Trump tariffs and other noise: Where we have our money today (portfolio update)

And “Seneca Foods (NASDAQ:SENEA) has too much debt” some said, we disagreed and so do their banks it seems

Here is the latest from Canadian Value Investors!

What worked well in an uncertain world

Trump tariffs and other noise: Where we have our money today

“Seneca Foods (NASDAQ: SENEA) has too much debt” some said, we disagreed and so do their banks it seems

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

What worked well in an uncertain world

We put off doing a summary of 2024 even though we did “well” last year, ~25%, but so did everyone in an index fund. However, we had a few wins that we think are worth talking about as they provide a lesson for dealing with 2025. All of these ideas had low market expectations, and the theses did not depend on macro or micro improvements, though they all had some that were likely and we viewed these improvements as free potential upside at the purchase price. The key is to keep things simple.

Todd Combs – “You try to avoid path dependencies. People almost always overestimate their abilities and the complexity of a task. Say someone thinks something has a 90% chance. When you break it down into its parts, say there’s 20, and each part has a 90% chance of failure you are now well below 50% chance of success.” This approach has helped him to mostly avoid huge mistakes.

Seneca Foods – This has gone well. At purchase it did not rely on meaningful improvement in competitive dynamics; that was free. See update below – “Seneca Foods has too much debt” some said, we disagreed and so did the banks. https://www.canadianvalueinvestors.com/p/seneca-foods-nasdaq-senea-canning

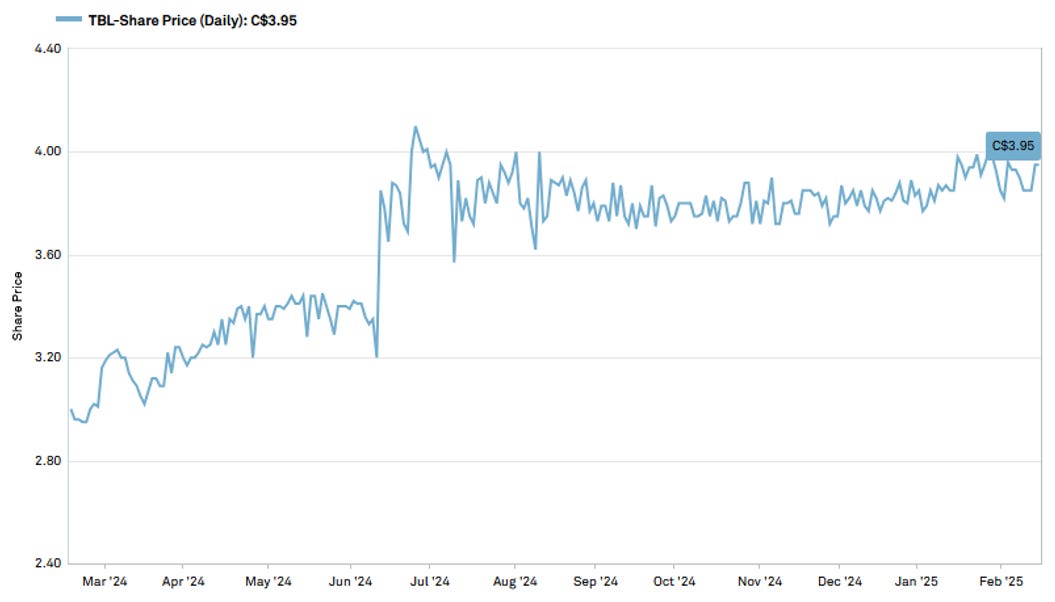

Taiga Building Products – Just cheap, with action by the key owner increasingly likely. The thesis does not rely on higher home building construction (despite Canada having a significant housing shortage); that is free at our purchase price. It has the weirdest chart of any of our holdings. https://www.canadianvalueinvestors.com/p/taiga-building-products-tbl-q1agm https://www.canadianvalueinvestors.com/t/tbl

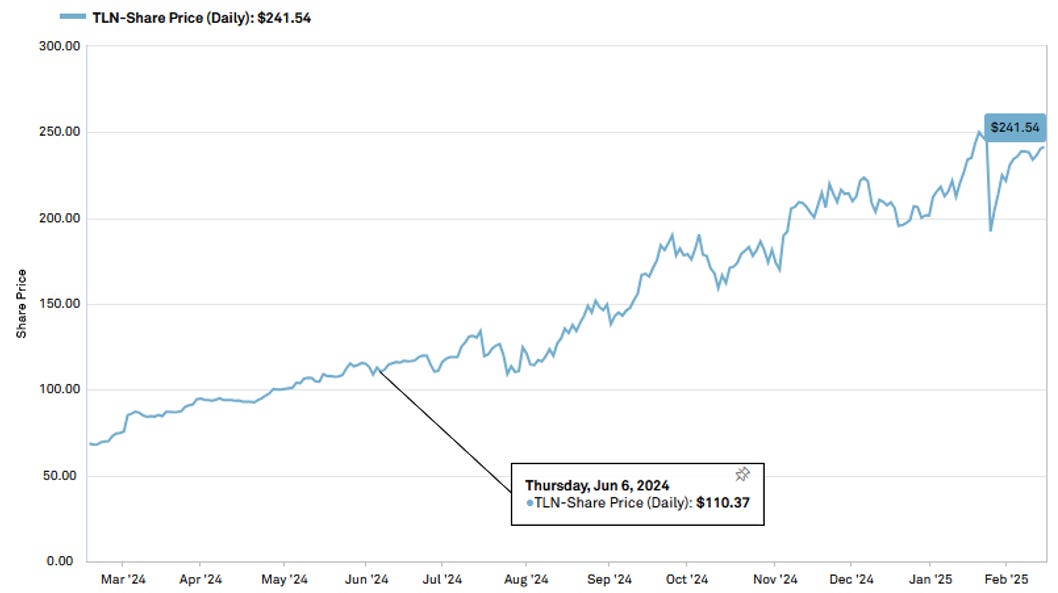

Talen Energy – An out of bankruptcy case study – Successfully exited since purchasing and posting in June. We did not depend on higher power prices or an AI power boom for this to go well; that was all free upside at purchase. Current owners might have to think about these things. https://www.canadianvalueinvestors.com/p/talen-energy-corporation-otc-tlne

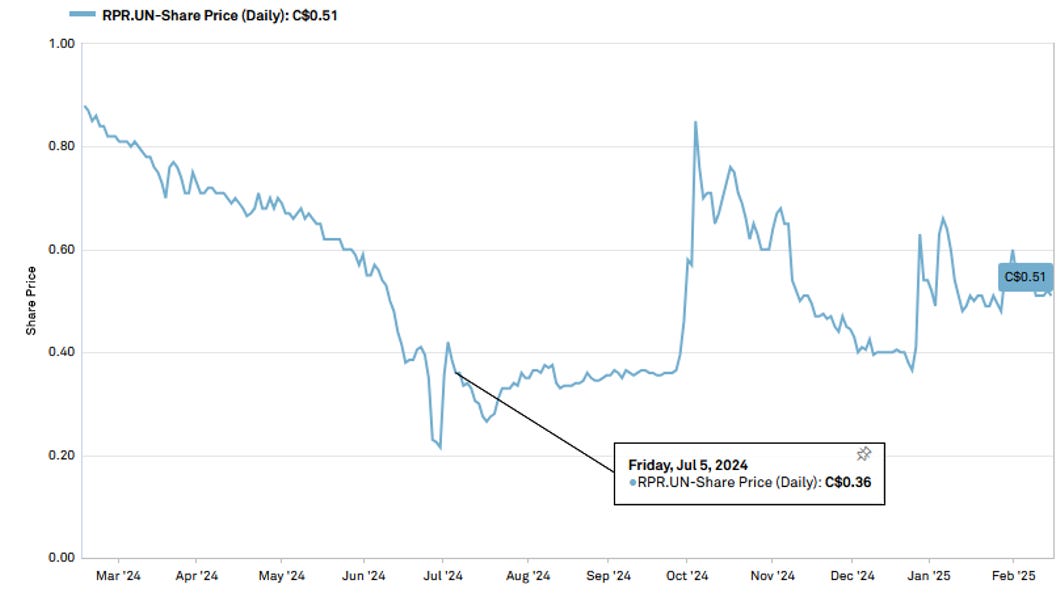

Slate Office REIT - Now Ravelin Properties REIT – Tentatively great, but too early to tell

https://www.canadianvalueinvestors.com/p/slate-office-reit-tsxsot-convertible https://www.canadianvalueinvestors.com/t/sotun

This might just work, though it is too early to tell. What made this interesting was the dynamics of the publicly listed debentures as we explained. If you bought the debentures at posting time in July at the $10s (3 different series, low liquidity), you would have done well with trades now at 50 cents on the dollar, and some higher interim trades. As we have posted about previously, we bought in the 10s and sold out of the debentures in the 50s as we viewed the risk/reward not worthwhile. Later we purchased the stock after the confirmed management change and rebranding and still own it (viewed as more interesting risk/reward vs the debentures today). However, we do not view this with the same lense as the debenture trade; risk is extremely high/higher. The company still needs to stabilize or be restructured. Importantly, the outcome of Slate will likely have little correlation with any of our other holdings.

Trump tariffs and other noise: Where we have our money today

“It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.” - George Soros

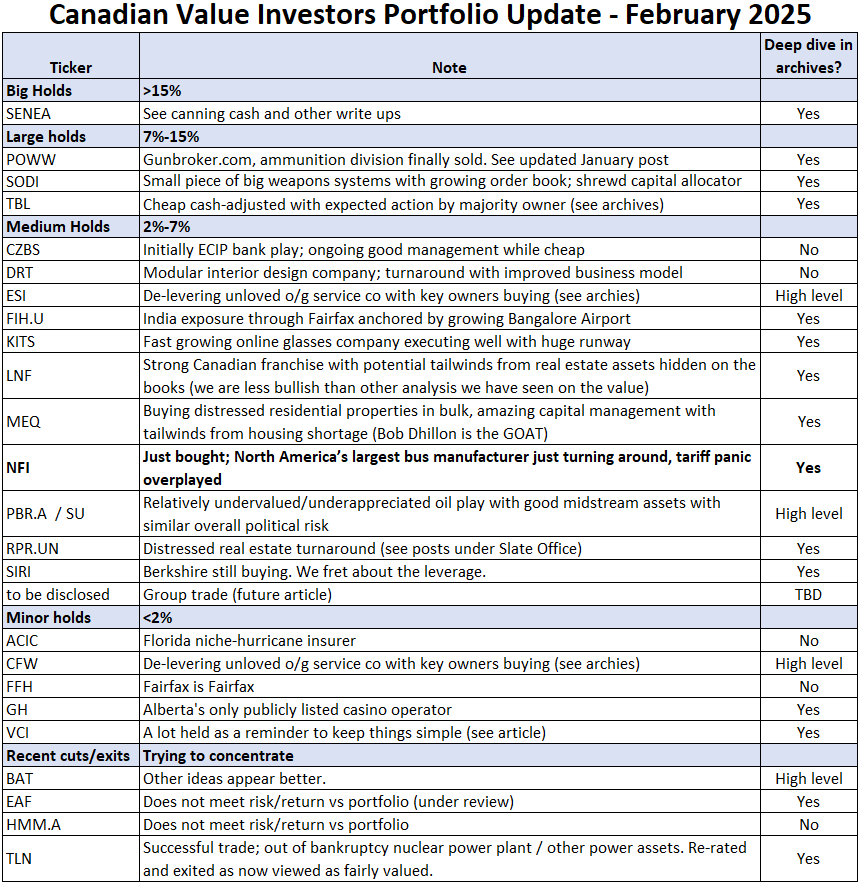

Our aim with our articles is to inform about a given business or industry. However, we think it is important that readers know we do put our money where our mouth is. This is where we are putting our money today.

Deep dives can be found here - https://www.canadianvalueinvestors.com/p/directory We do tag companies we comment on, so you can see our full post history of references.

Turn up the noise

https://globalnews.ca/news/11014173/bc-border-store-business-dropped-trump-tariffs-buy-local/

What we are trying to keep top of mind this year is, to paraphrase Warren Buffett, there are no points for difficulty when it comes to investing. We know that some of our holds are not easy ideas, but we hope expected returns might offset this. In fact, we fret about a few and find ourselves less concentrated than we would like to be in general; we are not sitting on no brainers and have diversified to help mitigate unforeseen negative tail risks. We hope to find better ideas soon.

However, the amount of ink wasted on worrying about who Canada’s next prime minister (or possibly president????) is and the potential impacts of tariffs is remarkable. Can our portfolio be impacted by all of this? Yes, but most bearish scenarios do not break our theses. In fact, we think this is period is going to provide a lot of amazing opportunities and we expect our portfolio to change significantly over the year as we hunt. Caution is warranted; there are real impacts for some businesses as the Global News article above shows.

We have three buckets:

Companies that will not be affected – Our main focus - You do not get points for difficulty. Certain industries are largely out of scope/too hard, unless they get egregiously mispriced. We wish analysts covering steel the best of luck.

Companies we think that will not be materially affected and are relatively cheap - An example of this thinking is Suncor (repurchased late last year). It is currently our only Canadian energy stock and the keyword is they are integrated. Their production is weighted towards heavy oil, which the U.S. refining complex needs and other key heavy oil producers are struggling due to domestic problems and are under similar Trump-risk (Pemex in Mexico, Venezuela). Should duties get out of control, their refining business should still be fine, possibly better, while a weaker Canadian dollar and likely cheaper natural gas input costs will help offset the impact.

Companies that we think are misunderstood and the potential return offsets the potential risk – NFI Group is our only example of this so far as we made our initial purchase in the recent tariff panic (of course, it is possible we might be very wrong). That said, we would not want an entire portfolio of NFI-like ideas. It works within the overall portfolio. - https://www.canadianvalueinvestors.com/p/nfi-group-inc-tsxnfi-is-this-our

And then it is important to keep in mind the general market level as Bloomberg reminds us with the table below. The next five years will probably be harder than the last five, but as Charlie Munger said, “why shouldn't it be hard to make money? Why should it be easy? It was never easy.”

“Seneca Foods (NASDAQ: SENEA) has too much debt” some said, we disagreed and so do their banks it seems

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.