Here is the latest from Canadian Value Investors!

We will not look at large caps. We will not look at large caps. – A few ideas from around the world including a new hold of ours.

Taiga Building Products Q2 Note

Slate Office REIT Q2 Note

Stock research sometimes takes you to strange places – Seneca Foods case in point

Power Problems – Talen Energy

Disclaimer - The content contained in this blog represents the opinions of contributors. You should assume contributors might have positions in the securities discussed and that this creates a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance whatsoever and are subject to certain risks, uncertainties and other factors. Information might also be completely out of date and may or may not be updated. No one guarantees the accuracy of any information provided and none of the information should be construed as investment advice under any circumstance. Frankly, no information here should be used for any purpose except for entertainment (and we hope you enjoy).

We will not look at large caps. We will not look at large caps. – A few ideas from around the world

We continue to believe that the best opportunities to outperform are in small caps. However, we do not want to be “small cap investors”. We have done just fine with a few large caps including PBR and PHIA (still long the former, not the latter).. That said, when dividing our time, we wanted to publicly remind ourselves that we should be spending the majority of our time on small caps. Everything in today’s email qualifies.

Two fun examples we recently came across are:

Boat Rocker Media TSX:BRMI

Disclosure: We are long.

After their recent division sale, they are now trading below cash.

~$70MM of cash vs market cap $54 / $0.95, no debt.

Business is now simplified focusing on content and talent management division is effectively gone (though retaining a 8% net equity stake in The Initial Group Global, LLC that they value at ~$11MM).

Key shareholder of Fairfax in background (44% owner).

Q2 just came out reflecting recent transactions and confirming cash and plan.

Key risk is will they deploy capital well.

We have to give credit to everyonehatespoetry for this one. Here is their post from June with background

Alico, $ALCO

Disclosure: We do not own this one but are evaluating.

Ever wondered where your Tropicana orange juice came from? Orange grower Alico Inc. is Florida’s largest orange producer and might be a bargain and they are the business is at an inflection point.

Macro corner - And finally, a great explanation of the recent market hiccup / Japan carry trade.

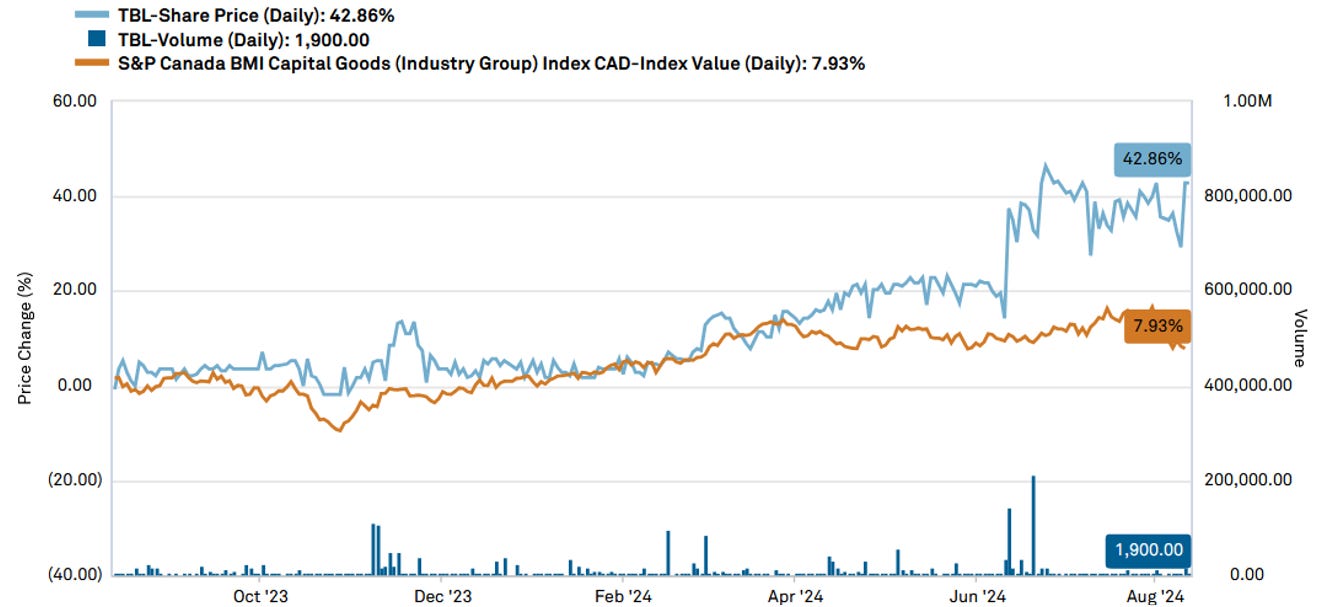

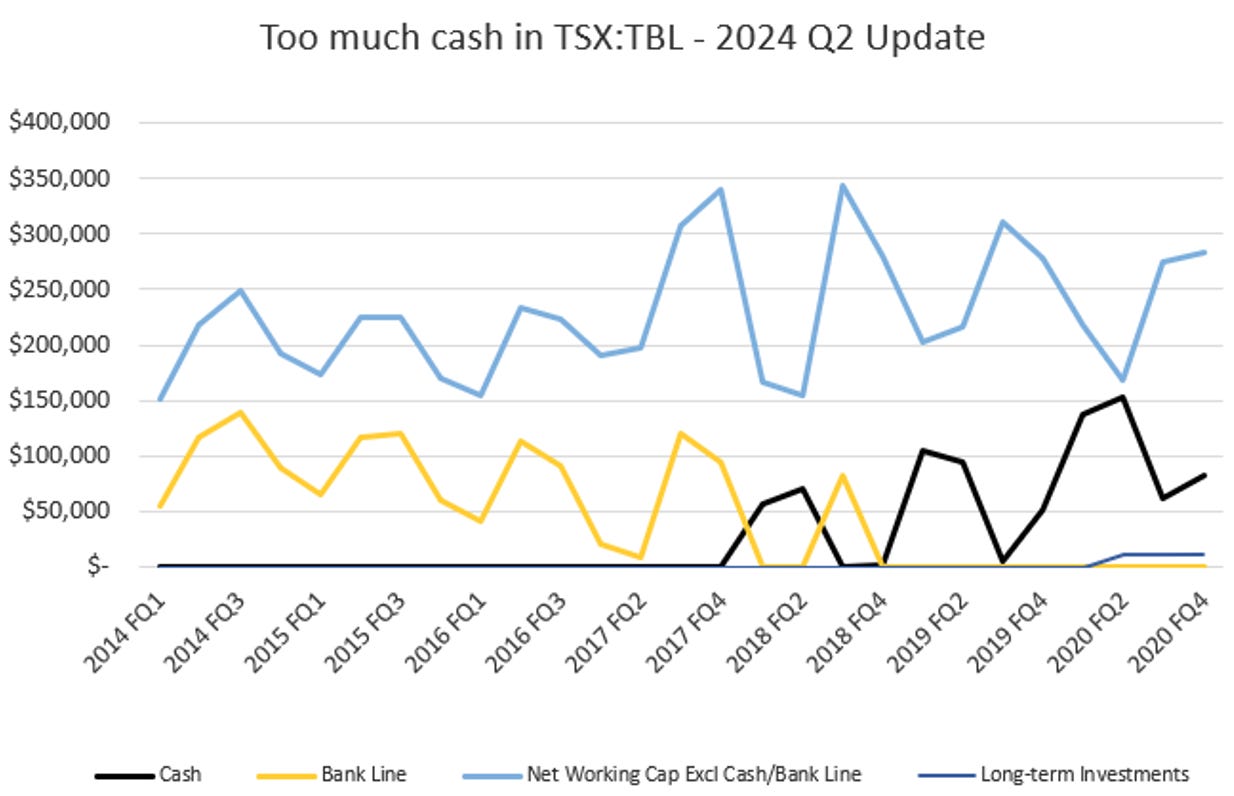

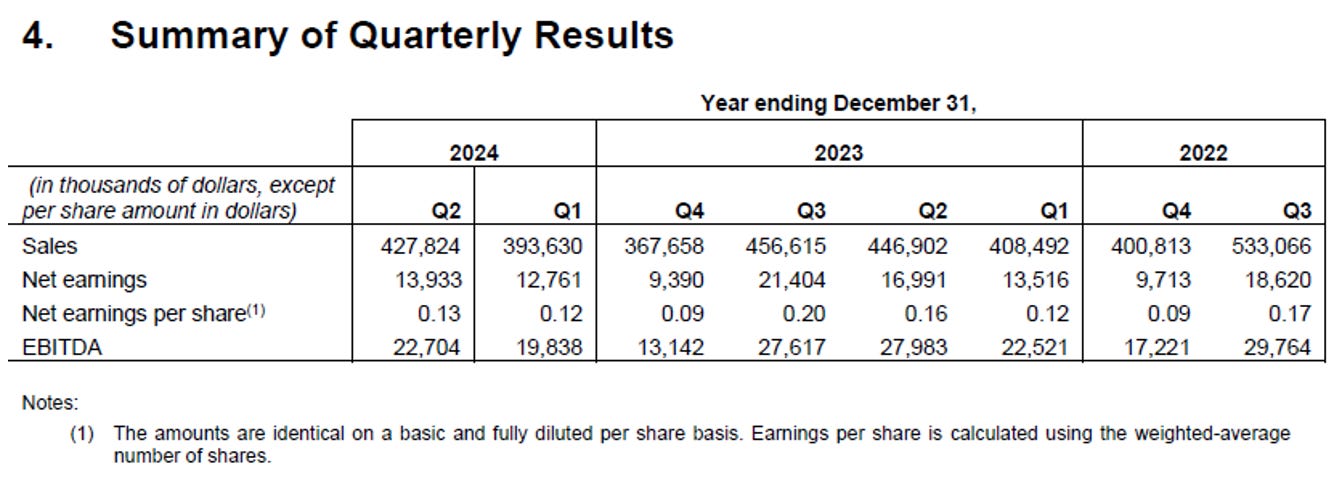

Taiga Building Products TSX:TBL Q2 Update – The cash piles gets even higher

Disclosure: We remain long.

Taiga Building Products reported Q2 results showing they are chugging along just fine. Sales and earnings actually continue to be stronger than we expected, with a run-rate assumption of $50MM of earnings per year post-COVID boom now not seeming unreasonable. Some of the much talked about performance improvements seem to have stuck.

While the stock price/market cap has increased to ~$4.00/~$430MM, it is important to remember that while the business has improved, debt has also reduced from over $100MM a few years ago to zero and cash is now at $83MM. Taking into account working capital swings (highest capital needs in the spring), we estimate that surplus cash in the business is now about $150MM-$200MM. Now we will just have to wait and see how they deploy it.

See last post and original here - https://canadianvalueinvestors.substack.com/p/taiga-building-products-tbl-q1agm

Slate Office REIT Q2 Update

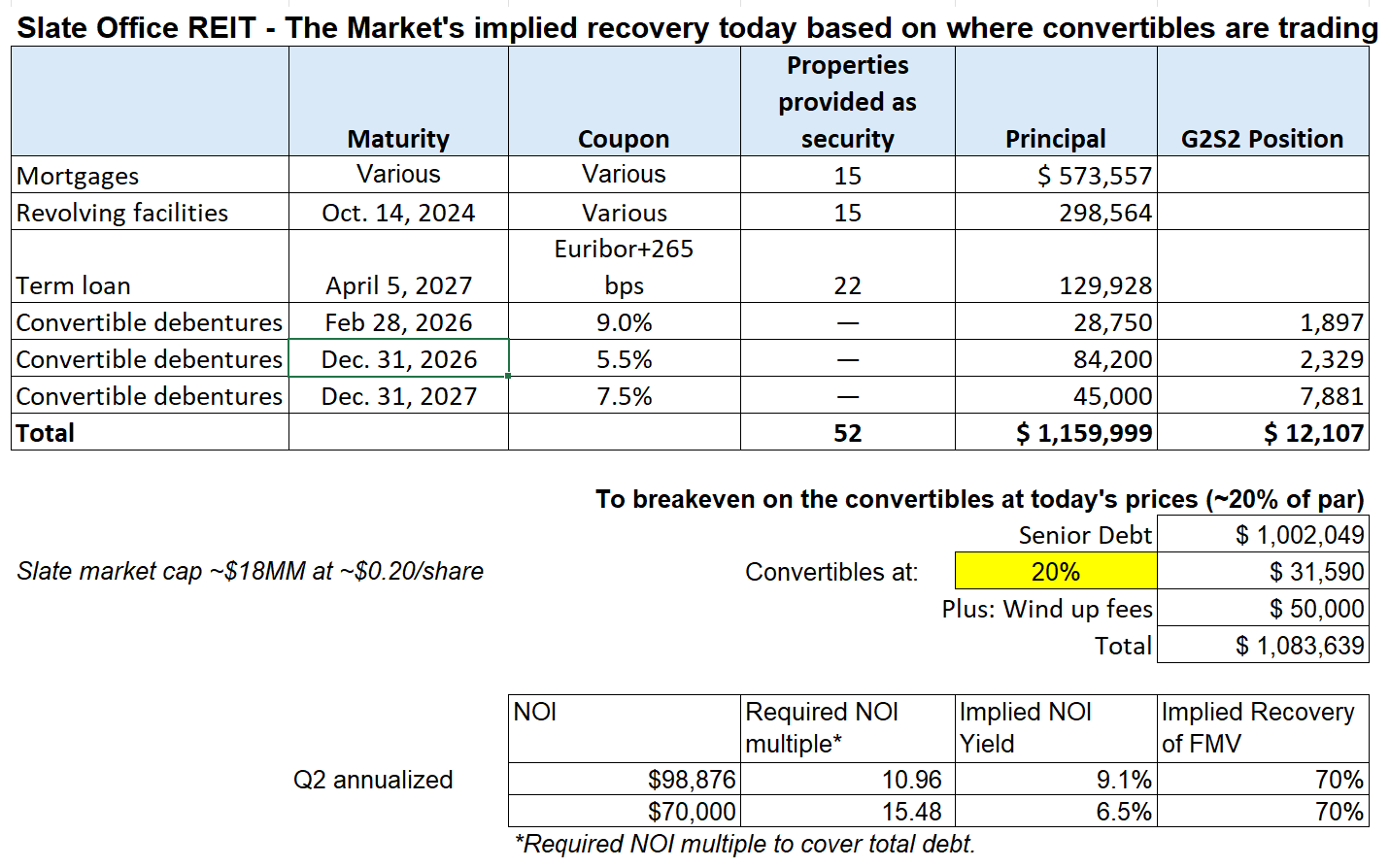

Disclosure: We are still long debentures, not the stock.

Slate Office released their Q2 results. They have made a bit of progress. Unsurprisingly, their conference call was cancelled – “Senior management will be foregoing the previously announced live conference call scheduled for 9:00 a.m. ET on Friday, August 9, 2024.”

The three different series of debentures are now consistently trading in the low $20s vs the high $10s before. We will leave the stock as an even riskier gamble for others.

Key Q2 highlights include:

·More write downs - The REIT revalued its property portfolio as at June 30, which resulted in a $154.4 million negative fair value adjustment in the second quarter as a result of third-party appraisals received, the REIT's own estimates, and property sales.

·Concern about being a going concern note added, as expected – “As a result, these events and conditions indicate that a material uncertainty exists that may cast significant doubt on the REIT's ability to continue as a going concern.”

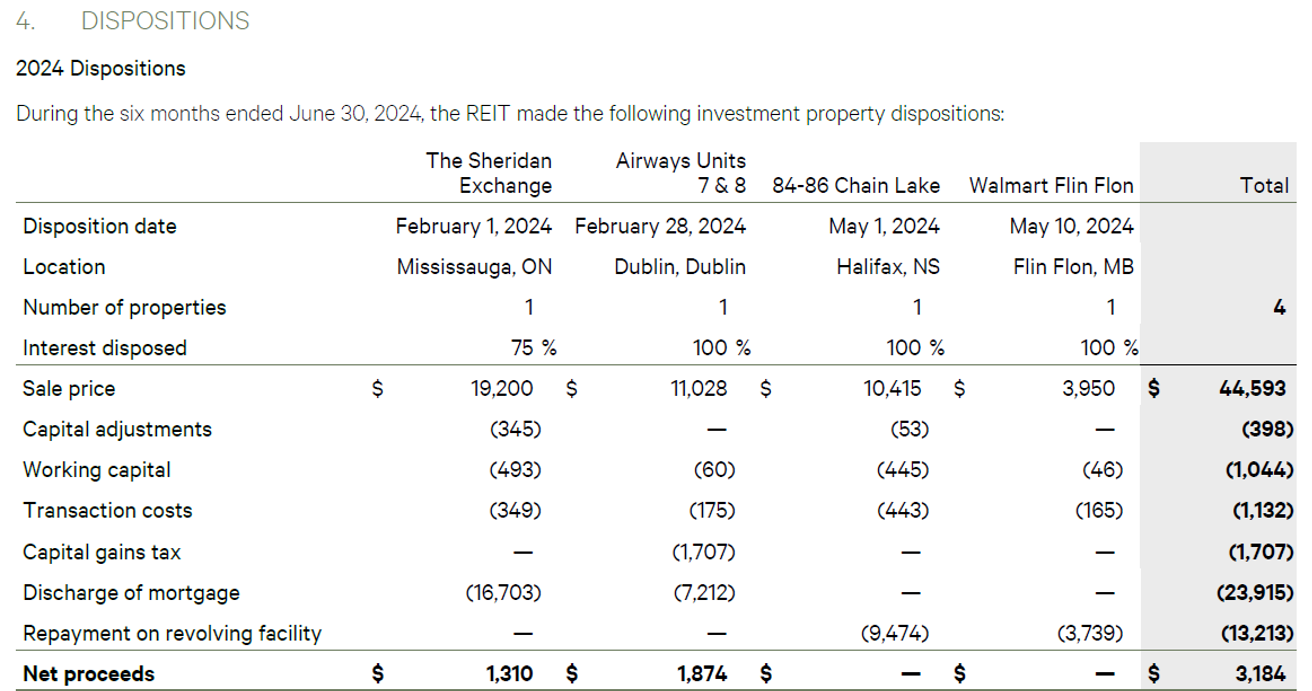

·Progress on additional sales – Two disposed went resulted in net proceeds after mortgages of ~$3MM vs sales of $30MM, while proceeds from their May transactions were largely swept by the revolver. See table below. They are also rumored to have sold another property recently.

·They expect to default on the third and final series of convertible debentures at the August payment and as a reminder “the trust indentures also provide that the Debenture holders will not be entitled to demand or institute proceedings for the collection of indebtedness represented by the Debentures at any time when a default has occurred under senior indebtedness and is continuing”

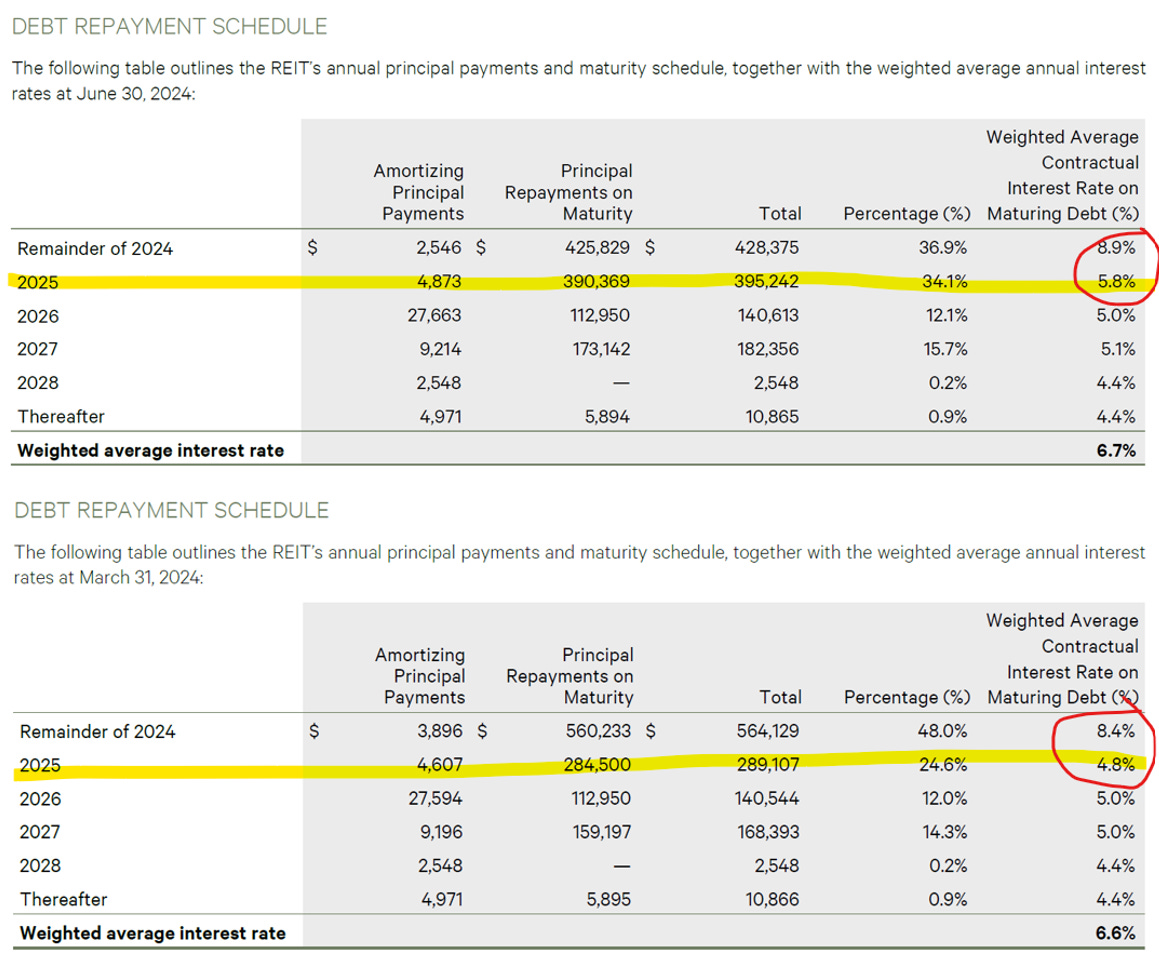

·They have made some progress on extending maturities with some 2024 maturities extended into 2025. This has also resulted in higher average interest (see tables below).

·The next key question is what happens with the revolver. Rates are up quarter over quarter given the defaults and waivers. Per Q1 “The contractual remaining term to maturity of revolving facilities is 0.5 year and the weighted average interest rate is 8.35%. Due to covenant violations, the revolving credit facility is contractually due on demand”, while in Q2 “The contractual remaining term to maturity of revolving facilities is 0.3 years and the weighted average interest rate is 9.36%.”

·We will continue to wait to see if these are a bargain or a boondoggle. See backgrounder here in case you missed it - https://canadianvalueinvestors.substack.com/p/slate-office-reit-tsxsot-convertible

And as previously posted their Board battles received some attention recently from the Globe and Mail - https://www.theglobeandmail.com/business/article-flirting-with-insolvency-slate-office-reit-sees-board-battle-erupt/

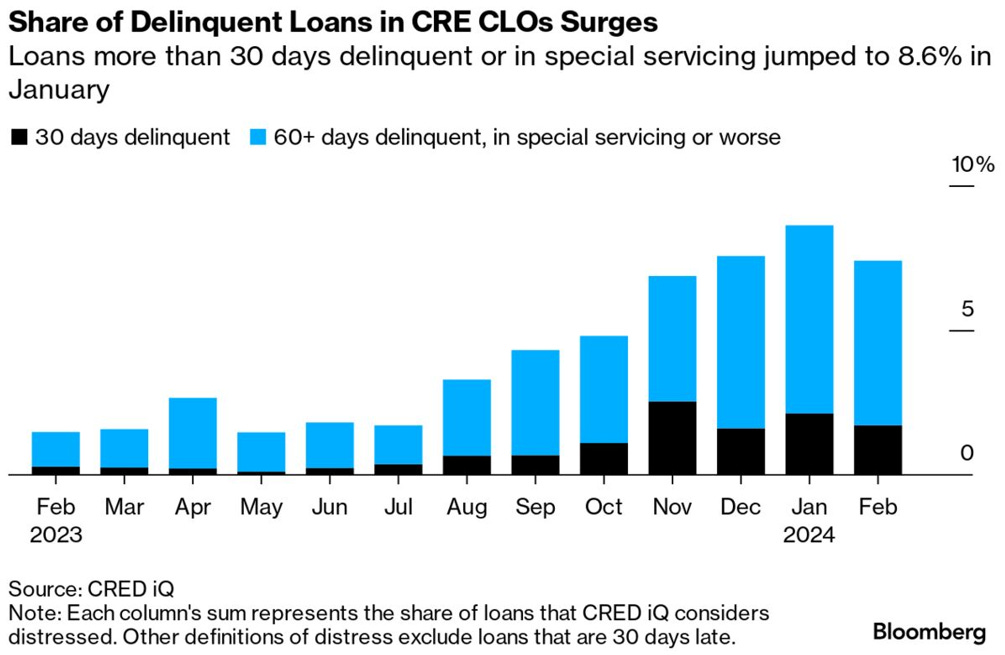

·A reminder that the macro background remains challenged – see final chart.

Stock research sometimes takes you to strange places – Seneca Foods case in point

Sometimes when we are analyzing stocks we come across hilariously unhelpful research. Seneca Foods $SENEA is no exception. Disclosure: We remain long.

Researching Ammo Inc. has always been interesting too. Their layaway program has launched! Disclosure: We remain long albeit with a reduced position.

Power Problems – Talen Energy

Disclosure: We are still long.

Interesting power price news for Talen Energy $TLN (still long) and power producers in general, and terrible for the country. Maybe reality is finally catching up to sun-powered dreams blowing in the wind.

NEW YORK, July 30 (Reuters) - An annual power market auction by the largest U.S. electrical grid operator resulted in prices more than 800% higher than last year as supply dwindled and demand increased, the operator said on Tuesday.

PJM Interconnection, which covers parts of 13 states from Illinois to New Jersey, revealed the results of its 2025 to 2026 capacity auction. Prices for power plants landed at $269.92 per megawatt-day, compared to $28.92 per megawatt-day for year-ago auction, the grid operator said in a statement.

Remember in January when the grid operator asked Talen to keep open fossil fuel plants that windmills and batteries were supposed to replace? https://www.reuters.com/business/energy/us-grid-operator-pjm-asks-talen-energy-postpone-fossil-fuel-plant-retirements-2024-01-10/

And when they said in May that “replacing a Talen Energy coal-fired power plant with battery storage is infeasible: PJM” https://www.utilitydive.com/news/talen-brandon-shores-wagner-battery-storage-sierra-club-pjm/715221/

Thanks for subscribing!