Velan Inc. TSX:VLN – All polished up and ready for sale

Disclosure: We own this one.

Market Cap: ~$300MM

To put it simply, Velan Inc. has been making valves since 1950, and they no longer want to be a public company. These valves are not for your garden hose. They supply niche valves for 90% of the refineries in North America, Canadian and American nuclear reactors, LNG terminals, and even the U.S. navy among other customers. The Company transitioned from family to non-family management and went through a successful multi-year restructuring (partially obscured by COVID and asbestos liabilities). Post-COVID, the family put it up for sale and got a great offer from Flowserve (NYSE:FLS), only to have it blocked by the French government in 2023 (it’s French division makes nuclear plant values among other things). Now, the French division is being sold to a French-friendly company while the asbestos liability is finally being fully resolved through an agreement with a reputable party, fully paid for by the French asset sale with some cash leftover.

It now trades at a low pro-forma multiple and after the shareholder “vote” on March 20th, the Company will be ready for a sale and we expect it will be sold soon. But at what price? We think the business is misunderstood given the significant impact the asbestos liability has had.

The 2023 Offer that Failed – Flowserve Inc.

The Asbestos Impact

The Asbestos Origin

The Turnaround

January 2025 Announcement

The Family Shuffles Out: The timeline

The Value Today: Pro-forma of the transactions

Appendices: Asbestos background, why Flowserve tried to buy, shareholder vote background, Flowserve deal timeline and details

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors have positions in the securities discussed, whether long, short, or somewhere in between, and that this creates an obvious conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertain risks, and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance, and the blog is a blog and not a registered investment advisor or broker in any jurisdiction. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

The 2023 Offer that Failed – Flowserve Inc.

Flowserve Inc. (NYSE:FLS, market cap ~US$7 billion) sells primarily pumps, valves, seals to the same industries as Velan. We note that the industry is still very fragmented. The acquisition would have brought Flowserve’s share of the global industrial valve market to just over 1%. However, all valves are not the same. Both Velan and Flowserve have focused on building niche products for certain subsectors.

Flowserve was quite bullish:

[Flowserve presentation] In fact, [Velan is] in 90% of refineries. Supplier to Canadian and U.S. nuclear plants, supplier to U.S. navy including nuclear submarines, supplier to LNG. – Per Q3 “As you know, we're well positioned for the multi-year nuclear power growth cycle with our proprietary valves offering for small modular reactors or SMRs, along with our global installed base of valves that exist in nuclear reactors. Velan has been actively involved in the nuclear space for more than 50 years, and we continue to get a growing momentum, as reflected by recently announced exclusive agreements and other alliances signed with the world's leading players in nuclear power, including GE-H, Westinghouse, Bruce Power and CANDU, from which we expect to generate significant order intake well into the future. In other energy-related markets such as oil and gas and LNG, we continue to benefit from global transition trends as customers move worldwide to reach their own net zero objectives. Here also, we have wider market penetration with a customer base spanning approximately 90% of North America's oil refineries and a growing presence throughout the world.”

For additional background comments from Flowserve, see Appendix – Why Flowserve Tried to Buy: Flowserve comments on Velan.

The Flowserve offer:

https://www.flowserve.com/en/node/4286/

· Accelerates Flowserve’s 3D Strategy and provides meaningful aftermarket revenues

· Velan brings a highly complementary valve portfolio to Flowserve’s FCD segment

· Transaction expected to be accretive to Flowserve’s Adjusted EPS in first full year after close

· Transaction provides compelling value to Velan shareholders following an extensive and robust review of strategic options

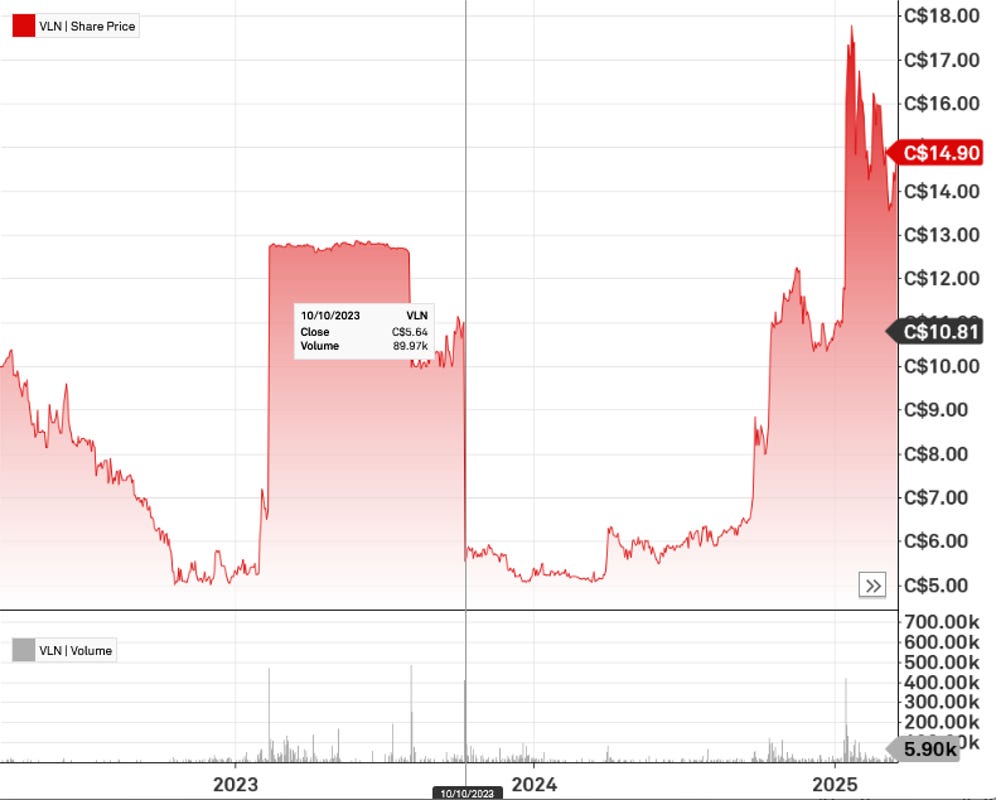

· Velan shareholders to receive C$13.00 in cash per multiple voting and subordinate voting share, representing a significant premium to Velan’s 30-day volume weighted price

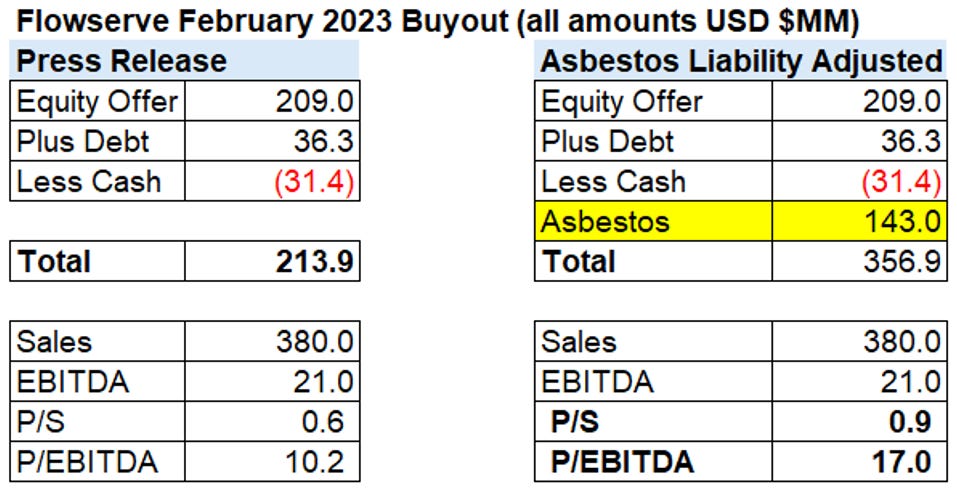

DALLAS & MONTREAL--(BUSINESS WIRE)--Feb. 10, 2023--Flowserve Corporation (“Flowserve”) (NYSE: FLS), a leading provider of flow control products and services for the global infrastructure markets, and Velan Inc. (“Velan”) (TSX: VLN), a leading manufacturer of highly engineered industrial valves, today announced that they have entered into a definitive agreement (the “Arrangement Agreement”) under which Flowserve will acquire Velan in an all cash transaction (the “Transaction”) valued at approximately $245 million (C$329 million), including the purchase of all of the issued and outstanding Velan equity for approximately $209 million (C$281 million) and the assumption of approximately $36.3 million (C$48.9 million) in outstanding gross debt as of November 30, 2022. Flowserve will also assume Velan’s $31.4 million (C$42.2 million) of cash and cash equivalents, also as of November 30, 2022. The Transaction is expected to close by the end of the second quarter of 2023.

Most analysis we read of the deal did not seem to fully appreciate the asbestos impact. We argue you need to account for the asbestos liability, which was significant. Using the amount they are getting rid of the liability for today is a good proxy we think.

We note that there was a lot of interest in Velan in the last process, but the asbestos liability created significant noise.

As part of Phase 1 of the auction process, 11 non-binding proposals were received from potential purchasers. In particular, on July 14, 2022, the Purchaser submitted an initial non-binding conditional letter of intent to potentially acquire all of the assets of the Company in an all-cash transaction for an implied Share price ranging from $9.89 to $15.89 depending on whether the Purchaser would assume the asbestos-related liabilities or not (the “Purchaser Initial Offer”).

The parties ultimately settled on the final C$13 per share offer.

As previously mentioned, the deal failed as a result of the French government. The deal failure press release is here - https://ir.flowserve.com/news-events/news-details/2023/Flowserve-Announces-French-Regulatory-Rejection-of-Velan-Transaction-10-05-2023/default.aspx

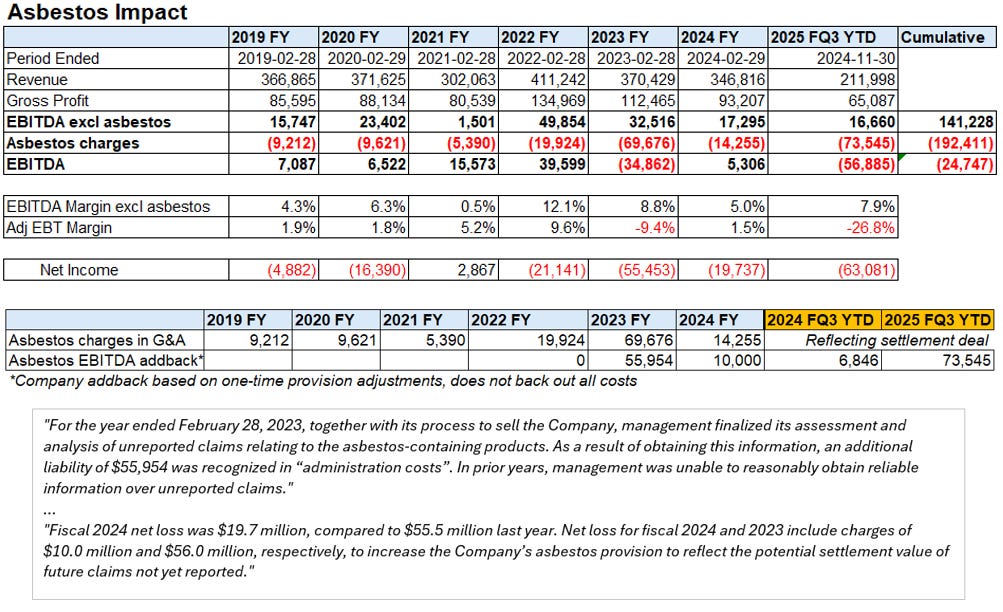

Asbestos Impact

The effect this liability had on the original sales process was significant. As per the Notice to Shareholders about the sale process:

As part of Phase 1 of the auction process, 11 non-binding proposals were received from potential purchasers. In particular, on July 14, 2022, the Purchaser submitted an initial non-binding conditional letter of intent to potentially acquire all of the assets of the Company in an all-cash transaction for an implied Share price ranging from $9.89 to $15.89 depending on whether the Purchaser would assume the asbestos-related liabilities or not (the “Purchaser Initial Offer”).

For details on the process, see Appendix – Flowserve Deal Pipeline, Due Diligence

In the deal, the assumptions were:

Purchaser to Assume the Company’s Asbestos-related Liabilities. By purchasing all of the Shares, the Purchaser will assume the asbestos-related liabilities arising from legal proceedings against certain of the Company’s affiliates and has a plan to manage those liabilities following closing of the Arrangement. Velan has experienced an increase in asbestos-related costs over time. There were 2,039 claims outstanding at the end of the year ended February 28, 2023 (2022 – 2,071, 2021 – 1,696, 2020 – 1,561). During the year ended February 28, 2023, the Company resolved 674 claims (2022 – 315, 2021 – 388, 2020 - 436), The Company was the subject of 642 new claims during the year ended February 28, 2023 (2022 – 690, 2021 – 523, 2020 - 648). For each of the years ended February 28, 2021 and 2020, the Company recorded legal and settlement cash costs for such liabilities of approximately $11 million and $9.6 million, respectively. For the year ended February 28, 2022, the asbestos-related expenses totalled $25.1 million, including legal and settlement cash costs of $12 million and an initial long-term provision of approximately $13 million for claims outstanding but not yet settled at that time. For the year ended February 28, 2023, the asbestos-related expenses totalled $13.8 million, including legal and settlement cash costs of $11.9 million and approximately $1.9 million of additional long-term provision for claims currently outstanding but not yet settled in comparison with the previous year’s provision. The $14.9-million provision is solely related to claims outstanding and does not consider nor is quantifying any future potential new claims.

The Asbestos Origin

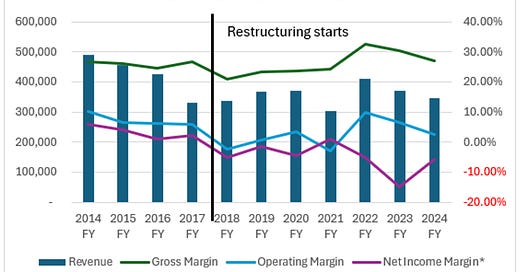

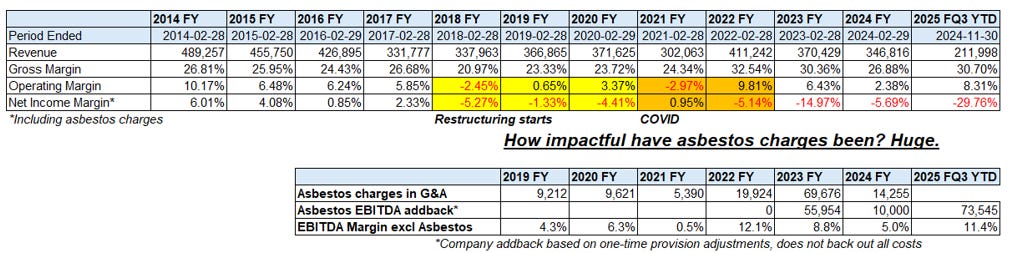

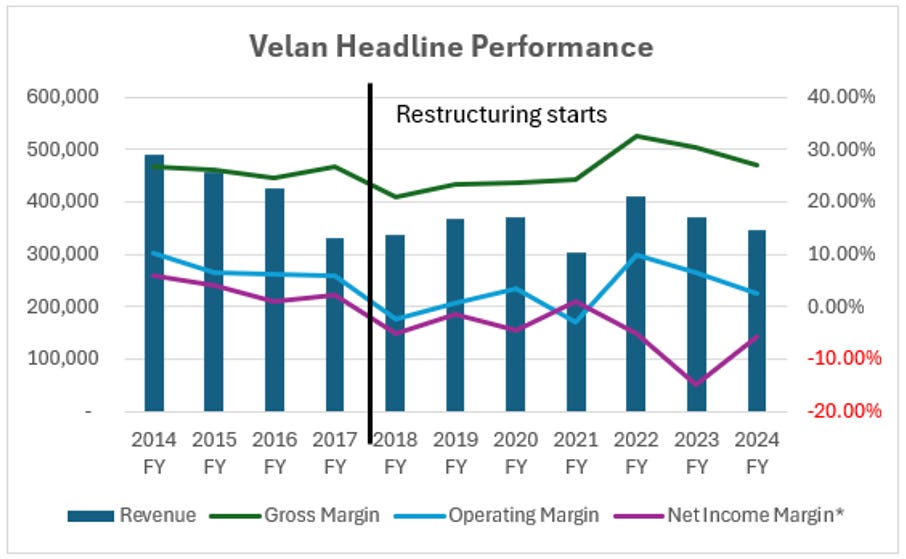

The impact of asbestos has been significant and became much worse over time to the point it offset all of EBITDA as shown below. Per Q1 2019:

Answer – John D. Ball: The Navy business was the source of most of our asbestos lawsuits, but it went back to their practices back in the 1970s and 1980s of using asbestos packing. And as we've discussed on past calls, you can't sue the U.S. Navy. So...what happened over the last 30 years, 40 years, most of the companies that manufacture the asbestos have been sued into oblivion, and then the attention shifted probably about 20 years ago to the companies whose valves were protected by the asbestos. Appendix – Asbestos background

See Appendix – Asbestos background for additional detail.

The sale involves numerous steps (further outlined in the March 20th meeting materials):

The Asbestos Divestiture Transaction consists of the proposed sale by the Company of its U.S. wholly-owned subsidiaries Velan Valve Corp. (“Velan U.S.”) and Velan Steam Trap Corporation (“Velan Steam Trap”) to an affiliate of Global Risk Capital LLC (the “Asbestos Purchaser”), at a cost to the Company of US$143 million (subject to certain adjustments). The Asbestos Divestiture Transaction will be achieved in several steps, including by (1) extracting the equity interests of certain non-U.S. subsidiaries from Velan U.S. and Velan Steam Trap, (2) creating a new U.S. subsidiary, Velan Valve United States OpCo, Inc. (“VVUSO”) to service customers of Velan U.S. on an uninterrupted basis, (3) vesting VVUSO with the current operating assets of Velan U.S., (4) selling Velan U.S. and Velan Steam Trap to the Asbestos Purchaser, which the Company will have capitalized with US$143 million (subject to certain adjustments) and which the Asbestos Purchaser will further capitalize with US$7 million upon closing, for a total of US$150 million…

The turnaround

What COVID and the asbestos problem hide is the improvements from their significant restructuring they started in 2017, including:

Keep reading with a 7-day free trial

Subscribe to Canadian Value Investors’ Substack to keep reading this post and get 7 days of free access to the full post archives.