Taiga Building Products (TSX: TBL) still cheap: A case study in the challenges of capital allocation

Year-end 2024 update

Disclosure: We are long TBL.

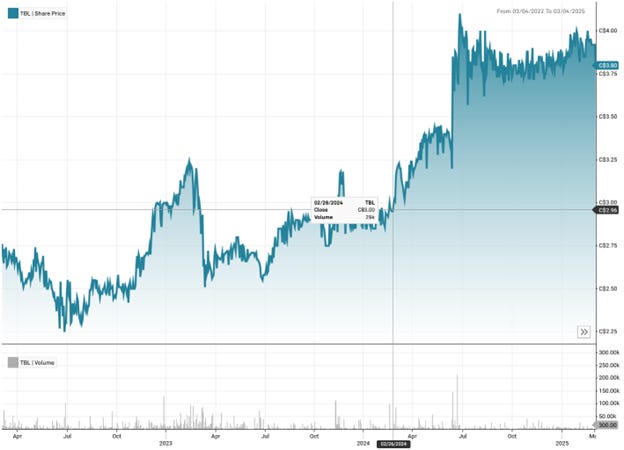

We have followed Taiga Building Prodducts for a number of years now and have written about them extensively. In fact, it has been almost exactly a year (February 28th, 2024) since we wrote Taiga Building Products TSX:TBL – Single digit P/E and the cash pile grows… now what? https://www.canadianvalueinvestors.com/p/taiga-building-products-tsxtbl-single when they were trading at ~$3 (now ~$4).

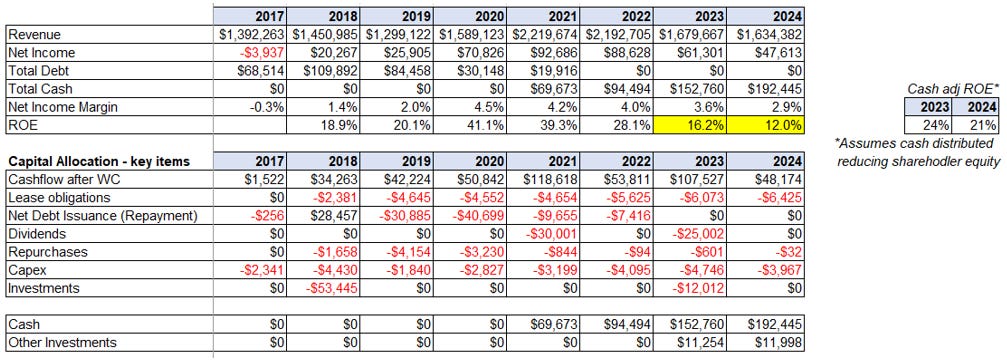

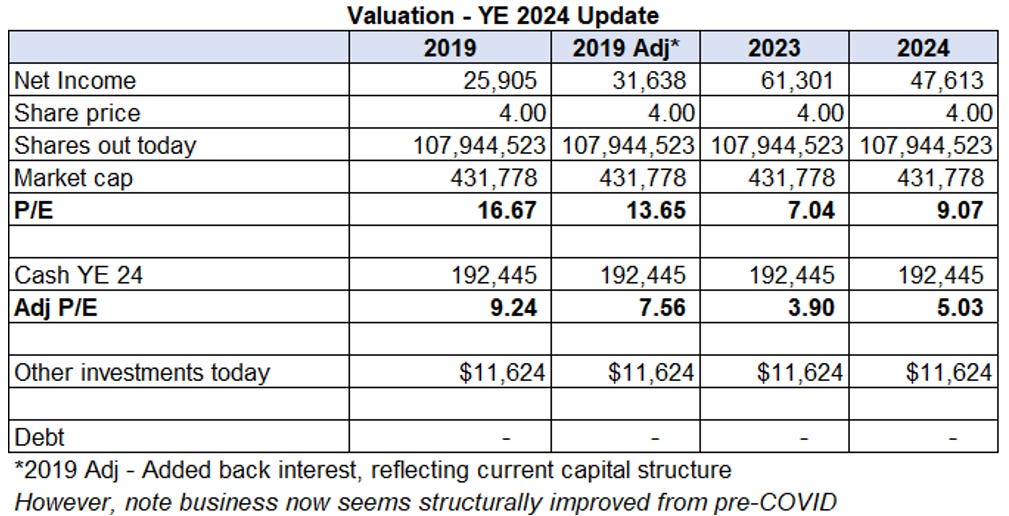

They just reported their 2024 year-end numbers. Since our February 2024 overview, cash has continued to pile up and the company is trading at a high single digit P/E / FCF, totally debt free, and excess cash is now ~50% of the market cap. In the meantime, the key shareholder – Avarga (~72%) – tried to take itself private but was just short of the compulsory 90% threshold to go private under Singaporean listing rules.

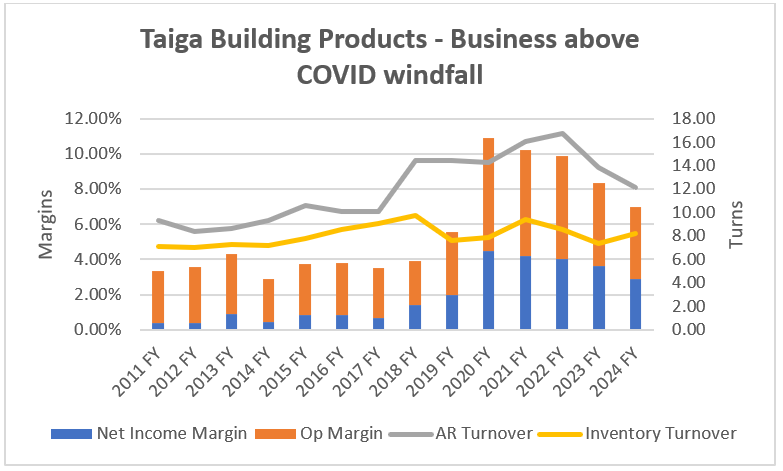

With 2024 results now behind them, the business really does appear to be structurally improved from pre-COVID. However, cash is so high it is significantly impacting returns on equity. Here is a case study of the challenges in capital allocation and a discussion of what might happen next.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

2024 year-end update

The Company has undergone a significant transformation over the past several years, benefiting from operational improvements, a major deleveraging, and a COVID-driven sales boom. The company, Canada’s largest independent building products distributor, has leveraged its stable gross margins and cost efficiencies to generate strong cash flow, sitting on a growing cash pile with no debt. The Company’s share price increased along with these improvements, though has been range-bound since last summer like nothing is happening in the world.

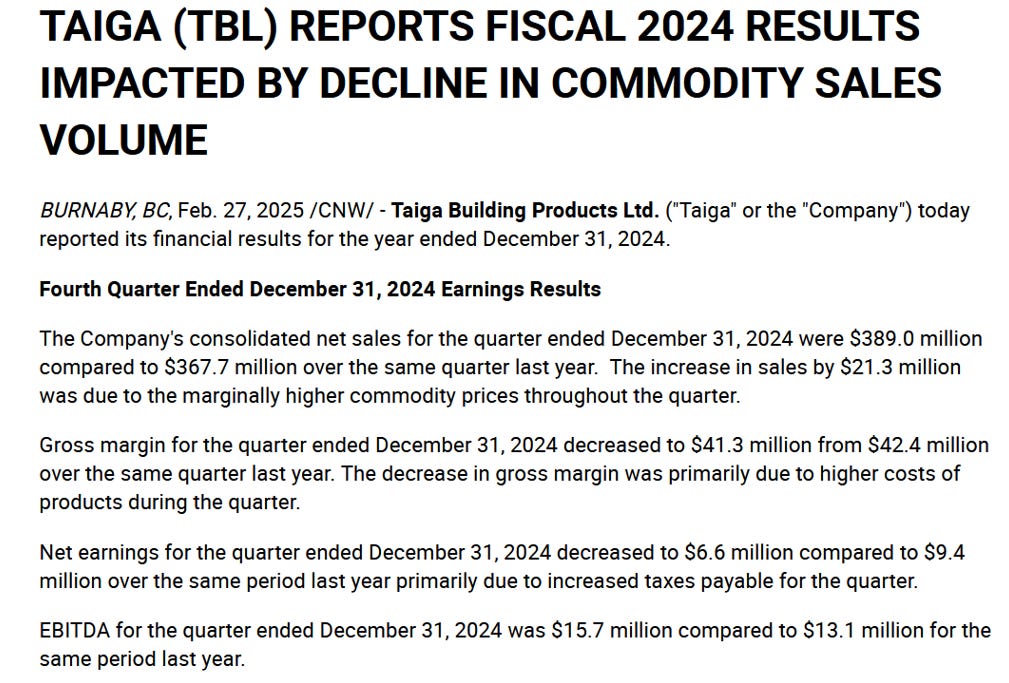

Despite business improvements, their headlines remain depressing and we once again award Taiga for most depressing quarterly earnings headline. We joke about this, and in reality, we think this is a practical approach that is keeping in mind their customers and suppliers, not shareholders, which we do not mind.

The business really seems to be structurally improved now – we are quite removed from COVID pricing issues in building supplies – but the Company’s return on equity is now significantly impacted by them holding too much capital in the business. It is cutting the return in half. The issue is the business simply cannot utilize the cash that it is generating internally.

“So what would you say you will do here?”

To recap previous posts, we think the business was surprised by the COVID windfall (as was the rest of the industry). They have done acquisitions previously and did them well, but COVID windfalls also caused valuations to stretch to a point that they were likely unattractive, while dividend distributions are inefficient for the parent (though they made one in 2023 - $25MM).

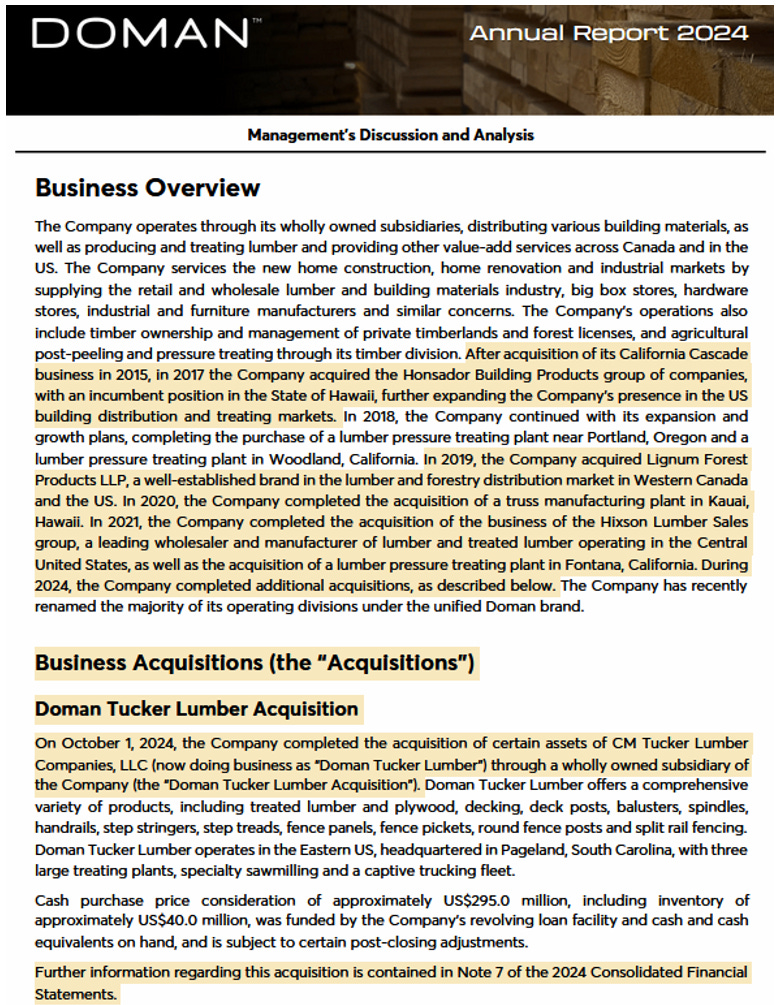

Acquisitions are happening for some, at least at key competitor Doman Building Materials Group Ltd. (TSX: DBM currently trading at 8-11x P/E, depending on estimates subject to Trump noise, while having significant debt).

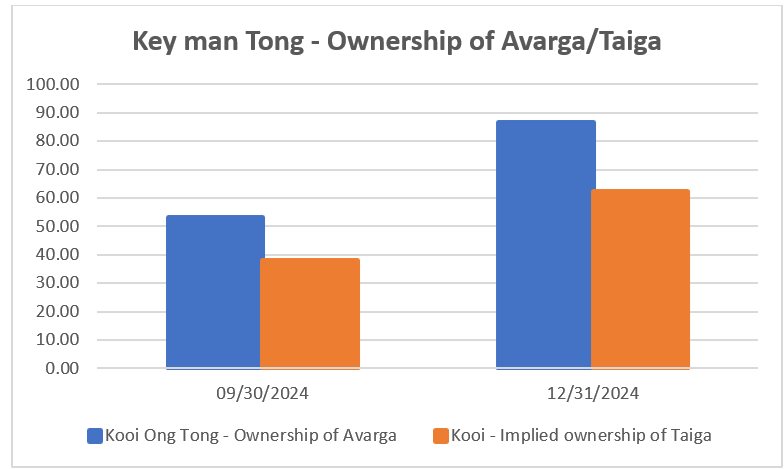

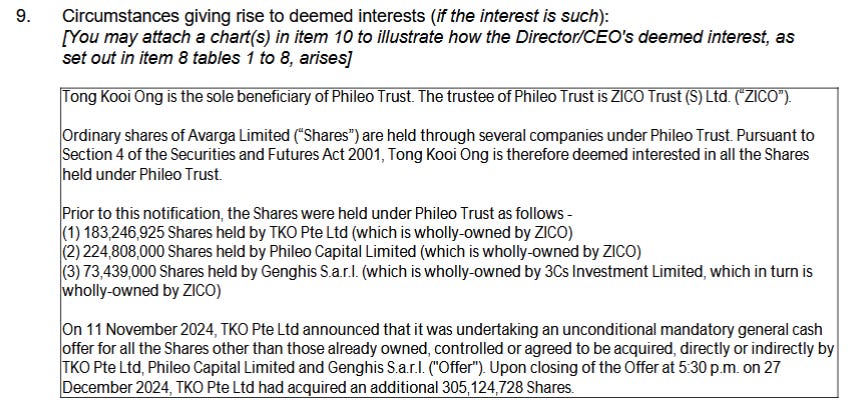

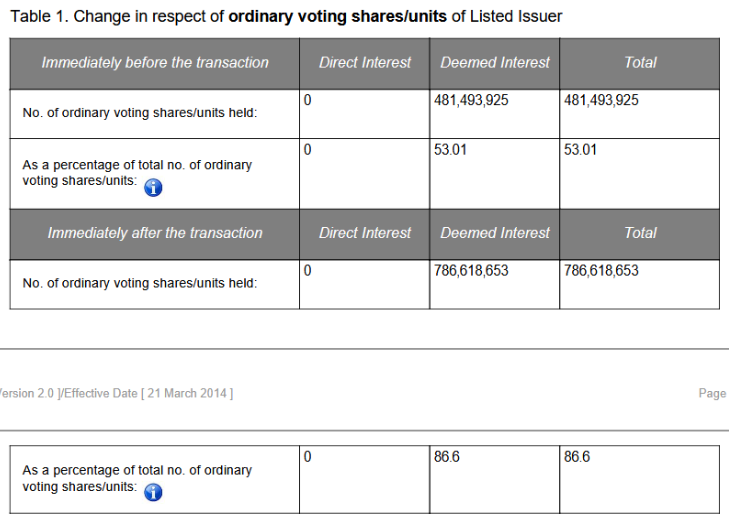

As we noted previously, their key owner Kooi Ong Tong was focused on Avarga last year and tried to take the parent Avarga private in December. https://www.canadianvalueinvestors.com/p/cvi-update-exited-talen-energy-taiga It was just short at ~87% vs the 90% threshold, and he is now dealing with two stuck public companies. His implied flow through ownership of Taiga is as shown below. Avarga today is trading at around the failed offer price of S$0.25/share, implying an EV of ~$250MM Canadian versus their share of Taiga at $310MM. We previously owned Avarga, but have opted to just hold Taiga for now to be closer to the business and its outcome (this is subject to change).

Where does this leave us?

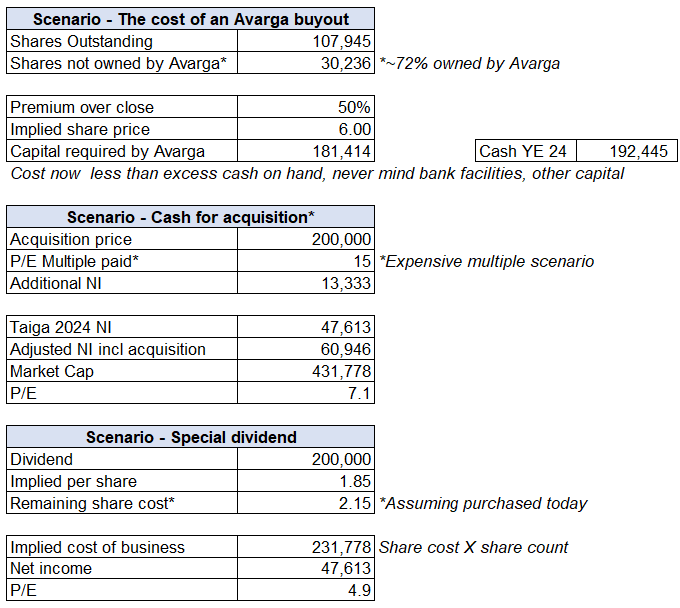

We do not believe this is stuck money, just slow money. The Avarga go-private offer was serious, almost made it, and would have allowed them to either better manage Taiga directly or then take Taiga private. The numbers are remarkable to us. The Taiga cash surplus is now so high that Avarga could make an offer to buy out minority shareholders at 50% above today’s price, never mind using a bit of leverage or other capital. The business today has a general purpose unused $250MM credit facility.

At least one of these entities will likely disappear from the public markets. The key owner is motivated to do something while Taiga’s share price remains supported making a take-under difficult. The question is what will happen for common shareholders of Taiga. We have created a few hypothetical scenarios below and will continue to wait in the meantime.