Talen Energy Corporation (OTC: TLNE) – An out-of-bankruptcy case study

Disclosure: We own this one.

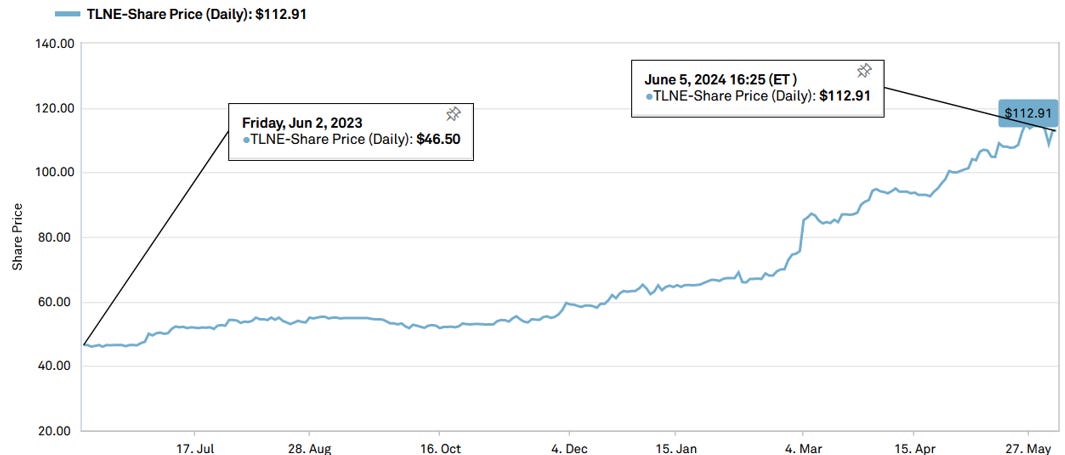

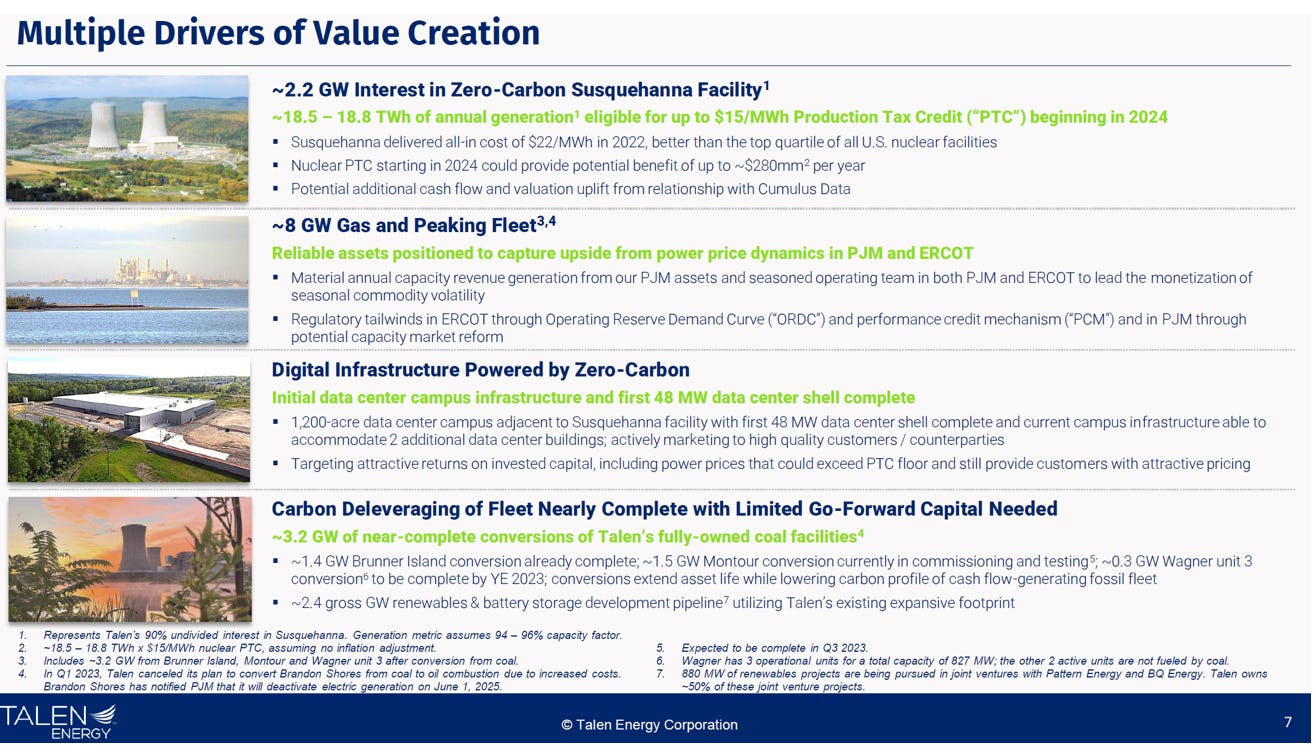

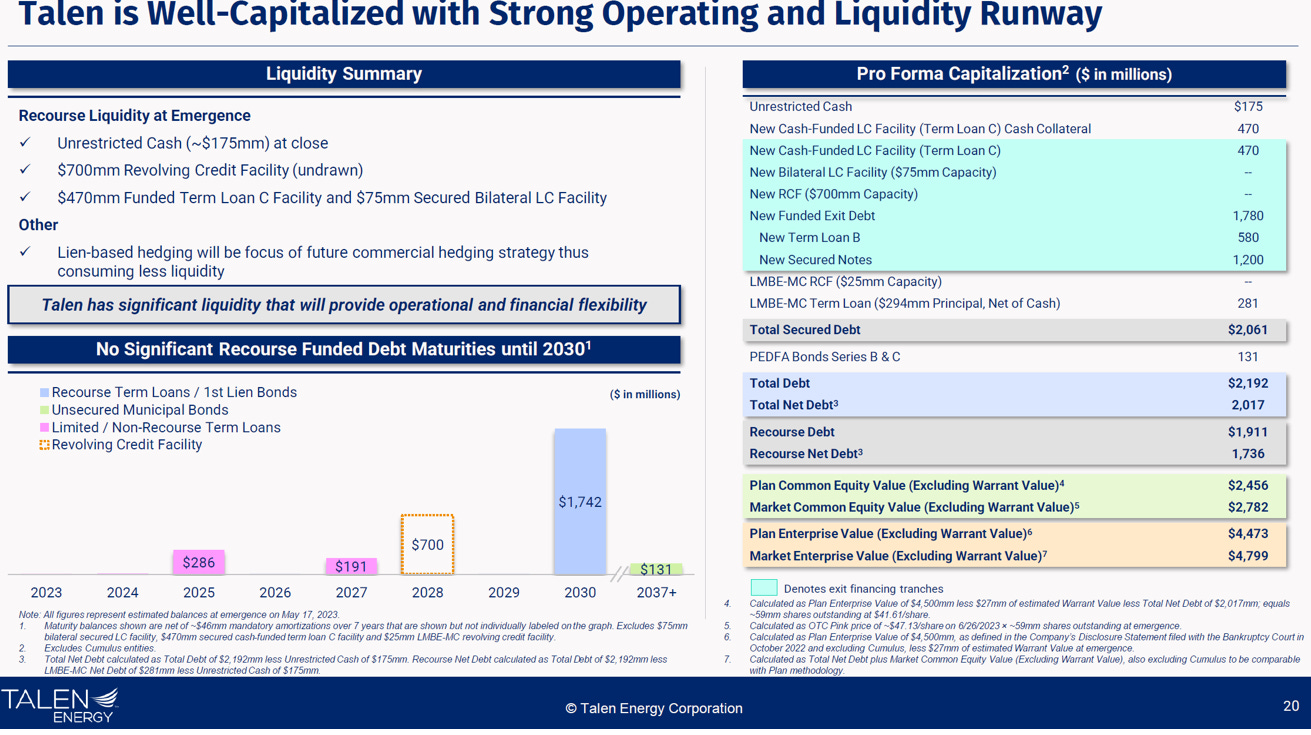

Recently bankrupt nuclear power plants trading over the counter are not for everyone. Talen Energy failed after being taken private and over-levered combined with a derivative book blowing up. They emerged from bankruptcy in 2023 with a clean balance sheet, and now – after a few asset sales – have a simpler business, a major deal with Amazon Web Services tied to their key nuclear asset, and tailwinds from the Inflation Reduction Act. It was silly cheap before, but is there still some value? We think so.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Major Event Timeline

2015 – Talen is created through a spin off from PPL Corporation. Stock performs poorly.

December 2016 – Talen is taken private by significant minority owner Riverstone Holdings below IPO price. Subsequently blows up.

May 2023 – Talen emerges from bankruptcy under new management.

May 1, 2024 – Sold 1.7-gigawatt ("GW") ERCOT generation portfolio for $785 million in gross proceeds (approximately $723 million in net proceeds). New Adjusted EBITDA range is $600 - $800 million, and new Adjusted Free Cash Flow range is $160 - $310 million.

May 13, 2024 – Increased buyback to $1B. $38MM spent to date. https://talenenergy.investorroom.com/2024-05-13-Talen-Energy-Reports-First-Quarter-Results,-Increases-2024-Guidance-for-Remaining-Fleet-and-Announces-Upsizing-of-Share-Repurchase-Program-to-1-Billion

Liquidity – $1,895 million; $1,349 million of unrestricted cash and $546 million of available under revolver. Net leverage ratio, utilizing the midpoint of 2024 Adjusted EBITDA guidance and net debt balances as of May 6, 2024, is approximately 1.2x.

May 29, 2024 - $600MM repurchase announced at prices “not less than $116.00 and not greater than $122.00” https://talenenergy.investorroom.com/2024-05-29-Talen-Energy-Corporation-Commences-a-Tender-Offer-to-Repurchase-up-to-600,000,000-of-its-Common-Stock

Implies repurchase of 4.9MM-5.17MM shares, or roughly 9% of shares outstanding.

Emerging from Bankruptcy

By the time bankruptcy came knocking, Talen was an interesting albeit eclectic mix of assets. Besides the Susquehanna nuclear power plant, they also had fossil fuel plants and solar projects in the same PJM transmission system serving Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and the District of Columbia. In addition, they were building out a data center powered by their nuclear plant, power generation assets connected to ERCOT (Electric Reliability Council of Texas), oh and a zero-carbon bitcoin venture.

Big changes have happened since. Subsequent to emerging in 2023 with new management, they sold their ERCOT assets, the data center project to Amazon, and now everything bitcoin related is up for sale thankfully.

When they first emerged, they had a market cap of ~$2.7 billion and an EV of ~$4.8 billion. What is interesting is that this EV was roughly the same as the construction cost of the Susquehanna nuclear power plant when it was first built back in the 1980s, never mind the other assets.

Thinking about asset value - Susquehanna Steam Electric Station

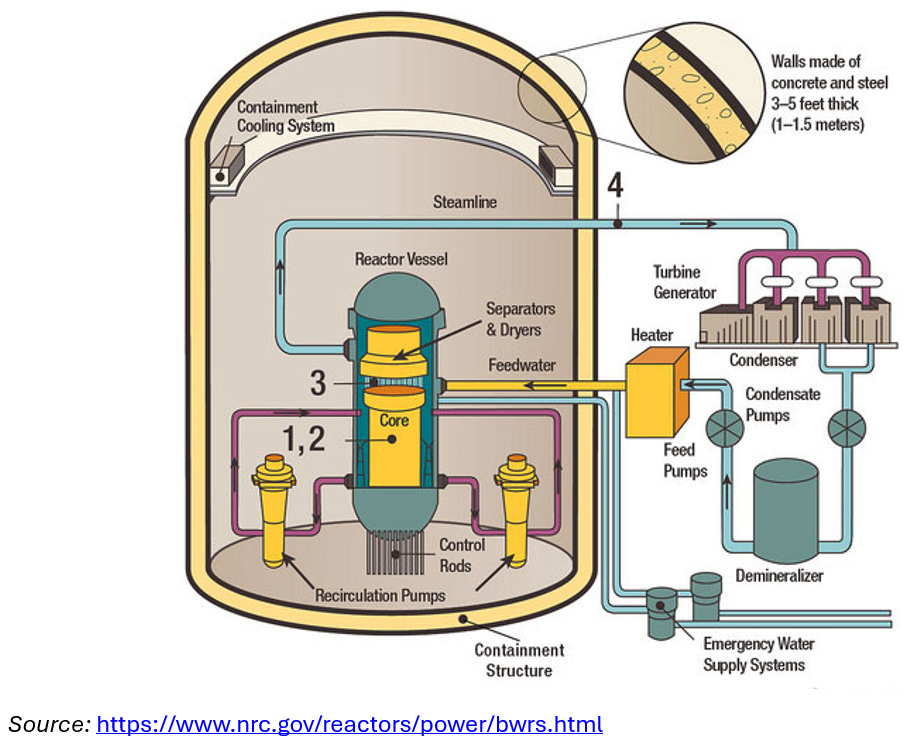

Although they had a number of different assets (and many still), the key asset is Susquehanna. The Susquehanna nuclear power station consists of two boiling water reactors, specifically a GE BWR (boiling water reactor) Type 4 Mark 2 first introduced in 1966. Construction began on Units 1 & 2 in 1973 with licensed operations commencing in 1983 and 1985 respectively. It is still one of the largest power producing assets in the United States. It was owned by PPL Corporation (founded as Pennsylvania Power & Light in 1920) until it was spun out in 2015, which is also public - NYSE: PPL. PPL currently owns 4 utilities with a market cap of ~$20 billion, EV ~$37 billion.

In 2009, the Nuclear Regulatory Commission granted Susquehanna a twenty-year license renewal for both units 1 & 2. Their licensed operational lives are currently to 2042 and 2044.

The neat thing about nuclear power plants in the United States is that there is a lot of information publicly available if you want to learn about them. For example, the Nuclear Regulatory Commission has a lot of information about each plant, including Susquehanna - https://www.nrc.gov/info-finder/reactors/susq1.html including enforcement actions https://www.nrc.gov/reading-rm/doc-collections/enforcement/actions/reactors/s.html#Susquehanna and even the plant’s response to lessons learned from the Fukushima incident in Japan - https://www.nrc.gov/docs/ML1929/ML19290H034.pdf

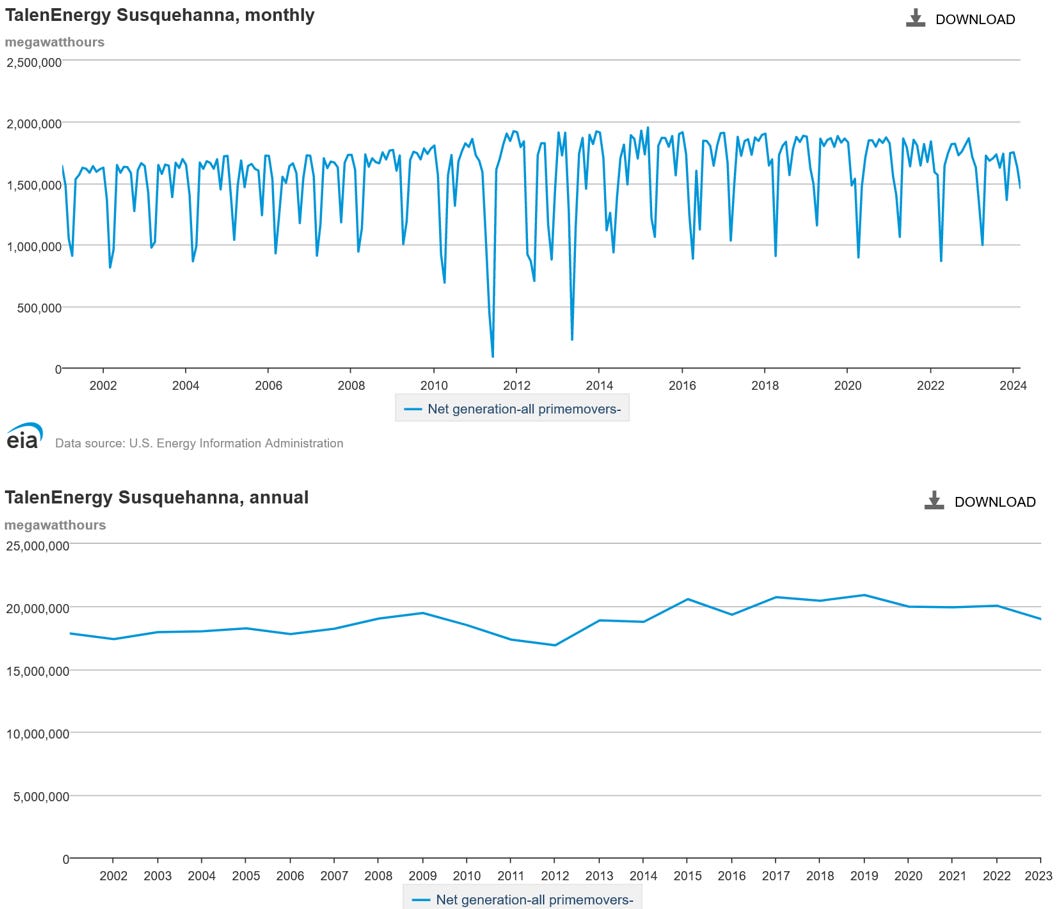

You can also easily get a 20-year lookback of power generation through the EIA. https://www.eia.gov/electricity/data/browser/#/plant/6103

Replacement Cost

The plant’s original cost to complete unit 1 in 1983 and unit 2 in 1985 was about $4 billion, or roughly $12 billion today. However, unfortunately life is a lot harder for builders of major infrastructure today than in the 1980s as we have just seen…

The Latest Plant Built

The latest nuclear reactor built in the U.S. is the Vogtle Unit 3 and 4 expansions in Georgia, which originally had two Westinghouse Pressure Water Reactors (PWRs), the main competition for GE’s Boiling Water Reactors used in Susquehanna, which is a neat side history we will not get into today. This expansion uses a newer AP1000design.

The ride has been bumpy, but unit 3 entered commercial service in 2022 and unit 4 is still under construction. A cumulative $12 billion in loan guarantees have been provided by the U.S. Department of Energy to the Georgia Power Company and friends for the project.

How much will it cost? Construction of units 3 and 4 was approved in 2009 and estimated to $14 billion. However, the latest estimate is over $30 billion and could increase further given 4 is still under construction. They each have capacity of 1,100 MW for a combined 2,200 MW giving you cost per MW of roughly $13.6 million. https://www.ans.org/news/article-3949/vogtle-project-update-cost-likely-to-top-30-billion/

Susquehanna is currently producing 18.5 TWh annually (~2,100 equivalent) today and at its actual nameplate capacity it implies a cost of $37 billion.

Is this cost really a fair representation of the next plant? One could argue this number is a bit high given the challenges around the novel construction process for Vogtle of trying to standardize and fabricate components off-site (which ultimately led to Westinghouse having over $13 billion in cost overruns and ultimately going into bankruptcy). But we are focused on the general direction and Talen’s entire enterprise value is less than $9 billion.

https://www.theregister.com/2023/08/01/us_nuclear_reactor_vogtle/

Peers – Constellation Energy Corp. (NASDAQ: CEG)

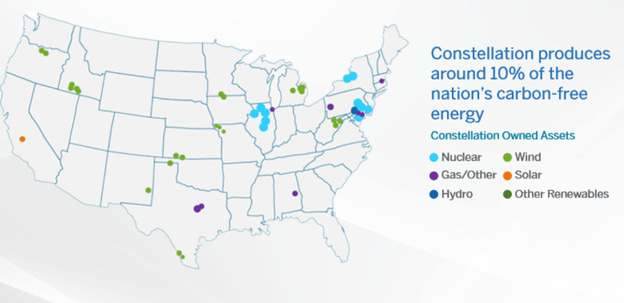

Constellation is an interesting comparable given its large nuclear power fleet. It currently trades at a forward 17x EV/EBITDA and a PE of ~25x.

Unlocking Value: The Campus sale, ERCOT sale, and buyback

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.