Value Investing 101

Value Investing..

Something often said but not understood..

Value Investing. Something often said but not understood. We here behind the scenes at Canadian Value Investors have collectively spent over two decades talking about Value Investing and have put together the following Value Investing 101 Guide – Or the CVI Value Investing Checklist. This is meant as a 101 guide to get you going as well as help those Continuous Learning Machines and the Checklist Makers out there who want to make sure their bases are covered.

“Value investing consists of quantifying what something is worth intrinsically, based primarily on its fundamental, cash flow-generating capabilities, and buying it if its price represents a meaningful discount from that value.” — Howard Marks, Oaktree Capital Management

“We don’t consider ourselves value investors. We consider ourselves investors, . . . There is no such thing in our mind as value or growth investing . . .” — Warren Buffett, May 2019

To make this easier to read and find things you want to learn about, we have broken it into: The CVI Investing Checklist, where you develop a structured system to invest, introducing the concepts of an Investment Checklist, investment concentration, permanent capital, and learning from mistakes. Following this, we cover the concept of Investment Cloning, which we believe is an unbelievably undervalued approach, particularly for those early in their investing careers. This includes case studies and step-by-step guides.

The CVI Value Investing Checklist

To be successful at our approach to value investing, you need to have the following:

The Characteristics of a Good Investor

A Checklist

Concentrated Investing

Permanent Capital

Continuous Learning (Including Learning From Your Mistakes and Others)

1) The Characteristics of a Good Investor

We plan on going into much more detail on this section later, but in the meantime we wanted to provide you with the basic foundation that these investing concepts are built on. To be clear, Checklists, Concentration, Cloning, and other concepts don’t work (and are in fact are probably harmful) unless you have the basics down.

Analysis

“The number one idea is to view a stock as an ownership of the business. ” — Charlie Munger, Harvard Law Bulletin, 2001

“The idea that everyone can have wonderful results from stocks is inherently crazy. Nobody expects everyone to succeed at poker. ” — Charlie Munger, Daily Journal AGM 2013

Investing well using these concepts takes a lot of time and knowledge. If you don’t find it interesting to learn about companies and how they work (or at a bare minimum learn what professional fund managers do) then this probably isn’t the thing for you. And that’s OK. Find your niche.

Patience and Decisiveness

Value Investing is both easy and hard. It’s about doing almost nothing and being content with that. You’re pounded by endless ideas and thoughts. “I made money on pot stocks.” “Did you buy bitcoin?” “How could you not be investing in the market?”

Mohnish Pabrai founded Pabrai Investment Funds in 1999 and currently manages over $500 million in a very concentrated value-oriented way (i.e. around 10 stocks). In a 2012 talk with students, he explained his process as follows:

“I told my staff and even my investors that we probably have very little to do for the next couple of years. We made all these bets, they are all undervalued. Now we just have to talk to students for the next two years [laughter] till the stocks go up in value. Then we will have something to do that at point. ” — Mohnish Pabrai, Ben Graham Centre for Value Investing Talk 2012

Of course he was at least half joking as continuous learning and self-reflection is extremely important as he notes below.

“Warren Buffett talks about this – let’s say you just turned 18, and someone said you can have any car you want. But the rule is you have to only have that same car for the rest of your life. You cannot change the car. What will happen is you will be really careful about what kind of car you buy.

But you will be even more careful about the way you drive it and the way you are maintaining it…Your brain and your body is the only one you are going to have…You want to basically be what Warren calls a continuous learning machine. Throughout your life you want to take this car and continually enhance the value of the car. And the way you enhance the value of the car is to continuously be learning and improving your mental models, and your thinking, and your knowledge – everything. You want to just continually ingest knowledge. Ghandi has a quote – in fact we have it in our office – he says, “Live as if you were to die tomorrow. Learn as if you were going to live forever”. ” — Mohnish Pabrai, Ben Graham Value Investing Talk 2012

But the key is you have to be OK doing nothing in the sense of frequently buying and selling stocks. Investment activity doesn’t correlate with success.

“The big money is not in the buying and the selling, but the waiting. ” — Charlie Munger

The concept is exemplified by Charlie Munger’s activity at the Daily Journal (where is the Chairman, another job he has besides being Warren Buffett’s right hand man) as described by Mohnish.

“There is a public company in Los Angeles called Daily Journal, where Charlie Munger is the Chairman. It is a small public company that basically runs legal newspapers, sells legal newspapers. And from 2000 to 2009 they were generating $3-5 million in cash flow every year. And they kept putting it in U.S. treasury bills.

Then, in the first quarter of 2009 – actually, Charlie told me it was one day in 2009 –they took that entire pile of cash and they put it into two bank stocks. So he does nothing for nine years … all kinds of things happen in the market over that time. He’s got all kinds of people telling him all kinds of things. Then there’s one day, and suddenly they go all in. The whole thing in one day. And again, no actions until just recently, in the fourth quarter of 2011, I noticed in their 13F filing where they again took whatever cash had built up and made an investment. ”

For full background – in Q1 2009 they purchased $15.5 million of stock and had $10.5 million of cash at the quarter ending March 31, 2009, so they had invested approximately 60% of their cash on hand. In Q1 2009 they had purchased another $4.9 million of stock and ended the quarter with $6.3 million of cash. Based on their cost base of $20.4MM ($14.5MM+$4.9MM) they had basically doubled their money by June 30th as their stocks were worth $46.3MM. Fastforward to December 31, 2017, the total market value of marketable securities on hand was $244.9MM on a cost base of $63.4MM for an annualized return of about 20% per year. Not bad for inactive traders.

“Over an 11-12 year period, there have only been two periods where they have actually made investments. So the number one skill that an investor needs to be successful is patience. Because the time frames under which an investment … matures and delivers results is very different from time frames humans are dealing with. The single greatest advantage that an investor has is if they have the temperament to be patient. And if they have the temperament of … understanding that they are always buying in the circle of confidence, buying things that are dramatically below that price, then waiting until they are fully priced before unloading them. Those are important things. the waiting. ” — Mohnish Pabrai

Of course, it's patience and gumption that get you there.

“It’s amazing how fast Berkshire acts when we find opportunity. You can’t be timid – and that applies to all of life. ” — Charlie Munger, Wesco AGM 2011

Willing to be Lonely

“The willingness to be lonely. A lot of people don’t want to be lonely. I couldn’t care less… I just think it’s hard to do. It’s really really difficult to go against the crowd. It’s just not normal. People are jumping in and buying things, and you’re selling. People are selling things because they’re terrified, and you’re buying. That’s really hard. I get excited when the market gets killed. And even though this sounds kind of weird, when stocks are getting killed and your stomach is churning – that’s when you get really excited. That’s when you know you’re going to make money. ” — Paul Lountzis, Lountzis Asset Management LLC – Ivey Business School 2017

The Power to Take Pain

“You can ask actuaries… it’s just normal. People buy when they feel good and sell when they feel bad. And to do the opposite is a lot harder to do than you think. It’s really hard. Do you know what it was like when [Mohawk Industries] got killed and lost 80% of its value? You want to throw up. I’m serious. This is people’s money! But we knew the company, we knew the industry, we didn’t budge. Not at all. We didn’t budge, and we bought more, and that’s really hard to do... It’s a personality, it’s a way of thinking, and it’s not the normal way that most people think. ” — Paul Lountzis, Lountzis Asset Management LLC – Ivey Business School 2017

Note: Mohawk Industries bottomed out at around $20 in 2009 and subsequently increased to $41 by 2010 $150 in 2014 and over $200 in 2016.

“Over many decades, our usual practice is that if something we like goes down, we buy more and more. Sometimes something happens, you realize you’re wrong, and you get out. But if you develop correct confidence in your judgement, buy more and take advantage of stock prices. ” — Charlie Munger, Wesco Annual Meeting, 2002

The Power of Humility

“Just doing it, you will automatically get mistakes, and of course you will learn from them. ” — Charlie Munger, 2017 Interview

“The first principle is that you must not fool yourself – and you are the easiest person to fool. ” — Richard Phillips Feynman

Understanding Your Circle of Competence

“If something is too hard, we move on to something else. What could be simpler than that? ” — Charlie Munger, Berkshire Annual General Meeting 2006

“We just put the money in. It didn’t take any novel thought. It was a once in a 40 year opportunity. You have to strike the right balance between competency or knowledge on the one hand and gumption on the other. Too much competency and no gumption is no good. And if you don’t know your circle of competence, then too much gumption will get you killed. But the more you know the limits to your knowledge, the more valuable gumption is.

For most professional money managers, if you’ve got four children to put through college and you’re earning four hundred thousand or one million or whatever, the last thing in the world you want to be worried about is having gumption. You care about survival, and the way you survive is just not doing anything that might make you stand out. ” — Charlie Munger, Jason Zweig Interview 2014“We have no system for estimating the correct value of all businesses. We put almost all in the “too hard” pile and sift through a few easy ones. ” — Charlie Munger, Berkshire AGM 2007

Have Someone to Talk To

“Even Einstein didn’t work in isolation. But he never went to large conferences. Any human being needs conversational colleagues.” — Charlie Munger, Wesco Annual General Meeting 2010

2) A Checklist

“I’m a great believer in solving hard problems by using a checklist. You need to get all the likely and unlikely answers before you; otherwise it’s easy to miss something important. ” — Charlie Munger, Wesco Annual General Meeting 2007

Checklists are very powerful and there’s a reason why pilots use them – we’re all fallable and forgetful. An example of a checklist of mental biases can be seen on our Behavioural Finance page. But the concept is the same for investments, in that it forces you to examine blind spots, which can be particularly big when you are excited about an investment idea.

These lists need to be built over time based on your experience. As noted by Charlie Munger:

“You need a different checklist and different mental models for different companies. I can never make it easy by saying, “Here are three things”. You have to derive it yourself to ingrain it in your head for the rest of your life. ” — Charlie Munger, Berkshire Hathaway AGM, 2002

Checklists are particularly useful for learning from mistakes, or working backwards to find out what went wrong and how to catch that type of mistake earlier next time. See our Learning from Mistakes section below for more detail and examples.

“We don’t like complexity and we distrust other systems and think it many times leads to false confidence. The harder your work, the more confidence you get. But you may be working hard on something that is false. ” — Charlie Munger, Seeking Wisdom 2003

We also encourage you to read The Checklist Manifesto, which is its own 101 guide on this process and has fun stories like how airplane pilots use checklists to keep you from crashing on your next trip to Maui (great gift for fearful flyers!).

3) Concentrated Investing

The Math

The best book we have found about concentrated investing is the creatively named book Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors.

The book covers several investors (like Warren and Charlie as well as Lou Simpson and John Maynard Keynes among others) and also the statistics behind concentration (we encourage you to read it!). Intuitively, the fewer stocks you own, the more your portfolio can deviate from the benchmark’s performance. But how different could it be? What’s the difference between 10 and 30 and 250?

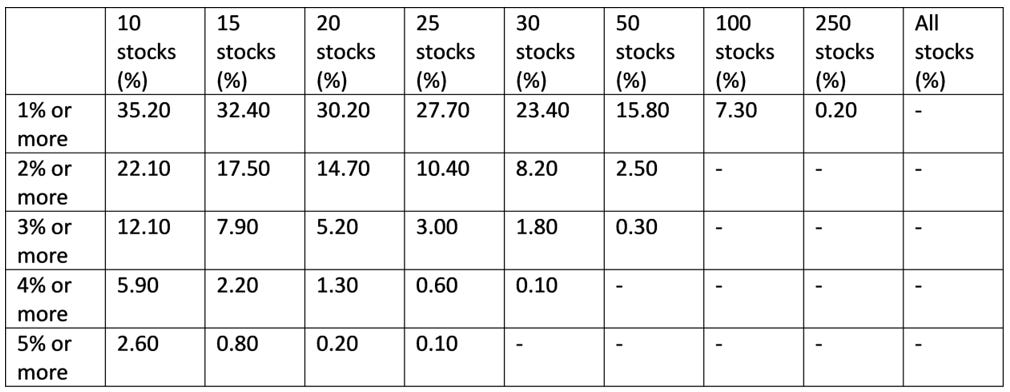

The authors conducted a Monte Carlo simulation where they randomly built portfolios from the S&P 500 from 1999 to 2014. In each year in the sample they randomly chose a portfolio of stocks, with 1,000 sample portfolios each year for a total of 120,000 portfolios over the 15 year period.

How did they do? 35.2% of the 10 stock portfolios outperformed the benchmark by 1% or more and 2.6% outperformed by 5% or more. At 30, it goes down to 23.4% and zero. Of course, concentration also increases your chances of underperforming the market.

Chance of Portfolio Outperforming S&P 500 Equal Weight (1999 to 2014)

Source: Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors

“The more broadly a portfolio is diversified, the more likely it is to match the performance of the averages, and the more concentrated a portfolio becomes, the more likely it is to deviate from those averages, either positively or negatively. Time-poor investors are therefore better served by a low-cost, broad based index that seeks to match the averages. ” — Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors

Concentrated Long-term Investing

The most concise explanation we have found on why you should focus on concentrated long-term investments is from Josh Tarasoff, who is General Partner of Greenlea Lane Capital Partners LP.

“There are really powerful secondary effects to having a very long term approach to investing. So if you invert it and you think about a shorter term approach to investing, let’s say that your investments last for two or three years. Your holding period is two or three years, and let’s say you have a portfolio with two dozen stocks, 24 stocks, just to make the math easy. That means that every year you need to replace 1/3 to 1/2, so 8 to 12, of your portfolio...So that’s one idea per month, or every six weeks, forever. That’s really, really hard. Ideas have to be good if you want to beat the market, and doing that is really, really, really hard. I think that it’s just taken for granted in the investment industry that it has to be really hard, and that it’s something where you’re buying and selling all the time, and there’s this time pressure to the job.” — Josh Tarasoff, Greenlea Lane Capital Partners

The system you build for yourself is important. If you convinced Warren Buffett to quit his Berkshire Empire and move into managing an “active mutual fund” that has a policy of having 200+ stocks at all times, has to cover all industry segments “appropriately”, and no one stock can be more than 1% of the fund, we are willing to coffee bet that his performance would be at best equal to whatever silly benchmark the fund has chosen.. and more than likely fall well short leading the fund to be rolled into another one or five of other terrible funds to preserve the fund company’s “active management leadership benchmark #1 spot”. He is an amazing investor but he also built a system that lets him succeed (i.e. where he can concentrate his investments and make infrequent patient decisions).

Concentration Case Study – Mohnish Pabrai’s Holdings (Pabrai Investment Funds)

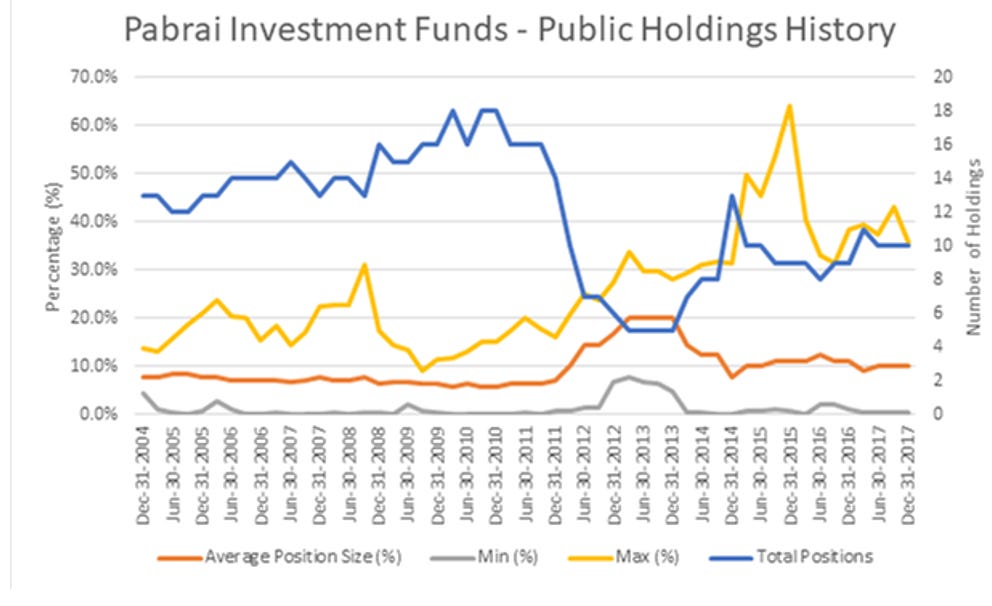

How do people that actually manage a lot of money concentrate and copy? We put together this case study on Mohnish Pabrai. This is because: 1) He grew assets under management from $1 million to over $400 million in less than a decade, 1) He has been concentrated from day 1, and finally 3) He is a vocal proponent of cloning.

How does he handle his holdings?

Mohnish exemplifies how to practice concentrated investing. Over the course of the history of the funds he has never had more than 20 positions. He also has a demonstrated ability to concentrate when he has ideas with high conviction (here we are separating “conviction” from “being right”).

Idea Shelf Life and Conviction

While he has had a number of small positions, if you look at his hold length it correlates quite strongly with his conviction (implied by the maximum portfolio weighting, i.e. the maximum percentage that an investment was of the entire fund on a percentage basis). For example, Berkshire was his longest hold and accounted for 15.3% of the portfolio vs the average stock weighting of 12% over the history of his fund. American Zinc Recycling LLc is almost just as long at 29 quarters and represented 31.9% of the portfolio at its peak, 62.5% above the portfolio average maximum weighting. The majority of the top 15 longest holds over the history of the fund are or were significantly overweight compared to the average maximum, while all of the bottom 15 holds except for one are significantly underweight.