Taiga Building Products TBL Q1/AGM Update: The cash pile really is too high

Disclosure: We own this one.

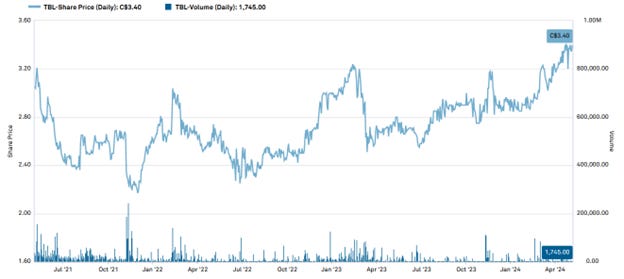

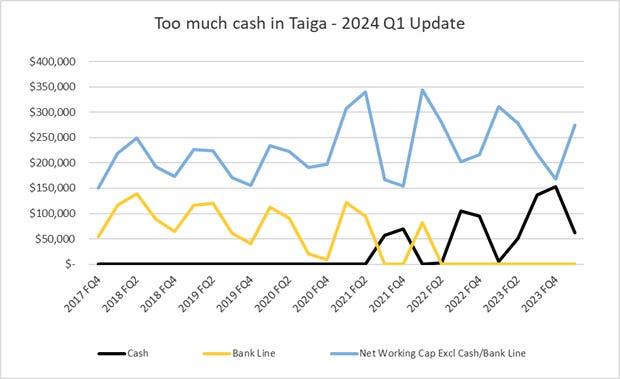

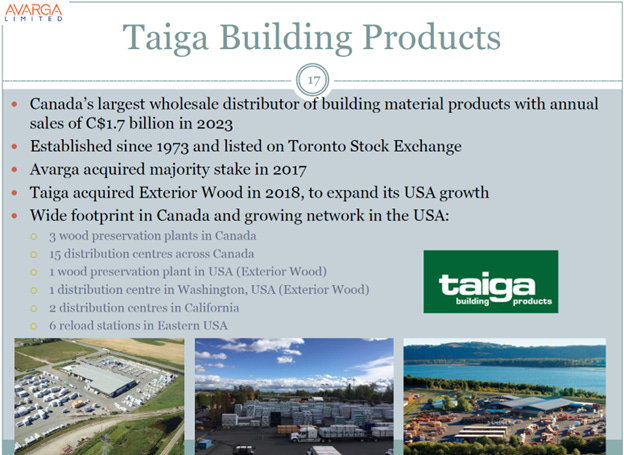

We have been writing about Taiga Building Products since 2022. A recapitalization and COVID boom turned Canada’s largest independent wholesaler of building products into a totally de-levered pile of cash trading at low single digit P/E. This seems to have started to be recognized by the market, with the stock price up 15% YTD. They released their Q1 financials last Friday and we believe it shows they are conservatively sitting on about $100 million of excess cash (and now their parent – Avarga – now appears to think so too). However, a key concern remains whether minority shareholders will be treated fairly. So far, not so bad, but minority shareholders are increasingly disgruntled it seems.

For the full background, see our February 2024 refresh: Taiga Building Products TSX:TBL – Single digit P/E and the cash pile grows… now what? https://canadianvalueinvestors.substack.com/p/taiga-building-products-tsxtbl-single

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

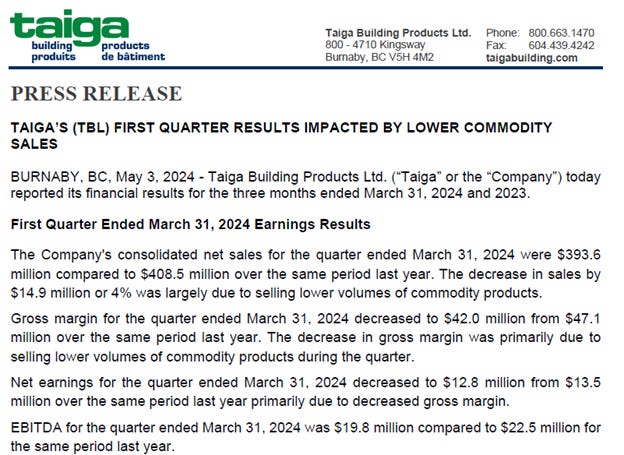

Taiga’s Q1 “Impacted”

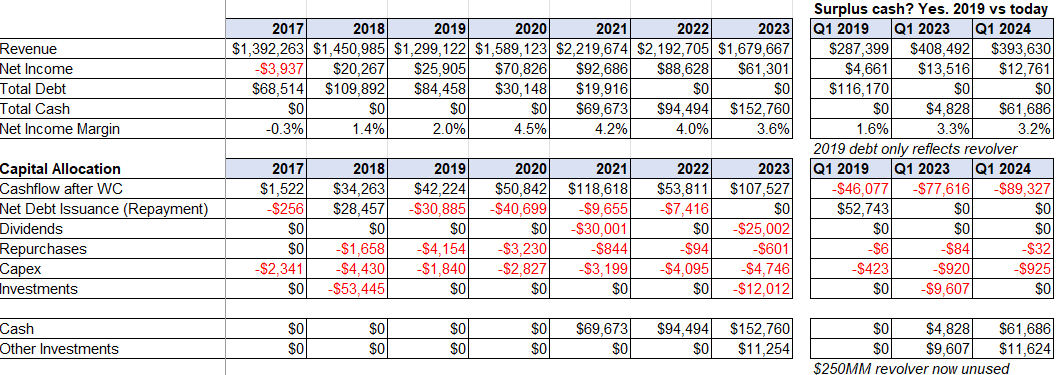

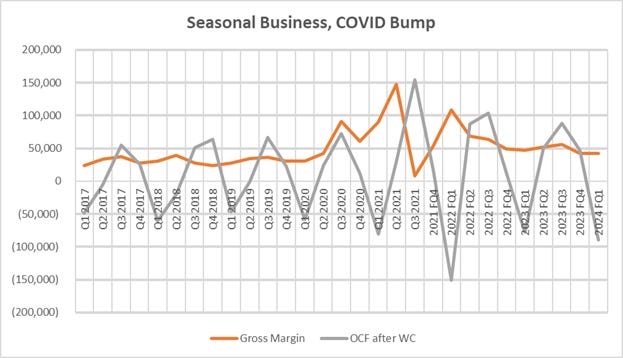

We continue to think that Taiga has some of the most depressing, unexciting press release headlines out of the companies we fellow. Q1 was no different. But performance remains well above pre-COVID levels despite the significant decline in lumber prices., margins are largely being maintained, and they continue to forget to celebrate that they have completely de-levered the balance sheet.

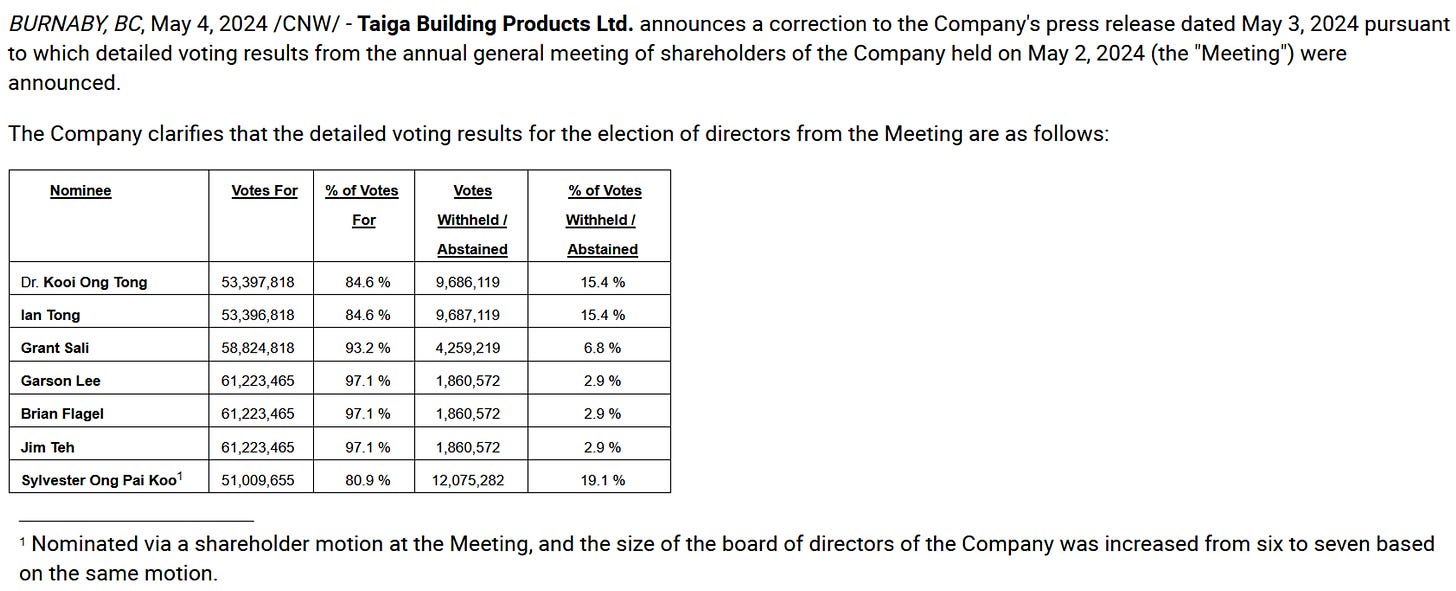

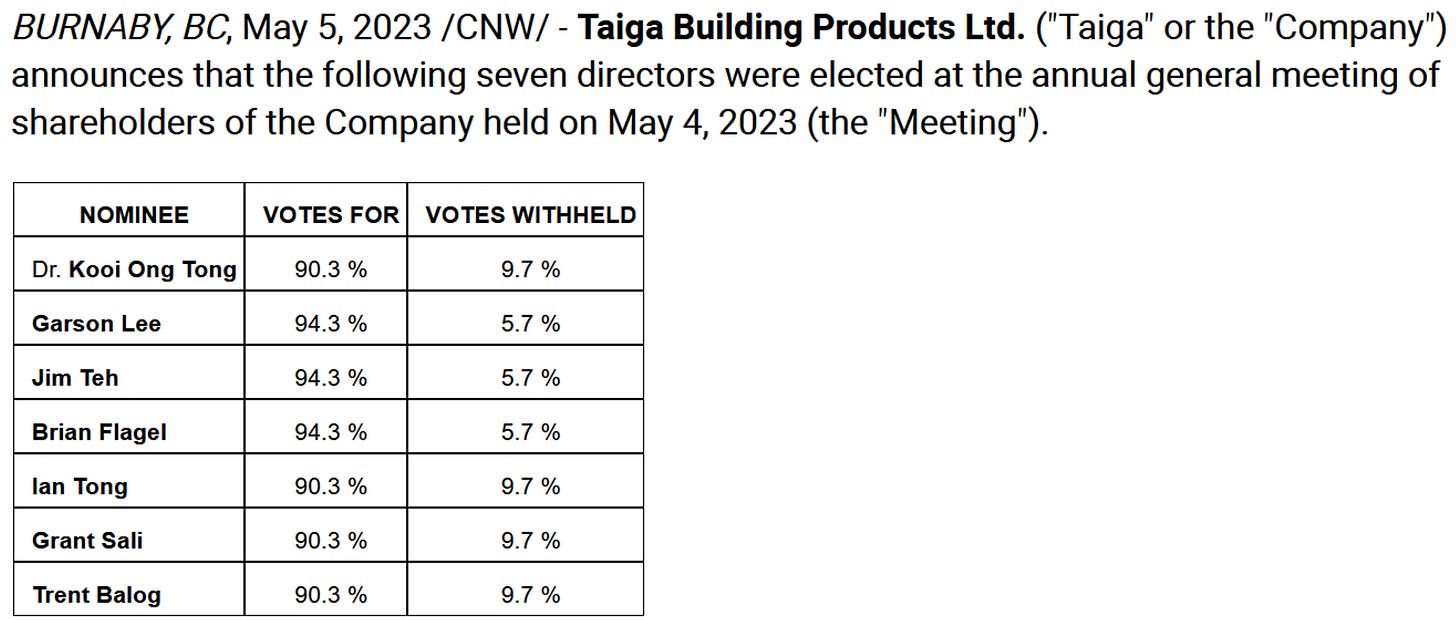

Taiga also held their AGM last week (now in person only and we were not able to attend unfortunately). The shareholder vote is interesting to say the least. 15.4% of shareholders withheld their support for Dr Looi Ong Tong and Ian Tong, who are the Chairman and CEO, respectively, of Avarga (the effective parent listed in Singapore - SGX: U09). Given Avarga owns ~72% of Taiga shares, that means a remarkable 55% of non-controlling shareholders did not vote For this AGM. And this is also a significant increase over last year. Tables below.

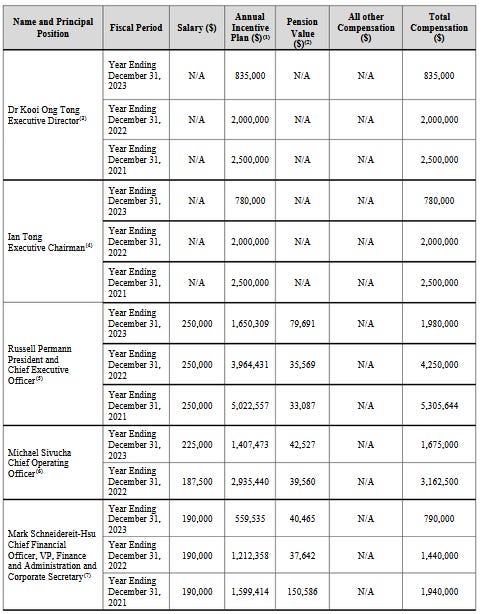

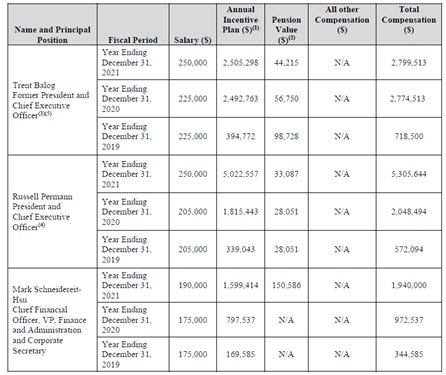

Part of it might be their compensation. At least it decreased materially year-over-year and is now back to 2019 levels.

There is also a new board member, Sylvester Ong Pai Koo.

Mr. Koo brings a wealth of experience in the construction and finance sectors to his new role. Educated at Simon Fraser University in Canada, he holds both Bachelor's and Master's degrees in Economics and Business Administration, with a focus on Accounting and Finance. His career is marked by significant leadership positions, notably as the Independent Non-Executive Chairman and Director at 3Cnergy Limited. He has also held directorships at PKS Jaya Sdn Bhd and previously, King Fraser International Pte Ltd. Sylvester's previous experience includes roles at Reinforced Earth (SEA) Pte Ltd, where he climbed the ranks from Commercial Manager to General Manager of Finance, managing significant financial operations and strategic planning for the company and its Asian subsidiaries.

We note that Dr Looi Ong Tong also went to SFU and Ian Tong attended UBC. But what is 3Cnergy? A company that is going through an RTO as of December and he subsequently resigned January 23rd as part of the RTO. https://www.straitstimes.com/business/reverse-takeover-transforms-3cnergy-into-hospitality-firm-with-portfolio-of-17-uk-hotels

Surplus cash, but what is normalized cashflow?

The two questions we have been asked most by readers (and also the ones we are also asking ourselves) are 1) what is the excess cash in the business, and 2) what is normalized cash flow now?

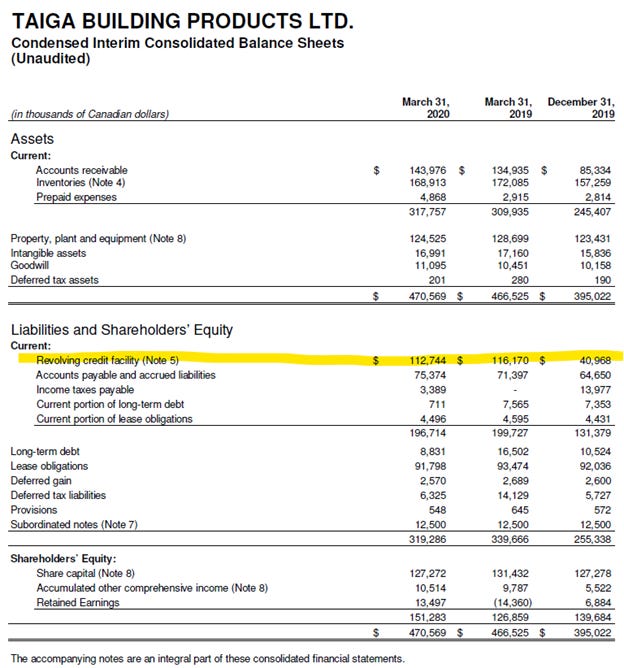

The first question is easy to answer. Taiga’s business and working capital needs are very seasonal driven by the home building season, with inventory building up in the spring and working down throughout the year. Once again, Taiga continues to have excess cash at their peak working capital needs. As a reminder the Company has a $250MM revolver with a syndicate of banks and historically Taiga did not sit on any cash and did not need to. March 2019 and 2020 (shown below) are what we view as a normal use. We do think that Avarga might decide to be a bit more conservative going forward, but we believe they kept excess cash over the last 2-3 years given volatility (understandably) and are now willing to deploy and/or return that capital as we get into below.

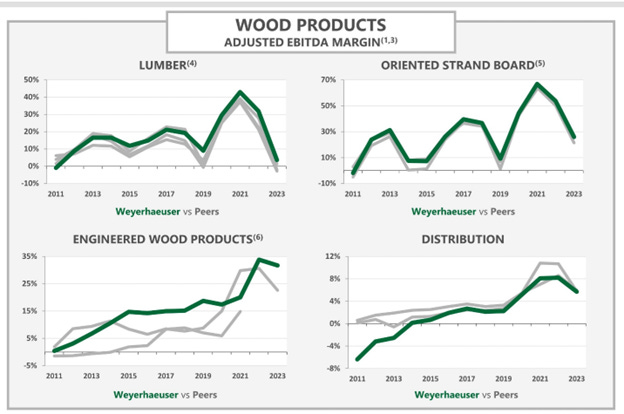

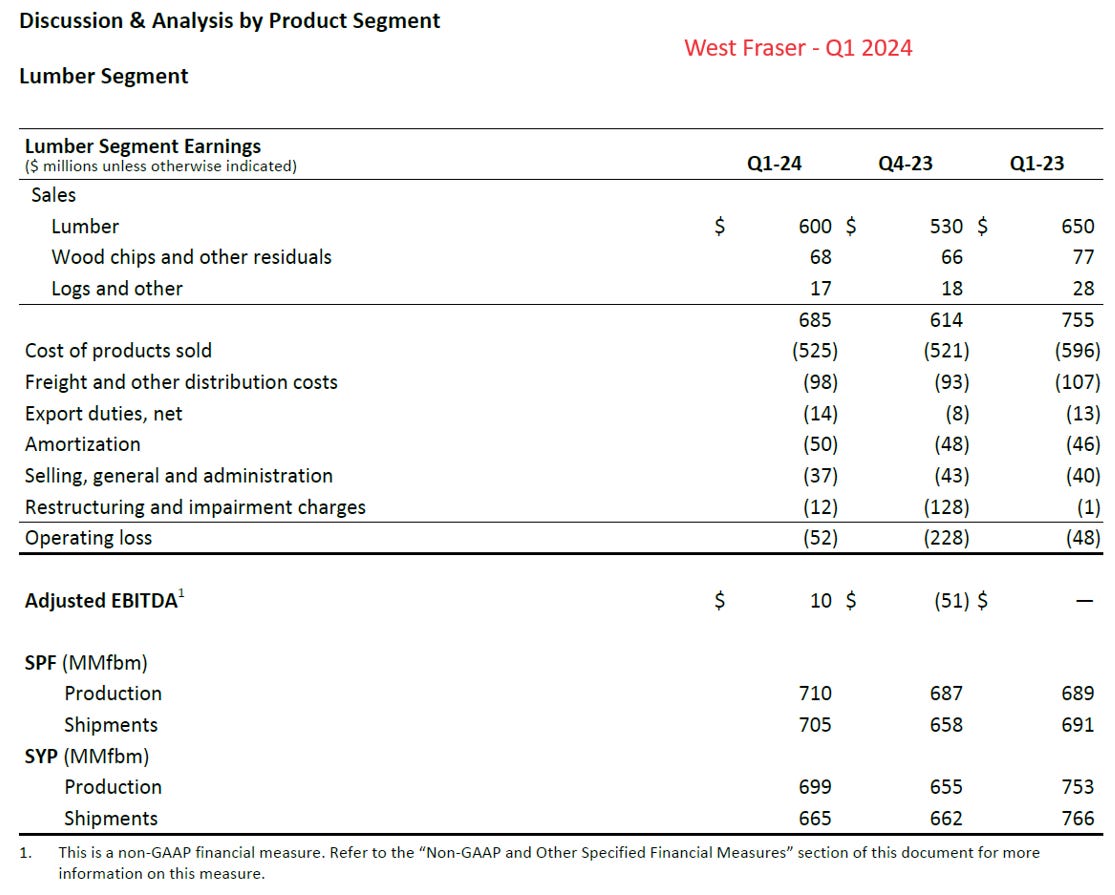

The second question – normalized cash flow – is harder to answer. Taiga’s Q1 2024 results were a lot more resilient than we expected. They have largely been able to maintain margins even though lumber prices declined precipitously in 2023 and high lumber prices have worked through Taiga’s inventory. For context, we have included some charts from Weyerheuser and West Fraser (no positions), which give you a bit of context for the supply side. Prices remain depressed with most Western Canadian production still uneconomic on a full-cycle basis.

To answer this question, we looked to Avarga’s recent filings for some answers.

Avarga’s Views

As usual, for the best information on Taiga you have to go to the parent’s Singaporean filings. As we noted in our February refresh, they provide a lot more context for their vision of Taiga and how things are going (and we put together all of their relevant historical filings in that post for you).

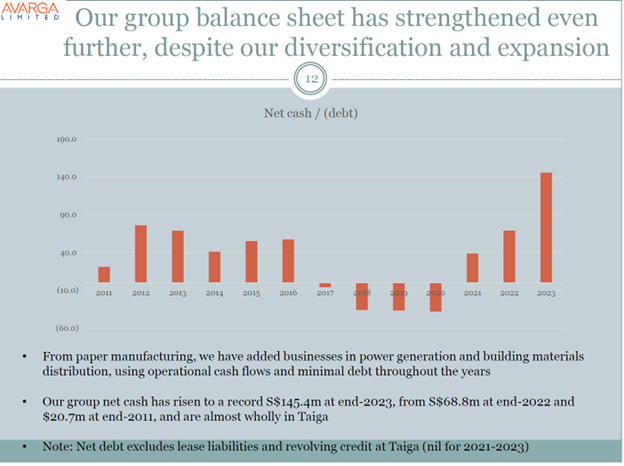

Avarga also just released their year-end report and presentation. Key points below (bold is our emphasis).

As the USA reverted from the quantitative easing and the very low interest rates environment to the opposite end, to contain inflation, impose quantitative tightening and raise interest rates sharply, we knew there will be major negative consequences on housing demand, on demand and prices for building materials and therefore on our main subsidiary company, Taiga Building Products Ltd, which is a major wholesale distributor of building materials in Canada and USA. For example, one of our major products, dimensional lumber, saw an over 70% collapse in prices. With sales of over C$2 billion annually, higher interest rates and the possible drying up of financing liquidity pose a critical risk to Taiga given we must carry huge inventories, receivables, and stocks in preparation.

And as expected, two of our banks have reduced their credit facilities to Avarga in Singapore, even as our balance sheet is now stronger than before. We are glad we can meet these obligations without taking desperate measures.

…

Despite the decline in profitability, there were certainly some positive takeaways for the year. Taiga maintained similar levels of volume sales to the abnormal years of 2021 and 2022 – indicating that aside from the inflated commodity prices in previous years, the underlying operations remain stable and healthy. While gross margin percentage declined from those years, it was higher than it was before the Covid-related inflationary period – this indicates the company is operating more efficiently, which we believe is a result of the investments and strategies that have been put in place over the years.

…

At Taiga, we are executing several interesting new ideas, including the use of data technology for better management, trading, a customer-centric digital platform, and the application of Artificial Intelligence for backfilling orders and logistics. We are also working to significantly enhance our Interstate 5 strategy in western USA. Further downside to commodity building prices is now minimal. We should now be more aggressive in the application of the cash reserves we have built up at Taiga.

Their paper and power businesses remain depressed.

Building Materials (Canada and USA):

Taiga’s revenue declined 23% to C$1.7b, while EBITDA fell 34% to C$91.3m, due mainly to lower commodity prices. Pre-tax profit declined from C$120.5m to C$76.7m

Net cash improved from C$94.5m to C$152.8m due to reduction in inventory

Navigated volatile lumber prices due to fast turnover, risk management controls

Paper Manufacturing (Malaysia):

Another challenging year due to more competition from the large Chinese players and cost pressures

Our restructuring and restrategisation efforts have mitigated operating losses before impairments

Before impairments, pre-tax losses narrowed to RM14.4m from RM21.1m

We made an impairment on PPE of S$14.5m, in view of the challenging outlook ahead. As a result, segmental pre-tax losses totaled S$18.7m

Power (Myanmar):

Produced 241.7m kWh in 2023, down 30% from 343.4m kWh, due to gas supply issues

We made an impairment of S$13.7m in view of the increasingly uncertain political situation and challenging operational outlook, particularly in relation to gas supply.

As a result, the division made a segmental pre-tax loss of S$10.2m.

The written down value of the asset is US$8.6m (S$11.3m) as at end-2023, only 2.5% of Avarga’s NAV

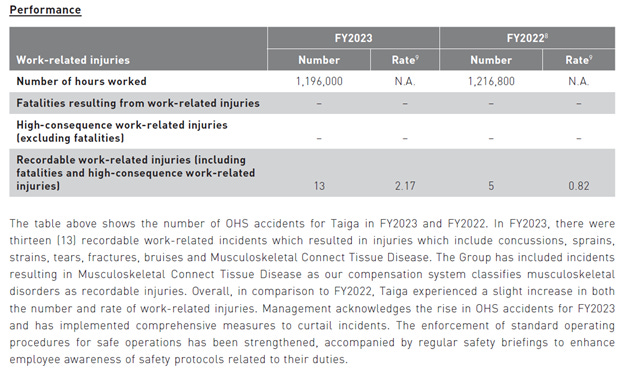

One point of concern to watch going forward is OHS incidents are up at Taiga.

Where does that leave us?

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.