The holidays turned into a busy time for two of our holdings. We have written about these companies extensively this year and wanted to address questions we received. But first, we would like to wish all our readers a Happy New Year! May this new year bring you health, happiness, and a tenbagger.

Here is the latest from Canadian Value Investors!

How to make your own alpha – Bill Ackman

Taiga Building Products TSX:TBL – Parent Avarga’s go-private of itself does not meet 90% threshold

Slate Office REIT TSX:SOT.UN – Shareholders receive a new management team for Christmas. Now what?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

How to make your own alpha – Bill Ackman

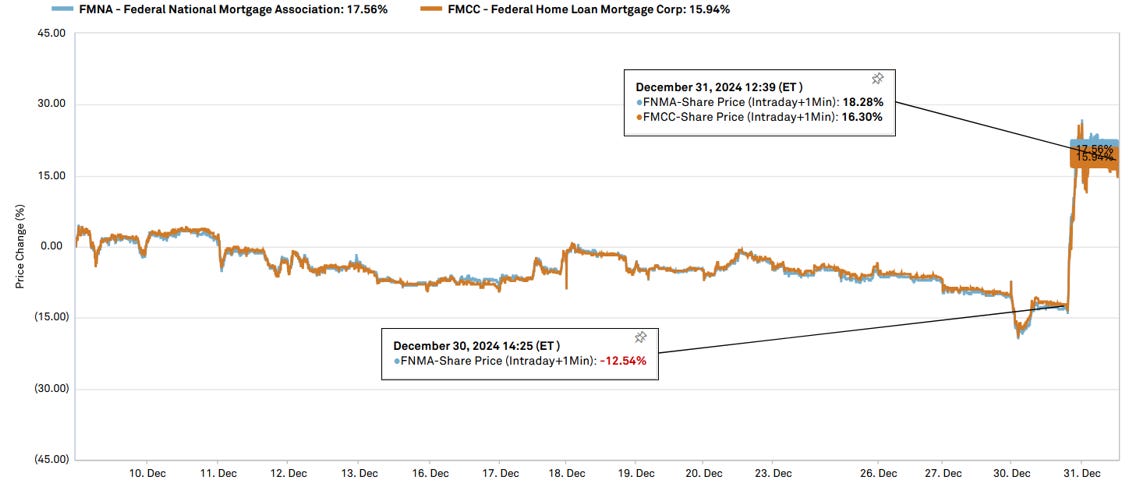

Bill Ackman posted about his bull thesis for Fannie Mae and Freddie Mac. Sometimes you just have to make your own alpha. https://x.com/BillAckman/status/1873818034428694837

Taiga Building Products – Parent Avarga’s go-private of itself does not meet 90% threshold

Disclosure: We remain long TBL. See our articles on Taiga here - https://www.canadianvalueinvestors.com/t/tbl

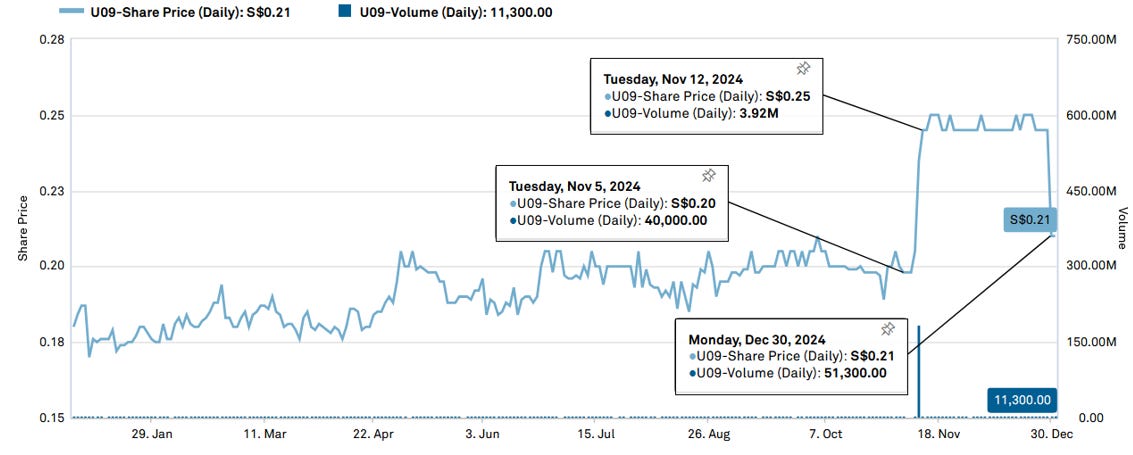

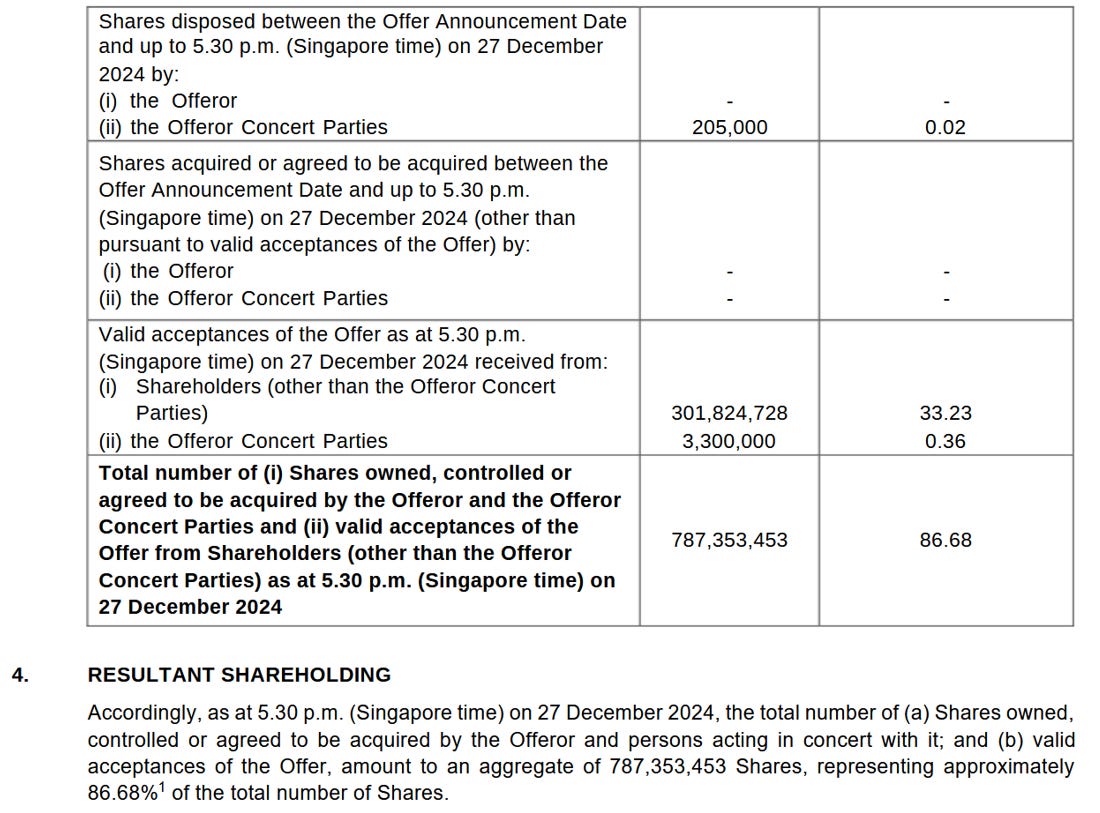

Looks like Taiga Building Product’s parent Avarga’s (SGX:U09) go-private did not meet the 90% threshold to force a compulsory acquisition by the December 27th deadline. Just short at 86.68%. After the offer deadline Avarga initially traded down, albeit on low volumes.

As a reminder, the offer for Avarga was technically TKO PTE. Ltd. and affiliates, which are controlled by Dr. Tong (also Chairman of Taiga).

By virtue of Phileo Trust, a family trust constituted under a trust deed where Dr Tong is the sole beneficiary, and with ZICO Trust (S) Ltd. as its appointed trustee, Dr Tong has a deemed interest in the following Shares pursuant to Section 4 of the SFA: (a) the 183,246,925 Shares held by TKO Pte. Ltd., which is wholly-owned by ZICO Trust (S) Ltd.; (b) the 224,808,000 Shares held by Phileo Capital Limited, which is wholly-owned by ZICO Trust (S) Ltd.; and (c) the 73,439,000 Shares held by Genghis S.á.r.l., which is wholly-owned by 3Cs Investments Limited, which is in turn wholly-owned by ZICO Trust (S) Ltd.

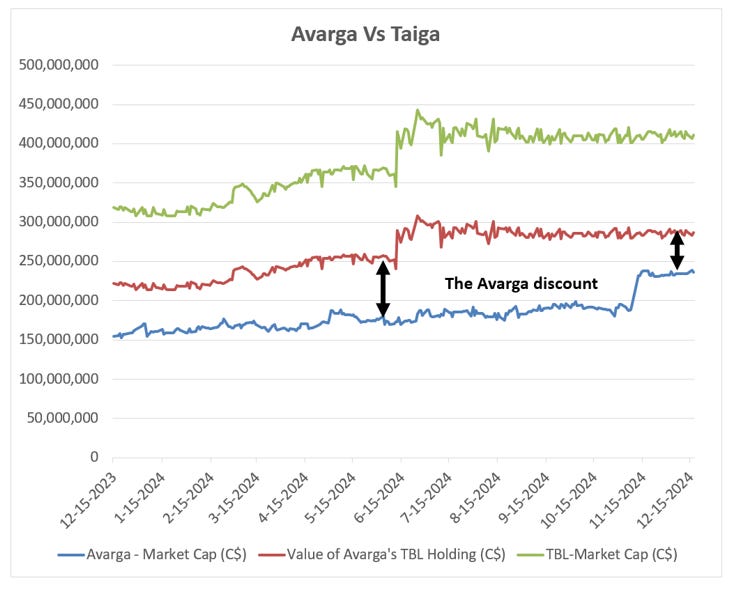

It appears we now have two awkward public companies with low free float. We continue to believe that either Avarga, Taiga, or both need to / will be privatized. The privatization of Avarga failing does not change our thesis or valuation. It appears that Avarga going first is the most likely. At the current market cap of S$222MM, the unowned wedge of shares is only worth ~$30MM while their interest in Taiga is worth significantly more.

Taiga itself has remained range-bound since June, albeit at very low volumes. We are not “chartists”, but it is interesting. And still cheap. We remain long.

Slate Office REIT – Shareholders receive a new management team for Christmas. Now what?

Disclosure: We are long the stock and debentures.

We have been following Slate Office REIT’s ongoing restructuring (all articles here - https://www.canadianvalueinvestors.com/t/sotun ). As a Christmas gift to shareholders, on Christmas Eve the new Board, led by George Armoyan / G2S2, managed to negotiate an early termination of the former management team (already kicked off the Board), put in a new CEO, and announced a rebranding.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.