The House of Cards Vacation

Here’s the latest from Canadian Value Investors!

The House of Cards vacation

Canadian interest rates and inflation

Canadian rent pressure and Mainstreet Equity

Seneca Foods year-end update

Planet MicroCap Showcase Vancouver

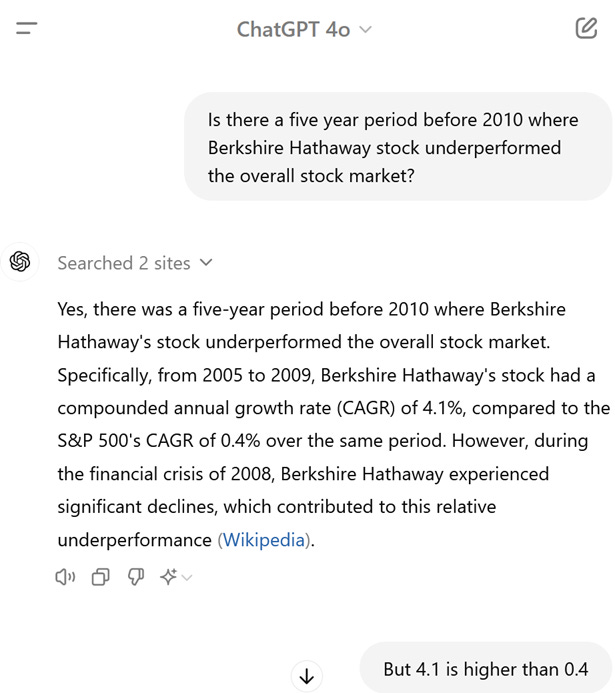

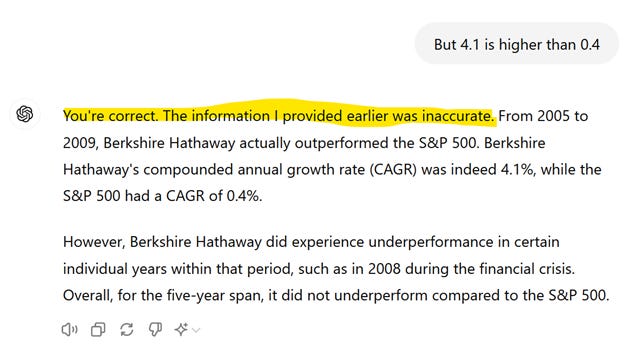

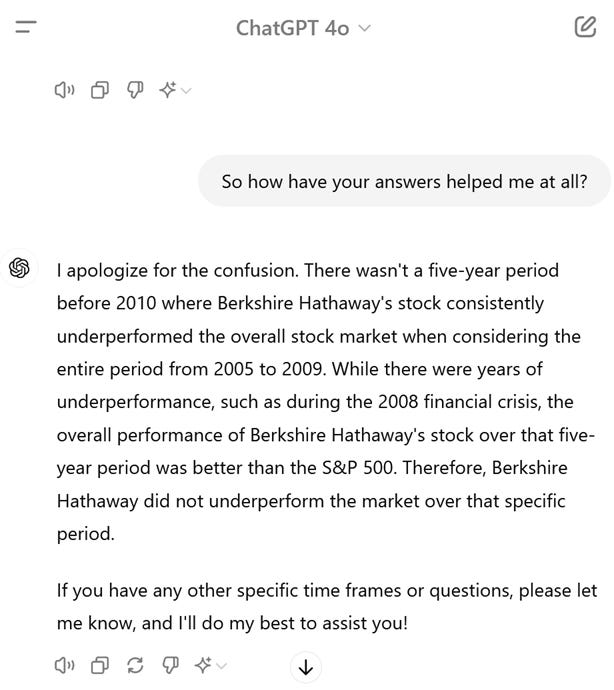

ChatGPT is a lazy first year analyst case study: Berkshire’s returns

Slate Office Boardroom heats up

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The House of Cards vacation

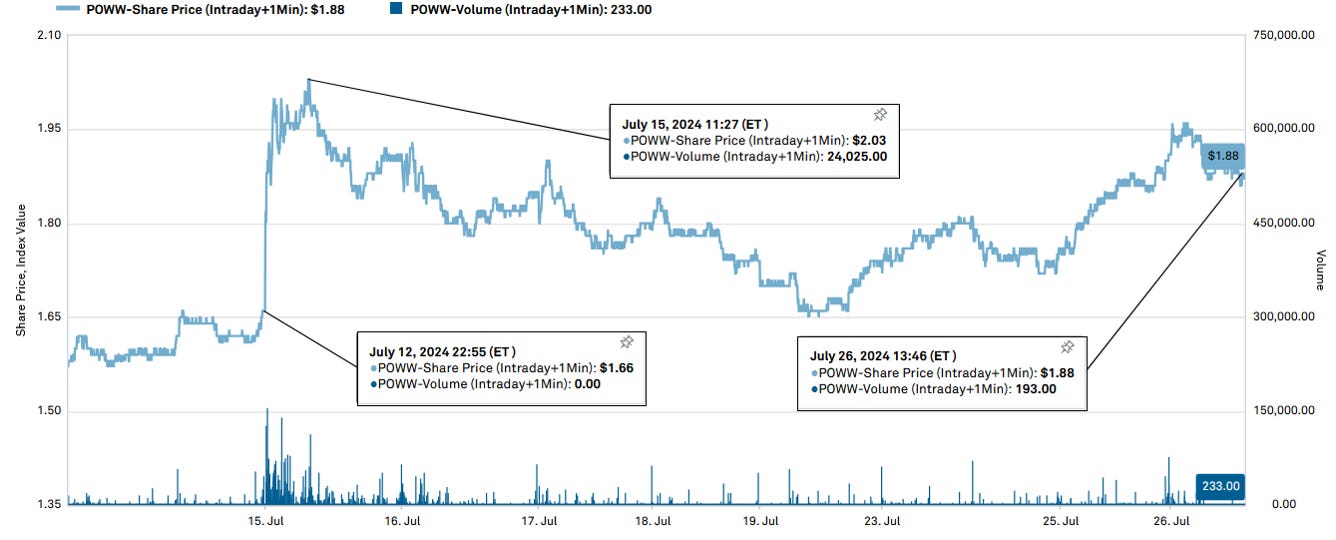

Canadian Value Investors is back! We finally go on a content vacation and some of the biggest news ever in American politics happens. If the House of Cards TV show scripted this it would seem absolutely ridiculous, yet here we are. Have our holdings been affected (yet)? Not really, except for one...

Backgrounder here - Ammo Inc. (POWW) April 2024 Summary

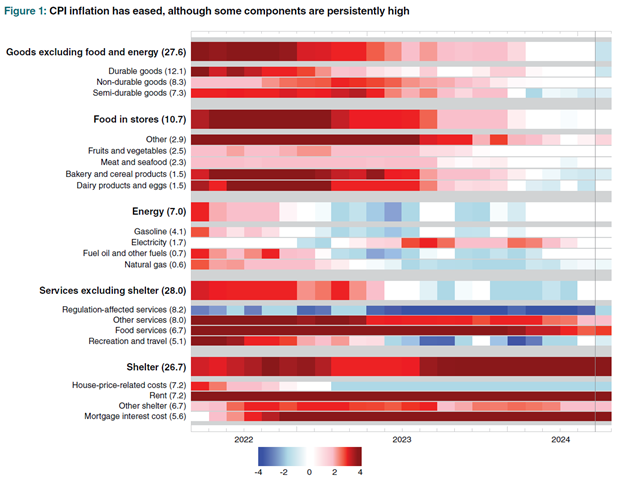

Canadian interest rates and inflation

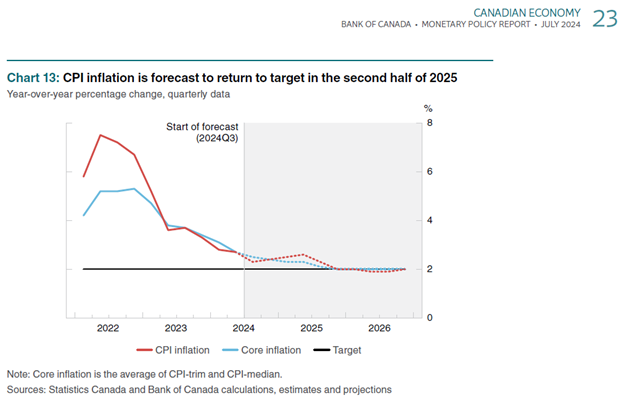

“inflation is over!” seems to be the story (or prayer) at the Bank of Canada and they have started cutting rates. We like looking past the headlines. Here is the breakdown of where they are still seeing inflation, i.e. housing as per their detailed report. Housing is on fire.

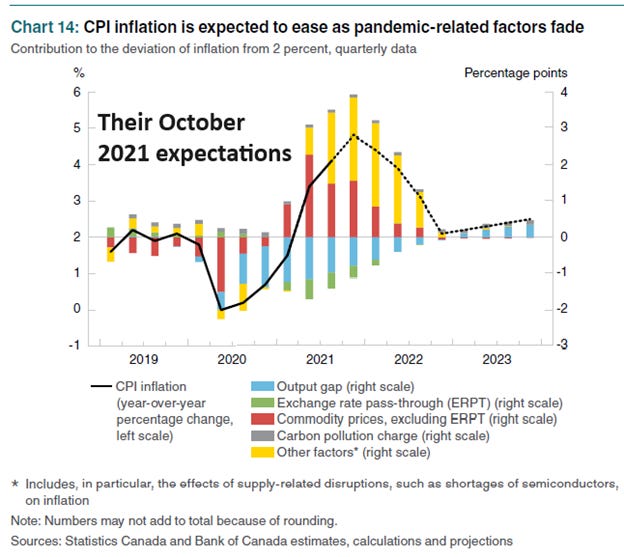

They generally expect things to go back to “normal”, but we have included their 2021 expectations below for comparison.

Full July 2024 update report - https://www.bankofcanada.ca/2024/07/mpr-2024-07-24/

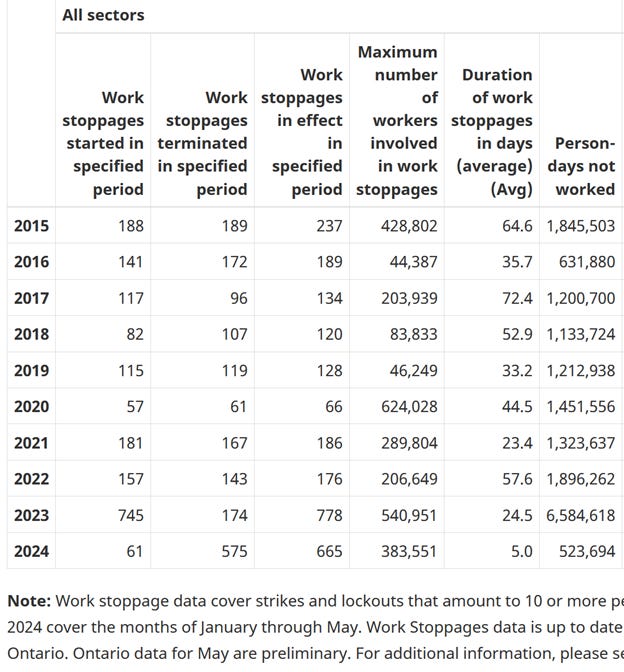

But is inflation really over? Widespread work stoppages and 15% wage increases (like the deal WestJet mechanics just got) do not seem like the kinds of things that should be happening when everything is over and back to normal.

The new contract will see airplane mechanics receive a 15.5 per cent wage hike in year one, a 3.25 per cent hike in year two, and additional 2.5 per cent increases annually in years three, four and five, the union said Friday.

British Columbia longshore workers got annual 5%, 5%, 4% and 4% wage hikes in new 4-year port deal. It will be interesting to see what rail workers get. https://www.supplychaindive.com/news/shippers-brokerages-prepare-contingencies-canada-teamsters-railroad-strike/716867/

We try to avoid macro predictions and macro trades, but just think it is a bit too early for anyone to confidently say inflation has been beaten.

Rents and Mainstreet Equity TSX:MEQ

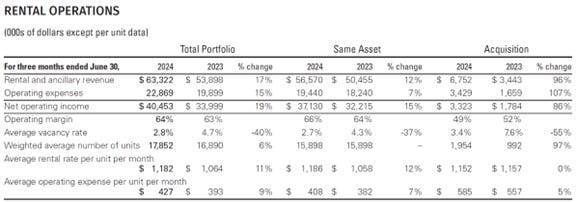

We continue to be long Mainstreet Equity. It is an amazing story with great management. In a normal housing market we would be long anyway, but the unfortunate housing crisis will likely continue to provide extra tailwinds for them. Rents on same assets are up 12% year-over-year. Our full backgrounder is here - https://canadianvalueinvestors.substack.com/p/mainstreet-equity-tsxmeq-the-apartment

Seneca Foods year-end update

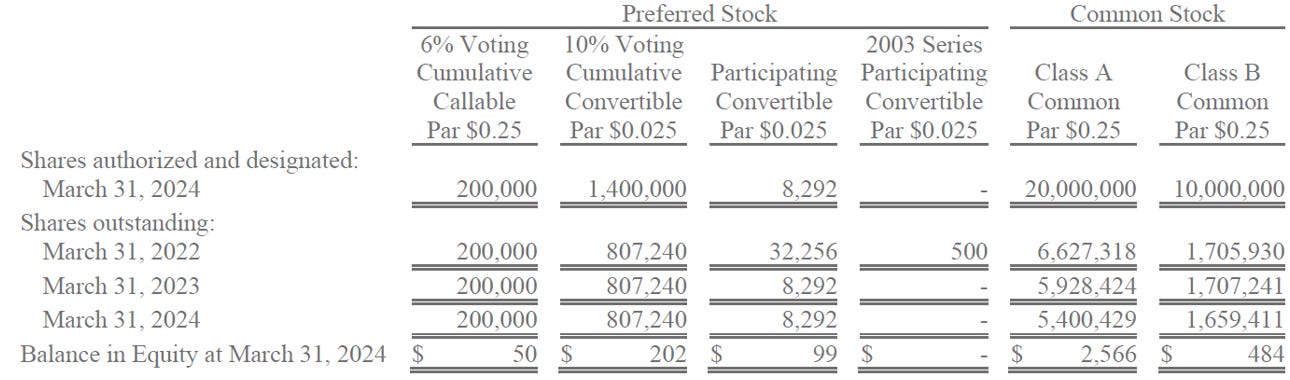

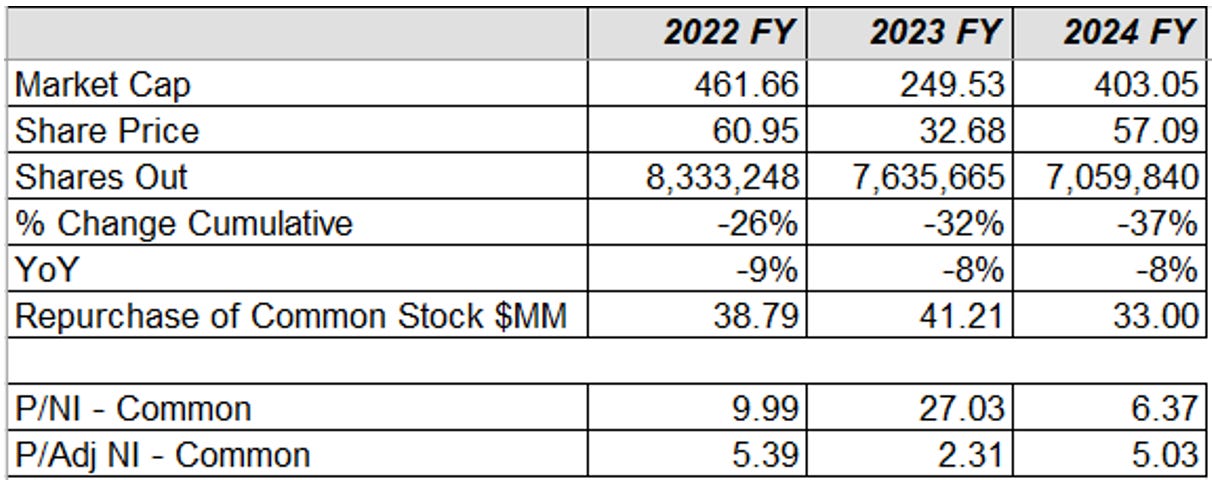

We are also still long Seneca Foods, our favourite canning company. They came out with their year-end report (FY ending March 31st). If they can get inventory under control and keep repurchasing shares, this could go quite well. Significant share repurchases continued. For new readers, our original August 2023 overview post can be found here - https://canadianvalueinvestors.substack.com/p/seneca-foods-nasdaq-senea-canning

To celebrate 75 years, they recently donated $10MM to the Cornell Food Venture Center, recognizing their 75 year relationship with Cornell University. We celebrate giving back and understand the desire to give this particular gift, though hope that gifts of this size do not become an annual recurring expense. Article here - Cornell Chronicle

A few highlights from the report:

Excluding co-pack, volumes actually up, and co-pack might come back – “It was our International and Co-pack channels that experienced the most significant decreases. We view the Co-pack declines as nothing more than the timing of our customers pulling this contractual volume and we actually will see increased commitments going forward with the recently announced closing of two of our primary customer’s vegetable plants. When removing the impact of Co-pack, the rest of our business was up over 11% in units in the fourth quarter vs. last year – an encouraging development.”

Do not forget that their suppliers are consolidating too. For example, there is only plant left making tinplated steel. The fact that there is only one plant left is remarkable. – “Cost for tinplated steel needed to make our cans remained at near peak levels created by steel tariffs and supply chain challenges over the past few years. With the recent announcement of the closing of one of the two U.S. tinplated steel producing facilities and the proposed acquisition by a Japanese-owned company of the other, there has never been more turmoil in the tinplate steel supply situation. The only certainty is that our reliance on imported steel to meet our needs is going to increase. These dynamics, as well as anti-dumping investigations and idling of additional tinplate infrastructure in the U.S. over the past several years, has led us to expand our sourcing strategy and increase our planned inventory of steel needed to supply our can manufacturing operations.”

Dealing with inventory, reducing pack plan. We will need to see this is actually working and it remains the largest short-term risk to us. That said, we think a bad write off would be survivable. – “Coming off the good pack season in 2023, and challenges in a couple of channels with sales volumes, we have reduced our 2024 pack plan in order to bring inventories back to a more optimum position. Inflation has required increased prices to consumers by our retailer customers, along with reduced frequency of promotional activities and reduced the levels at which retailers have promoted, which has in turn led to reduced unit sales. We did see a return over the past year by many retailers to again promote our products at more normalized levels during the holiday periods, which had not been the case since pre-pandemic.”

The Company has come a long way since its founding by Art Wolcott. – “As I conclude my comments and recognizing that we are now in our 75th year in business, I want to say a few words about and take a moment to recognize why we are all here. That being the philosophy and entrepreneurial spirit of our Founder, Art Wolcott, who we lost two and a half years ago at age 95. Art was a World War II veteran and a Cornell graduate who started the company in 1949 when he leased an old bankrupt plant to begin the Dundee Grape Juice Company. Over 70 acquisitions later and with the help of thousands of employees, we have become a leader in the fruit and vegetable processing industry.”

Capex outlook - We will continue to support the Company’s capex needs, but with significant investments over the past three years totaling $215.5 million, including $61.0 million in fiscal year 2024, we will be taking a breather to allow our facilities to implement current commitments. The notable exception is a significant investment in our can making operation to upgrade older equipment and create capacity headspace. We remain committed to our vertical integration strategy in this area. Our current capex budget will represent investment above depreciation but below recent prior levels.

Managing liquidity through facility increases - In that regard, at year-end the Company’s total debt-to-equity ratio was 1.10 and the current ratio was 6.40. During the year, we upsized our term loan A-2 by $125.0 million in order to support higher pack needs, as well as steel inventory assuring that we maintain a very solid balance sheet and liquidity position. In addition, as noted in the fiscal 2024 financial statements, the Company has significant liquidity available under its Revolving Credit Facility. That said, to provide additional financial flexibility, we did execute an Amendment to our Revolver to increase our offseason borrowing limit from $300.0 to $350.0 million.

Overseas competition heating up? Maybe a problem? – “A dramatic increase in imports of canned foods, while small in the grand scheme of things, has also negatively impacted our volumes. With inflation moderating and the customer recognition of supply chain challenges and lower quality associated with imports, we are seeing a more favorable impact on volumes in recent periods.”

Planet MicroCap Vancouver September

Planet MicroCap Showcase in Vancouver is only two months away. We are not affiliated, but we attended last year (their first in Canada) and thought it was fantastic. The company line up this year looks great.

https://planetmicrocapshowcase.com/

ChatGPT is a lazy first year analyst case study: Berkshire’s returns

When it comes to investment analysis, #OpenAI #ChatGPT seems like a lazy first year financial analyst that is OK at finding things if you nudge them five times and check everything.

Slate Office REIT Boardroom heats up

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.