Here is the latest from Canadian Value Investors!

Clarke Inc. TSX:CKI Special Situation(s)

Astrotech Corporation NSADAQCM:ASTC Special Situation – Shotgun acquisition

Clarke Inc. TSX:CKI Special Situation(s) – Sailing on the go-private ferry

Disclosure: We are long this stock and their debentures.

Clarke Inc. TSX: CKI is a neat collection of businesses and assets. It’s also probably being taken private shortly and has a special situation trade for you in the meantime. What’s the deal?

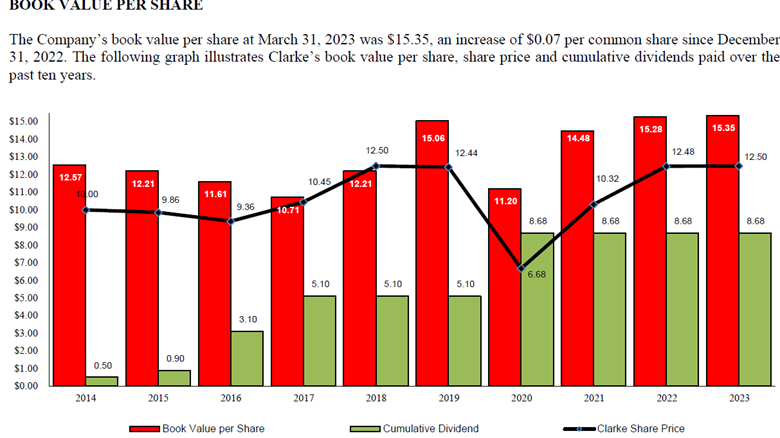

It is trading at below its stated book value (which seems reasonable and likely has suppressed value).

They are several years into a business simplification. They have sold off/dividended-out various public holdings (TerraVest – their case study at end – and Trican; both interesting investments) and are now focusing on their three business units.

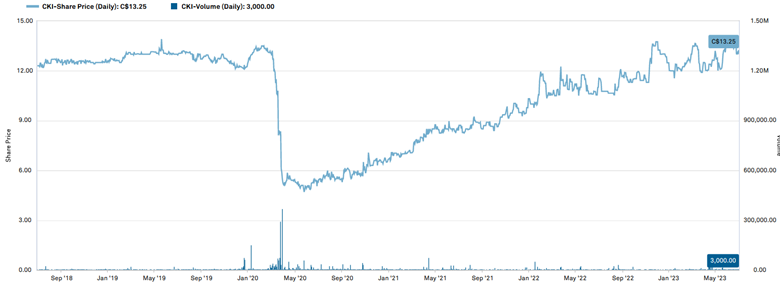

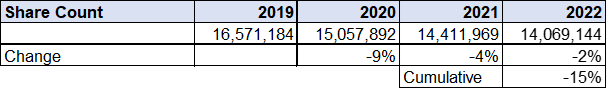

They have been consistently repurchasing shares for the last three years (15% cumulatively) and just renewed their NCIB. Now that they have cleared up the convertible debentures (see next), it is likely that they are going to be taken private soon.

We looked at Clarke back in 2021. Unfortunately, we did not buy, and it went straight up ~100% since. At the time their operations were messier and the majority of their business at the time (hotels and a ferry) were severely impacted by COVID.

They key 75% shareholder, G2S2 (run by Clarke’s Chairman) just put in the funds to repurchase the debentures. This is his party – “On June 30, 2020, Michael Rapps, former President and Chief Executive Officer of the Company, resigned and George Armoyan, Clarke’s Chairman, was appointed President and Chief Executive Officer.”

The only other large shareholder is 13% owner Letko Brosseau & Associates Inc. This might provide some comfort for small shareholders getting a fair deal (unless they also continue holding with G2S2 in a go-private transaction).

First - The short-term trade: Clarke Inc. announced that they are repurchasing all of their convertible debentures at the end of July. They are listed on the TSX under CKI.DB. If you can get them for ~$1,000 or less your return is just over 1% in a month or ~15% IRR.

On June 28th, Clarke announced repurchase of all of their convertibles, which were at a generous rate of 5.5%, (i.e. they really wanted to clean up the capital structure). As a bit of background, they assumed these when they acquired their hotel business Holloway. We think that this is an indication that they are going to be taken private shortly; the convertibles are being paid for with a credit facility from their main 75% shareholder, G2S2 Capital, and the company’s chairman also runs G2S2.

Halifax, NS (June 28, 2023) – Clarke Inc. (the "Company" or "Clarke") (TSX:CKI) announced today that it has delivered a notice to Computershare Trust Company of Canada ("Computershare"), as debenture trustee under the trust indenture between the Company and Computershare dated September 30, 2019, as supplemented by the first supplemental indenture dated September 30, 2021 (together, the "Indenture"). Such notice of redemption provides that the Company will redeem the entire aggregate principal amount of $35,000,000 of its outstanding 5.50% Series B Convertible Unsecured Subordinated Debentures due January 1, 2028, which are listed for trading on the Toronto Stock Exchange under the symbol CKI.DB (the "Debentures") in accordance with the terms of the Debentures.

The Debentures will be redeemed on July 28, 2023 (the "Redemption Date") for an aggregate redemption amount of $1,013.41 for each $1,000.00 principal amount of Debentures, being equal to the aggregate of (i) $1,000.00 principal amount of Debentures, plus (ii) all accrued and unpaid interest thereon to, but excluding, the Redemption Date (the "Redemption Price").

In connection with redemption of the Debentures, the Company has entered into a credit facility (the "Credit Facility") with the Company's controlling shareholder, G2S2 Capital Inc. ("G2S2"). The Credit Facility bears interest at 6.00% and is interest payments only until January 1, 2028, whereby afterwards the Credit Facility will continue as a revolving line of credit on demand. The interest-only period aligns with the current maturity date of the Debentures, ensuring that the Company will maintain the liquidity requirements that the Debentures provided.

Clarke Overview

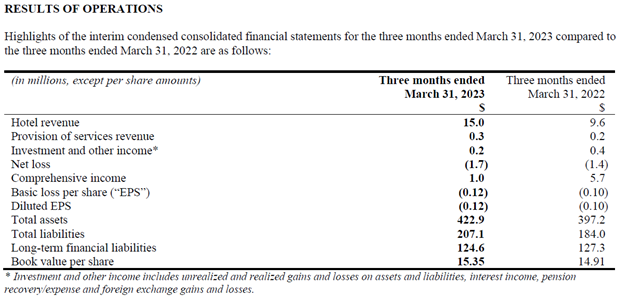

The Company consists of three business units: 1) A ferry monopoly on the St. Lawrence River operating since 1973 https://traverserdl.com/, 2) a portfolio of hotels performing well, and 3) creative real estate projects.

The ferry business is small and performance is opaque as they group it with other investments. However, after parsing through their financials, we estimate revenues and cash flow are $7-8MM and $1-2MM respectively.

The hotel division consists of 17 hotels under primarily Super 8 branding, but also Holiday Inn / Quality Inn / DoubleTree / Travelodge (detailed list is in the AIF). Four are in Grand Prairie, one landmark hotel in Whitehorse, and the rest in Alberta, B.C. and Ontario. COVID was tough, but – along with hospitality in general - the hotels are on the rebound. They are also doing renovations (Sternwheeler Hotel & Conference Centre in Whitehorse) and acquiring selectively. E.g. in 2022 they acquired the Stanford Inn & Suites in Grand Prairie for $11.6MM, at 206 rooms they paid ~$56,000 per door.

2019 background – “Holloway owns and operates hotels across Canada. In the first quarter of 2019, we began to consolidate Holloway’s results into our own results after acquiring control by obtaining 51% of Holloway’s outstanding shares. We acquired the remaining outstanding shares of Holloway on September 30, 2019 to increase our ownership to 100%.” The timing was terrible – right before COVID – but that was not foreseeable.

They have also wound down their management of third-party hotels to simplify the business (we agree).

The Company’s investment properties are interesting. Some are special situations (Houston) while others are taking advantage of existing assets (Carlin repurposing hotel site). The main developments are:

Carling – “Redevelopment of our excess land on Carling Avenue in Ottawa, ON (the “Carling Avenue Development”). While the first phase of construction is underway, pre-construction activities are also ongoing for its second phase. The two phases will consist of a multi-building residential apartment complex including ground-floor retail space. Phase one of the Carling Avenue Development consists of two residential towers with 404 rental units. While construction financing was secured in the fourth quarter of 2022, the project has been self-financed to date.” It’s a big project; $85MM credit facility was put in place https://canada.constructconnect.com/dcn/news/projects/2022/11/clarke-obtains-financing-for-ottawa-complex https://renx.ca/holloway-lodging-build-residential-towers-ottawa

Atwater Montreal – “The Company is a one-third partner in a real estate development project in downtown Montreal that is currently under construction. The building is located at 1111 Atwater Avenue (the “1111 Atwater Development”), the former site of the Montreal Children’s Hospital. The development involves a 38-storey building including seniors’ housing, rental units and luxury condominiums, with extensive amenities for residents.” This is a bit of an odd one; in Q4 they said they exercised their right to exit (to receive costs plus 6% interest) but Q1 they indicated they are in negotiations to waive this right (“amendment would include the rescindment and forfeiture of the Company’s right to exit the COA and certain changes to the timing and order of the distributions of the Development’s ultimate cashflows”). https://goo.gl/maps/925jZFkUGwXV4LC98

Three vacant office buildings in Houston, TX totaling approximately 435,000sf “acquired far below [replacement cost]”. How did they get them? “On January 30, 2019, the Company purchased a non-performing US dollar loan receivable, secured by an office building, for US$4,800. On March 5, 2019, the Company foreclosed on the office building. On May 24, 2019, the Company purchased two office buildings in Houston, TX, for US$8,310”.

First is their book value calculation and then ours. Ours is pretty similar (e.g. the ferry business adjustment as it practically no book value but has intrinsic value obviously), though with the significant development and construction ongoing the number is a bit of a moving target. The implied revenue and EBITDA/CF multiple of the hotel business is a bit high if you compare to cost, but the underlying business continues to improve. Secondly, a significant part of their book value is tied to their construction projects and they are spending a lot to develop them. All reports here - https://www.clarkeinc.com/financial-information

Overall, their track record is quite good and their development projects are the kinds of things we wish we could do ourselves. We expect they will be accretive. The key question is will they play games with the timing of going private to try and get a lower price than today. The issue with these situations is you are at the whim of the key owners. Why would the go private price have to relate at all with the private company/true intrinsic value? It does not. However, in this case all the business units have tail winds, not headwinds, and so there is incentive to do it soon and no obvious triggers to cause a significant short-term price decline to take advantage of. Their automatic repurchase plan is an indication of this. And secondly, the public wedge is just so small now. For us, this is worth a small bet.

The spread between the share price and book value has compressed since we last looked, but their projects arguably have suppressed value or at least option value. And here are the repurchases. Also, the Chairman and CEO does not take a salary/options, but does have a very good pension… We have seen much worse.

Automatic repurchase plan:

HALIFAX, NS, June 28, 2023 /CNW/ - Clarke Inc. ("Clarke" or the "Company") (TSX: CKI) (TSX: CKI.DB) announced today that it has filed a notice with the Toronto Stock Exchange and received its approval to purchase, through the facilities of the Toronto Stock Exchange or any Canadian alternative trading system, up to 699,232 common shares, representing 5% of the total 13,984,644 issued and outstanding common shares as of June 21, 2023 (the "Share Issuer Bid"). From December 1, 2022 to May 31, 2023 the average daily trading volume ("ADTV") of Clarke common shares was 3,278 common shares. Under TSX Rules, the Company is entitled to purchase up to 25% of the ADTV of the respective class of shares which is 819 common shares. Accordingly, under TSX rules and policies, the Company is entitled on any trading day to purchase up to 1,000 common shares. Any common shares purchased by Clarke pursuant to the Share Issuer Bid will be cancelled.

In connection with the program, the Company has established an automatic securities purchase plan (the "Plan") for the Share Issuer Bid. The Plan was established to provide standard instructions regarding how Clarke shares are to be repurchased under the Share Issuer Bid. Accordingly, Clarke may repurchase its shares under the Plan on any trading day during the Share Issuer Bid including during self-imposed trading blackout periods. The Plan will commence immediately and terminate with the Share Issuer Bid. The Company may otherwise vary, suspend or terminate the Plan only if it does not have material non-public information and the decision to vary, suspend or terminate the Plan is not taken during a self-imposed trading blackout period. The Plan constitutes an "automatic plan" for purposes of applicable Canadian securities legislation and has been pre-cleared by the Toronto Stock Exchange.

Purchases under the Plan may commence on July 4, 2023 and will terminate on July 3, 2024.

Astrotech Corporation NSADAQCM:ASTC Special Situation – Shotgun acquisition

Disclosure: We have a small position.

What do you do with a weird cash burning mass spectronomy company? Buy it of course. At least that’s what BML is trying to do. As of Q1 the company has ~$42MM of net cash and no debt vs its market cap of $23MM, i.e. a true net-net. However, they are burning cash, $7-8MM a year. Bizarrely, the Company recently announced a plan to raise equity, which did not sit well with their largest shareholder BML (13%), which is a value-oriented fund and they sent a non-binding offer (provided below). We have also included their portfolio below (seems like a good hunting ground!).

Per the Company’s acknowledgment, “The non-binding proposal is not subject to a financing condition but is subject to limited confirmatory due diligence and is based on the Company having at least $35 million of cash and cash equivalents as of the potential closing date of the proposed acquisition, net of any tail and closing costs, and not having issued any shares pursuant to its at-the-market offering agreement dated June 16, 2023 (the “ATM Agreement”). Effective June 27, 2023, the Company terminated the ATM Agreement in accordance with its terms.” The offer is ~$29MM for the Company and BML has cash on hand per their last 13-F to complete the acquisition.

BML bio per one of their analysts - BML Investment Partners is a concentrated value-oriented fund that invests primarily in domestic equity securities. The fund has no style or market capitalization mandate, but has focused mostly on small caps throughout its history. Based in the Midwest, BML has been exclusively managed since its November 2004 inception by Braden M. Leonard, its Founding Partner and second-largest investor. It generally purchases out-of-favor companies that fund management believes enjoy substantial return potential over a 2- to 3-year period. The fund employs a bottoms-up approach, eschews leverage, and adheres to a long bias the vast majority of the time.

Here is their letter. The conundrum is the offer had a very short life – it was provided June 26th and expires today. BML is a bit stuck; daily volume of ~10,000 means that cannot get out easily, meaning the offer likely has to be extended/adjusted or actually be accepted by the Board after market today. It might also start a process and attract competing bids (we view as unlikely).

Key risk: Entrenched management and Board who want their paycheques. High risk.

As always, do your own due diligence.