Disclosure: We are long this at time of posting.

Would you be interested in a company growing revenue at 10% a year, has returns on equity in the high teens, is buying back shares, and trading at 5x free cash flow? What if I told you this was business that primarily sold envelopes… and that this company is making almost every envelope in Canada. Are you interested, but a little confused now? That is how we felt when we first wrote about Supremex in 2022. At the time we went through a decade of conference call transcripts and twenty years of financials to try and figure it out.

It’s not all roses, but it’s neat. The Company has faced some recent headwinds in packaging and envelopes is in decline, but we think the current negativity might be excessive and not taking into account the potential of their packaging business, never mind the value of owned facilities.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The Sorpranos – Season 6 – Envelopes are being used less these days... but they’re still being used.

The Evolution of Supremex

Supremex today is very different than the Supremex of 2007 (when they IPO’d). They were originally just Canadian envelopes, but inside of what should be a seemingly sleepy business in decline is a growing niche packaging business that now makes up a significant portion of revenues and a U.S. envelope business now too.

The Supremex business was originally founded in 1977 and was initially a small-time player in the envelope world. By 1991, Supremex had become Canada’ s third largest envelope manufacturer (now #1), went through a bunch more transactions, and then was ultimately sold to Cenveo (then Mail-Well Holdings Inc.).

In 2007 Supremex was spun off from Cenveo to help Cenveo de-lever and this is the Supremex we have today. Interestingly, Cenveo subsequently went into Chapter 11 in the late 2010s, emerging in 2018 (debt reduced from $1.1 billion to $235MM). https://www.financierworldwide.com/cenveo-emerges-from-chapter-11-protection#.Y1BlCOTMJaY Cenveo is currently the largest envelope maker in the U.S.

Strategy

In 2014 the company was worried about their sole business line - Canadian envelopes - being in structural decline. To address this, their strategy was to: 1) Consolidate envelope manufacturers in Canada and selectively in the northeastern U.S. to gain economies of scale and pricing power, and 2) Use cash flow to grow a niche packaging business while paying dividends and buying back shares.

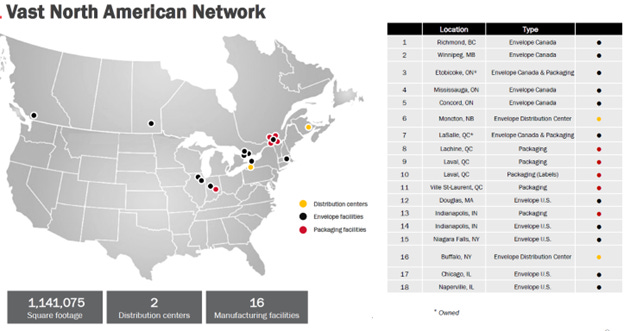

They have been active and the acquisition list is long, evenly split between packaging and envelope as shown below. Throughout the last decade they have acquired most of their competitors in Canada, and either have a geographic monopoly or near monopoly for most regions of Canada, with Supremex now producing ~90% of Canadian envelopes. Note that paper, envelopes, and packaging are low value items not worth shipping long distances (<1,000 KM historically, and less so in a high shipping cost world). The purchase of Royal Envelope cemented their lead in Canada and there are no material competitors left to acquire.

Here we compare their footprint in 2015 to today.

Mail is in decline, but they have managed to pass through costs and actually have grown margins over time, offsetting existing volumes with acquisitions, continued consolidation of facilities and price increases, so far. All of this has led to Canadian volume declines being offset by additional cost cutting, price increases, and acquisitions.

The Products

We should note that envelopes consist of both stock (e.g. Costco) and custom (e.g. bank debit card envelopes banks mail to you), while packaging is a mix of niche folding carton (higher differentiation, e.g. pharmaceuticals, consumer packaged goods) and commodity-type corrugate. The packaging split is roughly 50-50.

They managed well through the pandemic, but both envelopes and packaging hit a post-COVID slowdown. However, they continue to consolidate facilities and focus on cost control. They also seem quite diligent in general, including firing unprofitable customers.

April 2022 AGM Strategy Overview/Update

“We operate in 2 similar markets, namely envelope and packaging, but they have very different characteristics. The envelope market has been in secular decline for over 10 years. The Canadian market is approximately $115 million in size and has declined, on average, by 6.5% per year. Supremex enjoys approximately 85% of this market. Conversely, the U.S. envelope market is approximately 20x greater than the Canadian market and has declined approximately 3.4% per year over the past several. Although we have less than 3% market share in the U.S., we can cost effectively shift to 60% of the market from our facilities.

On the other hand, the packaging market continues to grow. Over the past 10 years, the Canadian market has averaged 11.8% growth per year while the U.S. market has grown at 11.2% on average over the past decade. Given these market trends, in 2014, we adopted a succinct growth strategy: one, leverage our Canadian envelope market position, our capacity and know-how as one of North America's largest envelope manufacturers and utilized its attractive cash yield to fund the pivot to packaging. In other words, we set out to stabilize our envelope segment and build our packaging capabilities. Our focus is to achieve equal revenue split between the envelope and packaging segments. I note that as recently as 2014, only 7% of our revenues were generated in packaging, and today, it is 31%. We are well on our way.”

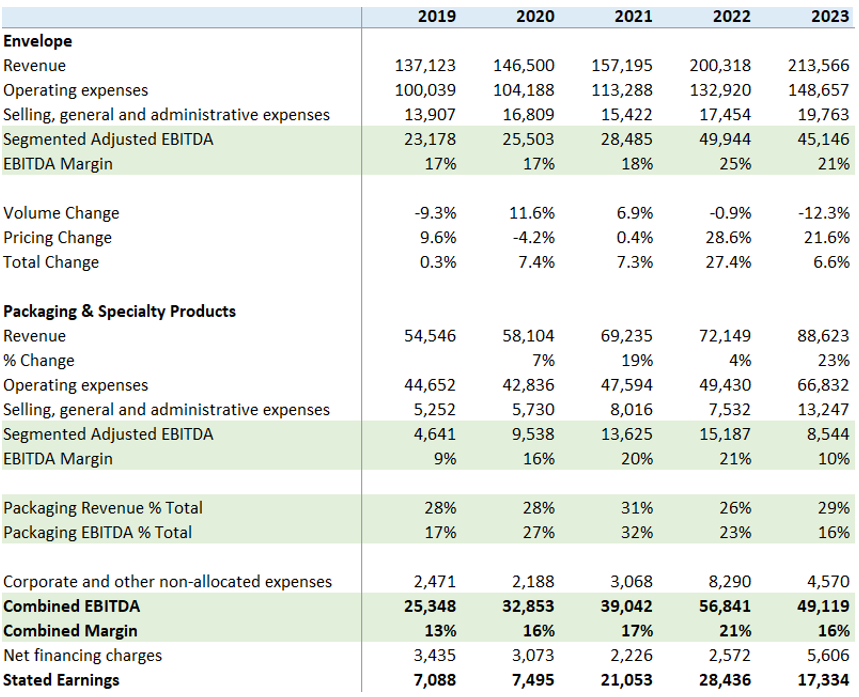

Product Segments: The numbers today versus yesterday

It is fun how numbers can tell a story. You can see the growth in U.S. sales and U.S. envelope/packaging unfold over time, and how Canadian acquisitions have offset natural declines. Although there is not anything of size left to acquire in Canada, an interesting thing they are doing is using the Canadian envelope facilities to sell on the U.S. side, allowing them to benefit from Canadian dollar cost advantages versus the U.S. dollar (at the moment anyway) and keep volumes higher. They have so far been able to pass through price increases, much better than we thought they would be able to (albeit we worry about it accelerating demand destruction). Per our original look:

Subsequently, they continued passing through envelope costs and grew packaging through acquisitions while prudently managing debt. However, it is important to note that packaging volumes were significantly down on an organic basis in 2023 and input costs have been declining while their margins have not been maintained, implying that they have not been able to hold onto incremental margin in the recent slowdown.

Their edge, offset by recent headwinds

They have consolidated envelope operations and have high market share in Canada and regionally in the U.S. Although it is in decline, they are doing the right things to maintain the business as best as they can.

Focusing on being a stable go-to partner helps keep business and margins. Competitors appear to be acting rationally. Continued consolidation on the paper supply side makes their long-term relationships with suppliers and customers more valuable. The soft side indicators appear to be good. For example, they appear to have managed employee relations better than some competitors during COVID (they did not furlough) and this might help manage costs/staffing, at least temporarily, if things remain tight and inflationary.

Diversification seems to be working, but recent hiccups make is cautious. Their packaging business was performing well. Between acquisitions and capex, the packaging business has taken up about $75 million of capital and is providing a mid-teens return (see below, though EBITDA should actually be reduced for a maintenance capex requirement). However, there have recently been stumbles with integrations and related volume, and organic sales declined when you back out their recent acquisition.

Packaging had some tailwinds beginning in 2022. Per their Q1 2022 call –

“The Packaging segment is getting a boost on the environmental side. Our Packaging segment is getting a boost on the environmental side is more pressure. More pressure is applied to have more sustainable products. And all of our products are paper based, so it tends to be an area where consumers are starting to look. So where there is a demand, they increase as well.”

They were actually in a backlog situation at the time – Stewart Emerson President, CEO & Director - Backlog, so new requests, customers showing up today, we're taking no new requests at this point from new customers and haven't for several months. And someone trying to get in the queue right now without sort of our current position would be looking at October, November at earliest. But we have left some space for committed customers that have sort of unforeseen demand. So we're pushed out quite a ways.”

We noted in 2022 that we do not want to bet that things remain this good in packaging as competitors have a nasty habit of stepping up in general. We are more confident of this not happening in the envelope space. Subsequently, as noted in their Q4 call, they have had some issues.

Turning to Packaging, I'll start with we are not happy or satisfied with our results. We have terrific assets, products and participate in desirable verticals and geographic markets and the packaging industries have the same headwinds as Envelopes.

We were not nimble enough or deep enough to overcome the challenges to the same degree. We like to say there's no wining in Envelope and Packaging, and it was instilled in me a long time ago, and it's a very fine line between an explanation and an excuse, but I'll take a stab at giving you some color while trying hard not to make excuses or whine. Well, we don't have the same empirical evidence we do with the United States Postal Service, we do have a number of anecdotal data points, including industry associations, M&A reviews, and maybe most importantly, contractual business that generally tracks with the wider industry. And all indications are that CPG focused packaging businesses have been experiencing virtually the same volume related challenges that Supremex packaging has been facing. I believe I use the analogy last quarter that for many right now, as weekly grocery bills significantly outpace wage gains, that bounce dryer sheets are a luxury item that many are foregoing as budgets get pinched and consequently the box manufacturers getting squeezed as well.

And this repeats itself across a number of verticals, including health and beauty, vitamins and e-commerce purchases. It is fair to say that sales and volume growth was bumpier than anticipated, and it's been and it has been for longer than anticipated time. However, like the Envelope segment, the Packaging segment also appears to be slowly coming out of a long slumber, and with significantly improved operations and a revamped sales team, weare well-positioned to capitalize.

We had a lot on our plate for 2023 with acquisitions to integrate and plans to relocate. In Q1 and Q2, we were completing the move and commissioning of our flagship folding carton location in machine and had much more cost overhang and inefficiencies than we would have liked.

The Capital Conundrum

“Keeping up with the Joneses” capex is a real risk here. When Berkshire Hathaway still ran textile mills, a key problem in the dying textile industry was companies spending tremendous amounts of money on capex improvements to improve efficiencies and lower costs, only to lose all of those benefits to their customers due to lack of pricing power. Supremex talks about low maintenance capex requirements (~$2-3MM per year), but they keep finding new “growth” capex and acquisitions.

Connected with this issue is the packaging business has been difficult to parse out. It is fragmented, different dynamics within subcategories, and they have been in this business during an exceptionally volatile period of time.

So far they appear to be prudent allocators of capital though, thoughtfully consolidating facilities and focusing on efficiencies and demonstrating margin protection (mostly, at least so far). We note that there are no incremental envelope competitors to purchase in Canada. As shown below, by our calculation of owner earnings since 2019, it has been eaten up by acquisitions, but the business today even with the declines is arguably better than it was five years ago. The Company has also repurchased 10% of their float over the period and has resumed dividends with two increases since they prudently paused during COVID in 2020.

What happens if acquisitions stop and they continued repurchases? One hypothetical scenario below. We struggle to be bullish on this one, but keep coming back to the price. We remain long in the meantime.

Some Key Considerations

What if the envelope business declines faster than the expected? What happens if it disappears completely tomorrow? – In general, when we analyze a business, we think about it using a range of scenarios and then estimate their probabilities. We hope that the envelope business is resilient and packaging grows. But, last year was particularly bad due to what seems like post-COVID inventory unwind at the customer level. The scenario above assumes a 10% annual decline in envelopes (vs ~6% prior to this historically) and 5% increase in packaging.

How good is the packaging business really? – We assume lower growth and lower margins and view upside via better packaging performance as being “free”.

There is hidden real estate value in the Canadian envelope business – The owned real estate attached to the Canadian envelope business is estimated to be worth $62 million or about $2.30 per share as per a recent shareholder proposal (see interesting points below). We view this as potential free upside (though we note that selling owned facilities would increase operating costs and add operational risk) and can also be thought of as the terminal/floor value of the envelope business if it was totally wound up.

Repurchases of shares started in 2020 and have been pretty material (~10% of shares outstanding). If these continue the impact could be quite significant for per share returns as demonstrated above.

They continue to be pretty prudent with the use of debt. They do want to continue to grow the packaging business and you should expect another acquisition or two.

Will they continue to be able to flow through envelope cost increases without destroying demand? – This is particularly a concern on the envelope side, as some customers who decrease purchases are sometimes doing so permanently. An example of this is envelopes for ATM deposits. All major banks have upgraded their ATMs to no longer require deposit envelopes, causing this customer segment for Supremex to disappear permanently. The higher the cost, the higher the incentive is to permanently remove this cost.

Background Notes

Cost efficiencies through consolidation

Customer dynamics and pricing

Owner earnings

Why did they go into U.S. envelopes anyway?

Structural issues in paper

Printer Gateway Boondoggle

Hidden Real Estate Value

Buyback / Dividends History

Envelope business – U.S. vs Canada

Pricing

U.S. volume

Building packaging and specialty products

Note: Cost Efficiencies Through Consolidation

Q1 2022 Stewart Emerson – “Well, the profitability is coming from all of the things you talked about. I mean, we closed the factory in Edmonton last year. We ceased manufacturing in New Brunswick. We've improved operations all the way around… They're all more efficient now, even though we're doing more cutting and chopping of orders, so that --to preserve paper for the next guy. All of the plants are more operationally efficient. We're more mature as an organization. I don't want to say the -- we're finishing up integration, but we're more mature as an organization, particularly on the packaging side.”

There are a lot of efficiency initiatives in the background. For example, per their 2017 Q3 call about insourcing corrugate –“Earlier in the year, we reconditioned Durabox's corrugator and realized roughly 10% to 12% in increased capacity. It should be noted that this increased capacity was applied to reducing the amount of corrugate we had to purchase as an outsource and was not for additional sales. The corrugator is fully utilized, and we are currently producing approximately 3/4 of our corrugated sheet requirements in-house. The balance is purchased outside.” In their Q4 2023 call they noted “we completed the closure of the St-Hyacinthe facility during the fourth quarter, sold excess equipment and transferred production to other locations in the greater Montreal area. We expect these initiatives to result in total annual cost savings of approximately CAD 1.5 million.”

Note: Customer Dynamics and Pricing

The dynamics of envelopes and packaging are very different, but Supremex has demonstrated pricing power in both, albeit with packaging having recent challenges. However, one concern we have is demand destruction from higher prices, particularly in the envelope space (see conclusion/key risks).

They argued in 2018 that it is “much easier to pass along costs [in packaging than envelopes], there tends to be -- while there is not as much overcapacity is the biggest driver. The big guys that are larger players in that folding carton space are like Supremex are in the Canadian envelope side, they're very aggressive at passing them through. But still if you lag, the customer will let you lag. And then the other part is that the contracts tend not to have longer lag times like some of the envelope contracts do.”

The ability to pass along costs in envelopes in the 2000s, even early to mid 2010s, was difficult given market fragmentation, but they appear to have much more success now given the concentration that has occurred.

The dynamics of packaging can be summed up from their 2017 calls

“Yes. So the first one we talked about was a couple of their larger customers, multinational consumer packaged goods companies limit their purchasing to X% of a supplier's total revenue. The sense is that we'll be able to move on that fairly quickly. So Stuart being, call it an $18 million business, was very restricted with a couple of these large multinationals. Now that they're part of a $200 million operation, we should be able to -- one of the customers we were actually awarded supplier of the year last year, and we maxed out actually -- completely maxed at what we were able to sell them.”…

One thing I've learned in the large multinational consumer packaged goods companies, they all seem to have a policy in place where they do not want to be more than 20%, 25% of a supplier's revenue.

I think it's a little bit risk management and they just don't want to be in a position where they could adversely affect the viability of an organization by pulling pieces of the business. So Stuart was, call it a $20 million business that was at those thresholds and maybe over those thresholds for a couple of its core customers. And now they're part of a $200 million company. And as a result, the penetration -- they call it the penetration rates, are much lower. I've been to visit 2 of the -- the 2 customers that we were sort of at that level with and extremely pleased with the development so that they wanted to put more business into Stuart just because of their quality and reputation and reliability. And as a result, we picked up a line of business with one of those players strictly as a result of having more room or reduced penetration rate. So that's paid -- right out of the gate paid some nice dividends.”

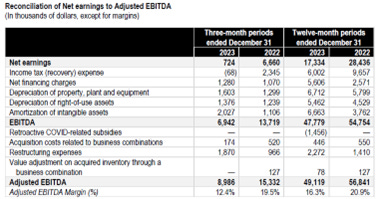

Owner Earnings

We want to flag that you have to make sure to calculate owner earnings. In Supremex’s case, their depreciation is much higher than actual capex needs, as PPE outstrips cash capex and, connected to this, intangibles related to acquisitions. This causes actual owner earnings to be understated if you just look at the income statement. We prefer to back out these items to see the current earning power of the business and have acquisitions taken into account in the capital employed.

Why did they go into U.S. Envelopes anyway?

Q4 2020 Call – [Would you buy a U.S. west coast envelope company or another packing company] Yes. So categorically, I mean, never say never. But our thrust in the U.S. envelope has really been around offsetting secular decline in the Canadian operations. And the hub of the Canadian operations are Toronto and Montreal. We don't have a ton of excess capacity in Western Canada. So not a lot of synergies or we wouldn't really be a strategic buyer in West Coast U.S. So highly unlikely that we would pursue anything on the West Coast and there's sort of nothing in U.S. envelope even in the east.

Will they make more Canadian or U.S. envelope acquisitions? Per the Q1 2021 call, no – “So never is a long time, but I don't see us doing another envelope acquisition in the near future. We've been pretty clear that the envelope acquisitions in the U.S. were designed solely to give us broader reach for capacity from Canada. We think our footprint there gives us access to about 60% of a huge market, of which we only have about 5% market share. So there's no need to tuck-in another envelope company to give us more reach. It's more about adding the resources, delivering a compelling value proposition and just executing on the value proposition.

On the packaging side, I mean, we've stated clearly that our objective is to be 50-50 -- sorry, before I leave envelope, there's really nobody left in Canada that would make sense for us at all. We've said clearly, we expect -- we want to be 50-50 packaging and envelope in the not-too-distant future. The opportunity while we pursued them to add Royal Envelope last year, which kind of made the delta a little bit tougher to reach. But we're going -- we expect to be able to do the 50-50 split through a combination of organic growth and M&A. We're comfortable with our liquidity, particularly as we continue to generate free cash.

Interestingly the key current constraint is paper (with paper plants going through a similar consolidation and many closing) – “In both Envelope and Packaging, we are operating in a period of a significantly constrained paper market. Although we have solid relationships with suppliers for a multitude of reasons, supply is tight, and it's a real challenge to meet existing obligations, much less capitalize on new opportunities. Backlogs are very strong. There are a lot of opportunities, and all of our facilities have available capacity, but paper continues to be an inhibitor to growth and will be for the next few quarters.

To address this tightness, we have sought out alternative sources of supply. And while it won't solve all of our problems, I'm pleased to report that we have secured additional shipments of high-quality paper, which is expected to start to arrive in early Q3. These alternative sources come at a premium price, but taking care of committed customers and meeting obligations is paramount to us. And we believe going this route in the long term is in the best interest of all Supremex stakeholders.”

Structural issues in paper

Per Q2 2022 – “Make no mistake, there are 2 forces at play in the envelope space today, and they're going to be with us for some time. Paper is going to remain tight for the foreseeable future. Those with strong supply chains and good balance sheets have a distinct advantage. The North American envelope -- and two,

the North American envelope industry cannot make nearly as many envelopes today as it could pre-pandemic. And let's face it, workers that were furloughed from envelope plants and found new jobs, many in emerging industries are not going to return to former employers anytime soon. The market is significantly constrained, and we are extremely well positioned, and this is why year-to-date envelope units are appreciably up and sales are up significantly. The runway in envelope has been considerably extended, some of it by things we have done, some of it by decisions of our competitors made in a time of crisis. In keeping with the baseball analogy, not only are we not behind with 2 outs in the bottom of the ninth, we actually have the lead. There's nobody out and we're ahead in the count.”

The new suppliers are overseas.

Q: Are these new suppliers and can you pass through the costs? – CEO new suppliers. We think that domestic low -- or the domestic supply should ebb in late Q3. So we went out and sourced some paper from new suppliers. It takes a little bit of time to get in the queue and get it to North America.

But on the margin compression, that's the $64,000 question. Some of that new supply will go to ensuring that existing customers and existing commitments are fulfilled. We think we can recoup some of the increased cost. And then some of that supply should go -- will go to new opportunities that we'll be able to pass through in full. So the split, I was just not completely sure of at this point.

Printer Gateway Boondoggle

Their acquisitions have largely been successful. A notable exception is Printer Gateway.

2017 Q4 – “With respect to Printer Gateway. As many of you know, we have had integration issues with our Printer Gateway operations since their acquisition just over a year ago. From the beginning, we experienced a difficult transition, including equipment issues and acquired leadership resources. Compounding the difficulties in transition, one of Printer Gateway's largest and most integrated customer unexpectedly ceased to operate in Canada at precisely the same time we were moving the business. In the third quarter, after protracted negotiations with the seller, our full escrow of $500,000 was returned, in addition to modest other amounts to satisfy the reps and warranties. Despite all of the above, we believe we have a -- we had a clear path to profitability. However, after careful analysis, we determined that this business required disproportionate management attention and resources to achieve acceptable profitability, especially given the subsequent acquisition of Stuart Packaging and our other more profitable and growing operations. From there, a swift decision was made to close this business on January 22, 2018, and to dedicate our resources to further grow our packaging operations and ensure our envelope businesses had the resources and the attention they deserve and need. Printer Gateway was acquired on December 23, 2016, for an initial cash consideration of $2.9 million. The EBITDA loss attributable to Printer Gateway of $400,000 in the fourth quarter and $1.4 million during 2017. Closing this operation will not affect our other operations and will even improve our operational profitability going forward. The impairment charge, including cost to shutdown, amounted to $2.2 million. Finally, we are in the process of liquidating the business and selling the building.”

2017 question - So in hindsight, was there anything that you took away or you saved or it was positive from the transaction? Or was it really a, God, I wish we hadn't done that?

Stewart Emerson President, CEO & Director - Well, it was a, God, I wish we hadn't done that. But at the same time, we're going to utilize the software in some of our envelope operations. So there is a bit of a benefit there.

Hidden Real Estate Value

2022 Shareholder Proposal by Mr. George Christopoulos at April 2022 AGM (71.4% voted against) – The proposal reads as follows: Supremex Inc. immediately sell and lease back 2 owned real estate properties located at 400 Humberline Drive, Toronto and 7213 Rue Cordner, Montreal and surface very significant hidden value of approximately $62 million or about $2.30 per share.

Buybacks / Dividends History

Rebought during very volatile period Q3 2020 – Q3 call “During the third quarter of 2020, we purchased for cancellation 152,900 shares under our NCIB program, which was initiated earlier in the quarter.”

Q4 2020 Discussion on dividend elimination - On the capital allocation front, with the ongoing threat of the pandemic, we elected to pursue a conservative approach and suspended our quarterly dividends starting in the second quarter and focused on returning shareholder value by deleveraging and repurchasing shares through the NCIB. With the pandemic ongoing, we are maintaining this approach and focusing our efforts to further improving operating efficiencies and building a stronger packaging platform to emerge with a stronger balance sheet and significantly improved cash flow generating capabilities.

Q3 2021 Repurchases continue with dividend cut - On August 27, 2021, we received approval from the TSX to renew our NCIB and purchase for cancellation up to 1.3 million of our common shares representing approximately 5% of our $26.9 million issued

in outstanding common shares as of August 18, 2021. Purchases under the NCIB will be made over a maximum period of 12 months beginning on August 31, 2021, and ending on August 30, 2022.

During the third quarter, the company purchased 292,400 common shares for cancellation under its current and prior NCIB program for a total consideration of $700,000. Year-to-date, the company purchased a little over 1 million common shares for a total consideration of $2.3 million. Subsequent to the end of the period, an additional 150,300 shares were purchased for cancellation for a total consideration of $347,855.

2022 Reinstatement - On January 5, 2022, the Board of Directors declared a dividend of $0.25 per common share payable on February 15 to the shareholders of record at the close of business on January 31. On January 6, 2022, we announced the reinstatement of the company's quarterly dividend after having suspended them in the early months of the pandemic. In line with this, yesterday, the Board declared a dividend of $0.25 per common share payable on April 8, 2022, to shareholders of record at the close of business on March 24, 2022.

Q2 2022 - We intend to renew our Normal Course Issuer Bid, which has been very active over the past 12 months. Since the start of the current NCIB, scheduled to expire August 16 of this year, we've repurchased a total of 1,326,200 common shares, representing 4.7% of the total shares outstanding. We believe the combination of the NCIB renewal and the continued dedication to our growth and diversification objectives is a capital allocation strategy that has the potential to return the most value to shareholders.

Envelope Business - Canadian VS U.S. Market Dynamics

Q2 2018 – “The capacity -- the majority of the capacity remains with Supremex or the available capacity remains with Supremex. I think the bigger constraint that we didn't really talk about, but the bigger constraint in both the Canadian and U.S. envelope markets are the paper conditions. What's driving these 3 increases in 3 quarters is that paper supply is incredibly tight, incredibly tight. If you've been a smaller purchaser of envelope paper, they are allocate -- the mills are allocating just what you've purchased in the last 2 or 3 months. If you're a larger player like Supremex being the third or fourth largest in North America, we have a little bit more availability and flexibility in terms of -- or a little more leverage with the mills, let's say. But even a company like Supremex the paper is very tight, lead times are way out there. So it's not like the local market competitors could just phone up the mill and ask for another 15% or 20% of paper. They just -- they can't get it because the market is so tight and that's really what's driving these price increases. So that goes to the point, but I think where you're trying to get at or I am surmising where you're trying to get to is how much more risk is there that your local market competitors are going to take it. Who knows, but they do have -- they have some constraints as well, both from a capacity and from a paper supply standpoint. U.S. market, in the markets that we operate in, it hasn't really changed much from a pure capacity standpoint. The structural change with Cenveo and such, they haven't really done anything in our local trading markets. So capacity hasn't materially changed. But I would say that the --it's clear to us and everybody is feeling the tightness or the pinch of supply of paper.”

I think, the U.S. supply-demand balance is very different than Canada. I think there's a fair bit of capacity, machine capacity. The constraint now being availability of paper. So in the U.S. Supremex doesn't have a paper constraint because its volume is down 12% than Canada. So we can take that paper and ship it to the U.S. operations or have it shipped to the U.S. operations or we can continue to have it shipped here but make the U.S. volume in Canada. So -- where our competitors in the U.S., so there's lots of machine capacity, let's say, in the U.S, the constraint -- we don't have the same constraint from a paper standpoint as our U.S. competitors do, A, because we're a little bit larger and, B, because we've lost those units in Canada, we still have access to the paper for the units we lost, if that makes any sense [ for you ].

Pricing

2017 Q3 call – “I can tell you that we've noticed or experienced some pricing pressures passing through cost increases, whether there's a small paper increase going through right now. Window film has been up, partially offset by the decline or by the improvement in the Canadian dollar, making the Canadian costs less expensive. But it is difficult to pass through price increases in the current -- cost increases in the current environment, which is why we're laser-focused on operational efficiencies.

2017 comment on Cenveo filing Chapter 11 – “Capacity and demand are out of balance right now, which leads to margin pressures, and I think the competitor that filed recently was chasing cash flow in a lot of ways. So we expect to see more rational pricing going forward, and we've already seen that. I mean, there's been an industry-wide price increase announcement that happened just before the filing. The Cenveo actually announced a 10% increase, and others have followed, including Supremex.”

Challenges passing through very large fast increases in cost Q3 2018 – “This being said, we were unable to pass through the unprecedented and precipitous paper and other raw material increases in lockstep with when they occurred. We have been through 3 subsequent price increases since the start of the year and 4 in the last 4 quarters. There are many reasons for this inability to just stay [ whole ] when even those with exceptional pricing power in the market would be hard-pressed to pass these increases along in lockstep.”

U.S. becoming more diligent Q3 2018 – “I hope I never said that we would have pricing power in the U.S. because we won't. It's a tough market. It's a challenging market. One competitor holds roughly 50% of the capacity and 40% of the volume.

I won't say that customer or that competitor was a bad actor. But as I said, as he emerged, as they emerged from Chapter 11, all indications are that they're going to be more disciplined actor. And I think the rest of the industry has endured enough pain down there that they're following quickly. I know when they put their increase out in late September, we announced exactly the same day -- just demonstrate that we're on board with an increase.”

Beware of how acquisitions can shield numbers if you don’t read the notes – Q2 2020 Call Canadian Envelope revenue was $22.2 million, down 4.7% from $23.3 million. Volume increased by 6.7% from the contribution of the acquisition of Royal Envelope. Excluding revenues from Royal Envelope, Canadian Envelope sales were down by approximately 26.8%,

Passing through costs successfully per Q1 2022 – Envelope revenue was up by 16.7% to $44.7 million, mainly driven by average selling price increases required to offset material cost increases. And Packaging and Specialty Products revenue rose 21.5% to $18.6 million, reflecting revenue growth in both Canada and the U.S., and across each of our lines of business. …

To summarize, there is demand for our products. To date, we've been able to pass through inflation, as witnessed over the past several quarters. And with this new supply, we have a great opportunity to better service customers.

US Volumes

U.S. Envelope market share in 2019 per Q4 2018 call - Yes, we still have less than 3% market share, we say, well, less than 5% market share.

2015 AIF - TheAmerican envelope manufacturing industry is a mature and declining industry which generated approximately US$2.6 billion in annual sales in 2015 based on a volume of 157 billion units, according to the Envelope Manufacturers Association (EMA).

In fiscal 2015, Supremex generated revenue of approximately $142.3 million on a volume of 4.9 billion units.

Make sure to back out amortization of customer relationships / non-compete agreements - $6.1MM in 2014.

2018 AIF - Management views the United States as a very attractive market with a significant share of the volume located in the Northeast and Midwest. Supremex has been actively pursuing growth opportunities in this market, taking advantage of its proximity to its largest manufacturing facilities in Canada, a fragmented competitive landscape and a favourable exchange rate environment.

In order to strengthen its position in the United States and become a bona fide regional player in this market, Supremex acquired two envelope manufacturers. In October 2015, the Company acquired Massachusetts-based Classic Envelope, adding to its existing New York-based Buffalo Envelope Inc. operations and, in August 2016, acquired substantially all of the assets of Indiana-based Bowers Envelope, a manufacturer and printer of envelopes strategically located at “The Crossroads of America”.

Management estimates that Supremex is now among the five largest envelope manufacturers in North America with a market share of less than 5% of the U.S. market.

Q2 2022 Conference Call - We have the scale associated with being in the top 5 largest envelope manufacturers in North America. We have coast-to-coast reach and a dominant position in Canada. We have strategically grown our footprint in the U.S. market, methodically built the brand, and developed an excellent reputation in the vast U.S. envelope market, while still only enjoying approximately 5% market share. à They are referencing U.S. market share.

Using Canada for U.S. Q4 2019 - U.S. envelope is doing exactly what we need it to do. It is driving volume, activity and efficiencies to the Canadian plants as the Canadian secular decline continues at a rate in excess of the U.S. decline. Units produced in Canadian plants for U.S. affiliates were up 27% year-over-year, which is an increase in excess of what we managed from 2017 to 2018.

Building Packaging and Specialty Products

2016 conference call, building a niche - “It's a niche product again, and that's kind of what our play is in the packaging business. We understand commodity and commodity envelopes. Our focus is really around, on the packaging side, to be more of a niche player and not fight the big guys. So yes, they're easy setup boxes. I can -- now that we've released them, I could actually send them out, send you some samples and have a look at it. But it's not going to revolutionize the business. It's not going to jump us to that -- we don't -- we're not anticipating it's going to jump us to that 25% threshold. But we've done a fair bit of R&D. We have a licensed product on a patent. We're a licensee of a patented product, and the market that we're playing in is at least as big as the envelope market in Canada.”

2017Q2 Stuart Packaging “amplifies our diversification strategy and represents an important building block in the Folding Carton packagings market. On July 20, we announced the acquisition of Stuart Packaging, a leading provider of premium quality folding-carton packaging solutions for the consumer packaged good market.”

Product split in at Q1 2021 conference call - Yes. So just for clarity, about half of our business is sort of traditional regular packaging. It's -- you've been through the plant. I mean, it's over-the-current counter pharmaceuticals with the major brands, major consumer packaged good brands. So that business tends to be pretty stable. We -- clearly, the health and beauty segment took a bit of a hit over the last 12 months, but it was offset by some modest growth on the pharmaceutical side. So the other part -- the part of your -- the business you're referring, more the e-commerce business. The lumpiness won't be there unless you lose a contract. We've made --we had good growth over the last 3 quarters, partially, as Steven said, because we onboarded a couple of major customers midway through Q1 last year, pipeline is really good.

This is fantastic! what is your base case price target? i've replicated and built out a few models and whilst being pessemistic i've gotten to around $7