,000 as of November 30, 2021.

November 2023 Note - Net bookings for the three months ended November 30, 2023 increased 115% to $4,842,000 versus $2,257,000 during the three months ended November 30, 2022. Backlog as of November 30, 2023 increased 102% to $12,986,000 as compared to a backlog of $6,430,000 as of November 30, 2022.

The macro picture continues to get better for them (and unfortunately worse for global stability). For example, “the US said Patriot missile interceptors shot down a number of the missiles in Sunday’s attack [on a U.S. base in Iraq], which also involved rockets flying at lower altitudes, possibly in an attempt to overwhelm air defences.” The patriot system is one of the largest programs Solitron contributes to. https://www.thenationalnews.com/mena/iraq/2024/01/21/us-iraq-missile-attack-al-asad/

Sifting through the noise

With moving the facility, acquiring a second business, and gains and losses on marketable securities investments, the financial statements over the last few years are understandably noisy. Cedar Creek (the fund the CEO, Tim Eriksen, runs and now owns/controls over 15% of Solitron) provided additional context in their last letter:

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.