Taiga Building Products / Slate Office REIT updates, and share of mind: Alibaba versus Vitreous Glass

Since our last update, we exited our Alibaba long-dated calls and Slate Office convertible debentures for 100%+ returns. Now we are hunting for easier ideas. Here is the latest from Canadian Value Investors!

Share of mind – Alibaba versus Vitreous Glass

Taiga Building Products – Now there really is too much cash in the business

Slate Office Convertible Debentures – a nice double+, off to easier problems

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Share of mind – Alibaba versus Vitreous Glass

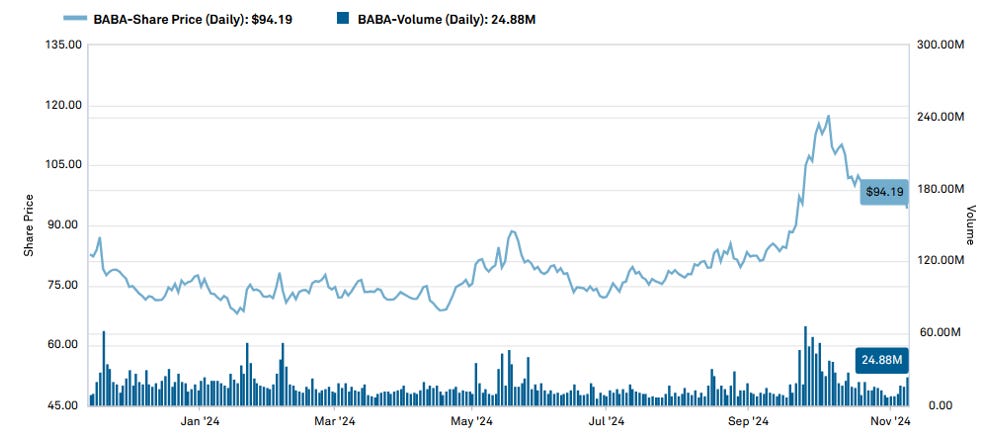

As we noted in our Q3 update, we had purchased some BABA 2026 calls early this summer. https://www.canadianvalueinvestors.com/i/149856089/so-far-so-good We subsequently sold in the recent wild run up roller coaster; volatility sure helps call option values, with them roughly doubling (some better timed trades would have done significantly better). However, we do not consider this a success – this was not meant to be the trade, we simply took advantage of short-term volatility that brought forward a lot of future expected value. This situation has reminded us of a concept we are trying to explicitly keep in mind and not drift away from again.

Share of Mind

Degree of difficulty counts in the Olympics. It doesn’t count in business. Now, you don’t get any extra points for the fact that something’s very hard to do. So, you might as well just step over one-foot bars instead of trying to jump over seven-foot bars. – Warren Buffett

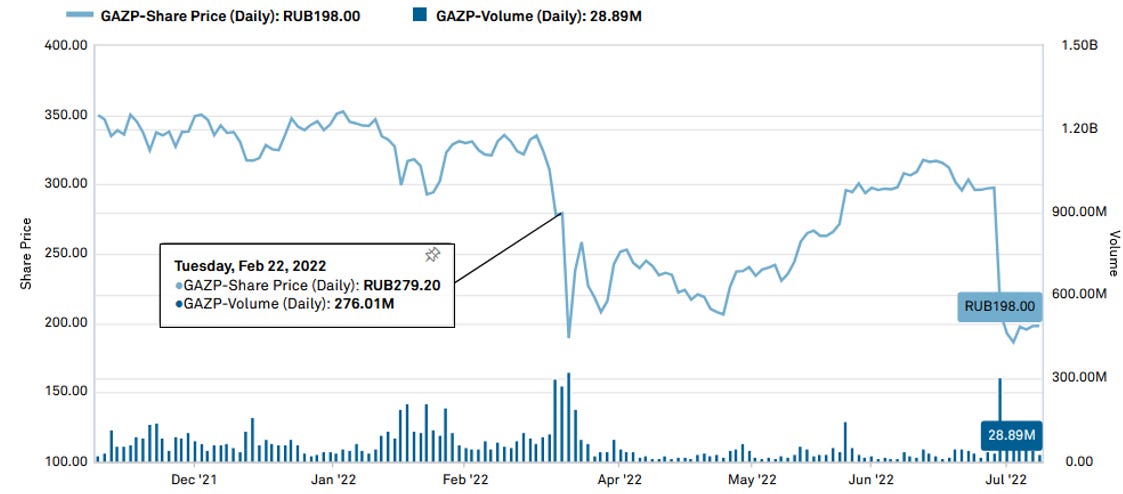

With stock investments, we think that you should consider the share of mind it requires. “Did you hear that China started a new round of war games around Taiwan?” someone said to us at dinner a month ago. For share of mind, you cannot get worse than Alibaba. It is a large complex business, based in China, with our ownership being through a derivative of a U.S. listed ADR in a Canadian brokerage account. This is literally the exact opposite of easy. There are many scenarios where the business could actually be fine or even great, but we get zero. Just ask North American investors who had an interest in Gazprom either directly or, even worse, through an ETF. Secondly, the information available to you to ponder these issues pours in like a tsunami, with no sure answer for each key issue separately and absolutely zero when taken collectively.

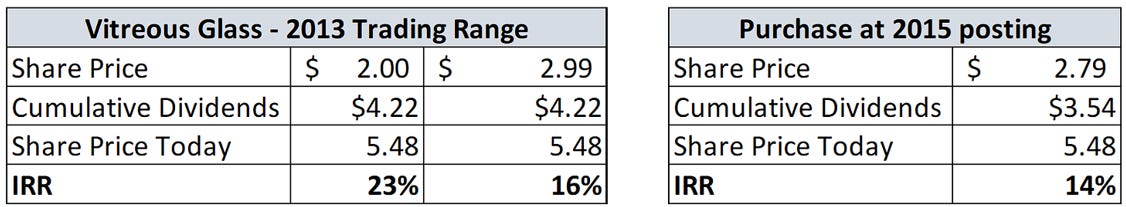

The extreme opposite is something like Vitreous Glass, which we wrote up last May - https://www.canadianvalueinvestors.com/p/vitreous-glass-tsxvvci-still-crushing

As we noted in the article, if we had continued to hold Vitreous Glass from our initial article and investment in 2013 (former site pre-Substack obviously), we would have returned ~14% IRR over a decade. This is not as thrilling as the BABA coaster, but it is a very respectable return and would have taken us about 15 minutes a year to stay on top of this little business in Alberta. Most importantly, the share of mind required is extremely low. When was the last time you talked about cullet (recycled waste glass) at a dinner party? Probably never, unless you were at one of the many dinners we have talked about Vitreous (sorry to the many friends and spouses that have suffered through this over the years).

As Todd Combs said:

“You try to avoid path dependencies. People almost always overestimate their abilities and the complexity of a task. Say someone thinks something has a 90% chance. When you break it down into its parts, say there’s 20, and each part has a 90% chance of failure you are now well below 50% chance of success.”

This approach has helped him to mostly avoid huge mistakes. Keep it simple.

Taiga Building Products TSX:TBL Q3 Update – Now there really is too much cash in the business

Disclosure: We remain long.

Out of all of our holdings, Taiga continues to win the award for most depressing press release headlines. Q3 did not disappoint – “TAIGA’S (TBL) THIRD QUARTER RESULTS IMPACTED BY LOWER VOLUME SALES OF COMMODITY PRODUCTS”.

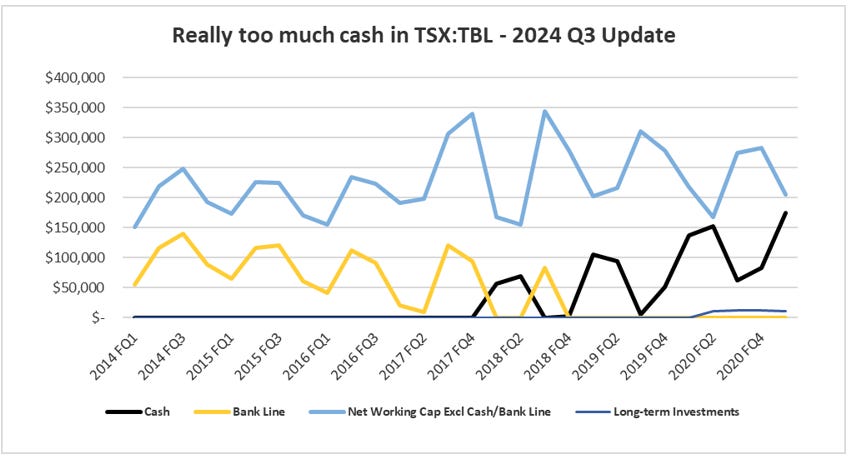

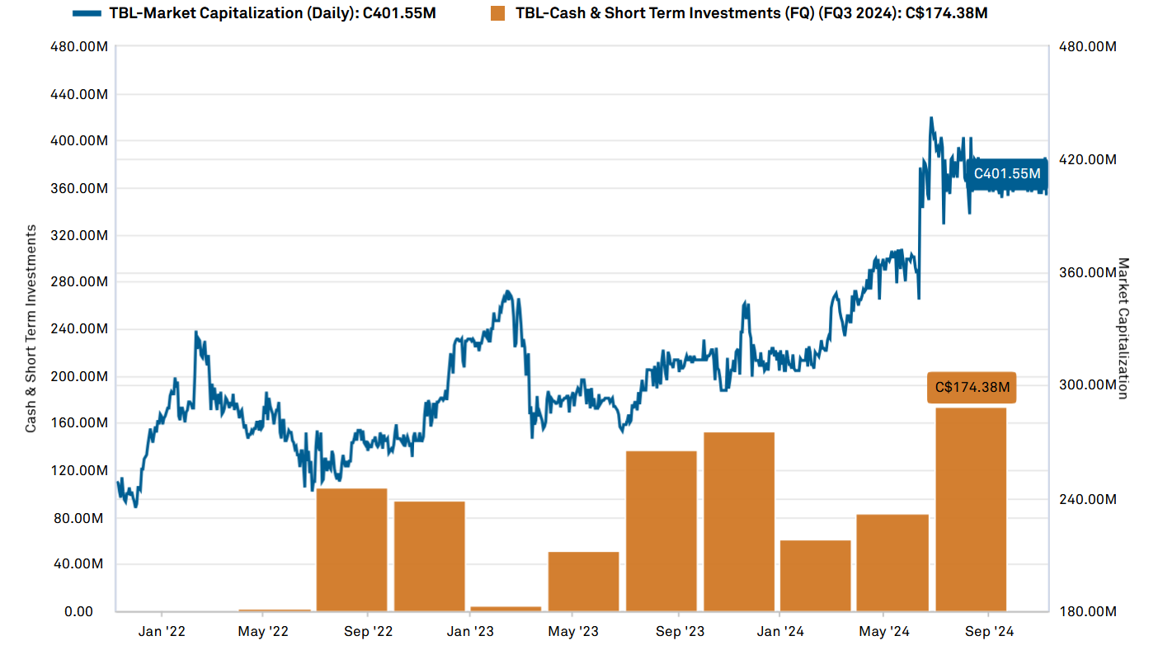

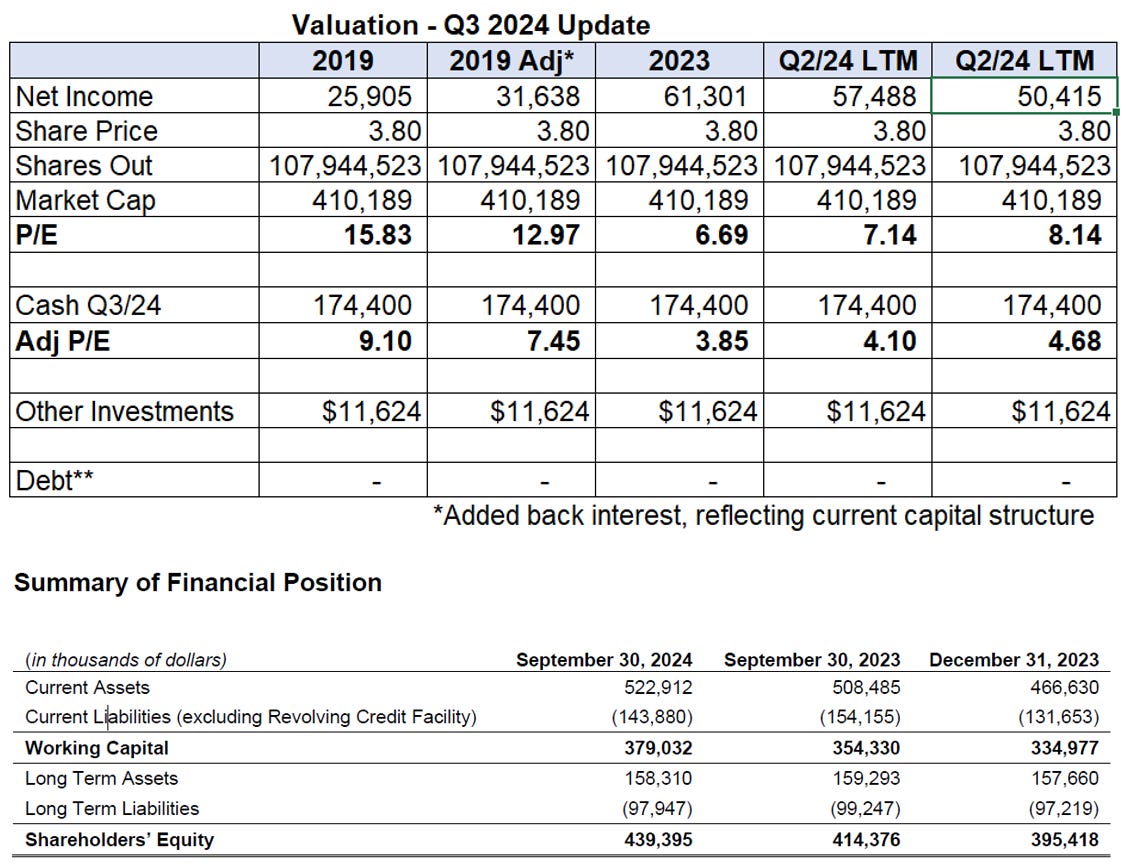

As usual, things were not that bad. Sales and net income did decline in the quarter year-over-year ($423.8MM and $14.3MM vs Q3/23 of $456.6MM and $21.4MM), stated to be driven by lower commodity prices rather than sales volumes; their business is a effectively receiving a very small piece of the building goods pie. However, performance remains above pre-COVID, they remain debt free, and cash has hit an all-time high now at almost half of the market cap (see below). The stock is up 26% YTD, but we think it remains cheap. See our background posts here including about their majority owner, Avarga. https://www.canadianvalueinvestors.com/t/tbl

They continue to look for acquisition opportunities. In the meantime, maybe it is time for another Christmas dividend (November 2023 special dividend of $0.23/share).

Slate Office Convertible Debentures – a nice double+, off to easier problems

We sold out of this position and it went well. We purchased various lots of the three series of convertible debentures in the high 10s/low 20s in June/July and exited in the 40s. We originally purchased and covered this in August, so not bad for a few months to say the least – see all posts here: https://www.canadianvalueinvestors.com/t/sotun

Why sell at these prices?

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.