Here is the latest from Canadian Value Investors!

What do valves, glasses, and buses all have in common? They are all owned by us. Today we have updates on Velan (valves, expected sale), KITS (glasses, growth), and NFI (buses, turnaround), three very different situations that we added to in the recent pullback. You can always find our post history organized by company here - https://www.canadianvalueinvestors.com/p/directory

Enron Analyst Day Video – January 2001

Velan Inc. (TSX:VLN) March Meeting Update – Deals moving forward

KITS Eyecare Ltd. (TSX:KITS) keeps kicking it – 2024 YE update

NFI Group (TSX:NFI) 2024 YE update – Is the bus out of the ditch?

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Enron Analyst Day Video – January 2001

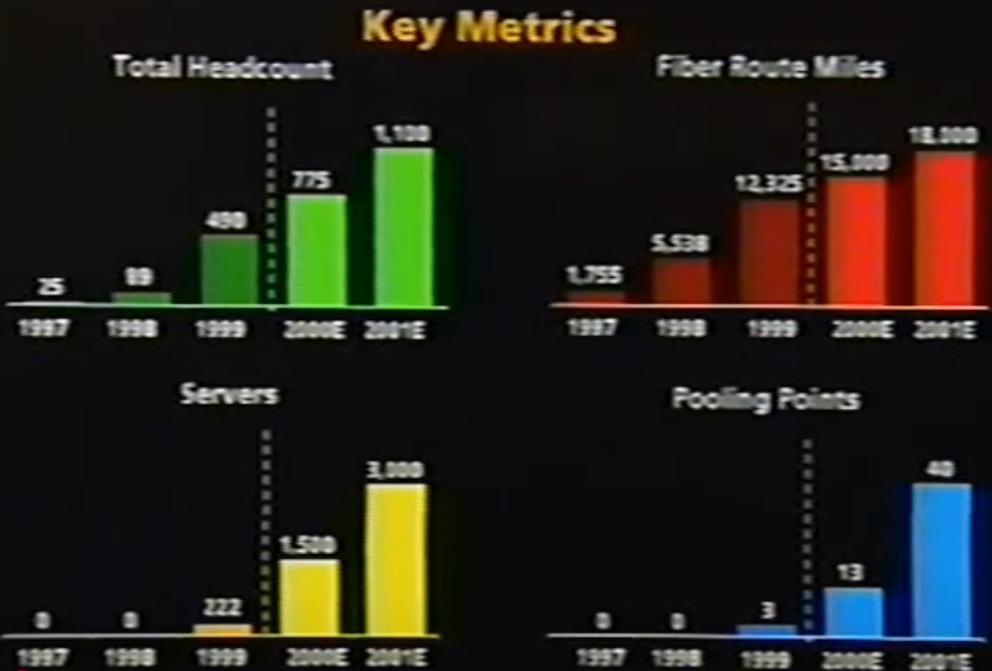

One habit we have picked up over the years is reading filings and watching presentations of companies that have failed. One gem we recently found was this Enron Analyst Day in January of 2001, not long before their spectacular blow up (the largest Chapter 11 in U.S. history at that time). Hard to believe they failed with all key metrics going up and to the right.

Velan Inc. (TSX:VLN) March meeting Update – Deals moving forward

Disclosure: We remain long.

Shareholders approved the deal, which will pay for the second deal, as expected. See our write up here - https://www.canadianvalueinvestors.com/p/velan-inc-tsxvln-all-polished-up

The “vote” on the sale of the French division, fully covering the asbestos liability deal, was a success. As we noted in our last article, their pre-meeting disclosures state “while it is required under the CBCA that the Meeting be held, the Required Shareholder Approval is already effectively secured, as Velan Holding Co. Ltd., the Company’s controlling shareholder and the sole holder of the Multiple Voting Shares, representing approximately 72% of the total Shares issued and outstanding.”

We expect the transactions will close shortly and the formal sale process of Velan itself will follow.

MONTRÉAL, March 20, 2025 /CNW/ - Velan Inc. (the "Company" or "Velan") (TSX: VLN) today announced that holders

("Shareholders") of subordinate voting shares (the "SVS") and of multiple voting shares (the "MVS") of Velan have approved a special resolution (the "Special Resolution") approving the proposed sale by the Company's U.K. direct wholly-owned subsidiary, Velan Valves Limited, of its direct French wholly-owned subsidiaries (being the Company's indirect wholly-owned subsidiaries), Segault and Velan S.A.S. ("Velan France"), to Framatome SAS, for a purchase price of US$177.6 million (€170 million), with the benefit of the transfer by Velan France of an intercompany loan receivable from the Company of US$23.5 million (€22.5 million), for total consideration to the Company of US$201.1 million (€192.5 million) (the "France Transaction").

Velan anticipates using part of the proceeds from the France Transaction to divest its asbestos-related liabilities pursuant to the divestiture transaction announced on January 14, 2025 (the "Asbestos Divestiture Transaction" and, together with the France Transaction, the "Transactions").

The Special Resolution relating to the France Transaction had to be approved by not less than two thirds of the votes cast at the special meeting of Shareholders held earlier today (the "Meeting") by Shareholders virtually present or represented by proxy and entitled to vote at the Meeting. Pursuant to the articles of the Company, each SVS and each MVS entitled the holder thereof to an equal number of votes at the Meeting and, as a result, each SVS and each MVS entitled the holder thereof to five votes at the Meeting.

At the Meeting, Shareholders carrying an aggregate of 95,971,655 votes, representing approximately 88.92% of votes entitled to be cast at the Meeting, were represented virtually or by proxy at the Meeting. The Special Resolution was approved by 100% of the votes cast by all Shareholders, 100% of the votes cast by Velan's MVS holders and 100% of the votes cast by Velan's SVS holders.

The France Transaction remains subject to the entering into of the definitive share purchase agreement and to the satisfaction or waiver of other customary closing conditions. The completion of the Transactions is now expected to occur in the coming weeks.

KITS Eyecare Ltd. (TSX:KITS) keeps kicking it

Disclosure: We remain long.

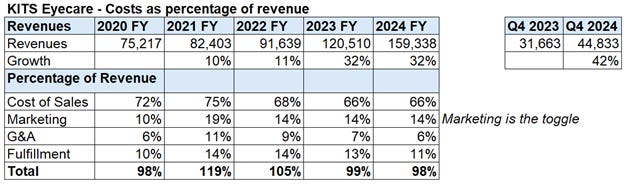

KITS recently released their year-end financials and it was another year of strong self-financed growth (marketing is the toggle). Subsequently, they updated their Q1 guidance upwards, an approach that we do not particularly like but understand why it happens. We remain long.

VANCOUVER, BC, March 17, 2025 /CNW/ - Kits Eyecare Ltd. (TSX: KITS) ("KITS" or the "Company"), a leading vertically integrated eyecare provider, announces an upward revision to the Company's Q1 2025 Adjusted EBITDA guidance. The Company now expects Q1 Adjusted EBITDA of approximately 6% to 8%, exceeding the previously guided range of 4% to 6%.

Updated First Quarter 2025 Outlook

For the first quarter of 2025, KITS management has increased their Adjusted EBITDA target range of 6% to 8%, an increase from the initial range of 4% to 6%. Forecasted revenue remains between $46 million to $48 million, representing a 32% to 38% growth rate year-over-year.

They also gave a great presentation at MicroCap Club that provided insight into a few key areas we have summarized below. Full presentation here.

Tariffs

Q: With 68% of Kits' revenue from the US and manufacturing based in Canada, how would tariffs affect the business?

A: We're closely monitoring developments. For contacts, most are made in the US or unaffected countries, so minimal disruption. For glasses, we currently meet country-of-origin requirements (mainly sourcing lenses from Europe, Taiwan, Israel), so we're not impacted for now. If the rules change, we’re prepared to respond quickly. We plan to set up micro-labs in the US, starting in Washington State, to maintain our cost structure. We can do this within 1–2 months without impacting capex as a % of revenue.…

The Vision Council in the U.S. [recently] stated that 73% of glasses in the U.S. are manufactured in China.

Online Market Penetration for Vision Products

Q: A 2024 Vision Council study shows only 15% of prescription glasses and 37% of contacts are sold online. Will that grow over 10 years?

A: Absolutely. Glasses have gone from ~6% to ~20% online since the pandemic. Contacts are now at ~40%. We believe glasses will reach 30% penetration and then accelerate like other categories that moved online. Millennial habits and growing traffic (up 80% YoY) support this. As customers become more comfortable, we’ll see continued share gains.Influencer Marketing Strategy

Q: Can you talk about the performance of your influencer strategy and whether it's changed over time?

A: Influencers are now our largest and most cost-effective acquisition channel. We focus on micro-influencers (10k–300k followers), who drive strong engagement. The best results have come from unpaid posts—like one recently where the influencer received free glasses. This strategy started slowly but has scaled significantly and organically. We now have a dedicated team managing it.…

“Micro-influencers are just so powerful in their local area” and this is combined with their “Own this Town” strategy of targeted marketing.

Vision Insurance Integration

Q: Is it difficult to get on insurance providers' plans, and how are you approaching that?

A: Yes, it’s complex mainly due to tech integration, not provider resistance. In Canada, we’ve built APIs with top insurers. Customers can log in, see what’s covered, and apply benefits at checkout—no paperwork. Net promoter scores are high. It’s a significant moat once built. In the US, it's more fragmented, but we’ve made good progress and have aggressive goals for 2025.

A reminder of their Own this Town marketing strategy.

Influencer Spark:

The idea originated when a single influencer post in Los Angeles led to a surge in orders localized to that city. This showed the power of focused regional engagement and inspired the team to double down on targeted city campaigns. Kits emphasizes scarcity-fueled invention, limiting spend to force smarter ideas. They see each city as a strategic experiment and adjust based on data.How It Works:

Select a City based on existing customer density or potential.

Launch a marketing blitz in that city for 2–3 months with elevated advertising and local influencer engagement.

Activate awareness and trial—this could include promotions like the “First Pair Free” campaign.

Evaluate performance and scale back to sustainable marketing levels.

Move to the next city while the retention team nurtures newly acquired customers.

Why It Works:

Efficient CAC: Controlled budget (marketing capped at <15% of revenue) pushes creativity and efficient customer acquisition.

Customer Proximity: Kits already has nearly 1 million active customers—they leverage this to expand in cities where they already have a base (e.g., 30k–50k contact lens customers in Chicago) and cross-sell glasses.

Retention Flywheel: Once a city campaign ends, Kits focuses on retaining those customers via:

High-speed fulfillment

Insurance integrations

Kits Plus membership

Referral codes and loyalty incentives

NFI Group (TSX:NFI) 2024 YE update – Is the bus out of the ditch?

Disclosure: We remain long.

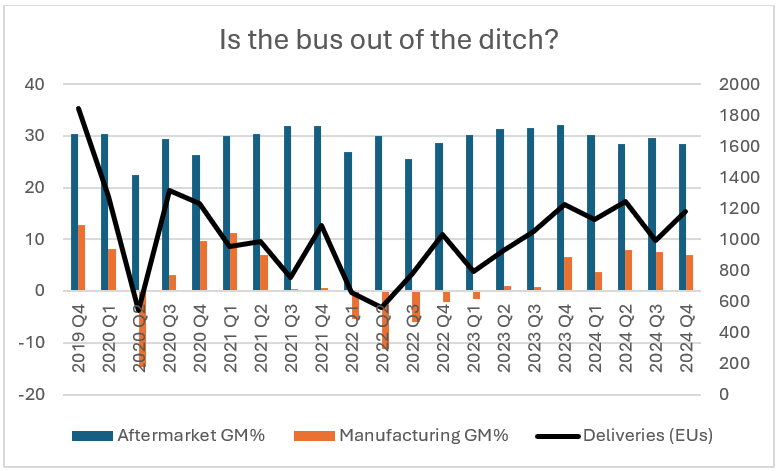

NFI Group, North America’s largest transit bus manufacturer, released their year-end financials. TL;DR higher backlog, improved margins, less suppliers in trouble, working capital days improved. And investor fatigue remains high. Our timeline remains roughly two years (demonstration of sustained improvement). The conference call provided some helpful insights that we have summarized below.

We bought more in advance of the results and it is now a top five hold.

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.