Taiga Building Products TSX:TBL – Single digit P/E and the cash pile grows… now what?

We are starting to find out.

Disclosure: We own this one.

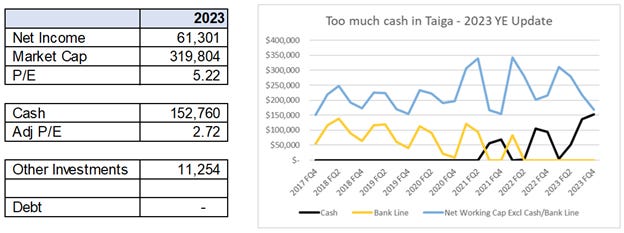

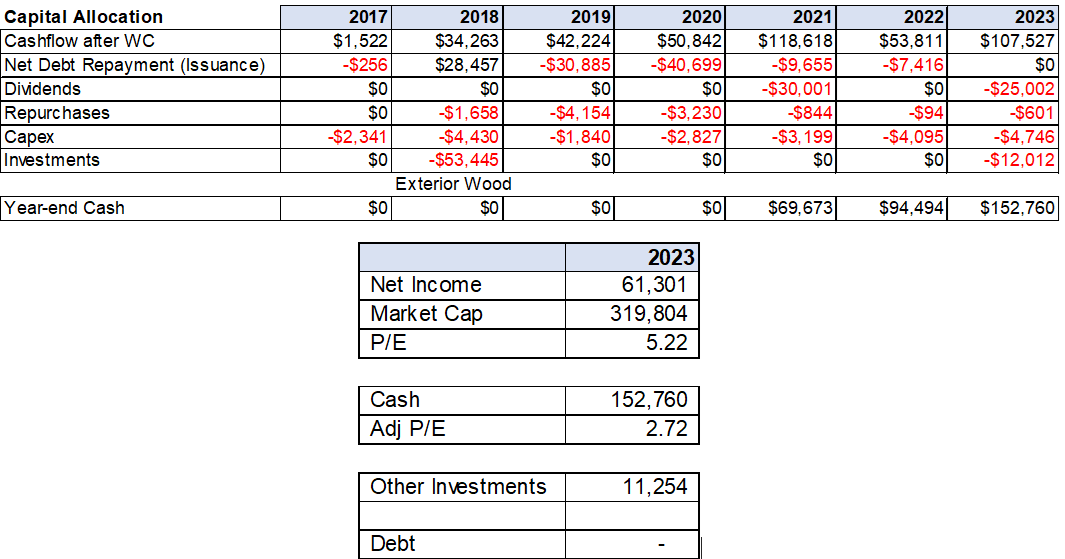

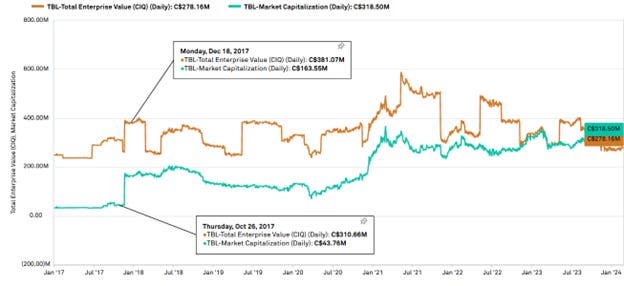

Well, well, Taiga Building Products. A recapitalization and COVID boom turned Canada’s largest independent wholesaler of building products into a totally de-levered pile of cash trading at low single digit P/E. Oh, they also have a growing U.S. distribution business and another business or two under the hood. But what are they going to do with that cash? We are starting to find out.

Table of Contents:

Background

The Business

Things to Consider

2023 Views – What Was Next? What has happened since?

Where are we going now, boss? Avarga’s Plans

Background: What is Avarga Anyway?

Background - We first wrote up Taiga in February 2022

The Company was established in 1973 and is the largest building products distributor in Canada. They also have a wood treatment business division, expanded through the acquisition of Exterior Wood, Inc. in 2018 for $56MM. At the time we wrote about them in early 2022, we argued historical results and COVID obscured the Company’s significant de-levering, acquisition, and operational improvements after a 2017 recapitalization. At a market cap at the time of ~$320MM (and still the same today), they paid a $30MM dividend the previous year (2021), repurchased >7% of their float, resolved a disastrous high interest loan, and were then sitting on ~$60MM of cash and Q3 YTD Net Income of $82MM or 4X market cap.

Taiga is on the list of companies that greatly benefited from COVID. Their customers are big box stores, home builders, and others who want significant volumes of (primarily) wood building products on short notice. For those that were building a dream home (yikes!), lumber prices were crazy throughout COVID, and this volatility hugely benefited lumber producers and also middlemen like Taiga.

The Old Debt Problem

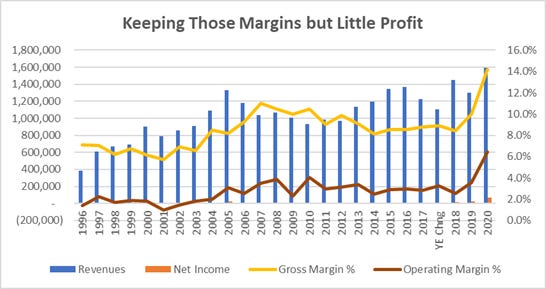

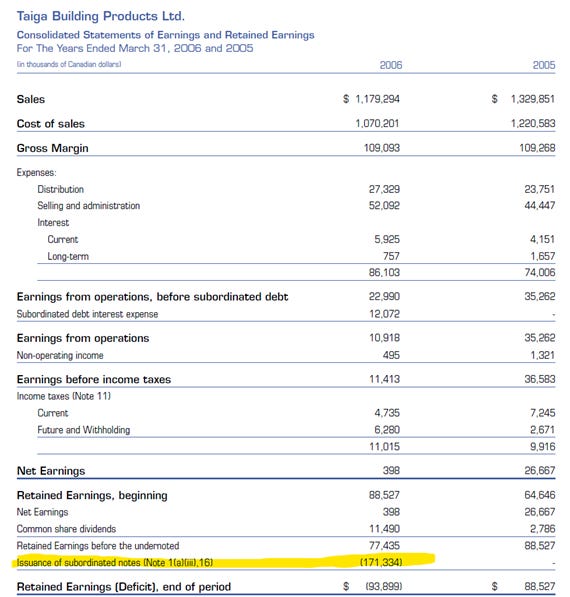

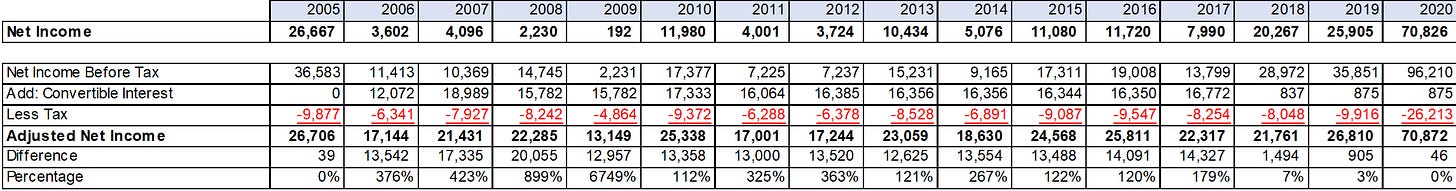

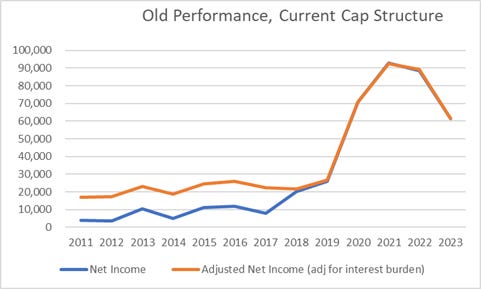

Taiga’s margins and returns on capital have been pretty stable back to the late 1990s. (Note: ROA has improved over time from 1-3% to 3-6%, but calculation of ROE depends on what you consider equity). But where is the actual profit? The problem goes back to 2005/6 when they issued a huge subordinated debt financing (really a distribution) as part of a reorganization.

Per the 2006 annual report:

On September 1, 2005, Old Taiga converted to an income fund-like structure using Stapled Units. The transaction was effected through a plan of arrangement (the “reorganization”) approved by the shareholders of Old Taiga on June 27, 2005. Under the reorganization, the issued and outstanding common shares of Old Taiga were exchanged for Stapled Units of New Taiga on the basis of four Stapled Units for each Old Taiga common share. Each Stapled Unit consists of one common share and a 14% unsecured Subordinated Note of New Taiga in the principal amount of $5.32. A total of 32,205,680 Stapled Units of New Taiga were issued. Stapled Units of New Taiga commenced trading on September 1, 2005 under the symbol “TBL.UN” on the Toronto Stock Exchange. As the reorganization results in the shareholders of Old Taiga owning directly all of the equity interests of New Taiga, the reorganization does not result in any change in beneficial ownership of New Taiga.

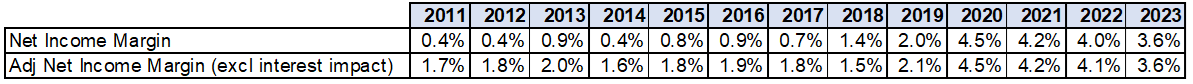

How disastrous was this financing? Very. If you back out the now retired convertible interest net income, the actual bottom line business performance looks dramatically different.

Per their disclosures:

In late 2003, Genghis S.á.r.l. ("Genghis") (formerly 3Cs Investments Limited) acquired an approximate 19.6% equity interest in Taiga, primarily through the purchase of approximately one third of Berjaya’s interest in Taiga, and Dr. Kooi Ong Tong, a representative of Genghis, was appointed as a director and chairman of the Company.

• In early 2017, Genghis and Berjaya sold their Common Shares to a subsidiary of Avarga Limited (formerly UPP Holdings Limited) (“Avarga”), a public company listed on the Singapore exchange. Dr. Tong, a current director of the Company, is the Executive Chairman, Chief Executive Officer and a major shareholder of Avarga. Ian Tong, the current chairman of the Company, is the Executive Director, Operations and Building Materials Distribution of Avarga. As a result of this transaction, Avarga acquired 18,908,208 Common Shares, representing approximately 58.34% of the then issued and outstanding Common Shares. See “Significant Developments over the Last Three Fiscal Years – Canada Revenue Agency Reassessment”.

• In late 2017, in connection with the Exchange Offer, Avarga acquired an additional 38,339,847 Common Shares, which combined with the other new Common Shares issued as part of the Exchange Offer and the Common Shares already held by Avarga, resulted in Avarga holding approximately 49% of the then outstanding Common Shares.

• In late 2017, in connection with the Exchange Offer, Genghis acquired 18,460,760 Common Shares, or approximately 15.8% of the then outstanding Common Shares.

• In late 2018, Avarga acquired Genghis’ 18,460,760 Common Shares, which increased the number of Taiga shares owned by Avarga to 75,708,814 Common Shares, representing approximately 65.1% of the outstanding Common Shares.

Avarga effectively took over the Company as part of this exchange and now has a controlling interest. Per the AIF:

On November 17, 2017, the Company completed an exchange offer (the “Exchange Offer”), pursuant to the terms and conditions set forth in the Company’s Exchange Offer and Consent Solicitation Statement dated September 29, 2017 (the “Exchange Offer Circular”), to purchase any and all of its outstanding Notes in exchange for new 7% senior notes of Taiga (the “New Notes”) due five years from the date of issuance, Common Shares at a rate of 833.33 Common Shares for each $1,000 principal amount of Notes, or any combination of the foregoing at the option of the holder. As a result of the Exchange Offer, the Company exchanged an aggregate of $113,791,000 principal amount of Existing Notes, representing approximately 88.4% of the Existing Notes outstanding. Holders of Existing Notes who participated in the Exchange Offer elected to exchange their Existing Notes for an aggregate of $12,500,000 principal amount of New Notes and 84,408,831 Common Shares.

On December 23, 2017 the Company redeemed all of its remaining Notes in the aggregate principal amount of $15,043,218 for a redemption price of 100% of the principal amount of the Notes, plus accrued and unpaid interest.

Avarga Limited now owns ~72%. They are publicly listed on the Singaporean stock exchange (See Background note: What is Avarga Anyway?).

New Owner and the COVID Boom

A few things changed since 2017:

Operational improvements given extra juice from COVID Boom.

Significantly de-levered.

Repurchasing shares, return of capital.

Completed large U.S. acquisition.

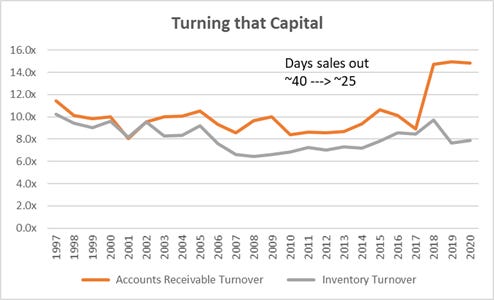

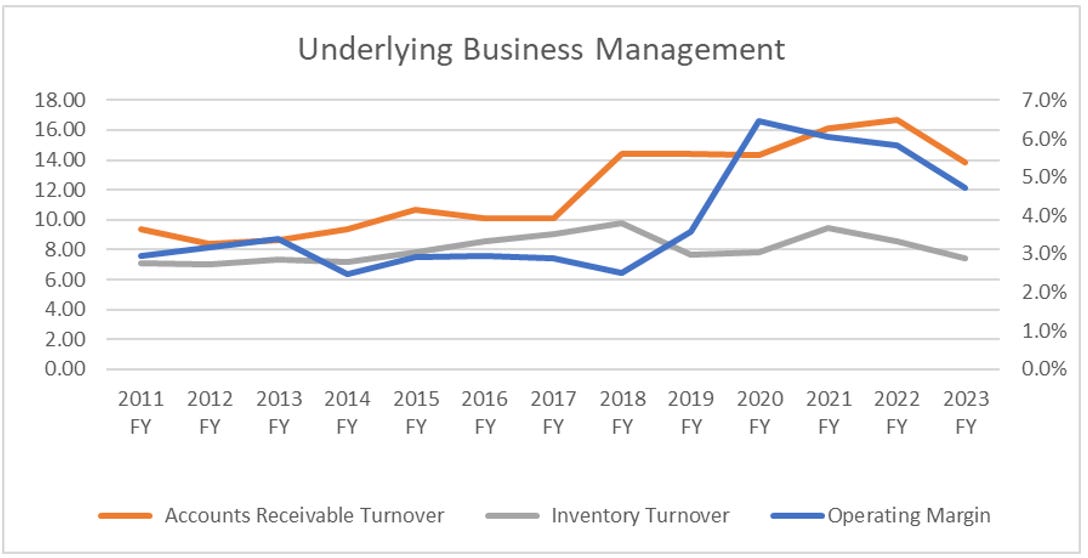

Operational Improvements are pretty straightforward and exemplified by them simply turning AR faster (from ~40 days to ~30 days) while gross margins remain strong and stable at 8-10% (14-20%+ in 2020/21 not sustainable, or at least we wouldn’t want to assume they are).

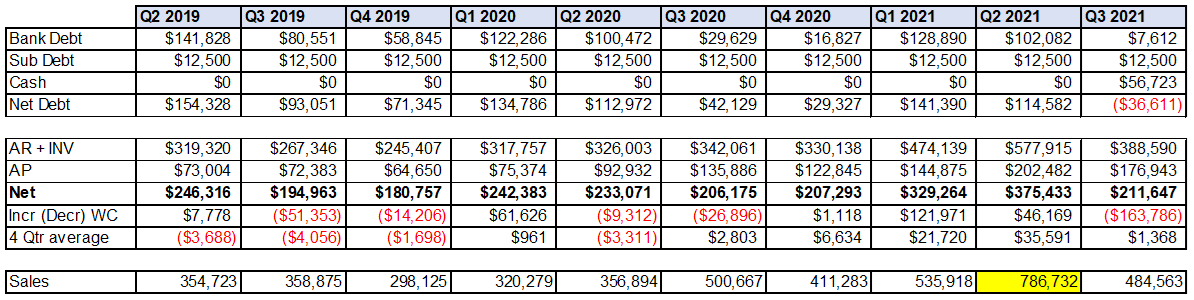

The volatility and COVID sales boom helped them completely de-lever into net cash position compared to ~$240MM of debt in 2017. Note the Company has a $250MM credit facility.

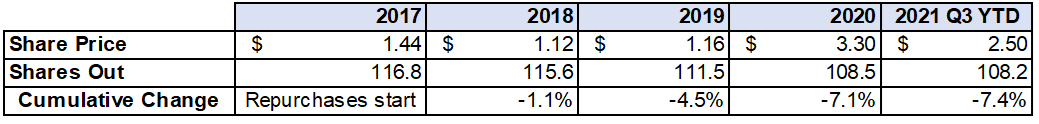

In addition to the one-time dividend last year of $30MM, they also started repurchasing shares prior to COVID and 7% repurchased so far. However, repurchases subsequently slowed down significantly.

The Business

Taiga’s disclosures are quite light, but the parent has provided a lot of insight into the business through their annual letters. We have put together 30 pages of comments they have made related to Taiga into a PDF for you in Avarga’s background below.

They have implemented variable costs better than we thought they could, have spent a lot of effort on streamlining the business, and have grown and diversified the business without talking about these efforts much.

Avaraga wrote about this years ago in their own letters:

Taiga has also performed smartly in cost management and this is a critical competitive advantage as a wholesale distributor. Indeed, a key part of Taiga’s strategy is to remain the lowest cost operator in this business in Canada. This allows the company to keep growing its market share.

One would expect operating cost as a percentage of sales to rise sharply when sales fell, like in 2010 and 2011. However, this was not the case for Taiga. Why? Taiga’s cost structure is weighted towards maximising variable costs rather than fixed costs.

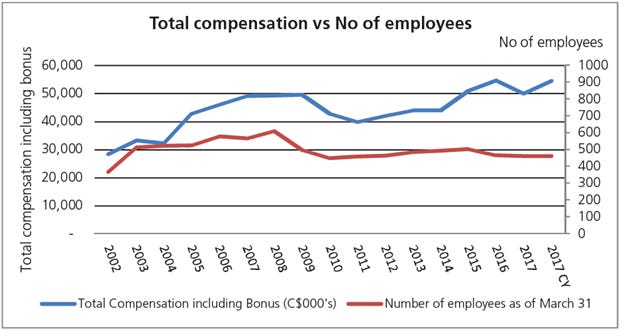

[This chart] shows the total compensation to employees and number of employees from 2002 to 2017. This cost alone is about half of the total operating costs of Taiga.

Even as sales grew strongly over the years, the number of employees has actually fallen. And a large part of the total compensation is in variable bonuses, which are tied to company’s profitability. Total compensation can fall substantially year-on-year. For example, total compensation for employees in 2011 was almost 20% less than in 2009.

The other point to note is that compensation per employee has risen substantially over the years, in line with profitability. I would say that management are extremely well paid, certainly well above the industry. As the saying goes, you get monkeys if you pay peanuts. Taiga has an excellent management team with a strong sense of ownership and a well-planned succession.

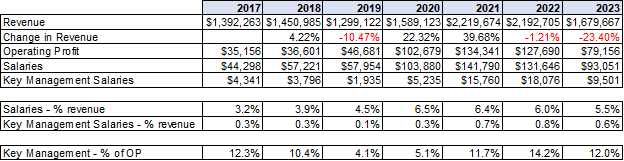

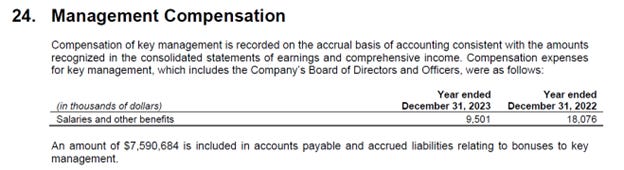

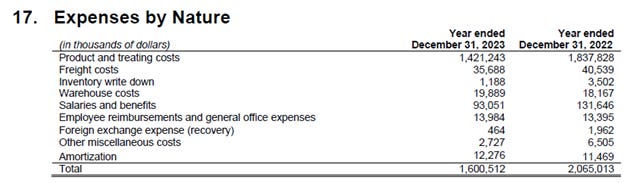

As you can see below, it appears that this is true.

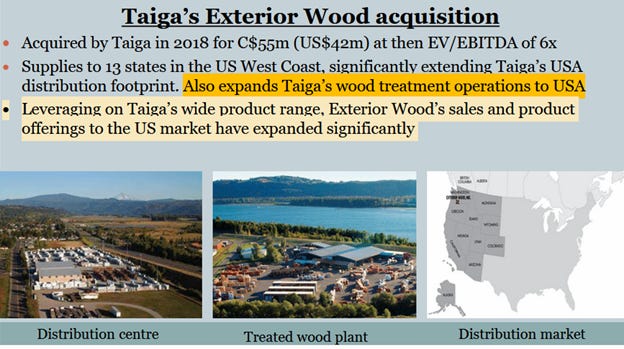

They have also tucked in new businesses. In 2019, Exterior Wood’s pre-tax profit and operating cash flows grew by more than 80%. It was acquired for US$42 million, it generated net cash flow of US$6 million and pre-tax profit of US$6.8 million, with Avarga expecting “much more synergy to be tapped going forward”.

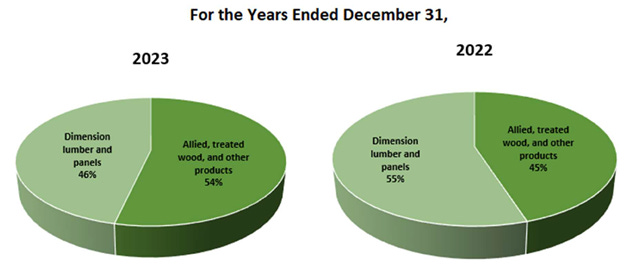

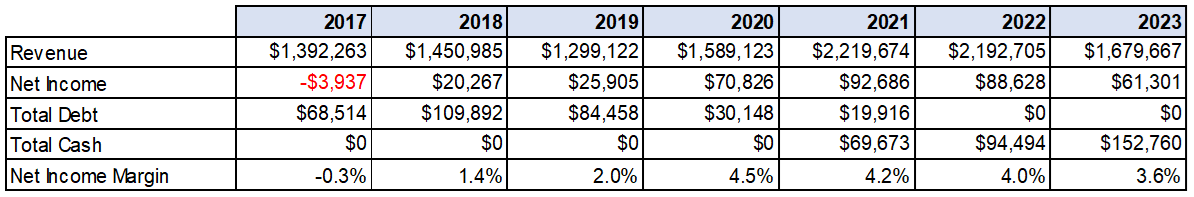

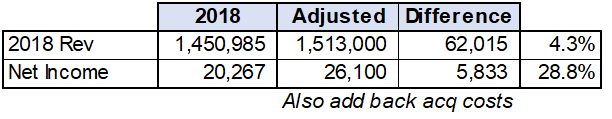

Note that the Company’s disclosures make it very hard to parse the detail by division, but the acquisition notes and subsequent performance give you an indication. Adjusted revenue and net income as follows.

They also seemed to have done a good job of technology and efficiency improvements behind the scenes to lower costs (rather than just increasing prices). It is hard to get a good grasp of this given the disclosure, but there is anecdotal evidence like this interview.

Taiga got through the pandemic thanks to “fortuitous” investment in technology, CEO says

Russ Permann says that Taiga’s “pretty significant investment” in its enterprise warehouse management system was “fortuitous,” coming to completion right before the pandemic began.

“We started the process of automating our facilities in 2015. We went live on our last system (a system provided by Major Data, which had been acquired by Epicor) and completed that just before the pandemic. I mean it was February 2020 that we completed it. Just in the nick of time, really. That [system] was an acquisition that we had made in 2018.

“What Covid really did, was accelerate us on this curve of really leaning into these tools more. And we definitely got more granular in the data, looking at our performance metrics more… If there was a ray of sunshine to come from the pandemic, that would be it for me.”

Things to Consider

Net Income is a function of sales via relatively stable margins, but results prior to mid-2018 do not include their U.S. acquisition of Exterior (with estimated pre-tax NI of US$6-12MM a year pre-acquisition depending on your view).

We thought it is prudent to assume the recent rapid decline of lumber prices could lead to realized losses on their inventory, but they have managed this significantly better than we thought they could. It could still be prudent to assume some cash might evaporate via losses on inventory. They would likely still be very under-levered, dramatically so compared to historical levels.

The revenue slowdown is real, but we never thought COVID dollar sales were sustainable and neither did the Company. What has surprised us is the pre-COVID improvements really do seem a bit sticker than we thought. Operating and net income margins improved pre-COVID and it is important to keep in mind pre-2017 performance was significantly impacted by excess leverage.

A key problem is competition is strong and getting stronger. For example, Home Depot is making a big push into distribution through their one billion dollar build out of 170 distribution facilities across the U.S. with a goal of having same-day or next-day delivery to 90% of the U.S. population. Home Depot was a Taiga customer until 2017. Upstream suppliers like lumber companies are also making their own efforts to get closer to the ultimate customer.

2023 Views – What Was Next?

In March 2023 we wrote:

Will they restart repurchases? Well, “on August 31, 2022, the Company commenced a further NCIB for its common shares. Under the terms of the NCIB, the Company may purchase up to 5,410,448 of its then outstanding 108,208,963 common shares, representing 5% of the outstanding common shares.” They repurchased a thimble worth of shares being ~$94,000. However, the parent does believe in buybacks (they are buying back their own shares). Taiga’s ability to repurchase though is limited by low volumes and low float given Avarga is not selling. However, significant volatility in lumber prices has understandably made them cautious over the last year or two (higher prices mean more capital required for inventory and inventory builds in the spring).

What about another dividend, like the $30MM in 2021? We think that Avarga held off on further dividends given: 1) the volatility, and 2) the lack of investment opportunities requiring significant capital at the parent level. Avarga themselves have stopped their own dividend given the market did not care about their dividend strategy in their own eyes (see full Avarga PDF for detailed notes on their capital allocation thoughts). For example, in 2020 Avarga said “as a wholesale distributor with high inventory turnover, it is very unlikely we will repeat last year’s performance as we will not sit on our inventory. Taiga does not and will not make speculative bets on commodities as a business, nor will it become reliant on economic cycles. Acknowledging that, Taiga has paid out a special dividend of C$30 million to its shareholders including Avarga.”

What about a take private, and what is the risk of a take-under (i.e. getting hosed)? There is potential for Avarga taking Taiga private. They have bought out minority shareholders before in other businesses (Avarga bought out all the minority partners in their paper business) and they likely have the credit capacity to do this. A material take-under from current prices seems unlikely. They have already sandbagged their financials/disclosures and the stock is trading at low multiple. It would require a very opportunistically timed buyout.

Maybe it is all about acquisitions? Avarga provides some color here – Per 2018 letter, “you might ask why then did Taiga acquire Exterior Wood in the USA. This strategy to expand to the pacific west coast of the USA has been in the making for years and it is not often the right opportunities turn up. In this case, it came about with the recent passing of the owner. The valuation was decent. The business model was similar, and we could add on products into the distribution channel.” And in 2019 – “While we extract most of the net cash flows from our paper and power businesses, we believe Taiga is at a stage where it needs to reinvest its capital and grow its operations. As I pointed out earlier, restructuring Taiga’s balance sheet led to the acquisition of Exterior Wood, which was a major contributor to our performance in 2020.” They were a prudent acquirer in our minds – “We acquired Exterior Wood in 2018 for US$42 million when our data showed the US housing market bottoming out. After full integration of the branch into our network, pre-tax profit for Exterior grew to US$13.0 million from US$6.8 million the year before.”

What has happened since?

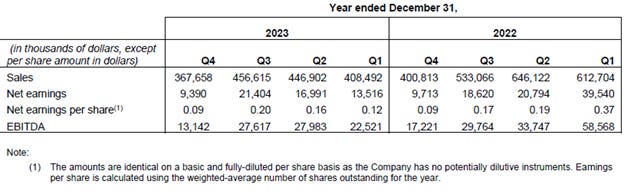

You could say their press releases are being excessively humble. Despite strong margins, a completely de-levered balance sheet, tons of cash, and performance structurally improved over pre-COVID times, the year-end press release would not indicate any of this.

Actions taken:

They paid a surprise dividend in December 2023 – They announced a 23.16 cent dividend (to get to a flat $25MM of cash). However, “The Board does not plan to make regular dividend distributions in the future, and no ongoing dividend strategy is currently in place.”

Share repurchases have not continued – At least not in a meaningful way. We find this extremely unfortunate.

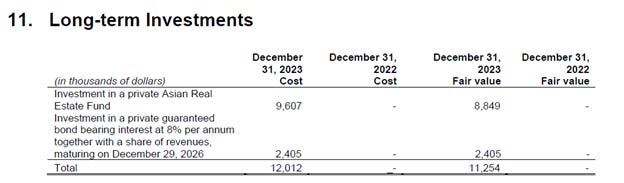

Diversification, but into what exactly...? – The finally had to disclose what their new investments are, being a “private Asian Real Estate Fund” and a private bond. We find the synergies between the lumber business and these types of investments unclear to put it lightly.

They can still go-private without any external financing - The key issue remains the controlling shareholder – Avarga Ltd. – and what they plan to do, and if they will treat minority shareholders fairly. Funny to think that given their 71% interest, they could self finance a buyout of minority holders with cash on hand and the existing undrawn $250MM bank line…

BURNABY, BC, December 21, 2022 - Taiga Building Products Ltd. ("Taiga" or the "Company") (TSX: TBL) announces that it has entered into a new $250 million senior secured revolving credit facility (the "Facility") with a syndicate of lenders led by the Bank of Montreal and including Scotiabank, Bank of America, TD Bank and CIBC. The Facility will mature on December 20, 2027 and is secured by a first perfected security interest in all real and personal property of the Company and certain of its subsidiaries. Russ Permann, President and Chief Executive Officer of Taiga, commented: " We’re very proud of the relationship we’ve built with our senior lenders. This credit facility renewal is a reflection of the strength of our enterprise and will support us in our pursuits in the coming months and years."

As a side note, Avarga’s market cap is now below the value of their ownership interest in Taiga. At the moment, Avaraga’s other two business owned at the parent level are not doing very well (see note below). We previously also owned Avarga. However, performance subsequently deteriorated in those two businesses due to macro issues (Chinese pulp competition for their paper division, Malaysian natural gas supply/political issues for their power plant). With this negative performance, we no longer viewed them as “free” and worried they might have negative value (cash burn in paper, potential write offs in power).

Where are we going now, boss? Avarga’s Plans

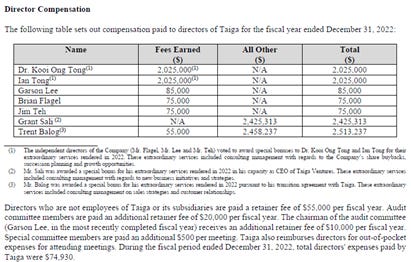

The key question is where is Avarga going to take minority shareholders. Will we be treated fairly? We have been relatively, so far (except for high Director compensation). Will these new investments be prudent in the end? What about the next one? We would prefer more dividends and repurchases, though repurchases are challenging given low volume. For the moment, we think the risk/reward is appropriate for ourselves, but we will be watching future capital allocation closely.

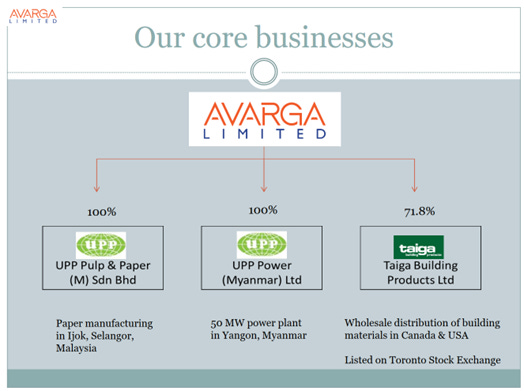

Background: What is Avarga Anyway?

Here is a full PDF of our notes on Avarga.

Some background on their other businesses below.

Avarga consists of three business, Taiga (they talk like they own the whole thing), a Malaysian pulp and paper business, and a Myanmar power plant backed by a 30 year PPA. Avarga was formerly UPP Holdings Limited. but was rebranded a few years ago (UPP referred to their paper business). Current management came in in 2012, with the key figure being Dr. Tong Kooi Ong. His bio makes us feel like we have been on a couch eating potato chips all our life (see end). They initially started with the one power plant and intended to do more, but subsequent deals had too low returns in their eyes (we agree). He stepped down from the CEO role in 2020 (still Chairman) and was replaced by his son, Ton Ian. This is something we typically do not like seeing, but we have found his actions and reporting so far have been better (repurchases instead of a dividend when they are discounted, focused on building up Taiga, etc).

When we first looked at Avarga, the other businesses were doing fine.

However, they subsequently both ran into separate serious headwinds. Their notes at the time:

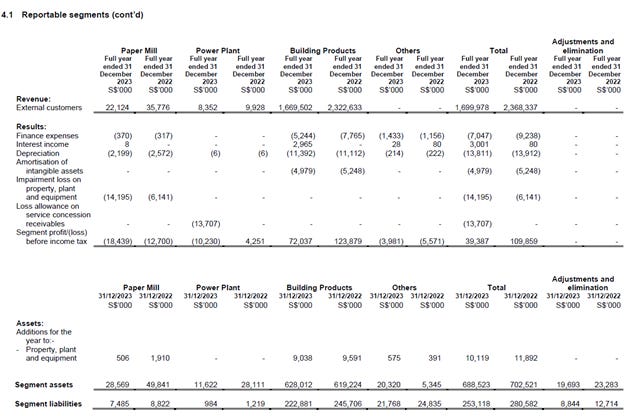

Paper - After an already adverse year in FY2022, operating conditions for the paper manufacturing division in Malaysia became even more challenging in FY2023 with the entry of two more large Chinese competitors, as well as capacity expansion by an existing large Chinese player. Meanwhile, cost pressures elevated further, especially for electricity and waste paper. In particular, waste paper costs rose sharply in 4Q2023 due to supply chain and logistics disruptions, and high shipping costs caused by geopolitical problems in the Middle East.

Power Plant - In FY2023, the power plant produced 241.72 million kWh of electricity, a decline of 30% from 343.38 million kWh in FY2022. The decline in production was due largely to gas supply issues, as the plant faced severe gas supply disruptions due to a shortage of gas in Myanmar.

On 1 February 2021, the Tatmadaw assumed control of the government. It announced a state of emergency in Myanmar, which has been extended several times. Economic conditions in the country have deteriorated significantly since then. The exit of major foreign players in the oil and gas industry have resulted in a shortage of gas available for power plants in the country. Security and political concerns have also escalated sharply since late Oct 2023, with fighting between government and other forces in several parts of the country. Given these increased uncertainties, we have decided to be prudent and impair the value of our power plant. We have made a one-off impairment of S$13.7 million, or 55% of the power plant’s carrying value. Due to this impairment, the power plant division reported a pre-tax loss of S$10.2 million for FY2023, compared with a pre-tax profit of S$4.3 million in FY2022. This is an increasingly difficult environment, and we will try to navigate and find possible solutions – none of which are likely to be fully satisfactory. More pain is inevitable.

Per their latest statements:

In 1H2023, the paper manufacturing division’s revenue declined by 41% to S$12.521 million from S$21.327 million in 1H2022, as we restrategised and discontinued producing several product lines. Despite the sharp drop in sales, pre-tax losses for the division narrowed to S$1.99 million in 1H2023, compared with pre-tax losses of S$2.312 million in 1H2022.

In 1H2023, the power plant produced 122.17 million kWh of electricity, a decline of 25.2% from 163.38 million kWh in 1H2022. The decline in production was due to gas supply issues. With Myanmar facing a general shortage of natural gas supplies, there has been periodic gas supply disruptions to our plant, despite the strong demand for electricity in the country. Due to the lower electricity sales, segmental pre-tax profit from the power division declined by 14% from S$2.075 million to S$1.775 million… Given these increased uncertainties, we have decided to be prudent and impair the value of our power plant. We have made a one-off impairment of S$13.7 million, or 55% of the power plant’s carrying value.