Unit Corp OTCMKTS:UNTC - The Christmas dividend… now what?

Here’s the latest from Canadian Value Investors!

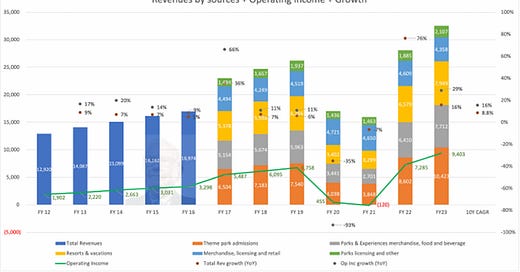

How does Disney make money off of your visit, and how is that turnaround going to go anyway?

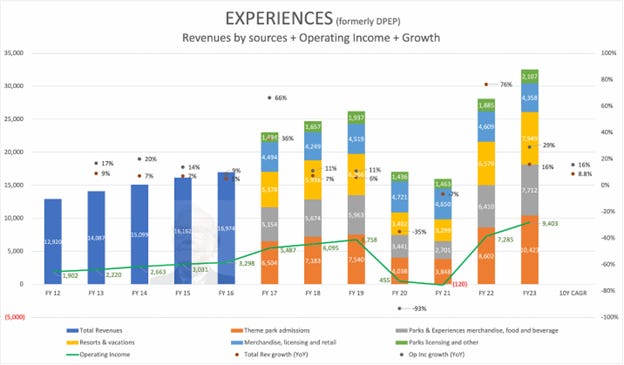

Canadian oil and gas leverage

Brazilian Boom

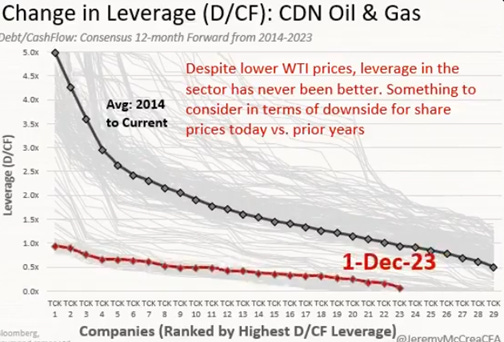

Unit Corp OTCMKTS:UNTC - The Christmas dividend… now what?

How does Disney make money off of your visit, and how is that turnaround going to go anyway?

Disclosure: No position currently, owned previously, and always evaluating. Valueinvestingsubstack did an interesting post on Disney. Will Disney generate ROIC? Maybe. But, the park chart is neat.

Canadian oil and gas leverage

https://x.com/JeremyMcCreaCFA/status/1733487093744369727

Brazilian Boom

Even with the big run up in things like PBR (disclosure: we are still long), Brazil remains significantly below where they used to be. They continue to have relatively low multiples for the market as a whole and we still think it is a great hunting ground for undervalued companies. Chart via https://x.com/TaviCosta/status/1724817995950653710

Unit Corp OTCMKTS:UNTC - The Christmas dividend… now what?

Disclosure: We do not own this, but are evaluating and might own in the future.

UNTC has been on our radar for a while and a just announced year-end dividend of 40% of their market cap made us finally take a closer look. We were going to send this article over the December 9th weekend, but wanted to see how it would trade on Monday the 11th after their Friday dividend announcement and update accordingly. So far, it was a mistake not to buy it when we found it, but is there still something here? Here we go.

UNTC is actually a restructuring that emerged in 2020. It blew up in 2019/2020 when a looming $650MM debt maturity in May 2021 was coming up. Here’s their “emergence” presentation. https://unitcorp.com/wp-content/uploads/2021/06/Unit-Emergence-Presentation-122020.pdf

It was really three few companies, now two companies:

An upstream oil and gas company selling assets

A drilling rig company

Superior Pipeline Company – sold

And they also happen to have $200MM of cash on a market cap of ~$540MM with no material debt. Three years later, the Company:

Continues to sell oil and gas assets (full list in notes)

Has paid out lots of dividends and is trading at low single digit free cash flow multiple… but what is true free cash flow? See valuation.

Current albeit dated presentation here - https://unitcorp.com/wp-content/uploads/2023/03/Investor-Presentation-March-2023.pdf

The company plan has been to:

Sell oil and gas assets (see full list in notes, another happening in Q4 discussed below) – We believe they will likely sell their remaining upstream assets to then either run or sell their drilling business (see valuation)

Distribute cashflow through base dividend, supplemented by special dividends and repurchases. E.g. in Q2 2023, the Company began paying a quarterly variable dividend of $2.50/share, a January 2023 special dividend of $10/share, and repurchased $79MM of shares through December 2022.

Then on December 8th, the Company announced a Christmas present consisting of $15/share special dividend, their regular $2.50 dividend, and a conditional cash dividend of $5 depending on the closing of the sale of their Texas Panhandle assets. https://unitcorp.com/unit-corporation-declares-quarterly-and-special-cash-dividends/

The Company is effectively run by key owner Prescott Group Capital Management L.L.C. and appears to be aligned with shareholders; they own ~36%, and the CEO appointed earlier this year - Philip Frohlich – is a Principal/PM at Prescott. There are no other material owners.

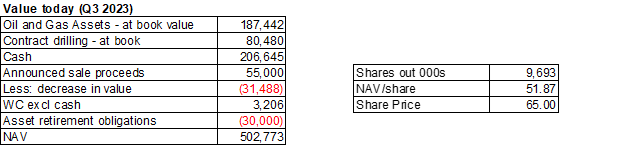

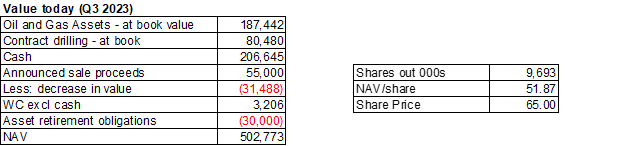

Based on simple book value, this is not too exciting. But what do you actually get at the end of the day?

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.