Vitreous Glass (TSXV:VCI) – Still crushing it after all these years

An investing case study of simplicity

Disclosure: We do not own this currently, but have always loved the story.

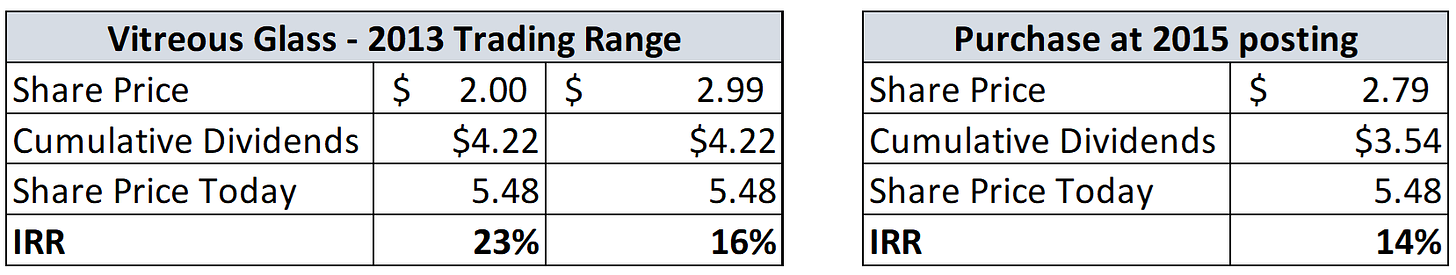

We knew nothing about fibreglass insulation before we found Vitreous. Listed on the TSX Venture, this little nano cap Alberta company that we first came across in 2013 and first wrote up in 2015 is a great business case for keeping things simple. It is a very straightforward, very well-run business that has found a great niche. Back then, after a meeting with a personable CEO, taking a plant tour, and spending many hours looking over old SEDAR reports we were bound to get a soft spot. More importantly, had we just continued to hold this simple little business since we first found it and bought it, we would have made an annual IRR of 23% (after dividends) over the last decade and saved ourselves a lot of time and headaches over the years. It is time for us to refresh our post and update on how Vitreous is doing a decade later.

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

Who wouldn’t want this kind of stability?

Established in Airdrie, Alberta in 1992, Vitreous Glass purchases recycled glass (primarily beverage containers) which is then cleaned, crushed and sold as "cullet" to two main fibreglass insulation manufacturers in the province. The Company is run by the plant manager and the founder/CEO. The Company has had two business segments during its lifetime: 1) waste glass processing, which it has done since company inception and is currently its only operations, and 2) a disastrous kitchen cabinet manufacturing and installation, which it started in early 2001 and divested in 2006. A business segment once described as "a complete mistake, just awful", its Kitchens business had erratic operating results and recurring losses; revenues in the few years prior to selling the business ranged from $4.5-$7.7m, with operating losses in the ~$300k-$700k range, and was ultimately sold for $500k.

The Company also formerly had a small operation in Pennsylvania, which discontinued operations in 2004 due to lack of supply availability and horrible margins (“everyone works for free”). Since then, they have kept the business extremely simple and have executed excellently, but first you must understand the beverage container recycling industry of Alberta.

Supply Side - The History of Recycled Glass in Alberta

Before Vireous, glass beer and beverage containers were not actually recycled. For those that do not live In Alberta, there is a provincial deposit system for all alcoholic and non-alcoholic beverage containers where you must pay at time of purchase. The rate is ten cents for containers less than one liter (previously five cents) and 25 cents for larger containers. When you return the container to one of the ~200 privately owned bottles depots around the province you receive the deposit back. As locals know, this has created a whole ecosystem of collectors and shopping carts. The deposit system initiative and legislation started in the 1970s and was implemented as a highway beautification effort and not actually for sustainability reasons.

For several years glass after the creation of the program, glass was collected and simply dumped into landfills. In an effort to turn this province’s trash into a treasure, the Alberta government - through the Alberta Gaming and Liquor Commission at the time - put out an exclusive contract bid for the glass it collects every year in an effort to reduce waste and generate some revenue. A group of investors came up with an idea and bid.

The idea is simple. Vitreous exclusively collects all of the waste glass and also buys smaller quantities from other sources. Waste glass is transported via truck, which is then cleaned, crushed, and sold as cullet to three fibreglass insulation manufacturers (two of which are large and have most of the market - Johns Manville/Schuller International Canada in Innisfail, and the Owens-Corning Fibreglass Canada plant in Edmonton), which use cullet as raw material in their production facilities. These three manufacturers produce all of the fibreglass building insulation made in Western Canada; hence, demand for Vitreous' product is ultimately driven by new-build real estate activity, but demand is practically guaranteed as we discuss below.

Vitreous has a contract that it must accept glass (up to 18,000 tonnes a year; no such agreement with its other suppliers) and ships to its three main customers on a day-to-day basis. Since Vitreous' product is essentially on-demand on short notice, having a secure supply of waste glass feedstock is imperative. The drawback to this arrangement is that Vitreous must accept all waste glass regardless of its actual needs. When we first found Vitreous, it was previously undersupplied but was oversupplied at our visit (for context, the Company had 31,000 tonnes of materials and an ideal level is 15,000 at the time). That said, the contract is at a very good low fixed rate per ton and it is a relatively homogenous and consistent source of waste glass. On the other side, it is also a fair agreement for the government. They like it as they do not have to deal with the product at all. It is a raw material that takes up space and was useless before Vitreous and today it still has no alternative higher uses.

The key challenge for Vitreous is that they have not been able to find alternative meaningfully large sources of waste glass and so they are supply constrained. Initiatives have been tried (e.g. car windshields) but finding large sources of waste glass that is easy to process, consistent, and contaminate free is very challenging. We note that separately, there is Brewers’s Distributor Ltd., a joint venture wholesaler between Labatt Breweries and Molson Breweries that distributes beer and collects reusable containers directly from commercial clients.

The real costs in raw cullet is shipping costs, which are significant. Despite most of Vitreous' glass being sourced locally, the cost of trucking transportation is estimated to be at least 3x the cost of just raw materials in COGS due to the classic high weight/volume, low value ratio. However, the benefit of long-haul transportation generally being uneconomic is that the Company receives little competition from out of the province. In effect, they have created a fairly run natural regional monopoly.

Demand Side - You could say Vitreous was ESG before it was a thing

The fibreglass manufacturing process is energy and capital intensive, as it involves melting materials to a liquid form. These materials can be either glass or sand, and all of Vitreous' customers prefer to use glass, as its melting point is significantly lower when compared with sand resulting in the plant using less energy. If customers were to switch from glass to exclusively sand, or vice versa, it would require downtime and a re-tooling of its machinery, also creating switching costs. Vitreous has worked with them to provide the right product and the customers consistently blend it into their production process. Like cullet, fibreglass insulation is expensive to ship long distances, given its low value-to-size (volume) and believe the probability of Vitreous' customers permanently moving plants is quite low. Vitreous is supply constrained.

Insourcing by its customers has also not been an issue and is still not expected to be. Vitreous' customers do not seem willing to in-source for several reasons despite the Company's very high profitability metrics. The main reason is that Vitreous' is an extremely well-run reliable operation with fair margins that has not given its customers any reasons to in-source. We believe that its customers have likely entertained offers to purchase the Company, but these offers are probably materially below where the stock price is today. It would also require the contract opening up in the first place. It is simply easier to just work with Vitreous than to buy the Company. For similar reasons, you would not build a competing processing facility to compete with Vitreous given the supply constraints.

Vitreous is well run and also prepared for manufacturing issues. The plant has spare parts for every major piece of machinery and any expected maintenance only takes approximately half a day and typically no returns (in the ~15 years prior to 2013, only one batch of unsatisfactory cullet has been returned). There are also logistical issues that Vitreous must deal with that its customers do not, such as finding storage for its waste glass in periods of low demand (as the Company must accept new raw inputs due to its contract), which allows its customers to focus on its main operations.

Although Vitreous passes on any increases in costs to its customers, in-sourcing does not make sense as their customers would still be paying these increased costs. Vitreous has kept a fair consistent margin and its customers receive dependable just-in-time inventory from Vitreous. It really comes down to two key factors: 1) Having a worry-free, risk-free secure supply of waste glass feedstock is extremely valuable since demand is on very short notice. 2) Alberta is a small market with really only one raw material provider. It therefore follows that it is does not make sense to have multiple waste glass buyers that each compete to purchase and sell small quantities of feedstock. In other words, it is a natural monopoly.

Management managing simply

Vitreous is largely owned by insiders. The founder/CEO Pat Cashion and family own ~36% of the stock. The Company retains a small amount of cash for major and minor maintenance and has no debt. Surplus cash is then distributed. Overall, it is just a profitable, simple, and fair enterprise.

What did we say back in 2015? – “Valuation - A Fun Story, but Not Cheap Enough”

Back then we said:

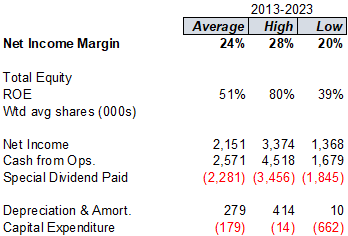

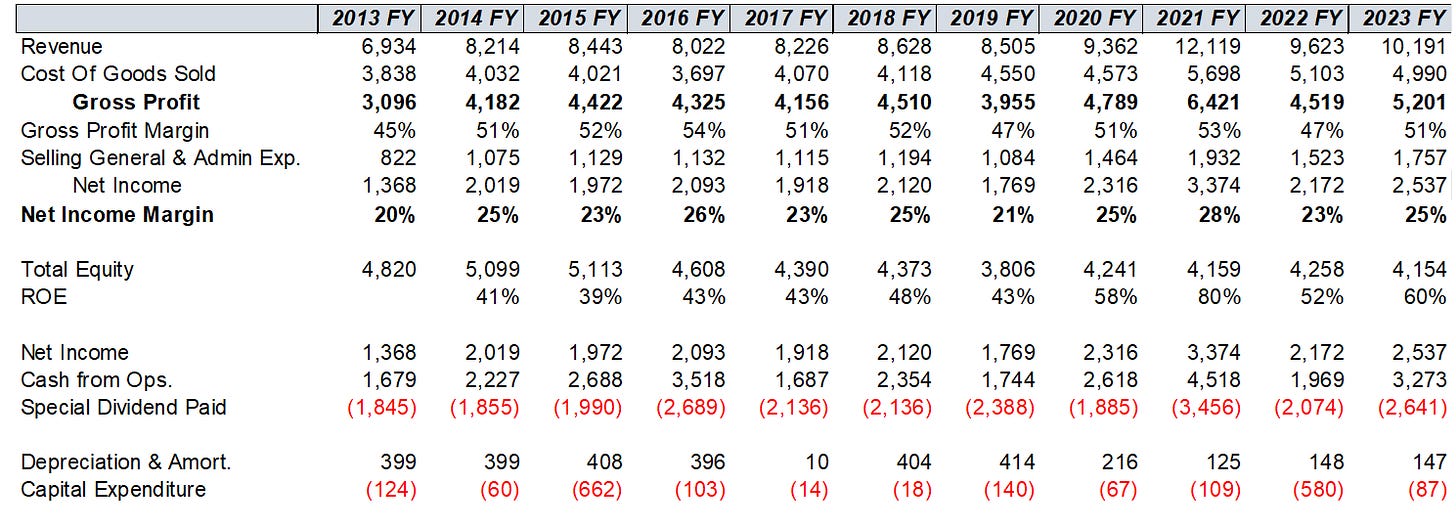

We estimate the Company earns ~$1.4-1.5 million in FCF/year, based on estimated normal capex requirements of ~$200k/year and normalized operating cash flows of $1.6-$1.7 million, based on historical results. Operating cash flows have not fallen below $1.2 million since the Company sold its Kitchens business.

At its current price of $2.60/share (~$16 million market cap and EV), we do not believe Vitreous is cheap enough. However, the stock is extremely illiquid, and you occasionally have ~10%+ daily movements. We would certainly look to add this to our portfolios at under ~$2/share (~$12.5 million EV), which would imply a more acceptable FCF yield in the mid-teens.

With a weaker Alberta market due to lower oil and gas prices, there are some serious risks to short-term slowdowns in business since it is primarily tied to new construction builds, but if the stock declines significantly because of this, we would view this as an attractive entry point into what is essentially a natural monopoly.

That said, with enough capital, Vitreous may also be a candidate for an interesting LBO, either for a whole acquisition or to buy out the founder if he is willing to sell. Cost savings from the CEO's salary would increase cash flows by $650k, and it appears there is little succession risk from a management skills standpoint. Given Vitreous' stable free cash flows, it may make sense to use Vitreous as an investment vehicle. A fun idea indeed.

Our concerns turned out to be a bit overblown and actual free cash flow was higher than expected. There are real risks; it is a small company with a key contract, key facility, and key staff, and this should not be ignored.

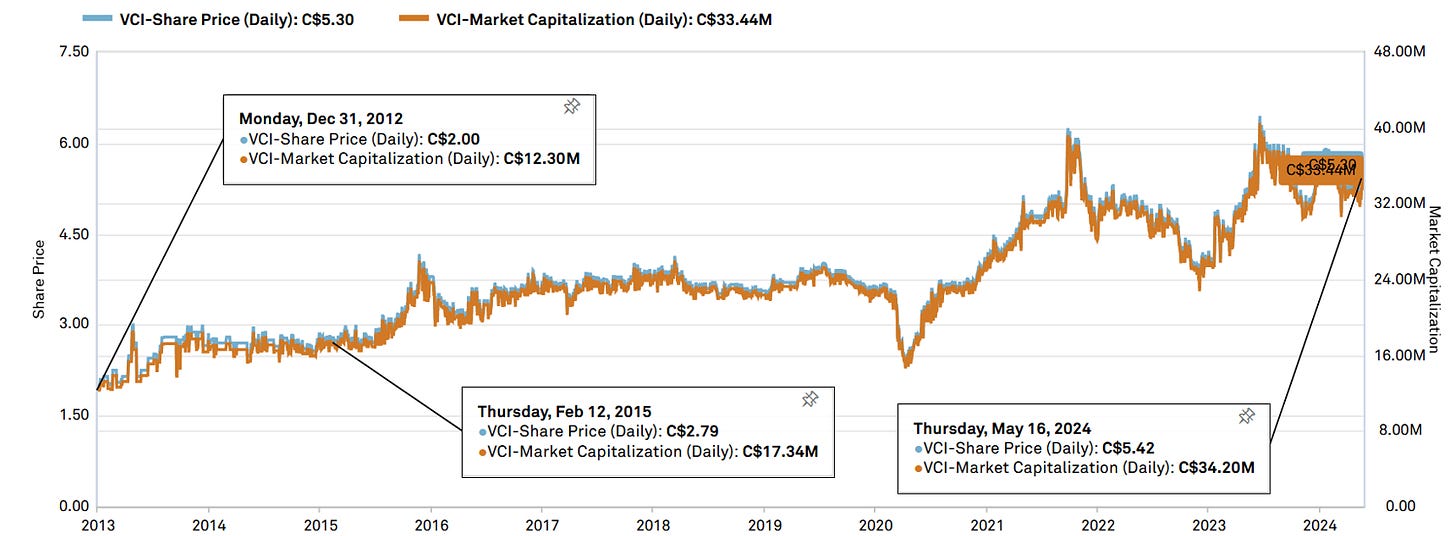

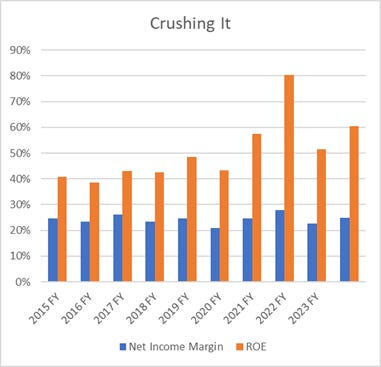

Had we kept Vitreous when we found it, it would have provided a 23% IRR over the last decade and had we bought Vitreous the day we wrote that article, our investment return would have been an IRR of 14%. This period, as we all know, had a number of hiccups including COVID-19, an oil crash, and a mini banking crisis among other issues. We have spent a lot of time looking at ideas over these years and have done well, but to think we could have sat back and enjoyed a very reasonable return for just a few minutes of work a year to check on things gives us pause.

Once again, today we think that Vitreous is too expensive for the expected return compared to our other holdings, but we will just have to see how the next decade goes. We hope our extra work will be worth it.